Best American Access Auto Insurance Discounts in 2026 (Save 30% With These Offers)

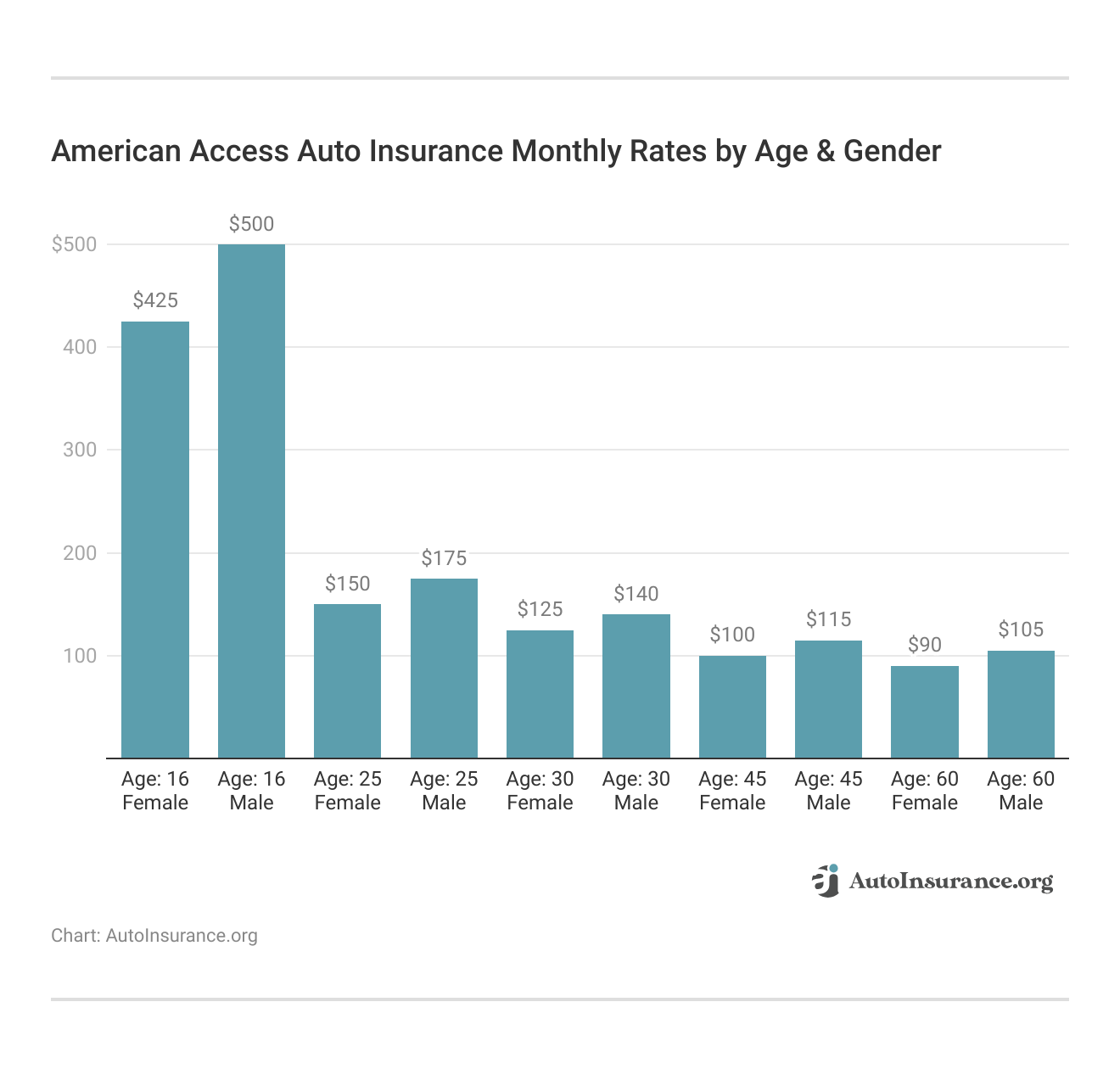

Discover American Access auto insurance discounts, including low mileage, multi-vehicle, and good driver savings, with up to 30% off. Rates start at $105/month. After being acquired by Kemper Corporation in 2021, American Access strengthened its presence in the non-standard auto insurance market.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated January 2025

The best American Access auto insurance discounts, including low mileage, multi-car, and good driver discounts, can save you up to 30%. These discounts can significantly reduce your premiums while offering great value for your coverage needs.

American Access Casualty Company (AACC), acquired by Kemper Corporation, has allowed Kemper to expand its presence in the non-standard auto insurance market, where American Access specializes. Learn more by reading our Kemper auto insurance review.

Our Top 10 Picks: Best American Access Auto Insurance Discounts

| Discount | Rank | Savings Potential | How to Qualify |

|---|---|---|---|

| Low Mileage | #1 | 30% | Drivers who travel less than 7,500 miles annually. |

| Multi-Vehicle | #2 | 25% | Families or households insuring more than two cars. |

| Good Driver | #3 | 20% | Policyholders who maintain a clean driving record for 3 years. |

| Homeowners | #4 | 15% | Customers who own their home |

| Anti-Theft | #5 | 10% | For cars with anti-theft devices. |

| Safety Features | #6 | 10% | For vehicles with advanced safety features. |

| Defensive Driving | #7 | 10% | For drivers completing a defensive driving. |

| Paperless Billing | #8 | 5% | For paperless statement opt-ins. |

| New Car | #9 | 5% | For new vehicle insurance. |

| Pay-in-Full | #10 | 5% | For full premium payment at start. |

AACC primarily serves customers who need specialized coverage due to their driving history, credit score, or other risk factors, aligning with Kemper’s focus on offering a wide range of insurance products. Enter your ZIP code and compare quotes to save on your auto insurance.

- The best American Access auto insurance discounts offer up to 30% savings

- Discounts include low mileage, multi-car, and good driver rewards

- Premiums are reduced based on safe driving and policy bundling

Best American Access Auto Insurance Discounts

American Access auto insurance provides different discount opportunities to lower your costs. From the fewer miles, you travel annually to the insurance of more cars in the same household to having a safe driving record, you are given ways of lowering the price while still getting comprehensive coverage.

Below are the best American Access auto insurance discounts available, making coverage more affordable while meeting legal requirements. Explore how to get a no-claim bonus (NCB) auto insurance for more details.

Low Mileage Discount

The low mileage discount from American Access auto insurance is an excellent option for those who drive fewer miles annually. This discount is suited for those with shorter commutes, retirees, or anybody who doesn’t drive much. It helps reduce premiums by lowering the risk of accidents.

Therefore, if you don’t drive much, you can use this discount to get your insurance premiums down while you still have full coverage. Look at our guide on trustworthy discount auto insurance companies for complete information.

Multi-Car Discount

One of the most popular American Access auto insurance discounts is the multi-car discount. If you insure more than one vehicle under the same policy, you can benefit from significant savings. By bundling multiple cars, American Access Casualty Company helps families and households reduce premiums. To learn more, view our guide on how to get a defensive driver auto insurance discount.

Safe Driver Discount

Even high-risk drivers have the opportunity to save—American Access Casualty rewards safe driving with its safe driver discount. If you maintain a clean driving record without any recent accidents or violations, you may be eligible for a reduced rate on your American Access auto insurance premium. For deeper details, access our guide on the best auto insurance discounts for a new car.

Paid-in-Full Discount

You can save money by paying your American Access auto insurance policy in full at the start of the term. However, this mainly works for clients who prefer full-time payment or avoid monthly and daily payments instead.

This one-time payment plan will help them minimize the high total cost during payment of this auto insurance American Access Casualty Company. Learn additional insights from our guide on the best student auto insurance discounts.

Homeowner Discount

Owning a home can lead to additional savings. American Access Casualty offers a homeowner discount to policyholders who own their residence. This discount is another way to make access to car insurance more affordable, even for high-risk drivers. For a detailed breakdown, explore our guide on the best auto Insurance discounts for police officers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accessing Your Discounts

To maximize your savings with American Access auto insurance discounts, you can work with an American Access agent login or contact American Access customer service for assistance. When working with an agent, checking your eligibility for discounts and applying them to your policy is easy. You can also contact the American Access insurance phone number for guidance.

To maximize your savings with American Access auto insurance, start by exploring discounts like safe driver, multi-car, and low mileage options, which can collectively save you up to 30% on premiums. These tailored discounts reduce costs and ensure you maintain the coverage necessary for your unique needs.Heidi Mertlich Licensed Insurance Agent

If you have questions about your policy, payments, or claims, accessing your information is simple. You can visit the American Access agent login portal or call the American Access insurance claims phone number for quick support. Read our best garaging & storing auto insurance discounts to find out more.

Claims and Reviews

Claiming with American Access casualty is straightforward. Policyholders can contact the American Access insurance claims phone number to report an accident or file a claim.

American Access insurance claims are handled promptly to ensure customers receive the necessary assistance. You can also check American Access insurance reviews from other customers for more insights. Discover our best longevity auto insurance discounts for further insights.

Payment Options

Regarding online payments for policy charges, America Access Insurance lets you manage these via your AAINS insurance pay portal; they are also very amenable to over-the-phone calls to ensure payment. Additionally, you have a local location nearby from which you can request information on the nearest “American Access Insurance near you.” Browse our best CPA auto insurance discounts to gain more information.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How High-Risk Drivers Can Maximize Savings with American Access Auto Insurance Discounts

There are numerous ways high-risk drivers can save money with American Access Casualty Company. Discount offers are given on safe driving, homeownership, or covering several vehicles at once through American Access Auto Insurance Discounts. Find all your answers about discounts, claims, and payments through the American Access agent login.

Alternatively, American Access Insurance can help with that by phone. For additional details, refer to our best pay-in-full auto insurance discounts. Are you looking for more affordable quotes? Enter your ZIP code to find the right provider for you and your budget.

Frequently Asked Questions

What six car insurance discounts should I ask about with Kemper?

When seeking discounts from Kemper, consider asking about multi-car, good driver, low mileage, homeowner, anti-theft device, and bundling discounts. These six car insurance discounts can help lower your premium. Visit our best auto-pay insurance discounts to get the full scoop.

Does Kemper offer hidden auto insurance discounts?

Like many insurers, Kemper may have hidden auto insurance discounts, such as discounts for safe driving, installing safety features in your car, or being a loyal customer. Ask your agent about all available savings.

How do I make an American Access insurance payment?

You can pay online via the American Access insurance login portal or by calling the American Access insurance phone number. You can also make payments over the phone or in person at local offices.

What is the American Access insurance phone number for customer service?

Call American Access Insurance customer service at their dedicated support line, 630-645-7755. This phone number can be used to inquire about policy details, claims, and payments. For deeper information, access our best multi-vehicle auto insurance discounts.

How do I access my American Access insurance login?

You can access your account by visiting the American Access insurance login page. You can manage your policy, make payments, and check your coverage status here. If you want coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

What are the best car insurance discounts available with American Access under Kemper?

The best car insurance discounts available through American Access include multi-car, safe driver, low mileage, and paid-in-full discounts. These can save you up to 30% on your premiums.

What connection does Kemper have with American Access?

Kemper Corporation acquired American Access Casualty Company in 2021, expanding its reach in the non-standard auto insurance market. American Access continues to operate under Kemper’s umbrella, providing services to high-risk drivers. View our best non-smoker & non-drinker auto insurance discounts to find out more.

How can I file a claim with Kemper after the acquisition of American Access?

To file a claim with Kemper or American Access, visit their websites or call the American Access insurance phone number for support. Claims can be filed online or through customer service.

Are there specific Kemper auto insurance discounts for high-risk drivers?

Kemper offers auto insurance discounts tailored to high-risk drivers through American Access. These discounts may include safe driver, low mileage, and homeowner discounts.

What is the relationship between Kemper and American Access?

In 2021, Kemper Corporation acquired American Access Casualty Company, allowing Kemper to expand its non-standard auto insurance offerings. American Access now operates under Kemper’s leadership but continues to provide its services as part of the larger Kemper group.

Look at our best auto insurance discounts for recent graduates for complete information.

How can I maximize savings with Kemper and American Access auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.