Mercury Auto Insurance Review (2026)

Our Mercury auto insurance review reveals that Mercury Insurance Company has an A rating from A.M. Best. On average, Mercury auto insurance rates are $244 per month, which is 89% higher than the national average of $129. Mercury insurance policies are only available in 11 states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

When the Mercury Insurance Group sold its first policy in 1962, it focused on providing affordable car insurance to California drivers. Since then, Mercury has expanded into 10 more states: Arizona, Georgia, Florida, Nevada, Illinois, Virginia, Texas, Oklahoma, New Jersey, and New York.

Although Mercury isn’t the biggest insurance company, but Mercury car insurance quotes are so affordable that it can easily compete with even the most prominent insurers. Combined with a long list of coverage options and a solid usage-based insurance option, it’s no wonder Mercury has so many happy customers.

While buying auto insurance from a smaller company might not initially appeal to you, Mercury offers some serious perks. Read our Mercury Auto Insurance Review to learn what the Mercury Insurance company can do for you, then compare rates with local insurance companies to find the best plan.

What You Should Know About Mercury Insurance Group

One of the best ways to figure out if Mercury auto insurance is the right company for you is to look at Mercury car insurance reviews. An excellent place to start is with third-party company reviews.

A.M. Best rates companies on their financial security. Mercury Insurance’s A.M. Best rating is an A, which means it has the strength to pay out any claims you might have to make.

The National Association of Insurance Commissioners (NAIC) rates insurance companies by the number of Mercury car insurance complaints compared to their size. The national average ratio is 1.0. Mercury has a 0.71, which means it receives fewer complaints than other insurance companies.

J.D. Power is a trusted name in consumer satisfaction reports. In 2021, J.D. Power ranked Mercury as the number one company for digital insurance shopping satisfaction. However, Mercury auto insurance company ranks near the middle for overall satisfaction, meaning it has an average number of happy customers.

Finally, the Better Business Bureau (BBB) rates companies on their ability to resolve customer claims. While it hasn’t been officially rated yet, hundreds of Mercury insurance reviews are on the BBB site.

How do real customers feel about their Mercury auto insurance? Customer reviews tend to be mixed. When things go well, and customers don’t have to make a claim, they praise Mercury for its professional representatives and low rates. Unfortunately, many customers are unsatisfied with the claims process, saying that Mercury does everything in its power to deny payments.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mercury Insurance Group Insurance Coverage Options

Each of the 11 states Mercury operates in has car insurance requirements before you can legally drive. When you get Mercury auto insurance quotes, it will at least include the minimum coverage you need.

You’ll probably need full coverage insurance if you have a loan or lease on your car, which Mercury can also provide. Mercury’s car insurance availability includes:

- Liability. Consisting of bodily injury and property damage coverage, liability insurance pays for damage you cause in an accident. It does not cover repairs to your car.

- Collision. You need collision insurance if you want your car covered in an accident. Mercury offers the actual cash value of your vehicle if it’s totaled.

- Comprehensive. Mercury comprehensive coverage will help repair your car after a covered event, such as fire, weather, vandalism, or theft.

- Uninsured/underinsured motorist. If someone without insurance hits you, uninsured motorist insurance steps in to pay for car repairs, medical bills, and lost wages. Underinsured motorist coverage fills the gap if an at-fault party does not carry sufficient policy limits to cover all of your damages.

- Medical payments. Healthcare bills after an accident can get costly. Medical payments coverage (MedPay) will help cover healthcare costs for you and your passengers, no matter who is at fault.

- Rental car. Mercury will cover a temporary ride when your vehicle is in the shop after an accident. Coverage is available for up to 30 days at $30-$100 per day.

- Rideshare. If you drive for a company like Uber or Lyft, Mercury can cover you while you work for as little as $27 a month.

- Mechanical protection. Buy this optional insurance to cover major mechanical breakdowns. Keep in mind that mechanical breakdown insurance does not cover normal wear and tear.

Mercury rental car, Mercury SR22 insurance, and Mercury mechanical protection availability vary by state, so make sure to ask. A Mercury auto insurance representative can also help you decide which types of coverage you need.

Does Mercury offer other types of insurance?

In order to get a bundling discount, you need to buy more than one Mercury insurance policy. Luckily, Mercury has plenty of options:

- Homeowners/condo/renters

- Landlord

- Umbrella

- Business owners

- Commercial auto

- Mechanical protection

It might not be the most extensive list of insurance options, but Mercury can cover most of the important things in your life.

Mercury Insurance Group Insurance Rates Breakdown

So, what is the average auto insurance cost per month with Mercury? The average auto insurance premium varies greatly. In general, Mercury insurance quotes are below the national average. While all drivers could potentially save money with Mercury, teens and older adults see some of the lowest rates.

Additionally, Mercury is an excellent option for high-risk drivers.

Mercury will combine factors like your age, gender, location, driving history, and credit score to make a unique quote for you. Keep reading to learn more about Mercury auto quotes.

How much is minimum coverage with Mercury?

If you’re on a tight budget, minimum coverage is the least amount of insurance you can buy and still be street-legal. It doesn’t cover your car, but it’s the cheapest insurance option. Here is a look at some of the top national insurance company costs for minimum coverage, so you can get an idea of how much this type of coverage costs.

Mercury vs. Competitors: Minimum Coverage Auto Insurance Monthly Rates

| Insurance Company | Monthly Rates |

|---|---|

| $87 | |

| $62 | |

| $47 | |

| $76 | |

| $43 | |

| $96 |

| $42 | |

| $63 |

| $56 | |

| $47 | |

| $53 | |

| $32 | |

| U.S. Average | $65 |

Although Mercury does well in different categories, you might see higher rates than the national average when you look at minimum coverage. However, minimum coverage laws vary by state, meaning Mercury insurance in Arizona might be much different than the average auto quotes in California.

How much is full coverage with Mercury?

Full coverage refers to a package consisting of liability, comprehensive, collision, and uninsured motorist. It also usually includes medical payments, though not all the time.

If you have a loan or lease on your car, your lender will probably require you to carry full coverage. See below for the average full coverage policy costs from major national insurance companies.

Mercury vs. Competitors: Full Coverage Auto Insurance Monthly Rates

| Insurance Company | Monthly Rates |

|---|---|

| $228 | |

| $166 | |

| $124 | |

| $198 | |

| $114 | |

| $248 |

| $110 | |

| $164 |

| $150 | |

| $123 | |

| $141 | |

| $84 | |

| U.S. Average | $170 |

If you need full coverage insurance, comparing rates with other companies is vital in finding a reasonable price.

How much is Mercury for teen drivers?

Age is a critical factor when determining your auto insurance rates. Insurance companies keep careful track of claims numbers, and the data shows that teen drivers are more likely to engage in reckless behavior and cause accidents.

Because of this, rates for teen drivers are some of the highest in any demographic. However, Mercury offers competitive rates for young drivers. Take a look at the national averages so you can compare them with the rate you receive from Mercury.

Although a few companies are generally cheaper, Mercury might be the best choice for finding cheap teen car insurance.

How much is Mercury for young adult drivers?

While teen insurance can be costly, rates start to drop when you reach your twenties. Although it takes until about 25, you’ll see much lower rates if you keep your driving record clean.

While Mercury still has competitive rates for young drivers, it matches other companies more closely than it did for teens. You will also see that male vs female insurance rates differ. Gender also plays a role with you get an auto insurance quote from Mercury.

Rates for young drivers are lower than what teens see, but they’re still relatively high. There are ways to lower your rates, especially by taking advantage of discounts. If you’re under 25 and in college, you might qualify for one of Mercury’s student discounts.

How much is Mercury for adult drivers?

Your Mercury insurance quotes will reach their lowest during your adult years, with drivers in their fifties most likely to have the cheapest rates. Other factors play an important role in your rates, but statistics show that 50 and 60-year-olds pay the least for insurance.

Although Mercury has low rates for teens, its adult rates tend to be closer to the national average. Make sure to ask about discounts when you get your quote to lower your rates as much as possible.

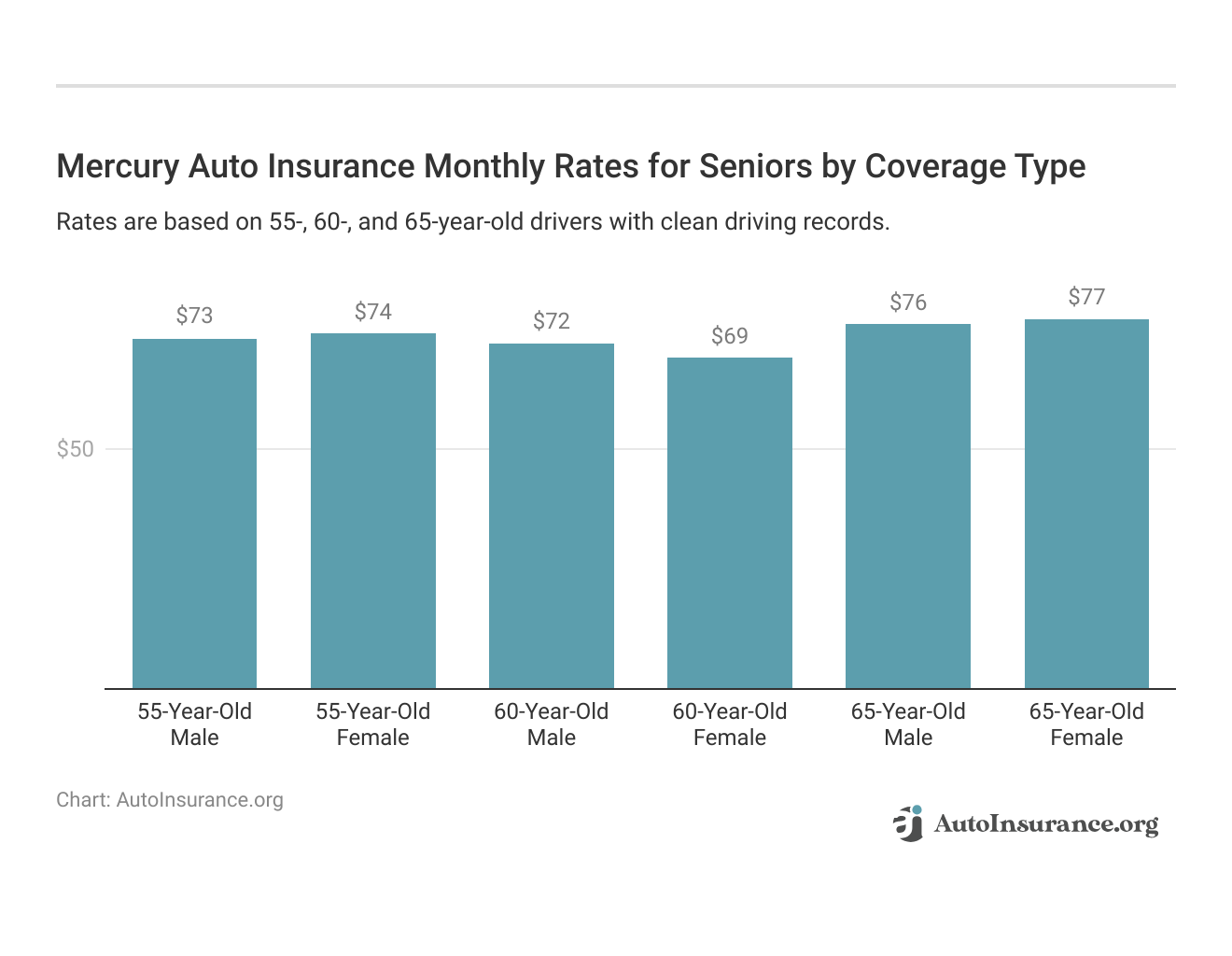

How much is Mercury for older adults?

Senior adults typically see their rates increase as they approach 70 and 80. There are several reasons for the increase, but it mostly comes down to statistics — older adults get in more accidents.

You might find affordable rates with Mercury as an older adult, as long as you have a clean driving record. Let’s look at the national averages for senior drivers.

Unfortunately, car insurance rates for older adults can get expensive no matter where you shop. However, Mercury might offer you the most affordable plans.

How much is Mercury insurance after an accident?

It’s an unfortunate part of life — accidents happen. Unfortunately, your insurance rates will increase after an at-fault accident. While some companies impose a dramatic spike in prices after an accident, you can never tell how much your Mercury rate increase will be.

Here is a look at average rates after you have been involved in one or multiple accidents.

Mercury vs. Competitors: Auto Insurance Monthly Rates for Drivers With an Accident

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $321 | $228 | |

| $251 | $166 | |

| $182 | $124 | |

| $282 | $198 | |

| $189 | $114 | |

| $334 | $248 |

| $163 | $110 | |

| $230 | $164 |

| $265 | $150 | |

| $146 | $123 | |

| $199 | $141 | |

| $111 | $84 | |

| U.S. Average | $173 | $119 |

The average Mercury policy increases by about 26%, which is a slightly smaller increase compared to the national average.

However, you won’t be stuck with higher rates forever. While every company varies, it usually takes about three years of accident-free driving for an incident to stop affecting your insurance rates.

How much is Mercury insurance after a speeding ticket?

Like accidents, getting a speeding ticket will increase your rates. According to the National Highway Traffic Safety Administration (NHTSA), speeding was a factor in 29% of all traffic fatalities. With this in mind, it’s easy to understand why insurance companies are wary after you receive a speeding ticket.

Mercury vs. Competitors: Auto Insurance Monthly Rates for Drivers With a Ticket

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $268 | $228 | |

| $194 | $166 | |

| $150 | $124 | |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $136 | $110 | |

| $196 | $164 |

| $199 | $150 | |

| $137 | $123 | |

| $192 | $141 | |

| $96 | $84 | |

| U.S. Average | $147 | $119 |

Mercury rates are comparable to other companies after a speeding ticket, but you might see much higher or lower rates depending on the state you live in. For example, Mercury insurance in Oklahoma after a speeding ticket is much higher than the average rates in California.

How much is Mercury insurance after a DUI?

DUIs affect your car insurance rates more than almost any other traffic violation. If you have more than one DUI or other traffic violations on your record, you might need to look for high-risk insurance.

Mercury can help with affordable rates after a DUI. Getting familiar with the national company rates after a DUI will give you a good idea of how much to expect to pay if you decide to go with Mercury.

Mercury vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | One Accident | One DUI | One Ticket | Clean Record |

|---|---|---|---|---|

| $321 | $385 | $268 | $228 | |

| $251 | $276 | $194 | $166 | |

| $182 | $185 | $150 | $124 | |

| $282 | $275 | $245 | $198 | |

| $190 | $309 | $151 | $114 | |

| $335 | $447 | $302 | $248 |

| $163 | $180 | $136 | $110 | |

| $230 | $338 | $196 | $164 |

| $265 | $200 | $199 | $150 | |

| $146 | $160 | $137 | $123 | |

| $199 | $294 | $192 | $141 | |

| $111 | $154 | $96 | $83 | |

| U.S. Average | $173 | $209 | $147 | $119 |

Unfortunately, you’ll see much higher rates for insurance after a DUI, no matter where you shop. However, comparing quotes with multiple companies can help you save money. Since Mercury is comparable to — and sometimes lower than — other providers, it’s an excellent place to start.

How much is Mercury insurance if you have poor credit?

Statistically, insurance companies know that people with lower credit scores are more likely to file a claim. You can lower your rates by increasing your score.

Mercury vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $200 | $150 | $100 | |

| $190 | $140 | $95 | |

| $180 | $135 | $90 | |

| $205 | $155 | $110 | |

| $170 | $130 | $85 | |

| $210 | $160 | $105 |

| $195 | $145 | $100 | |

| $200 | $150 | $95 |

| $185 | $140 | $90 | |

| $190 | $145 | $95 | |

| $195 | $150 | $100 | |

| $175 | $125 | $80 |

While Mercury doesn’t do as well as companies like GEICO or Nationwide, its rates are still competitive enough that it’s worth requesting quotes.

Before focusing too much on credit scores, you should know that checking them in every state is not legal. For example, Mercury can’t check your credit score if you live in California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mercury Insurance Group Discounts Available

Smaller companies often struggle to compete with larger providers when it comes to discounts. While Mercury doesn’t have quite as many as some of its competitors, it still has a good selection:

- Digitally signing policy documents

- Multi-car

- Policy bundling

- Anti-theft devices

- Signing up for auto-pay

- Paid-in-full

- Good driver

- Good student

Another way to save on your auto insurance with Mercury is by signing up for the RealDrive program. This program tracks how many miles you drive and lowers your rates accordingly. Not every driver will benefit from the Mercury Real Drive program, but it could interest people with short commutes or remote workers.

However, RealDrive and other discounts aren’t available in every state, so check with an insurance representative before you sign up for a policy.

MercuryGO

Telematics technology allows insurance companies to monitor your driving behavior and adjust your rates based on your habits. Usage-based insurance is a great way to save money, as long as you’re a safe driver and comfortable being monitored.

Mercury’s usage-based plan is MercuryGO. You automatically earn 5% off your rates for signing up, no matter your driving behaviors, but further discounts are available based on how well you drive.

MercuryGO monitors the following driving behaviors:

- Speeding

- Phone use while driving

- Hard braking

- Fast accelerations

- Sharp turns

After three months of tracking, you’ll receive new rates. Every driver’s discount varies, but you can save up to 40% on your total bill.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How Mercury Insurance Group Ranks Among Providers

When evaluating insurance providers, comparing Mercury auto insurance ratings against those of other companies is a crucial step for informed decision-making.

Geico vs Mercury

Assessing the auto insurance ratings of these two providers is essential for individuals seeking comprehensive coverage. Both Geico and Mercury Insurance are prominent players in the insurance industry, each with its own strengths and weaknesses.

Geico offers a broader range of insurance types, including auto, home, and renters, while Mercury focuses mainly on auto insurance.

Farmers vs Mercury

Farmers Insurance is known for its extensive coverage options, including auto, home, life, and business insurance, catering to diverse insurance needs. On the other hand, Mercury Insurance primarily focuses on auto insurance, with additional offerings such as home and renters insurance available in select regions.

Farmers Insurance boasts a robust customer service reputation and strong financial stability, while Mercury’s auto insurance rating for service may vary by region.

AAA vs Mercury

While both AAA and Mercury may offer discounts and solid customer service, AAA’s extensive network of services and longstanding reputation for reliability may appeal to those seeking a comprehensive insurance and roadside assistance package.

On the other hand, Mercury’s strength lies in its tailored auto insurance solutions and financial stability.

Liberty Mutual vs Mercury

While both companies prioritize customer service and financial stability, Liberty Mutual’s extensive portfolio and nationwide presence may appeal to those seeking a comprehensive insurance solution across multiple lines.

Conversely, Mercury’s focus on auto insurance allows for a more specialized and potentially cost-effective approach for individuals primarily concerned with coverage for their vehicles.

Frequently Asked Questions

What states does Mercury offer insurance in?

Mercury sells insurance in 11 states – Arizona, California, Georgia, Florida, Nevada, Illinois, Virginia, Texas, Oklahoma, New Jersey, and New York.

Why is Mercury insurance so cheap?

Many people wonder, “is Mercury insurance cheap?” Mercury maintains low rates due to a commitment to affordable coverage and plenty of discounts for drivers.

How do you file a claim with Mercury?

You can call and speak with a representative to file Mercury auto claims. You can also fill out the online claims form.

Does Mercury insurance have an app?

It might not be as impressive as other companies, but Mercury does have an app. You can use the app to access your insurance cards, pay your bills, and start a roadside assistance claim.

How do you contact Mercury?

To contact a Mercury insurance representative. First, you can call the Mercury insurance phone number which is a 24/7 helpline for questions, claims, and anything else you might need.

You can also fill out a contact form online and wait for a representative to contact you.

Does Mercury insurance have roadside assistance?

Mercury offers a roadside assistance add-on for newer cars. Mercury insurance roadside assistance cost is about $10 a month. Mercury roadside assistance includes towing, battery jumps, flat tire changes, fuel delivery, and locksmith services.

Does Mercury insurance cover rental cars?

While Mercury doesn’t cover the cost of a rental car for vacation or business trips, your personal policy applies to a rental vehicle. That means if you have liability, comprehensive, and collision on your car, your rental will be covered by the same.

How do you cancel a Mercury insurance policy?

Are you looking to cancel Mercury insurance? Unfortunately, you can’t cancel your Mercury automobile insurance policy online. Instead, you’ll have to speak to a representative, and you might have to pay a cancellation fee of up to 10% of your remaining premium.

What types of coverage does Mercury auto insurance offer?

Mercury auto insurance offers a variety of coverage options to protect you and your vehicle. Mercury provides standard auto insurance coverages such as liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

Additionally, they may offer additional coverage options and benefits that you can choose from, such as Mercury gap insurance and Mercury insurance roadside assistance.

How can I get a quote from Mercury auto insurance?

To obtain a quote from Mercury auto insurance, you can visit their official website or contact their customer service directly. On their website, you may find a quote form where you can provide the necessary information about your vehicle, driving history, and coverage requirements to receive an estimate.

Alternatively, you can reach out to a Mercury agent for assistance.

Does Mercury car insurance cover rental cars?

Does Mercury Insurance cover windshield replacement in California?

Is Mercury auto insurance good?

How much is Mercury car insurance?

Is Mercury insurance in Florida?

Is Mercury insurance in Georgia?

Why has my Mercury auto insurance rate increased?

What is the Mercury Casualty Company phone number?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.