NGM Auto Insurance Review (2026)

NGM Insurance Company in Jacksonville, Florida, is part of the Main Street America Group of insurance companies. It sells auto, home, life, and other insurance products. Read more to learn about the auto insurance offered by NGM Insurance and see how it compares to the competition.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated December 2024

If you are trying to find out how to get cheap auto insurance from NGM Insurance Company, you are in the right place.

NGM Insurance Company (National Grange Mutual Insurance Company) is the main insurance provider of the Main Street America Group of insurance companies. They are one of the Main Street America Group subsidiaries.

What is Main Street America? The Main Street America Group in Jacksonville, FL, where the company headquarters is located, provides insurance services throughout the country. They provide insurance policies for both businesses and individuals.

Is Grange Insurance a good company? This NGM auto insurance review will tell you what the NGM Insurance Company is all about and so much more.

If you’d like to find affordable NGM auto insurance, enter your ZIP code for free online auto insurance quote comparisons.

What You Should Know About NGM Insurance Company

NGM Insurance Company, a key entity within the Main Street America Group, operates from its headquarters in Jacksonville, Florida. It has carved a niche in the national insurance landscape by offering an array of products, including auto, homeowners, and life insurance.

Founded as part of a larger initiative to provide quality insurance solutions accessible to a broad demographic, NGM stands out for its commitment to personalized service and community-focused business practices.

The company prides itself on its ability to tailor insurance products to meet the unique needs of its customers, reflecting its deep understanding of the diverse insurance landscape across the states it serves.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NGM Insurance Company Reviews and Satisfaction

Feedback from NGM Insurance customers paints a picture of a company with a dual reputation. On the positive side, many policyholders appreciate the competitive pricing and comprehensive coverage options that NGM provides.

However, some reviews indicate areas needing improvement, particularly in claims service and customer support responsiveness.

These mixed reviews suggest that while NGM excels in affordability and product offerings, there is potential for enhancing the customer service experience to elevate overall satisfaction rates among its users.

In terms of insurance company reviews, this scenario is not unusual. It’s quite often that unhappy customers are more inclined to write reviews, thereby resulting in lower ratings in the customer service department.

NGM has an A+ rating with the Better Business Bureau and the NGM Insurance A.M. Best rating is an A+ based on issuer credit rating and an A based on its financial strength rating. A.M. Best also sees NGM as having a stable outlook.

What’s the Auto Insurance History of NGM Insurance?

National Grange Mutual is the primary insurance carrier of the Main Street Insurance Group, which consists of eight companies:

- NGM Insurance Company

- Old Dominion Car Insurance Company

- Grain Dealers Mutual Insurance Company

- Main Street America Protection Insurance Company

- Main Street America Assurance Company

- NSA Insurance Company

- Austin Mutual Insurance Company

- Spring Valley Mutual Insurance Company

Main Street Insurance Group was founded in 1923 and offers coverage in 37 states. The group also offers surety and fidelity bonds in 47 states and the District of Columbia.

Together, these companies provide a wide variety of affordable insurance lines including auto, home, life, excess liability, and specialty products.

Their client list includes not only individual consumers at the retail level, but also small businesses, sole proprietors, and not-for-profit organizations.

Their leadership includes NGM Insurance Company asset management ARM (Associate in Risk Management) trained experts.

How is NGM Insurance’s online presence?

National Grange Mutual Insurance does provide its customers with a website where they can find a local agent, make a payment, file a claim, and do a variety of other insurance-related tasks.

The site allows you to find a variety of contact information, such as the NGM Insurance Company’s Keene, NH fax number, for example.

Online payments through the company website can be made using the Main Street America (MSA) group bill matrix by means of electronic funds transfer (EFT).

You can also use the NGM website to request an ID card, a certificate of insurance, or a policy change. NGM insurance’s covid information for those affected by the Covid-19 pandemic is also available online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NGM Insurance Company Insurance Coverage Options

NGM Insurance offers a comprehensive suite of auto insurance options designed to meet the varying needs of drivers. This includes standard coverage such as liability, collision, and comprehensive insurance, which are foundational to protecting drivers against financial losses in accidents or vehicle damage.

Unique to NGM is the Auto Elite Endorsement, an enhanced coverage option that provides additional benefits such as accident forgiveness and decreased deductibles over time. This endorsement reflects NGM’s commitment to offering products that go beyond basic needs, providing extra value and protection to policyholders.

One thing you’ll need to decide before purchasing your auto insurance policy is how much coverage you need. Most states have a minimum liability coverage requirement and you’ll need to fulfill this requirement at the very least to drive legally.

If you decide that you need more than the minimum coverage required by your state, there are a number of different options available to you as additional coverage.

The table below shows some of the different types of policies and coverages available to you, along with what they do.

Types of Auto Insurance Coverage

| Auto Coverage Type | Purpose of Coverage |

|---|---|

| Bodily injury liability | Part of your liability coverage that pays for medical bills if you’ve injured someone else in an automobile accident |

| Collision | Covers damage to your car after an automobile accident |

| Comprehensive | Covers damage to your car that happens when you’re not driving |

| Personal injury protection | Covers medical expenses for you or your passengers after an automobile accident |

| Property damage liability | The other part of liability coverage that covers the cost of any property damage you’ve caused in an automobile accident |

| Uninsured/underinsured motorist | Covers the costs if you’re in an automobile accident caused by a driver with little or no car insurance |

Always check with your insurance company to see what add-ons, endorsements, and riders are available to you, and make sure to take into account price and need when adding these things to your insurance policy.

NGM Insurance Company Insurance Rates Breakdown

There are often many benefits to choosing an insurance agent in your area for your insurance needs.

For one, these agents often act as brokers, meaning that they have more leeway when it comes to working with various insurance companies to customize a policy that’s right for you.

Smaller companies are often more personalized when it comes to customer service as well.

The auto insurance market is very competitive and reputation is one thing that smaller companies can leverage to their advantage since they’re able to provide service on a more personal level.

You can take a look at the table below to get an idea of what you might pay for auto insurance depending on how much coverage you decide to buy. The table shows average annual rates based on coverage levels.

Average Auto Insurance Rates by Coverage

| Coverage Types | Average Annual Auto Insurance Rates | Average Monthly Auto Insurance Rates |

|---|---|---|

| Comprehensive coverage | $150.36 | $12.53 |

| Collision coverage | $299.73 | $24.97 |

| Liability coverage | $516.39 | $43.03 |

| Total Full Coverage Cost | $954.99 | $79.58 |

It’s important to keep in mind that these are just general estimates. Your actual rates will depend on a variety of factors, such as age, driving history, ZIP code, etc.

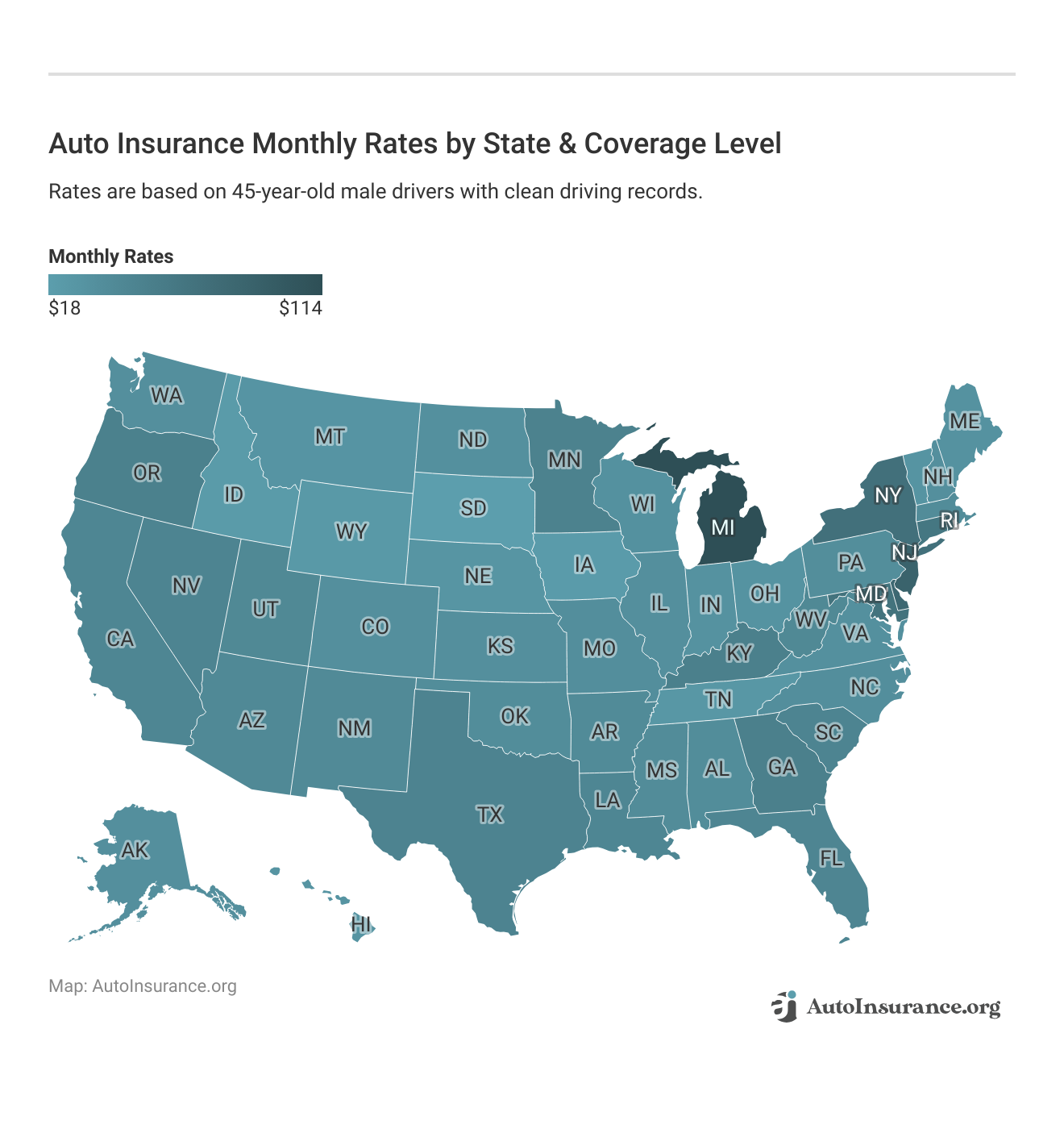

What is NGM Insurance Company’s availability by state?

National Grange Mutual is part of the Main Street Insurance Group and offers coverage in 37 states with notable presences in Arizona and Massachusetts among others.

Each region has tailored services to meet local legal requirements and consumer needs, ensuring that coverage and customer service are optimized for local policyholder populations.

NGM utilizes a network of local, independent agents who understand their communities’ needs, offering a personalized touch often missing from larger, more impersonal providers.. The group also offers surety and fidelity bonds in 47 states and the District of Columbia.

If you’re looking for an independent agent, they operate through six different regions: Northeast, New England, Mid-Atlantic, West, Southwest, and Southeast.

NGM and Main Street America prefer to utilize local, independent agents rather than corporate agents.

They do so because independent agents have the freedom to represent seven or eight different auto insurance carriers, giving them the flexibility to match the right insurance policy with each individual customer.

The company also believes in the value of personal, one-on-one relationships with agents, believing that they better facilitate the insurance process.

On the Main Street America website, the company provides a “find an agent” link. The link redirects your browser to a standard search page that allows you to find a local auto insurance agent based on your address.

For more information about these additional offices, you’re encouraged to contact the corporate headquarters using the information listed above. The NGM auto insurance phone number is 1-800-468-3466.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NGM Insurance Company Discounts Available

Generally, your discount options through your auto insurance company depend on what each provider has to offer, but many discounts are standard throughout the industry.

The table below shows some of the most common auto insurance discounts available, an estimate of how much money each can save you, as well as the major auto insurance companies that offer the discount.

Standard Auto Insurance Discounts Offered by Major Companies

| Discounts Offered | Average Savings | Available With |

|---|---|---|

| Low mileage/Low usage discount | Up to 20% | State Farm, Allstate, Travelers, Nationwide, Progressive |

| Defensive driving discount | 10%–15% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

| Safe driver discount | 10% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Military and federal employee discount | 8%–15% | Geico, Esurance, USAA |

| Good student discount | 5%–25% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Senior/Mature driver discount | 5%–10% | Geico, Allstate, Liberty Mutual, State National |

| Homeowner discount | 3% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

As you can see, it’s always a good idea to check with your insurance provider to see what types of discounts you may qualify for, as they can save you a lot of money on your auto insurance. NGM offers the following discounts:

Auto Insurance Discounts Offered by NGM

| NGM Auto Insurance Discounts Offered |

|---|

| Accident Prevention Course |

| Accident-Free |

| Anit-Theft |

| Coverage Level |

| Driver Training |

| Electronic Funds Transfer |

| Good Student |

| Loyalty |

| Mature Operator (65+) |

| Multi-Policy |

| Multi-Vehicle |

| New Customer |

| New Vehicle |

| Paid in Full |

| Student Away from School |

| Vehicle Safety |

| Violation-Free |

NGM also offers discounts for bundling your insurance policies.

Claims Processing and Support

NGM Insurance streamlines the claims process to ensure efficiency and ease for its policyholders. Customers can initiate claims through multiple channels, including a direct call to the NGM Insurance claims phone number or via an online platform, if available. The company promises prompt service and has invested in training its claims representatives to handle inquiries competently and compassionately.

Feedback suggests that while most claims are processed efficiently, enhancements in communication during the process could improve customer satisfaction significantly.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Financial Strength and Stability

With an A rating from A.M. Best, NGM Insurance is recognized for its financial stability and robust management practices. This rating is indicative of the company’s strong ability to meet its ongoing insurance obligations. The financial health of NGM is supported by solid asset management strategies and a consistent track record of financial performance, which reassures policyholders of the company’s reliability and longevity in the insurance market.

Frequently Asked Questions

Does NGM Insurance offer SR-22 insurance?

NGM Insurance Company, as part of the Main Street America Group, offers a variety of auto insurance options, but it is not explicitly stated whether they provide SR-22 insurance certificates. SR-22 is a form that is filed with a state’s DMV as proof of financial responsibility and is typically required for drivers who have had their driving privileges suspended due to incidents such as DUIs, other major traffic violations, or having been caught driving without insurance.

If you require an SR-22 and are considering NGM Insurance, it is advisable to contact them directly or speak with an insurance agent who can confirm whether NGM facilitates the filing of SR-22 forms. Their customer service team or your local insurance agent can provide specific details based on your state’s requirements and help you understand what options are available under NGM’s policies.

What kinds of questions should I be prepared for when purchasing my auto insurance policy?

When applying for auto insurance, you will need to provide personal information such as your full name, address, date of birth, and Social Security number to verify your identity and insurance history. You will also need to give details about your vehicle including its make, model, year, vehicle identification number (VIN), any safety features it has, and any modifications.

Your driving history is also crucial, so be prepared to discuss any past accidents, traffic violations, or claims. Insurers will ask about your current insurance coverage, including your provider and coverage levels, and if you’ve had any gaps in insurance.

They’ll also want to know how you use your vehicle—whether it’s for personal use, commuting, or business—and your annual mileage. Additionally, you’ll need to provide information about other drivers in your household or others who may frequently use your vehicle. Finally, discuss your specific coverage needs, such as liability, collision, and comprehensive coverage. Providing detailed and accurate information will ensure you receive the most accurate coverage and premium rate tailored to your situation.

Are there benefits to using an agent to purchase auto insurance?

Yes, using an agent to purchase auto insurance offers several benefits. An agent can provide personalized service, helping you to understand complex insurance terms and coverage options. They can compare policies from different insurers to find the best coverage at the most competitive rates.

Additionally, having a consistent point of contact can be helpful for addressing your concerns and modifying your policy as your needs change. Agents also assist in the claims process, making it smoother and less stressful. For those who value face-to-face interaction and expert guidance, using an insurance agent can enhance the insurance buying and management experience.

How does adding drivers to my auto insurance policy affect my rates?

Adding drivers to your auto insurance policy generally increases your premiums because the insurance company assumes that your vehicle will be used more frequently, which raises the likelihood of an accident. The impact on your rates also depends on the risk profile of the additional drivers. For instance, adding a teenager, who is considered high-risk due to their lack of driving experience, typically results in a significant premium increase. Conversely, adding a driver with a solid driving record might not affect your rates as dramatically.

Each driver’s age, driving history, and sometimes even credit score can influence the overall cost of your insurance policy.

Why would my provider cancel my auto insurance policy?

Your auto insurance provider may cancel your policy for several reasons. Common causes include having your driver’s license suspended or revoked, non-payment of premiums, or fraudulent activity during the application process, such as lying about your driving history.

Insurers might also choose not to renew your policy if they consider you a high-risk driver based on your claims history or traffic violations. Each of these factors increases the insurer’s risk, prompting them to potentially terminate the policy to avoid future claims.

Does NGM Insurance Company offer home and life insurance in addition to auto insurance?

Yes, NGM Insurance Company offers a range of insurance products, including auto, home, life, and other specialty insurance options.

What is the Better Business Bureau rating for NGM Insurance Company?

NGM Insurance Company has an A+ rating with the Better Business Bureau, indicating a high level of trustworthiness and customer satisfaction.

Can I make online payments for my NGM Insurance Company policy?

Yes, NGM Insurance Company provides online payment options through their website, including electronic funds transfer (EFT) for convenient and secure payments.

Can I bundle my auto insurance policy with other insurance policies from NGM Insurance Company?

Yes, NGM Insurance Company offers multi-policy discounts, allowing you to bundle your auto insurance policy with other insurance products they offer for potential cost savings.

Does NGM Insurance Company offer roadside assistance coverage?

Roadside assistance coverage is not mentioned in the provided content. For information regarding roadside assistance or any additional coverage options, it’s recommended to contact NGM Insurance Company directly or consult their policy documents.

What do reviews say about NGM Insurance Company?

How can I contact NGM Insurance for claims?

What types of insurance does NGM offer?

Is NGM Insurance available in my state?

What are NGM’s financial strength and AM Best ratings?

Can I manage my NGM Insurance policy online?

What is the of NGM Insurance Company address?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.