NYCM Auto Insurance Review for 2026 (See Rates & Discounts Here)

NYCM auto insurance review reveals the company’s competitive pricing, offering policies as low as $250 per month for qualifying drivers. With a focus on customer satisfaction and comprehensive coverage, the high NYCM insurance rating underscores its reputation for reliability and value in the industry.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated August 2025

This NYCM auto insurance review celebrates competitive pricing at NYCM Insurance Group alongside driver-concentrated perks.

With a monthly starting rate of $250, policyholders enjoy 24/7 claims service and a discount-in-safe-driver program, perfect for people with clean records.

NYCM Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claims Processing | 3.4 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 1.9 |

| Digital Experience | 4.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.0 |

| Policy Options | 2.8 |

| Savings Potential | 4.1 |

NYCM Insurance offers incredible value and flexible payment plans, making it a strong choice for those seeking the best New York auto insurance. However, coverage is only available in select states, and their quotes are consistently compared with other providers to help customers find the best option.

Now compare affordable NYCM auto insurance options by entering your ZIP code into our free rates comparison tool.

- NYCM offers rates starting at $250 for New York drivers

- New York Central car insurance provides safe driver discounts

- NYCM Insurance Group boasts personalized claims handling

Coverage Cost of NYCM Auto Insurance

NYCM auto insurance rates can determined by driving history, age, gender, and location. For example, a driver with a clean record may have an average premium of $250, while younger drivers or those with previous accidents may pay more.

NYCM Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $528 | $561 |

| 16-Year-Old Male | $630 | $669 |

| 18-Year-Old Female | $228 | $300 |

| 18-Year-Old Male | $247 | $325 |

| 25-Year-Old Female | $117 | $150 |

| 25-Year-Old Male | $122 | $156 |

| 30-Year-Old Female | $95 | $123 |

| 30-Year-Old Male | $95 | $123 |

| 45-Year-Old Female | $95 | $123 |

| 45-Year-Old Male | $95 | $123 |

| 60-Year-Old Female | $95 | $123 |

| 60-Year-Old Male | $95 | $123 |

| 65-Year-Old Female | $95 | $123 |

| 65-Year-Old Male | $95 | $123 |

When comparing NYCM rates to national averages, the company offers competitive premiums for New York residents but may differ from national providers in other states.

The cost of the best NYC, New York auto insurance can vary depending on your ZIP code and local risk factors, helping drivers make informed decisions when choosing coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nycm Insurance (New York Central Mutual) Insurance Coverage Options

NYCM offers the following types of auto insurance:

- Liability auto insurance. Pays for property damage and bodily injury to others if you cause an accident.

- Personal injury protection (PIP) coverage. It covers medical bills, rehabilitation costs, lost wages, and household care costs if you’re injured and unable to work after an accident.

- MedPay. It covers medical bills and rehabilitation costs if you’re injured in an accident.

- Uninsured motorist coverage (UIM). It helps cover injuries or property damage caused by another driver with no insurance, insufficient insurance, or a hit-and-run driver.

- Collision auto insurance. Pays for damages to your vehicle after a covered accident or collision.

- Comprehensive auto insurance. Pays for damages to your vehicle caused by falling objects, inclement weather, vandalism, fire, or theft.

Because New York is a no-fault insurance state, you must carry a minimum amount of PIP and UIM. Learn more about no-fault auto insurance and how it raises NY insurance rates.

On top of the standard coverage above, drivers can also buy these additional coverage options:

- Basic Economic Loss, Optional (OBEL). You are entitled to an NYCM payout for loss of income if you were hurt in a no-fault accident. The typical upper limit is $2,000 monthly for 36 months. However, the $50,000 maximum payment can be used before the 36 months.

- Supplemental uninsured motorist protection. The $25,000 per person and $50,000 per accident limits on New York’s uninsured motorist coverage are only valid within the state. Contact NY Mutual car insurance for supplemental uninsured motorist coverage for more information.

- Rental car reimbursement. NYCM sells auto insurance for rental cars if your vehicle is damaged and undergoing repairs. The business collaborates with Hertz and Enterprise. Call NYCM customer service at 800-234-6926 to learn more.

- Roadside assistance. NYCM offers roadside assistance coverage in three different tiers: Basic ($7 yearly), Choice ($10 annually), and Choice Plus ($15 annually). Although the tiers have varying restrictions, they offer locksmith services, flat tire repairs, battery jump starts, and emergency gasoline and liquid delivery.

If you add these coverages, your NYCM auto insurance rates will increase.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What You Should Know About Nycm Insurance

NYCM is a property and casualty insurance provider with over 800 employees based in the heart of New York. VanNess DeMar Robinson launched the business in 1899 and continues to offer the same exceptional security and service that NYCM Insurance was founded on more than a century ago.

NYCM’s management, now in its fifth generation, brings an in-depth understanding of New Yorkers’ needs and lifestyles. With its expertise and commitment to customer satisfaction, NYCM is one of the best auto insurance options after a DUI in New York.

A.M. Best Rating

NYCM Insurance is a top option for NY drivers as it received an overall “A” rating from A.M. Best.

Due to its lengthy history, broad product offering, and cooperation with independent insurance agents, NYCM Insurance has developed a strong reputation as a dependable and stable insurance provider.

Complaint Level

Of the top New York insurance giants, NYCM has the lowest NAIC ratio, at 0.32. The low number means fewer customer complaints.

Nycm Insurance Insurance Rates Breakdown

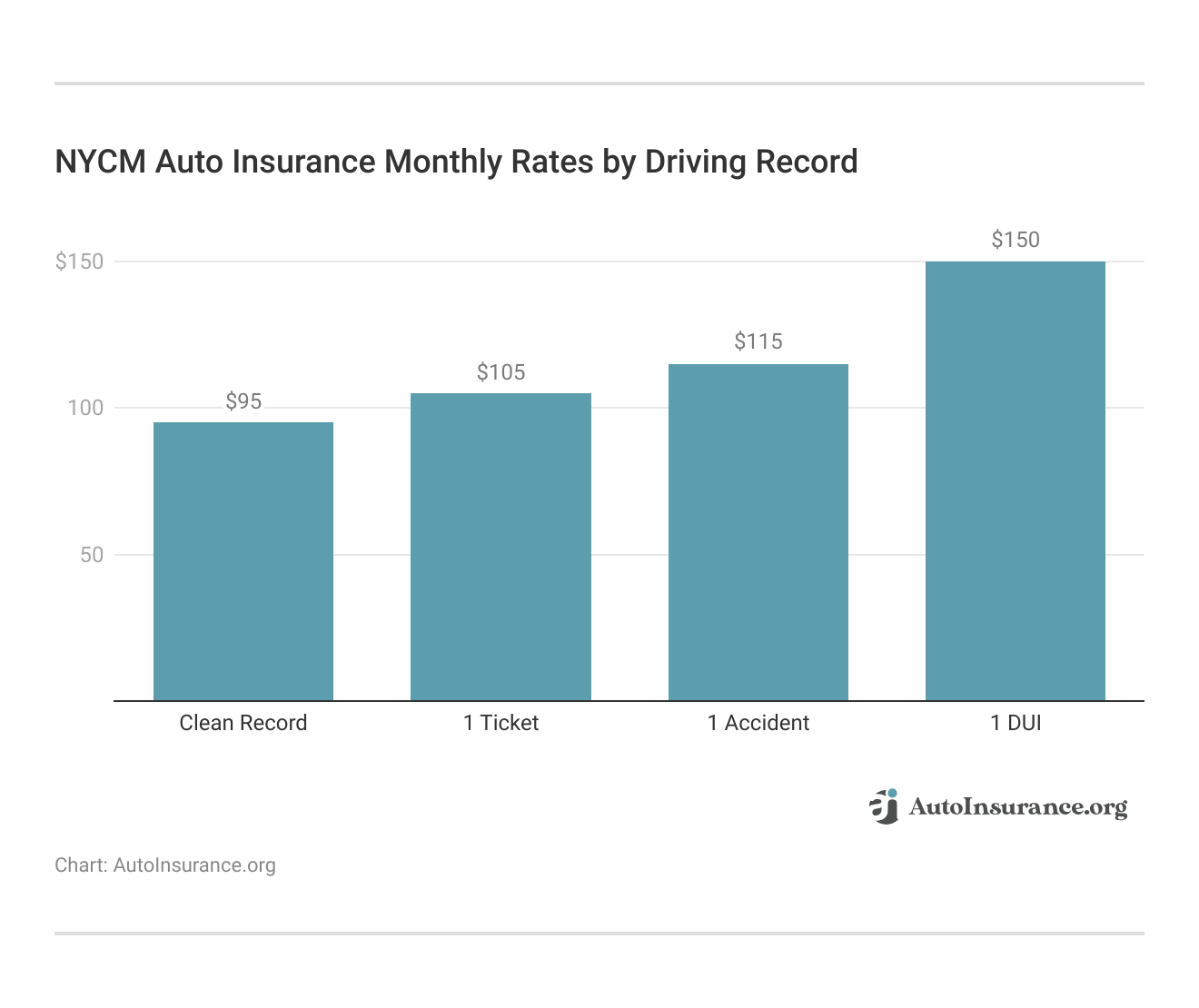

New York auto insurance rates are more expensive than average, at $250 per month. Fortunately, for a 40-year-old driver with a clean driving record, the average cost to insure with NYCM is around $225 monthly.

At $250 per month, NYCM auto insurance provides competitive rates, making it a smart option for budget-focused drivers seeking reliable coverage. Comparing these rates with other providers can help you make the most cost-effective decision for your needs.Dani Best Licensed Insurance Producer

This is more expensive than the national monthly average of $140 but cheaper than other companies in New York. For a driver with a speeding ticket conviction or at-fault accident, NYCM rates still exceed the national average by around 40% and 10%, respectively.

NYCM tends to price younger drivers added to an existing policy at 40% cheaper than the national average.

NYCM Rates Breakdown

Here’s how New York Central Mutual car insurance compares to its competitors:

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| U.S. Average | $45 | $119 |

As you can see, GEICO, State Farm, and Allstate edge out NYCM on price alone. However, NYCM has much higher customer satisfaction.

Nycm Insurance (New York Central Mutual) Discounts Available

NYCM offers customers extensive auto insurance discounts. Some examples include:

- Electronic Funds (EFT) Discount and Auto-Pay. Customers who pay with an automatic withdrawal from a chosen checking, savings, or credit card account may be eligible for up to a 2.5% electronic funds (EFT) discount, also known as an auto-pay discount.

- Driver Education Discount. Drivers under 21 who successfully complete a driver education course are eligible for the appropriate driving training discount.

- Student-Away-at-School Discount. This discount is available for students aged 24 or younger who are away at school at least 100 miles from where the vehicle is customarily garaged and don’t use it regularly.

- Accident Prevention and Defensive Driving. Earn a 10% discount after completing a course, which can be taken online at your own pace.

- Airbag/Automatic Passive Restraint. If your car has motorized safety belts and one or more airbags, you can save up to 30% on MedPay and Personal Injury Protection (PIP).

- Daytime Running Lamps. Earn up to 3% for this safety feature.

- Anti-Theft Systems. Earn up to 25% off for alarms, passive and active disabling devices, tracking transponders, and etched VIN in car windows.

- Coupler/Combination Discount. You can combine your renters or home insurance with your auto company to save as much as 20%.

- Home Ownership Discount. Earn 2.5% off for owning a home, mobile home, or condo.

- New Vehicle. Earn up to 30% off for a newly titled vehicle on an auto policy.

- Senior Discount. Policyholders 65 and older can earn up to 5% for having NYCM insurance for over five years.

- Good Student Discount. Students with transcripts proving a “B” average or higher may be eligible for a 10% discount.

- Paid-in-Full Discount. Earn up to 10% to pay your balance ahead of time.

Find out how many NYCM auto insurance discounts you qualify for to determine if the amount results in overall savings vs. the competition.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Reviews of NYCM Auto Insurance

The insurance group NYCM receives excellent ratings from rating agencies. It is one of the reputable companies. J.D. Power’s overall rating is 3.5 stars, meaning satisfactory customer satisfaction. The Better Business Bureau gives NYCM an A+ rating, thus showing a good record in practice.

NYCM Auto Insurance Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

| Not Available |

| Score: Score: 842 / 1,000 Avg. Satisfaction |

| Not Available |

Consumer Reports also gives NYCM 3.5/5, highlighting its reliability. NYCM holds a strong standing with the NAIC and A.M. Best, which rated it an A, showcasing its financial strength. These ratings are key to evaluating the trustworthiness and performance of the company’s types of auto insurance.

Pros and Cons of NYCM Auto Insurance

Pros:

- Affordable Rates: Group averages between $250 for a clean record holder.

- Diverse Discounts: Bundling policies and maintaining a good driving record will save the day.

- Financial Stability: A rating from A.M. Best is an A, which denotes excellent reliability.

Cons:

- Limited Availability: New York state citizens are the only people who get this coverage.

- Average Ratings: 3.5 starts on J.D. Power indicates room for services to rise. Delve into the specifics in our article “Best Auto Insurance Discounts.”

How Nycm Insurance Ranks Among Providers

Going off the price, NYCM is more expensive than most competitors. However, it boasts a phenomenal customer satisfaction rating, which may matter more to some consumers, according to NYCM insurance reviews.

NYCM Car Insurance Reviews

NYCM Auto Insurance is well-regarded for its commitment to providing quality insurance solutions tailored to New York residents. With a long history from 1899, NYCM (New York Central Mutual) has built a solid reputation for reliability and customer satisfaction. Numerous reviews highlight NYCM’s efficient customer service and competitive pricing, positioning it as a strong choice for New Yorkers seeking comprehensive auto insurance coverage.

New York Central Mutual Reviews and Ratings From Agencies

As an established insurance entity, NYCM has garnered respect in the insurance community, evidenced by its positive ratings from various agencies.

NYCM Experience/Bodily Injury Claim

byu/Anaksunamun23 inInsurance

An “A” rating from A.M. Best affirms the company’s financial stability and assures policyholders of its capability to handle claims effectively. Customers often note NYCM’s responsive customer service and the ease of the claims process, making it a trustworthy provider. Cheap, no-fault auto insurance also provides reliable coverage options that align with customers’ financial strength.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NYCM Is a Reliable Insurance Company

Evaluating NYCM’s performance and customer feedback, it’s clear that the company offers competitive options for the cheapest SR-22 insurance in New York. Its focus on local needs and extensive history in the state enables it to provide policies tailored to the unique aspects of living and driving in New York.

This local expertise contributes to NYCM’s reputation as a reliable insurer. To find affordable NYCM auto insurance, enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is the typical turnaround time for claims at NYCM Insurance?

NYCM Insurance customers can file a claim by phone at any time. The company also offers an excellent service that allows customers to select a convenient time for a callback after submitting a claim. New York Central Mutual Insurance reviews praise the company’s reliable customer support and quick response times, reinforcing its strong reputation.

How accessible is customer assistance at NYCM Insurance?

NYCM Insurance’s claims and customer care departments are available 24/7. The company’s strong social media presence on platforms like Facebook, Twitter, and LinkedIn helps customers connect more efficiently. New York Central insurance reviews frequently praise these communication options for their responsiveness and reliability.

What is the claims procedure at NYCM Insurance?

NYCM customers can submit claims anytime through various convenient methods. While the carrier’s website offers guidance on registering a claim, it does not provide specific details about the claims handling process, which is essential when learning how to check your auto insurance claims history.

Does NYCM Insurance deliver a user-friendly experience for customers?

Thanks to NYCM Insurance’s strong social media presence, NYCM Insurance provides an excellent, user-friendly experience overall. It offers several cutting-edge customer care choices, including online tools for finding an agent and getting a quote and 24/7 customer support hours. The carrier collaborates with independent insurance brokers to give its clients the best service possible.

What is NYCM Auto Insurance?

NYCM Auto Insurance is an insurance company that provides auto insurance coverage to individuals and families. It primarily operates in New York State and caters to the insurance needs of residents in that region.

Is NYCM Auto Insurance a reputable company?

NYCM auto insurance is generally considered a reputable company and is often listed among the best auto insurance companies for paying claims. Serving customers in New York State for several years, they have earned a solid reputation in the industry. Research customer reviews for more insight into their claims process and service quality.

What types of coverage does NYCM Auto Insurance offer?

NYCM Auto Insurance offers various types of auto insurance coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. They also provide optional coverage options and endorsements that you can choose to customize your policy further.

How can I get a quote from NYCM Auto Insurance?

To obtain a quote from NYCM Auto Insurance, visit their official website or contact customer service directly. On their website, you may find a quote form where you can provide the necessary information about your vehicle, driving history, and coverage requirements to receive an estimate. Alternatively, you can call their customer service department for assistance.

How is NYCM Auto Insurance customer service?

NYCM Auto Insurance aims to provide strong customer service with a responsive team that effectively handles inquiries, concerns, and claims. However, experiences can vary, so it’s helpful to read reviews and evaluate how their service compares to other auto insurance companies with the best customer service before deciding.

Who owns NYCM?

NYCM, or New York Central Mutual Insurance, operates as a mutual insurance company, meaning it is owned by its policyholders rather than private investors or shareholders.

What states does NYCM cover?

Can I manage my NYCM Auto Insurance policy online?

What is NYCM Insurance Company’s revenue?

Who is the CEO of NYCM?

Who owns New York Central Mutual Insurance?

What is the phone number for NYCM billing?

What does NYCM insurance stand for?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.