Shelter Auto Insurance Review for 2026 (See Actual Rates)

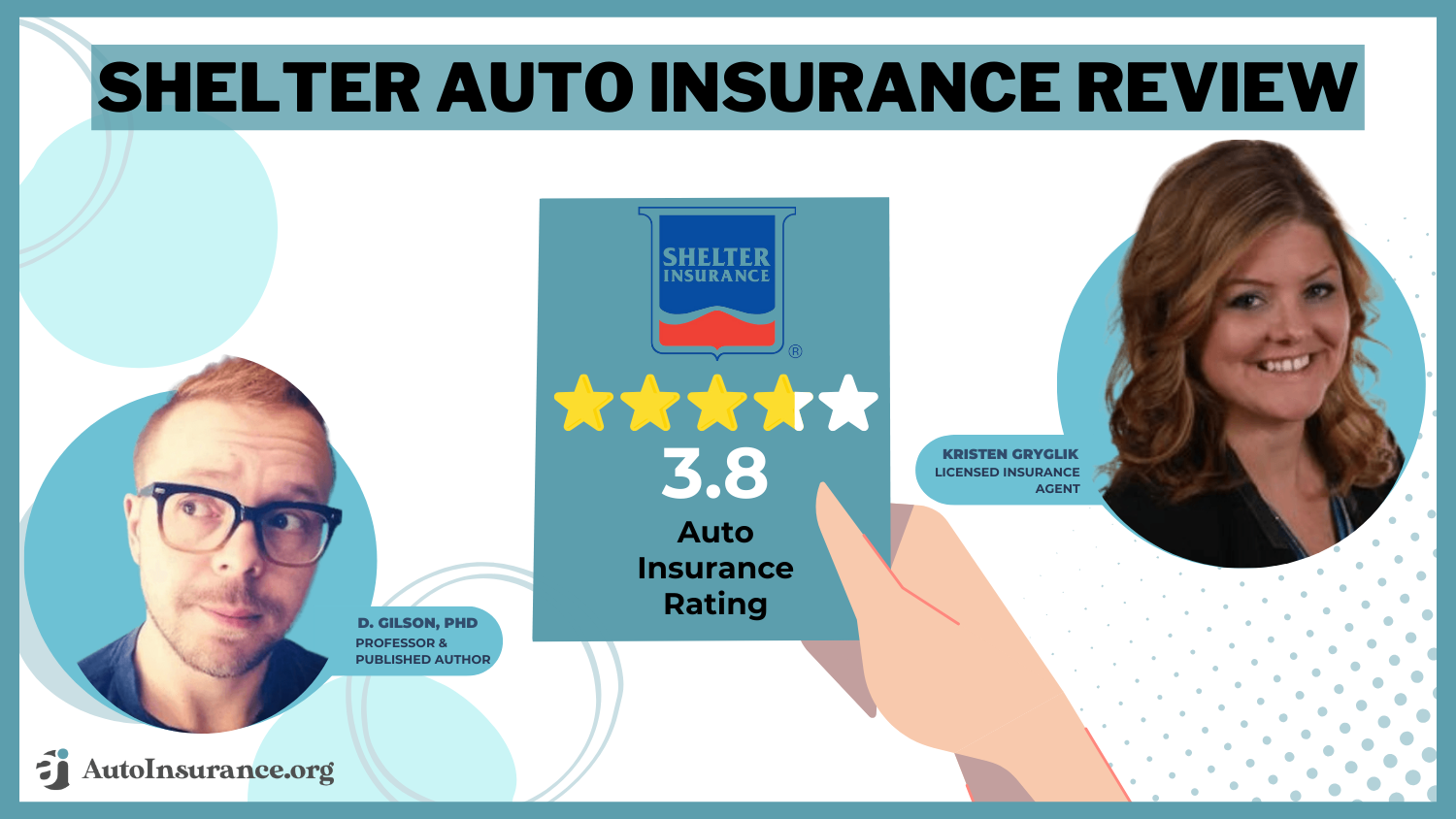

Our Shelter auto insurance review found that the company sells various car insurance coverages and has strong industry ratings. However, its rates are more expensive than some competitors, and it doesn't sell in all states. Shelter's minimum auto insurance rates for good drivers start at $44/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated December 2024

Our Shelter auto insurance review found that Shelter Insurance offers various products and discounts to its customers.

However, car insurance rates with Shelter Insurance are relatively expensive, and auto insurance coverage is only available in 15 states in the U.S.

Still, Shelter auto insurance ratings for customer satisfaction and financial strength suggest it’s a good option for anyone searching for car insurance.

Shelter Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.1 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.0 |

| Policy Options | 3.1 |

| Savings Potential | 4.4 |

Before you commit to Shelter, however, read our Shelter review and get multiple auto insurance quotes to get a good idea of what works best for you. Compare rates now by entering your ZIP in our free quote tool.

Shelter Auto Insurance Rates

Like all companies, Shelter car insurance rates will vary based on the factors that affect auto insurance rates, such as age, gender, coverage level, and more. See below what different ages and genders pay for minimum versus full coverage at Shelter Insurance company.

Shelter Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $275 | $625 |

| Age: 16 Male | $325 | $675 |

| Age: 18 Female | $250 | $565 |

| Age: 18 Male | $295 | $615 |

| Age: 25 Female | $140 | $285 |

| Age: 25 Male | $160 | $310 |

| Age: 30 Female | $115 | $260 |

| Age: 30 Male | $125 | $270 |

| Age: 45 Female | $50 | $150 |

| Age: 45 Male | $44 | $141 |

| Age: 60 Female | $73 | $180 |

| Age: 60 Male | $75 | $190 |

| Age: 65 Female | $65 | $170 |

| Age: 65 Male | $70 | $178 |

While young drivers have the most expensive rates at Shelter, bear in mind that these rates are for teenagers buying their own Shelter car insurance policies. Rates at Shelter will be more affordable for teenagers who join their parent’s Shelter policy.

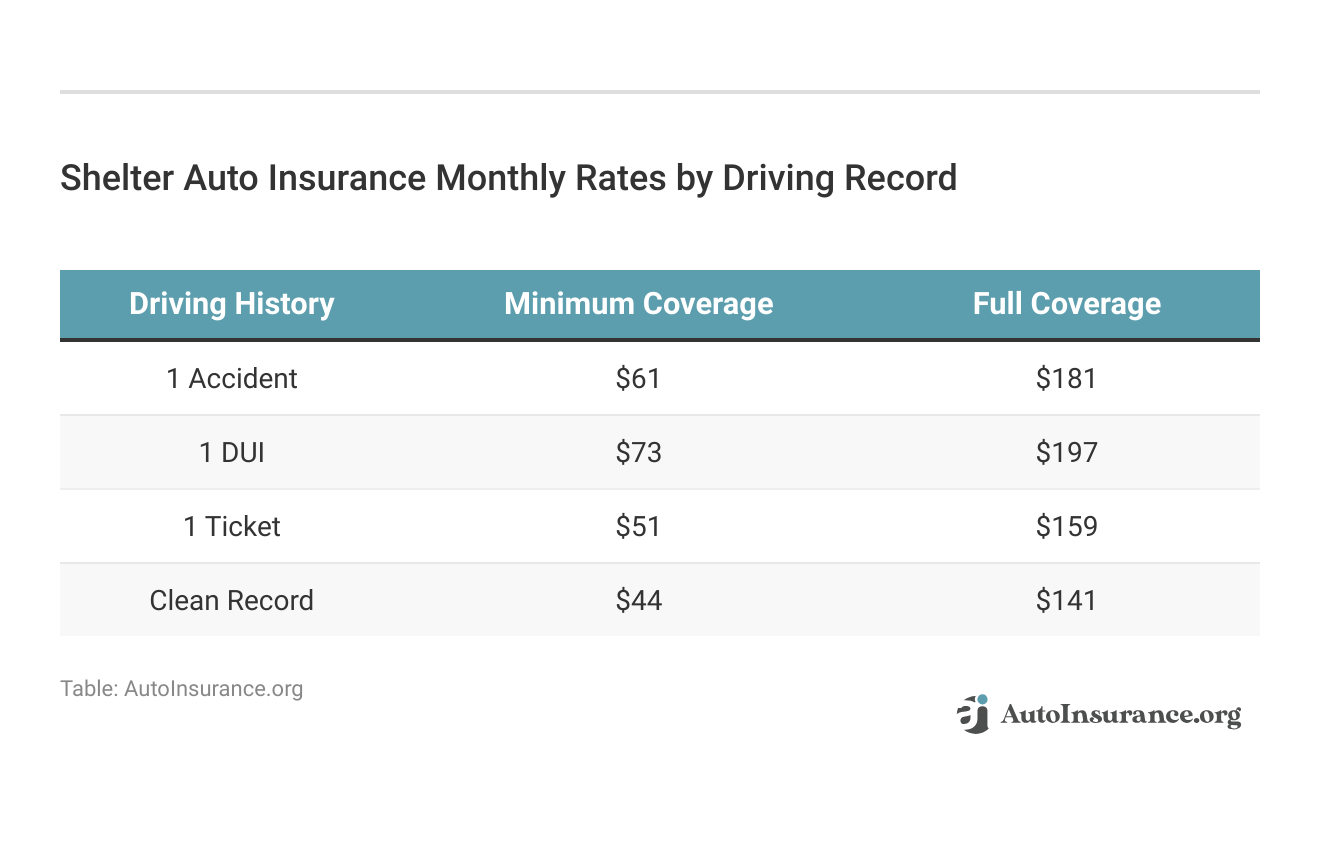

In addition to age and gender, drivers will have different rates based on their driving record. See what Shelter charges on average for different driving infractions.

DUI charges will raise rates the most at Shelter, but a ticket won’t increase customer’s auto insurance rates too much. If you see Shelter Insurance rate increases on your policy after a driver infraction, make sure you compare quotes from multiple companies to find the best deal.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Shelter Auto Insurance Rates to Top Providers

Now that we’ve covered auto insurance rates at Shelter, let’s compare with the top insurers in the country. First, take a look at how Shelter insurance rates compare to top companies based on age and gender.

Shelter Full Coverage Auto Insurance Monthly Rates vs. Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $104 | $105 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $120 | $128 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $465 | $535 | $172 | $180 | $160 | $159 | $148 | $150 |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

Shelters’ rates aren’t the cheapest for some drivers ages, such as teens, but they aren’t the most expensive either. Shelter’s rates based on driving records are also similar to its rates for different genders and ages, with it being a middle-cost company for most drivers.

See rates from the top insurance companies compared to Shelters’ auto insurance rates below.

Shelter Full Coverage Auto Insurance Monthly Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $120 | $165 | $225 | $145 |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

Shelter’s rates for people with speeding tickets, new or teen drivers, and people who are at fault in a car accident are higher than most companies. Shelter insurance rates increase for drivers involved in an accident. So, auto insurance rates will be higher than the national average with Shelter Insurance Company.

If you have a DUI on your record, you’ll definitely pay more for insurance (Read More: Cheap Auto Insurance After a DUI). You could even have a hard time finding an auto insurance company willing to offer you coverage, as you’ll have to pay for high-risk auto insurance.

Before committing to Shelter car insurance, or any other company, compare quotes online to find a company offering the coverage you want at a price that works with your budget.

Shelter Mutual Insurance Company Insurance Coverage Options

When it comes to car insurance, it’s nice to have options. With Shelter, you can choose various coverage options to find the best policy to suit your needs.

Shelter’s auto insurance coverages for customers include:

Shelter Auto Insurance Coverage List

| Coverage Type | What it Covers |

|---|---|

| Collision | Covers vehicle damage from a collision, regardless of fault |

| Comprehensive | Covers non-collision damage like theft, vandalism, or fire |

| Gap Insurance | Covers the gap between car value and loan if totaled |

| Liability | Covers injuries and property damage if you're at fault |

| Medical Payments | Covers medical expenses, regardless of fault |

| New Car Replacement | Replaces your vehicle if totaled within 1 year or 15k miles |

| Personal Injury Protection (PIP) | Covers medical, wage, and injury costs, regardless of fault |

| Rental Reimbursement | Covers the cost of a rental car while your vehicle is repaired |

| Roadside Assistance | Offers services like towing, tire changes, and jump-starts |

| Uninsured/Underinsured Motorist | Protects you in accidents with UI/IM |

With so many coverage options, it makes sense that many online Shelter car insurance reviews mention the customizable nature of the company’s policies. Not sure how much auto insurance you should be carrying?

You’ll need at least liability coverage that meets the minimum auto insurance requirements in your state, and if your vehicle is leased, you’ll also need collision insurance.

Most drivers should carry full coverage on their vehicles unless the vehicle is significantly older and depreciated in value.Brandon Frady Licensed Insurance Producer

Depending on your particular needs, you may also want to add on a few optional auto insurance coverages, such as roadside assistance coverage.

Other Types of Insurance From Shelter

In addition to auto insurance, Shelter offers the following insurance products to customers:

- Motorcycle, RV, ATV, and Boat Insurance

- Renters Insurance

- Farm Insurance

- Flood, Personal Articles & Umbrella Insurance

- Business Insurance

When comparing Shelter Insurance vs. State Farm or other well-known companies, Shelter doesn’t offer as many insurance products. However, for a small company operating in just 15 states, Shelter has plenty of options for its customers.

Shelter Mutual Insurance Company Discounts Available

Because Shelter’s auto insurance rates are more expensive, you’ll want to take advantage of the discounts Shelter offers to clients. Shelter offers several auto insurance discounts to its policyholders, including:

Shelter Auto Insurance Discounts

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Anti-Theft Device | 15% | Get a discount for having an anti-theft device installed in your vehicle |

| Claims-Free | 10% | Receive a discount if you haven’t filed a claim within a certain number of years |

| Defensive Driving | 10% | Complete an approved defensive driving course to qualify for this discount |

| Good Student | 10% | Students with a B average or higher qualify for a discount |

| Homeowner | 10% | Homeowners can receive a discount on their auto insurance premium |

| Multi-Car | 15% | Insure more than one vehicle under the same policy to receive a discount |

| Multi-Policy | 25% | Save by bundling auto insurance with home or renters insurance |

| New Car | 15% | Get a discount for insuring a vehicle that is less than three years old |

| Pay-In-Full | 10% | Pay your entire premium upfront to receive a discount |

| Safe Driver | 20% | Receive a discount for maintaining a clean driving record over a specific period |

Discounts can save people up to 25% on a car insurance policy, so check with a Shelter insurance customer service representative to see how much you could save on coverage. Some of the discounts you will have to apply for, such as the good student discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shelter Auto Insurance Customer Reviews

Shelter Insurance customer reviews show it has few complaints relative to the company’s size. However, this isn’t to say there isn’t negative feedback from drivers on sites like Reddit.

Reddit has complaints from non-customers working with Shelter to get their at-fault claim payout, and Shelter Insurance claims reviews also show some customers weren’t completely satisfied with customer service.

Read More: Auto Insurance Companies With the Best Customer Service

Checking customer reviews is a great way to see what consumers think of a company. If you know someone who has shelter insurance, such as family or a friend, you can also ask if they would recommend Shelter.

Shelter Auto Insurance Ratings

In addition to customer reviews, checking what reputable businesses are saying about Shelter will give you insight into the company’s financial strength, consumer complaints, and more. For example, Consumer Reports rated Shelter as decent after reviewing the company (Learn More: Best Auto Insurance Companies According to Consumer Reports).

See what other reputable rating sites are saying about Shelter Insurance below.

Shelter Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Claims Resolution |

|

| Score: 0.85 Fewer Complaints |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: A Excellent Financial Strength |

Shelter Insurance ratings are great. Shelter Insurance’s A.M. Best rating is A (excellent) in terms of financial strength. Shelter insurance reviews from the BBB also reveal that the company boasts an A+ rating, though the BBB website lists several Shelter insurance complaints from customers.

Based on information from the National Association of Insurance Commissioners, Shelter Insurance insurance reviews are encouraging to anyone considering the company as an insurance provider.

Shelter Auto Insurance Pros and Cons

Shelter auto insurance has a few pros that attract customers to purchase its auto insurance policies, such as:

- Customizable Policies: Shelter customers can choose their coverage amounts, auto insurance deductibles, and more for a customized policy.

- Discount Options: Shelter has multiple discounts to help its consumers safe for safe driving and more.

- Business Ratings: Shelter has strong financial stability ratings and fewer consumer complaints than average.

However, Shelter may not be right for all auto insurance customers. The main cons of Shelter Insurance are:

- Availability: Shelter is not sold in every state, so customers will have to switch providers if they move out of the network.

- Higher Rates: Shelter is not the cheapest auto insurance company on the market for most drivers.

Every driver has different auto insurance needs, so while Shelter may be great for one driver, it could not be ideal for another. Considering the pros and cons of Shelter will help drivers determine if It is the right fit for them.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Shelter Auto Insurance is Right for You

If you’re searching for the best auto insurance companies in your area, you may want to consider Shelter Insurance. Shelter offers car insurance coverage options that people can adapt to meet their needs. The company also provides discounts to its policyholders to help them save on coverage.

Unfortunately, Shelter Insurance is only available in 15 states in the U.S. Shopping for Shelter insurance online and compare quotes from other companies with Shelter auto insurance quotes to see who can offer you the best price.

Ready to find the best auto insurance deal in your area? Enter your ZIP into our free quote comparison tool to get several affordable quotes.

Frequently Asked Questions

What states does Shelter insurance cover?

Shelter Insurance is a Missouri-based company. The company offers insurance products in the following states: Arkansas, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, Nevada, Ohio, Oklahoma, and Tennessee. If you don’t live in one of the states above, you’ll have to look elsewhere for car insurance coverage.

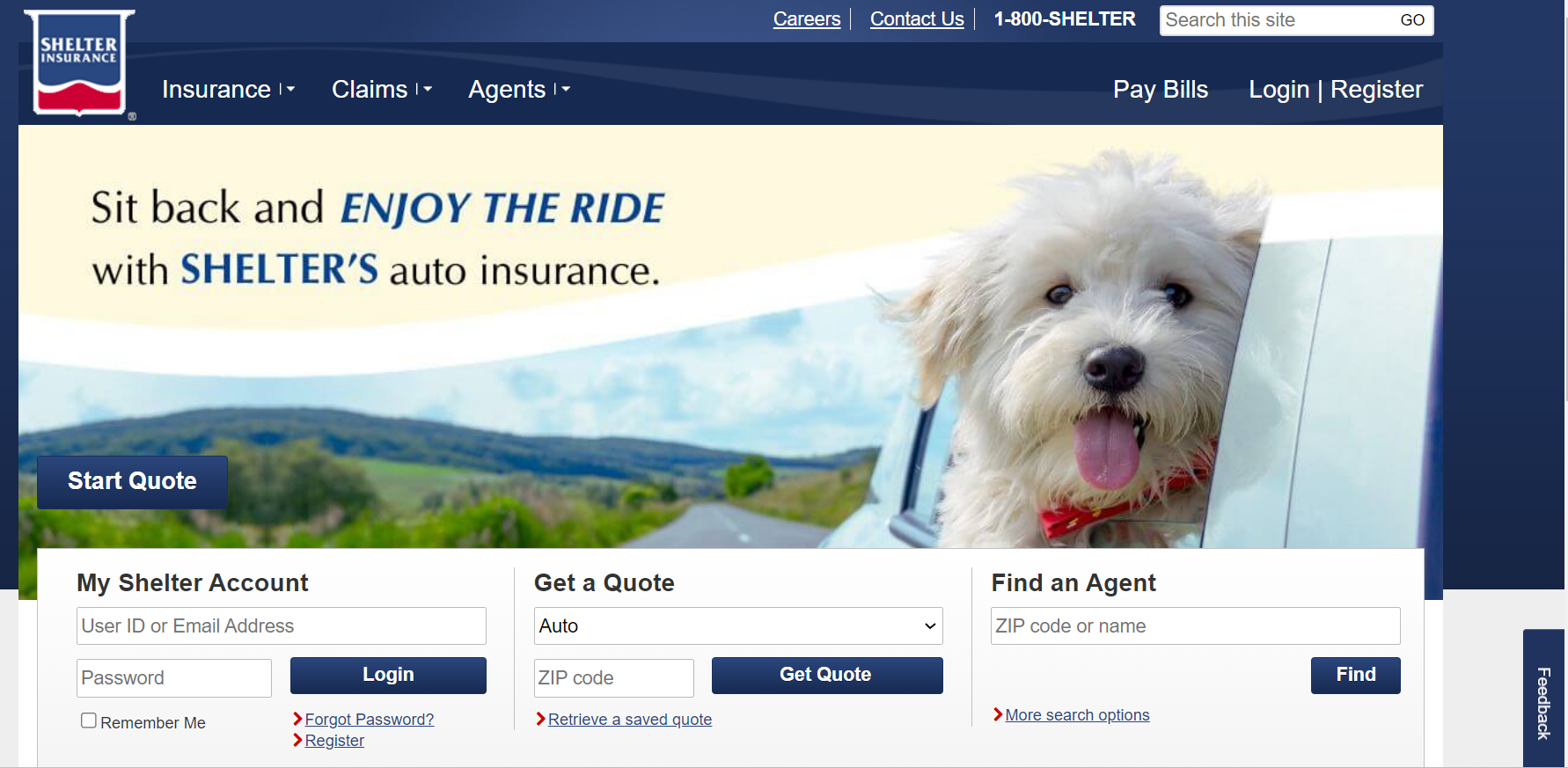

How can I get a Shelter insurance quote?

You can find Shelter Insurance auto quotes on the company’s website and over the phone. If Shelter Insurance isn’t available in your state, find an affordable company by comparing quotes. Get started by using our free quote comparison tool today.

How can I file Shelter insurance claims?

You can use Shelter’s company website to file a car insurance claim or call Shelter insurance claims department to speak with a representative (Learn More: How to File an Auto Insurance Claim).

What is Shelter Insurance?

Shelter Auto Insurance is a type of insurance coverage that protects individuals and their vehicles against financial loss in the event of an accident, theft, or damage. It is offered by Shelter Insurance, a reputable insurance company.

What types of auto insurance coverage does Shelter offer?

Shelter Auto Insurance provides various types of coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Shelter also offer optional add-ons such as roadside assistance and rental car reimbursement.

What factors affect the cost of Shelter Auto Insurance?

The cost of Shelter Auto Insurance depends on various factors such as your age, location, driving record, type of vehicle, coverage options, and deductible amount. Additionally, your credit scores may also affect auto insurance rates.

Does Shelter insurance cover windshield replacement?

Yes, Shelter covers windshield replacement if you have comprehensive coverage on your auto insurance policy.

Where is Shelter Insurance headquarters address?

Shelter Insurance’s headquarters is located at 1817 West Broadway, Columbia, Missouri, 65218.

Does Shelter insurance have health insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

How is Shelter insurance rated?

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Shelter Insurance is a Missouri-based company. The company offers insurance products in the following states: Arkansas, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, Nevada, Ohio, Oklahoma, and Tennessee. If you don’t live in one of the states above, you’ll have to look elsewhere for car insurance coverage.

You can find Shelter Insurance auto quotes on the company’s website and over the phone. If Shelter Insurance isn’t available in your state, find an affordable company by comparing quotes. Get started by using our free quote comparison tool today.

How can I file Shelter insurance claims?

You can use Shelter’s company website to file a car insurance claim or call Shelter insurance claims department to speak with a representative (Learn More: How to File an Auto Insurance Claim).

What is Shelter Insurance?

Shelter Auto Insurance is a type of insurance coverage that protects individuals and their vehicles against financial loss in the event of an accident, theft, or damage. It is offered by Shelter Insurance, a reputable insurance company.

What types of auto insurance coverage does Shelter offer?

Shelter Auto Insurance provides various types of coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Shelter also offer optional add-ons such as roadside assistance and rental car reimbursement.

What factors affect the cost of Shelter Auto Insurance?

The cost of Shelter Auto Insurance depends on various factors such as your age, location, driving record, type of vehicle, coverage options, and deductible amount. Additionally, your credit scores may also affect auto insurance rates.

Does Shelter insurance cover windshield replacement?

Yes, Shelter covers windshield replacement if you have comprehensive coverage on your auto insurance policy.

Where is Shelter Insurance headquarters address?

Shelter Insurance’s headquarters is located at 1817 West Broadway, Columbia, Missouri, 65218.

Does Shelter insurance have health insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

How is Shelter insurance rated?

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

You can use Shelter’s company website to file a car insurance claim or call Shelter insurance claims department to speak with a representative (Learn More: How to File an Auto Insurance Claim).

Shelter Auto Insurance is a type of insurance coverage that protects individuals and their vehicles against financial loss in the event of an accident, theft, or damage. It is offered by Shelter Insurance, a reputable insurance company.

What types of auto insurance coverage does Shelter offer?

Shelter Auto Insurance provides various types of coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Shelter also offer optional add-ons such as roadside assistance and rental car reimbursement.

What factors affect the cost of Shelter Auto Insurance?

The cost of Shelter Auto Insurance depends on various factors such as your age, location, driving record, type of vehicle, coverage options, and deductible amount. Additionally, your credit scores may also affect auto insurance rates.

Does Shelter insurance cover windshield replacement?

Yes, Shelter covers windshield replacement if you have comprehensive coverage on your auto insurance policy.

Where is Shelter Insurance headquarters address?

Shelter Insurance’s headquarters is located at 1817 West Broadway, Columbia, Missouri, 65218.

Does Shelter insurance have health insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

How is Shelter insurance rated?

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Shelter Auto Insurance provides various types of coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Shelter also offer optional add-ons such as roadside assistance and rental car reimbursement.

The cost of Shelter Auto Insurance depends on various factors such as your age, location, driving record, type of vehicle, coverage options, and deductible amount. Additionally, your credit scores may also affect auto insurance rates.

Does Shelter insurance cover windshield replacement?

Yes, Shelter covers windshield replacement if you have comprehensive coverage on your auto insurance policy.

Where is Shelter Insurance headquarters address?

Shelter Insurance’s headquarters is located at 1817 West Broadway, Columbia, Missouri, 65218.

Does Shelter insurance have health insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

How is Shelter insurance rated?

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Yes, Shelter covers windshield replacement if you have comprehensive coverage on your auto insurance policy.

Shelter Insurance’s headquarters is located at 1817 West Broadway, Columbia, Missouri, 65218.

Does Shelter insurance have health insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

How is Shelter insurance rated?

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Shelter Insurance does not offer health insurance. However, you can find Shelter life insurance, home, and business insurance. Home insurance can be bundled with auto insurance to help you save on your Shelter insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

Shelter auto insurance ratings from major insurance rating agencies like A.M. Best or Standard & Poor’s are positive. The company has received an A.M. Best rating of A.

How to cancel Shelter insurance?

Does Shelter insurance cover rental cars?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Is Shelter auto insurance legit?

Is Shelter insurance good?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Is Shelter insurance expensive?

Does Shelter offer motorcycle insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Does Shelter insurance has towing coverage?

Does Shelter has commercial truck insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

What’s Shelter insurance claims phone number?

Do Shelter insurance policies include grace period?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Shelter provide renters insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.