State Farm Auto Insurance Review for 2026 (+Actual Rates)

Our State Farm auto insurance review shows it as the best overall for affordable, high-quality coverage. With an average rate of $33/month, it's an excellent option for most drivers. Exceptional customer service makes State Farm one of the top choices for auto insurance, as highlighted by reviews.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

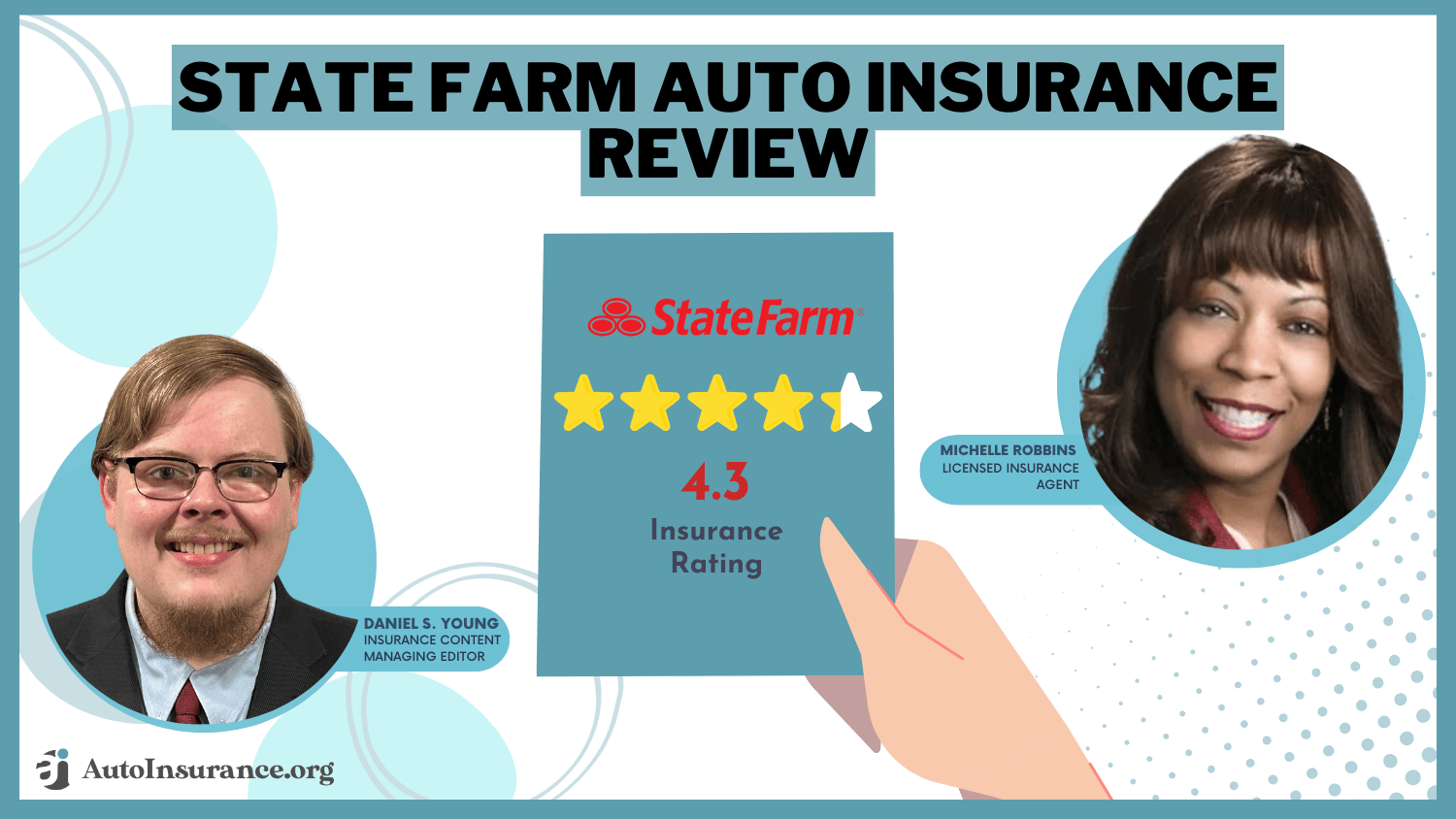

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated December 2024

Our State Farm auto insurance review lists the best rates for high-quality coverage. It offers some of the cheapest premiums, with an average monthly cost of around $33, and excellent customer service.

With a comprehensive list of policy options, including low-cost plans for those needing state-minimum coverage. This option has a robust claims process and outstanding customer satisfaction. Elevate your knowledge with our “Comparing Insurance Providers.”

State Farm Auto Insurance Rating

Rating Criteria ![]()

Overall Score 4.3

Business Reviews 5.0

Claim Processing 4.3

Company Reputation 4.5

Coverage Availability 5.0

Coverage Value 4.2

Customer Satisfaction 4.1

Digital Experience 4.5

Discounts Available 5.0

Insurance Cost 3.9

Plan Personalization 4.5

Policy Options 3.8

Savings Potential 4.3

The review encapsulates crucial aspects ranging from rates to the customer experience, serving you with the best pocket-friendly bargain. Start saving on auto insurance by entering your ZIP code and comparing quotes.

- Our State Farm auto insurance review highlights its affordable $33/month rates

- State Farm excels in customer service and claims satisfaction for policyholders

- Comprehensive coverage options make State Farm a top pick for reliable insurance

State Farm Average Cost vs. Competitors

State Farm’s average car insurance price is usually around the same or slightly higher than that of other leading insurers. On the other hand, drivers with a high-risk profile may get lower quotes from alternative insurers.

State Farm vs. Competitors: Minimum Coverage Auto Insurance Monthly Rates

| Insurance Company | Monthly Rates |

|---|---|

| $33 | |

| $61 | |

| $44 | |

| $53 | |

| $30 | |

| $68 |

| $44 |

| $39 | |

| $37 |

The cost breakdown validates this, confirming that State Farm has some of the best rates overall (for families and young drivers) so long as you have a decent driving record. Read further about our “AAA vs. State Farm Auto Insurance.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Auto Insurance Coverage

Price is a significant factor when shopping for auto insurance companies. The above rates may vary depending on age, location, and coverage level; State Farm’s average monthly premium is a competitive option for many drivers.

State Farm stands out with its dependable coverage, affordable premiums, and strong customer support, earning its spot as a leading auto insurance provider.Tracey L. Wells Licensed Insurance Agent & Agency Owner

State Farm is a customer service-based company with generally competitive rates for safe drivers and those in high-risk categories.

State Farm’s mix-and-match plans offer different price options for people who want to save a little money but still get good coverage. Learn more about our “Largest Auto Insurance Companies in the U.S.” for a broader perspective.

State Farm Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

State Farm offers reasonable car insurance rates for good drivers, which depend on age, gender, and the type of coverage. Rates drop quite a bit for those 25 and older but expect a premium to be higher if you’re under that cutoff.

State Farm Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $124 $311

Age: 16 Male $146 $349

Age: 18 Female $101 $229

Age: 18 Male $125 $284

Age: 25 Female $39 $102

Age: 25 Male $42 $111

Age: 30 Female $36 $101

Age: 30 Male $40 $103

Age: 45 Female $34 $94

Age: 45 Male $33 $86

Age: 60 Female $30 $76

Age: 60 Male $31 $77

Age: 65 Female $35 $85

Age: 65 Male $32 $84

State Farm prices for experienced drivers are very favorable. Costs go down with age and decrease between genders. Costly premiums are a common challenge for young drivers, but Alaska minimum coverage insurance can make them more manageable. Access the complete picture in our “Auto Insurance for Men vs. Women.”

State Farm Auto Insurance Rates by Driving Record

Your driving record contains details about your past, including speeding tickets, accidents, and DUIs. How infractions like speeding tickets affect your auto insurance varies depending on how long your record clears. However, the average time a violation affects your insurance is about three years.

State Farm Auto Insurance Monthly Rates by Driving Record

| Driving History | Minimum Coverage | Full Coverage |

|---|---|---|

| 1 Accident | $51 | $130 |

| 1 DUI | $65 | $165 |

| 1 Ticket | $44 | $115 |

| Clean Record | $33 | $86 |

State Farm offers affordable insurance for people with imperfect driving records. Compare State Farm’s rates with those of other companies below. Explore our “American Family vs. State Farm Auto Insurance.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Coverage Options

It is a versatile choice for many drivers because State Farm offers many coverage options to meet customers’ needs in all circumstances. These options include:

- Bodily Injury and Property Damaged Liability Coverage: The benefit includes Band-Aids and sheetrock repair for accidents with the insured at fault.

- Comprehensive and Collision: Covers other damage to the insured vehicle when caused by theft, vandalism, or an accident comprised of initiating a wreck.

- Personal Injury Protection (PIP): This type of no-fault insurance covers medical expenses for injuries sustained regardless of who was at fault.

- Uninsured/Underinsured Motorist Coverage: This covers you against accidents caused by drivers with little or no insurance.

- Rental Car Reimbursement and Roadside Assistance: Bonus coverage offers more ways to keep the insured vehicle on the road even when in repair.

This flexibility is beneficial, as you can choose a plan that best aligns with your lifestyle and needs. Whether you are looking for comprehensive coverage or a more basic option, you can tailor your insurance to your specific circumstances.

This adaptability allows you to prioritize essential features, ensuring you only pay for what you truly require. Additionally, it can lead to significant savings while providing peace of mind, knowing you have the right coverage for your unique situation. Check out our “Best Non-Standard Insurance Companies.”

State Farm Available Discounts

State Farm provides a range of discounts to help reduce the overall cost of coverage. Key discounts include:

- Safe Driver Discount: For drivers with a clean record.

- Multi-Car and Multi-Policy Discounts: Savings for insuring multiple vehicles or bundling other policies (home, renters, life).

- Good Student Discount: Available to young drivers with strong academic records.

- Steer Clear Program: Aimed at young or inexperienced drivers who complete State Farm’s safe driving program.

- Drive Safe & Save Program: Usage-based discount that monitors driving habits to reward safe behavior.

These discounts appeal to those looking to save, especially students, families, and policyholders who maintain multiple policies with State Farm. Find out more by reading our “Best State Farm Auto Insurance Discounts.”

State Farm Customer Reviews

Most policyholders describing the company positively note its customer service, reasonably easy claims process, and diverse range of coverage.

State Farm Insurance Policy Review – request by Agent

byu/1rightwinger inInsurance

State Farm is a customer service standout, nearly consistently ranking high in J.D. Power claims satisfaction among insurers that cut through consumer complaint data.

However, some users said it could improve its digital tools and mobile app offering. Its endurance-based customer care and support philosophy across its lifecycle resonates with customers, as evidenced by solid repeat purchases. Unlock additional information in our “Popular Auto Insurance Companies.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Business Review

State Farm is one of the largest auto insurance companies in the U.S., so it has a solid financial rating and some stability. It is widely recognized for its high economic strength, as reflected in its stable credit ratings, including an A++ rating from A.M. Best.

State Farm is hard to beat for reliable insurance, offering comprehensive coverage and exceptional customer service at just $33 per month, making it an excellent value for drivers.Michelle Robbins Licensed Insurance Agent

The company has the largest network of local agents in the U.S., making it easy for customers to receive personalized service anywhere.

State Farm Insurance Rating

| Agency | |

|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 0.78 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

State Farm also shows a strog affinity for corporate social responsibility and community engagement, which positively adds to its brand image. Access supplementary details in our “State Farm Drive Safe and Save Review.”

State Farm Pros and Cons

State Farm offers competitive rates, flexible coverage, and discounts like Drive Safe & Save, ideal for safe drivers and families. While highly rated in claims and stability, it may cost more for high-risk drivers and has limited digital tools.

Pros

- Competitive rates for safe drivers and families

- Wide range of coverage options and policy flexibility

- Numerous discounts, including Drive Safe & Save and Good Student Discount

- High customer satisfaction with claims handling

- Financial solid stability and A++ rating from A.M. Best

Cons

- Higher rates for high-risk drivers

- Limited digital tools compared to some competitors

- Discount availability may vary by location

State Farm provides competitive rates and extensive coverage options, making it a top choice for safe drivers and families. Enhance your comprehension with our “Auto Insurance Rates for Married vs. Single Drivers.”

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What You Should Know About State Farm Insurance

As this State Farm auto insurance review has shown by all these pros and cons, the company provides an excellent service to customers that is reliable.

State Farm is still among the best-priced auto insurance companies in all 50 states and DC. It offers competitive rates overall, but especially for safe drivers, and it provides a considerable menu of coverage options plus a long list of discounts.

Although it’s not the cheapest option for high-risk drivers, State Farm is reliable for most other drivers because of its customer satisfaction and financial strength. Discover what lies beyond our “Best Auto Insurance Companies According to Reddit.” Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Frequently Asked Questions

Is State Farm insurance good for auto coverage?

Yes, State Farm is widely regarded for its reliable auto coverage and customer service. Expand your understanding with our “Farmers vs. State Farm Auto Insurance..”

What is the State Farm insurance rating for customer satisfaction?

State Farm receives high ratings, especially in customer satisfaction and claims handling.

How do State Farm life insurance reviews compare with other insurers?

State Farm’s life insurance is praised for affordable rates and comprehensive policies.

How does State Farm vs. Travelers compare for auto insurance?

State Farm has more local agents, while Travelers may offer more discounts. Our “State Farm vs. Travelers Auto Insurance” will help you gain a deeper understanding.

What can I expect from State Farm home insurance reviews?

Reviews highlight vital customer service and a smooth claims process for home insurance.

How does State Farm renters insurance review rate in terms of coverage and service?

State Farm renters insurance is known for affordability and extensive personal property coverage.

Why do male vs. female insurance rates differ, and how does State Farm calculate these rates?

Rates differ due to statistical risk; State Farm considers age, driving record, and other factors. Obtain further insights from our “Why are auto insurance rates higher for males?“

Does State Farm offer gap insurance, and how does it work?

State Farm provides gap insurance, covering the difference between a car’s value and loan balance.

How reliable are State Farm renters insurance reviews?

Reviews show that State Farm is reliable, with excellent coverage options for renters.

What is the difference between Geico vs. State Farm regarding rates and coverage?

Geico often has lower rates, while State Farm is praised for better local service. Our “Geico vs. State Farm Auto Insurance” provides a more nuanced perspective.

How do State Farm homeowners insurance reviews compare for claims and customer service?

What are the benefits of enrolling in State Farm automatic payment for auto policies?

Does State Farm rental car insurance provide sufficient coverage while traveling?

What factors impact the State Farm full coverage cost for auto insurance?

What are the State Farm insurance ratings for financial stability and claims service?

Which homeowners insurance service does Liberty Mutual vs. State Farm offer better?

How does the State Farm rating for auto insurance compare with competitors?

How much does State Farm full coverage insurance cost on average?

How does State Farm auto insurance coverage compare with other insurers?

What do State Farm claims reviews reveal about the claims process?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.