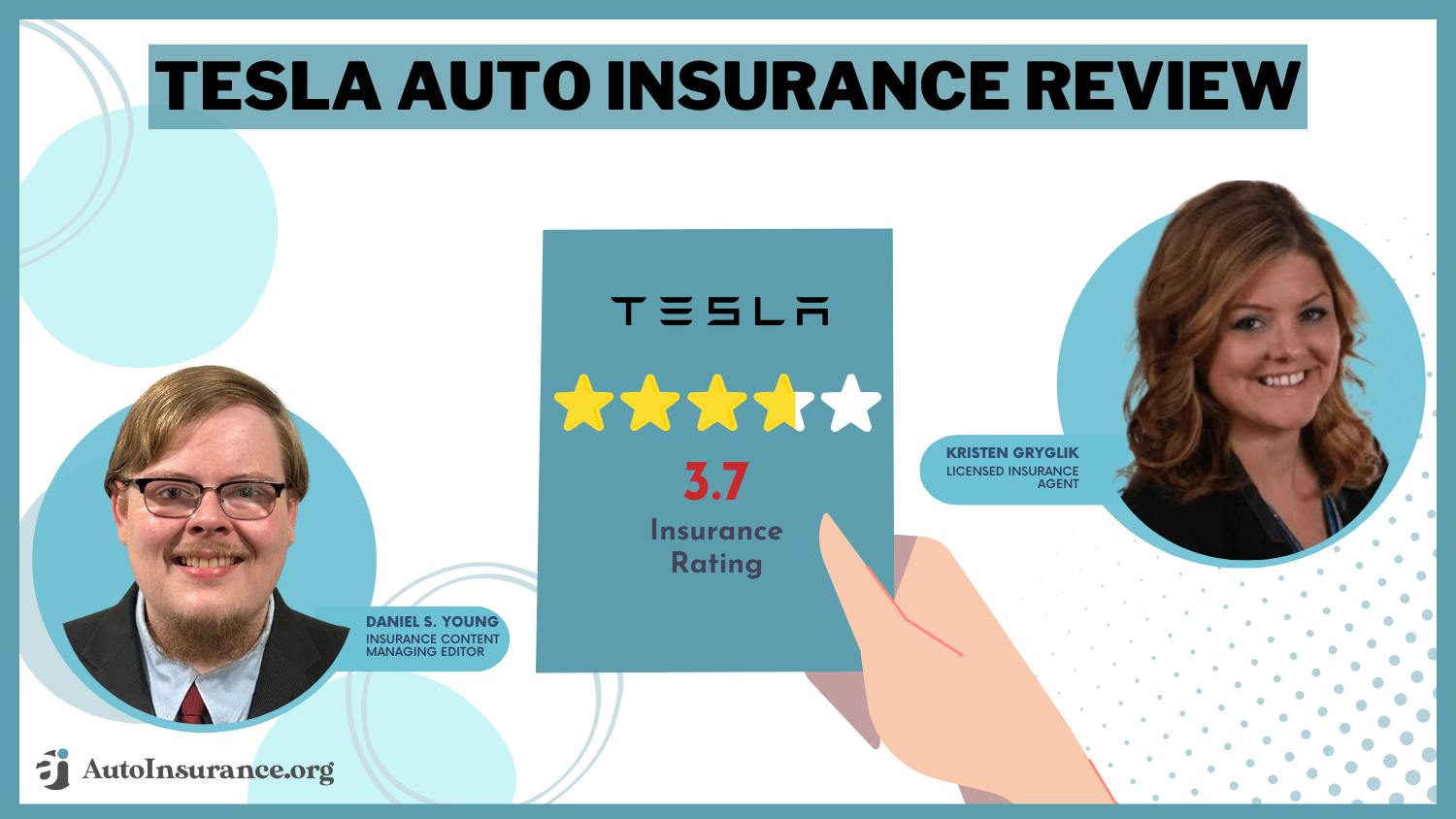

Tesla Auto Insurance Review for 2026 (Expert Evaluation)

Our Tesla auto insurance review reveals coverage that begins at $60 a month, specifically designed to meet the requirements of a Tesla driver. This model is helpful for the best drivers who may enjoy the cheaper rates. Find out more about service quality by reading Tesla car insurance reviews.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated December 2024

This Tesla auto insurance review highlights Tesla’s unique benefits, including rates starting at $60 per month and discounts for safe driving based on behavior tracking.

Tesla insurance benefits drivers who emphasize affordability and pricing based on technology. However, some users have experienced issues, particularly when the Tesla insurance adjuster does not respond during the claims process.

Tesla Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.7 |

| Business Reviews | 5.0 |

| Claim Processing | 4.6 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.0 |

| Discounts Available | 3.7 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.0 |

| Policy Options | 2.8 |

| Savings Potential | 3.8 |

Safe, tech-savvy drivers may find Tesla’s approach beneficial, but comparing multiple quotes is wise to ensure the best rate and service.

The benefits of auto insurance are called into question if it doesn’t provide the necessary support when needed. Use our free comparison tool below to find affordable Tesla auto insurance coverage today.

- The Tesla auto insurance review shows rates beginning at $60 a month

- Tesla insurance company provides discounts for safe driving habits

- The Tesla insurance review highlights exclusive tech-driven pricing benefits

Tesla Auto Insurance Pricing Analysis

When researching Tesla auto insurance, one must consider average coverage rates relative to driving records, age, gender, and location.

Tesla Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $250 | $420 |

| Age: 16 Male | $270 | $450 |

| Age: 18 Female | $210 | $355 |

| Age: 18 Male | $230 | $385 |

| Age: 25 Female | $125 | $210 |

| Age: 25 Male | $135 | $230 |

| Age: 30 Female | $100 | $165 |

| Age: 30 Male | $105 | $175 |

| Age: 45 Female | $64 | $127 |

| Age: 45 Male | $63 | $125 |

| Age: 60 Female | $65 | $105 |

| Age: 60 Male | $70 | $110 |

| Age: 65 Female | $60 | $100 |

| Age: 65 Male | $65 | $105 |

Most competing firms have competitive pricing, averaging $60 a month. However, the premiums include many factors, such as age and driving history. The more youthful the driver or the worse credit shows, the higher the premium for that individual; conversely, older drivers typically pay less.

Tesla auto insurance provides a pricing structure that rewards safe driving behaviors, allowing customers to benefit from competitive rates based on their unique driving patterns.Jimmy McMillan Licensed Insurance Agent

The national average for automobile insurance is around $100 a month, and Tesla’s pricing tends to fall in that range. Drivers living in states like Michigan or New York, where higher insurance costs apply, could pay higher premium rates than the national average. In contrast, drivers in Vermont and Maine should expect reduced premium rates.

For insights into customer experiences, check Tesla insurance reviews. For claims, contact the Tesla insurance claims phone number. The State National Insurance Company (Tesla) is involved in this coverage. Additionally, understanding what is an auto insurance price match can help ensure you’re getting the best deal.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tesla Auto Insurance Comparison With Competitors

When comparing Tesla’s insurance rates to those of other providers, like State Farm, it’s crucial to consider significant demographic variables, including age, gender, driving history, and geographic area.

Tesla Auto Insurance Monthly Rates vs. Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $469 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $125 | $150 | $175 | $250 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

For example, a 30-year-old male driver with a flawless driving record might find the cheap Tesla auto insurance rates more appealing, which could average around $120 per month for similar coverage.

State Farm is a top choice for basic coverage, making it especially beneficial for younger drivers or those with less-than-ideal driving histories. Alternatively, you can contact Tesla Insurance’s customer service to learn about their pricing model, which rewards safe driving and is an appealing option for those who prioritize low-risk driving.

For further information, view the Tesla Insurance California review or call the Tesla Insurance contact number: 844-348-3752 for further clarification—furthermore, the underwriter at Tesla Insurance has a fundamental role in setting such low rates.

Tesla Auto Insurance Coverage Choices

Tesla auto insurance offers a variety of coverages suitable for particular needs. The ones listed here are the following:

- Complete Coverage: The above covers liability, collision, and uninsured motorist coverage.

- Basic Coverage: The minimum state-mandated insurance must provide only basic liability coverage at the lowest cost.

- Full Cover: This covers damage caused by theft, vandalism, or natural disasters.

- Gap Insurance: This is beneficial for new Tesla buyers. It covers the difference between the vehicle’s value and the debt.

- SR-22 Filings: Drivers who commit certain offenses must file an SR-22 with a witness of their financial ability.

While Tesla’s auto insurance offers a solid range of options, it has received a lower rating for its variety of coverage choices (2.0), suggesting areas for enhancement.

Customers can contact Tesla insurance support by calling their customer service numbers and checking their insurance hours. They can then receive help choosing an auto insurance policy that best meets their needs.

Tesla Auto Insurance Discount Opportunities

A few things that make Tesla more attractive to drivers are its many discount opportunities, which result in very low premiums. By learning about these discounts, you can find the best coverage within your budget. Some notable discounts include contacting the Tesla Insurance phone number (California) for questions or more information.

Tesla Car Insurance Discounts by Savings Potential

| Discount Name | |

|---|---|

| Multi-Car | 12% |

| Autopilot | 10% |

| Defensive Driving Course | 10% |

| Group | 8% |

| Mature Driver Improvement Course | 7% |

| Non-Stacking | 6% |

| Anti-Theft Device | 5% |

| Airbag | 3% |

These savings can be huge; an overall rating of 3.7 means customers like all these features. However, for further questions about Tesla insurance customer service, dial the following number and hours of Tesla insurance.

Customers usually seek the best auto insurance discounts, so any Tesla discount is much more precious. Meanwhile, using discounts to take advantage of enhanced coverage keeps the costs under control for a Tesla driver, further reinforcing the affordability of auto insurance with Tesla.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tesla Auto Insurance Consumer Feedback

Many varying opinions and positive and negative experiences dominate customer reviews of Tesla insurance in New York. Users on Reddit and Quora shared a wide variety of stories about claims processes and the quality of customer service.

Tesla Insurance – Give Me The Good And The Bad

byu/Freudian_Slip22 inTeslaModelY

Some appreciated the innovative price model and coverage options, while others left with responsiveness issues when making a comprehensive auto insurance claim.

The customer review rating is 1.7, which means that Tesla needs to do something about its service and support system. You can provide such details using the Tesla Insurance phone number and hours.

Tesla Auto Insurance Ratings From Trusted Sources

Evaluating the performance of Tesla auto insurance involves reviewing ratings from reputable organizations. The table below summarizes the critical ratings:

Tesla Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 865 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.91 Fewer Complaints |

|

| Score: B++ Good Financial Strength |

So, a perfect score of 5.0 makes Tesla absolutely one of the reputable auto insurance companies, reflecting solidity in business performance and high reliability, particularly in dimensions such as innovativeness and user experience.

Tesla auto insurance consistently earns high ratings from trusted sources, reflecting its commitment to innovation and customer satisfaction.Chris Abrams Licensed Insurance Agent

Customers can reach the Tesla insurance number in California for support; therefore, they will undoubtedly get all the help they need whenever they seek it.

Tesla Auto Insurance Pros and Cons

Tesla car insurance can be positive and negative, and the difference between its advantages and disadvantages is essential to making a good choice. By understanding these factors, a potential customer can be well-informed.

Pros

- Lower Premiums: The price starts at $60 monthly and is competitive with many other insurers.

- Tech-Driven Rates: Pricing reflects safe behavior on the road for potential savings.

- Many Coverage Options: They offer several options, including top multi-vehicle auto insurance discounts.

Cons

- Customer Service Issues: Many people have complained that the increased demand for claims adjusters to be more responsive is causing delays in the process.

- Limited Coverage Variety: Lower rankings might indicate the need for more specific options.

- Customer Service Issues: Many people have complained that the increased demand for claims adjusters to be more responsive is causing delays in the process.

- Limited Coverage Variety: Lower rankings might indicate the need for more specific options.

Though Tesla auto insurance offers competitive rates and innovative pricing models, customers need to watch out for service issues on customer service and contemplate their choices before making conclusions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Snapshot of Tesla Auto Insurance Review

State National Insurance Company Tesla offers personal auto insurance policies beginning at around $60 per month. Advanced technology to monitor driving habits promotes a “get rewarded for being a safe driver” philosophy and pushes premiums down.

The reception of the claims and complaints regarding the processing and service quality of the brand insurance was mixed. Tesla offers an all-inclusive package for customers and a primary one, giving consumers a choice of whether it suits their needs and budget.

Among the features of Tesla auto insurance are its technology-driven pricing and customized coverage, perfect for discriminating Tesla owners.

There are also other add-ons involving gap insurance or SR-22 filings. For those looking to save, consider how to get a defensive driver auto insurance discount.

Consumers can lower their insurance costs by using available discounts. Comparing rates from various providers helps them find the best coverage for their needs. Go for all-inclusive Tesla auto insurance rates, and find yours by entering your zip code below.

Frequently Asked Questions

Who is Tesla insurance underwritten by?

The State National Insurance Company provides Tesla insurance for your insurance services at Tesla. Those considering their options should read the State National auto insurance review, which reviews the coverage and performance of this particular insurance provider.

Is Tesla insurance any good?

Tesla insurance has mixed views. On the positive side, it is competitive regarding rates and provides discounts based on good driving behavior. However, most customers needed help with customer service and claims responsiveness. Overall, there has always been a feeling that service quality needs to improve to be on par with customer ratings.

Who insures Tesla?

The company offers specialized coverage designed for Tesla vehicles. You can also compare rates and coverage options from other insurers, such as State Farm, Geico, and Progressive, which offer policies to Tesla owners.

What types of coverage does Tesla insurance offer?

Tesla provides all kinds of coverage that people may need, including liability, collision, comprehensive, and coverage for uninsured/underinsured motorists. Some add-ons are unique to Teslas, such as gap insurance and special custom part coverage.

How are Tesla insurance rates determined?

The factors influencing Tesla’s insurance costs are driving, location, and history. Telematics helps the insurance company monitor safe driving habits, and discounts for safe drivers apply. Knowing why and how auto insurance differs from one state to another is important because each state has variations in regulations and risks that may affect the rates.

Can I get discounts with Tesla insurance?

Yes, safe driving behavior brings discounts, bundling policies, and loyalty as a Tesla customer. It can get more affordable overall premium costs in such cases. Compare quotes from top home insurance providers by entering your ZIP code below and exploring the Lemonade vs. Progressive options.

What is the process of claiming Tesla Insurance?

Tesla allows customers to submit claims through the mobile app or call the claims support hotline.

Is Tesla insurance available in all states?

Tesla does not offer insurance in all states. It is available in a few select states, and the company plans to expand in more states as it grows. To determine if it’s available in your state, visit the company’s website.

What should I do if I have an issue with my Tesla insurance policy?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

How does Tesla insurance compare to traditional insurance providers?

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

The State National Insurance Company provides Tesla insurance for your insurance services at Tesla. Those considering their options should read the State National auto insurance review, which reviews the coverage and performance of this particular insurance provider.

Tesla insurance has mixed views. On the positive side, it is competitive regarding rates and provides discounts based on good driving behavior. However, most customers needed help with customer service and claims responsiveness. Overall, there has always been a feeling that service quality needs to improve to be on par with customer ratings.

Who insures Tesla?

The company offers specialized coverage designed for Tesla vehicles. You can also compare rates and coverage options from other insurers, such as State Farm, Geico, and Progressive, which offer policies to Tesla owners.

What types of coverage does Tesla insurance offer?

Tesla provides all kinds of coverage that people may need, including liability, collision, comprehensive, and coverage for uninsured/underinsured motorists. Some add-ons are unique to Teslas, such as gap insurance and special custom part coverage.

How are Tesla insurance rates determined?

The factors influencing Tesla’s insurance costs are driving, location, and history. Telematics helps the insurance company monitor safe driving habits, and discounts for safe drivers apply. Knowing why and how auto insurance differs from one state to another is important because each state has variations in regulations and risks that may affect the rates.

Can I get discounts with Tesla insurance?

Yes, safe driving behavior brings discounts, bundling policies, and loyalty as a Tesla customer. It can get more affordable overall premium costs in such cases. Compare quotes from top home insurance providers by entering your ZIP code below and exploring the Lemonade vs. Progressive options.

What is the process of claiming Tesla Insurance?

Tesla allows customers to submit claims through the mobile app or call the claims support hotline.

Is Tesla insurance available in all states?

Tesla does not offer insurance in all states. It is available in a few select states, and the company plans to expand in more states as it grows. To determine if it’s available in your state, visit the company’s website.

What should I do if I have an issue with my Tesla insurance policy?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

How does Tesla insurance compare to traditional insurance providers?

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

The company offers specialized coverage designed for Tesla vehicles. You can also compare rates and coverage options from other insurers, such as State Farm, Geico, and Progressive, which offer policies to Tesla owners.

Tesla provides all kinds of coverage that people may need, including liability, collision, comprehensive, and coverage for uninsured/underinsured motorists. Some add-ons are unique to Teslas, such as gap insurance and special custom part coverage.

How are Tesla insurance rates determined?

The factors influencing Tesla’s insurance costs are driving, location, and history. Telematics helps the insurance company monitor safe driving habits, and discounts for safe drivers apply. Knowing why and how auto insurance differs from one state to another is important because each state has variations in regulations and risks that may affect the rates.

Can I get discounts with Tesla insurance?

Yes, safe driving behavior brings discounts, bundling policies, and loyalty as a Tesla customer. It can get more affordable overall premium costs in such cases. Compare quotes from top home insurance providers by entering your ZIP code below and exploring the Lemonade vs. Progressive options.

What is the process of claiming Tesla Insurance?

Tesla allows customers to submit claims through the mobile app or call the claims support hotline.

Is Tesla insurance available in all states?

Tesla does not offer insurance in all states. It is available in a few select states, and the company plans to expand in more states as it grows. To determine if it’s available in your state, visit the company’s website.

What should I do if I have an issue with my Tesla insurance policy?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

How does Tesla insurance compare to traditional insurance providers?

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

The factors influencing Tesla’s insurance costs are driving, location, and history. Telematics helps the insurance company monitor safe driving habits, and discounts for safe drivers apply. Knowing why and how auto insurance differs from one state to another is important because each state has variations in regulations and risks that may affect the rates.

Yes, safe driving behavior brings discounts, bundling policies, and loyalty as a Tesla customer. It can get more affordable overall premium costs in such cases. Compare quotes from top home insurance providers by entering your ZIP code below and exploring the Lemonade vs. Progressive options.

What is the process of claiming Tesla Insurance?

Tesla allows customers to submit claims through the mobile app or call the claims support hotline.

Is Tesla insurance available in all states?

Tesla does not offer insurance in all states. It is available in a few select states, and the company plans to expand in more states as it grows. To determine if it’s available in your state, visit the company’s website.

What should I do if I have an issue with my Tesla insurance policy?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

How does Tesla insurance compare to traditional insurance providers?

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

Tesla allows customers to submit claims through the mobile app or call the claims support hotline.

Tesla does not offer insurance in all states. It is available in a few select states, and the company plans to expand in more states as it grows. To determine if it’s available in your state, visit the company’s website.

What should I do if I have an issue with my Tesla insurance policy?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

How does Tesla insurance compare to traditional insurance providers?

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

If you experience any problems with your Tesla’s coverage, it is best to contact Tesla customer service to resolve them. They can answer any questions about a policy, claims, or coverage. You must read about how to save more by bundling an insurance policy, which is very helpful.

On average, Tesla has relatively cheap insurance rates, mainly if the owner uses the car with advanced technology features. Nonetheless, some traditional insurers offer comprehensive coverage and good customer service. Therefore, compare quotes from Tesla and conventional insurance providers to select the best.

Who underwrites Tesla insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Tesla insurance good?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.