Tri-State Auto Insurance Review (2026)

The Tri-State auto insurance review evaluates the company's policies with a monthly base rate of $50. This review highlights coverage options, customer service experiences, and overall satisfaction, detailing Tri-State Insurance Company's pros and cons for potential customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated December 2024

This Tri-State auto insurance review highlights affordable rates starting at $50 per month and solid coverage options for high-risk drivers.

Competitively priced for individuals with less-than-perfect driving records, Tri-State Insurance for vehicles provides good coverage at discounted rates, making it ideal for budget-conscious drivers seeking protection.

Tri-State Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 3.0 |

| Claim Processing | 2.8 |

| Company Reputation | 2.5 |

| Coverage Availability | 4.7 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 2.5 |

| Discounts Available | 4.3 |

| Insurance Cost | 4.0 |

| Plan Personalization | 2.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.1 |

There are very few available and insufficient discounts on this option. Still, Tri-State car insurance is a good option for drivers who want reasonable premiums with reliable coverage, especially for high-risk auto insurance profiles.

To discover if you qualify for lower Tri-State auto insurance rates, simply input your ZIP code into our free quote tool above to compare prices from nearby providers.

- The Tri-State auto insurance review reveals rates starting at $50/month

- Tri-State car insurance services include accident forgiveness options

- Enjoy up to 25% off with Tri-State auto coverage multi-policy discounts

Tri-State Auto Insurance Coverage Cost

While generalizing it with a tri-state consumer, the analysis reveals the premium rates mostly depend on age, location, driving history, and gender, as is commonly seen with TSC Direct auto insurance.

Tri-State Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $240 | $400 |

| Age: 16 Male | $270 | $450 |

| Age: 18 Female | $210 | $370 |

| Age: 18 Male | $230 | $400 |

| Age: 25 Female | $85 | $150 |

| Age: 25 Male | $90 | $160 |

| Age: 30 Female | $60 | $120 |

| Age: 30 Male | $65 | $125 |

| Age: 45 Female | $50 | $105 |

| Age: 45 Male | $53 | $107 |

| Age: 60 Female | $55 | $110 |

| Age: 60 Male | $57 | $115 |

| Age: 65 Female | $60 | $120 |

| Age: 65 Male | $65 | $130 |

For example, drivers with less experience typically face higher insurance rates, while older, more experienced drivers enjoy lower premiums because they tend to have fewer accidents. In the tri-state area, the monthly premium for TSC car insurance is around $112, which is lower than the national average of $120. It aligns with many reviews of TSC insurance, highlighting its competitive regional pricing.

Tri-State auto insurance offers exceptional coverage at an affordable monthly rate of just $50, making it a top choice for drivers seeking value.Travis Thompson Licensed Insurance Agent

Average rates again vary from state to state, which, in many cases, depend on the locality since the city drivers tend to be charged higher rates for being associated with higher accident rates, among other factors.

More so, given the fact that what is the average auto insurance cost per month, it is essential to note that Tri-State’s review ranking score is 3.9 out of a maximum grade of 5, which simply indicates that its service levels are satisfactory and, hence, pricing can be tolerated by many.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Tri-State Auto Insurance Cost Compared to Competitors

Further comparisons of state auto insurance reviews (BBB) and rates from Tri-State General Insurance with its close competitors, State Farm, reveal substantial differences according to demographic considerations.

For instance, a 30-year-old male driver with no violations may have his fees at about $1,200 when insured by Tri-State, but State Farm might be able to offer coverage at about the same range of about $1,000. Younger drivers between the ages of 18 and 25 may face higher rates with State Farm, so Tri-State is more competitive for them.

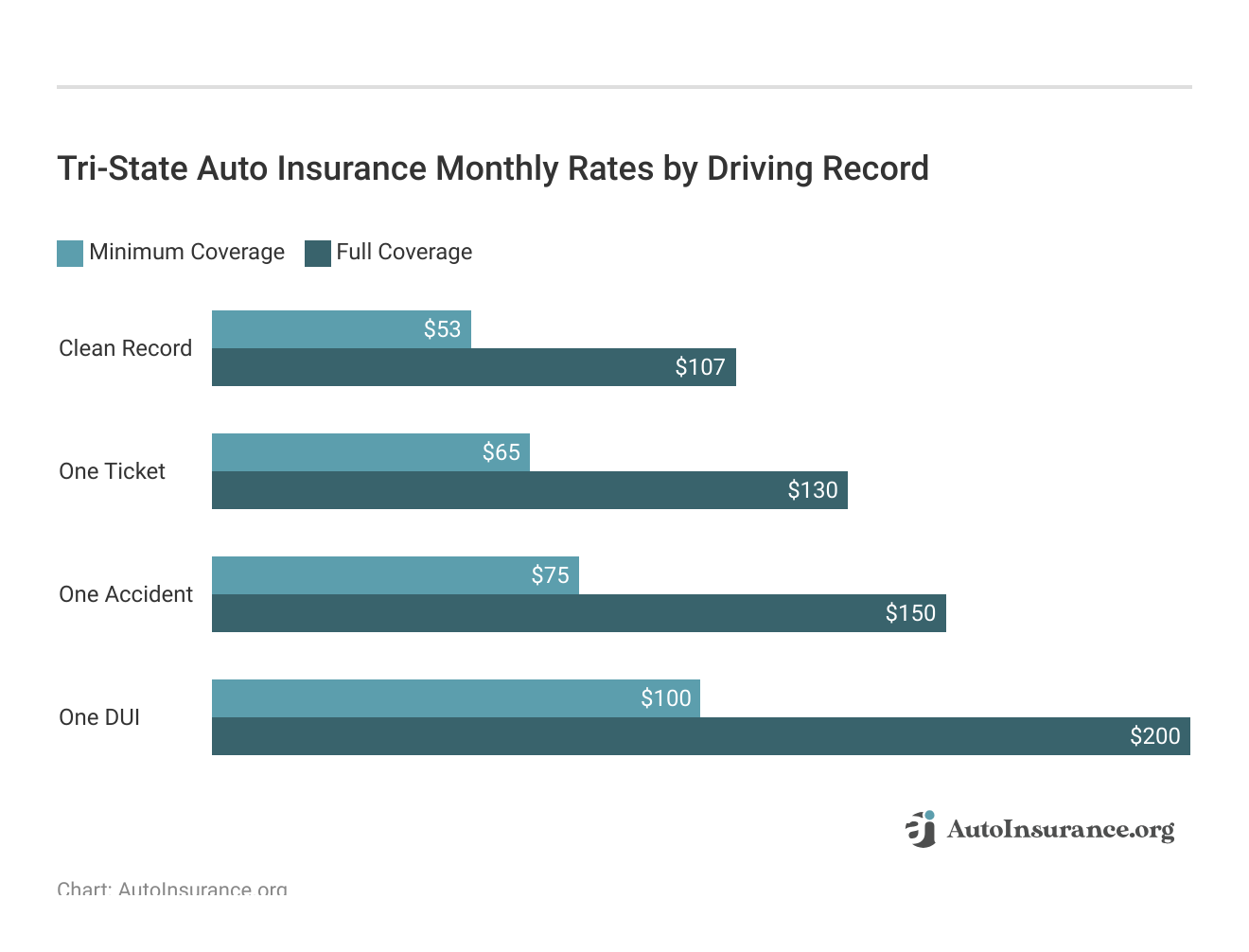

Tri-State Consumer Direct Auto Insurance Monthly Rates vs. Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $107 | $130 | $150 | $200 |

Stillwater home insurance reviews show the same demographic impacts, and for any claims, Tri-State Insurance Company of Minnesota claims the phone number to deliver its support directly.

Moreover, a driver needs to know how auto insurance companies check driving records; this disclosure shows how State Farm tends to boast many available discounts, while Tri-State has the sweet spot of individualized service and flexible payment methods.

Tri-State Insurance Coverage Options

Tri-State auto insurance offers a comprehensive selection of coverage options tailored to fit the diverse needs of its customers. Below are the various types of coverage available:

- Complete Coverage: Includes liability protection and damage coverage for your vehicle. You need full coverage insurance to finance a car, making this option essential for securing a loan.

- Minimum Coverage: Meets state requirements, suitable for budget-conscious drivers.

- Comprehensive Coverage: Protects against non-collision incidents like theft and natural disasters.

- Gap Insurance: Covers the difference between your car’s value and the remaining loan balance in case of a total loss.

- SR-22 Filings: Required for high-risk drivers to comply with state insurance laws.

Tri-State’s review ranking score of 2.5 indicates that while options are plentiful, customer satisfaction with these offerings may vary.

Available Discounts Through Tri-State Auto Insurance

Tri-State auto insurance provides some premium discounts to help policyholders control their premiums. With a review ranking of 4.3, these options do an excellent job of adding value to Tri-State auto insurance, thus making it one of the best auto insurance discounts for cost-conscious drivers.

Read other Tri-State auto group reviews to see what customers appreciate about savings and service. It helps to read these reviews or get more in-depth information on how other policyholders feel about this type of coverage before deciding to opt-out.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tri-State Auto Insurance Customer Review

The Tri-State Insurance Company of Minnesota reviews indicate that there is strict control over its policyholders. Many comments that the firm reaches out to them during the challenging moments with answers that are hard to match.

On the other hand, some customers complain about the inability to get hold of the representatives and, hence, varying outcomes. Those in need can use the Tri-State Insurance Company of Minnesota phone number, often broadcasted as Tri-State 1-800-join-now.

Tri-State auto insurance consistently receives positive feedback for its affordable rates and comprehensive coverage, making it a top driver choice.

This feedback from sites such as Reddit, Quora, and entitled direct review reveals a mixed impression of positive and negative feedback that shows how other people’s experiences determine the overall view of the company.

The ranking score is 2.5, as registered in the review ranking, and this reflects just how varied these opinions are of what an auto insurance policyholder in the Tri-State system is.

Business Reviews of Tri-State Auto Insurance

A good critique of Tri-State car insurance would also not be complete without including ratings from more or less credible sources. The following table provides the provider’s ratings on different platforms:

Tri-State Consumer Direct Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 825 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: A+ Excellent Financial Strength |

Incorporating social media posts that show the provider’s ratings can give the company more transparency and give possible clients an insight into the company’s standing. If you are wondering how to check if an auto insurance company is legitimate, an appraisal of these ratings may be your first step.

Tri-State has a business review ranking score of 3.0, illustrating that they are fair but still have much to improve. For further information, contact the Tri-State Insurance company phone number.

Pros and Cons of Tri-State Auto Insurance

When choosing between various options for buying auto insurance, one has to weigh the pros and cons of a specific insurance company. Tri-State auto insurance is like every other insurance company in terms of plans.

Tri-State auto insurance offers solid benefits like affordable rates and coverage for high-risk drivers, but potential customers should weigh these pros against limited options for additional features.Eric Stauffer Licensed Insurance Agent

However, here are some pros and cons of Tri-State auto insurance, which might help you choose the right auto coverage:

Pros

- Diversified Coverage Options: Offers comprehensive plans with various options to suit diversified needs.

- Attractive Discounts:The company provides the most competitiveauto insurance discounts for a new car, thus covering a broad scope of demographics.

- Satisfactory Customer Service: Several positive claims are reportedy the customers dealing with the insurance services.

Cons

- Mixed Reviews from Customers: Many dissatisfied comments regarding customer service experiences could be a cause for concern.

- Online Features: Users have criticized the website for not having convenient online features.

- Mixed Reviews from Customers: Many dissatisfied comments regarding customer service experiences could be a cause for concern.

- Online Features: Users have criticized the website for not having convenient online features.

When balancing these pros and cons, would-be customers can assess whether Tri-State auto insurance would suit their needs regarding insurance services, especially for clients seeking products in the Tri-State financial network. A well-informed choice will assist you in making the best decision regarding your insurance coverage needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Summation of the Tri-State Auto Insurance Review

The coverage available, pricing, and customer satisfaction in an auto insurance review will be able to inform the decision better. On average, the monthly premium is $112. Its rate is established based on age, gender, and driving record; in many cases, Tri-State is more affordable than State Farm for younger drivers.

Full coverage and gap insurance are options, as well asSR-22 filings. Customers may request the state auto phone number if assistance is required and ascertain the recommended auto insurance coverage levels before deciding on one. Customer reviews indicate that the company has strengths, particularly customer service.

With an average monthly rate of just $50, Tri-State auto insurance stands out for its affordability and competitive coverage options.

J.D. Power and the Better Business Bureau provide other review sites with highbrowed views that, from a middle-of-the-line perspective, make it possible for people and potential customers to think about it thoroughly.

Talk continues with the Tri-State Insurance Company in Minnesota, and TSC direct car insurance may be an option if you qualify. Find the lowest Tri-State auto insurance quotes by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

What is full coverage auto insurance?

Complete coverage is a combination of liability, collision, and comprehensive coverage. With Tri-State Consumer Direct insurance services, NYC drivers can pay around $185 for full coverage auto insurance.

What are the liability coverage requirements in New York?

The minimum requirement for auto insurance is liability coverage. The liability coverage limit in New York is $25,000 for bodily injury, $50,000 for the death of one person involved in an accident, $50,000 for bodily injury, and $100,000 for the death of two or more people in an accident.

The property damage limit is $10,000 for a single accident. With the Tri-State Insurance Company, you’ll pay around $110 monthly for liability insurance.

Are small auto insurance companies cheaper than big auto insurance companies?

Who has the cheapest auto insurance? The best way to determine that is to compare quotes from multiple companies, big and small. Every company is different in terms of the rates they charge. A small company may not have the clout and name recognition of a big company like Geico, but that doesn’t mean it won’t have low rates.

Some people prefer smaller companies for personal service and local focus, even if the rates are slightly higher. However, good insurance means much more than low rates. Check out Tri-State auto insurance company reviews to see if the company has good customer service.

What is the Tri-State auto telephone number?

If you are wondering how to contact Tri-State auto insurance customer service, the Tri-State auto insurance phone number is 855-712-4092, which also serves as the Tri-State auto billing phone number. In addition, the Tri-Stateauto insurance claims phone number is 800-220-1351.

What auto insurance coverages are available at Tri-State Insurance?

From what we’ve seen on its website, liability, collision, and comprehensive coverage are available at TSC, also known as the Tristate Insurance Company. In addition to the basic coverages, TSC also has additional liability coverages such as personal injury protection (PIP) and medical payments (Med Pay).

What is Tri-State Health Insurance?

Tri-State (Tristate) Health Insurance is a health insurance company located in Illinois that has no connection to Tri-State auto insurance or any Tri-State Consumer Direct services.

Is TSC Direct a good insurance company?

As noted above, the company has an A+ rating with the BBB and an A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears good overall.

Learn More: Auto Insurance Companies With the Best Customer Service

Does another name know Tri-State Consumers Direct?

No, Tri-State Consumers Direct is not known by another name. Several companies have similar names, such as TSR Insurance, TC Insurance, Tri-State Insurance Group of Keller, TX, Tri-State Insurance Company of Minnesota, State Auto, Tri-State General Insurance, and Tri-State Insurance Group.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

Complete coverage is a combination of liability, collision, and comprehensive coverage. With Tri-State Consumer Direct insurance services, NYC drivers can pay around $185 for full coverage auto insurance.

The minimum requirement for auto insurance is liability coverage. The liability coverage limit in New York is $25,000 for bodily injury, $50,000 for the death of one person involved in an accident, $50,000 for bodily injury, and $100,000 for the death of two or more people in an accident.

The property damage limit is $10,000 for a single accident. With the Tri-State Insurance Company, you’ll pay around $110 monthly for liability insurance.

Are small auto insurance companies cheaper than big auto insurance companies?

Who has the cheapest auto insurance? The best way to determine that is to compare quotes from multiple companies, big and small. Every company is different in terms of the rates they charge. A small company may not have the clout and name recognition of a big company like Geico, but that doesn’t mean it won’t have low rates.

Some people prefer smaller companies for personal service and local focus, even if the rates are slightly higher. However, good insurance means much more than low rates. Check out Tri-State auto insurance company reviews to see if the company has good customer service.

What is the Tri-State auto telephone number?

If you are wondering how to contact Tri-State auto insurance customer service, the Tri-State auto insurance phone number is 855-712-4092, which also serves as the Tri-State auto billing phone number. In addition, the Tri-Stateauto insurance claims phone number is 800-220-1351.

What auto insurance coverages are available at Tri-State Insurance?

From what we’ve seen on its website, liability, collision, and comprehensive coverage are available at TSC, also known as the Tristate Insurance Company. In addition to the basic coverages, TSC also has additional liability coverages such as personal injury protection (PIP) and medical payments (Med Pay).

What is Tri-State Health Insurance?

Tri-State (Tristate) Health Insurance is a health insurance company located in Illinois that has no connection to Tri-State auto insurance or any Tri-State Consumer Direct services.

Is TSC Direct a good insurance company?

As noted above, the company has an A+ rating with the BBB and an A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears good overall.

Learn More: Auto Insurance Companies With the Best Customer Service

Does another name know Tri-State Consumers Direct?

No, Tri-State Consumers Direct is not known by another name. Several companies have similar names, such as TSR Insurance, TC Insurance, Tri-State Insurance Group of Keller, TX, Tri-State Insurance Company of Minnesota, State Auto, Tri-State General Insurance, and Tri-State Insurance Group.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

Who has the cheapest auto insurance? The best way to determine that is to compare quotes from multiple companies, big and small. Every company is different in terms of the rates they charge. A small company may not have the clout and name recognition of a big company like Geico, but that doesn’t mean it won’t have low rates.

Some people prefer smaller companies for personal service and local focus, even if the rates are slightly higher. However, good insurance means much more than low rates. Check out Tri-State auto insurance company reviews to see if the company has good customer service.

If you are wondering how to contact Tri-State auto insurance customer service, the Tri-State auto insurance phone number is 855-712-4092, which also serves as the Tri-State auto billing phone number. In addition, the Tri-Stateauto insurance claims phone number is 800-220-1351.

What auto insurance coverages are available at Tri-State Insurance?

From what we’ve seen on its website, liability, collision, and comprehensive coverage are available at TSC, also known as the Tristate Insurance Company. In addition to the basic coverages, TSC also has additional liability coverages such as personal injury protection (PIP) and medical payments (Med Pay).

What is Tri-State Health Insurance?

Tri-State (Tristate) Health Insurance is a health insurance company located in Illinois that has no connection to Tri-State auto insurance or any Tri-State Consumer Direct services.

Is TSC Direct a good insurance company?

As noted above, the company has an A+ rating with the BBB and an A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears good overall.

Learn More: Auto Insurance Companies With the Best Customer Service

Does another name know Tri-State Consumers Direct?

No, Tri-State Consumers Direct is not known by another name. Several companies have similar names, such as TSR Insurance, TC Insurance, Tri-State Insurance Group of Keller, TX, Tri-State Insurance Company of Minnesota, State Auto, Tri-State General Insurance, and Tri-State Insurance Group.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

From what we’ve seen on its website, liability, collision, and comprehensive coverage are available at TSC, also known as the Tristate Insurance Company. In addition to the basic coverages, TSC also has additional liability coverages such as personal injury protection (PIP) and medical payments (Med Pay).

Tri-State (Tristate) Health Insurance is a health insurance company located in Illinois that has no connection to Tri-State auto insurance or any Tri-State Consumer Direct services.

Is TSC Direct a good insurance company?

As noted above, the company has an A+ rating with the BBB and an A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears good overall.

Learn More: Auto Insurance Companies With the Best Customer Service

Does another name know Tri-State Consumers Direct?

No, Tri-State Consumers Direct is not known by another name. Several companies have similar names, such as TSR Insurance, TC Insurance, Tri-State Insurance Group of Keller, TX, Tri-State Insurance Company of Minnesota, State Auto, Tri-State General Insurance, and Tri-State Insurance Group.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

As noted above, the company has an A+ rating with the BBB and an A- rating with A.M. Best. Those are both signs of a solid reputation. Individual experience with an insurance company can vary, but TSC, or the Tristate Insurance Group, appears good overall.

Learn More: Auto Insurance Companies With the Best Customer Service

No, Tri-State Consumers Direct is not known by another name. Several companies have similar names, such as TSR Insurance, TC Insurance, Tri-State Insurance Group of Keller, TX, Tri-State Insurance Company of Minnesota, State Auto, Tri-State General Insurance, and Tri-State Insurance Group.

Does Tri-State Auto Insurance offer discounts?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

How can I manage my Tristate car insurance policy?

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

Yes, the Tri-State Insurance Group offers various discounts to policyholders. These discounts are based on factors such as safe driving, multiple policies with the company, bundling various vehicles, and having certain safety features in your car.

Enter your ZIP code below to see how much you’ll pay for TSC Direct with these discounts by getting a quote.

The Tri-State Consumer Insurance Company provider portal will navigate you to the TSC login page, where Tri-State Insurance Co. customers canmanage their auto insurance policy.

What are the Tri-State auto customer service hours?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How do I pay my Tri-State insurance premiums?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.