Comprehensive Auto Insurance Defined in 2026 (Everything You Need to Know)

Comprehensive auto insurance starts at $7 per month. There are many benefits of comprehensive auto insurance, including glass coverage and protection from animal damage, weather, or theft. You can learn more about the definition of comprehensive auto insurance below and compare average costs for cheap coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Joel Ohman

Updated October 2024

What is comprehensive auto insurance? Comprehensive car insurance from the best auto insurance companies protects your car from non-collision damage, from hitting a deer to hail damage, by paying for repairs or your totaled car’s value.

Minimum state auto insurance requirements don’t include comprehensive coverage, but your lender will require it if you have a leased car. The good news is that comprehensive auto insurance rates are usually very cheap, with prices starting at an average of $7 per month.

If you’re still wondering, “What is covered under comprehensive auto insurance?” keep reading to learn the comprehensive auto insurance definition, benefits of the coverage, and average comprehensive auto insurance costs. Enter your ZIP code into our free quote tool above to instantly get cheap coverage from the best comprehensive auto insurance companies in your area.

- Comprehensive auto insurance covers several events outside of a driver’s control

- Lenders require comprehensive car insurance if a driver has a leased car

- On average, comprehensive auto insurance costs $12 monthly in the U.S.

What Comprehensive Auto Insurance Covers

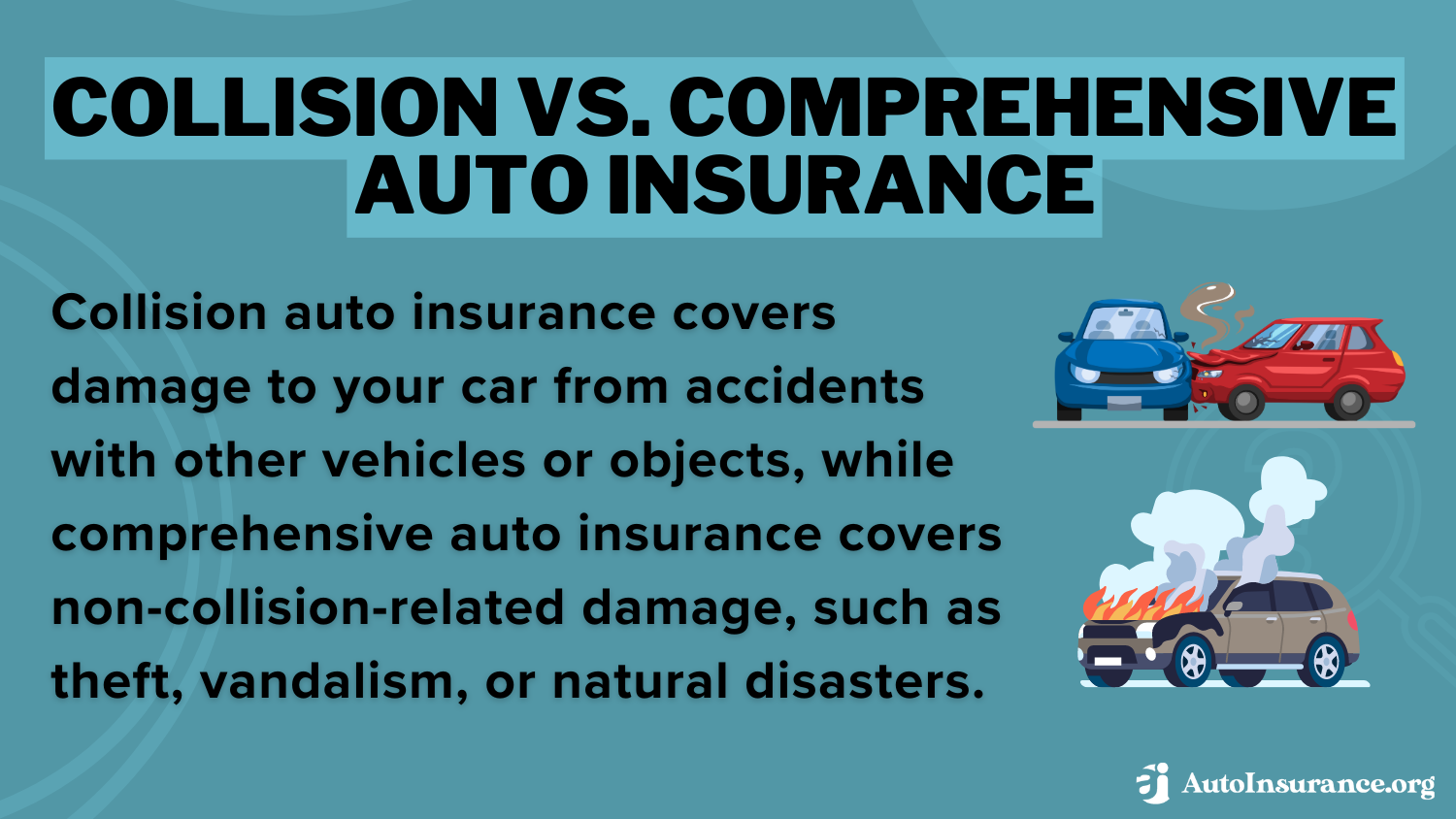

What does comprehensive auto insurance cover? Most comprehensive insurance definitions are simple: various non-collision events are covered under comprehensive car insurance, meaning any incidents not caused by a car wreck. However, in some states, it may not be enough to have comprehensive insurance, meaning you may need fire or flood insurance separately to be fully covered.

Certain events covered by auto insurance comprehensive coverage include:

- Animal Collisions

- Falling Objects

- Fire and Explosions

- Vandalism and Theft

- Weather Extremes

Some of the incidents covered under the comprehensive auto insurance coverage definition weather category include hail, lightning, floods, and heavy winds. If you’re left wondering, “What does comprehensive insurance cover?” after a rock hits your windshield, you’ll need to check with your provider. Most require glass coverage with your comprehensive auto insurance to fully replace your windshield if it gets damaged.

Read More: Does car insurance cover windshield damage or replacement?

Now that you know the answer to, “What does comprehensive mean on car insurance?” we’ll discuss what events aren’t covered by comprehensive coverage auto insurance.

Comprehensive Insurance Cost

How much is comprehensive car insurance? Comprehensive car coverage costs around $12 monthly. Take a look at the table below to compare comprehensive auto insurance costs by U.S. state:

Of course, there are various factors that affect auto insurance rates for comprehensive coverage, such as location, driving record, vehicle type, and other factors. Some of the most expensive states for comprehensive car insurance include North Dakota, South Dakota, and Wyoming.

On the other hand, states with a cheap comprehensive insurance price include Oregon, Maine, and California.

Cost can be a huge deterrent for some drivers when choosing coverages. The best way to get the cheapest comprehensive auto insurance rates for you is to get quotes from a few different companies in your area.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Comprehensive Auto Insurance Doesn’t Cover

When it comes to car insurance, comprehensive coverage handles a lot. However, it doesn’t cover everything. Some insurance companies may not include fire and flood damage in their auto insurance comprehensive coverage definition if your area is prone to fires and floods. Comprehensive insurance also won’t cover any of the following:

- Damages or Injuries From an At-Fault Accident: Liability auto insurance pays for others’ injuries or property damage if you cause an accident. The question, “What is comprehensive car insurance?” never involves paying for other people’s cars.

- Car Damage From a Collision: Wondering what’s comprehensive insurance compared to collision? If you cause an accident and have collision auto insurance, collision covers it. If the accident wasn’t your fault, the other driver’s liability would cover it. Learn more about collision vs. comprehensive auto insurance coverage.

- Injuries to You or Your Passengers: Comprehensive insurance doesn’t cover injuries to drivers or passengers from an accident.

Not everything is covered under comprehensive claims for auto insurance, as your other insurance coverages will take care of the abovementioned incidents.

Deductibles for Comprehensive Car Insurance Explained

Most comprehensive coverages will have a comprehensive auto insurance deductible unless drivers pay for the more expensive plans with no deductible. Generally, comprehensive deductibles range from $500 to $2,000.

When you choose a comprehensive auto insurance deductible amount, you agree to pay that amount in a covered claim. So, if you have a $500 deductible, you must put $500 toward repairs, and your insurance will cover the remainder of the bill.

If your car gets totaled under a comprehensive covered event, then insurance will pay for the car’s value minus the comprehensive deductible. So if your car is currently worth $10,000, but you have a $1,000 deductible, insurance will pay you $9,000.

This may lead you to wonder, “What is a good comprehensive deductible?” The best comprehensive deductible for you depends on your financial situation and risk tolerance, but common deductible amounts range from $250 to $1,000.

While raising your deductible will lower the cost of your comprehensive insurance rates, you should always ensure you can afford your deductible. If you can’t pay the comprehensive insurance policy deductible to get your car repaired, you should lower the deductible amount even if it raises your rates slightly.

Full Coverage vs. Comprehensive and Collision

What does comprehensive mean in auto insurance vs. full coverage? The comprehensive car insurance definition often gets confused with full coverage auto insurance. However, they’re not the same thing. Comprehensive insurance is a specific coverage, whereas full insurance coverage refers to several types of auto insurance.

Typically, full coverage consists of liability insurance, comprehensive car insurance, and collision coverage. Collision auto insurance helps pay for car damages following a collision.

You may be wondering when to drop collision insurance, given its high cost. We recommend you consider dropping your collision policy once annual premiums exceed 10% of your car’s value, or if you have enough saved to pay for repair or replacement.

Other coverages that often come with a full coverage policy include medical payments, personal injury protection auto insurance, and uninsured/underinsured motorist.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if You Need Comprehensive Car Insurance Coverage

If you’re having trouble deciding whether the benefits of comprehensive auto insurance outweigh the cost, you should consider a few things.

One major thing to keep in mind is costs. Comprehensive coverage offers valuable protection, but it will increase the cost of your monthly premiums. While it's usually affordable, drivers in areas with high crime rates or natural disasters may see high prices.Scott W. Johnson Licensed Insurance Agent

Shop around for comprehensive auto insurance quotes from the best auto insurance companies if any of the following apply to your vehicle:

- Financed: Your lender will require you to carry comprehensive insurance to protect their assets. Remember, it’s usually cheaper to purchase your own personal comprehensive insurance than to buy it through the lender.

- New or Expensive: You should carry comprehensive insurance if you would face heavy financial losses if your car were damaged or totaled.

However, there are also situations where you can skip buying comprehensive car insurance. The best way to determine if you don’t need comprehensive coverage is to calculate your car’s cash value and consider it against your comprehensive auto insurance deductible and monthly payments.

For example, if your car is so old that it is only worth $2,000, and your comprehensive auto insurance deductible is $1,500, it’s not worth keeping comprehensive insurance. As such, your monthly payments would soon equal or surpass the small payout that insurance would give you after an accident. In some cases, you may even end up paying more for insurance over time compared to your claim amount.

How to Buy Comprehensive Auto Insurance by Itself

For the most part, you can’t buy a policy with just comprehensive insurance. Most insurance companies will require that you also purchase collision insurance if you want comprehensive coverage.

Collision insurance is a valuable addition to most policies. It pays for damage to your vehicle after a collision, even if you’re at fault. It also covers collisions with:

- Potholes

- Stationary Objects

- Hit-and-Runs

- Parking Lot Objects

As you can see, collision insurance offers excellent coverage for your vehicle. Most insurance companies sell these coverages together and won’t sell comprehensive without collision.

One exception to this rule is if you plan on keeping your car parked safely in a garage. If that’s the case, your insurance company may sell you comprehensive without collision. That way, your car will be protected from damage that might happen while parked, like a tree falling through your garage in a storm.

Find the Best Comprehensive Auto Insurance Today

What is comprehensive insurance? Now that you know the auto insurance comprehensive definition, you know there are various benefits to comprehensive car insurance, ranging from glass coverage to protection against animal collisions, weather damage, and more. However, drivers with older cars that aren’t worth much can skip comprehensive coverage without financial risk and pick from different types of auto insurance.

If you have a newer or leased car and want to protect it, you should compare affordable comprehensive auto insurance costs by getting quotes from several companies. Simply enter your ZIP code into our free quote tool below to instantly compare rates from the top providers near you.

Frequently Asked Questions

What is the comprehensive coverage definition?

You may be wondering, “What is auto comprehensive insurance?” Comprehensive automobile coverage refers to protection for your vehicle from non-collision events, such as theft, animal damage, weather, and vandalism. It either pays for repairs or the value to replace your vehicle minus your comprehensive auto insurance deductible.

What does a comprehensive policy cover?

Comprehensive insurance covers the following events:

- Weather Damage

- Falling Objects

- Vandalism, Theft, and Fire

- Animal Contact

- Civil Disturbances

Ready to get complete coverage for these situations? Enter your ZIP code into our free quote comparison tool below to shop for prices from the top comprehensive providers near you.

Is comprehensive insurance worth it?

Whether comprehensive insurance for auto owners is worth it depends on their situation and vehicle. If your car is new or has a high market value, it’s generally worth getting comprehensive driving insurance. Learning how to get multiple auto insurance quotes can help you find affordable comprehensive coverage.

Do drivers need comprehensive auto insurance on old cars?

Drivers with older vehicles commonly ask, “Do I need comprehensive insurance on an old car?” You don’t need comprehensive auto insurance if you don’t have a car loan or lease. It’s best to skip comprehensive coverage if your old car isn’t worth much, and you wouldn’t get much money from a comprehensive auto insurance claim after the cost of your deductible.

Is it worth having full coverage on an old car?

You may wonder, “Is comprehensive full coverage worth it for an older vehicle?” Whether having full coverage on a car is worth it depends on various factors, such as the car’s value, your financial situation, and risk tolerance.

Will comprehensive auto insurance cover theft?

You may be wondering, “Does comprehensive cover theft?” Yes, comprehensive insurance will pay your car’s value minus your chosen comprehensive auto insurance deductible if it gets stolen.

How much is comprehensive insurance?

A top question readers ask is, “How much does comprehensive auto insurance cost?” The average comprehensive insurance price per month is $12, but it varies by provider and driving profile. However, you should learn how to evaluate auto insurance quotes will help you find the lowest rates.

How much comprehensive auto insurance should I carry?

Comprehensive auto insurance isn’t like liability auto insurance, where you choose the amount of coverage you want. Instead, you choose your comprehensive auto insurance deductible. Minus your deductible, comprehensive insurance will pay for repairs or pay the value of your car if it gets totaled.

Can I just have comprehensive auto insurance?

No, you’ll also need to carry your state’s required minimum liability insurance. Some insurance companies also only sell comprehensive insurance as a package deal with collision insurance, so you may have to purchase both types of auto insurance to have comprehensive coverage.

Is comprehensive auto insurance mandatory?

No state law requires comprehensive auto insurance. However, if you have a car loan or lease, your lender or leasing company may require you to carry comprehensive coverage until you fulfill your financial obligations.

How does the deductible work for comprehensive insurance?

Can I lower the deductible for comprehensive coverage?

Will comprehensive insurance cover a cracked windshield?

Does comprehensive insurance cover rental cars?

Is it better to have collision or comprehensive coverage?

Is comprehensive insurance full coverage?

Who has the best comprehensive coverage: State Farm or Geico?

Does comprehensive cover engine failure?

Why is comprehensive insurance so expensive?

Does comprehensive insurance cover pothole damage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.