Is full coverage auto insurance required to lease a car?

Most lenders require collision and comprehensive coverage on top of the minimum liability coverage. So the answer to, "Is full coverage auto insurance required to lease a car?" is usually always yes. American Family, Geico, Nationwide, and State Farm are the most affordable options, at under $300 a month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated December 2024

When is leasing a car a good idea? Leasing a car is a convenient way to get a brand-new car while still preserving your money. However, you should also examine if it is the best way that you can use your money.

Can you lease a car without insurance? Leasing a car does not come with insurance. Driving without insurance is illegal in almost every state, but is full coverage auto insurance required to lease a car? Investing in full coverage insurance to lease a car can help protect your assets should a collision occur. On the other side, what happens if you don’t have full coverage on a leased car?

Read our comprehensive guide to help you build your insurance policy for a leased car that will point you to finding low-cost, full-coverage auto insurance in no time. We will also answer the question, “Does leasing include insurance?”

It’s never too early to start comparing full-coverage auto insurance rates for leased cars.

- It’s important to review your leasing agreement to verify how much auto insurance for leased vehicles you’re required to carry.

- If you’re offered the option to add lease insurance coverage to your contract, coverage is generally very expensive because it’s considered a convenient option.

- When you lease a car, who is responsible for repairs? You are, and you must have full coverage insurance to lease a car on the day you take possession of the vehicle.

- Comprehensive and collision coverage are options that each pays for damage, repairs, or vehicle replacement.

- Not only do you have to carry physical damage coverage, but you must also carry Gap insurance.

Do you need full coverage on a leased car?

Do I need full coverage on a leased car? The short answer is yes. Leasing or financing a vehicle requires you to buy full-coverage car insurance. Full-coverage auto insurance is more expensive than liability-only auto insurance coverage, but you can still find cheap auto insurance for leased cars if you are willing to shop around.

More than a quarter of new car sales reported in the last year were leased vehicles.

Most dealerships require it as part of the contract. Auto leasing insurance requirements have become increasingly important to understand as leasing has gained popularity in recent years.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What It Means to Lease a Car

Leasing and financing sound like the same thing, but they are two different ways of paying for a car. What does leasing a vehicle mean?

Leasing a vehicle means you use a vehicle for several years or until you reach a certain mileage before you return it to the dealership. It is not the same thing as an auto loan.

How do car leases work? You can go to a dealership and ask to lease a car. Under the right credit score, the dealer will lease you a vehicle for a specific time and number of miles.

Ever wonder what a typical lease agreement includes? In Texas, for example, the auto lease agreement will include:

- Vehicle Description

- Lease Terms

- Monthly Payment Details

- Mileage Allowance

- Insurance Requirements

- Early Termination

- End of Lease Options

- Wear and Tear

- Security Deposit

Once you get close to the mileage mark or date of lease expiration, the dealer will give you the option to lease another vehicle or buy your currently leased car.

While you’re leasing your vehicle, you’ll need to have full coverage auto insurance.

What Full Coverage Auto Insurance Means

Full coverage auto insurance is collision and comprehensive coverages added to your liability policy. To fully protect assets, dealerships require full coverage car insurance to lease a vehicle.

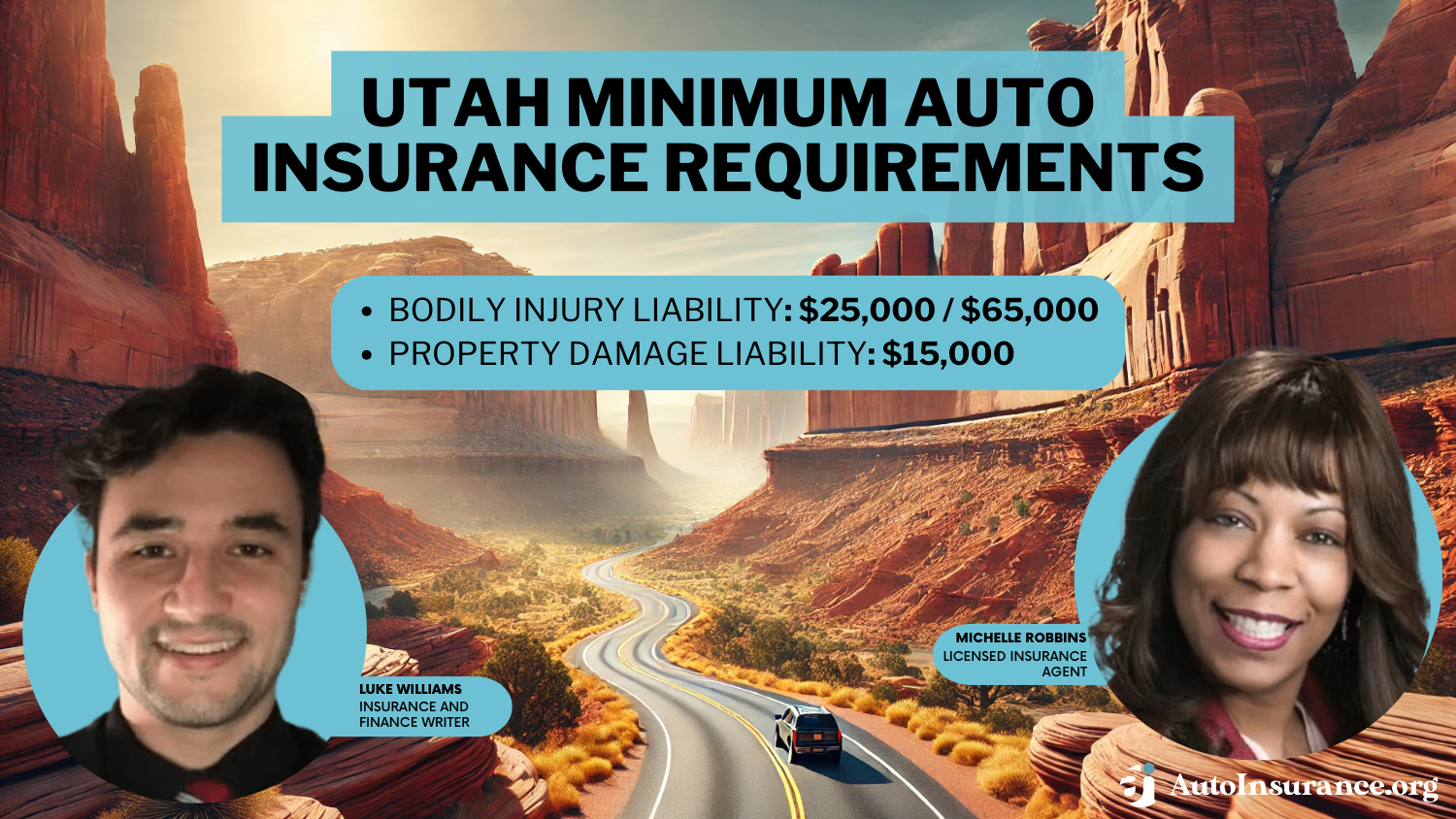

Although minimum auto insurance requirements by state might require a minimal amount of liability coverage, dealerships, and other financial companies will require full coverage. They may even ask that you raise your liability limits.

Leased vehicles often exceed the $25,000 minimum requirement, so you’ll need a coverage limit of $50,000 at the very least.

Yes, you do have to pay insurance when leasing a car. Every company sets its rules, but you must maintain insurance that meets the company’s standards at all times. Do your research. Full insurance coverage on a leased car may differ per company.

You May Need Full Coverage on a Lease

What is full coverage on a leased car will change depending on where you live, what company you buy the policy, and the dealership’s requirements.

There are legal requirements and requirements from the leasing company or dealership that the person leasing the vehicle is obligated to abide by. These requirements are in place to protect both the person leasing the vehicle and the leasing company’s interests.

If you are leasing a vehicle and get into a car crash or the car becomes damaged, the dealership wants you to carry enough insurance to fix the car to its pre-crash state.

If you don’t maintain full coverage on your vehicle, you’ll be in violation of your contract. You could have your vehicle repossessed, or you could be forced to pay insurance fees in your contract.

It’s important to note that lease auto insurance requirements will vary from state to state and dealership to dealership. For example, Florida’s lease insurance requirements for 2019 will be different from Georgia’s lease requirements in 2020, which will be different from California’s lease insurance requirements.

Mazda lease insurance requirements will also be different from Nissan, Honda, or Audi lease insurance requirements. The same goes for Toyota lease insurance requirements.

For example, you might need Hyundai lease Gap coverage or Audi lease Gap insurance. Other car brands may not require Gap at all.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Coverage Insurance Rates for Leased Vehicles

That answer depends on the dealership, but it’s a good idea to protect your vehicle because that means protecting your money. When you’re buying a leased vehicle auto insurance policy, you can’t just check a box that says you want full coverage.

Instead, you have to add the right options to your plan to adequately protect you and satisfy your lender. If you’re reading over your contract, carrying full coverage means that you have a comprehensive and collision policy.

This table compares full coverage car insurance rates at various coverage levels.

Auto Insurance Average Monthly Rates By Coverage Type

| Insurance Company | High Coverage | Low Coverage | Medium Coverage |

|---|---|---|---|

| $428 | $386 | $408 | |

| $285 | $281 | $295 | |

| $375 | $327 | $347 | |

| $286 | $250 | $268 | |

| $530 | $484 | $505 |

| $292 | $283 | $287 |

| $363 | $311 | $335 | |

| $288 | $255 | $272 | |

| $385 | $352 | $372 | |

| $222 | $200 | $212 |

While full coverage is more expensive, it provides more protection than minimum coverage.

Read more: Cheap Full Coverage Auto Insurance

Insurance Costs on a Leased Car

You may be surprised to learn the monthly cost of insurance on a car lease is very similar, regardless of if you’re leasing a car or if you own the car. However, lease car insurance coverage may include more policies, like Gap insurance, which will increase your rates. This doesn’t mean that leased cars are cheaper to insure. Insurance limits for leased vehicles vary for each vehicle depending on your needs.

You can find cheap car insurance for leased vehicles by getting car insurance quotes to compare companies. Car insurance for leased cars is important. Insurance typically is not included with a car lease. Also, depending on your driving history, coverage needs, and requirements from the lender, leased car insurance may be more expensive.

What Comprehensive and Collision Benefits Cover

Comprehensive and collision are forms of physical damage coverage that cover your car. What is the minimum insurance coverage needed for a leased car?

Liability insurance covers the other driver’s medical expenses and car repairs if you are found to be the at-fault driver. Collision insurance covers your medical expenses and car repairs if you are in an accident, and the accident is deemed your fault.

According to the Insurance Information Institute, 12 states, plus Puerto Rico, have no-fault insurance laws. If the accident is deemed the other driver’s fault, their liability insurance covers your accident-related expenses.

Comprehensive insurance pays for damage to your car that was not caused by a car accident. Typical items covered by comprehensive policies include certain types of weather damage, objects falling on your car, and theft.

Both comprehensive and collision coverage are physical damage coverage options that will pay for your mechanic bills and bodywork if your car is damaged after a long list of different types of losses.

Carrying both comprehensive and collision is required under your lease because the company still owns the car and has a financial interest in it. Most experts call this full coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cost of Auto Insurance Isn’t Included in Your Lease Payments

Your lease payments are different. It’s up to you to get auto insurance for a leased vehicle.

What’s included in a car lease? If you skim through your contract’s financial details, you’ll find all of the various charges included in your monthly installments.

What You Need To Know About Insuring a Leased Vehicle

If you are asking, “Do I pay for the insurance on a leased car?” Take a second look at your leasing contract. When you browse through all of the charges that are included in the lease, you won’t see a charge for your auto insurance.

Your leasing and insurance packages are two separate entities.

While insurance isn’t included in the contract, some companies include an option to buy. So, when it comes to who pays for insurance on a leased vehicle, the answer is you do.

It can be tempting to buy your auto insurance on a leased car through the leasing company but think twice before you do it.

As car rental agencies offer you the option to buy gas through the company for convenience, the leasing companies offer insurance for convenience. Unfortunately, that convenience comes at a cost. The best insurance for a leased vehicle can be found by comparison shopping.

You Have To Buy Auto Insurance When Leasing a Car

How does insurance work when leasing a car? This process is very similar to when you purchase a car, with only a few considerations: required coverage, insurance provider options, rules for additionally insured, and gap insurance.

When you lease a car, what is covered by insurance depends on what policy you purchase. Driving a leased car without insurance is not an option. While you might not necessarily need full coverage insurance on a leased car, you do need insurance that abides by the details of your contract.

What happens if you don’t have full coverage on a leased car? Full coverage auto insurance is almost always required on leased vehicles. If you don’t carry the required amount of insurance, the company can end your lease and make you return the car.Kristen Gryglik Licensed Insurance Agent

What happens when you lease a vehicle? When you lease a vehicle from a dealership or one of the many third-party auto leasing companies, you are responsible for insuring the leased vehicle and maintaining a certain amount of coverage on the vehicle. This is because the dealership still owns the vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Difference of Leasing vs. Financing a Vehicle

What’s the difference between leasing and financing? Leasing is almost like renting a vehicle until you reach a mileage limit or a lease end date. Financing is paying monthly installments for a car until you own it.

When you buy a car outright, you have the option to purchase the minimum auto insurance requirements. However, it’s not the best option for the latest model year vehicles.

For those who lease or finance a vehicle, you’re required to carry full coverage car insurance, which affects the total cost of your car insurance rates per month.

As far as auto insurance goes, your auto insurance rates aren’t determined because you lease or finance a vehicle. The factors that determine your auto insurance are your age, location, coverage level, credit history, and driving record.

Outside of insurance, the ways that you can customize your car differ based on whether you are leasing or financing your car. Can you modify a leased car? You will need to check the terms and conditions outlined in the lease agreement.

Benefits of Leasing a Vehicle

When you lease a vehicle, you’re renting the vehicle for a certain number of years. This period is known as a lease term. You don’t have to buy it, and you can receive a new vehicle once you meet the mileage limit or if the lease expires.

Someone who can lease a car is likely to have a good credit score, which auto insurance companies favor and promotes a lower-than-average auto insurance rate.

Benefits of Financing a Vehicle

Financing a vehicle is like buying a car. Although you can trade in your car, financing allows you to make payments until you own the car. Making timely payments can help your overall credit. Also, a clean driving record can make a monthly payment much cheaper.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Minimum Limits of Liability Auto Insurance When You Lease

You already know you cannot lease a car without insurance. One of the other drawbacks of leasing is that you can’t just carry the minimum limits of liability that the state requires.

You can get liability insurance on a leased car, but you’ll require higher coverage levels as well.

Since the state’s requirements for third-party coverage are fairly low, the lessor will require you to carry higher limits of liability to ensure that you and the company are protected in the event of a lawsuit. Here’s what’s commonly required:

- $100,000 per person in Bodily Injury Liability

- $300,000 per accident in Bodily Injury Liability

- $50,000 per accident in Property Damage Liability

Some states require as little as $12,500 for bodily injury liability and $5,000 for property damage liability. However, most leasing companies will require more.

It is not unheard of for them to set their requirements at $100,000 per person for bodily injury claims and $50,000 for property damage.

Gap Insurance Needs When Leasing a Car

Gap stands for Guaranteed Auto Protection. It is an additional form of protection that covers depreciation when you’re filing an auto insurance claim. According to the law experts at NOLO, Gap insurance is a good investment if you’re leasing your vehicle.

In most cases, the cost of Gap coverage is automatically added to your monthly payments. The lessor does this to ensure that the coverage is always available. If the coverage isn’t added to your payments, you need to see if you can add the Gap protection to your insurance policy.

Gap Insurance on a Leased Car

Do you need gap insurance for a leased car? Gap coverage is required because even for brand-new vehicles, their value declines fairly quickly. This means, if you were to get into an accident at any point after driving it off the sales lot, your comprehensive and collision coverage would likely not cover the full amount owed on the vehicle.

Gap insurance covers the gap between what you still owe on your lease and the current market value of your car at the time of the collision.

For example, get into an accident, and your leased vehicle is considered a total loss. Your insurance company will determine what your car was worth just before the accident.

If the insurance company determines your car was worth $10,000 at the time of the accident, and you still owed $13,000 on your lease, you’d be responsible for paying $3,000 to the car dealer plus your deductible if you do not have Gap insurance.

If you have Gap insurance, your Gap coverage pays any remaining difference between your car’s worth and your lease payoff amount.

You may have to shop around to find a company that offers Gap, but once you do, you will find that the added protection is very affordable. Some credit unions also offer Gap.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What the Lease Contract Says About Auto Insurance

While it is vital to pay attention to your state laws and lease car insurance requirements, review your coverage amounts to ensure that you’re not paying too much in auto insurance rates.

The bottom line is that people who are leasing the vehicle will need to be sure they are purchasing the legally and contractually required insurance types and amounts.

Does leasing a car mean you own it? No, the dealership still owns the vehicle at the end of the contract.

State Insurance Requirements Are Not the Same as the Requirements Through the Lessor

You’re required by law to purchase insurance on any vehicle that you own. It doesn’t matter if you’re leasing the car, financing the vehicle, or buying the vehicle outright when it comes to mandatory insurance laws.

While some of the required coverage options are the same, the coverage required by the state is very different from what’s required by your leasing company.

The laws drafted by state officials say that drivers must carry liability insurance to pay for the damages they cause behind the wheel.

Here are some examples of how coverage differs by state:

- If you lease a car in Florida, the car insurance requirements are Personal Injury Protection (PIP), Property Damage Liability (PDL), and Bodily Injury Liability (BIL).

- In California, the car insurance requirements for a leased car are Liability Insurance, Uninsured Motorist Coverage, Collision and Comprehensive Coverage, and Gap Insurance.

- While leasing a car in Hawaii the car insurance requirements are Minimum Liability Coverage, Personal Injury Protection, and Uninsured/Underinsured Motorist Coverage (UM/UIM).

- Leasing a car in Maryland means that you need the following car insurance: Liability Coverage, Uninsured Motorist Coverage, and Personal Injury Protection.

- If leasing a car in Utah, you will need Liability Coverage, Personal Injury Protection, and Uninsured/Underinsured Motorist Coverage.

There are no state laws that say that drivers must protect their cars under their auto insurance policies. Unlike the state, leasing companies have an insurable interest in the car that’s being driven.

Cost of Auto Insurance for a Leased Car vs. a Bought Car

Does it cost more to insure a leased car? Auto insurance for a lease versus a purchased vehicle usually receives similar rates.

One of the main reasons why someone with a leased car pays more for insurance than someone with a financed car is because of the auto insurance requirements.

Leasing companies are much more strict than finance companies when it comes to insurance limits.

The liability limits you must carry are much higher than the limits you’re legally obligated to carry. This difference will drive up your rates.

The only way to bring them down is to raise your physical damage deductibles. Unfortunately, with most leasing companies, high deductibles aren’t an option.

To help offset usually paying more for auto insurance on a leased vehicle, be proactive in asking insurance providers you’re researching about all applicable discounts. You can stack discounts to result in some nice savings on your rate.Michael Leotta Insurance Operations Specialist

If you plan on leasing a car, it’s important to price the cost of insurance first. Insurance is something that you must buy and maintain, so you need to budget accordingly. You cannot get free car insurance by leasing a car.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

You Get Into an Accident With Your Leased Car and Have No Insurance, What Now?

We never wish for an accident to occur, but what happens if someone hits your leased car? When a car accident with a leased car occurs and the driver is uninsured, it can lead to significant complications. If this occurs, the driver becomes personally responsible for damages to the leased vehicle and any other vehicles or property involved. This includes repair costs for the leased car and potential legal expenses if other parties pursue compensation. Additionally, what happens when you wreck a leased car without insurance can result in the leasing company taking action, such as terminating the lease agreement due to non-compliance with insurance requirements.

Additional Leased Auto Insurance Coverage Options

In addition to full coverage insurance and Gap insurance, you may want to consider additional coverage options to ensure you have enough insurance coverage on your leased vehicle. Car leases do not include insurance at all.

Other types of auto insurance coverage that may be mandatory in your state or wise to consider include:

- Bodily Injury Liability – Most states make this type of coverage a legal requirement of all drivers. If you cause an accident and someone else is hurt or killed, this coverage is extremely valuable.

- Property Damage Liability – This coverage is for situations where you are again at fault but damage or ruin someone else’s property. In most cases, it is a vehicle, but it could also be utility poles, trees, or garage doors. It is also mandated in most states.

- Uninsured Motorist/Underinsured Motorist – If you are hit by a driver who does not have auto insurance or is not adequately covered, this coverage is essential, which is why many states require it of their drivers. You are allowed to purchase more than the required amount. However, many drivers elect to purchase greater amounts of collision and comprehensive coverage instead.

- Medical Payments – If you or one of your passengers are injured in an accident and needs medical care, it will be covered under the medical payments coverage part of your auto insurance policy. This coverage is accessible no matter who is at fault for the accident, and some states may legally require it. It is also referred to as personal injury protection. Read our article, Do you need medical payment coverage on auto insurance? for details.

Be sure to shop around and compare leased vehicle insurance rates from many companies before you buy full coverage auto insurance on a leased car.

No matter what coverages you choose, you need to get multiple quotes to ensure you are getting the best deal. Compare full coverage auto insurance quotes today for your leased car.

The Bottom Line:Is full coverage auto insurance required to lease a car?

When considering auto insurance for leased cars, it’s essential to understand the specific requirements and coverage options available. The best car insurance for leased vehicles often includes comprehensive coverage, collision coverage, and Gap Insurance to protect against the difference between the car’s actual value and the amount owed on the lease in case of a total loss. Yes, you can have liability insurance on a leased car. Liability insurance is typically required on a leased car, covering damages to others in an accident. While cheap car insurance for leased cars can be found, factors like driving record and coverage limits affect pricing.

When considering full coverage insurance on a leased car, several factors come into play. One common question is “Who pays the insurance on a leased car?” Typically, the lessee, or the person leasing the car, is responsible for purchasing and maintaining the required insurance coverage. Leasing companies often require lessees to have full coverage insurance, which includes comprehensive and collision coverage, in addition to liability coverage.

This leads to another frequently asked question: “Does leasing a car require full coverage?” Yes, most leasing agreements mandate full coverage insurance to protect the leased vehicle adequately.

The requirements to lease a car often include proof of full coverage insurance before taking possession of the vehicle. Full coverage insurance helps protect both the lessee and the leasing company against financial losses in case of accidents, theft, or damage to the leased car.

Comparing quotes can help find affordable options and you can see what is covered in a car lease. It’s important to note that leased car insurance may be more expensive than financing due to higher coverage requirements from leasing companies. Florida lease insurance requirements and California car lease insurance requirements may vary, so reviewing state-specific guidelines is crucial to ensure compliance with minimum coverage levels.

Ultimately, how much insurance is when you lease a car depends on many factors, like where you live and how clean of a driving record you have. Is it cheaper to insure a leased or financed car? A three-year car lease with insurance will cost the same as if you owned or financed the vehicle. Don’t forget that car leases do not include insurance, it’s an additional factor you need to consider in your budget. The best insurance for leased cars depends on a few factors, but get a quote today to see what the best option for you is.

Frequently Asked Questions

Can you cancel insurance on a leased car?

You must carry full coverage on your leased vehicle. The only way you can cancel your insurance on a leased car is to replace it with a new policy immediately.

How much should you put down on a car lease?

The average recommended down payment on a leased vehicle is 20% of the purchase price.

If you lease a car, can you own it?

If you lease a car, do you own it? Not necessarily. However, there are different types of auto leases, and you can invest in a lease-to-own program if that is what interests you.

Can you add things to a leased car?

Technically you can; however, it is recommended that you do not modify a leased vehicle.

Can someone else drive a leased car?

Leased car insurance requirements will cover any named driver on the policy. Car leasing with insurance works the same as if you owned the vehicle. As long as you have a high coverage policy, your vehicle will be covered.

What do I do when someone hits my leased car?

What happens if you crash a leased car is the same as any other vehicle, file a claim with your insurance company. If your leased car is in an accident, you’re responsible for fixing it, which is why full coverage insurance is recommended.

Is buying a vehicle better than leasing a vehicle?

That’s a matter of preference. Some individuals would rather own their vehicle, while others don’t want the pressure of owning a vehicle or paying a finance company.

Is it a good idea to lease a car?

It’s a good idea to lease a car if you’re concerned about depreciation. For example, if the market value of your car unexpectedly drops, your decision to lease will prove to be a wise financial move.

How do loans affect auto insurance?

Banks and finance companies require you to get full coverage auto insurance, which affects your overall auto insurance cost.

Can I switch to liability-only insurance after I lease a car, or does leasing a car require full coverage?

No, it is generally not advisable to switch to liability-only insurance once you have leased a car. As per the lease agreement, you are typically required to maintain full coverage insurance throughout the lease term. Failing to do so may lead to lease violations, penalties, and potential financial liabilities in case of accidents or damages to the vehicle.

Is full coverage insurance more expensive than regular liability insurance?

What happens if you don’t have insurance on a leased car?

Do car leases include insurance?

Who carries the best car insurance for leased cars?

Can a friend drive my leased car?

How does leasing a car affect car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.