Do you need auto insurance to get a license plate? (2026)

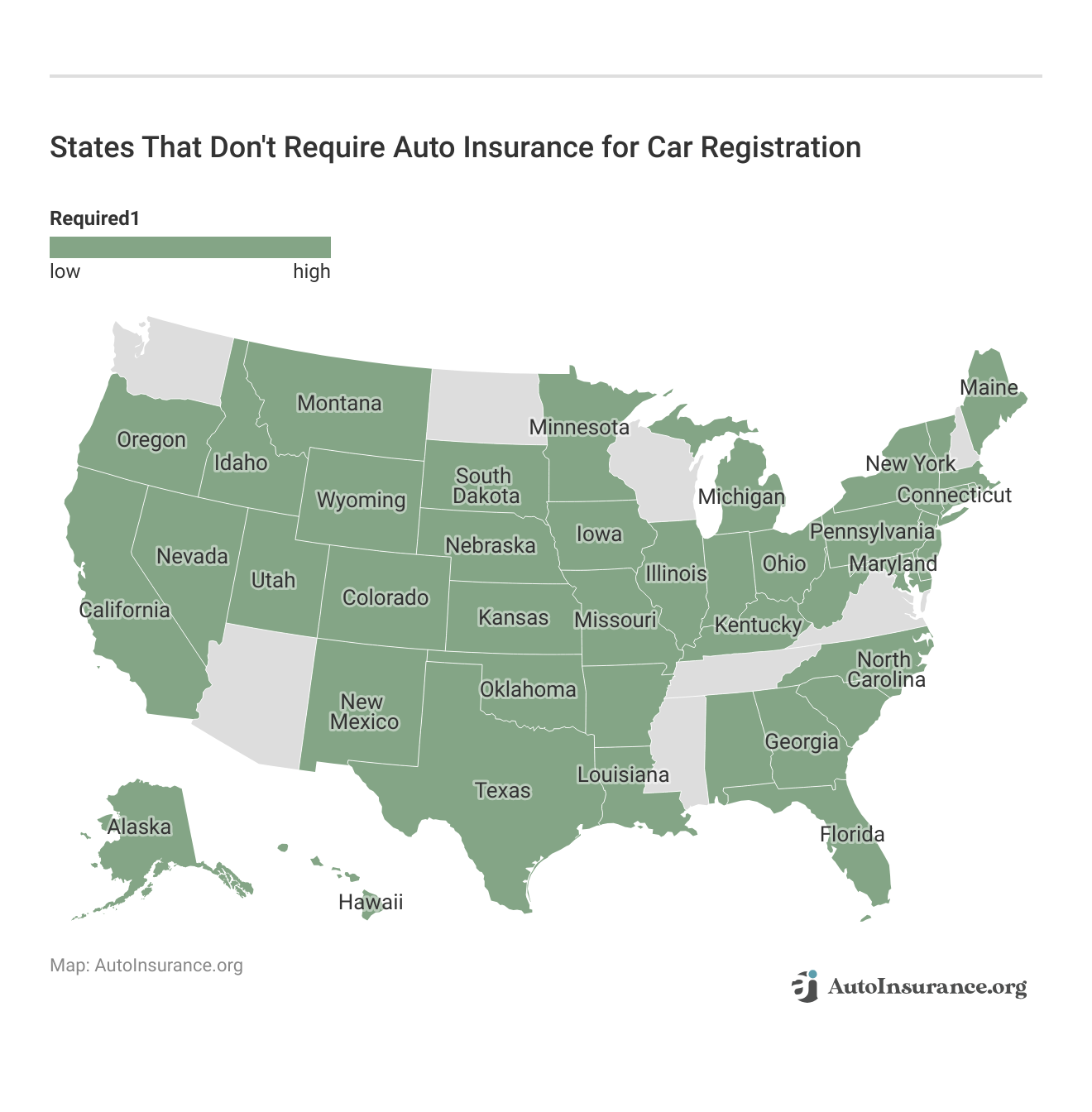

You do need auto insurance to get a license plate in 42 states. However, insuring a car without a license plate is possible in states offering alternatives to traditional coverage. Below, we'll overview how to get insurance on a car with temporary plates and why securing a policy before registration is essential.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated December 2024

Can you get a license plate without insurance? In most states, you do need auto insurance to get a license plate, though it isn’t required in eight states. However, you’ll still need to show some financial responsibility by paying an uninsured motorist fee or getting a surety bond.

Read More: How to Create a Surety Bond for Auto Insurance

Do you need insurance for temporary plates? Even with temporary tags, driving without insurance is illegal in most states.

To meet your legal obligation, enter your ZIP code into our quote comparison tool above and shop for the cheapest liability-only auto insurance near you.

- Most states require car insurance or financial responsibility to get a license plate

- The amount and types of auto insurance you need varies from state to state

- Even if you’re driving a car with a temporary tag, you’ll need to get insurance

You’ll Need Insurance to Get a License Plate in Most Cases

A top question readers ask is, “Can you get a tag without insurance?” Yes, in 42 states, you must prove that you have insurance on your vehicle before you are allowed to put a license plate on that vehicle, which involves meeting state minimum auto insurance requirements.

Most states require that you show proof of insurance or financial responsibility to register your car and get license plates. Examples of financial responsibility include getting a surety bond, obtaining self-insurance, or paying an uninsured motorist fee.Eric Stauffer Licensed Insurance Agent

So, where can I get plates without insurance? There are only eight states that do not require this for the registration process.

New Hampshire is one of two states that does not require liability insurance to operate a car. However, if you live in New Hampshire, you will still have to prove that you could cover the cost of repairs stemming from an accident. Check out our comprehensive guide to understand more about New Hampshire minimum auto insurance requirements.

Virginia auto insurance laws also allow you to pay a $500 uninsured motor vehicle fee to “drive at your own risk.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Required Car Insurance for Obtaining a License Plate

Now that we’ve explained the answer to, “Do you need insurance to get tags?” you might be curious why this is the case. The laws requiring proof of insurance or financial responsibility to register your car help to keep drivers, bicyclists, and pedestrians safe while on the road and prevent anyone from facing financial hardship due to an accident.

The amount and type of car insurance coverage required, however, does vary from state to state. While some require basic liability insurance, other states ask for more. Be sure you know the exact requirements before you register or even attempt to drive your car.

Penalties for Driving Without Auto Insurance by State

States Penalties

Alabama Fine: Up to $500; registration suspension, $200 reinstatement fee

Alaska License suspension for 90 days

Arizona Fine: $500+; license/registration suspension for 3 months

Arkansas Fine: $50-$250; suspended registration; $20 reinstatement fee; possible impoundment

California Fine: $100-$200; possible impoundment

Colorado Fine: $500+; 4 points; license suspension until proof of insurance

Connecticut Fine: $100-$1000; suspended registration/license for 1 month; $175 reinstatement fee

Delaware Fine: $1500+; license suspension for 6 months

Florida Suspension of license/registration; $150 reinstatement fee

Georgia Suspended registration; $25 lapse fee; $60 reinstatement fee

Hawaii Fine: $500 or community service; 3-month license suspension or 6-month insurance policy

Idaho Fine: $75; license suspension until proof of insurance

Illinois Fine: $500+; license plate suspension until $100 reinstatement fee

Indiana License/registration suspension for 90 days to 1 year

Iowa Fine: $250-$500; possible community service; possible impoundment

Kansas Fine: $300-$1000; possible jail for 6 months; license/registration suspension; $100 reinstatement fee

Kentucky Fine: $500-$1000; possible jail for 90 days; plates/registration revoked for 1 year

Louisiana Fine: $500-$1000; if in accident, registration revoked, driving privileges suspended for 180 days

Maine Fine: $100-$500; license/registration suspension until proof of insurance

Maryland Loss of plates/registration; uninsured motorist penalty fees; $25 restoration fee

Massachusetts Fine: $500-$5000; possible imprisonment for 1 year or less

Michigan Fine: $200-$500; possible imprisonment for 1 year; license suspension for 30 days; $25 service fee

Minnesota Fine: $200-$1000; possible community service; possible imprisonment for 90 days; license/registration revoked for 12 months

Mississippi Fine: $1000; driving privileges suspended for 1 year

Missouri Four points; suspended until proof of insurance; $20 reinstatement fee

Montana Fine: $250-$500; possible imprisonment for 10 days

Nebraska License/registration suspension; $50 reinstatement fee for each

Nevada Fine: $250-$1000; registration suspension; $250 reinstatement fee

New Hampshire Not mandatory, but SR-22 may be required post-conviction or accident

New Jersey Fine: $300-$1000; license suspension for 1 year; $250/year surcharge for 3 years

New Mexico Fine: $300; possible imprisonment for 90 days; license suspension

New York Fine: $1500; $750 civil penalty; license/registration suspension; $8-$12 daily penalties for lapse

North Carolina Fine: $50; registration suspension until proof of insurance; $50 restoration fee

North Dakota Fine: $1500; possible 30-day imprisonment; 14 points; proof required for 1 year; $50 fee

Ohio License/plates/registration suspension; $100 reinstatement fee; high-risk coverage for 3-5 years

Oklahoma Fine: $250; possible 30-day imprisonment; license suspension; $275 reinstatement fee

Oregon Fine: $130-$1000; possible 1-year license suspension; proof required for 3 years

Pennsylvania Registration suspended for 3 months; $88 restoration fee or $500 civil penalty

Rhode Island Fine: $100-$500; license/registration suspension for 3 months; $30-$50 reinstatement fee

South Carolina Fine: $100-$200; possible 30-day imprisonment; $200 reinstatement fee

South Dakota Fine: $100; possible 30-day imprisonment; 30-day to 1-year license suspension; SR-22 required for 3 years

Tennessee $25 coverage failure fee; additional $100 fee if unpaid; possible registration suspension

Texas Fine: $175-$350; $250 surcharge for 3 years

Utah Fine: $400; license suspension; $100 reinstatement fee; proof required for 3 years

Vermont Fine: $500; license suspension until proof of insurance

Virginia $500 uninsured motorist fee; suspension if unpaid

Washington Fine: $250+

West Virginia Fine: $200-$5000; 30-day license suspension; $200 penalty fee

Wisconsin Fine: $500

Wyoming Fine: $750; possible 6-month imprisonment

Is not having auto insurance a criminal offense? Driving without the required insurance is usually considered a misdemeanor and can lead to fines and even jail time.

Getting Insurance With a Temporary Tag

So, do I need insurance for temporary plates? Yes, if you’re in a state that requires car insurance, you must purchase a policy for your car with a temporary tag. In addition, all states prohibit driving without insurance or proof of financial responsibility.

When you buy a new or used car, you will usually receive a temporary tag to display until your regular license plate arrives. You might also need a temporary tag if you have a vehicle that you are restoring on your property, or if you are moving to the U.S. from another country and shipping your vehicle from overseas. See our guide on the best international car shipping auto insurance.

The same may be true if you moved to a new state. You will need to re-register the vehicle in your new state, usually within 30-60 days. These scenarios might understandably have you wondering if you need insurance during these transitions.

Read More: How to Change Auto Insurance When Moving Out of State

How to Provide Proof of Insurance for Registration

Now that you know the answer to, “Do I need insurance to get license plates?” we’ll help you figure out how to prove you carry an active insurance policy.

Once you choose which insurance policy you want to buy, you will have to make sure it’s active before you register your car at your state’s department of motor vehicles (DMV). To make the process as easy as possible, you can find specific information for your state here.

You might be wondering how to get a copy of your auto insurance card. Simply call your insurer and request they mail you one, or you can get one online.

Once you have proof of insurance, bring it with you, along with the following:

- Your valid driver’s license

- Proof of ownership of the car

- Any required inspection paperwork

- The application for the license plate

If you buy your car at a dealership, this can often be handled right there. However, you will still need your driver’s license and proof of insurance.

Looking ahead, you may be thinking, “Do I need insurance to get a license plate renewed?” You’ll need insurance to renew registration in most states, and drivers typically must renew their tag every one to five years. Fortunately, most states have an online renewal process that makes it easy to pay the fee and provide proof of insurance and other documents from the comfort of home.

Learn More: Vehicle Registration Fees by State

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Need Insurance Before Getting a License Plate

So, can you get license plates without insurance? In most cases, you’ll need to get car insurance before a license plate.

However, you might also wonder, “Do you need insurance for temp tags?” Insuring a car when waiting on plates is also required.

By getting your state’s minimum car insurance requirements in place before you get on the road, you can be sure you are a legal driver who qualifies to register your car and get license plates. Enter your ZIP code into our free quote comparison tool below to find the cheapest minimum coverage near you.

Frequently Asked Questions

Can I get license plates without insurance?

Many readers may wonder, “Can you have a license plate without insurance?” In most jurisdictions, auto insurance is a requirement to obtain a license plate for your vehicle.

Insurance laws are in place to ensure that drivers have financial protection in case of accidents or damages. Proof of insurance coverage is typically required when registering a vehicle and obtaining license plates. It is important to check the specific insurance requirements in your jurisdiction, as they may vary.

Can you get insurance without a license plate?

Some may ask, “Can I get insurance without a license plate?” Yes, you’ll usually want to secure insurance coverage before getting a license plate, as most states require it. Typically, insurers require your vehicle indentification number (VIN) and other personal information, rather than a plate number, to get a policy.

Read More: Does your car need to be registered to get auto insurance?

Do you need car insurance to get tags at a kiosk?

You might also wonder, “Do I need insurance to get tags at a mobile kiosk?” Yes, you’ll need insurance in most states to get your tags, whether it’s in person at the DMV or a kiosk.

What type of auto insurance coverage is typically required for license plates?

The specific amount and type of auto insurance coverage required for license plates can vary depending on the jurisdiction. However, the most common requirement is liability insurance.

Liability insurance provides coverage for damages or injuries caused to others in an accident for which you are at fault. The minimum liability coverage limits required can also vary by jurisdiction, so it’s essential to comply with the local regulations.

Can you get tags without insurance if you don’t own a vehicle?

So, can I get tags without insurance if I don’t have a car? It is not possible to obtain a license plate without owning a vehicle or having auto insurance. License plates are issued for specific vehicles, and proof of ownership and insurance coverage is typically required during the registration process.

If you don’t own a vehicle, you would not be eligible to obtain license plates. If you plan to drive a vehicle that is owned by someone else, it’s important to ensure that the vehicle is properly insured, and you may need to be listed as a driver on the insurance policy.

Read More: Adding a Driver to Auto Insurance

What happens if I drive without insurance or license plates?

Driving without auto insurance or license plates is illegal in most jurisdictions. Consequences for driving without insurance or proper registration can vary but can include fines, vehicle impoundment, license suspension, and other penalties.

Driving without insurance puts you at financial risk because you would be personally responsible for any damages or injuries caused in an accident. It’s crucial to comply with insurance and registration requirements to drive legally and protect yourself and others on the road.

So, do I need insurance to get a tag? Most states require insurance to register a car, but you’ll need to prove financial responsibility.

Can I transfer my license plates to a new vehicle with the same insurance?

In many cases, you can transfer your license plates from one vehicle to another, provided that both vehicles are eligible for the transfer and you maintain the same insurance coverage.

The specific rules for license plate transfers vary by jurisdiction, so it’s important to check with your local Department of Motor Vehicles (DMV) or relevant authority to understand the requirements and procedures. It’s also advisable to inform your insurance company about the change in vehicles to ensure proper coverage during the transfer process.

Read More: Do you need proof of insurance to transfer a car title?

What should I do if my auto insurance policy is canceled or lapses?

If your auto insurance policy is canceled or lapses for any reason, it’s important to take immediate action. Driving without insurance is illegal in most places, and it exposes you to significant financial risk.

Contact your insurance company to understand the reason for the cancellation or lapse and determine if the coverage can be reinstated. If not, shop for alternative insurance options to obtain coverage as soon as possible. It’s crucial to maintain continuous auto insurance coverage to comply with legal requirements and protect yourself financially.

Do you need insurance for a temporary plate?

Do you need insurance to get a temp tag? Yes, most states want drivers to carry proof of insurance, even if you still have a temporary tag.

So, can you get temp tags without insurance in any state? Some states don’t require insurance when registering a car, including Arizona, Mississippi, New Hampshire, North Dakota, Tennessee, Virginia, Washington, and Wisconsin.

Can I get a tag without insurance in Georgia?

Georgia drivers may wonder, “Can you get a car tag without insurance in GA?” Georgia auto insurance law requires continuous auto insurance coverage for vehicles with active registration.

Do you have to have insurance to get a tag in Alabama?

Can I get a license plate without insurance in NY?

Do you need car insurance to get a license plate in California?

Do I need insurance to get plates in Ohio?

Do you have to have proof of insurance to get a tag in Tennessee?

Can you get a license plate without insurance in New Hampshire?

Can you get a plate without insurance in Virginia?

Do I have to have insurance to get a tag temporarily in Arizona?

Do you need a license plate to get insurance?

Do I need insurance to get a license?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.