Does car insurance cover hail damage?

If your vehicle has full coverage, including comprehensive coverage alongside liability, your car insurance will cover hail damage.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Corporate Paralegal

Brett Surbey is a corporate paralegal specializing in tax reorganizations and the creation of corporations so they can successfully navigate all aspects of their business and mitigate risks where necessary. He has assisted lawyers on a number of enigmatic transactions, including M&As, complex corporate succession plans, and amalgamations. In addition to his legal career, he is a known e...

Brett Surbey

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

You’re probably aware of the damage a hail storm can cause. The damage from a hail storm can be detrimental to your car, home, and property. In 2021, there were more than 3,700 hailstorms in the U.S., causing billions of dollars in repairs.

If you own a vehicle, you may be curious whether your auto insurance covers damage caused by a hail storm. The good news is that a car insurance policy can cover vehicle damage from hail, but you must have the right coverage.

A car insurance policy that includes comprehensive auto insurance coverage will pay for vehicle damages caused by hail. However, if you carry your state’s minimum coverage instead of a full coverage policy, you’ll have to pay for damage to your vehicle out of pocket.

- A full coverage policy will cover hail damage to your vehicle

- Comprehensive coverage helps pay for repairs after covered events outside of a car accident, like theft, damage from wild animals, or hail damage

- Hail storms cause billions of dollars in damage every year in the U.S.

Does car insurance cover hail damage to your vehicle?

Your car insurance might cover hail damage to your vehicle, but it depends on the type of car insurance you have.

Numerous car insurance options exist, and many people purchase the minimum car insurance required in their state. Minimum coverage consists of different liability coverages to protect you from legal ramifications if you’re at fault in an accident and hurt someone or damage a vehicle.

Unfortunately, liability auto insurance doesn’t offer any protection for your vehicle. If you only carry liability insurance on your car, you’ll have to pay for your vehicle repairs out of pocket, whether from an accident or another scenario.

Comprehensive car insurance coverage helps pay for your vehicle repairs if it gets damaged by hail. This coverage works for any damage to your vehicle not caused in an accident. You can purchase comprehensive coverage by itself or invest in a full coverage policy.

Does a full coverage policy cover hail damage to my vehicle?

A full coverage car insurance policy helps pay for repairs if your vehicle gets damaged by hail. Full coverage includes comprehensive and collision insurance, meaning you have coverage in virtually any circumstance.

Collision car insurance coverage pays for repairs to your car if you need them after an accident. In contrast, comprehensive coverage pays for repairs if your vehicle gets damaged by vandalism, theft, inclement weather, and other non-accident-related incidents.

Full coverage insurance costs more than a liability insurance policy. Still, if you have a clean driving record, you could get affordable rates for a full coverage policy in your area. The best way to ensure you don’t overpay for your car insurance coverage is to find and compare quotes from multiple companies.

Does liability insurance cover hail damage?

As stated earlier, liability auto insurance doesn’t cover damage to your vehicle. Therefore, whether your car gets damaged in an accident or due to inclement weather, you’ll have to pay for repairs out of pocket if you only have a liability policy.

Liability insurance allows you to drive legally in your state, and coverage is often cheap. Still, liability coverage leaves much to be desired regarding damage to your car.

You may be worried about the cost if you want full coverage, including collision and comprehensive insurance. Still, you can shop online and compare quotes to see if any companies in your area offer coverage that works with your budget.

You can also add comprehensive insurance to an auto insurance policy without adding collision. The average cost for comprehensive insurance is around $14 per month.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does comprehensive insurance always cover hail damage?

Comprehensive car insurance pays for repairs associated with inclement weather. This coverage helps with damage from storms, snow, sleet, hail, falling debris, and trees.

While you don’t have to purchase comprehensive insurance to meet your state’s minimum coverage requirements, you may be required to carry both comprehensive and collision coverage if you have a loan or lease on your vehicle.

If you paid your vehicle off and aren’t required to carry full coverage, you should still consider doing so. Full coverage could still be helpful if your car gets damaged.

Remember that your car insurance must be in place before an event occurs. So you must have comprehensive insurance on your policy if you want to file a comprehensive claim.

How much is comprehensive car insurance?

The average cost for a comprehensive auto insurance policy is around $170 annually or $14 per month. Where you live will likely impact how much you’ll pay for comprehensive coverage.

Auto Insurance Monthly Rates by Company and State

| State | Allstate | Geico | Progressive | State Farm | U.S. Average |

|---|---|---|---|---|---|

| Alaska | $135 | $76 | $97 | $65 | $93 |

| Alabama | $108 | $89 | $112 | $108 | $104 |

| Arkansas | $162 | $91 | $131 | $80 | $116 |

| Arizona | $180 | $65 | $84 | $81 | $103 |

| California | $199 | $101 | $132 | $108 | $135 |

| Colorado | $166 | $94 | $120 | $94 | $119 |

| Connecticut | $196 | $62 | $133 | $91 | $120 |

| District of Columbia | $241 | $69 | $115 | $111 | $134 |

| Delaware | $207 | $101 | $90 | $116 | $128 |

| Florida | $183 | $89 | $153 | $99 | $131 |

| Georgia | $165 | $61 | $115 | $107 | $112 |

| Hawaii | $118 | $60 | $78 | $64 | $80 |

| Iowa | $126 | $81 | $75 | $65 | $87 |

| Idaho | $128 | $57 | $91 | $53 | $82 |

| Illinois | $176 | $47 | $89 | $64 | $94 |

| Indiana | $140 | $63 | $69 | $71 | $86 |

| Kansas | $160 | $75 | $127 | $81 | $111 |

| Kentucky | $236 | $80 | $111 | $98 | $131 |

| Louisiana | $206 | $141 | $161 | $124 | $158 |

| Massachusetts | $143 | $72 | $95 | $78 | $97 |

| Maryland | $201 | $135 | $121 | $107 | $141 |

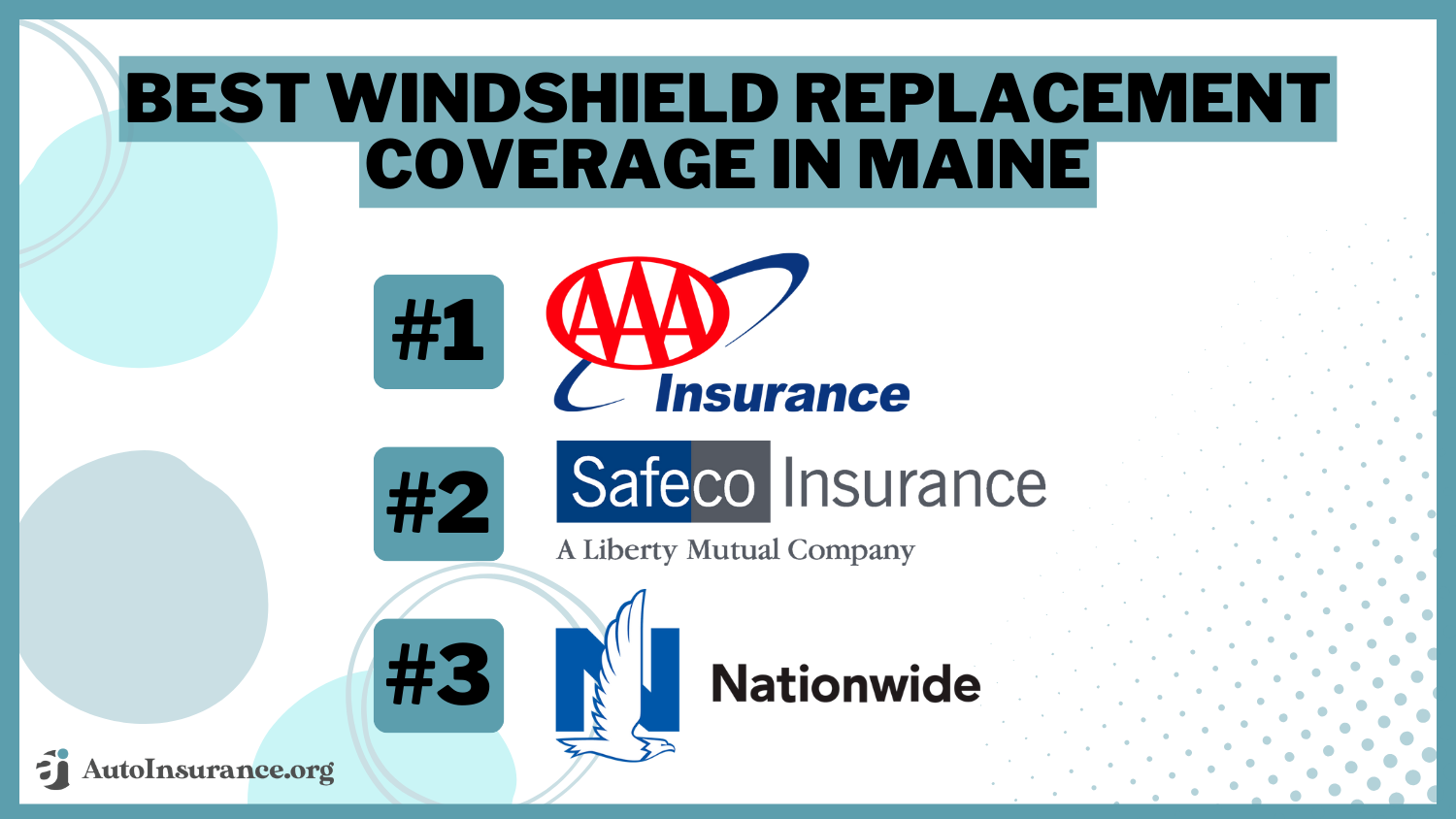

| Maine | $108 | $37 | $94 | $59 | $74 |

| Michigan | $406 | $99 | $152 | $209 | $216 |

| Minnesota | $160 | $90 | $101 | $67 | $105 |

| Missouri | $148 | $90 | $98 | $85 | $105 |

| Mississippi | $147 | $72 | $120 | $82 | $105 |

| Montana | $154 | $82 | $171 | $70 | $119 |

| North Carolina | $169 | $69 | $32 | $77 | $87 |

| North Dakota | $136 | $61 | $110 | $76 | $96 |

| Nebraska | $125 | $92 | $95 | $69 | $95 |

| New Hampshire | $128 | $50 | $63 | $59 | $75 |

| New Jersey | $157 | $74 | $93 | $113 | $110 |

| New Mexico | $158 | $90 | $86 | $69 | $101 |

| Nevada | $165 | $110 | $82 | $103 | $115 |

| New York | $147 | $78 | $96 | $137 | $114 |

| Ohio | $120 | $59 | $85 | $70 | $83 |

| Oklahoma | $135 | $109 | $110 | $91 | $111 |

| Oregon | $153 | $93 | $78 | $75 | $100 |

| Pennsylvania | $148 | $68 | $148 | $76 | $110 |

| Rhode Island | $189 | $125 | $116 | $76 | $126 |

| South Carolina | $133 | $79 | $105 | $88 | $101 |

| South Dakota | $136 | $57 | $105 | $67 | $91 |

| Tennessee | $144 | $78 | $92 | $72 | $97 |

| Texas | $201 | $105 | $121 | $90 | $129 |

| Utah | $117 | $73 | $95 | $103 | $97 |

| Virginia | $103 | $69 | $61 | $63 | $74 |

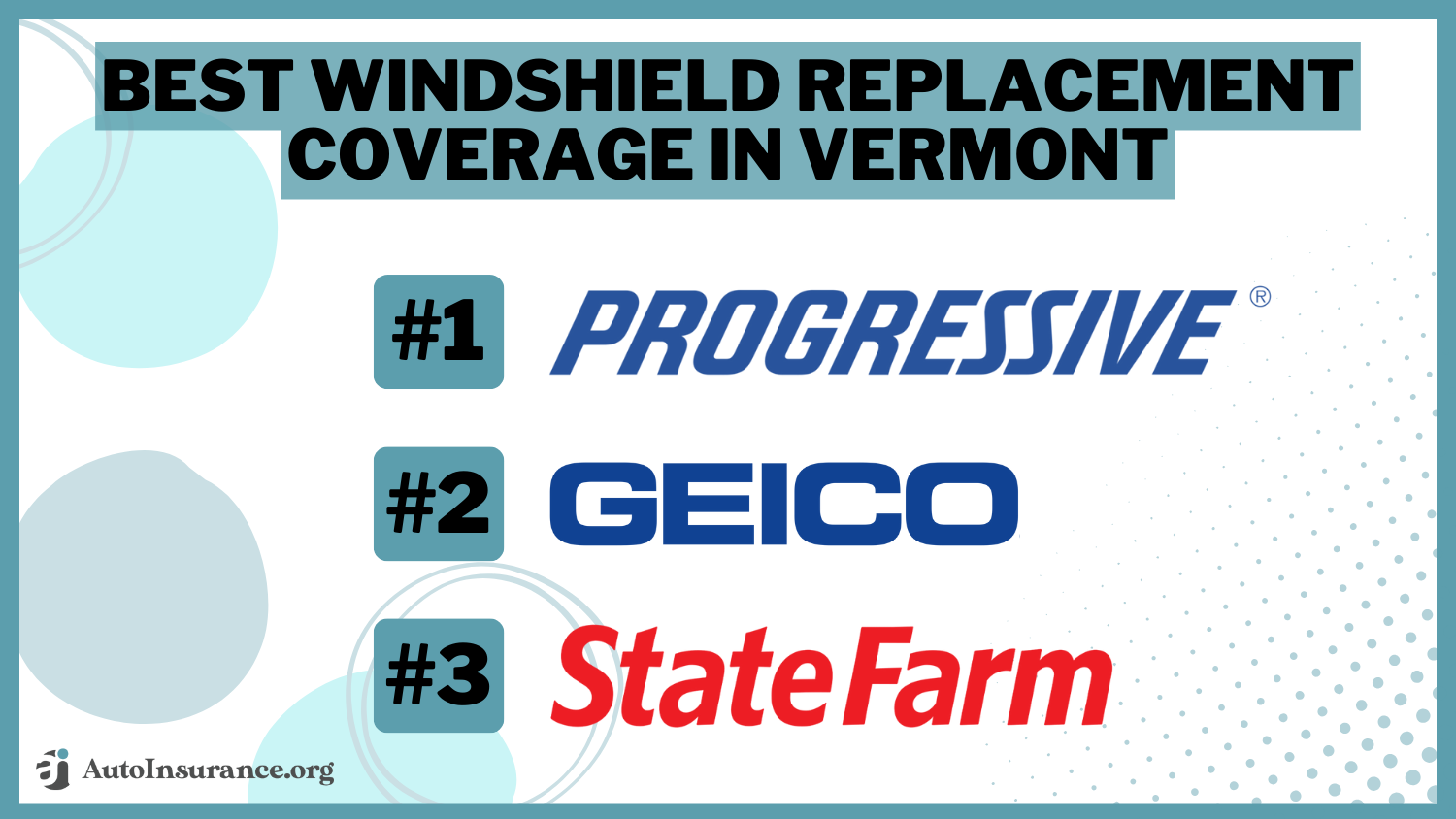

| Vermont | $142 | $38 | $181 | $87 | $112 |

| Washington | $114 | $75 | $60 | $69 | $80 |

| Wisconsin | $123 | $62 | $94 | $58 | $84 |

| West Virginia | $162 | $83 | $110 | $79 | $109 |

| Wyoming | $155 | $111 | $106 | $82 | $113 |

California auto insurance has the cheapest annual rates for comprehensive coverage. In California, you’ll pay around $96.53 annually or $8 per month for comprehensive insurance.

South Dakota auto insurance is the most expensive car insurance in the U.S. If you live in South Dakota, you’ll pay $347.61 annually or $29 per month for comprehensive auto insurance coverage.

Knowing your state’s average cost for comprehensive coverage can be helpful. Still, you won’t know exactly how much you’ll pay for comprehensive insurance until you find and compare quotes from different companies.

Comparing quotes is a good way to know which company in your area will offer you the coverage you want at a price that works best.

Should I file a car insurance claim after a hail storm?

You can file a claim after a hail storm, but you’ll want to consider the cost of your car insurance deductible. The average cost for repairs following a hail storm is around $3,000. So if you have a $500 deductible and need repairs that cost $3,000 or more, filing a claim is a good idea.

However, if you have a $500 deductible and repairs would cost around $300, pay to fix the hail damage out of pocket. Otherwise, you’ll need to pay an extra $200 for your deductible, and your auto insurance rates could increase because you filed a claim.

Even if the cost of damages is a bit more than your deductible, you’ll want to weigh the benefits and drawbacks of filing a claim. For example, you may save some money on vehicle repairs, but you could pay higher auto insurance rates at your next renewal because you filed a claim.

Speak with your insurance company to let them know what happened and ask how much your deductible for repairs will be. Then you can make an informed decision concerning whether you’ll file a claim on your insurance policy.

How do I file a claim for hail damage?

To file a car insurance claim for hail damage, you’ll take the same steps as you would when filing any other claim on your car insurance.

Some companies allow you to file a claim on the company app or website, while others require you to call and speak with a representative. Either way, you should file a claim as soon as you can after vehicle damage.

Depending on the damage, you may find that several other individuals in your area are also filing insurance claims. Therefore, you may have better luck with timely repairs if you contact your insurance company early to file a claim.

How much auto insurance coverage do I have for hail damage?

Hail damage coverage depends on a few factors, like:

- Your comprehensive coverage limits

- Your deductible

- The severity of your vehicle damages

Suppose you have a $500 deductible on your comprehensive coverage, and the repairs will cost $1,200. In that case, if your comprehensive coverage limit is higher than $1,200, your vehicle repairs have complete coverage once you pay your deductible.

Review your car insurance policy to see how much coverage you have for comprehensive insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can hail damage total a car?

Hail can damage a car to the point that an insurance company declares it a totaled vehicle. You’ll need to file an insurance claim to determine whether your vehicle is worth repairing.

What should I do if my car gets damaged by hail?

If your car gets totaled because of hail damage, your insurance company will base your insurance payout on its actual cash value (ACV). Your vehicle’s ACV is the estimated market value. In many cases, this number is typically lower than what you paid for your car.

You’ll receive the ACV for your vehicle from your insurance company if you have the appropriate coverage in your policy.

This amount may be significantly less than what you paid for the vehicle. If so, you’ll have to decide whether you want to pay for repairs to the vehicle or buy a different car. Buying a different car could mean paying more out of pocket or taking out a loan for the difference.

Most insurance companies prefer to total a vehicle and pay the ACV rather than pay for the repairs to a salvage title due to the risks associated with rebuilding a totaled vehicle. You have choices, but you should assess how much you’ll get for your car before making any decisions.

Where are hail car insurance claims most common?

Hail insurance claims are most common in Texas. Texas auto insurance companies paid over $474 million for auto and property damage claims due to hail damage.

Colorado follows Texas regarding hail insurance claims, then Illinois, Missouri, Minnesota, Kansas, Nebraska, Iowa, Oklahoma, and South Dakota.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can I protect my vehicle from hail damage?

Keep your vehicle in a covered garage or carport to protect it from hail damage. If your vehicle stays outside, even under natural coverage, it could get damaged by a hail storm.

You can purchase a car cover to prevent hail damage on your car if you don’t have access to a covered garage or carport. Pull over and stop driving if you’re driving in a hail storm to help your vehicle undergo less significant damage.

Car Insurance and Hail Damage: The Bottom Line

Hail can cause serious damage to your vehicle. However, a comprehensive auto insurance policy covers your vehicle if it gets damaged by hail.

Before filing an insurance claim for hail damage, check your policy to see how much you’ll pay for the deductible. If repairs cost less than your deductible, consider paying for them out of pocket to avoid increased insurance rates at your next renewal.

Frequently Asked Questions

Does Geico cover hail damage?

Geico hail damage coverage comes from a Geico comprehensive policy. If you have comprehensive coverage with Geico, you can file a Geico hail damage claim to have your vehicle repaired.

Is it worth filing a claim for hail damage?

If repairs to your vehicle cost more than your deductible, filing a claim with your insurance company may be a good idea. However, remember that filing a claim may cause your rates to go up in the future.

Do I pay a deductible for hail damage to my car?

You’ll pay a deductible if you file a claim for repairs to your vehicle because of hail damage. Check your policy to see how much you’ll pay for your deductible.

Does car insurance typically cover hail damage?

Yes, car insurance policies generally provide coverage for hail damage, depending on the type of coverage you have and the specifics of your policy.

What type of car insurance coverage typically covers hail damage?

Comprehensive coverage is the type of car insurance that typically covers hail damage. It is an optional coverage that protects your vehicle against various non-collision incidents, including hailstorms.

Does liability insurance cover hail damage?

No, liability insurance does not cover hail damage. Liability insurance only covers damages and injuries you cause to others in an accident, but it does not provide coverage for damages to your own vehicle.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.