How to Cancel Ameriprise Auto Insurance in 2026 (5 Easy Steps)

To learn how to cancel Ameriprise auto insurance effectively, follow several steps. Review your policy, contact customer service, prepare documentation, submit a notice, and verify cancellation. With rates starting at $30 per month, this process ensures a smooth transition without gaps.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated October 2024

To learn how to cancel Ameriprise auto insurance effectively, you must follow a structured process with rates starting at $30/month.

This article outlines essential steps to cancel your policy by reviewing your policy, contacting customer service, preparing documentation, submitting a written notice, and verifying cancellation. For more details, check out our guide to Ameriprise auto insurance discounts for members.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Step #1: Review Policy – Check your cancellation terms

- Step #2: Contact Customer Service – Call Ameriprise support

- Step #3: Prepare Documentation – Have your policy info ready

- Step #4: Submit Written Notice – Send your cancellation request

- Step #5: Verify Cancellation – Ask for written confirmation

Instantly End Your Ameriprise Insurance Coverage in 5 Steps

Step #1: Review Policy

To obtain instant proof of your auto insurance policy online, the first step is to log into your insurance provider’s online account portal. Most insurance companies offer a secure website or mobile app where you can access your account. Ensure you have your login credentials ready, including your username and password.

Monthly Auto Insurance Rates by Provider and Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $42 | $135 |

This overview compares monthly auto insurance rates from various providers. Geico offers the lowest minimum coverage at $30, while Liberty Mutual is the highest at $68. For full coverage, Allstate is the most expensive at $160, with Geico again providing the lowest rate at $80.

Other providers include American Family, Farmers, Nationwide, Progressive, State Farm, Travelers, and USAA, showcasing a range of rates based on coverage levels. If you haven’t registered for online access, you must create an account by providing your policy number and other personal details.

This step is crucial because it allows you to access your policy documents, including your proof of insurance, which is often available for download or printing. Discover how to choose an auto insurance company.

Step #2: Contact Customer Service

Once logged into your account, navigate to the auto insurance policy details section. This is typically labeled “Policies,” “Documents,” or “My Account,” depending on the provider. Here, you’ll find all the relevant documents related to your policy, including coverage information, payment history, and proof of insurance.

Being familiar with this section will help you easily locate and review important details, making finding the exact document you need quicker, especially your proof of insurance. Find out more about what an auto insurance policy looks like.

Step #3: Prepare Documentation

In the policy section, look for the option to view or download your proof of insurance, often labeled “ID Cards” or “Proof of Coverage.” This document is your official insurance coverage evidence and is typically required when registering your vehicle or during a traffic stop.

To ensure a smooth transition when canceling your Ameriprise auto insurance, always secure new coverage before contacting customer service.Daniel Walker Licensed Auto Insurance Agent

By selecting this option, you can view a digital version of your insurance card. This is a convenient way to access proof of coverage instantly without waiting for a physical card to arrive in the mail. Find out if you need proof of insurance to buy a car.

Step #4: Submit Written Notice

After locating your proof of insurance, the next step is to download or print it. Most insurance providers allow you to download a PDF version of the document, which you can save on your mobile device or computer. If you prefer a physical copy, you can print it directly from the website.

A downloaded or printed copy ensures you can provide proof of coverage quickly when needed, even in an area without internet access. Learn how to check if a vehicle has auto insurance coverage.

Step #5: Verify Cancellation

Once you’ve downloaded or printed your proof of insurance, the final step is to store it in an easily accessible place. You can save a digital copy on your smartphone for convenience or keep a printed version in your glove compartment.

This step is important because proof of insurance is required in various situations, such as during a traffic stop or when you’re involved in an at-fault accident. A readily available copy ensures you’re always prepared to present it when necessary.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Ameriprise Insurance Policy

Although there are many reasons you may want to cancel your auto insurance, there is a process to follow to make the transition easier. Not knowing how to cancel auto insurance through any company can make the process painful. However, cancellation policies are standard, and this helpful guide will tell you everything you need to know.

First, find out when your Ameriprise insurance policy ends. While the company doesn’t say it charges a cancellation fee, it may depend on your state and specific policy.

Next, look for new coverage. If you still intend to drive, you need auto insurance, so shop around to find the coverage you need at the best price. Be sure to activate your new policy before canceling your current coverage. Then, cancel your coverage. To cancel an Ameriprise account, contact customer service by phone or email.

The Ameriprise Costco auto insurance phone number is (888) 239-9953. You can also email [email protected]. If you’d like quick confirmation of the cancellation, calling Ameriprise might be the better option, as they may not respond to an email immediately.

You’ll also want information to make your Ameriprise cancellation process run smoothly, including your name, address, and policy number. It is essential to ensure your new coverage begins before your auto insurance ends.

If not, you’ll be driving without insurance. According to the Insurance Information Institute, driving without insurance leads to fines, a driver’s license suspension, and impounding your vehicle. Your car insurance rates also increase if you have a coverage lapse. To keep rates low and avoid fines, ensure your new coverage is in place before you cancel.

More About Ameriprise Auto Insurance

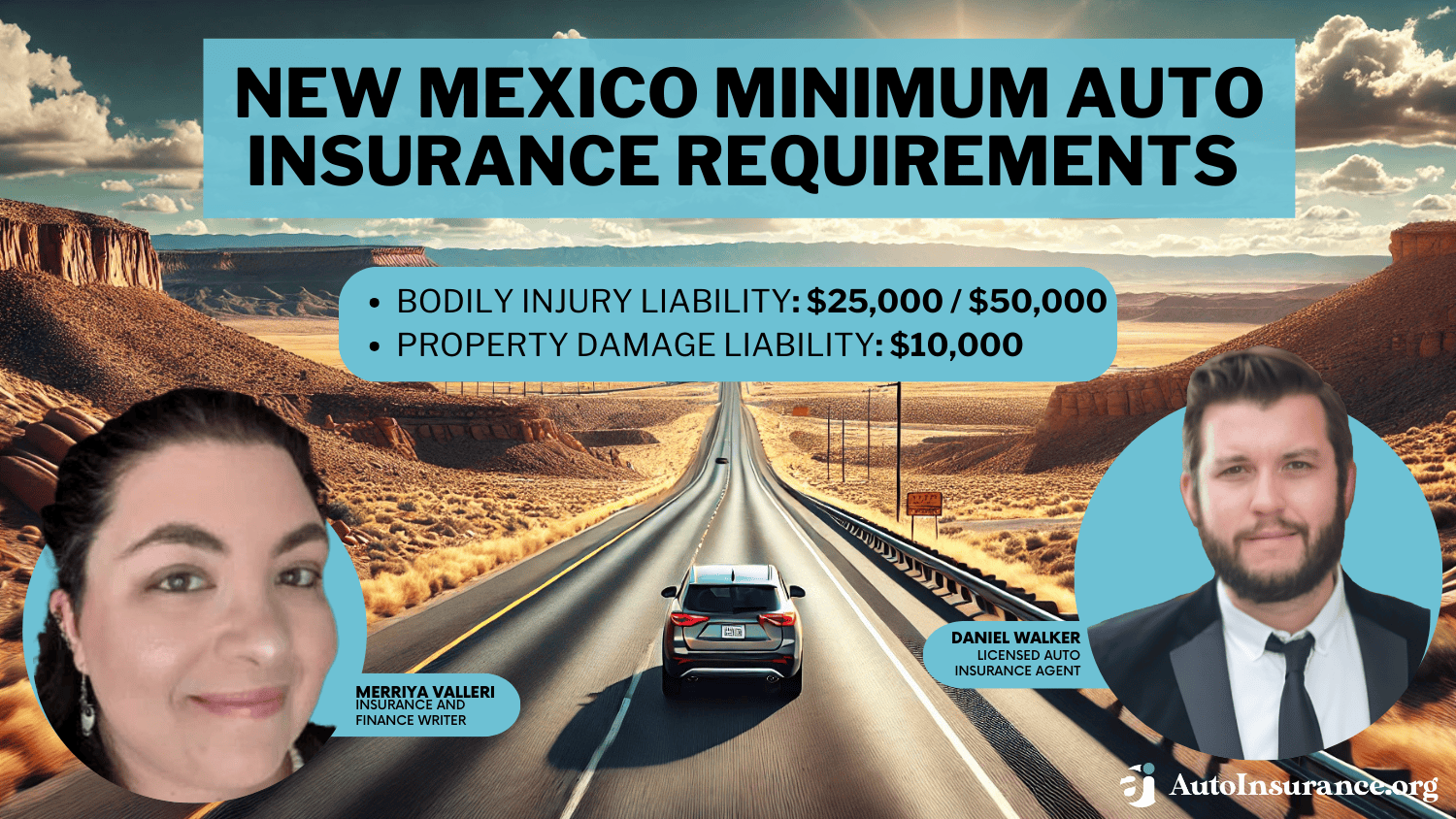

Ameriprise offers auto insurance through Costco and home, renters, and umbrella policies. Their Costco auto insurance features exclusive discounts, savings, and customizable options. Basic coverage includes bodily injury, personal injury protection, medical expenses, and property damage insurance.

You can also add comprehensive and collision coverage. Comprehensive insurance protects against damages not caused by collisions, such as vandalism and weather, while collision insurance covers damages from accidents, regardless of fault.

Both collision and comprehensive insurance usually have an auto insurance deductible. Roadside assistance and towing are also available. These are great options if you experience a flat tire or another unexpected incident while on the road. Ameriprise offers several auto insurance discounts to policyholders, which can help lower your rates. Car insurance discounts include:

- Defensive driver

- Garaging

- Good student

- Student away

- Education

Additional coverage offered by Ameriprise includes uninsured motorists, gap, and rental car insurance. Whether you’re a defensive driver, a good student, or simply looking for coverage options tailored to your situation, these discounts can make a difference in your overall insurance costs. Explore your eligibility today and enjoy the savings.

Guide to Cancelling Ameriprise Auto Insurance

To cancel Ameriprise auto insurance, review your policy’s cancellation terms and ensure you have new coverage in place to avoid lapses. Then, contact customer service via phone or email to initiate the cancellation, providing necessary details such as your name, address, and policy number.

Ameriprise typically does not charge a cancellation fee, though this may vary by state.

You may be eligible for a refund of any unused auto insurance premium after cancellation, so keep a record of your cancellation confirmation and relevant documents. They offer various auto insurance products, including liability, collision, and comprehensive coverage, often with discounts for Costco members.

Stop overpaying for your insurance by entering your ZIP code below to find the lowest rates in your area.

Frequently Asked Questions

Will I receive a refund if I cancel my Ameriprise auto insurance policy early?

If you cancel your policy before the end of the policy term, you may be eligible for a refund of the unused portion of your premium. The refund amount will depend on various factors, including your state and the specific terms of your policy.

Access detailed insights by understanding your auto insurance policy.

Can I cancel my Ameriprise auto insurance policy if I move to a different state?

You can cancel your policy if you move to a different state. In such cases, it is important to inform Ameriprise about your change of address and your intention to cancel the policy.

What should I do with my Ameriprise auto insurance documents after canceling the policy?

After canceling your policy, it’s recommended to keep a copy of the cancellation confirmation for your records. You may also need to provide proof of prior insurance to your new insurance company, so retaining relevant documents can be helpful.

Can I cancel my Ameriprise auto insurance policy if I have an open claim?

Generally, you can cancel your policy even if you have an open claim. However, discussing the specific details of your claim with Ameriprise and understanding any potential implications before canceling your policy is important.

Will canceling my Ameriprise auto insurance policy affect my eligibility for future insurance coverage?

Canceling your policy will unlikely affect your eligibility for future insurance coverage. However, other insurance companies may consider a history of policy cancellations when determining premiums or coverage options.

Read our guide to find out what documents you need to get auto insurance.

Can I cancel my insurance policy for free?

You can cancel your policy entirely, but it may not be completely free. An administrative fee might apply to cover the insurer’s costs. Typically, this fee is minimal and will likely be lower than any charges incurred if you cancel outside the cooling-off period.

How to cash out an Ameriprise account?

You can use your debit card at Allpoint and Visa ATM locations to withdraw cash. Ameriprise doesn’t impose ATM transaction fees; however, some banks and ATM operators may charge fees for using their machines. To avoid these charges, use ATMs that display the Allpoint network alliance logo.

What is the penalty for early withdrawal from Ameriprise?

If you make early withdrawals from earnings, you might face taxes and a 10% IRS penalty if you take distributions before age 59½ (with some exceptions). Inherited Roth IRAs must also comply with the required minimum distributions.

Is my money safe with Ameriprise?

When you choose Ameriprise Financial, we prioritize protecting your financial information and assets against fraud. Our commitment to client security includes an Online Security Guarantee that backs all client accounts.

For more details, explore how to save money by bundling insurance policies.

How do you terminate an agreement with a financial advisor?

To end your relationship with a financial advisor, inform them in writing and keep a copy for your records. Cancel any permissions you’ve granted them, such as transaction authorities or access to your bank accounts. This written document will summarize the advice provided by your licensed financial planner or advisor.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.