Best McAllen, Texas Auto Insurance in 2026

On average, McAllen, TX auto insurance rates are $6,758/yr. The cheapest auto insurance company in McAllen, Texas, is USAA. However, McAllen, TX auto insurance quotes vary for each person. McAllen car insurance must meet the minimum Texas car insurance requirements with coverage levels of 30/60/25 for liability. Compare McAllen, TX auto insurance online to find the best price for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated September 2024

- On average, McAllen, TX auto insurance rates are $6,758/yr

- USAA, State Farm, and Geico are the cheapest auto insurance companies in McAllen

- The most significant factors in auto insurance are your driving record, age, vehicle, and credit history

How much is auto insurance in McAllen, TX? McAllen, TX auto insurance rates are $6,758 per year, which is $2,715 more expensive than the Texas auto insurance average and $2,826 more than the national average.

McAllen, TX auto insurance quotes are expensive, but personal factors could change your overall auto insurance cost.

Read through this short guide to learn how to secure cheap auto insurance in McAllen, TX, for every age, credit history, and driving record.

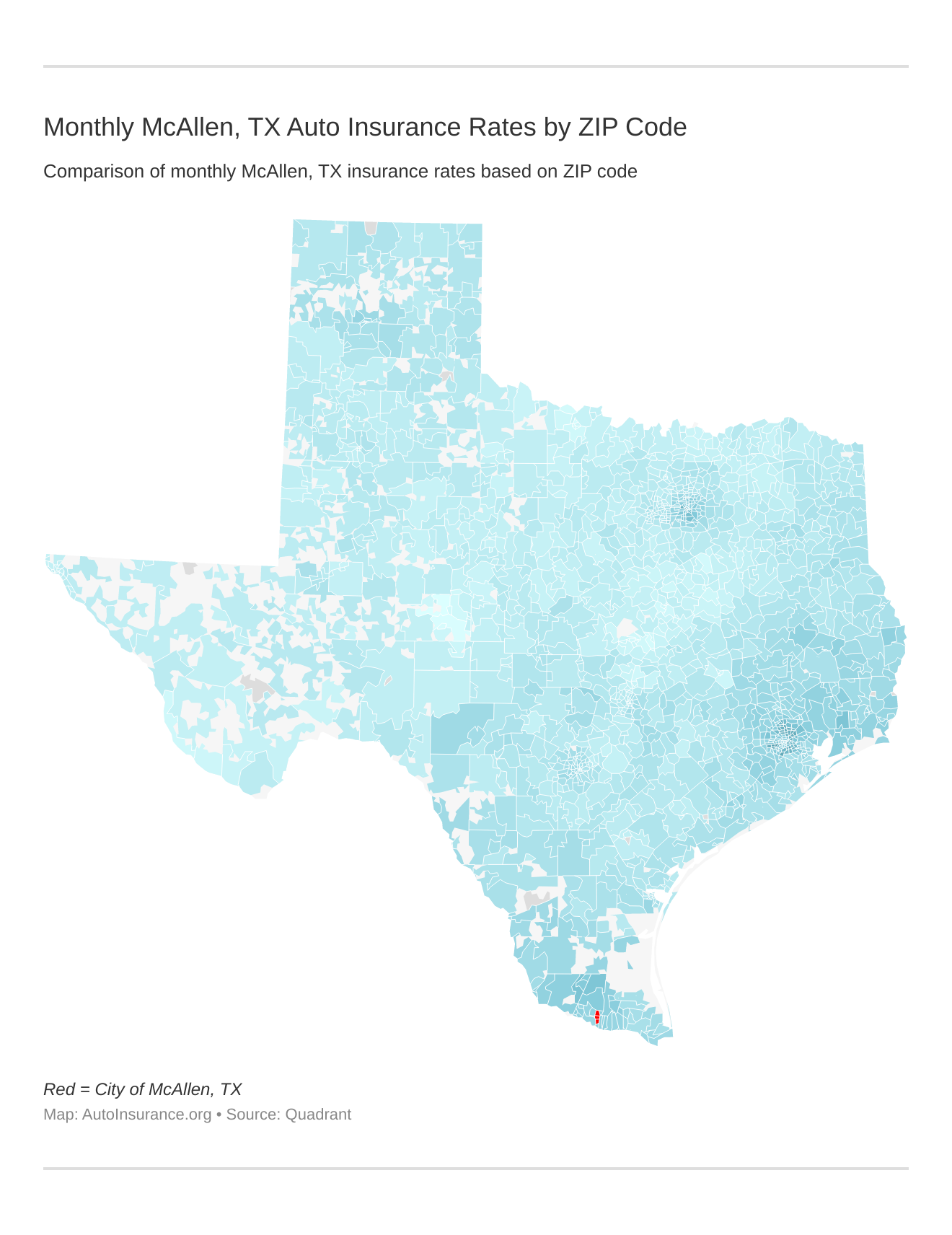

Monthly McAllen, TX Car Insurance Rates by ZIP Code

Find more info about the monthly McAllen, TX auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

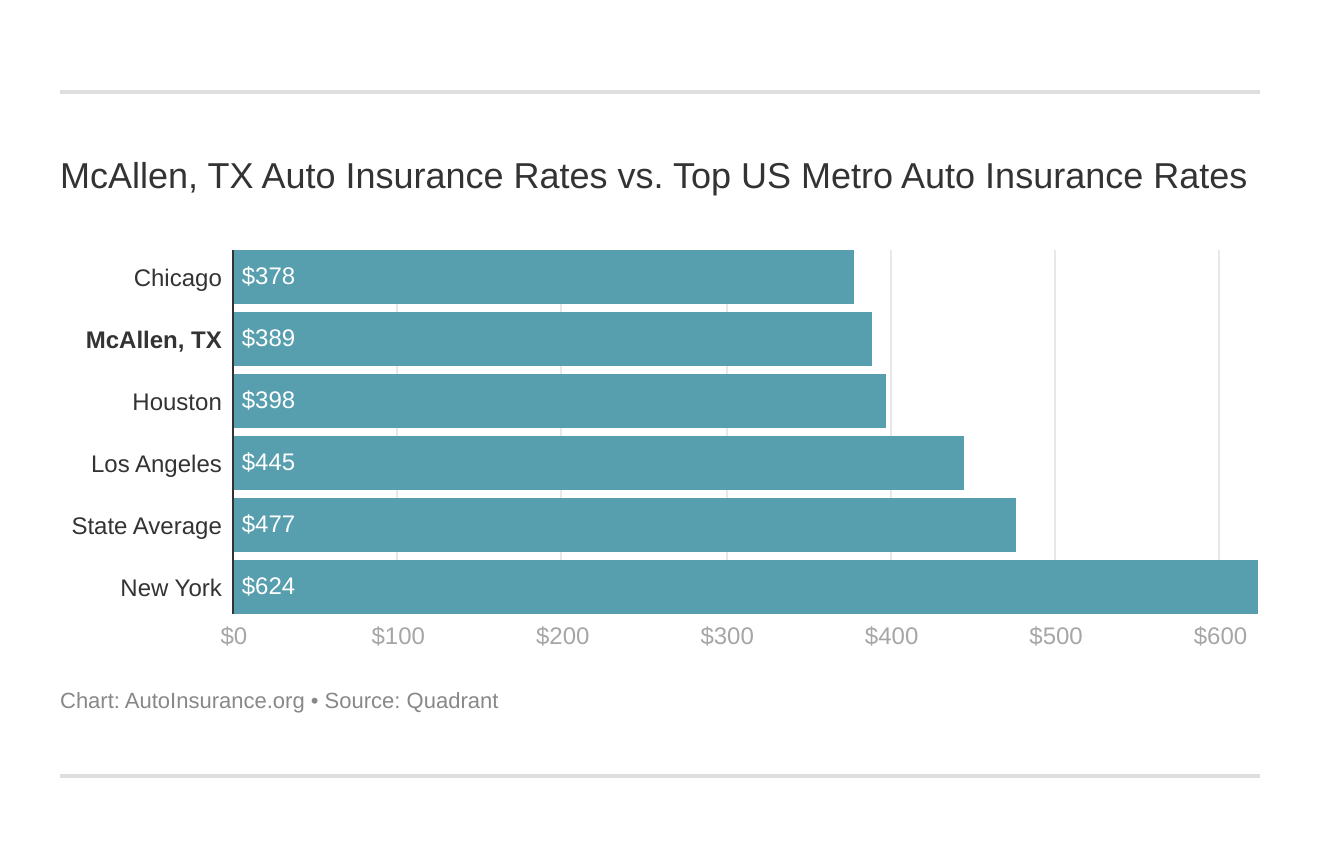

McAllen, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare McAllen, TX against other top US metro areas’ auto insurance rates.

Are you ready to compare affordable McAllen, TX auto insurance quotes? Enter your ZIP code above to get started.

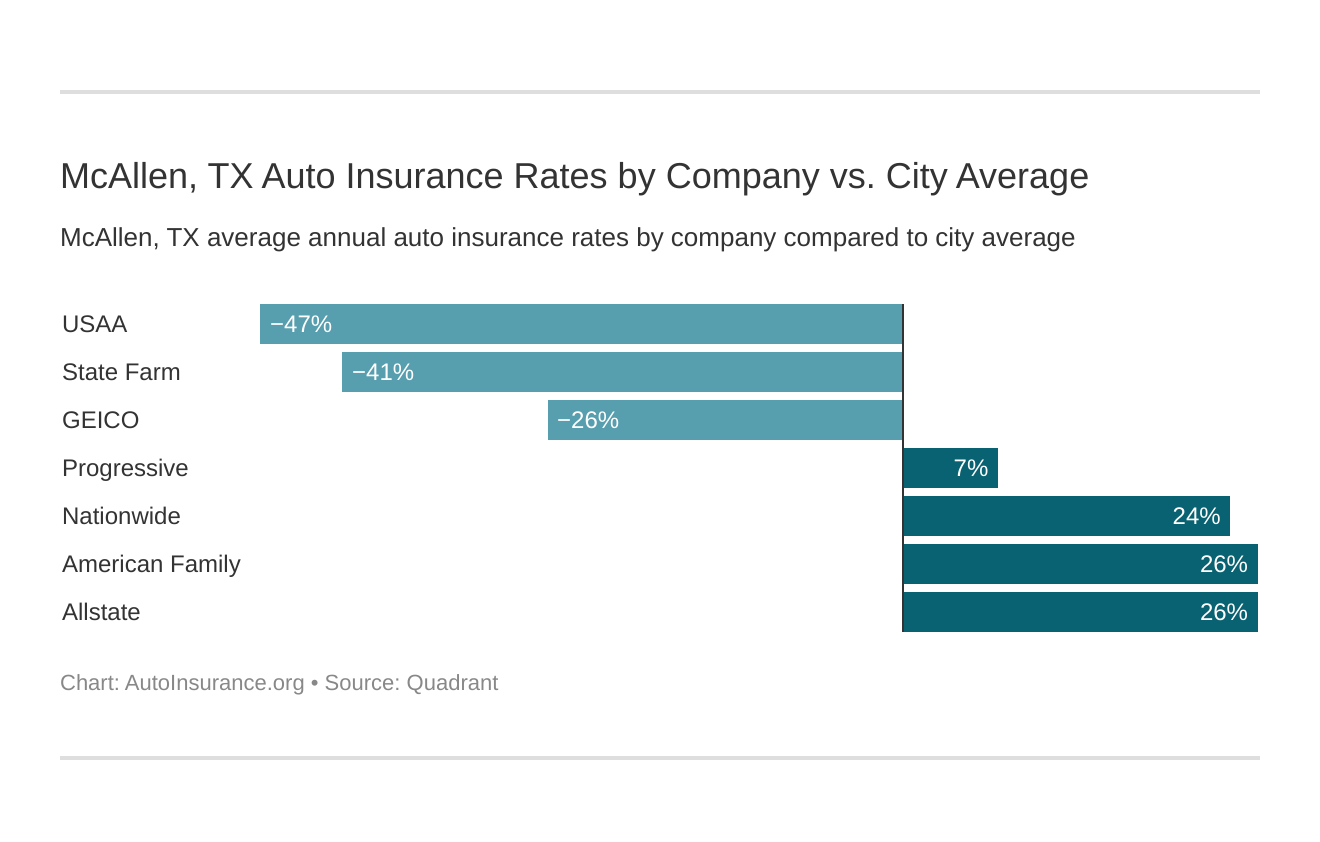

What is the cheapest McAllen, TX auto insurance company?

The cheapest auto insurance company in McAllen, based on average rates, is USAA.

The cheapest McAllen, TX car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Texas car insurance company rates?” We cover that as well.

The best auto insurance companies in McAllen, TX, ranked from cheapest to most expensive are:

- USAA – $2,893

- State Farm – $3,068

- Geico – $3,583

- Progressive – $5,025

- Nationwide – $5,979

- American Family – $6,072

- Allstate – $6,097

Each McAllen, TX car insurance company has unique rates because personal factors are calculated differently.

All listed companies are cheaper than the McAllen auto insurance average. Smaller companies in your area may be more affordable, but be sure to compare quotes before you make a final decision.

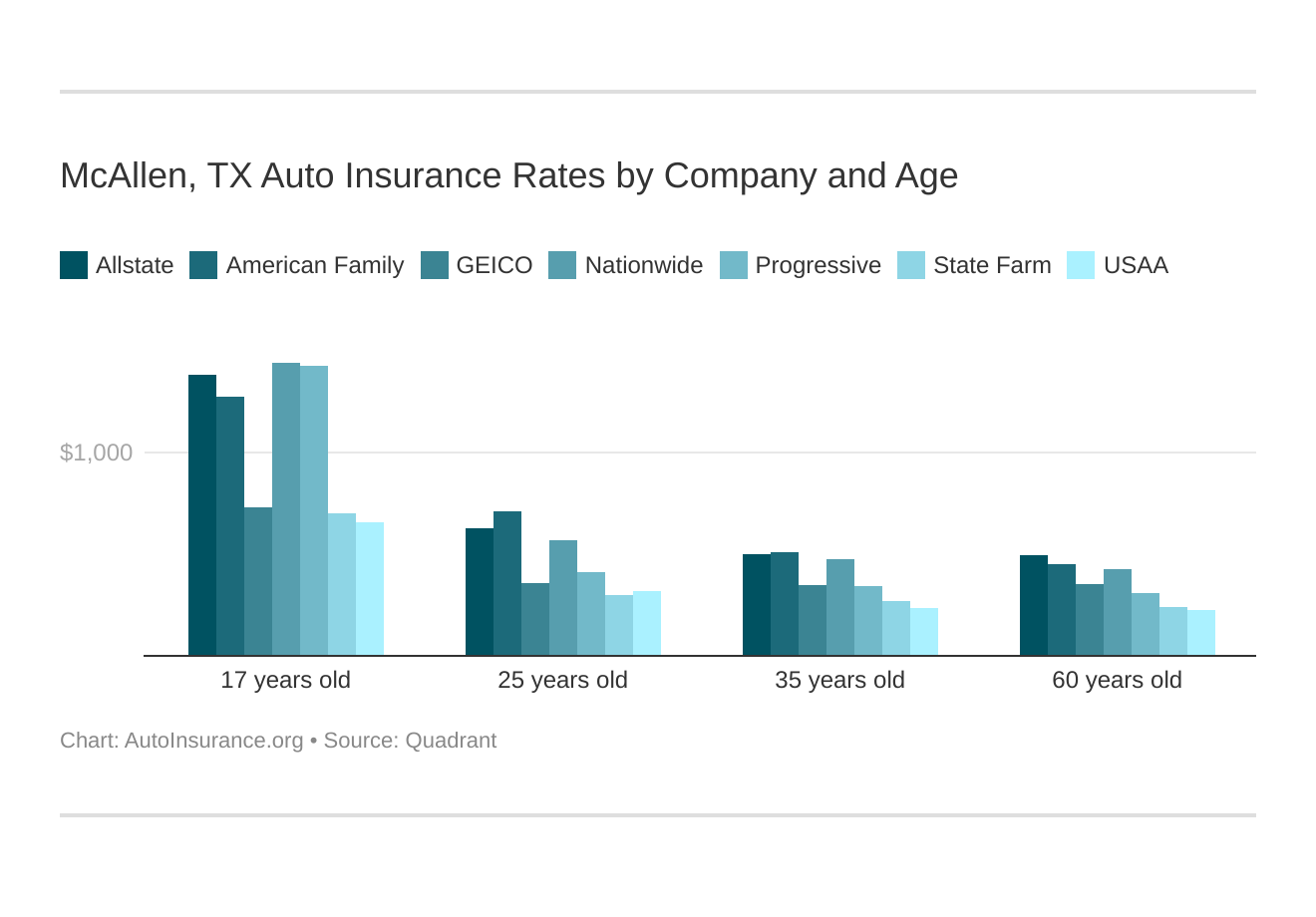

McAllen, Texas car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

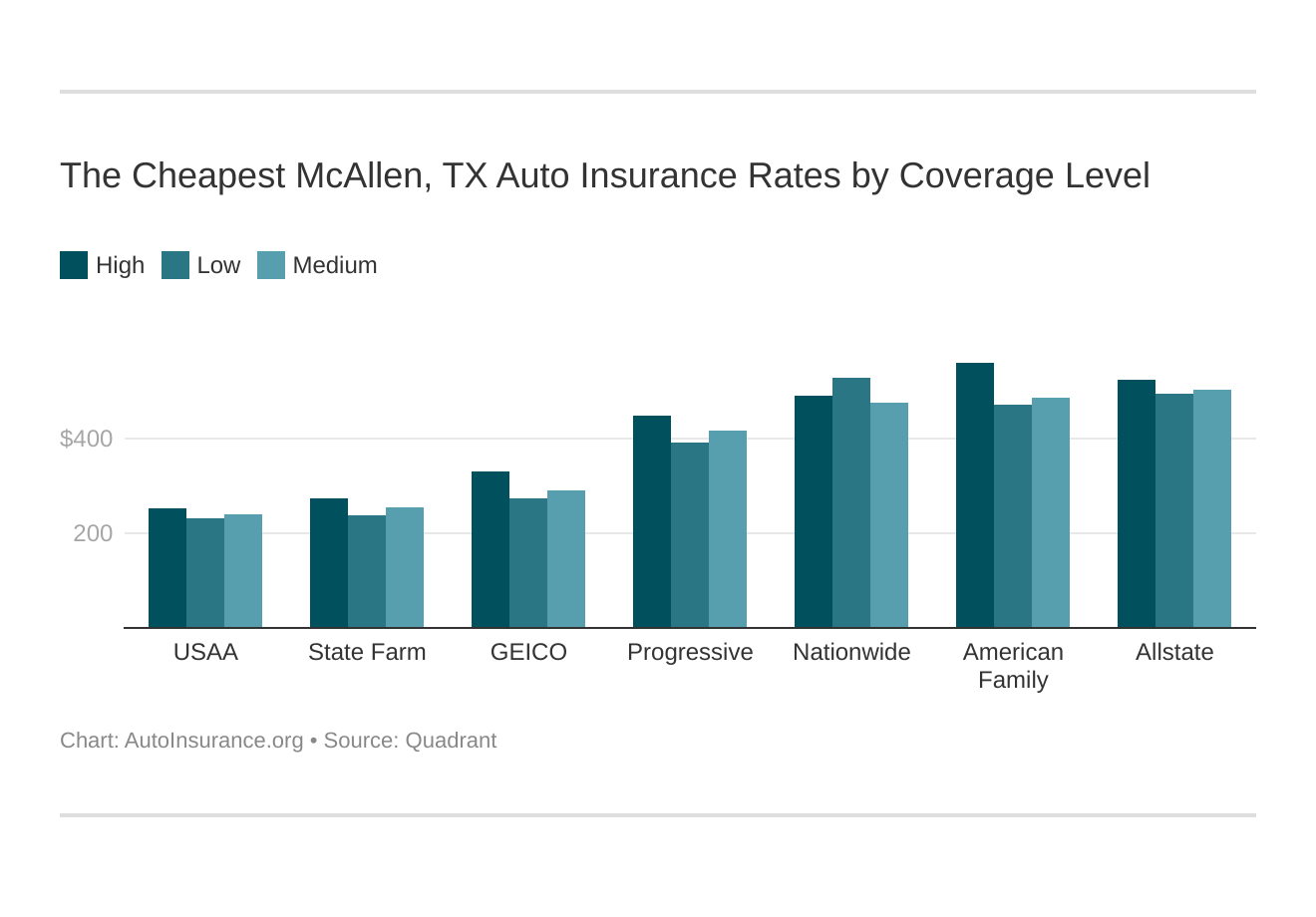

Your coverage level will play a major role in your McAllen, TX car insurance rates. Find the cheapest McAllen, Texas car insurance rates by coverage level below:

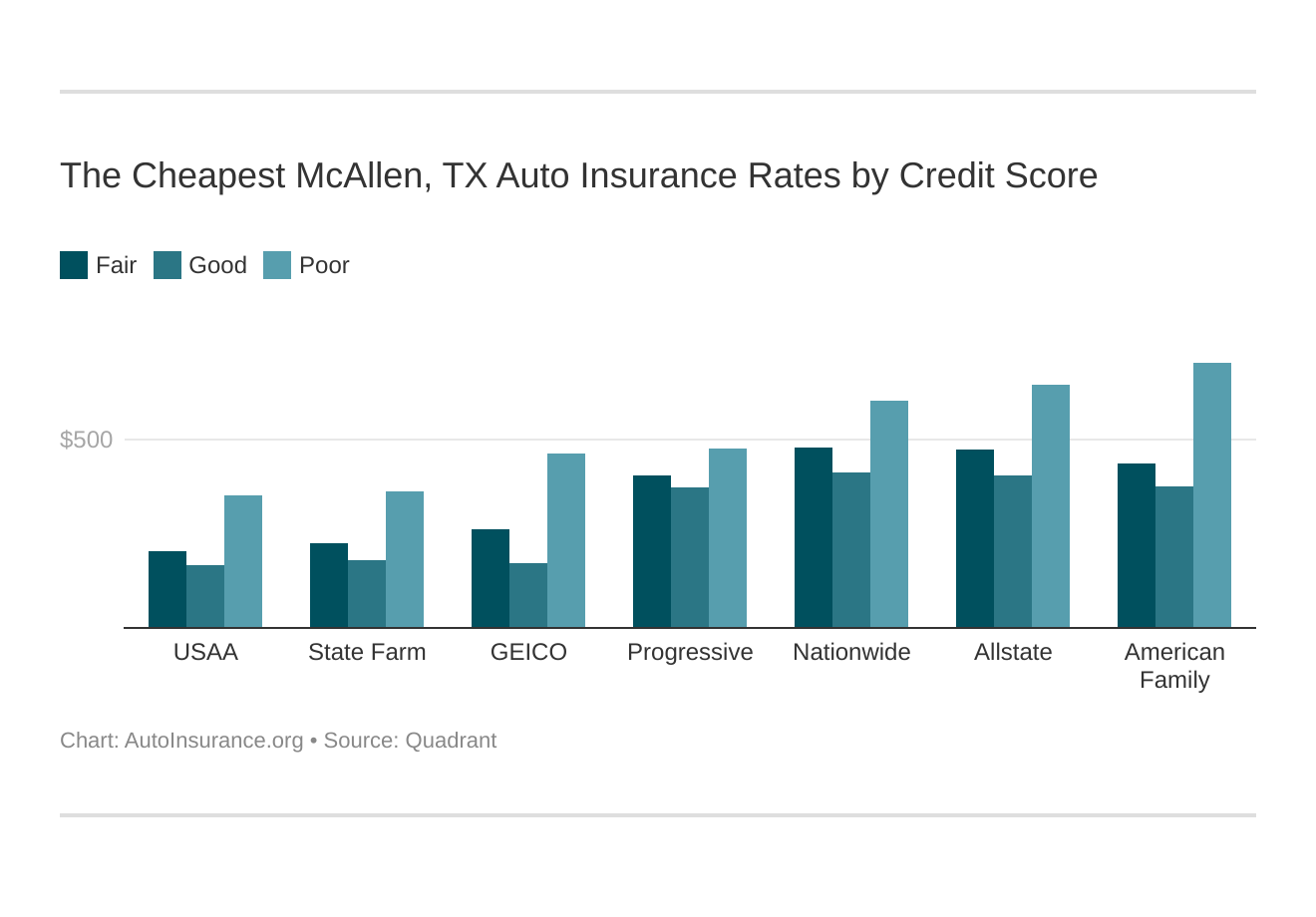

Your credit score will play a major role in your McAllen, TX car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest McAllen, Texas car insurance rates by credit score below.

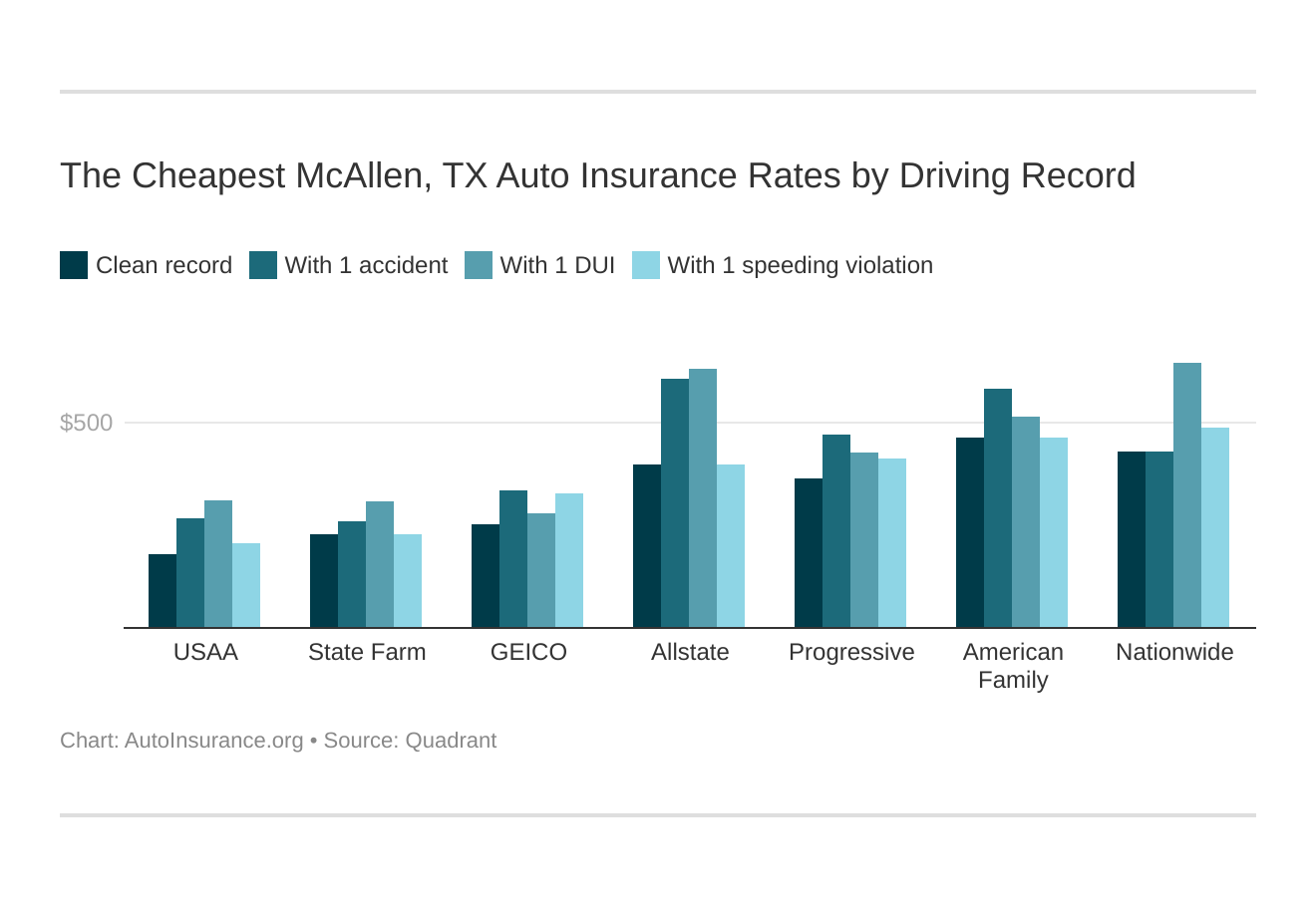

Your driving record will affect your McAllen car insurance rates. For example, a McAllen, Texas DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest McAllen, Texas car insurance rates by driving record.

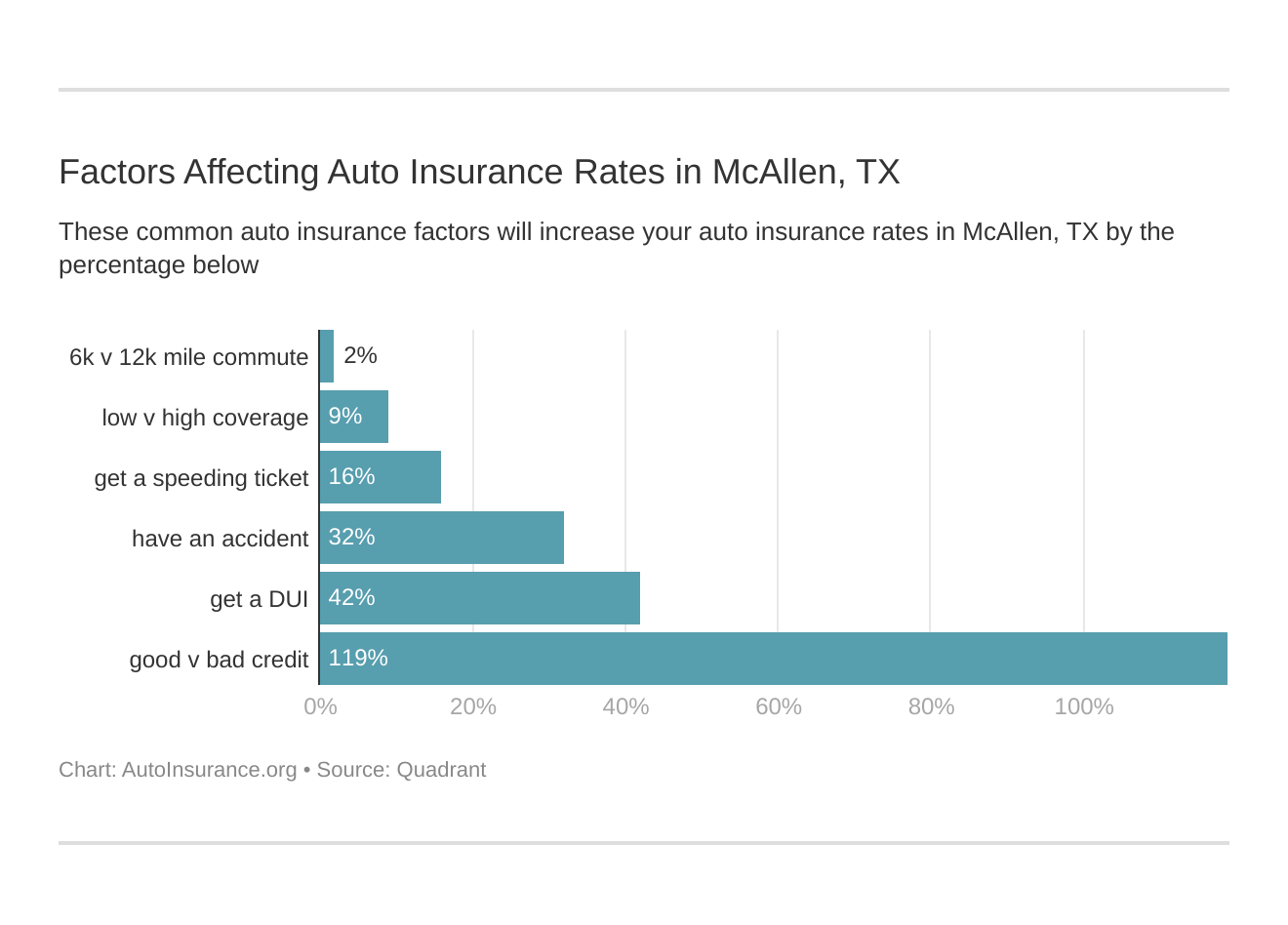

Factors affecting car insurance rates in McAllen, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest McAllen, Texas car insurance.

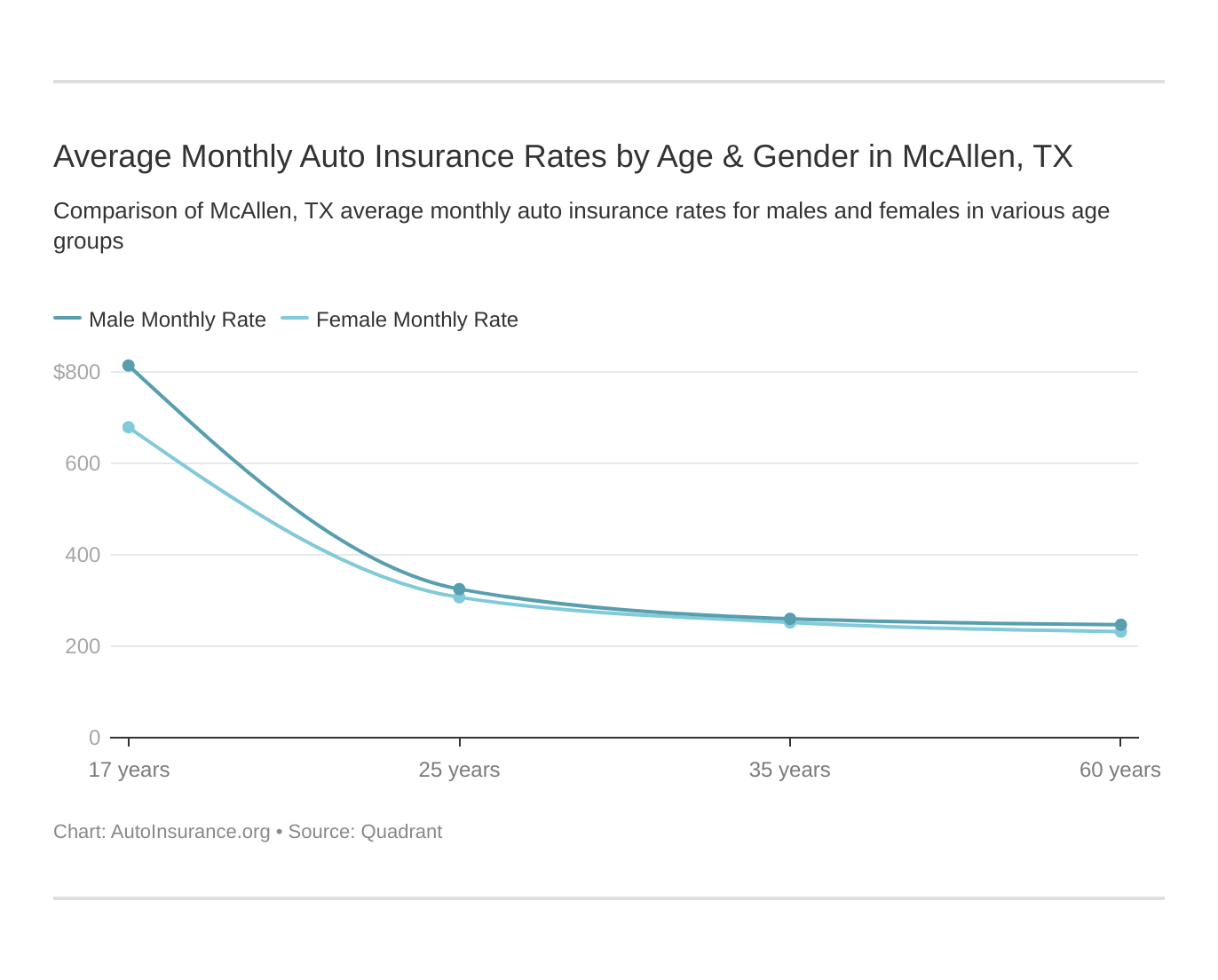

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in McAllen. TX does use gender, so check out the average monthly car insurance rates by age and gender in McAllen, TX.

What are the auto insurance requirements in McAllen, TX?

All McAllen drivers have to meet the Texas state law minimum requirements for auto insurance.

In Texas, you have to carry at least:

- $30,000 for bodily injury liability of one person

- $60,000 for bodily injury liability of multiple people

- $25,000 for property damage liability

Texas is an at-fault state, which means an at-fault driver must use their auto insurance policy to pay for the no-fault driver’s bodily injury and property damage from the collision.

Collision, comprehensive, and uninsured/underinsured coverages aren’t required, but they’re necessary for drivers who have a high-value vehicle or a vehicle for that being financed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What factors affect auto insurance rates in McAllen, TX?

Let’s go over how various factors affect auto insurance in McAllen, TX. Each company calculates factors differently, but they all depend on you.

Does your driving record have an impact on McAllen, TX auto insurance?

The most significant factor that affects McAllen, TX car insurance rates is your driving record. If you want to secure affordable McAllen, TX car insurance quotes, you must maintain a clean driving record.

Driving violations will drive up your rates. The most impactful infractions are accidents and DUI convictions, which nearly double your auto insurance rates.

How do age, gender, and marital status affect McAllen, TX auto insurance?

Age correlates to your overall driving experience. Therefore, older and married drivers pay much less for car insurance.

Gender also affects your rates. Male drivers take more risk while operating a motor vehicle, so auto insurance in McAllen is more expensive for young and single male drivers.

However, married female drivers over 34 years old pay significantly less.

Can credit history affect auto insurance in McAllen, TX?

To secure affordable McAllen, TX car insurance, you should maintain a good credit score. Car insurance providers correlate good and excellent credit to fewer chances of filing a claim.

How does location affect McAllen, TX auto insurance?

So how does location impact auto insurance premiums in McAllen, Texas? Let’s compare McAllen car insurance to other cities in Texas.

- Auto Insurance in McAllen, TX – $6,758/yr

- Auto Insurance in San Antonio, TX – $5,579/yr

- Auto Insurance in Dallas, TX – $5,855/yr

San Antonio and Dallas auto insurance are more affordable than McAllen’s rates. That can change with the auto insurance company and other factors that determine auto insurance.

How does your commute mileage impact McAllen, TX auto insurance?

Auto insurance companies consider how much you drive your vehicle to determine risk.

According to City-Data, the average commute time in McAllen, TX is 19 minutes, which is six minutes faster than the national average. Less time on the road could mean more savings on McAllen, TX car insurance.

Can a vehicle’s make and model year determine McAllen, TX auto insurance?

Your car insurance rates in McAllen, TX may cost at least $2,800, but you can receive a discount for anti-theft and safety features.

Safety features have become the standard, so any new vehicle you buy will have anti-theft and safety features built-in – which means more savings for auto insurance bills.

Do vehicle thefts impact auto insurance in McAllen, TX?

The short answer is yes. An area with higher than average auto thefts can affect your comprehensive auto insurance rates.

According to Neighborhood Scout, there were 3,595 property crimes in McAllen. The 2019 FBI statistics reported that about 28 of those crimes were vehicle theft.

Your auto insurance provider may not charge you as much since McAllen auto thefts are lower than other Texas cities, like Dallas and Houston.

McAllen, TX Auto Insurance: What’s the bottom line?

The best way to secure cheap McAllen, TX auto insurance is through discounts, a clean driving record, and good credit. If you don’t qualify for savings, keep shopping around until you can get an affordable policy.

Before you buy McAllen, TX auto insurance, be sure you’ve checked out rates with the best companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

Can I get auto insurance coverage while visiting McAllen, TX from another state or country?

Contact your insurance provider to determine if your existing policy covers out-of-state or international travel. Additional temporary coverage may be required to comply with local requirements during your visit.

How often should I review and update my auto insurance policy in McAllen, TX?

Review and update your auto insurance policy annually or during significant life changes such as vehicle purchases, address changes, or modified driving habits.

Are there any specialized auto insurance options available in McAllen, TX?

Specialized auto insurance options in McAllen, TX include:

- Classic car insurance for antique or collectible cars.

- Commercial auto insurance for business vehicles.

- Non-owner car insurance for frequent renters or borrowers.

- High-risk auto insurance for drivers with poor records.

What should I do if I’m involved in an accident in McAllen, TX?

If involved in an accident in McAllen, TX:

- Ensure safety and call for medical assistance.

- Exchange contact and insurance information.

- Document the scene and gather witness information.

- Report the accident to your insurance company.

- Cooperate with law enforcement.

- Seek legal advice if necessary.

How can I lower my auto insurance rates in McAllen, TX?

To lower your auto insurance rates in McAllen, TX:

- Maintain a clean driving record.

- Increase deductibles.

- Inquire about available discounts.

- Review coverage needs.

- Install safety features.

- Improve your credit score.

Can I bundle my home and auto insurance in McAllen, TX?

Yes, bundling your home and auto insurance in McAllen, TX can often lead to discounts. Many insurance companies offer multi-policy discounts when you combine your home and auto insurance with them. Inquire with insurance providers to explore bundling options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.