What to Do If Your Car Insurance Payment is Declined in 2026 (3 Simple Steps)

Not sure what to do if your car insurance payment is declined? Check that your payment information is correct, verify you have enough funds, and then contact your company. Cancelations due to insufficient funds can result in poor credit scores. Poor credit insurance rates start at $308/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated December 2024

Knowing what to do if your car insurance payment is declined will help you avoid cancellation. First, you need to double-check that your payment information is correct and that you have sufficient funds. Then, you need to contact your company to get coverage reinstated as quickly as possible.

Payments for auto insurance occasionally fail to go through for various reasons, and you need to act based on the method by which you send automatic payments. Ultimately, you are responsible for sorting out the problem, though insurance companies and banks usually work with you.

If this happens, you need to know what to do to reinstate your policy as quickly as possible, because driving without auto insurance is illegal in most states.

There are several steps to take to identify the problem, and you need to initiate all of them. If you need to find auto insurance quickly, enter your ZIP in our free tool.

- Step #1: Verify Payment Information – Verify your bank or credit card info

- Step #2: Check Bank Funds – Confirm that you have sufficient funds

- Step #3: Reinstate Policy if Necessary – Make sure to get coverage right away

3 Simple Steps to Follow If Your Car Insurance Payment is Declined

If your car insurance payment is declined, don’t panic. There are three quick steps you can follow to resolve the matter as quickly as possible. Whether it’s an issue of incorrect bank information or not being able to afford payment, we cover the necessary actions to take below (Learn More: What should I do if I can’t afford auto insurance?).

Step #1: Verify Payment Information

Make sure you understand how auto insurance payments work to avoid missing a payment. But in the case that you do miss a payment due to a failed automatic payment, there are simple ways to solve the problem. As is the case in many problems, start with the easiest potential solution. Check to see that your information is correct. An incorrect expiration date or another minor issue can affect automatic payments.

If your insurance company withdraws your payments directly from your financial account without any action on your part, contact them to make sure they have the correct account, as well as the right name, routing number, and transfer number for your financial institution.Dani Best Licensed Insurance Producer

Make sure that whoever took the information about your account did not drop zeros at the beginning of the identifying numbers or make other inputting errors. If your insurance company is responsible for withdrawing your payment, they should not cancel your policy if the mistake is on their end.

Step #2: Check Bank Funds

If your account did not have enough money to pay the automatic draft from your insurance company, your bank or credit union may have refused to pay. If this is the problem, you need to do these things:

- Check the Withdrawal Date: Confirm with your insurance company the date they withdraw your payment from your account.

- Check AHC Policies: Automatic payments are also called automated clearinghouse or ACH payments. Check with your financial institution about policies regarding ACH withdrawals.

- Check Bank Funds: Direct deposits post at midnight, which is considered the next day for business purposes. Make sure you have adequate funds before the withdrawal occurs.

If you have had an emergency and know that you can’t afford your auto insurance, contact your insurance company and explain the situation. Tell your company when you will be able to make the monthly payment, and they may be able to work with you to find a solution.

Prevention is better than problem-solving. Check your account at least twice weekly to monitor withdrawals and payments. Set up email notices if you have that option so you will know when various payments go out.

They may be willing to work with you to make a partial payment or give you a one-time delay to keep your policy from being canceled.

Step #3: Reinstate Policy if Necessary

If your coverage was canceled due to nonpayment, it’s important to reinstate your policy immediately. In some cases, your insurance company may allow you to reinstate your policy if you rectify the payment issue promptly.

When reinstating your auto insurance policy, make sure to ask about the specific requirements and any associated fees or penalties for reinstating your coverage.

If reinstating your policy is not possible or feasible, start exploring alternative insurance options. You can often buy auto insurance online very quickly and set up direct auto payment so you don’t have lapsed payments.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Problems with the Bank’s Bill Pay Feature for Auto Insurance

Choosing to have your auto insurance payments deducted automatically is convenient. However, occasionally system glitches or human errors result in your payment not going through. If you have a failed auto-draft payment, your insurance company might cancel your policy.

If you use your financial institution’s automated bill pay feature, make sure you added your car insurance account correctly if your Progressive payment was returned by the bank, or with any other insurance company. This includes your insurance account number and the postal address of your insurance company.

Read more: How to Get an Electronic Automatic Billing Auto Insurance Discount

These types of problems generally occur only on the first automatic withdrawal or bill pay transaction. The right details are vital for the automatic payment retry process to be completed successfully.

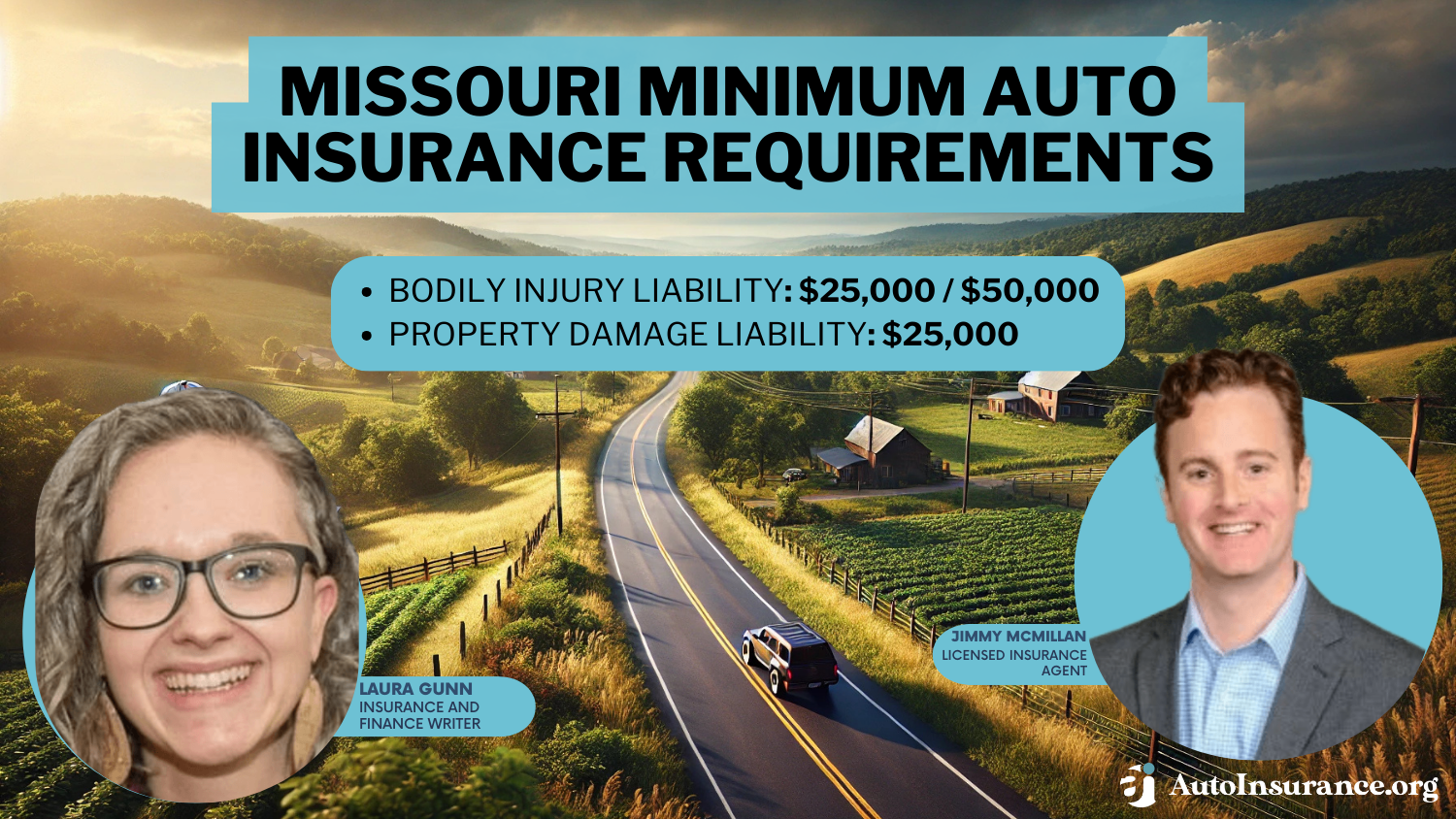

Bear in mind that rejected payments due to insufficient funds, however, will result in poor credit scores, which directly impact how much you pay for auto insurance (Read More: Does not paying your auto insurance affect credit?).

Full Coverage Auto Insurance Monthly Rates by Credit Rating

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $322 | $382 | $541 | |

| $224 | $264 | $372 | |

| $306 | $325 | $405 |

| $203 | $249 | $355 | |

| $366 | $467 | $734 |

| $244 | $271 | $340 |

| $302 | $330 | $395 | |

| $181 | $238 | $413 | |

| $338 | $362 | $430 | |

| $152 | $185 | $308 |

Improving your credit score will make it easier to keep car insurance rates affordable, which will help prevent rejected payments due to insufficient bank funds.

Learn More: How Credit Scores Affect Auto Insurance Rates

If you are having trouble paying for your car insurance, it may be a good time to look at how much coverage you actually need to pay to see if you can reduce costs. You should also take advantage of discounts and comparison shop quotes to find a cheaper auto insurance policy.

Making Automatic Payments of Auto Insurance Easier

Keeping track of automatic payments is often more complicated than making them. Because of the convenience of digital payment transactions, multiple types of payments exist (Read More: How do auto insurance payments work?). Make sure you understand the exact process used for withdrawing your digital insurance payment:

- Set Limits: Carefully manage the number of automatic monthly payments you set up. If you have too many automated withdrawals, keeping track of them becomes complicated.

- Know the Method: Be sure you understand how your payments are set up. Is your car insurance company withdrawing them? Is your financial institution sending them on a fixed date? This knowledge helps you keep track of the process.

- Schedule Wisely: Direct auto bill pay can only go through if you have enough money in your bank account. Contact your auto insurance company and schedule your monthly payment just after your payday. This step can remove much stress.

Automatic auto insurance payments are intended to make it easy for you and for your insurance company, and most companies offer a discount for automatic payments, such as the State Farm automatic payment discount or Progressive auto pay discount. These discounts are often automatically applied to your policy when you choose auto-pay as your payment method.

Some companies will also offer a discount if you pay in full for your policy, such as the Liberty Mutual one-time payment discount. If you are having regular trouble making your payment, however, contact the company about rescheduling its due date to avoid cancellation.

What To Do if Your Bank Returns Your Auto Draft Car Insurance Payment

If you have ever experienced having a payment returned by the bank, you know the sinking feeling that comes with the notice. However, you can sort out this problem. Doing so takes patience and determination, but act quickly, and you can manage it. Generally, your insurance company will work with you to re-establish your policy.

If you need to find a new auto insurance company because your company refuses to reinstate you, shop around for new insurance providers and compare quotes to find the best coverage and rates for your needs. Having more affordable auto insurance rates will make it easier to avoid cancellation due to late payments due to lack of funds.

If you find a problem, make sure report it immediately to your insurance company as well as to your financial institution. The nature of the payment determines which entity you contact first. Begin by talking to whoever initiates the payment. Keep records of who you speak to and what actions occur each time.

If you notice a payment was missed in your regular account inspections, handle it immediately. If you are able to make the payment, contact your insurance company to pay manually to ensure your policy will continue uninterrupted.

To prevent future pain from having your auto insurance payment returned by the bank, make a budget. Your auto insurance payment is the same each month, so you can easily factor that in with your monthly expenses to avoid unpleasant surprises like cancelation.

If you feel you can’t afford your auto insurance at the moment, there may be other solutions to help you balance your checkbook. Look into ways that you can make your insurance more affordable, such as adding auto insurance discounts or shopping at the cheapest auto insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Avoiding Canceled Auto Insurance Policies After Failed Withdrawals

Automatic payments are convenient — except when they fail. If your automatic payment for your car insurance policy does not go through, you could face the cancellation of your auto insurance policy. However, staying on top of your financial transactions can help you prevent problems as well as detect glitches early.

The sooner you spot a missed auto insurance payment, the easier you can solve the problem and reinstate your policy if it was canceled.Brandon Frady Licensed Insurance Producer

It is important to get insurance coverage as soon as possible if your auto insurance was canceled due to nonpayment (Learn More: What to Do if You Can’t Pay Your Auto Insurance). Find affordable auto insurance today with our free quote tool.

Frequently Asked Questions

Why did my insurance company cancel my policy after a failed auto-draft payment?

Insurance companies typically require policyholders to make regular premium payments to maintain coverage. If your auto-draft payment fails for any reason, such as insufficient funds or an expired credit card, your insurance company may cancel your policy due to non-payment.

What immediate steps should I take if my insurance company cancels my policy after a failed auto-draft payment?

If your insurance company cancels your policy, it’s important to take immediate action to ensure you have appropriate coverage. Here are the steps you should consider:

- Contact Your Company: Reach out to your insurance company as soon as possible to understand the reason for the cancellation and to discuss potential options for reinstating your policy or securing new coverage.

- Address Payment Issues: Resolve any payment-related issues promptly. If the failed payment was due to insufficient funds, make sure you have sufficient funds available and arrange for payment. If the payment method needs to be updated, provide the necessary information to your insurance company.

In some cases, you will be able to reinstate coverage at your old company. If not, you will need to look at different auto insurance companies for coverage.

Can I reinstate my policy after it has been canceled due to a failed auto-draft payment?

The ability to reinstate your policy after it has been canceled due to a failed auto-draft payment depends on your insurance company’s policies and the specific circumstances. Some insurance companies may offer a reinstatement option if you resolve the payment issue promptly and meet any necessary conditions.

However, it’s important to contact your insurance company directly to discuss reinstatement options and understand any associated fees or penalties. You may have to get insurance with another company if your old company doesn’t reinstate you (Read More: Can I get auto insurance if I owe another company?).

Why did my automatic payment not go through?

If your auto pay failed, it may not have gone through due to insufficient funds or incorrect payment information. Double check your information and funds before contacting your auto insurance company to see if it’s an error on their end.

Are there any fees or penalties for reinstating a policy after a failed auto-draft payment?

The fees and penalties for reinstating a policy after a failed auto-draft payment can vary depending on your insurance company’s policies. Some companies may charge a reinstatement fee in addition to requiring you to pay the missed premium amount.

It’s crucial to contact your insurance company directly to inquire about any applicable fees or penalties associated with reinstatement if your car insurance payment bounced.

What should I do if reinstating my policy is not possible or feasible?

If reinstating your policy is not an option or not feasible, you’ll need to secure alternative insurance coverage to ensure you’re protected. Here are the three steps you can take:

- Research Alternative Providers: Start researching and comparing insurance providers to find new coverage. Consider factors such as coverage options, rates, customer reviews, and any specific requirements you may have.

- Obtain Quotes: Reach out to multiple insurance companies to obtain quotes based on your specific needs and circumstances. This will help you compare prices and coverage options.

- Purchase New Insurance: Once you have found a suitable insurance provider, go ahead and purchase a new policy. Make sure you understand the coverage details, payment terms, and any other relevant information before finalizing the purchase.

It’s crucial to maintain continuous auto insurance coverage to comply with legal requirements and protect yourself from potential financial risks with a lapse in coverage. If you had a lapse in coverage, make sure to check out the best auto insurance companies that don’t penalize for a lapse in coverage.

What should I do if my car insurance was cancelled for non-payment?

If you were unable to pay car insurance bills and your car insurance was canceled for non-payment, contact your company to see if you can get it reinstated. If not, you may have to shop for a new car insurance company. You can find a new company today by entering your ZIP in our free tool.

What happens if your car insurance payment bounces?

If your payment bounces and you don’t correct it before the company’s grace period ends, the insurance company will cancel your auto insurance policy.

Can you push back car insurance payments?

Yes, some auto insurance companies will allow you to defer the payment if you ask for an extension (Learn More: Can you change the date that your auto insurance payment is due?).

Why hasn’t my car insurance come out of my bank?

It could be due to several reasons, such as an error on the auto insurance company’s side or problems with banking details and funds. Contact your auto insurance company immediately for assistance with your payment if you notice your car insurance payment hasn’t been taken out.

When does Progressive take automatic payments?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.