Does auto insurance pay if my car is stolen?

Auto insurance pays if your car is stolen when you have comprehensive coverage. Comprehensive car theft insurance costs $199/mo. Scroll down to find out how theft claims affect auto insurance rates and learn what to do when your car is stolen and insurance won't pay.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2024

Does auto insurance pay if my car is stolen? Whether your insurer will pay for your stolen vehicle depends on the type of auto insurance you have.

Does full coverage insurance cover theft? Yes — comprehensive policies protect you and your car against problems not caused by collisions, such as theft, vandalism, and weather events. If your uninsured car is stolen, you will be liable for all associated costs, including any remaining loan or lease payments.

Keep reading to learn when you get a stolen car insurance payout and what happens if someone steals your car and totals it. Enter your ZIP code above to get free auto insurance quotes from local companies.

- A comprehensive auto insurance policy will protect your car from theft

- You might want theft insurance on an automobile that is parked

- Always file a police report if your car is stolen; then call your insurance company

What to Do if Your Car Is Stolen

My car was stolen and totaled — what do I do? If your car is stolen you should first call the police about the theft and file a police report, then call your car insurance carrier to let them know about the stolen car.

After you file a police report, call your insurance company and let them know that your car has been stolen. Does insurance pay for a stolen car? Yes, but your auto insurance company will likely tell you to wait a certain number of days (determined by the individual insurance company).

If my car gets stolen does my insurance go up? It can, so be sure you know what your car insurance policy covers before something like this happens.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance May Cover a Stolen Car

Does liability coverage cover theft? The insurance coverage you purchase determines whether you will be covered in the event of theft. If your car gets stolen, insurance companies won’t cover you if you only have liability coverage.

Does auto insurance pay if my car is stolen? Insurance does cover it if you have comprehensive coverage. But liability insurance doesn’t cover theft.

Does liability insurance cover a stolen car? No, liability coverage only protects you if you cause an accident that injures others or damages their property. Comprehensive coverage acts as stolen car insurance.

What happens if your car is stolen and never found? How long before insurance pays for a stolen car varies by company, but if your car is not found within thirty days of the claim, you will receive a payment for the value of the vehicle. If the car is found but damaged, you will be paid the repair costs, less any applicable deductible.

Insurance Pays if a Car Is Stolen, but Later Found Damaged

How long does it take for insurance to pay out on a stolen vehicle? Most car insurance companies have a set number of days to wait for a stolen car to be found before they pay on a claim — usually 30.

What happens when your car is stolen and recovered? If the stolen car is found before the insurance payout, you’ll need to decide whether it’s worth paying your deductible and having your insurance company pay for the damage or just paying to fix the car out of your own pocket.

How much will insurance pay for a stolen car? If your stolen car is found badly damaged and the insurance company decides to write it off as “totaled,” it will cut you a check only for the market value of the car, not for how much you originally paid for it or necessarily how much a replacement car will cost. Learn more in our article, Totaled Car Value Calculator.

If your car is stolen and totaled, you’ll most likely hear the term “actual cash value” (ACV) from your insurer. What is the actual cash value of a car? That means the car’s market value at the time of loss or damage, minus any depreciation. For details, see our article Replacement Cost vs. Actual Cash Value: Car Insurance.

What happens if your car is stolen and you still owe money? You're still obligated to make payments on your vehicle until it's paid off. If you have comprehensive auto insurance, that amount will be minus what your insurance provider pays your lender or leasing company once a claim is settled. Your insurance company will pay the actual cash value of your vehicle, which is why some drivers opt for gap insurance coverage, which pays the difference between what your car is worth and what you owe.Brandon Frady Licensed Insurance Producer

What Comprehensive Insurance Covers

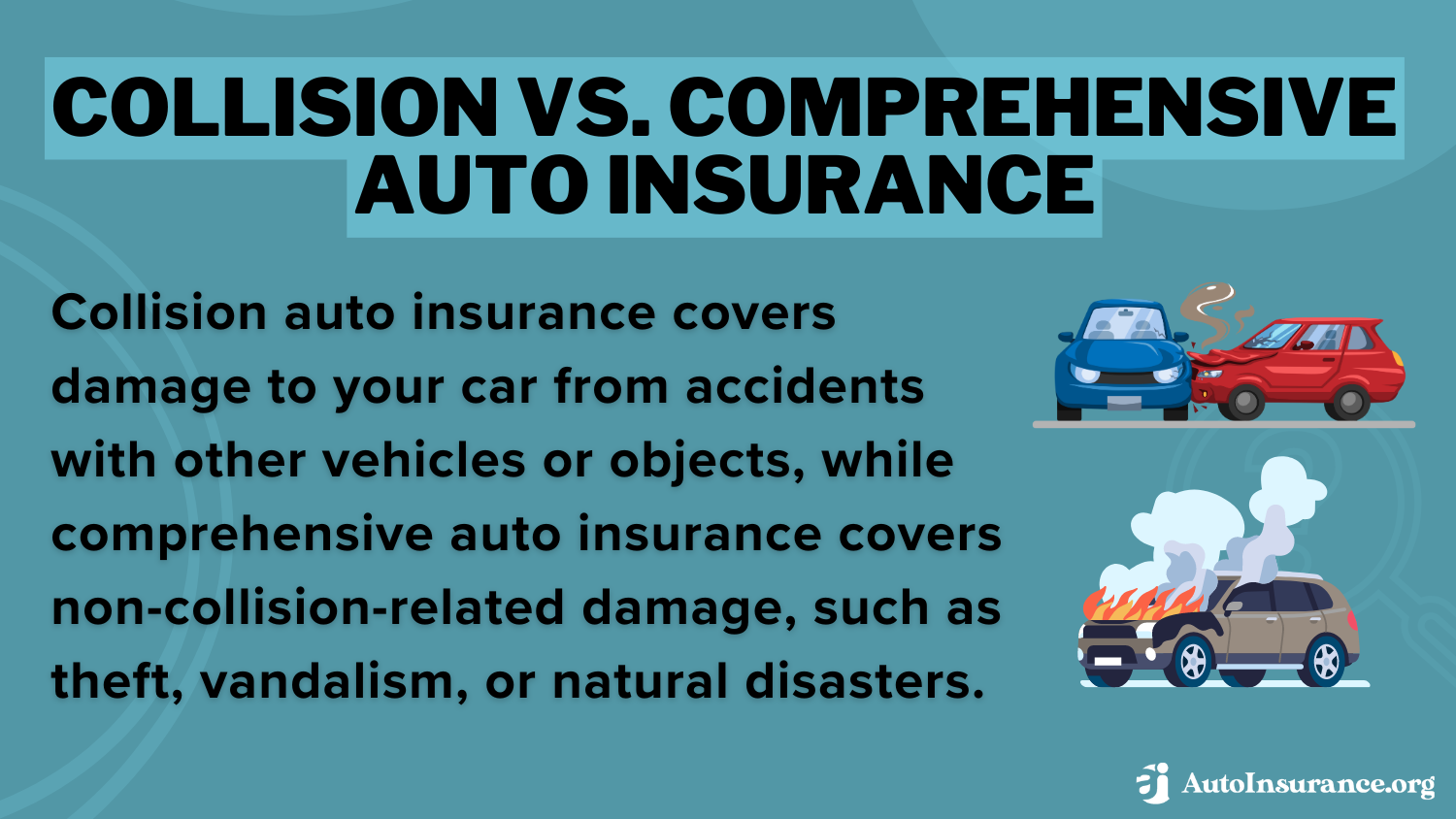

What is the difference between comprehensive auto insurance and liability auto insurance? Although some state auto insurance laws only require drivers to carry a liability insurance policy on their car, it is a good idea to also have a comprehensive and collision policy.

A comprehensive insurance policy will protect your vehicle from losses and damage not caused by a collision. It also covers vehicles damaged by you, but not in an accident.

What does insurance cover if your car is stolen? There are exceptions to every policy, but generally, comprehensive coverage includes losses from fire, earthquake, explosions, falling or flying objects, like the neighbor’s son’s baseball, vandalism, theft, floods, riots, and breakage of glass, as well as damage to your car caused by hitting an animal.

In the event of a stolen car, you can add rental reimbursement coverage to comprehensive policies to help pay for a rental car.

You are required to wait two days until the rental coverage kicks in, in case your car wasn’t actually stolen and you merely forgot that you lent it to a friend or family member.

However, most rental companies will waive the 48-hour requirement in the case of a stolen vehicle. Check with your insurance carrier before you rent the car and find out the amount of time they’ll cover the rental for, as well as the maximum cost that they’ll cover per day.

It’s a good idea to be fully protected with as much auto insurance as you can afford. Find out the rates in your area using the look-up tool on this page.

Read More: How does gap insurance work after a car is stolen?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Theft Affects Auto Insurance Rates

My car has been stolen, will my insurance go up? Not necessarily. With comprehensive coverage, your car is insured against theft. And the insurance company is only liable for the current market value of the car.

How does having your car stolen affect your insurance? If your car is stolen, insurance companies will consider your driving habits and the city and state where you register your vehicle.

If your car is stolen does insurance go up? Scroll through the data below to see how auto theft affects insurance rates.

Theft Coverage Auto Insurance Rates by State

Does insurance go up if a car is stolen? Theft rates in your area do impact car insurance. For example, insurance companies will consider drivers who live in an area where a lot of cars are stolen to be high-risk and will set rates accordingly.

If you’re wondering “Does a stolen car increase insurance?”, check the local theft rates in your city.

Vehicle Theft Rates by State

| State | Theft | Rates (2023) |

|---|---|---|

| Alabama | 17,000 | $72 |

| Alaska | 2,000 | $86 |

| Arizona | 25,000 | $81 |

| Arkansas | 10,000 | $76 |

| California | 160,000 | $82 |

| Colorado | 20,000 | $82 |

| Connecticut | 7,000 | $96 |

| Delaware | 3,500 | $103 |

| District of Columbia | 1,500 | $111 |

| Florida | 40,000 | $105 |

| Georgia | 30,000 | $87 |

| Hawaii | 5,000 | $73 |

| Idaho | 4,000 | $57 |

| Illinois | 25,000 | $74 |

| Indiana | 15,000 | $63 |

| Iowa | 7,000 | $59 |

| Kansas | 10,000 | $72 |

| Kentucky | 12,000 | $78 |

| Louisiana | 20,000 | $117 |

| Maine | 2,500 | $59 |

| Maryland | 20,000 | $93 |

| Massachusetts | 10,000 | $94 |

| Michigan | 30,000 | $114 |

| Minnesota | 12,000 | $73 |

| Mississippi | 12,000 | $83 |

| Missouri | 20,000 | $73 |

| Montana | 3,000 | $72 |

| Nationwide | 750,000 | $81 |

| Nebraska | 5,000 | $69 |

| Nevada | 15,000 | $92 |

| New Hampshire | 2,000 | $68 |

| New Jersey | 25,000 | $115 |

| New Mexico | 10,000 | $78 |

| New York | 60,000 | $113 |

| North Carolina | 30,000 | $66 |

| North Dakota | 1,500 | $64 |

| Ohio | 25,000 | $66 |

| Oklahoma | 15,000 | $84 |

| Oregon | 10,000 | $75 |

| Pennsylvania | 30,000 | $81 |

| Rhode Island | 3,000 | $109 |

| South Carolina | 25,000 | $81 |

| South Dakota | 2,000 | $64 |

| Tennessee | 25,000 | $73 |

| Texas | 70,000 | $92 |

| Utah | 7,000 | $73 |

| Vermont | 1,500 | $64 |

| Virginia | 20,000 | $70 |

| Washington | 30,000 | $81 |

| West Virginia | 5,000 | $85 |

| Wisconsin | 15,000 | $61 |

| Wyoming | 2,000 | $71 |

| Nationwide | 750,000 | $81 |

Can I get insurance after my car was stolen? Of course, but it might be more expensive than your previous policy. How does car theft affect insurance premiums? Find your state in the table above to see if your auto insurance costs more than average.

Read more: Auto Insurance Rates by ZIP Code

Theft Coverage Auto Insurance Rates by Company

Is car theft covered by insurance? Most companies pay for auto theft if you have comprehensive auto insurance. We answer a few frequently asked questions about auto theft coverage from popular companies:

- Does AAA cover stolen cars? Yes, the AAA stolen car policy applies with comprehensive coverage. If you’re a club member, AAA offers up to $2,000 in reward for information that leads to an arrest.

- Does Progressive cover stolen cars? Yes, the Progressive Insurance stolen car policy covers the ACV of your vehicle. Policyholders receive a Progressive stolen car payout typically within 30 days.

- Does Geico cover stolen cars? Yes, if you have Geico, stolen cars are covered with comprehensive insurance.

What happens if the stolen car is found after insurance payouts from Geico or Progressive? The insurance company will keep your recovered vehicle if you already received a payout for the ACV.

Does car insurance cover theft of items?

Does insurance cover car theft? While comprehensive insurance pays for vehicle theft, it also covers items stolen from a car that is meant to be a permanent part of the car or that can’t function without the car. This would likely include items like a built-in, factory-installed navigation system or stereo, but not a dashboard-mounted GPS unit.

Unfortunately, comprehensive policies do not cover personal items inside your car. If you have homeowners or renters insurance, these policies should cover any personal items stolen out of your car, regardless of whether your car was parked in your driveway or in a parking lot.

If the items are valuable, file a police report for the stolen items, and then call your insurance company. If the items cost less to replace than the deductible on your insurance policy, then you should probably forget the claim and just replace them yourself.

When you call your insurance company, ask about your personal property coverage and the items that are not covered. Items excluded, or with limited coverage, include money, jewelry, furs, watches, and business property.

Your home insurance will not help you with any damage to your vehicle, so you will have to call both your homeowners and your auto insurance companies if your car was damaged during the theft of the items inside.

The Bottom Line: Does auto insurance pay if my car is stolen?

Does insurance cover stolen cars? Comprehensive car insurance will cover auto theft, but this type of policy isn’t required by law.

If your car was stolen, insurance won’t pay if you only have liability coverage. You have to add comprehensive insurance to your minimum policy, which can increase monthly rates to $199.

Comprehensive theft coverage auto insurance also pays for vandalism, weather events, and damages caused by animals. If your car gets stolen and insurance won’t pay out, look over your policy closely. Comprehensive coverage always pays for theft unless explicitly listed as an exclusion.

Does a stolen car increase insurance? Your rates will increase after you file a claim, so compare free auto insurance quotes here to find more affordable coverage.

Frequently Asked Questions

Does auto insurance pay if my car is stolen?

If your car is stolen and you have comprehensive coverage, auto insurance may pay you. However, the amount you receive will be based on the current market value of your car.

If your car is stolen, how long does it take for insurance to pay?

It takes about a month for insurance companies to payout on claims.

What should I do if my car is stolen?

If your car is stolen, you should first call the police to report the theft and file a police report. Then, contact your car insurance carrier to inform them about the stolen car.

Does insurance go up if your car is stolen?

Yes, your auto insurance rates will go up after a theft claim. Fortunately, the increase is slight and much less than if you were in an at-fault accident or collision.

How long does a car have to be stolen before insurance pays?

Most insurers wait up to 30 days to write off a stolen vehicle.

Does liability insurance cover theft?

No, liability coverage does not cover theft. You need comprehensive insurance for car theft.

Does auto insurance cover the theft of personal items from my car?

Comprehensive auto insurance policies typically cover parts stolen from a car if they are permanent or the vehicle cannot function without them. However, homeowners or renters insurance policies generally cover personal items stolen from the car.

What happens when your car is stolen and then found wrecked?

If it can be repaired, your comprehensive insurance will cover the costs minus your deductible. If your car was stolen and totaled, your insurance provider will pay out the actual cash value of the vehicle.

What happens if a stolen car is found after the insurance payout?

After the insurance payout, the vehicle belongs to the insurance company. If recovered, the insurer can do what it wants with the vehicle, including reselling or salvaging the car.

If my car is stolen will insurance cover a rental?

Rental car reimbursement coverage pays for rental cars after a claim, but you need to add this coverage for an additional cost.

What happens if a rental car is stolen?

What do you pay out of pocket on an auto insurance claim?

How does an insurance company determine the value of your car?

Can I negotiate actual cash value?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.