Worst States for DMV and DOT Data Breaches (2026)

In the worst states for DMV and DOT data breaches, your personal data may not be safe even at government-funded organizations. Over the last 15 years, data breaches at DMV and DOT locations have affected 235,207 individuals. Some of the information that can be stolen through a security breach at a state DMV or DOT office includes Social Security numbers, birth certificates, home addresses, vehicle registration numbers, and other sensitive information.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Joel Ohman

Updated October 2024

If you’ve experienced data theft, such as having your credit card number stolen or accidentally downloading a virus onto your laptop, you understand the significant amount of time, effort, and expense involved in addressing such issues.

This is particularly relevant when considering concerns about DMV security, such as potential DMV selling personal information and the need for thorough DMV investigations. While you might expect your data to be safe at a government institution like the Department of Motor Vehicles (DMV) or the Department of Transportation (DOT), the truth is that anywhere your information is stored, there is always the risk of data theft.

If you reside in one of the states with the highest risk for DMV leaks and DOT data breaches, your personal information could be more vulnerable than anticipated. DMVs and DOTs manage a broad range of driver data, including Social Security numbers and email addresses, which makes them prime targets for DMV cyber attacks.

Some of the more basic information, like your email address and phone number, may even be sold to third parties who have contracts with the DMV or DOT in your state.

This puts your personal data at even more risk, as somebody could breach these third parties. So instead of wondering which states have the cheapest auto insurance rates, you should be wondering which states put your information most at risk.

To help drivers understand the risks associated with data breaches at DMVs and DOTs, we’ve compiled a list of the top 10 states with the most severe data breaches over the past 15 years. While DMV and DOT security breaches are not extremely frequent, they do occur and can jeopardize thousands of customers’ personal information. This information is particularly relevant when considering which state has the worst DMV security, including instances like the PA DMV hacked situation. By examining these 3 data states, we aim to highlight the potential vulnerabilities and the impact of DMV security breaches.

In addition to our data breaches list of the worst attacks and breaches by state, we will also go over the following:

- Recent data attacks in the new

- What to do if your data is stolen

We’re also going to keep this objective as well. So no:

- Why is the DMV the worst

- Best States for DMV

- Why are DMV lines so long?

We’ll also ignore geography other than the United States, so no answers to “the most scammed country” or the “least scammed countries.”

Even if you haven’t been caught up in a DMV or DOT data breach (which can result in financial losses), everyone likes saving money on necessities like auto insurance. The quickest and easiest way to do that is to compare live auto insurance quotes from different insurance companies.

Enter your ZIP code into our free online quote comparison tool to get the best auto insurance quotes in your area personalized for your insurance needs.

Continue reading to learn about the impacts of DMV and DOT data breaches and attacks, and discover how you can protect your information. Additionally, find out how having 4 dots on your driver’s license might be relevant, access all permit test questions and answers, and see examples of how bank and financial institution records are handled by the DMV.

- DMV and DOT data breaches are not common, but they expose sensitive information like SSNs and addresses

- The worst states for DMV and DOT data breaches affected 235,207 drivers in the last 15 years

- Some DMVs and DOTs sell drivers’ information to third parties, putting drivers’ information at even more risk

10 Worst States for DMV and DOT Data Breaches

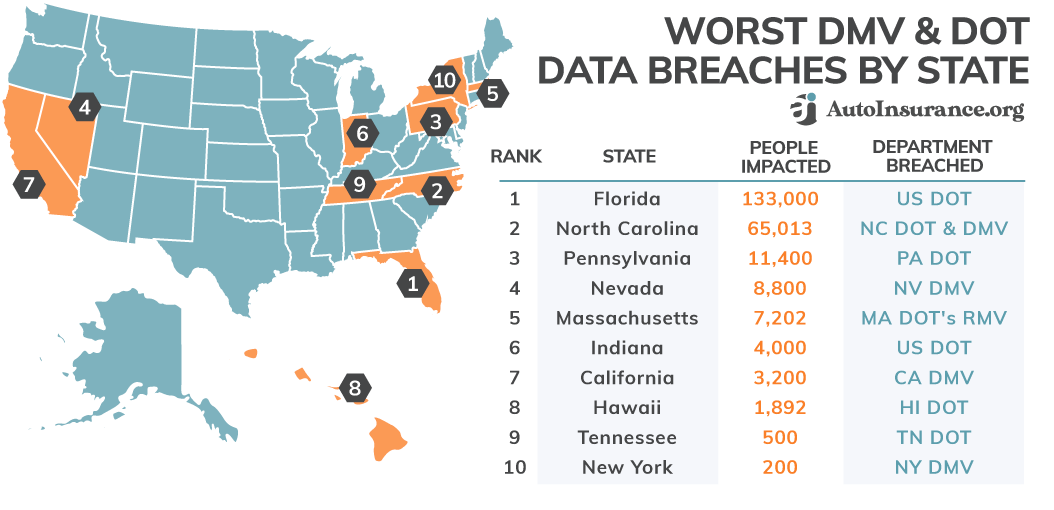

To find the 10 worst states for DMV and DOT data breaches, our researchers looked at the data breach report from the Identity Theft Resource Center (ITRC) and pulled data from the last 15 years (since 2005) to determine which states had the most individuals affected by DMV and DOT data breaches.

Worst States for DMV and DOT Data Breaches

| Rank | State | Individuals Impacted | Breaches in 15 years |

|---|---|---|---|

| 1 | Florida | 133,000 | 1 |

| 2 | North Carolina | 65,013 | 3 |

| 3 | Pennsylvania | 11,400 | 1 |

| 4 | Nevada | 8,800 | 1 |

| 5 | Massachusetts | 7,202 | 1 |

| 6 | Indiana | 4,000 | 1 |

| 7 | California | 3,200 | 1 |

| 8 | Hawaii | 1,892 | 1 |

| 9 | Tennessee | 500 | 1 |

| 10 | New York | 200 | 1 |

The data breaches over the past 15 years are concerning. Even a single breach at a state DMV can impact thousands of people. Typically, larger states store more driver information, making it easier for attackers to obtain significant amounts of data in DMV and DOT breaches. This underscores the importance of having a DMV cheat sheet and understanding DMV crime rates, as well as the need for effective DMV customer service to address these issues promptly.

To show you how often DMV and DOT data breaches happen, we’ve put together 15 years of data from the ITRC in the graphic below.

The graphic shows a slight decrease in the number of breaches over the years. This reduction might be attributed to enhanced security measures and advancements in technology, as companies apply lessons learned from past incidents. For instance, changes in DMV map outlines and understanding the DMV meaning area may have contributed to improvements, while addressing issues like drivers license data breaches also plays a role.

Stick with us to learn more about the DMV and DOT data breaches in the top 10 states.

#10 – New York

- Department Breached: New York Department of Motor Vehicles

- Individuals Impacted: 200

- Years of Breaches: 2010 and 2018

In 2010, the New York DMV was breached, affecting a total of 200 individuals. Government breaches are rarer than most. According to the New York State Attorney General’s report on breaches from 2006 to 2013, the total government agency breaches equaled 14.

There was a total of 241 breaches in New York, which means government breaches only made up roughly 6 percent of all breaches.

However, even though this is a small percentage of overall data breaches, government breaches are serious.

Even though 200 is a small number of overall drivers in New York, the New York DMV stores sensitive information, so even small data leaks can be devastating for those who have New York registered cars and New York auto insurance.

#9 – Tennessee

- Department Breached: Tennessee Department of Transportation

- Individuals Impacted: 500

- Year of Breach: 2007

Tennessee earns the 9th spot, as the Tennessee DOT had a 2007 breach that affected an estimated 500 individuals.

Unfortunately, the Tennessee DOT doesn’t keep a record of data breaches, so the exact nature of the breach at the Tennessee DOT is unknown. However, we do know that according to the Federal Bureau of Investigation (FBI), in 2007, Tennessee received 3,147 complaints of fraud from Tennessee residents and businesses.

Because this is a lower number compared to most states, Tennessee ranks near the bottom for the worst data breaches in the United States. This means that even a small data breach that affects 500 people is significant in the state of Tennessee.

If you need auto insurance in Tennessee, be careful where you share your private information.

#8 – Hawaii

- Department Breached: Hawaii Department of Transportation

- Individuals Impacted: 1,892

- Year of Breach: 2009

The Hawaii DOT had a breach in 2009 that impacted 1,892 individuals. This is a significant number of people’s information breached in Hawaii. Why?

According to the Department of Commerce and Consumer Affairs (HI DCCA) in Hawaii, in 2009, there were a total of 5,820 people affected by security breaches.

This means that 32 percent of the people affected were caused by the breach at Hawaii DOT. This is a high percentage for a DOT breach.

Do you drive in Hawaii? Be sure you know the state minimum requirements for auto insurance in Hawaii.

#7 – California

- Department Breached: California Department of Motor Vehicles

- Individuals Impacted: 3,200

- Years of Breaches: 2014, 2015, and 2019

In 2019, the California DMV suffered a breach when the Social Security numbers of roughly 3,200 individuals were accidentally exposed. According to a CNN article about the breach, the SSNs were exposed through a Government Requester Code Account Program.

It is unknown who accessed the SSNs during the four-year period the SSNs were accessible on the program, although CNN reports that the DMV says the SSNs weren’t available to anyone outside the government.

Since the California DMV data breach, the DMV has announced enhancements to its security measures to prevent a recurrence of Social Security Number leaks. This follows recent updates to the California DMV organizational chart and improvements in how the California permit test answers are handled.

You can also read our related article: “Do auto insurance companies need your Social Security number?”

#6 – Indiana

- Department Breached: Department of Transportation

- Individuals Impacted: 4,000

- Year of Breach: 2007

In 2007, an estimated 4,000 individuals were impacted by a breach at the DOT in Indiana. The DOT does not have old records available, so it is unknown exactly what data was leaked in the 2007 incident.

However, according to the FBI, in 2007, Indiana actually ranked 23rd in the country, as its number of complaints was over 55 per 100,000 people. This means that Indiana is right in the middle of the pack for data theft complaints in 2007.

As an auto insurance policyholder in Indiana, you have the option of filing a complaint with your state’s insurance office or commission. Learn more by heading to our Indiana auto insurance page about how to handle situations involving insurance fraud and file complaints.

#5 – Massachusetts

- Department Breached: Massachusetts Department of Transportation’s Registry of Motor Vehicles

- Individuals Impacted: 7,202

- Year of Breach: 2019

In 2019, the Massachusetts DOT suffered a breach in its registry of motor vehicles that affected 7,202 individuals. How?

According to a copy of the Massachusetts DOT’s notice posted by the Office of the Vermont Attorney General, one of the Massachusetts DOT’s vendors incorrectly disclosed customers’ names and license numbers.

While the Massachusetts DOT stated they weren’t aware of any misuse of the information by their vendor, they did have to offer to replace any license plates for free for the 7,202 individuals who had their information released.

For more information on getting insured as a driver in this state, read our article, Massachusetts Auto Insurance.

#4 – Nevada

- Department Breached: Nevada Department of Motor Vehicles

- Individuals Impacted: 8,800

- Years of Breaches: 2005 and 2016

Back in 2005, the Nevada DMV had a breach that affected 8,800 individuals’ data. Large breaches at companies in Nevada are not uncommon.

According to the FBI, in 2005 Nevada ranked first for the number of perpetrators of data theft, which was over 26 for every 100,000 people.

With such a large number of data breaches and internet fraud complaints in 2005, it is no wonder that the Nevada DMV was also a target of data theft and breaches.

Unfortunately, data theft and breaches can affect your auto insurance rates. Check out our Nevada auto insurance page for more information about what factors affect your rates and the best auto insurance companies in Nevada that could suit your needs.

#3 – Pennsylvania

- Department Breached: Pennsylvania Department of Transportation

- Individuals Impacted: 11,400

- Year of Breach: 2006

In 2006, the Pennsylvania DOT had a data breach that impacted 11,400 individuals. This is a high number of people who had data exposed at the Pennsylvania DOT.

According to the FBI, in 2006, the number of internet crime complaints in Pennsylvania accounted for 4 percent of all complaints in the United States, which ranks Pennsylvania near the upper-middle in the country for internet crime complaints.

The good news is that with a clean driving record, you can get Pennsylvania auto insurance for as little as $80 a month.

#2 – North Carolina

- Departments Breached: North Carolina Department of Transportation and Department of Motor Vehicles

- Individuals Impacted: 65,013

- Years of Breaches: 2006, 2007, 2009, and 2017

North Carolina has suffered a number of breaches over the last 15 years, the total impact equaling 65,013 individuals who had their information incorrectly released. All of the following breaches occurred at North Carolina DMV and DOT locations.

- 2006 Breach: 16,000 individuals affected

- 2007 Breach: 25,000 individuals affected

- 2009 Breach: 13 individuals affected

- 2017 Breach: 24,000 individuals affected

A total of four breaches over the last 15 years is the highest number out of any state. The 2007 breach affected the most people.

According to a WRAL news report on the breach, the security breach was the names and SSNs of DOT employees and contractors. All individuals affected by the breach were advised to freeze their credit.

Credit scores affect auto insurance rates in many states. In North Carolina, numerous factors — including some that are outside of your control — determine your rates. Learn more at our North Carolina auto insurance page.

#1 – Florida

- Department Breached: U.S. Department of Transportation

- Individuals Impacted: 133,000

- Year of Breach: 2006

Florida tops our list as number one of the worst DOT breach. In 2006, the U.S. DOT in Florida was breached, impacting 133,000 individuals. How? A laptop was stolen from a government vehicle.

According to the news report on the theft by the Sun Sentinal, the laptop contained the following sensitive information of 133,000 Floridians in a database:

- Social Security numbers

- Birth dates

- Addresses

The number of people put at risk from this data theft in Florida is the highest in the last 15 years of DMV and DOT data breaches, which is why it earns the No. 1 spot on our list.

Florida is also one of the most expensive states to buy insurance. Be sure to shop around for affordable Florida auto insurance and find the best provider near you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

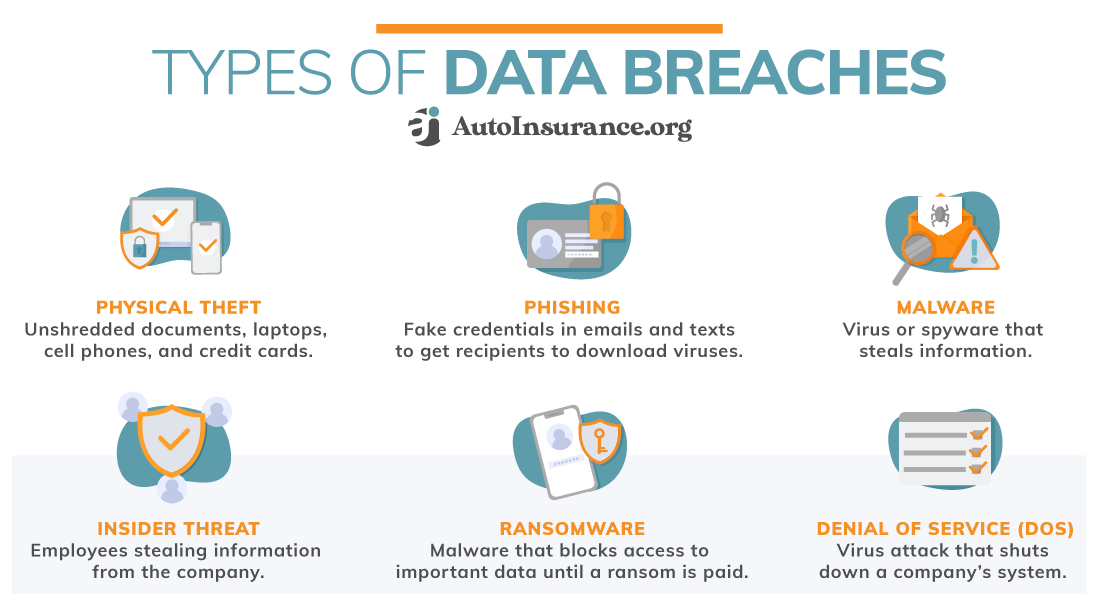

How Data is Stolen From the DMV and DOT

Data can be stolen or leaked from government institutions the same as any company or individual. While the government has more safeguards to guard information than a regular citizen, this doesn’t mean that data is 100 percent safe at a government institution.

So how is data usually stolen or accidentally leaked? Take a look at the graphic below to see the most common ways data is stolen or leaked.

While some data breaches can occur due to physical theft, most do occur from cyber attacks like ransomware and viruses.

According to the FBI’s 2019 report, phishing had the highest number of cybercrimes in the United States. A total of 114,702 people fell victim to phishing in 2019.

The cost of cybercrime in 2019? $3.5 billion. Not only is there the money stolen from victims, but the government has to invest in fighting cybercrime, replacing stolen documents, and investigating cybercrime. All of this can get expensive very fast.

At the DMV and DOT, the data stolen can also be sold for a hefty price, as there are Social Security numbers, birth certificates, and more stored at the DMV and DOT. Take a look at the graphic below to see what kinds of personal information may be at risk in a data breach or attack.

Any time your information is stored somewhere, it is at risk. Luckily, DMVs and DOTs that have been the victims of data breaches usually take steps to ensure the same thing doesn’t happen again, whether it is a computer breach or unshredded documents.

Recent Data Breach in the News

What companies have been hacked in 2020? If you live in Texas, then you have likely heard of the 2020 data breach at the Texas Department of Motor Vehicles.

According to FOX News in Houston, almost 28 million Texas drivers had data stolen that contained their driver’s license numbers, addresses, names, birthdates, personal addresses, and vehicle registration.

How did this happen? Most people are not aware that DMVs and DOTs make a great deal of their annual profit by selling drivers’ data to third parties.

While you’d expect your information to be accessed by police officers and insurance companies to make sure you aren’t driving without auto insurance, the DMV and DOT may also sell your information to towing companies, private investigators, advertising firms, marketers, security companies, and many more.

With the Texas DMV, the data leak was through a third-party insurance software company. The tool that the insurance software company used to store the DMV information was hacked, putting the 28 million Texas drivers at risk.

Bottom line? Any time a DMV or DOT sells your information to a third party, the risk of your information being leaked or stolen increases. Unfortunately, there are currently a number of loopholes in the privacy laws in states that allow the DMV and DOT to continue selling information to third parties.

Have questions about the difference between DMV and insurance provider penalties? Check our article: DMV Points vs. Insurance Points.

Interviews with Lawyers and Privacy Experts

Want more information on data breaches? We’ve collected advice from experienced lawyers and privacy experts, so read on to see what the experts have to say about the risks of data breaches and what can be done to prevent data breaches from happening.

What are the most common ways criminals breach data at government corporations like the DMV and DOT?

“Inside jobs. Employees who have access to the information are the most likely culprit when it comes to either stealing that information for their own personal gain or mistakingly exposing it by introducing malware into the system.”

What’s the worst that could happen from someone getting a person’s personal information from the DMV or DOT?

“All of the above I listed, including criminal identity theft and new account fraud. When a driver’s license is compromised, that is the most effective way to actually ‘be’ someone.”

What practical steps should drivers follow if their data is stolen?

“There’s no such thing as ‘freeze credit cards.’ There is something called a ‘credit freeze’ also known as a security freeze. And there is also no such thing as getting a new Social Security number. If that is even available, it is only available to victims of domestic violence.

A credit freeze is a tool offered by the three credit bureaus for free. Simply go online to TransUnion, Equifax, and Experian, and within their website search the terms either credit freeze or security freeze. There is no cost to freeze or unfreeze a person’s credit. A credit freeze is basically a lock on a person’s credit, giving them control of when a lender can see their credit scores.

Once a person freezes their credit, a lender who goes to check that person’s credit would not see that person’s credit scores, therefore the lender wouldn’t know what their risk level is. And as a result, the lender is unlikely to grant credit.

A credit freeze coupled with identity theft protection services are a multi-layer approach to mitigate and in some cases prevent fraud. Keep in mind that neither a credit freeze nor identity theft protection services can prevent all forms of identity theft.

Is a fraud alert the same as a credit freeze? No, they are not the same. A fraud alert lasts for one year, but scammers can still access credit files and apply for new credit.

While a creditor might know you had your ID stolen, creditors can still issue credit. The only thing a fraud alert does is notify lenders that something might be wrong with your credit.

In comparison, a credit freeze protects your credit. When ID thieves access Social Security numbers, they can also apply for credit in your name. However, if the credit file is frozen, thieves cannot access it, as freezing your credit makes the files not accessible.

In order to gain access to your frozen credit, such as when you want to apply for a credit line, you will have to unfreeze it by using a PIN given to you by the credit bureau.

Keep in mind that freezing a credit report does not affect the lines of credit that you have already open, and the freezing process is free for those who are ID theft victims.

However, anyone can pay a small fee to TransUnion, Experian, and Equifax, the three main credit reporting bureaus, to freeze their credit. What exactly does a freeze do? Credit freezes protect you from new account fraud. A freeze also prevents criminals from opening up new lines of credit or new accounts that require a credit check.

Had your identity stolen? You should consider freezing your credit. If you have a Social Security number, you are a target, so you can make your SSN and credit useless to thieves. Even if thieves get it, they cannot use it to open a new account with your name.

Before doing a credit freeze, you don’t have to know too much and can just do it. Your credit will be frozen on all credit applications. It is not inconvenient to freeze your credit, as it only takes a few minutes to freeze and unfreeze your credit file. Of course, you must unfreeze your credit before you can apply for new credit.

While this means that you have to take a little time to let the thaw pass, it usually takes only a couple of minutes. A thaw makes the credit freeze more secure and helps keep you safe, and credit freeze doesn’t hurt your credit in any way. In addition, if you have an existing creditor, they can still do ‘soft’ checks on your credit report. You can freeze your credit here:

So what does a freeze not do? It doesn’t protect you from credit card fraud or a bank account takeover. If you lose your wallet, a freeze won’t help you, as it doesn’t protect you from tax-related identity theft, Social Security fraud, and many other forms of account takeover. Again, a freeze’s main purpose is to prevent ‘new account fraud.’

Do you need identity theft protection if you have a freeze? Security is all about ‘layers of protection,’ and a freeze only protects you from certain things. On the other hand, identity theft protection will mitigate other forms of fraud.

Identity theft protection services don’t protect you from things like tax-related identity theft or even medical-related fraud, but the identity theft protection ‘fraud resolution experts’ and the insurance that comes with identity theft protection services will help victims fix those forms of fraud.”

Robert Siciliano is a cyber social identity protection instructor at ProtectNow.

ProtectNow specializes in security awareness, threat prevention, and fraud protection.

“Well, the worst thing that can happen from someone getting a person’s personal information from the DMV or DOT is murder.

An example of this was the death of Rebecca Schaeffer in 1989, when a fan tracked her down and shot her in her home.

As a result, the Driver’s Privacy Protection Act was passed in 1994 to prevent it from happening again. Unfortunately, this law has a lot of exceptions, such as what information can be shared and who it is shared to.

Some states handle your information differently, but some examples of who might be able to get hold of your information are law enforcement, private investigators, and insurance companies.

If we really want the dangers of shared personal information to go away, these exceptions need to be removed or more strictly monitored.

As I mentioned previously, some state laws vary, and in some cases, you might be able to do something to withhold information from being shared.

It’s best to find out what the exact laws are in your state, but an example of what can be done in some states is you can request to withhold your name and address from various files (also known as ‘opt-out’).

When you request this, you’ll need to complete a form to have it implemented. Even in this case, your information may continue to be shared when individual requests are filed under the Driver’s Privacy Protection Act, so you might not consider the effort to be worth the trouble.”

Blake Hardwick represents the NYC personal injury attorney office, Greenberg & Stein, PC.

This law office has over 75 years of litigation experience including data-breach claims.

What is a DMV data breach?

“A DMV data breach is a breach of the personal information of drivers, license holders, or employees of a state motor vehicle agency.”

What is the DOT data breach?

“The DOT is one of the most trusted federal agencies. However, there have been multiple data breaches at their offices that have put the personal information of millions of Americans at risk. A DOT data breach is a breach of the personal information of drivers, license holders, or employees of a state department of transportation.”

Who is at risk for a DMV and DOT data breach?

“DMV and DOT data breaches can result in significant financial and personal damage. The worst states for DMV and DOT data breaches are those with weak data security measures, lax privacy laws, and large government agencies with a high concentration of sensitive data.”

How are DMVs and DOTs defending against cyber attacks?

“When it comes to cyber security, DMVs and DOTs are taking steps to protect themselves from data breaches. Here are some of the steps DMVs and DOTs are taking to defend against cyber attacks:

DMVs use various security measures, including firewalls and intrusion detection systems, to protect their systems from unauthorized entry.

DOTs have put in place policies and procedures to protect their data from unauthorized access, including requirements for regular internal testing and reviews of security measures. They also have a dedicated team that monitors cyber threats and responds quickly to incidents.

Both agencies have developed incident response plans that outline the steps they will take in the event of a data breach. These plans include ensuring that affected individuals are notified immediately and that any relevant evidence is preserved for investigation.

The two agencies have several policies and procedures to protect their data, and they work closely with their respective cybersecurity teams to keep their systems safe.”

Noah Cammann is the CEO of Cofes.com.

Cofes specializes in online security for VPNs, CRM, accounting, and HR.

What is DOT data breach?

“DOT data breaches are defined as any unauthorized access to, or disclosure of, personally identifiable information that is contained in DOT records. This can refer to any type of data breach, including those that occur at DOT agencies and contractors.

The most common types of DOT data breaches include theft of computer systems or data, accidental disclosure of personal information, and cyber attacks.

DOT records can be revealing about people’s personal lives, such as their Social Security numbers and addresses. In addition, they can contain highly sensitive health information, including HIV status, financial information such as bank account numbers, and employee records which could include salary and job titles.

As a result, any unauthorized access to these records can cause serious damage to the individuals involved.”

How many states have had a DMV or dot data breach in the last 12 months?

“Many state governments have been hit with data breaches in the last 12 months. The states with the most breaches are California, Texas, Florida, and Illinois. These states have had a total of 7, 4, 5, and 3 data breaches, respectively.

It is important to keep your personal information secure when traveling in these states as there is a high chance that your personal information has been compromised.”

Which states have the worst records for keeping their information secure?

“There are a number of states that have had particularly poor records when it comes to data breaches.

According to the National Institute of Standards and Technology (NIST), five states have had the worst record for data breaches over the past three years: California, Illinois, Maryland, New York, and Pennsylvania.

In these states, there have been a total of 178 data breaches involving more than 1 million records. This is more than triple the number of data breaches in any other state during this time period.

One major reason for this trend is that many of these states have not taken adequate steps to protect their information.

For example, California has seen a surge in data breaches due to its population size and the volume of personal information that is stored there. Illinois has also seen a high number of data breaches due to its reliance on electronic health records (EHRs). In both cases, inadequate security measures allowed unauthorized individuals access to sensitive information.”

Muhammad Junaid is a Marketing Manager at BuyTVInternetPhone.

His site rates security and cost for internet, phone, and cable providers.

What are the most common ways criminals breach data at government corporations like the DMV and DOT?

“One of the most common ways criminals breach data at government corporations like the DMV and DOT is through phishing scams. In a phishing scam, criminals send emails that appear to be from a legitimate source, such as the DMV or DOT, to trick people into clicking on a link or attachment that will install malware or allow criminals to access sensitive information.

Other common ways criminals breach data at these organizations include using stolen credentials, exploiting vulnerabilities in systems or applications, and social engineering.”

Can you do anything if you suspect the DMV or DOT has sold your information to a third party or that a third party has misused your information?

“If you suspect that the DMV or DOT has sold your information to a third party or that a third party has misused your information, you can file a complaint with the Federal Trade Commission (FTC). You can also contact your state’s Attorney General’s office to file a complaint.”

What laws need to be passed to prevent the DMV or DOT from selling information to third parties? Does your state have these in place?

“A few laws needed to be passed to prevent the DMV or DOT from selling information to third parties.

The first law is the Driver’s Privacy Protection Act (DPPA), passed in 1994 and prohibits the DMV from releasing personal information about drivers without their consent. The second law, the Gramm-Leach-Bliley Act (GLBA), passed in 1999, requires financial institutions to protect consumers’ personal information.

The third law, the Fair Credit Reporting Act (FCRA), passed in 1970, requires credit reporting agencies to maintain accurate and up-to-date information.

Your state may have one or more of these laws in place, but it depends on your state’s specific laws.

For example, California has all three of these laws, while other states may only have one or two. If you’re unsure whether your state has these laws, you can contact your state’s Attorney General’s office for more information.”

Allan McNabb is the CEO of Image Building Media.

His company provides internet marketing services.

What are the most common ways criminals breach data at government corporations like the DMV and DOT?

“The DMV and DOT are two of the most common government entities that criminals target due to the amount of data stored there.

In most cases, criminals break into these agencies through unauthorized access to sensitive systems, such as email accounts or computer networks. Once inside, they can steal or access sensitive information, such as personal identification numbers (PINs) or driver’s license records.

One of the most common ways criminals breach data at government corporations is through unauthorized access to sensitive systems. Criminals can gain access to systems by stealing passwords or cracking encryption codes.

Once they have gained access, they can exploit vulnerabilities in the system to steal data or install malicious software.”

What’s the worst that could happen from someone getting their personal information stolen from the DMV or DOT?

“When it comes to data breaches, the DMV and DOT are some of the worst places for someone to have their personal information stolen.

These agencies store a lot of personal information, such as social security numbers, driver’s license numbers, and even addresses. If this information falls into the wrong hands, it could be used for identity theft or other serious crimes.

In fact, in 2016 alone, there were at least six incidents where people’s personal data from the DMV or DOT was compromised. These include a man who had his social security number and driver’s license number stolen and two cases where people’s addresses were stolen.”

What practical steps should drivers follow if their data is stolen?

“If your driver’s data is stolen, it’s important to take some practical steps to protect yourself. First, you should change your password and PIN for any accounts that may have been compromised. Next, you should monitor your credit report for any unusual activity. Finally, you should reach out to the relevant authorities if you believe your data has been used illegally.”

Vlad Mishkin is the founder of WebScraping.Ai.

His company solves web scraping issues at scale.

What are the most common ways criminals breach data at government corporations like the DMV and DOT?

“Phishing is the most common attack vector. Criminals send emails and other messages to DMV staff posing as a trusted authority. The emails contain links to fake websites where DMV employees are tricked into handing over passwords, money, or information.”

What’s the worst that could happen from someone getting a person’s personal information from the DMV or DOT? Identity theft, stalking, etc.?

“The DMV keeps detailed personal information about drivers, including Social Security numbers. A data breach could put drivers at risk of identity theft and fraud, scams, and extortion.”

Can you do anything if you suspect the DMV or DOT has sold your information to a third party or that a third party has misused your information?

“There’s nothing that can get the information back once it’s been sold, but you can report the incident to the appropriate authority, such as your state attorney general.”

Is there any way you can prevent the DMV or DOT from selling your information?

“The Drivers Privacy Protection Act (DPPA) requires DMVs to obtain consent before selling a driver’s personal data. Be sure not to blindly sign paperwork that allows the DMV to do so.”

What laws need to be passed to prevent the DMV or DOT from selling information to third parties? Does your state have these in place?

“The DPPA already prevents this. The DPPA is a national law. Some states have supplemental laws that bolster the DPPA, but every state must meet the DPPA’s federal baseline protections.”

What practical steps should drivers follow if their data is stolen? Freeze credit cards, get new SSNs, etc.?

“It depends on what was stolen. If the information included a Social Security number, then a credit freeze or fraud alert is a good idea. If it was just your name and contact details, just be on the lookout for scams and phishing.”

Paul Bischoff is a privacy advocate and researcher with Comparitech.

He covers cybersecurity, digital privacy, VPNs, encryption, and identity theft.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions: Personal Information Data Breaches

We’ve covered a lot of ground in this study of DMV and DOT data breaches, but we understand you probably still have a number of questions. Read on to see what common questions others are asking about data breaches and why data breaches are bad.

#1 – What causes the highest percentage of data breaches?

Answers will vary on this depending on who you ask, but two of the biggest ways data gets leaked are hackers and human error. While a hacker makes sense, most people aren’t aware that it’s usually simple things like making a weak password or forgetting to sign out of a device that can contribute to data breaches.

#2 – What are the world’s biggest data breaches?

One of the largest data breaches in history was at Yahoo, where billions of people’s data were hacked. Other memorable data breaches at major companies include Facebook and Equifax.

#3 – What are the potential effects of a data breach?

How does a data breach affect me? There are a number of effects that can occur after a data breach. From the customer’s side, they may face financial losses, identity theft, spam, and more.

As for the company, it may lose customers after a data breach, as customers no longer trust it. A company may also have to pay thousands of dollars, or even millions, to fix the issue and install better security.

#4 – Where can I find a data breach dataset?

You can find information and records of data breaches at the ITRC, a comprehensive data breach tracker information center. There is also state-by-state information on cybercrime at the FBI.

Some states may also have information on data breaches on attorney general office websites, although this information is harder to find because not all states record data breach information for the public.

#5 – How common are data breaches?

Data breach reporting shows that breaches are extremely common. According to the FBI, the bureau receives more than 1,200 complaints of cybercrime per day. Keep in mind that these are just complaints or reports of cybercrime breaches.

This means that each complaint may not equal just one person for something like a DMV and DOT data breach. A data breach could affect thousands of people, but only one report is filed for it by the company that was breached.

#6 – What was the biggest data breach in history?

According to Security Magazine, CAM4.com, an adult streaming site, saw the largest data breach in history, with hackers gaining access to 10.88 billion records including first and last names, email addresses, countries of origin, sign-up dates, device information, and more. The breach occurred in 2020.

#7 – What is the most recent data breach?

Fortunately, the start of 2021 has been relatively quiet on the data breach front, according to some watchdog publications, but the end of 2020 was considered “chaotic” with billions of records compromised in thousands of data breaches.

#8 – What companies have been hacked in 2020?

The top 10 companies to have been hacked in 2020 based on the number of accounts or records compromised include CAM4.com, Advanced Info Service, Keepnet Labs, BlueKai, Whisper, Sina Weibo, Estée Lauder, Broadvoice, Wattpad, and Microsoft.

#9 – What is the biggest hacker attack in history?

The biggest hacker attack was in 2020 when CAM4.com was hacked and 10.88 billion accounts were compromised. Previous major attacks include the hacking of Yahoo in 2013 and 2014 that compromised 3 billion accounts, and the Experian hack which exposed 15 million people’s personal data.

#10 – How many data breaches have there been 2020?

Data breaches are fairly frequent, with some companies noting that already in January 2021 there have been dozens. The major data breaches seem to be rising, with 2020 the ugliest year on record for breaches with at least 36 billion accounts compromised.

#11 – Has Amazon had a security breach?

In 2021, it was revealed that Juspay, a company that processes credit and debit card payments for companies like Amazon and Swiggy, was breached with over 100 million accounts compromised. Credit and debit card masked numbers, mobile numbers, and email IDs were stolen, though the company was quick to say that hackers did not steal any sensitive information like full credit or debit card numbers.

#12 – Has Google ever had a data breach?

Google has had successive data breaches for its Google+ product, with hackers stealing confidential information in 2018 for around 5 million customers. Google, however, did not announce this to the public, prompting a public outcry when the Wall Street Journal broke the news. This and the weaknesses in the legacy Google+ API have led to it being shut down, with thoughts of rebuilding it in the future.

Methodology: Ranking the Worst States for Driver-Related Data Breaches

Our researchers used the data from the Identity Theft Resource Center (ITRC) as the base for our study. Using the ITRC’s data, our team combed through the last 15 years of data breaches and pulled information for any data breaches involving a DMV or DOT.

Since not every breach leads to information leakage, incidents involving the DMV or DOT that had no impact on individuals were excluded from the list. This consideration applies to states with the hardest driving tests and those involving hacks of DMV databases.

Once the complete list of DMV and DOT breaches with data on the number of individuals was formulated, our researchers pulled out the top 10 worst states for data breaches at the DMV or DOT based on the number of individuals affected.

Our team found this to be the most accurate way to base how bad a data breach was at a DMV or DOT, as monetary losses are not always available, especially with many of the attacks happening over a decade ago. Assessing how much information was leaked in the number of total attacks in each state is the best way to judge which states had the biggest breaches over the last 15 years.

We know that data breaches can be scary. Having your credit card information stolen or being the victim of identity theft can lead to problems years down the road. One way to mitigate the financial losses of this kind of event is to find the most competitive auto insurance rates using the web.

The most effective method to reduce your auto insurance costs is by comparing quotes from various insurance providers. This approach helps you identify the coverage options you need within your budget, especially if your vehicle is out of the database coverage area. Additionally, consider how the RMV evaluation in Hardwick might affect your insurance options.

Plug your ZIP code into our free online quote generator to find the best auto insurance quotes in your area that fit your insurance and budgetary needs.

Frequently Asked Questions

What are DMV and DOT data breaches?

DMV (Department of Motor Vehicles) and DOT (Department of Transportation) data breaches occur when sensitive personal information, such as driver’s license numbers, vehicle registration details, or Social Security numbers, is illegally accessed or exposed due to a security breach within these government agencies.

Which states have experienced the worst DMV and DOT data breaches?

While specific rankings may vary, some states have faced significant DMV and DOT data breaches in the past. Examples of states that have experienced notable breaches include California, Florida, Texas, Illinois, and New York.

What are the consequences of DMV and DOT data breaches?

DMV and DOT data breaches can have serious consequences for individuals and the affected states. The exposed personal information can be used for identity theft, financial fraud, or other malicious activities. It can lead to financial losses, damage to personal reputation, and the need for extensive identity theft protection measures.

How can individuals protect themselves in states prone to DMV and DOT data breaches?

While individuals cannot control the occurrence of data breaches, they can take steps to protect their personal information. These measures include monitoring financial accounts regularly, using strong and unique passwords, enabling two-factor authentication, being cautious of suspicious emails or calls requesting personal information, and considering credit monitoring or identity theft protection services.

What are the efforts being made to prevent DMV and DOT data breaches?

States and government agencies are implementing various measures to prevent data breaches and enhance data security. These efforts include improving security infrastructure, implementing strict data protection protocols, conducting regular security audits and assessments, providing employee training on data security, and complying with relevant data protection regulations.

Was the Florida DMV hacked?

As of now, there is no widespread, confirmed report of the Florida DMV being hacked. However, data breaches can occur, so it is important to stay updated through official channels or news outlets for any developments.

What AAA DMV services are available?

AAA provides various DMV services, including vehicle registration renewals, title transfers, and obtaining driving records. Some AAA offices may offer additional services like notary services and personalized assistance with DMV paperwork.

What is the latest news from the California Department of Motor Vehicles?

To get the latest news from the California Department of Motor Vehicles (DMV), check their official website or recent press releases. News updates can include changes in regulations, service disruptions, or updates on new initiatives.

What should you do if you receive a fake DMV letter in the mail in California?

If you receive a fake DMV letter in the mail in California, do not respond or provide any personal information. Contact the California DMV directly using their official contact information to report the suspicious letter and verify any requests.

Has the Washington Department of Licensing experienced a data breach?

There have been instances where the Washington Department of Licensing experienced data breaches. For the most current information, refer to official statements from the Department of Licensing or recent news reports.

What are the reviews for the Redlands DMV?

What are the details of the State Farm data breach?

Has the Louisiana Office of Motor Vehicles experienced a data breach?

How does California DMV fraud affect millions of cars?

What are the details of the Geico data leak?

How many items are on the DMV written test?

How to cheat on the DMV written test?

What area is considered the DMV?

What city is known as the DMV?

What does DMV mean?

What happens if I fail the DMV written test three times in California?

What is the DMV area in the USA?

What is the DMV known for?

What states are considered the DMV?

What states make up the DMV?

Where is the DMV located in the USA?

When was the DMV created?

Why is it called the DMV?

Did the DMV get hacked?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.