AAA vs. AARP Auto Insurance in 2026 (Side-by-Side Comparison)

AAA and AARP auto insurance give good coverage, with prices beginning from $43 each month. AAA is very strong in roadside assistance, giving towing service up to 200 miles. Through The Hartford, AARP makes sure older drivers can renew their policies, which is important when comparing AAA vs. AARP based on specific needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated December 2024

Company Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

When deciding between AAA and AARP auto insurance, it is essential to understand exactly what each offers before committing to a policy. It’s not just about picking the one with the cheapest auto insurance.

Continue reading to compare AARP vs. AAA auto insurance quotes and policy options from both companies. This will help you understand how each insurer’s car insurance might benefit you.

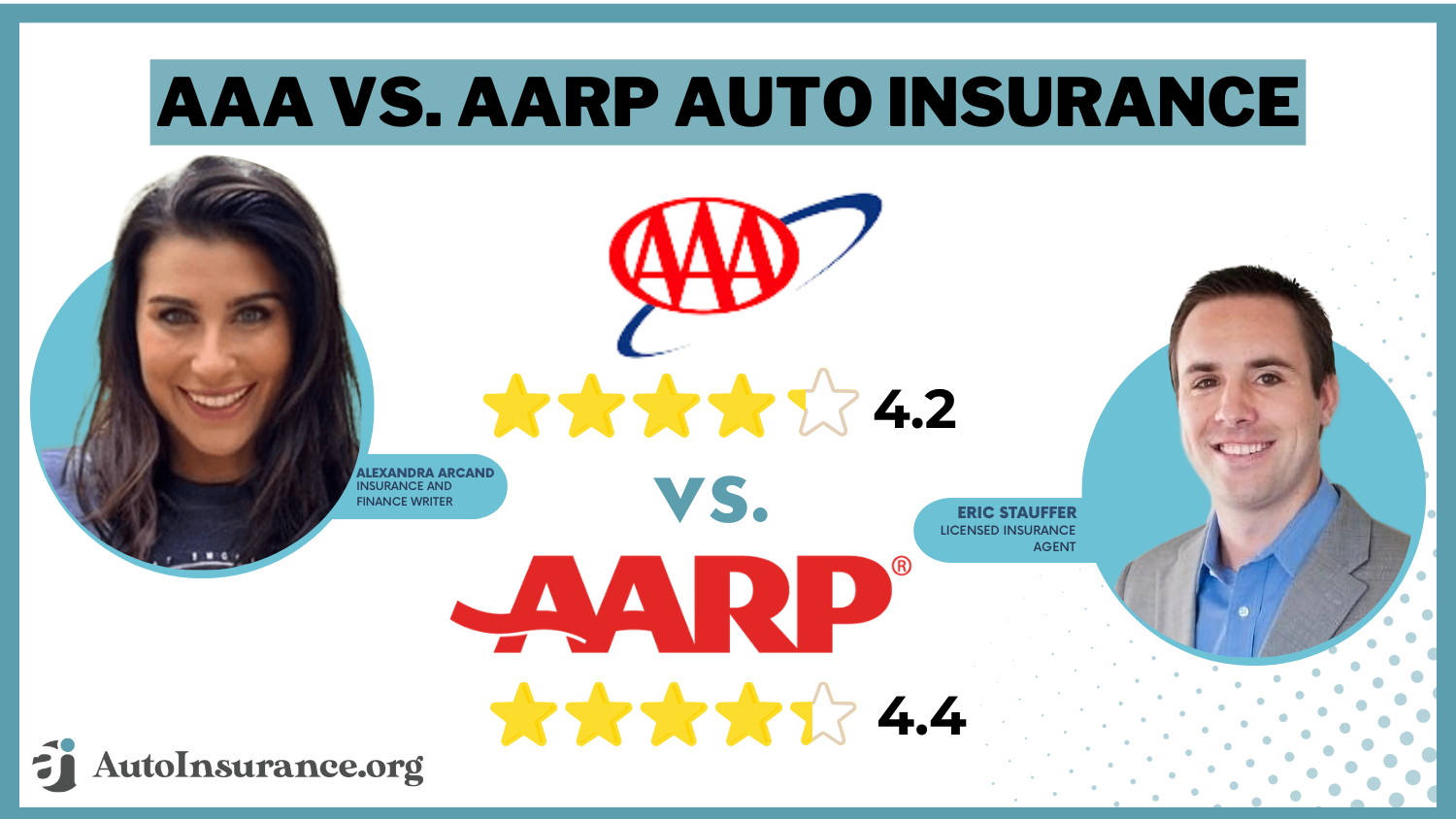

AAA vs. AARP Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.5 | 5.0 |

| Claim Processing | 3.3 | 4.8 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.0 | 4.6 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.0 | 3.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.2 |

| Plan Personalization | 4.0 | 3.5 |

| Policy Options | 4.4 | 4.4 |

| Savings Potential | 4.3 | 4.5 |

| AAA Review | AARP Review |

Both companies offer unique coverage choices, so it is essential to compare what they provide to find what fits best for you. See how AAA and AARP can help your insurance needs through these features.

Use our free comparison tool above to see what auto insurance quotes for AAA and AARP look like in your area.

- AAA and AARP offer insurance starting at $43 per month

- AAA includes 200-mile towing, which is ideal for long trips

- AARP provides guaranteed policy renewal for senior drivers

Introduction to AAA vs. AARP Auto Insurance Rates

This table shows the differences in full coverage car insurance costs between AAA and AARP, sorted by age and gender. This helps us see how prices change based on these factors, giving an idea of which company may have better deals for different groups of people.

AAA vs. AARP Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $445 | $425 |

| Age: 16 Male | $465 | $475 |

| Age: 30 Female | $103 | $145 |

| Age: 30 Male | $99 | $155 |

| Age: 45 Female | $86 | $105 |

| Age: 45 Male | $88 | $115 |

| Age: 60 Female | $76 | $90 |

| Age: 60 Male | $77 | $95 |

AAA gives lower prices to many age groups, mostly for men. On the other hand, AARP can sometimes be a bit more costly but is still attractive for older drivers who want special perks. This comparison indicates significant differences in the way companies adjust premiums according to age and gender.

The table below shows difference between AAA and AARP auto insurance rates for full coverage, showing how driving history changes monthly premiums. The prices change a lot depending on things like clean records, speeding tickets, and DUI incidents. Learn how auto insurance companies check driving records before providing rates.

AAA vs. AARP Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $88 | $115 |

| Not-At-Fault Accident | $133 | $125 |

| Speeding Ticket | $108 | $145 |

| DUI/DWI | $148 | $230 |

Choosing between AAA and AARP auto insurance depends heavily on your driving record. AAA generally offers more affordable rates for most driving scenarios, but AARP remains competitive in specific cases.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA vs. AARP: Discounts, Roadside Assistance, and Coverages

Before we examine the many discounts and policy benefits of AAA and AARP, it’s essential to understand that AARP is not an insurance company—it is the American Association of Retired Persons.

AAA and AARP are membership programs selling auto insurance coverage through affiliated partners. AARP partners with The Hartford Insurance, while AAA uses different partners depending on the state. For example, AAA sells policies through Interinsurance Exchange to drivers in Southern California. Read our Interinsurance Exchange auto insurance review to learn more.

If you have AARP or AAA membership, you’re paying for the premium service of their trusted recommendations, which may or may not be helpful to you. If you’re interested in finding affordable AAA or AARP car insurance quotes, consider the pros and cons of joining either group by reading reviews on the website from actual members.

AAA vs. AARP Car Insurance Discounts

Both companies offer substantial and the best auto insurance discounts if you qualify, but AARP will better understand a lower credit score. This might benefit you in most states where a credit report can factor into the underwriting process for your policy. AARP and AAA car insurance discounts allow bundling your policy with life and property insurance; AARP even offers a loyalty discount.

AAA vs. AARP Roadside Assistance

AAA provides drivers with towing and roadside assistance plans through its network of regional partners. AARP partners with Allstate to offer roadside assistance plans to members. As part of a special promotion, Allstate car insurance offers AARP members a 10%—20% discount off the company’s standard rates.

AAA and AARP offer similar services to their customers if they’ve opted for this feature, from changing a tire, recharging or replacing your battery, or using a winch to pull your car out of the wrong spot. The most considerable distinction is that AAA provides 200-mile towing coverage and various types of auto theft insurance, while AARP does not.

AAA’s towing distance could benefit folks making long, cross-country trips, considering how scarce auto services become once you drive across I-40 in New Mexico or Arizona.

AAA vs. AARP Auto Insurance Coverages

AAA and AARP auto insurance offer policies meeting your state’s auto insurance requirements. That means they will cover you for bodily injury liability, property damage liability, personal injury protection (PIP), medical payments, and uninsured and underinsured motorist coverage (UM and UIM).

They also provide full coverage if you need additional collision and comprehensive insurance. However, AARP shines where it guarantees you’ll be able to renew your coverage automatically as long as you’re paid up and can acquire a driver’s license. This may not be a concern for many people, but for retirees and those on a fixed income, information like this can save them a world of trouble.

AAA vs. AARP Customer Service Ratings and Satisfaction

AARP and The Hartford have below-average complaint ratings for auto insurance, but AAA has many more complaints than the average company. Customers also report higher claims satisfaction with AARP. AAA shines when it comes to the total shopping experience.

Comment

byu/Lolaindisguise from discussion

inFrugal

Those who prefer to use their smartphones to access policy information and check accounts will appreciate the AAA mobile app, as it has a much higher rating on both the Google Play Store and Apple. AARP does not even have an app on the Apple Store. You’ll use The Hartford’s app instead since it is the actual company providing car insurance for AARP members.

Claims Satisfaction

Have you ever changed your insurance company based on how you were during a previous claim handling or interrogated during a new policy’s underwriting process?

Then, you’ll appreciate that AARP pays off during critical times when it comes down to fixing a problem and getting it right for the customer. For claim satisfaction, AARP outperforms AAA car insurance. Understand how to file an auto insurance claim to ensure a smooth process.

Customer Complaints

Compared to AARP, AAA receives more complaints overall. Its complaint ratio is 3.82, meaning AAA auto insurance receives over three times the number of complaints of other insurers its size. Since AARP partners with The Hartford, customers will enjoy better customer service.

However, while AARP is a non-profit organization, The Hartford is a publicly traded, for-profit insurance business. If you choose to buy AARP vehicle insurance, you’ll be handled by a separate, publicly traded for-profit corporation once you have a policy.

Consumer Feedback: How AAA and AARP Stack Up

Consumer reviews and business ratings give much important info when we look at AAA versus AARP auto insurance. Many people say that AAA has better J.D. Power satisfaction score and fewer complaints are strong points, while AARP stands out with very good financial strength as rated by A.M. Best. Because of these differences, it is important to consider both companies based on what things you find most important.

Insurance Business Ratings & Consumer Reviews: AAA vs. AARP

| Agency |  | |

|---|---|---|

| Score: 823 / 1,000 Avg. Satisfaction | Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A- Good Business Practices |

|

| Score: 74/100 Good Customer Feedback | Score: 68/100 Avg. Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. | Score: 1.93 More Complaints Than Avg. |

|

| Score: A+ Excellent Financial Strength | Score: A+ Superior Financial Strength |

AAA has more better customers and fewer issues, but AARP is stronger in financial health. Knowing these details lets drivers choose better between AAA and AARP auto insurance.

When your budget 🔢is stretched to the max, you need to find a balance⚖️ between car insurance coverage and premiums. We have tips to help you find what you need as well as our top 10 list picks👉: https://t.co/3H5IJVVPnP pic.twitter.com/l79FE6Pyaa

— AutoInsurance.org (@AutoInsurance) October 21, 2024

AAA and AARP play different roles in the market, each giving unique benefits according to what customers like. AAA focuses on helping drivers with roadside assistance, while AARP concentrates on services for older adults. Because of this difference, both organizations offer various choices that many drivers might find useful based on their needs. Looking for the best auto insurance for seniors? Find top-rated providers here.

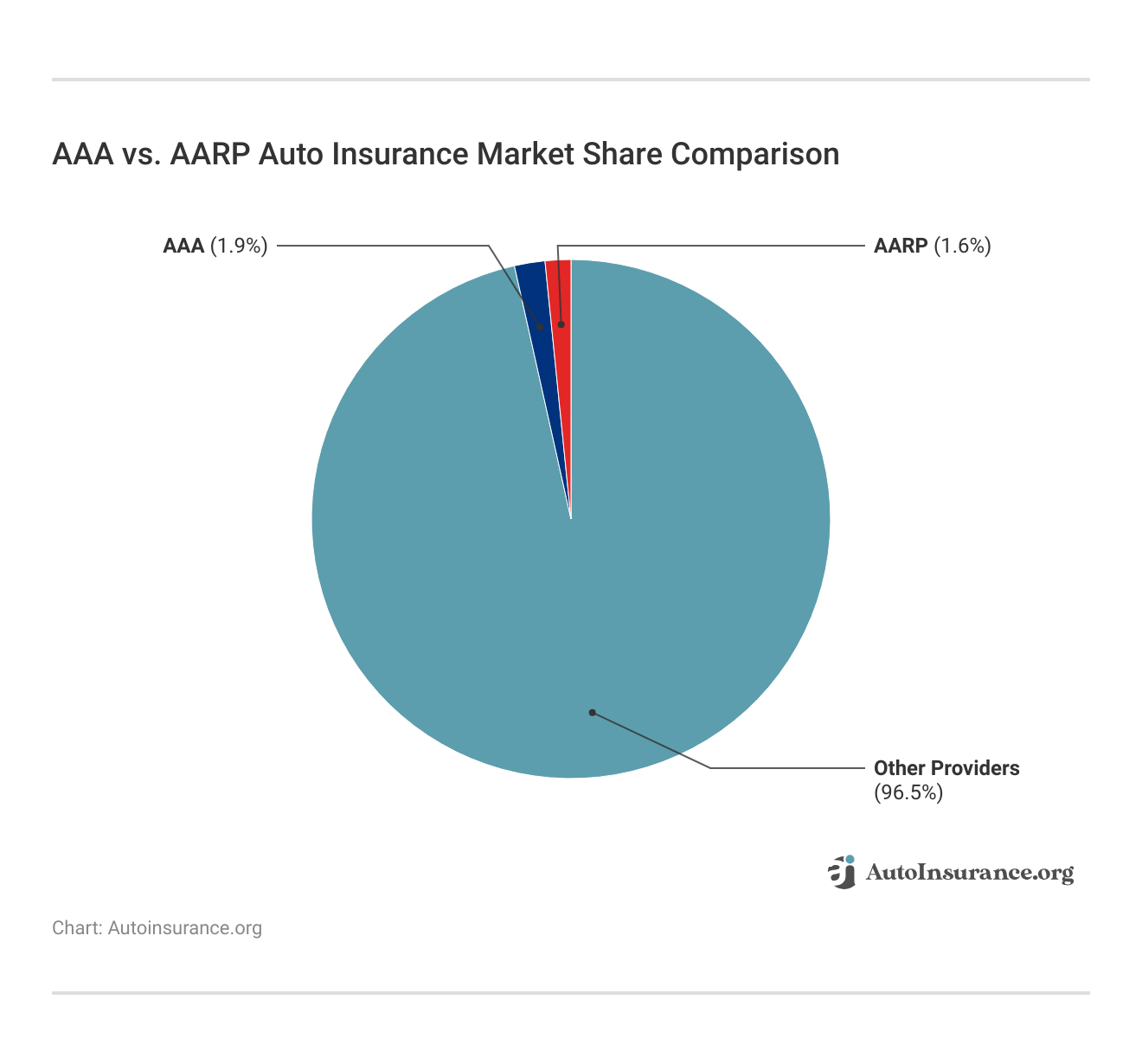

The AAA vs. AARP auto insurance market share has a clear difference, where AAA owns 1.9% and AARP holds 1.6% of the market slice. Both groups cover small parts if we compare them to other providers that control huge part, about 96.5%, of the whole market pie. Understanding these shares helps drivers decide which company better aligns with their insurance needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA Pros & Cons

Pros

- Wide Towing Coverage: AAA’s 200-mile towing coverage is very good for drivers who often go a long way.

- Affordable for Clean Records: For drivers with clean records, cost-effective insurance is possible. Monthly prices can be as low as $88.

- Competitive DUI Rate: If looking at the AARP rate, AAA charges $148 for people with DUI, which is much lower.

Cons

- Many Complaints: AAA has a complaint ratio of 3.82, showing more unhappy customers than other insurance companies.

- Higher Accident Rates: AAA charges $133 for drivers with a not-at-fault accident, which is more expensive than what AARP offers in the same situation.

AARP Pros & Cons

Pros

- Guaranteed Policy Renewal: AARP, through The Hartford, ensures seniors can renew their policies regardless of age or driving history.

- Competitive Accident Rates: AARP offers a lower rate of $125 for drivers with a not-at-fault accident, beating AAA’s rate. See how insurance companies handle claims involving at-fault accidents.

- Intense Claims Satisfaction: AARP outperforms AAA in customer satisfaction, especially when handling claims.

Cons

- Expensive DUI Rates: AARP charges $230 for drivers with a DUI, which is substantially higher than AAA’s rate.

- Limited Towing Distance: AARP doesn’t match AAA’s 200-mile towing service, offering more basic roadside assistance.

Making the Right Choice With AAA or AARP

AAA and AARP auto insurance give different benefits. AAA is known for strong roadside assistance plans and towing services, while AARP offers policies that focus more on seniors with renewal guarantees through The Hartford. By comparing these options, especially looking at prices based on your driving history and any discounts they offer, you can choose what fits best for you.

For DUI offenses, AAA remains more affordable at $148, compared to AARP’s $230.Laura Berry Former Licensed Insurance Producer

If you want cheaper rates, better customer support, or confident coverage choices, comparing AAA and AARP can help you see which is best for your car insurance needs. You can only decide which insurance company can best serve you for what you pay. So, take the time to compare these and more companies with our free quote comparison tool below.

Frequently Asked Questions

How can I get an AAA auto insurance quote?

You can get an AAA auto insurance quote by visiting their website, contacting a local office, or calling customer service to receive a personalized estimate. Discover how to get free online auto insurance quotes quickly and easily.

What is the difference between AARP roadside assistance and AAA?

The main difference between AARP roadside assistance and AAA is that AARP partners with Allstate, while AAA has its extensive roadside network offering 200-mile towing.

What does AARP home insurance cover?

AARP home insurance, provided through The Hartford, covers damages to your home, personal belongings, liability protection, and additional living expenses in case of a covered loss. Enter your ZIP code below into our free comparison tool today to get the best auto insurance rates possible.

How can I get an AARP auto insurance quote?

You can get an AARP auto insurance quote online by visiting the AARP website or contacting their insurance partner, The Hartford, for a personalized estimate.

Which is better, AAA or AARP for auto insurance?

Which is better, AAA or AARP, depends on your needs—AAA offers more comprehensive roadside assistance, while AARP provides stronger policy renewal guarantees for seniors. Get comprehensive auto insurance defined to know how it safeguards your vehicle.

Is AARP the same as AAA?

No, AARP is not the same as AAA. AARP focuses on benefits for seniors, including insurance, while AAA provides auto-related services like insurance and roadside assistance.

What is the difference between AAA and AARP?

The difference between AAA and AARP is that AAA focuses on auto services and roadside assistance, while AARP is geared toward seniors and offers various discounts and insurance options.

Is AARP better than AAA for auto insurance?

It depends on your specific needs. AARP excels in policy renewal for seniors, while AAA may offer lower rates for drivers with clean records.

Are AARP and AAA the same organization?

No, AARP and AAA are not the same. AARP offers discounts and insurance products to seniors, while AAA focuses on auto-related services and roadside assistance. Learn how to access the best membership auto insurance discounts and save more.

What are the benefits of AAA vs. AARP membership?

Compared to AAA membership, AAA offers extensive travel and roadside services, while AARP provides discounts and insurance options primarily for seniors.

Is AAA or AARP better for discounts?

What does AAA car insurance full coverage include?

What are the benefits of AAA vs. AARP?

What does AARP travel insurance cover?

What makes AARP car insurance for seniors special?

Is there an AARP discount for AAA membership?

What is AAA non-owner car insurance?

What does AARP property insurance cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.