Amica Auto Insurance Review 2026 (Rates & Customer Reviews)

Our Amica auto insurance review found that Amica is an excellent choice for car insurance coverage, with high ratings for financial stability and customer satisfaction. While rates can be higher for high-risk drivers, Amica's average minimum coverage rate starts at just $46/mo for good drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

Our Amica auto insurance review found that the company offers competitive rates for car insurance and has a higher-than-average rating regarding customer satisfaction.

Amica offers standard auto insurance coverage options and add-ons like roadside assistance and full glass repair.

However, not all types of auto insurance are available in every state. Keep reading this Amica auto insurance review before you start comparing insurance quotes to ensure you find the best company for your needs.

Amica Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.2 |

To compare your Amica car insurance quote against top providers, such as State Farm vs. Amica, we recommend using a quote comparison tool. For free quotes from companies in your area, enter your ZIP into our quote tool above to get started.

- Amica has higher-than-average customer service satisfaction ratings

- Some auto insurance coverages are not available in states

- The company received an A+ (Excellent) rating with A.M. Best

Cost of Amica Auto Insurance

Your Amica auto insurance rates will be personally tailored to you, but to give you an idea of what you’ll pay for coverage, we’ve gathered average rates by age, driving record, and more. To start, take a look below to see what you’ll pay based on coverage, age, and gender.

Amica Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $215 | $695 |

| Age: 16 Male | $238 | $735 |

| Age: 18 Female | $175 | $512 |

| Age: 18 Male | $204 | $597 |

| Age: 25 Female | $55 | $182 |

| Age: 25 Male | $57 | $190 |

| Age: 30 Female | $51 | $168 |

| Age: 30 Male | $53 | $176 |

| Age: 45 Female | $46 | $153 |

| Age: 45 Male | $46 | $151 |

| Age: 60 Female | $42 | $136 |

| Age: 60 Male | $44 | $140 |

| Age: 65 Female | 45.53 | $150 |

| Age: 65 Male | 44.85 | $148 |

Teen drivers may be discouraged by the high price of full coverage, but full coverage provides the best protection for new drivers.

Bear in mind that the rates shown are also for teens purchasing their own Amica policy. Rates will be more affordable if parents add the teen to their existing policy (Read More: Should I add my teenager to my auto insurance policy?). Read on to learn more about rates by age and driving history at Amica.

Amica Auto Insurance Rates Based on Age

Auto insurance for teens comes with the highest rates. Let’s take a look at Amica’s minimum and full-coverage auto insurance rates for teenage males and females with clean driving records.

As you age and gain experience behind the wheel, your car insurance rates will start to decrease as long as you keep your record clean. The table below shows Amica’s average rates for senior auto insurance.

It’s a good idea to get an Amica auto insurance quote rather than relying on national averages to get a more accurate rate on car insurance (Learn More: How to Get Fast and Free Auto Insurance Quotes).

Amica Auto Insurance Rates Based on Driving History

One of the best ways to keep your car insurance low is to keep your driving record clean. The table below shows the average rates you can expect to pay at Amica based on driving violations.

Violations like DUIs, tickets, and accidents can cause your rates to increase. Here is a further breakdown of how much auto insurance for drivers with DUIs costs with Amica.

Accidents are another red flag to auto insurance companies and will also raise rates. If you are involved in an accident and found to be at fault, you will likely see a rate increase at Amica, like those shown below.

Tickets are another factor that will impact your auto insurance rates. Take a look at how a ticket may affect your car insurance rates with Amica below.

As you can see, being a safe driver pays off with lower rates at Amica. If you do have driving violations on your record, then keeping a clean driving record will help your rates drop over time (Learn More: How to Lower Your Auto Insurance Rates).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Amica Auto Insurance Rates to Top Providers

Your driving record, age, gender, marital status, and the type of auto insurance coverage you need are all factors that significantly impact your Amica auto insurance rates (Learn More: Factors That Affect Auto Insurance Rates). Insurance with Amica is often competitive in price, but rates for coverage tend to be slightly higher than rates from competitors.

The table below shows the average annual rate for a full coverage auto insurance policy with Amica compared to other insurance providers, such as Farmers vs. Amica.

Amica Auto Insurance Monthly Rates vs. Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $67 | $176 | |

| $51 | $137 | |

| $53 | $176 | |

| $64 | $167 | |

| $32 | $87 | |

| $77 | $200 |

| $53 | $136 |

| $50 | $136 | |

| $39 | $103 | |

| $40 | $108 | |

| U.S. Average | $53 | $139 |

Now that you can see how rates by coverage compare, take a more detailed look at coverage options by gender and age below.

Amica Full Coverage Auto Insurance Monthly Rates vs. Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $104 | $105 | |

| $320 | $350 | $160 | $170 | $130 | $140 | $110 | $120 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $120 | $128 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

The table below shows how Amica’s average rates compare to other companies for drivers with different driving records.

Amica Full Coverage Auto Insurance Monthly Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $140 | $231 | $283 | $187 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

You can see that Amica rates are, on average, near the top of the list in terms of cost. However, if you’re wanting to compare rates with a company not listed above, such as Mercury vs. Amica, you should get a quote from both companies.

Amica Auto Insurance Coverage Options

Amica offers different options for car insurance, and the company allows customers to choose the coverage types they need and customize an auto insurance policy that works best for their unique lifestyle.

Options with Amica auto insurance include the following:

Amica Auto Insurance Coverage

| Coverage | Description |

|---|---|

| Accident Forgiveness | Prevents your rates from increasing after your first at-fault accident. |

| Collision Coverage | Pays for damages to your car resulting from a collision, regardless of who is at fault. |

| Comprehensive Coverage | Covers damages to your car from non-collision incidents like theft, fire, or natural disasters. |

| Full Glass Coverage | Covers the full cost of repairing or replacing your vehicle's windshield without a deductible. |

| Gap Insurance | Pays the difference between your car's actual cash value and what you owe on it. |

| Liability Coverage | Covers bodily injury and property damage to others for which you are legally responsible. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers after an accident. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs after an accident. |

| Rental Car Reimbursement | Covers the cost of renting a car while your vehicle is being repaired after a covered accident. |

| Roadside Assistance | Provides assistance like towing, tire changes, and jump-starts when you're stranded. |

| Uninsured/Underinsured Motorist | Covers damages if you're hit by a driver with no or insufficient insurance. |

Depending on what you’re looking for, you may find that a combination of several of the coverage options above works best for you. Amica allows you to choose the types of coverage you need, such as Amica comprehensive insurance or Amica gap insurance, and you can alter your policy at any time to ensure it works well (Read More: How much car insurance do I need?).

If you choose less coverage on your vehicle, you can expect to pay less for your insurance. But it’s a good idea to purchase enough coverage to be safe and comfortable on the road.Benjamin Carr Former Insurance Agent

You can also get other insurance products with the company, such as Amica life insurance or home insurance. However, it’s critical to check out Amica life insurance reviews and Amica homeowners insurance reviews before deciding on either coverage.

Not all coverage options are available in every state, so you may want to call and speak with an Amica insurance representative to learn whether the coverage you’re looking for is an option in your area. Keep reading our Amica review to compare its rates against top competitors, such as Amica vs Geico.

Amica Auto Insurance Discounts Available

Amica Mutual Insurance Company offers several options for auto insurance discounts. These are some of the best Amica auto insurance discounts:

Amica Auto Insurance Discounts

| Discount | Percentage |

|---|---|

| Anti-Theft Device Discount | 15% |

| AutoPay Discount | 5% |

| Claim-Free Discount | 20% |

| Defensive Driver Discount | 10% |

| Good Student Discount | 15% |

| Loyalty Discount | 20% |

| Multi-Policy Discount | 30% |

| Multi-Vehicle Discount | 25% |

| New Vehicle Discount | 15% |

| Paid-in-Full Discount | 10% |

Amica car insurance discounts could help policyholders save as much as 25% on their car insurance premiums if customers combine discounts like a defensive driver discount with an anti-theft device discount.

If you believe you may qualify for one or more discounts with Amica, call the Amica insurance phone number and speak with a representative in your area to see how much you could save on coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica Auto Insurance Reviews From Customers

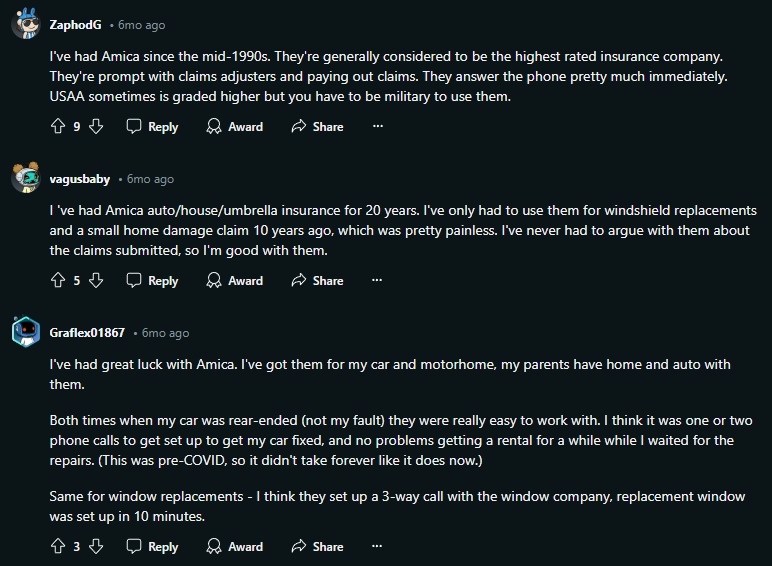

Customer reviews of Amica coverage are generally positive. Amica claims reviews on Reddit show that many users believe the Amica insurance company is a trusted provider with good claims handling and is one of the best auto insurance companies for paying claims.

Reddit is a great place to check for Amica reviews from customers and see what common questions are asked about the company.

On the other hand, Amica insurance reviews with BBB (Better Business Bureau) are poor, averaging 1.27 stars out of 5, though there are only 74 customer reviews. Most Amica complaints on the BBB website cite poor Amica insurance customer service and raising rates for no reason.

Amica Auto Insurance Reviews From Businesses

In addition to Amica ratings from customers, potential clients should take a look at Amica’s reviews from businesses before buying a policy (Read More: How to Research Auto Insurance Companies Before Buying). We have collected the most important business ratings of Amica below.

Amica Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 903 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Financial Stability |

|

| Score: 85/100 Excellent Customer Feedback |

|

| Score: 0.73 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

Amica auto insurance reviews with Consumer Reports show customers are satisfied with their coverage, and NAIC complaints are below average. The company also has great financial stability, as it was rated highly by A.M. Best.

Amica Auto Insurance Pros and Cons

Not sure if Amica is right for you? We’ve summarized the main pros and cons in our review for you. To start, let’s rehash Amica’s auto insurance pros.

- Customer Service: Amica has some of the highest customer ratings, with high ratings from Consumer Reports and similar businesses.

- Widespread Availability: Amica sells auto insurance coverage in every U.S. state, which is ideal for customers who frequently move.

- Discount Options: Amica has bundling discounts and more to help its customers save on auto insurance policies.

Of course, like most auto insurance companies, Amica has some cons that may make customers think twice before purchasing a policy. These main cons include:

- Coverage Availability: Amica doesn’t sell all of its auto insurance coverages in every state, so some customers may not get all the specialty add-on coverages they want.

- Higher Rates for Some Drivers: Amica insurance rates for high-risk drivers can be more expensive than its competitors.

Before buying an auto insurance policy online from the company, fully consider Amica’s pros and cons to make sure it’s the right choice for you (Learn More: Where to Buy Auto Insurance Online).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Know About Amica Mutual Insurance Company

So, what is Amica? Amica Mutual Insurance offers auto, home, and life insurance coverage throughout the U.S. So, if you’re looking to bundle your home and auto, check out Amica home insurance reviews before you decide.

Read More: How to Save Money by Bundling Insurance Policies

Amica auto insurance ratings and customer reviews are encouraging for anyone considering purchasing a policy with the company. Amica garners an A+ (Superior) financial strength rating and a stable future outlook with AM Best. Additionally, Amica has an A+ rating with the Better Business Bureau (BBB). In addition to the company’s professional ratings, Amica auto insurance reviews made by policyholders are also quite positive.

Amica states that helpful, timely responses are important to its company philosophy, and many clients agree that Amica’s customer service is beneficial.

If you’re considering purchasing a car insurance policy with Amica, you may want to read some reviews for Amica auto insurance online, including our Amica insurance review. Ready to get an auto insurance quote? Simply insert your ZIP code into our free quote comparison tool below to see rates from the best companies in your area.

Frequently Asked Questions

Does Amica have good auto insurance rates?

Auto insurance with Amica is often affordable, though rates may be higher than those of other insurance companies when you get an Amica quote.

How does Amica auto insurance compare to other companies?

Amica offers a wide range of coverage that’s not available at all insurers, but its rates are often more expensive than companies like State Farm and Geico (Learn More: Cheapest Auto Insurance Companies). However, Amica insurance ratings are high for customer satisfaction compared to its competitors.

What company owns Amica Insurance?

Amica Mutual Insurance company is its own entity, offering several types of insurance products, including auto insurance.

How is Amica customer service?

Amica is known for providing excellent customer service. Reviews on Amica auto insurance show the company has consistently received high customer satisfaction ratings and has a strong reputation in the insurance industry. Amica aims to provide prompt and personalized support to their policyholders, whether it’s for inquiries, policy changes, or claims assistance.

Is Amica auto insurance better than Geico?

The answer to this question depends on your needs. Amica offers excellent customer satisfaction and several options for discounts and add-ons to customize your auto insurance policy. If these things are important to you, you may find that Amica is better than Geico insurance.

Is Amica cheaper than Geico? Generally, Geico has the cheapest rates of all auto insurance companies, including Amica. Read our Geico auto insurance review to learn more about the company.

Is Amica insurance good?

A top question readers ask is, “Is Amica a legit company?” Yes, when you read Amica car insurance reviews, you’ll find that Amica is a reliable company based on Amica ratings from businesses and customers. Amica received an A+ financial rating from A.M. Best and an A+ from the Better Business Bureau for customer satisfaction.

Is Amica auto insurance available in all states?

Amica Auto Insurance is available in most states across the United States. However, insurance availability may vary depending on the specific state regulations. It’s best to check with Amica or visit their website to determine if they offer coverage in your state.

Does Amica provide roadside assistance?

Yes, Amica offers optional roadside assistance coverage, commonly known as Amica Emergency Roadside Assistance. Amica roadside assistance can help you in situations such as a flat tire, lockout, dead battery, or if you run out of gas. It provides 24/7 access to their network of service providers to assist you when needed.

How do I file an Amica auto insurance claim?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Is Amica good at paying claims?

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Auto insurance with Amica is often affordable, though rates may be higher than those of other insurance companies when you get an Amica quote.

Amica offers a wide range of coverage that’s not available at all insurers, but its rates are often more expensive than companies like State Farm and Geico (Learn More: Cheapest Auto Insurance Companies). However, Amica insurance ratings are high for customer satisfaction compared to its competitors.

What company owns Amica Insurance?

Amica Mutual Insurance company is its own entity, offering several types of insurance products, including auto insurance.

How is Amica customer service?

Amica is known for providing excellent customer service. Reviews on Amica auto insurance show the company has consistently received high customer satisfaction ratings and has a strong reputation in the insurance industry. Amica aims to provide prompt and personalized support to their policyholders, whether it’s for inquiries, policy changes, or claims assistance.

Is Amica auto insurance better than Geico?

The answer to this question depends on your needs. Amica offers excellent customer satisfaction and several options for discounts and add-ons to customize your auto insurance policy. If these things are important to you, you may find that Amica is better than Geico insurance.

Is Amica cheaper than Geico? Generally, Geico has the cheapest rates of all auto insurance companies, including Amica. Read our Geico auto insurance review to learn more about the company.

Is Amica insurance good?

A top question readers ask is, “Is Amica a legit company?” Yes, when you read Amica car insurance reviews, you’ll find that Amica is a reliable company based on Amica ratings from businesses and customers. Amica received an A+ financial rating from A.M. Best and an A+ from the Better Business Bureau for customer satisfaction.

Is Amica auto insurance available in all states?

Amica Auto Insurance is available in most states across the United States. However, insurance availability may vary depending on the specific state regulations. It’s best to check with Amica or visit their website to determine if they offer coverage in your state.

Does Amica provide roadside assistance?

Yes, Amica offers optional roadside assistance coverage, commonly known as Amica Emergency Roadside Assistance. Amica roadside assistance can help you in situations such as a flat tire, lockout, dead battery, or if you run out of gas. It provides 24/7 access to their network of service providers to assist you when needed.

How do I file an Amica auto insurance claim?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Is Amica good at paying claims?

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Amica Mutual Insurance company is its own entity, offering several types of insurance products, including auto insurance.

Amica is known for providing excellent customer service. Reviews on Amica auto insurance show the company has consistently received high customer satisfaction ratings and has a strong reputation in the insurance industry. Amica aims to provide prompt and personalized support to their policyholders, whether it’s for inquiries, policy changes, or claims assistance.

Is Amica auto insurance better than Geico?

The answer to this question depends on your needs. Amica offers excellent customer satisfaction and several options for discounts and add-ons to customize your auto insurance policy. If these things are important to you, you may find that Amica is better than Geico insurance.

Is Amica cheaper than Geico? Generally, Geico has the cheapest rates of all auto insurance companies, including Amica. Read our Geico auto insurance review to learn more about the company.

Is Amica insurance good?

A top question readers ask is, “Is Amica a legit company?” Yes, when you read Amica car insurance reviews, you’ll find that Amica is a reliable company based on Amica ratings from businesses and customers. Amica received an A+ financial rating from A.M. Best and an A+ from the Better Business Bureau for customer satisfaction.

Is Amica auto insurance available in all states?

Amica Auto Insurance is available in most states across the United States. However, insurance availability may vary depending on the specific state regulations. It’s best to check with Amica or visit their website to determine if they offer coverage in your state.

Does Amica provide roadside assistance?

Yes, Amica offers optional roadside assistance coverage, commonly known as Amica Emergency Roadside Assistance. Amica roadside assistance can help you in situations such as a flat tire, lockout, dead battery, or if you run out of gas. It provides 24/7 access to their network of service providers to assist you when needed.

How do I file an Amica auto insurance claim?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Is Amica good at paying claims?

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

The answer to this question depends on your needs. Amica offers excellent customer satisfaction and several options for discounts and add-ons to customize your auto insurance policy. If these things are important to you, you may find that Amica is better than Geico insurance.

Is Amica cheaper than Geico? Generally, Geico has the cheapest rates of all auto insurance companies, including Amica. Read our Geico auto insurance review to learn more about the company.

A top question readers ask is, “Is Amica a legit company?” Yes, when you read Amica car insurance reviews, you’ll find that Amica is a reliable company based on Amica ratings from businesses and customers. Amica received an A+ financial rating from A.M. Best and an A+ from the Better Business Bureau for customer satisfaction.

Is Amica auto insurance available in all states?

Amica Auto Insurance is available in most states across the United States. However, insurance availability may vary depending on the specific state regulations. It’s best to check with Amica or visit their website to determine if they offer coverage in your state.

Does Amica provide roadside assistance?

Yes, Amica offers optional roadside assistance coverage, commonly known as Amica Emergency Roadside Assistance. Amica roadside assistance can help you in situations such as a flat tire, lockout, dead battery, or if you run out of gas. It provides 24/7 access to their network of service providers to assist you when needed.

How do I file an Amica auto insurance claim?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Is Amica good at paying claims?

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Amica Auto Insurance is available in most states across the United States. However, insurance availability may vary depending on the specific state regulations. It’s best to check with Amica or visit their website to determine if they offer coverage in your state.

Yes, Amica offers optional roadside assistance coverage, commonly known as Amica Emergency Roadside Assistance. Amica roadside assistance can help you in situations such as a flat tire, lockout, dead battery, or if you run out of gas. It provides 24/7 access to their network of service providers to assist you when needed.

How do I file an Amica auto insurance claim?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Is Amica good at paying claims?

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

If you need to file a claim with Amica Auto Insurance, you can do so online or by contacting their claims department directly. They have a streamlined claims process, and once your claim is submitted, a claims representative will guide you through the necessary steps, such as providing relevant documentation and arranging repairs or reimbursement.

Reviews for Amica insurance show that most auto insurance policyholders with Amica are satisfied with their service and claims handling. In addition, in a 2023 J.D. Power study, Amica earned the top spot for overall customer satisfaction with claims.

Can I manage my Amica auto insurance policy online?

What states does Amica insurance cover?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

How long has Amica insurance been around?

Is Progressive better than Amica?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Why is Amica insurance so expensive?

Does Amica have a cancellation fee?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Why did Amica go to 6 month policies?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is there Amica accident forgiveness?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.