Fremont Auto Insurance Review (2026)

Exclusive to Michigan, Fremont auto insurance (review below) also sells other personal lines of coverage, including boat, home, life, renters, and umbrella policies. Policies are sold through independent agents.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

It isn’t easy to find an auto insurance plan that meets your needs. Should you get full coverage or liability only? Do small auto insurance companies offer the best rates or should you go with a large one? Should you bundle your policies? You can spend hours researching different plans and still not find the right one for you.

If you’re looking for auto insurance, we’re here to help. Our Fremont auto insurance review is a complete guide to the company, from their coverage options to their website design.

Fremont Insurance Company, in Fremont, MI, is a property and casualty insurer. The company is a subsidiary of Fremont Michigan InsuraCorp., Inc. and uses the shortened acronym FMIC.

Fremont Insurance is focused on personal lines, offering auto, boat, home, life, renters, and umbrella policies.

Is Fremont Insurance a good choice for your needs? Read on to find out.

If you are ready to get a free online auto insurance quote, we can help. Just enter your ZIP code into our FREE tool above.

What You Should Know About Fremont Insurance Company

How do customers rate Fremont Insurance Company? The Fremont Insurance Company is registered with the Better Business Bureau (BBB) of Michigan. They currently hold a B- rating.

According to the BBB website, the B- rating is because of a failure to respond to one complaint that was filed against the company.

This may seem concerning, but the company boasts a customer retention rate of 91 percent, which is an astounding retention number in the world of insurance.

The total number of Fremont Insurance complaints are what the Better Business Bureau ratings are based on, along with the seriousness of those complaints, and whether or not the company in question dealt with customer concerns satisfactorily.

While the company is listed on their website, Fremont Insurance is not BBB accredited.

Beyond the Better Business Bureau, the only other rating the company has is an A- with A.M. Best. The A.M. Best scale goes from A++ to D, with an A- considered to be an excellent rating.

Because of the company’s small size and limited availability, there are no ratings available with Moody’s, Standard & Poor’s, NAIC, or J.D. Power and Associates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fremont Insurance: Auto Insurance History

In 1875 members of Pomona Grange No. 11 had gathered to discuss their farming interests and decided that farm insurance was too expensive. They thought they could do better for themselves, so they formed the Patrons Mutual Fire Insurance Company to insure their own property.

In 1932 the company expanded beyond Newaygo to include the entire state of Michigan. This is when the name changed to Fremont Mutual Insurance Company.

In 1952, the company decided to expand past farm fire insurance to include dwellings, commercial, and wind insurance.

In 2004 the company was converted from a mutual company to a stock company, changing the name from Fremont Mutual to Fremont Insurance Company.

In 2011, the company merged with its parent company to form Fremont Michigan InsuraCorp, Inc. Only after becoming part of its parent corporation did Fremont begin offering personal auto insurance.

How is Fremont’s online presence?

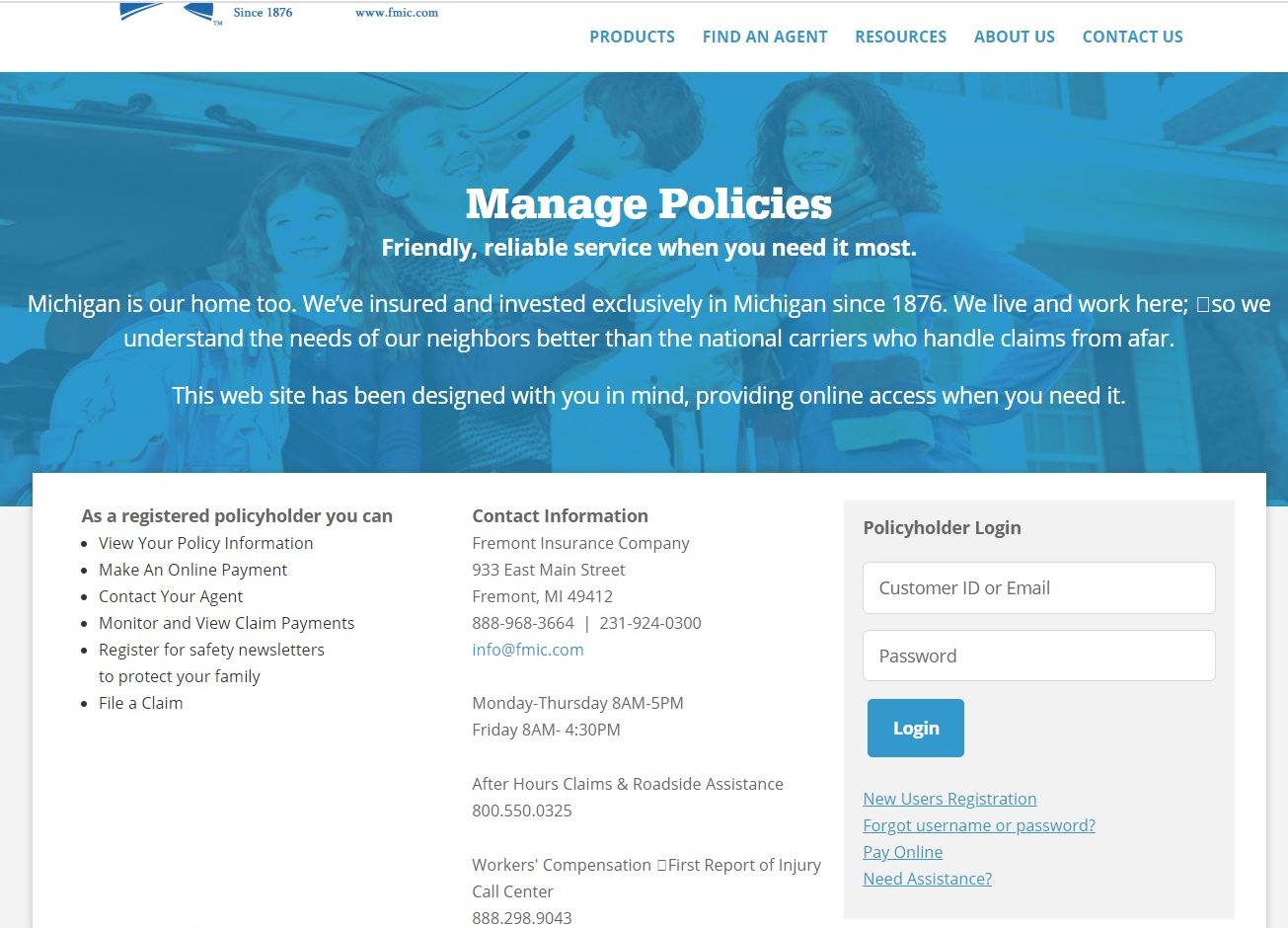

Fremont Insurance does have a website for their customers that has a lot of useful information.

You can use your policyholder login to pay your bills, follow up on claims, and contact your agent if you chose an agent who works through Fremont. What you cannot do, however, is get an online quote. Because the company only sells through agents, you cannot get a quote online.

Does Fremont Insurance have commercials?

There is no record of any television or radio commercials for Fremont Insurance, but this doesn’t mean they don’t exist.

It is also possible that the company may focus more on print advertising or other types of ads, given their relatively small size and limited geographical area.

Is Fremont Insurance involved in the community?

Outside of the fact that they employ people locally in the state, Fremont does do some community work to help support people in Michigan.

Recently Fremont Insurance raised $10,983.34 for UnitedWay. They also raised $1,415 in the fight against breast cancer.

What do Fremont Insurance employees have to say?

Fremont insurance jobs are highly sought after by Michigan residents. Although the employment section of Fremont’s website states there are currently no open positions, there’s also a very detailed statement indicating that the company is always willing to look at resumes and consider candidates who may have a good future with them.

Resumes can be mailed directly to the human resources department located at the corporate offices, or sent via e-mail to the address provided on the website.

In addition to salary, the Fremont office offers a good selection of benefits. Included in those benefits are:

- health and dental insurance

- health flex accounts

- paid vacation and sick time

- a flexible schedule

- continuing education opportunities

- a program to help employees purchase their own PCs

These things are probably a large part of why 77 percent of their employees would recommend the company as a good place to work and 100% of them like the CEO, according to Glassdoor.com.

Design of Fremont Insurance Website and App

Yes, you can access your policy, pay your bills, review claims, and learn about other available products on the website. You’ll also find a Fremont insurance agency locator

The company does not, however, appear to have a smartphone app available at this time. Some smaller insurance companies will join forces with a larger insurance company and share the same app, so it is worth asking your agent if there is an app available for Fremont Insurance.

Is Fremont Insurance Company in liquidation?

No, Fremont Insurance is not in liquidation. The confusion here comes from the fact that a California company by the name of Fremont Indemnity is in liquidation, so searching the names online brings up information about both companies.

Fremont is also not associated with FMIC Insurance Agency Inc., which is an agency of Forestry Mutual. Finally, although the address PO BOX 2946 Milwaukee, WI 53201 is associated with Fremont, it is not one of their main contact addresses.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fremont Insurance Company Insurance Coverage Options

What coverages does Fremont Insurance Company offer? According to its website, Fremont Insurance offers the following personal insurance options:

- Homeowners

- Personal Auto

- Mobile Homeowners

- Renters and Rentals

- Marine

- Farmowners and Country Estates

As far as the personal auto insurance is concerned, the company offers the basic types of auto insurance coverages such as:

- Liability — Liability insurance protects you by paying for damages to another person’s vehicle and their medical costs if you are at fault in an accident.

- Uninsured Motorist Coverage — Uninsured motorist coverage, often referred to as UM, is optional in Michigan. It covers you at the same levels as your liability coverage if you are in an accident where an uninsured driver was at fault. Keep in mind that Michigan is a no-fault state, which increases premium costs and sometimes leaves questions about who pays for things like deductibles and lost wages.

- Collision — Collision insurance protects you by paying for damages to your vehicle if you are at fault in an accident, whether you hit another vehicle or a stationary object such as a fence post. A lender may require you to carry collision insurance on your vehicle if you have a car loan.

- Comprehensive — Comprehensive insurance covers damage to your car that isn’t caused during an accident. Some examples of what might be covered under a comprehensive policy are hail damage and theft. Do I need comprehensive auto insurance coverage? It’s not for everybody, but people who are financing a vehicle or cannot afford to replace a vehicle if it is stolen or destroyed in a flood may need comprehensive coverage.

If you choose to purchase a policy from Fremont Insurance you can talk to your agent about these and any other coverages they may be able to provide you.

You can also purchase additional coverages, such as:

- Rental Reimbursement

- Roadside Assistance

- GAP Insurance

Fremont also offers business insurance policies, such as:

- Businessowners

- Commercial

- Business Automobile

- Workers Compensation

- Cyber Liability

- Umbrella Insurance

The most unique coverage available through Fremont is the Mobileowners coverage.

This coverage is available to people who own mobile homes. It has traditionally been difficult for people who own mobile homes to find insurance for their property, so Fremont has created a product specifically for this specialized market.

What are Fremont’s bundling options?

Bundling, or combining multiple insurance policies with the same company, provides a standard discount with most insurance companies.

The most popular bundling option at Fremont Insurance is home owner’s insurance and auto insurance, but you can bundle any policies you have, including renters, watercraft, mobile homeowners, farm owners, etc.

Fremont Insurance Company Insurance Rates Breakdown

A big question many customers have about auto insurance is whether or not auto insurance from a small company is okay or if the major auto insurance companies are better than smaller ones. While large companies have more name recognition, a small company is perfectly capable of offering a solid financial product, especially a company that has been around as long as Fremont Insurance.

The company does not sell direct to the consumer, so they employ more than 1,000 corporate to insurance agents at 250 locations within the state. Their agents number more than 1,200 and are scattered around Michigan in both small and large agencies.

Because Fremont Insurance quotes require the use of agents, the company doesn’t have an online quote system available.

This means we are unable to get a quote to compare their rates with other insurance companies.

We can, however, take a look at rates from some of the top auto insurance companies in Michigan to get an idea of average auto insurance rates in Michigan.

Average Annual Auto Insurance Rates for Top Michigan Insurers Compared to State Average Rates

| Companies | Average Annual Auto Insurance Rates | Compared to State Average Rates |

|---|---|---|

| USAA CIC | $3,618.06 | -$6,808.70 |

| Progressive Marathon | $5,354.18 | -$5,072.58 |

| Nationwide Mutual Fire | $6,287.43 | -$4,139.33 |

| Geico Ind | $6,382.54 | -$4,044.22 |

| Farmers Insurance Exchange | $8,275.23 | -$2,151.53 |

| Travelers Affinity | $8,707.10 | -$1,719.67 |

| State Farm Mutual Auto | $12,481.81 | $2,055.05 |

| Liberty Mutual Fire | $19,913.09 | $9,486.33 |

| Allstate F&C | $22,821.42 | $12,394.66 |

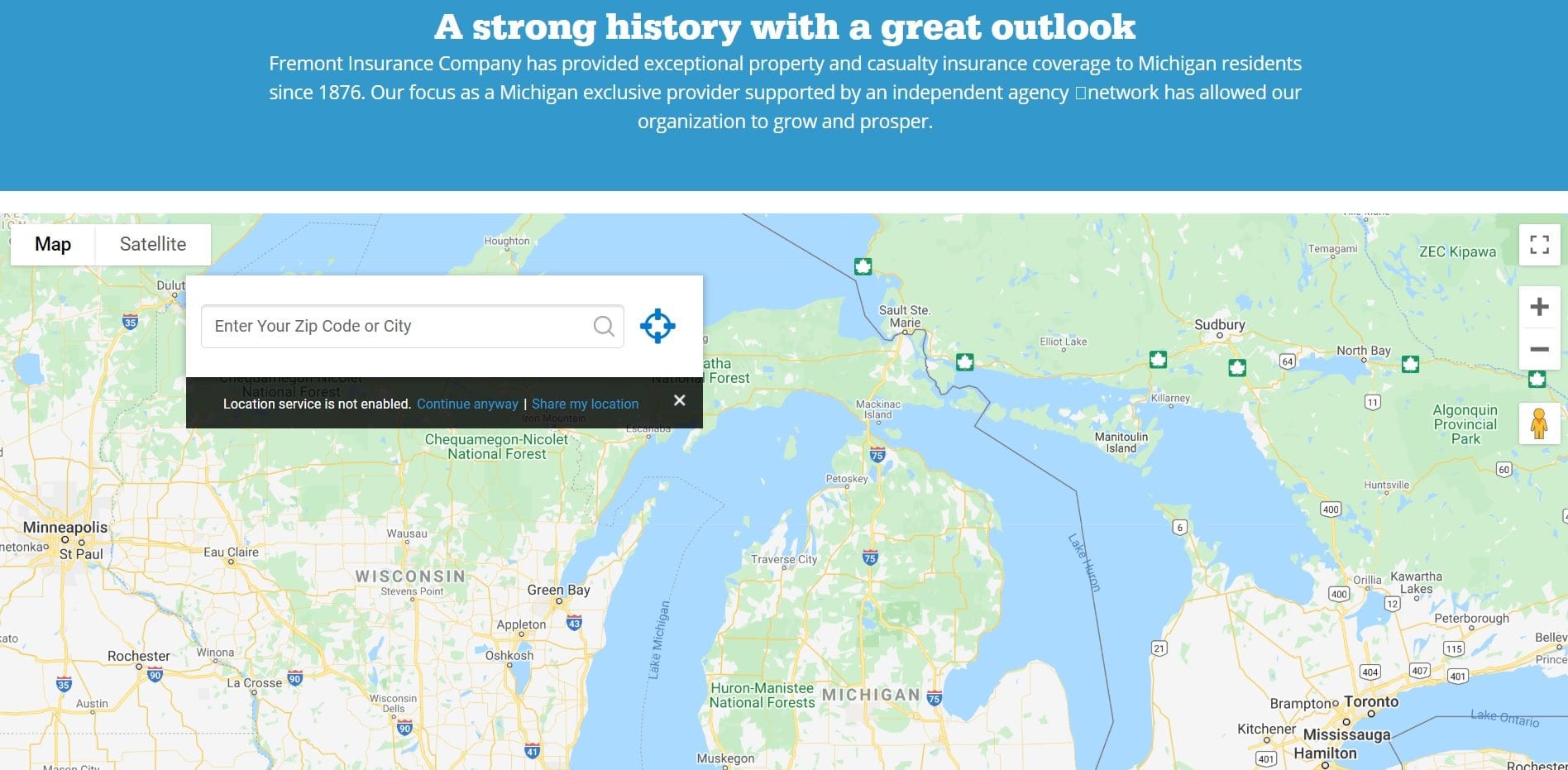

Finding an agent near you is as simple as visiting the company website and using their agent locator tool. The tool will return all of the agents located in your county, with name, address, phone number, and website where applicable.

The agent locator tool offers two different options for finding a local agent. The first is to simply find your county on an interactive map and click on it.

The other option is to use the site’s search engine which requests either your ZIP code or county. It returns results in the same way as the interactive map.

Keep in mind, however, that it is usually better to use an independent agent when choosing a policy. Independent agents are those who are not working for or affiliated with any particular insurance company.

Choosing an independent agent is a good way to make sure they are working in your best interest.

Don’t assume that just because someone says they are an independent agent that they are unaffiliated. Always ask to be certain that your agent is not receiving compensation from the insurance company for selling their policies.

What is Fremont Insurance availability by state?

What states does Fremont Insurance Company do business in? The company has limited its insurance and investments to the state of Michigan exclusively since the company’s founding in 1876.

The company only insures Michigan residents based on a philosophy that, as state residents themselves, they are uniquely qualified with personal knowledge of conditions and environments of Michigan, helping it retain more than 90 percent of its customers annually.

Fremont Insurance Company Discounts Available

Wondering which states have the cheapest auto insurance? Check out our piece on cheap auto insurance by state. Hint: Not Michigan, unfortunately. Based on information from III Michigan has some of the highest premiums in the nation, so it is important for drivers in the state to take advantage of every possible discount.

According to its website, Fremont offers the following discounts for auto insurance:

- Multi-Car

- Multi-Policy

- Insurance Score

- Claims Free

- Accident Free

- Violation Free

- Good Students

- Low Mileage

- Groups

New discounts become available all the time. For example, as NAIC reports, many insurance companies offer discounts for electric or other energy-friendly vehicles. Insurance companies add or remove discounts on a regular basis, so be sure to check with your agent to see if there are any other discounts available to you through Fremont Insurance.

What programs are available from Fremont Insurance?

Fremont Insurance doesn’t have any programs listed on their website, but if you call an agent for a quote you can ask about what programs they have available. The video below discusses one of the most popular trends in auto insurance.

Some examples of programs that are common among insurance companies are listed below:

- Usage-Based Apps

- Coupons or Discounts

- Accident Forgiveness

Check with your agent to see what programs may be available through Fremont Insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Fremont Auto Insurance Policy

Before you decide to cancel your Fremont auto insurance, it is important to make sure you have a new policy lined up first.

Canceling without having new coverage in place could leave you with a gap in coverage, which would mean your vehicle was unprotected during that time and possibly increase your rates in the future.

How do you cancel?

Fremont does not have anything on their website about canceling a car insurance policy online, so your best bet is to reach out to the agent who sold you the policy to have them process your cancellation.

Your agent can also answer questions about the potential for cancellation fees, refunds, and other issues that might be impacted by the insurance laws in the state of Michigan.

If you used your agent to purchase a new policy, they may have already put things in motion to cancel your Fremont policy without any additional work on your part.

How to Make a Fremont Auto Insurance Claim

For customers making glass claims, the claim must be filed with Fremont’s partner, Alliance Claims Solutions. Alliance handles the entire process including:

- Taking your claim

- Making sure your glass is replaced

- Satisfying payment with the vendor

Fremont includes the website and contact information for Alliance on its website. Customers who are unable to get satisfaction through Alliance are still welcome to contact Fremont.

Everything else begins with either a call to your local agent or a visit to the Fremont website. You can also use the Fremont Insurance claims phone number at 888-968-3664.

Outside of glass issues, the best way to file an auto insurance claim with Fremont is to call your local agent first, if possible, because they will be able to service your claim more quickly. They’ll also have knowledge of any local conditions or circumstances that might affect your claim.

Under no circumstances should customers admit liability or make promises of payment to anyone else involved in the accident.

Fremont Insurance roadside assistance helps with flat tires, lockouts, and towing needs. They provide a toll-free telephone number on their website that customers can call to access this service. It’s not clear whether roadside assistance is limited to specific policies, but your local agent can determine that for you.

Once you have filed your claim, you can use your Policyholder Login to keep up to date with the claim status. You can also use the login to pay your bill and take care of other policy maintenance issues.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to Get a Fremont Auto Insurance Quote Online

While many of the largest insurance companies in the country offer online quote systems, Fremont Insurance requires you to contact an independent agent to get a quote.

If you have questions about how to find an independent agent in your area, you can always search online or use Fremont’s agent search page. Simply enter your ZIP code or city for a list of local agents in your area.

However, keep in mind that it is always best to find an independent, unaffiliated agent. This is the only way you can be certain that there is no conflict of interest.

Fremont Insurance refers to their agents as “independent agents” on their website, but this is incorrect wording.

An independent agent is someone who is not affiliated with any particular agency. They don’t receive any compensation, financial or otherwise, from the insurance company for placing your policy with them.

For an agent to be described as “our agent” by an insurance company, they would not be considered independent. We recommend you verify that any agent you speak with is not employed by or affiliated with any specific insurance company before choosing a policy.

If you would like to get quotes from the best companies without the assistance of an agent, you can use our free quote tool below.

Frequently Asked Questions

What is Fremont Auto Insurance?

Fremont Auto Insurance is an insurance company that provides coverage for automobiles in the city of Fremont. They offer various types of auto insurance policies to protect drivers and their vehicles.

What types of auto insurance policies does Fremont Auto Insurance offer?

Fremont Auto Insurance offers a range of auto insurance policies, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). They also offer optional add-ons like roadside assistance and rental car reimbursement.

How can I contact Fremont Auto Insurance?

You can contact Fremont Auto Insurance by visiting their website and accessing their contact information. They typically provide phone numbers, email addresses, and sometimes even live chat options for customer support.

What factors affect the cost of auto insurance with Fremont Auto Insurance?

Several factors can influence the cost of auto insurance with Fremont Auto Insurance, including your driving record, age, type of vehicle, location, and coverage options you choose. Generally, drivers with a clean driving record, older drivers, and those with low-risk vehicles may receive lower premiums.

How can I get a quote from Fremont Auto Insurance?

To get a quote from Fremont Auto Insurance, you can visit their website or call their customer service. They will typically ask for information about your vehicle, driving history, and coverage preferences to provide you with an estimated premium.

Can I manage my Fremont Auto Insurance policy online?

Yes, Fremont Auto Insurance often provides an online portal or mobile app that allows policyholders to manage their policies online. Through these platforms, you can make payments, view policy details, update information, and file claims.

What should I do if I need to file a claim with Fremont Auto Insurance?

In the event of an accident or damage to your vehicle, you should contact Fremont Auto Insurance as soon as possible to initiate the claims process. They will guide you through the necessary steps, which may include providing relevant information, submitting documentation, and scheduling vehicle inspections.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.