Viking Auto Insurance Review for 2026 (See Rates & Discounts Here)

Explore our Viking auto insurance review, now operating under Dairyland, for coverage options and competitive rates starting at $185/mo. Viking offers high-risk insurance and coverage for motorcycles and off-road vehicles. Compare rates and policy options based on your driving record and location.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated January 2025

In this Viking Auto Insurance review, now under the Dairyland brand, the company offers rates starting at $185 per month for high-risk drivers, including SR-22 filings.

Viking, now under Dairyland, offers liability, collision, and comprehensive coverage, making it a solid choice for drivers with a troubled history. Our Dairyland auto insurance review shows how these policies protect against accidents, theft, and weather damage.

Viking Auto Insurance Rating

| Rating Criteria | Viking |

|---|---|

| Overall Score | 3.4 |

| Insurance Cost | 4.0 |

| Coverage Availability | 4.7 |

| Policy Options | 2.5 |

| Claim Processing | 2.9 |

| Discounts Available | 4.7 |

| Customer Satisfaction | 3.8 |

| Business Reviews | 3.0 |

| Company Reputation | 3.0 |

| Digital Experience | 3.0 |

| Plan Personalization | 3.0 |

| Coverage Value | 3.1 |

| Savings Potential | 4.2 |

Known for providing essential protection against accidents, theft, and weather damage, Viking’s policies are tailored to meet a variety of needs.

Compare auto insurance rates from top companies near you using our free quote tool. Just enter your ZIP code to get started.

- Viking auto insurance offers high-risk coverage, including SR-22 filings

- Comprehensive options like motorcycle and off-road vehicle insurance are available

- Customer service reviews are mixed, with complaints on claims handling

Viking Auto Insurance Review: Rates by Age, Gender, and Coverage Options

Founded in 1971 and now under the Dairyland brand, Viking Insurance, part of Sentry Insurance since 2005, offers high-risk auto insurance, SR-22 filings, and coverage for motorcycles and off-road vehicles. Operating in 38 states, it provides customized coverage for high-risk drivers, though premiums are typically higher due to this focus.

When considering Viking auto insurance, it’s important to understand how factors that affect auto insurance rates, like age, gender, and coverage level, influence your premiums. This breakdown shows what to expect for both minimum and full coverage across different age groups and genders.

Viking Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $410 | $470 |

| Age: 16 Male | $460 | $510 |

| Age: 18 Female | $390 | $460 |

| Age: 18 Male | $440 | $500 |

| Age: 25 Female | $250 | $290 |

| Age: 25 Male | $260 | $300 |

| Age: 30 Female | $230 | $270 |

| Age: 30 Male | $235 | $275 |

| Age: 45 Female | $210 | $260 |

| Age: 45 Male | $212 | $262 |

| Age: 60 Female | $190 | $240 |

| Age: 60 Male | $195 | $245 |

| Age: 65 Female | $185 | $230 |

| Age: 65 Male | $190 | $235 |

Viking auto insurance offers varying monthly rates depending on coverage level, age, and gender. For minimum coverage, premiums range from $185 for 65-year-old females to $460 for 16-year-old males. Full coverage premiums range from $230 for 65-year-old females to $510 for 16-year-old males.

When comparing auto insurance rates, it's important to consider additional coverage options beyond the basics of liability, collision, and comprehensive. Gap insurance, for instance, can help cover the difference between what your car is worth and the amount you still owe on a loan or lease. Roadside assistance is another valuable add-on that provides emergency services such as towing, tire changes, and lockout assistance. These extra coverages not only provide more protection but can also be cost-effective when bundled with other policies, potentially lowering your overall premiums.Michelle Robbins Licensed Insurance Agent

Premiums tend to decrease as drivers get older, and rates are lower for drivers in the 30-45 range. Gender also influences rates, with male drivers typically paying slightly higher premiums than females for similar coverage levels.

Keep in mind that Viking’s premiums tend to decrease as you age, with the best rates typically available to drivers in their 30s and 40s. Gender also factors into costs — on average, men pay higher premiums than women. Be sure to compare these rates with other providers to ensure you’re getting the best deal for your needs.

Viking Insurance Rates for Young Drivers vs. Top Competitors

Comparing Viking auto insurance head-to-head with other top competitors, the rate differences begin to come to life, especially among younger drivers. Age and gender are hard factors that drive premiums, and understanding how they vary can help you steer clear of options that may cost more or that aren’t suitable for you.

In comparing Viking Auto Insurance to its best competitors, it is evident rates deviate dramatically from age and gender. With Viking, a 16-year-old female with 2 years of experience would quote around $410, compared with $220 with a competitor like USAA. Viking also charges $460 for 16-year-old males; USAA charges $240, and generally higher.

Viking Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age 16 Female | Age 16 Male | Age 18 Female | Age 18 Male |

|---|---|---|---|---|

| $280 | $300 | $260 | $290 | |

| $260 | $280 | $250 | $270 | |

| $230 | $250 | $220 | $240 | |

| $290 | $310 | $270 | $300 |

| $240 | $260 | $230 | $250 |

| $260 | $280 | $250 | $270 | |

| $250 | $270 | $240 | $260 | |

| $270 | $290 | $260 | $280 | |

| $220 | $240 | $210 | $230 | |

| $300 | $320 | $280 | $310 |

Similarly, premiums for 18-year-olds vary, with Viking’s rates generally higher than those of Geico and USAA, which offer competitive options. Reasons auto insurance costs more for young drivers include limited experience, higher accident risk, and statistical data showing young drivers’ tendency for risky behaviors.

Viking offers much higher and lower rates for young drivers than the competition. To ensure that you’re getting the least expensive coverage, it is crucial that you shop around and look for quotes from various providers. That way, you can look for the right policy that fits in your budget and meets your coverage requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

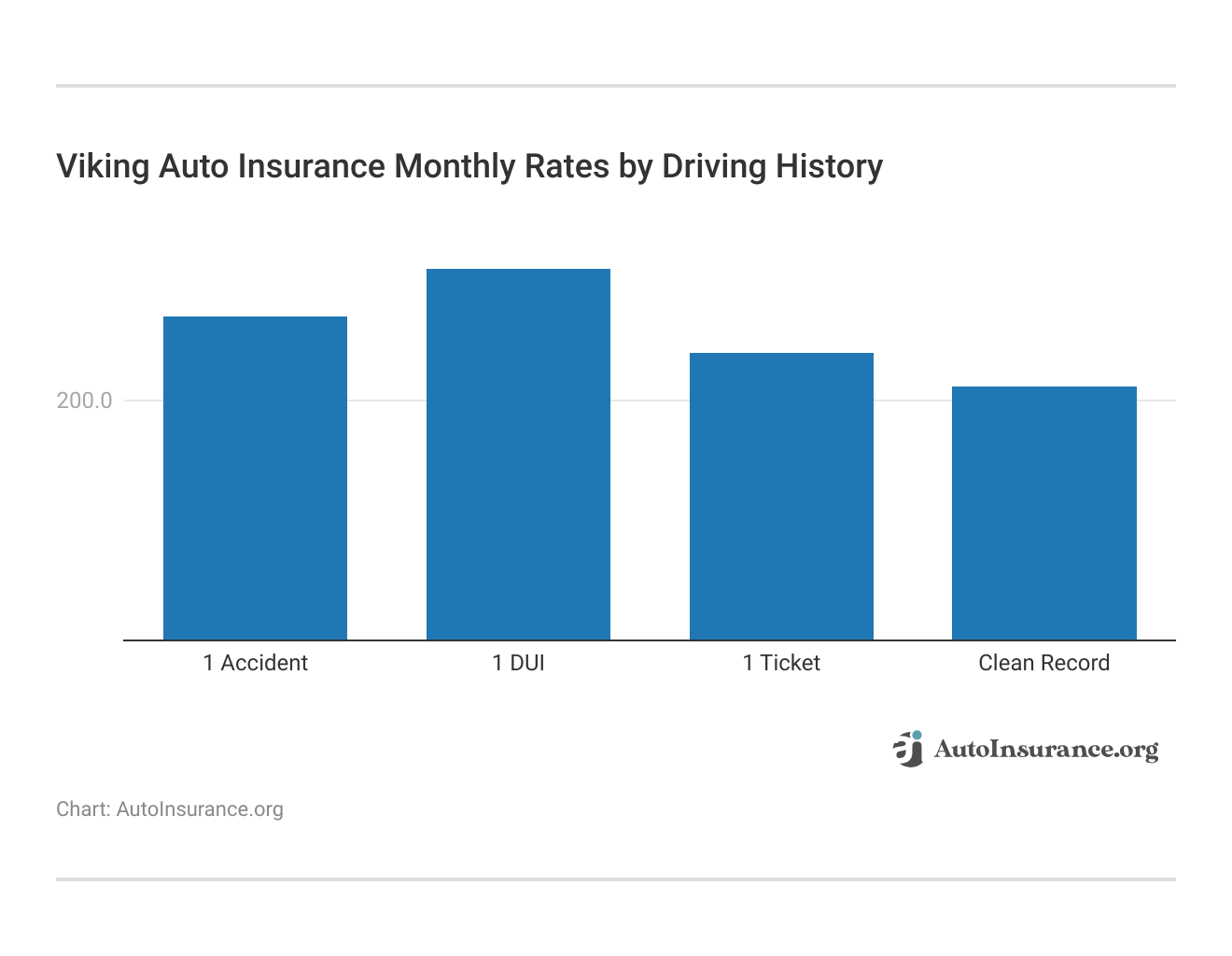

The Impact of Your Driving History on Auto Insurance Premiums

Your driving history is a significant factor in how much your monthly premiums will be when selecting Viking auto insurance. Drivers with accidents, DUIs, or tickets will typically see higher rates, while those with a clean record can benefit from more affordable premiums.

Viking auto insurance offers varying monthly rates based on your driving history. Premiums are higher for drivers with accidents, DUIs, or tickets, while those with a clean record benefit from lower rates. However, if you’re looking for cheap auto insurance after an accident, Viking may provide competitive options, though your premiums could still be affected by your past driving history.

For example, drivers with one accident may pay $270, while those with a DUI may face rates around $310. Expect lower premiums if your record is spotless — up to $200 lower. These rates highlight how your driving history can significantly impact your monthly insurance costs.

As shown in the rate breakdown, your driving history can have a significant impact on your insurance costs. To make sure you pay the least amount for coverage, always keep a clean driving record and shop around to get the best rates.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Essential Coverage Options From Viking Auto Insurance: Protecting You on the Road

Viking also has several different coverage options meant to protect you out on the road — whether you’re to blame in an accident or find yourself up against an unexpected event. Viking insurance for cheap full coverage auto insurance if you’re looking to get auto coverage that offers you comprehensive protection at a very low cost that won’t empty your pockets.

From basic liability coverage to unique protection for high-risk drivers, Viking offers adaptable plans to suit your needs. Here’s a look at the different types of coverage you can get.

- Liability Coverage: Protection if you cause an accident. That way you won’t have to face a financial burden for any damages you might cause with your actions on the road.

- Collision Coverage: Reimburses you for the cost to replace or repair your car if it’s damaged in a collision, no matter who’s at fault. Such coverage is important for the driver who wish to secure their own vehicle in the case of an accident.

- Comprehensive Coverage: Offers protections for damages to your car that are not related to a collision, including theft, vandalism, natural disasters, or colliding with an animal. This is important for full protection outside of accidents.

- Uninsured/Underinsured Motorist Coverage: Covers you if you’re involved in an accident with a motorist who does not have enough insurance (or any insurance). It helps cover your medical bills and vehicle repairs when the other driver is at fault but lacks sufficient coverage.

- SR-22 Coverage: For high-risk drivers who need to file an SR-22 form, often required after a DUI or serious traffic violation. Viking files SR-22s for drivers as a means of getting back on the road legally and maintaining insurance while they are in this status.

Choosing the right coverage is essential for full protection on the road. Viking Auto Insurance offers a range of plans, including liability, collision, comprehensive, and SR-22 coverage, designed to fit different needs.

Liability covers damages or injuries you cause, collision covers damages to your car in a crash, and comprehensive pays for things like theft or natural disasters. SR-22 coverage exists for high-risk drivers. Comparing these options will allow you to find the best fit depending on your driving needs and your budget.

Specialized Coverage Options for Your Vehicle

Viking auto insurance is more than just the basics for protecting your vehicle. Apart from standard coverage, they also offer specialized options that guarantee to protect your customizations and your convenience as well. Here’s more about some of the main extra coverage options that are available.

- Special Parts Coverage: Covers aftermarket parts and upgrades you’ve added to your vehicle, ensuring that your custom modifications are protected.

- Towing and Labor: Covers the cost of a tow truck to take your car to a repair shop after a covered event, helping you get back on the road faster.

- Gap Insurance: The difference owed on an auto loan or lease if your car is declared a total loss in an accident, so you aren’t stuck paying back the remainder of your loan or lease.

- Rental Reimbursement: Rental car coverage enables you to have a rental car while your car gets repaired after an insurable event.

Additional coverage options, like special parts coverage, towing and labor, gap insurance, and rental reimbursement, offer peace of mind by covering unique needs.Liability covers damages or injuries you cause, collision covers damages to your car in a crash, and comprehensive pays for things like theft or natural disasters.

These options provide extra protection for your vehicle, your finances, and your transportation needs, ensuring you’re fully prepared for unexpected events on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Viking Auto Insurance Review: Customer Satisfaction and Financial Strength Insights

Viking Auto Insurance has varying ratings from trusted agencies, some praising their service and others providing insight on where they can do better. J.D. Power says the company has a score of 780 on a scale of 1,000, which means customer satisfaction is below average. This suggests there is room for improvement in their customer service and overall experience.

Viking Auto Insurance holds strong ratings across several consumer review platforms. J.D. Power gives it a score of 820 out of 1,000, indicating above-average satisfaction. Consumer Reports rates Viking at 73/100, reflecting mixed customer feedback, while the company maintains a low number of complaints (1.10/5).

Viking Insurance Business Ratings and Consumer Reviews

| Agency | Ratings |

|---|---|

| Score: 820 / 1,000 Avg. Satisfaction |

|

| Score: A- Good Business Practices |

|

| Score: 73/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

Additionally, A.M. Best gives Viking an A+ rating, signifying superior financial strength, which reassures policyholders about the company’s ability to settle claims and remain financially stable.

Recent experience with Dairyland auto insurance?

byu/Tumbler1081 inInsurance

This Reddit review shares a user’s experience with Dairyland auto insurance, which acquired Viking Insurance. The commenter highlights their 15-year relationship with Dairyland in California, mentioning a smooth $3,000 payout after an accident over 10 years ago.

Comment

byu/Tumbler1081 from discussion

inInsurance

They also note that, as a good middle-aged driver, they now pay $20 per month for basic coverage, with premiums decreasing over time. The review emphasizes the satisfaction with Dairyland’s service, despite mixed reviews from other sources.

For drivers seeking affordable rates and comprehensive coverage options, especially those with a clean driving record, comparing quotes from multiple providers like Geico or USAA can help ensure you get the best deal.Tonya Sisler Insurance Content Team Lead

Viking auto insurance offers fair financial strength and coverage, but its below-average customer satisfaction and higher complaints may concern some. Prospective policyholders should consider the top 7 factors that affect auto insurance rates to ensure a good fit.

Exploring Viking Auto Insurance: Coverage, Rates, and Customer Perspectives

Viking Auto Insurance provides competitive rates for high-risk drivers, starting at as low as $185 a month, and also offers SR-22 filings and motorcycle and off-road vehicle insurance. While the company operates in 38 states and is backed by the financial strength of Sentry Insurance, its customer satisfaction scores are lower than average.

Premiums vary based on age, gender, and driving history, with younger drivers facing higher rates. Viking offers liability, collision, and comprehensive coverage, but high-risk drivers should compare rates with the best auto insurance companies for high-risk drivers for the best deal.

Enter your ZIP code in our free tool below to find the cheapest auto insurance coverage, no matter how much you need.

Frequently Asked Questions

Is Viking travel insurance worth it for frequent travelers?

When frequent travelers are concerned with their investment, Viking travel insurance is worth to have. Its coverage includes trip cancellations, medical emergencies, and lost luggage, as peace of mind while traveling. But you should check against other providers to make sure it aligns with your particular travel requirements.

What do Viking insurance reviews say about the company?

Reviews of Viking insurance complaints are mixed, and many customers highlight its affordability for high-risk drivers as well as its specialized coverage options. However, its customer satisfaction ratings are below average, especially for its customer service. These reviews will help you determine if Viking will be the insurance provider for you.

For affordable auto insurance quotes from Dairyland in your area, enter your ZIP code in our free comparison tool now.

What is Viking Insurance Company of Wisconsin and what does it offer?

Viking Insurance Company of Wisconsin, now under the Dairyland name, specializes in high-risk auto insurance. It offers liability, collision, and comprehensive coverage, along with SR-22 auto insurance filings and coverage for motorcycles and off-road vehicles. SR-22 is for drivers needing proof of financial responsibility after certain violations.

What is Viking car insurance and what coverage options does it offer?

Viking car insurance, which now does business as Dairyland in many states, provides several coverage options like liability, collision, comprehensive, and SR-22 insurance. The company is mainly recognized for providing high-risk auto insurance and drivers who require higher coverages.

Is Viking insurance good for high-risk drivers?

Yes, should high-risk drivers consider Viking insurance? They offer customized coverage for those who might struggle to secure an auto insurance policy because of poor driving history with accidents or violations. Though premiums may be higher, Viking specializes in providing these drivers with dependable coverage.

What is Viking’s cancellation policy for auto insurance?

Viking’s cancellation policy lets policyholders cancel their coverage at any time. You may receive a refund for unused auto insurance premiums in some cases, after deducting any cancellation fees. But before seeking a cancellation, you should also review the policy terms for specifics.

What are Viking insurance associates and what role do they play?

Viking insurance representatives are agents that provide customers with the right coverage as per their choice. These associates can help customers compare policies, explain coverage options, and walk them through the claims process. These tend to be within the wider Dairyland network.

How can I contact Viking insurance customer service for assistance?

To reach Viking insurance customer service, you can call their parent company, Dairyland, at 1-888-344-4357. Their customer service team can help with policy questions, billing issues, and claims inquiries.

What is Viking auto salvage and how does it affect my insurance policy?

Viking auto salvage refers to vehicles deemed a total loss by the insurer and sent to salvage yards. Understanding Viking’s salvage policy can affect your settlement and coverage after an accident. To get the best deal, compare auto insurance rates by vehicle make and model, as this impacts premiums and potential payouts.

What is the Viking insurance phone number for claims or customer support?

The Viking insurance phone number for claims and customer support is 1-800-334-0090 for claims. For other inquiries, customers can contact Dairyland’s general service number at 1-888-344-4357.

What is the Viking insurance claims address for filing claims?

Does Viking offer motorcycle insurance coverage?

How do I file a claim with Viking Insurance?

What should I know about Viking insurance auto claims?

What services does Viking Insurance provide?

Where can I find information about Viking insurance claims?

What are Viking Travel Insurance reviews saying about their coverage?

What types of coverage does Vikings Insurance Company offer?

What is the relationship between Viking Insurance and Dairyland?

Who owns Viking Insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.