DWI vs. DUI Differences Explained for 2026 (Understand the Terms)

Understanding DWI vs. DUI differences is crucial for navigating the legal implications and insurance costs. DWI refers to driving while intoxicated while DUI refers to driving under the influence, but the penalties vary by severity and state. DWI and DUI can increase auto insurance rates by up to 71%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

DWI vs. DUI are both charges that can significantly impact your auto insurance rates, but they differ based on legal definitions and auto insurance laws.

Understanding the DWI meaning vs DUI distinctions is essential for anyone facing these charges or aiming to manage insurance costs effectively.

Explore the differences between DWI (Driving While Intoxicated) and DUI (Driving Under the Influence), how each can affect your driving record and insurance premiums, and offers guidance on finding competitive insurance rates tailored to your circumstances.

Enter your ZIP code above in our free comparison tool to see how “DWI vs. DUI” can impact your car insurance rates.

- DWI vs. DUI definitions vary by state, impacting rates and legal outcomes

- Both charges can significantly alter insurance premiums and driving records

- Learn effective strategies to find the best insurance rates post-charge

DWI vs. DUI Explained

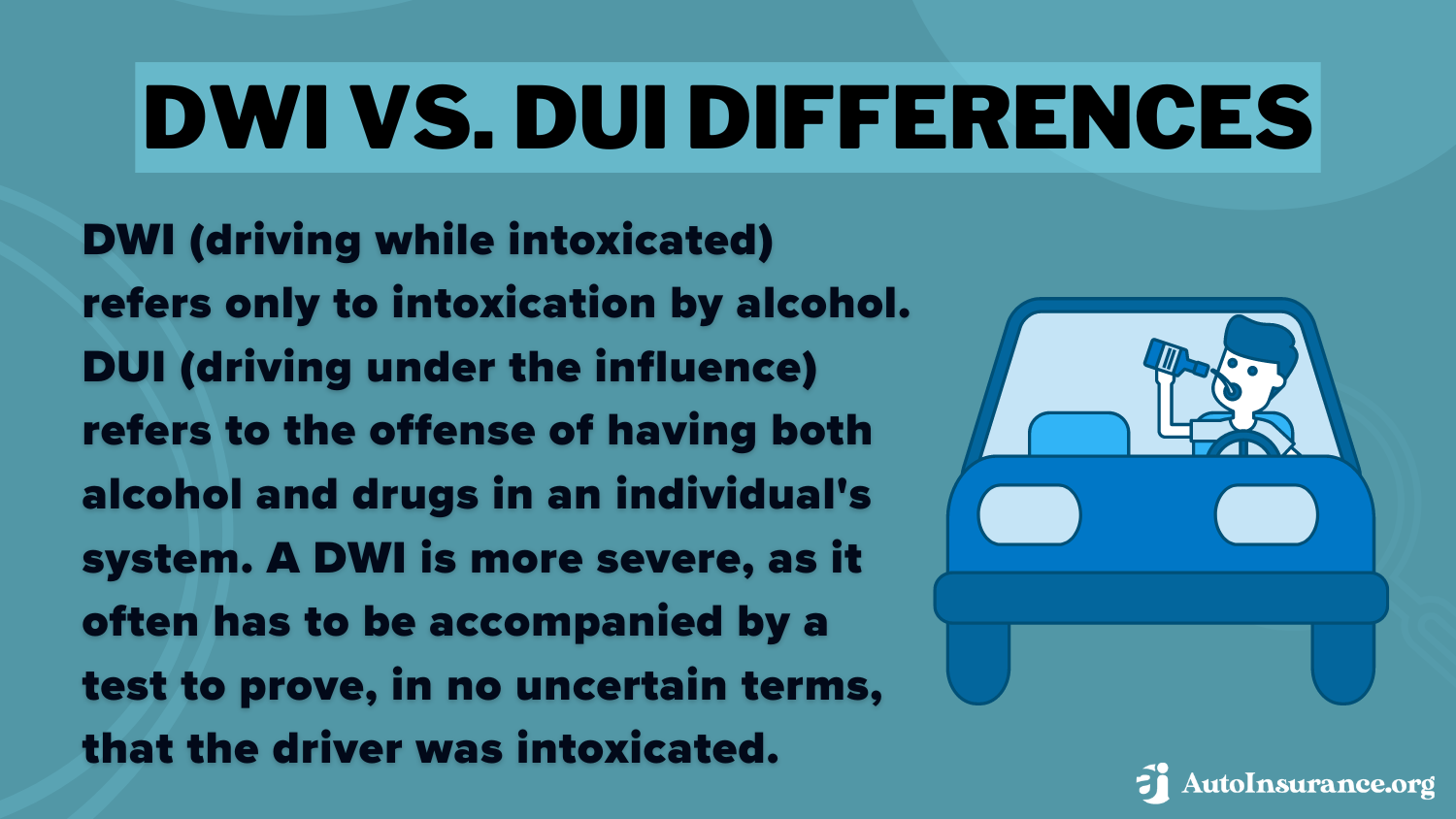

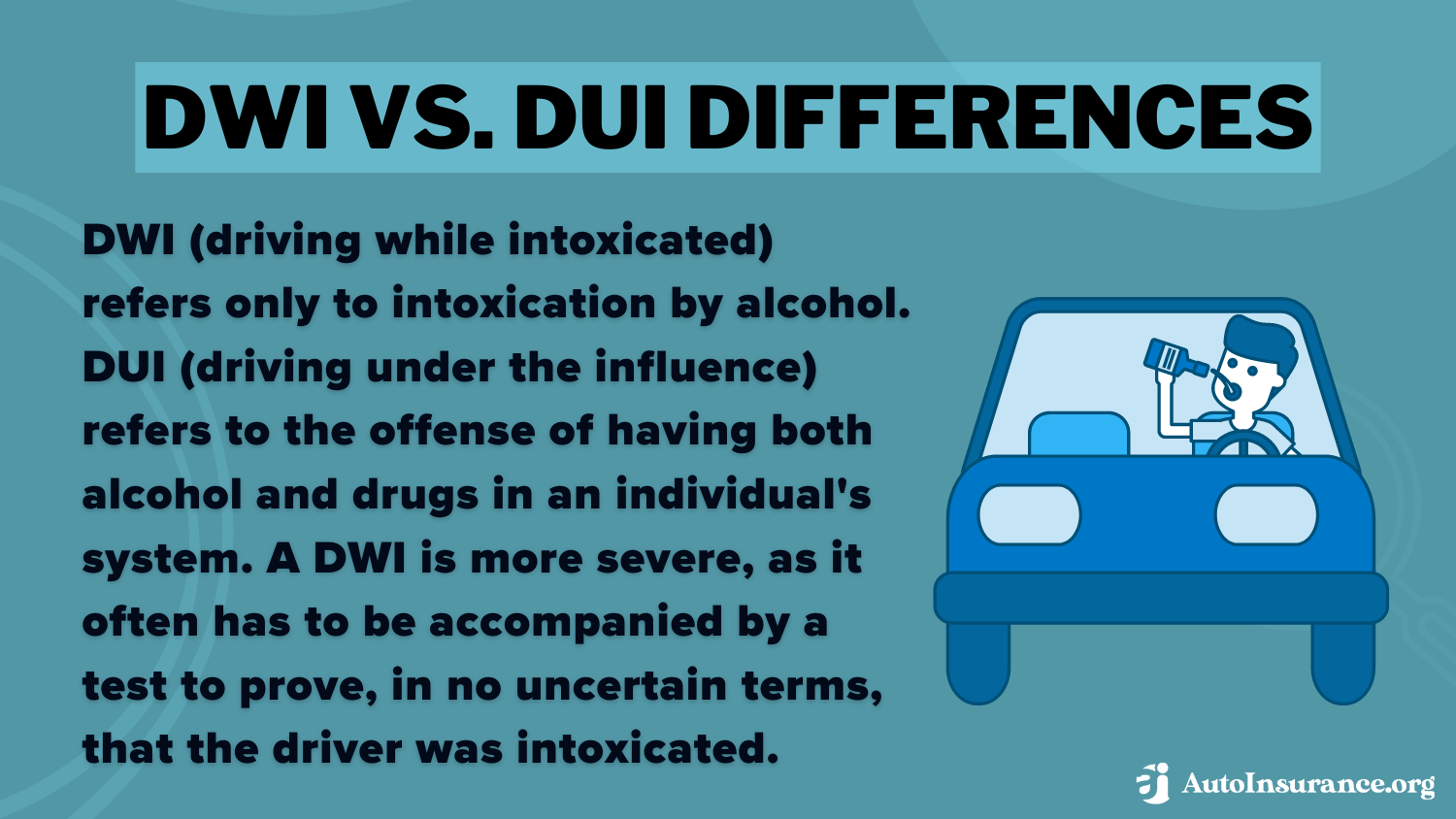

A DWI and DUI are both illegal acts of driving a vehicle while impaired by alcohol and/or drugs. There are federal mandates for DUI’s or DWI’s. Federally, if you’re stopped for a DUI or DWI you must submit to a test of your blood alcohol level. The federal limit is 0.08%. State limits can be higher or lower.

The way a DWI and DUI are handled can vary by state, with many states applying a zero-tolerance policy. This generally means that the difference between DWI and DUI often leads to both being treated with equal severity. When asking is DUI or DWI worse, it’s important to note that in these states, the offenses are typically addressed with the same level of seriousness.

In some states, the DUI definition and implications extend to encompass both drugs and alcohol. The phrase “under the influence” may denote impairment from alcohol, drugs, or a combination of the two. Additionally, in certain states, DWIs can be considered a more serious offense, reflecting a higher blood alcohol level. When considering whether is a DWI or DUI worse, DWIs are often associated with more severe penalties.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

DUI Explained: Beyond the Influence

DUI defined is “driving under the influence.” If you get a DUI, It can be for driving under the influence of alcohol or other drugs. To clarify, what does DUI mean? It refers to driving while impaired by either legally prescribed, over-the-counter, or illegal drugs.

A DUI indicates that a driver has accessed or controlled a vehicle with plans to drive under the influence of substantial amounts of alcohol or drugs, which can greatly affect auto insurance for different driver types.

DWI Intoxication Defined

What is the DWI meaning? It stands for “driving while intoxicated” or “driving while impaired.” A police officer can charge you with a DWI if they determine that drugs are impairing your abilities or if you were driving while drowsy. To understand what DWI stands for, it’s crucial to recognize that it involves charges related to significant impairment.

Unlike a DUI, a DWI offense indicates that a driver’s blood-alcohol level was tested and found to be extremely high. To understand what DWI stands for, it’s important to note that both DUI and DWI involve illegal driving under the influence. Specifically, what does a DWI mean? It indicates particularly high levels of alcohol or drugs in the driver’s system.

DUI vs. DWI: Severity Scale

In states where DUI and DWI are distinguished, a DUI is often regarded as a lesser offense or misdemeanor compared to a DWI. When considering whether a DUI is worse than a DWI, it’s important to note that DUIs can sometimes be issued without a blood alcohol test. This highlights the importance of maintaining a clean driving record, particularly in how auto insurance companies check driving records.

In certain situations, DWIs might be downgraded to DUI charges through a plea deal. Understanding what is the DWI meaning can provide clarity on how these charges are handled and their potential impact. Regardless of whether it’s a DUI or DWI, both negatively impact your record. Understanding the DUI vs DWI meaning is important, as a DUI alone can lead to an average car insurance increase of 71%.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Clarifying Impaired Driving Charges

Driving impaired can result in various charges beyond DUI or DWI, depending on the state. These include DWAI (Driving While Ability Impaired), OUI (Operating Under the Influence), OVUII (Operating a Vehicle Under the Influence of an Intoxicant), and OWI (Operating While Intoxicated). Each charge carries different legal consequences, making it vital to understand the specific laws in your state.

Knowing the range of impaired driving charges helps you navigate the legal landscape and avoid severe penalties. Always stay informed about your state’s laws to protect your driving record and avoid costly repercussions.

Read more: Does a physical control violation affect auto insurance rates?

Consequences of DUI/DWI Charges

Being charged with a DUI or DWI can have serious consequences, including increased insurance premiums, hefty fines, mandatory community service, and even the suspension or loss of your driver’s license. These penalties can also lead to losing your car insurance coverage, making it essential to understand the full impact of these charges.

- Increased car insurance costs

- Hefty monetary fines

- Mandatory community service

- Suspension or loss of driver’s license

- Potential loss of car insurance coverage

Assessment by breathalyzers, or electronic devices that measure the breath alcohol content (BrAC) from a person, can also be a consequence of DUI’s or DWI’s. The device ensures that a driver has a 0.0% blood alcohol level and is fit to start a vehicle.

In the event a driver loses their car insurance coverage to one or more DUI or DWI charges, one may have to utilize SR-22 auto insurance. An SR-22 is special documentation used by the DMV and/or car insurance companies to prove a person has met the minimum liability coverage of the state.

When you compare a DUI vs. DWI, you’ll find that any differences between them typically depend on the state you live in and how they dictate DUI and DWI charges and offenses.

Read more: Does a suspended license affect auto insurance rates?

State Variations in DUI Laws

Specifically, how do different states refer to a DUI and its variations, and what are the penalties? The intricacies of state laws are too numerous to detail fully.

We will explore key aspects, such as blood alcohol concentration limits, penalties, and point expiration periods, within the context of the types of auto insurance available. To understand these regulations better, consider what does DUI stand for and how it influences these legal aspects.

Blood Alcohol Concentration Limits

What is the BAC limit in your state? The National Highway Traffic Safety Administration points out that a BAC of 0.08 — also called the “per se” limit — is illegal in all states, the District of Columbia, and Puerto Rico. Utah has the strictest standard of 0.05. Besides the per se limit, states and municipalities also have zero-tolerance and enhanced-penalty BAC levels.

State Blood Alcohol Concentration Limits

| State | Drunk Driving Offense | Zero Tolerance BAC Level | Enhanced Penalty BAC Level |

|---|---|---|---|

| Alabama | DUI | 0.02 | 0.15 |

| Alaska | DUI | 0.00 | 0.15 |

| Arizona | DUI | 0.00 | 0.15 |

| Arkansas | DWI | 0.02 | 0.15 |

| California | DUI | 0.01 | 0.15 |

| Colorado | DUID | 0.02 | 0.15 |

| Connecticut | OWI | 0.02 | 0.16 |

| Delaware | DUI | 0.02 | 0.16 |

| District of Columbia | DUI | 0.00 | 0.2 and 0.25 |

| Florida | DUI | 0.02 | 0.2 |

| Georgia | DUI | 0.02 | 0.15 |

| Hawaii | DUI | 0.02 | 0.15 |

| Idaho | DUI | 0.02 | 0.2 |

| Illinois | DUI | 0.00 | 0.16 |

| Indiana | DUI | 0.02 | 0.15 |

| Iowa | OWI | 0.02 | 0.15 |

| Kansas | DUI | 0.02 | 0.15 |

| Kentucky | DUI | 0.02 | 0.18 |

| Louisiana | DWI | 0.02 | 0.15 and 0.2 |

| Maine | OUI | 0.00 | 0.15 |

| Maryland | DUI | 0.00 | 0.15 |

| Massachusetts | OUI | 0.02 | 0.2 (for drivers aged 17-21) |

| Michigan | DWI | 0.00 | 0.17 |

| Minnesota | DWID | 0.00 | 0.16 |

| Mississippi | DUI | 0.02 | N/A |

| Missouri | DWI | 0.02 | 0.15 |

| Montana | DUI | 0.02 | 0.16 |

| Nebraska | DUI | 0.02 | 0.15 |

| Nevada | DUI | 0.02 | 0.18 |

| New Hampshire | DUI | 0.02 | 0.16 |

| New Jersey | DWI | 0.01 | 0.10 |

| New Mexico | DUID | 0.02 | 0.16 |

| New York | DWI | 0.02 | 0.18 |

| North Carolina | DWI | 0.00 | 0.15 |

| North Dakota | DUI | 0.02 | 0.18 |

| Ohio | DUI | 0.02 | 0.17 |

| Oklahoma | DUI | 0.00 | 0.15 |

| Oregon | DUI | 0.00 | 0.15 |

| Pennsylvania | DUI | 0.00 | 0.1 |

| Rhode Island | DUI | 0.02 | 0.1 and 0.15 |

| South Carolina | DUI | 0.02 | 0.17 |

| South Dakota | DUI | 0.02 | 0.17 |

| Tennessee | DUI | 0.02 | 0.2 |

| Texas | DWI | 0.00 | 0.15 |

| Utah | DUI | 0.00 | 0.16 |

| Vermont | OWI | 0.02 | 0.16 |

| Virginia | DUI | 0.02 | 0.15 and 0.2 |

| Washington | DUI | 0.02 | 0.15 |

| West Virginia | DUI | 0.02 | 0.15 |

| Wisconsin | DUI | 0.00 | 0.17, 0.2, and 0.25 |

| Wyoming | DUI | 0.02 | 0.15 |

In many states, the enhanced penalty BAC threshold is twice or almost twice the per se limit. Pennsylvania’s enhanced limit is more stringent than that of any other state. For a detailed example of a state, read our article on Connecticut penalties for a DUI conviction and its implications for SR-22 auto insurance.

DUI/DWI Penalties

Previously, we analyzed drunk driving rates by state and predicted drops in DUI incidents due to coronavirus, providing an overview of DUI penalties across various states. In most states, being caught driving under the influence will result in jail time and a likely fine for a first offense.

For example, first, second, and third DUI offenses in Montana are misdemeanors. A fourth offense is a felony. Oregon has a minimum jail time of 2 days and a maximum fine of $6,250 for first-time DUI offenses.

Managing Points on Your Driving Record

Understanding how long points remain on your driving record is crucial for managing your driving privileges and insurance rates. Different states have varying rules on point expiration, ranging from 12 months to as long as 10 years for major violations.

By staying aware of these timelines, you can better schedule defensive driving courses or avoid accidents and traffic violations that could negatively impact your driving record and insurance premiums. Understanding what does DUI stand for in driving can help you navigate these issues more effectively.

Points Expiration

| State | How long does it take for points to expire? |

|---|---|

| Alabama | 2 years |

| Alaska | 2 points after 12 months |

| Arizona | 12 months |

| Arkansas | 36 months |

| California | 36 months for minor violations, 10 years for major |

| Colorado | Points do not expire |

| Connecticut | 24 months |

| Delaware | Points lose half their value after 12 months |

| D.C. | 2 years |

| Florida | 5 years |

| Georgia | 2 years |

| Hawaii | N/A |

| Idaho | 3 years |

| Illinois | 4-5 years for minor violations, at least 7 for major |

| Indiana | 2 years |

| Iowa | 5 years, 12 years for DUIs |

| Kansas | N/A |

| Kentucky | 2 years |

| Louisiana | N/A |

| Maine | 1 year |

| Maryland | 2 years |

| Massachusetts | 6 years |

| Michigan | 2 years |

| Minnesota | N/A |

| Mississippi | N/A |

| Missouri | 3 years |

| Montana | 3 years |

| Nebraska | 5 years |

| Nevada | 12 months |

| New Hampshire | 3 years |

| New Jersey | 3 points per year without violations |

| New Mexico | 1 year |

| New York | 18 months |

| North Carolina | 3 years |

| North Dakota | 1 point will be reduced every 3 months after a suspension. 3 points can be removed with a defensive driving course |

| Ohio | 2 years |

| Oklahoma | 2 points per 12 months |

| Oregon | N/A |

| Pennsylvania | 3 points per 12 months |

| Rhode Island | N/A |

| South Carolina | Points reduce by half after 1 year, fully by 2 years |

| South Dakota | Depends on the violation |

| Tennessee | 2 years |

| Texas | 3 years |

| Utah | 3 years |

| Vermont | 2 years |

| Virginia | 2 years |

| Washington | N/A |

| West Virginia | 2 years |

| Wisconsin | Points remain for as long as you have a ticked on your record (about 5 years) |

| Wyoming | N/A |

Maintaining a clean driving record is crucial to prevent increased insurance rates and penalties. Understanding point expiration timelines in your state can assist you in managing your record more effectively. Additionally, knowing what does DWI stand for can help you better navigate and avoid complications that might affect your insurance premiums.

Read more: Do points affect auto insurance rates?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How DUIs and DWIs Impact Your Auto Insurance Rates

If you are wondering, “Will a criminal record affect my auto insurance?” the answer is yes. Whether you have a DUI or a DWI on your record, you risk losing your existing auto insurance policy. Regardless of whether you retain your current policy or need a new one, your rates will go up. When considering which is worse, DWI or DUI, both can lead to significant increases in insurance premiums.

Read more: How to Find Auto Insurance Quotes Fast Without Commitment

When it comes to DWI vs. DUI, the convictions are generally viewed similarly by auto insurance companies, in that they both indicate a higher risk of accidents and claims. So, whether DWI or DUI, expect to see a significant increase in your insurance premiums, as well as possibly a requirement to purchase an SR-22.Schimri Yoyo Licensed Insurance Agent & Financial Advisor

Here is a breakdown of the different types of moving violations and how they can increase your auto insurance rates:

Auto Insurance Average Rate Increase by Driving Violation

| Driving Violation | Monthly Rates | Average Rate Increase Percentages |

|---|---|---|

| Clean Record | $155 | N/A |

| DUI/DWI First Offense (3-5 Years) | $168 | 8% |

| Cell Phone/Texting | $176 | 13% |

| Speeding (Less Than 20 Mph Over) | $176 | 13% |

| Speeding (More Than 20 Over) | $176 | 13% |

| At-Fault Accident | $197 | 27% |

| Reckless Driving | $197 | 27% |

| Hit And Run | $197 | 27% |

| DUI/DWI (12-24 Months) | $197 | 27% |

| DUI/DWI Second Offense (3-5 Years) | N/A | N/A |

Interestingly, a first-time DUI or DWI offense might result in only a minor increase in your rates, but felony or additional offenses lead to much higher increases. Additionally, finding cheap auto insurance after a DUI can be challenging as many major auto insurance companies may hesitate to cover drivers who have committed two or more DUI/DWI offenses.

In any event, you should avoid driving under the influence of alcohol or any substance. Avoid driving impaired for any reason, and get some rest if you feel tired. Get the top 5 tips for avoiding highway hypnosis.

We hope that this discussion of DUI vs. DWI was informative and answered the questions including “What does DWI mean?” and “Is DWI or DUI worse?”

DWI vs. DUI: Insurance and Legal Impacts

Facing a DWI or DUI can result in serious consequences, including substantial fines, higher insurance premiums, and potential loss of coverage. Since each state addresses these charges differently, it’s essential to be aware of your local laws. To effectively manage the financial and legal impacts, it’s important to understand these differences and know where to compare auto insurance rates to secure the most affordable coverage.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Frequently Asked Questions

What does DUI stand for and how is it different from DWI?

DUI stands for “Driving Under the Influence.” While definitions may vary by jurisdiction, what does DUIs mean typically refers to the offense of operating a motor vehicle while impaired by alcohol or drugs, regardless of the specific level of impairment.

In some areas, the terms “DWI vs. DUI” are used interchangeably, while other jurisdictions differentiate between DUI and DWI based on the level of impairment or the substances involved.

What’s worse a DWI or DUI?

The terms DWI and DUI are used interchangeably in different jurisdictions, but their specific definitions and penalties can vary. In discussing “DWI vs. DUI,” some states make a distinction between the two terms, with DWI often indicating a higher level of intoxication or impairment compared to DUI. However, the specific differences can vary from state to state.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What does DWI stand for and what does it mean?

DWI stands for “Driving While Intoxicated.” This term refers to a criminal offense where an individual operates a vehicle while impaired by alcohol or drugs, which affects their ability to drive safely. Understanding what does DWI stand for can help clarify the severity of this offense.

Explore our comprehensive resource on insurance coverage titled “Best Auto Insurance Companies for Impaired Drivers” to enhance your knowledge.

What are the penalties for DWI/DUI convictions?

The penalties for convictions under “DWI vs. DUI” depend on various factors, including the jurisdiction and the offender’s prior record. Typical consequences may include fines, license suspension or revocation, mandatory alcohol education programs, probation, community service, and even jail time. Penalties usually increase for repeat offenses.

Is it possible to be charged with both DWI and DUI simultaneously?

In some jurisdictions, it is possible to be charged with both DWI and DUI simultaneously under “DWI vs. DUI” regulations. This can occur when a person is found to be operating a vehicle under the influence of both alcohol and drugs, or when a state differentiates between the two charges based on specific circumstances.

What is DWI vs. DUI in Nevada?

In Nevada, the legal term used is DUI, distinguishing it from DWI, which may be used in other states. Find the best auto insurance after a DUI in Nevada.

Is it possible to obtain insurance coverage after a DWI or DUI conviction?

Yes, it is possible to obtain insurance coverage after a “DWI vs. DUI” conviction, but it may be more challenging and expensive. Some insurance companies specialize in providing coverage to high-risk drivers, including those with a history of DWI or DUI convictions. These companies typically offer policies with higher premiums. It is advisable to shop around and compare quotes from multiple insurers to find the most affordable option.

What are the financial costs associated with a DWI or DUI conviction beyond increased insurance premiums?

The financial costs of a DWI vs. DUI conviction extend beyond higher auto insurance premiums. They can include legal fees, fines, court costs, and the price of alcohol education programs. Additionally, the requirement to install an ignition interlock device and its maintenance fees can also add to the financial burden.

How do DWI and DUI convictions affect future employment opportunities?

A DWI vs. DUI conviction (Driving While Intoxicated or Driving Under the Influence) can impact employment opportunities, especially in industries requiring driving or operating heavy machinery. Employers often conduct background checks that reveal such convictions, potentially leading to adverse hiring decisions.

Can DWI or DUI charges be expunged from my driving record?

In some states, it’s possible to have a DWI vs. DUI expunged from your driving record, depending on the severity of the offense and state laws. Expungement typically involves meeting specific criteria, such as a period of clean driving or completing a court-ordered program. Consulting with a legal expert can provide guidance specific to your state’s laws.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.