Michigan Minimum Auto Insurance Requirements in 2026 (Coverage You Need in MI)

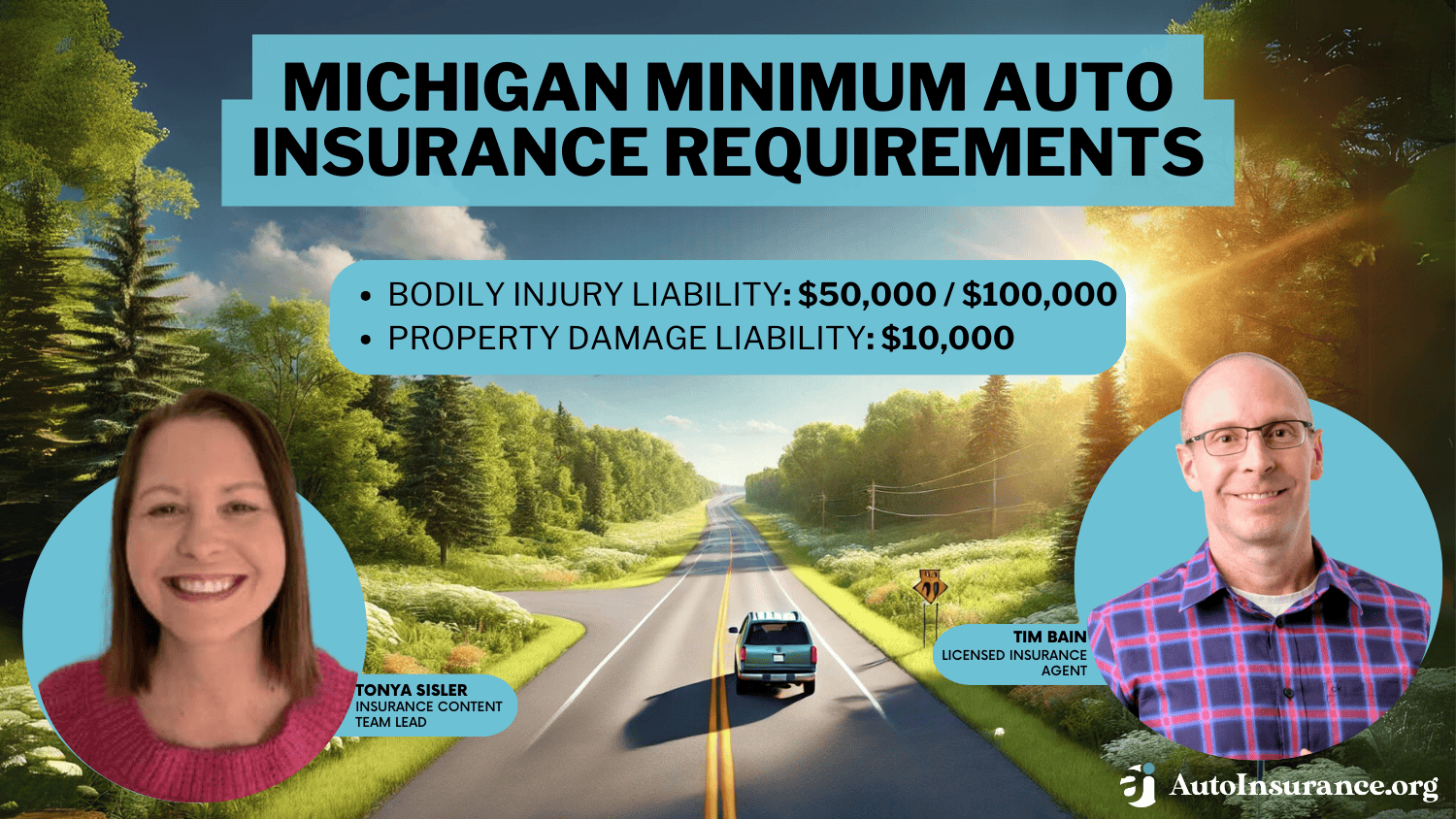

Michigan minimum auto insurance requirements are 50/100/10, meaning that drivers must carry $50,000 for bodily injury per person, $100,000 for all persons injured in an accident, and $10,000 for property damage. Michigan car insurance rates start at $47/month, but comparing rates can help you save.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated December 2024

To meet state law, drivers must meet Michigan minimum auto insurance requirements. This means they need at least $50,000 for bodily injury per person, $100,000 per accident, and $10,000 for property damage.

Personal Injury Protection (PIP) and Property Protection Insurance (PPI) are also required. PIP helps with medical expenses, while PPI covers property damage.

Geico has the lowest car insurance rates, starting at $47 per month. Other companies like USAA and Progressive may offer good prices as well.

Michigan Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $50,000 per person / $100,000 per accident |

| Property Damage Liability | $10,000 per accident |

The best thing to do is compare rates to find what works best for you. Following Michigan’s car insurance rules keeps you covered and saves you from fines.

Understanding the type of coverage you need and how to find the most affordable policy makes shopping for car insurance much simpler for Michigan Residents. Use our free insurance comparison tool above to ensure you get the best rate.

- Michigan minimum auto insurance requirements are 50/100/10

- Meeting Michigan’s minimum insurance is essential to avoid penalties

- Geico offers the lowest rates, starting at $47 per month

Michigan Minimum Coverage Requirements & What They Cover

Drivers must carry the minimum auto insurance in Michigan to comply with the law. This includes bodily injury liability insurance of $50,000 per person and $100,000 per accident and property damage liability of $10,000 for out-of-state damages.

Personal Injury Protection (PIP) is also required to cover medical expenses no matter who is at fault, with coverage options ranging from unlimited to limits like $500,000 or $250,000, depending on your health insurance.

Comparing auto insurance quotes is essential in Michigan to ensure you meet the state’s minimum coverage requirements while saving money on your premiums.Michelle Robbins Licensed Insurance Agent

Additionally, the minimum insurance coverage required in Michigan includes Property Protection Insurance (PPI) of $1 million for property damage within the state, excluding vehicles. If you’re moving to Michigan, new Michigan auto insurance laws require you to update your policy within 30 days to meet state regulations.

Non-residents driving in Michigan don’t need to follow Michigan’s requirements but must follow their home state’s insurance laws. While the required coverage meets legal standards, many drivers choose optional coverage like collision or comprehensive insurance for better protection. Comparing quotes is a smart way to find affordable options that meet your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Michigan

Getting the cheapest car insurance in Michigan is a smart way to save money while meeting the mandatory auto insurance requirements in Michigan. According to our Geico auto insurance review, the company offers the lowest rates for minimum coverage at $47 per month, followed by USAA at $51 per month and Progressive at $73 per month.

Company Facts

Min. Coverage in Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

These providers make it easier to comply with Michigan’s new auto insurance law, which is focused on making insurance more affordable and flexible for drivers. Choosing one of these options ensures you meet the minimum auto insurance rules in Michigan without spending too much.

The new auto insurance laws in Michigan give drivers more options when selecting coverage, including changes to Michigan’s Personal Injury Protection requirements. These updates help drivers choose coverage that fits their budget, especially if they already have health insurance for medical costs.

Michigan Min. Coverage Auto Insurance Monthly Rates by City

City Rates

Ann Arbor $300

Battle Creek $316

Dearborn $933

Detroit $1,537

Flint $641

Grand Rapids $310

Kalamazoo $307

Lansing $325

Livonia $480

Portage $285

Rochester $359

Southfield $893

Sterling Heights $602

Troy $429

Warren $648

Companies like Geico, USAA, and Progressive offer plans that work well with these laws, making them great choices for affordable coverage. Take the time to compare quotes to find the best deal while staying covered under Michigan’s insurance rules.

Other Coverage Options to Consider in Michigan

If you’re a driver in Michigan, meeting the mandatory car insurance in Michigan is required by law, but additional coverage can help protect you better. Here are some options to think about:

- Collision and Comprehensive Coverage: Collision auto insurance coverage pays for repairs or replacement if your car is damaged in a crash, no matter who’s at fault. In addition, comprehensive auto insurance coverage covers damage from theft, vandalism, natural disasters, or accidents involving animals.

- Uninsured Motorist Coverage: Uninsured Motorist Property Damage (UMPD) coverage protects you if you’re hit by a driver without insurance or not enough insurance to cover your damages.

- Medical Payments or Personal Injury Protection (PIP): This covers medical bills, lost wages, and other expenses if you or your passengers are injured, regardless of fault. Personal Injury Protection (PIP) is required in Michigan.

By exploring other coverage options in Michigan, you can tailor your policy to protect yourself better, your passengers, and your vehicle.

Adding the right coverages will not only meet mandatory car insurance in Michigan but also give you peace of mind on the road.

Michigan Car Insurance Minimums for Leased/Financed Vehicles

Michigan auto insurance laws pose additional requirements for anyone who leases or finances a vehicle. A leased vehicle is a vehicle you essentially borrow from a car dealership for a pre-determined timeframe.

The average lease is anywhere from two to three years, which means you pay a payment to the lender during this time and turn the car in after you make the last payment. You get a new car to lease at this point, which means you never own your car.

The lender then comes up with an agreement you must sign to repay the loan in the agreed-upon time. Once you make the last payment, the car is officially yours.

When you lease or finance your car, you must carry full coverage auto insurance until your car is paid off. If you do not carry full coverage, your lender sends you a notice requiring you to get a policy in place immediately. If you fail to purchase full coverage insurance for your vehicle, your lender can do it for you.

You are required to pay the premiums, and they’re almost always more expensive from the lender than they are if you shop for your policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalties for Driving Without Insurance in Michigan

Driving without insurance is illegal, and law enforcement officers do not issue a warning for this crime. You aren’t pulled over and given a lecture to purchase a policy. You are given a ticket, you are charged fines, and you are penalized.

Fines range from $200 to $500 if you haven’t insurance. First-time offenders are usually given a $200 fine, and the fine increases each additional time they’re caught. Your license is automatically suspended for 30 days, and you cannot get it back without proving you purchased a Michigan auto insurance policy. You must also pay local reinstatement fees to get it back.

This Geico commercial is one of the greatest commercials of all time pic.twitter.com/u4yS6BRTnO

— Historic Vids (@historyinmemes) December 28, 2023

Most first-time offenders are not sentenced to jail for driving without insurance. However, if you’re caught more than once, a judge might determine you pay a fine and spend up to a year in jail.

You might also avoid a fine but spend up to a year in jail if that’s what a court of law decides when hearing your case. It’s too expensive to drive without insurance in Michigan.

Read more: What is needed for adequate auto insurance coverage?

How to Get Car Insurance in Michigan

When getting car insurance in Michigan, it’s important to know the amount of car insurance you need in Michigan. Driving without auto insurance coverage can cost you a lot, even sending you to jail, which will hurt your job prospects and personal life.

It’s also easy to find affordable coverage that meets mandatory car insurance in Michigan. To comply with Michigan state minimum car insurance rules, make sure you have the required coverage, but remember, you can always add extra for peace of mind.

Look into discounts, like for retired drivers, multi-car policies, or living in a safe area—many companies offer these to help lower your rates while ensuring you’re covered under car insurance requirements in Michigan.

Ask for different discounts to see what rates you can get with different companies. You can find affordable insurance; you must compare rates and know what you need to get a good rate. Use our FREE insurance comparison tool below! Just enter your ZIP and compare rates now.

Frequently Asked Questions

What is the minimum insurance coverage required in Michigan?

Car insurance requirements in Michigan are unique. The mandatory auto insurance in Michigan includes:

- Personal Injury Protection (PIP): Michigan requires drivers to have unlimited Personal Injury Protection coverage, which provides medical expenses, lost wages, and other related costs regardless of fault.

- Property Protection Insurance (PPI): Michigan drivers must also carry a minimum of $1 million in Property Protection Insurance, which covers property damage caused to others in the state.

Is PIP required in Michigan?

Yes, you have to have PIP insurance in Michigan. PIP coverage provides unlimited medical benefits, lost wages, and other related costs for injuries sustained in an auto accident, regardless of fault. However, as of July 2020, Michigan’s personal injury protection requirements have changed.

Drivers can choose different levels of PIP coverage or opt-out entirely, under certain conditions, if they have qualifying health insurance coverage that specifically covers auto accident injuries. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Can I opt out of Personal Injury Protection (PIP) coverage in Michigan?

Yes, as of July 2020, Michigan drivers can opt out of Personal Injury Protection (PIP) coverage if they have qualifying health insurance coverage that specifically covers auto accident injuries. However, it’s important to consider the implications of opting out, as it may impact your ability to receive comprehensive medical coverage for injuries sustained in an auto accident.

Read more: At-Fault Accident Defined

What is Property Protection Insurance (PPI) in Michigan?

Property Protection Insurance (PPI) is a mandatory car insurance coverage in Michigan that provides a minimum of $1 million in liability coverage for property damage caused to others in the state. PPI helps cover the cost of damages to buildings, fences, parked vehicles, and other types of property.

Can I get uninsured/underinsured motorist coverage in Michigan?

Yes, Michigan allows drivers to add uninsured/underinsured motorist (UM/UIM) coverage to their auto insurance policies. UM/UIM coverage protects you if you’re involved in an accident with a driver without insurance or insufficient coverage to pay for your injuries or damages.

Can I choose my own auto insurance provider in Michigan?

Yes, as a resident of Michigan, you have the freedom to choose your own auto insurance provider. Numerous insurance companies are licensed to operate in the state, offering various coverage options and premiums. It’s recommended to compare auto insurance quotes from multiple providers to find the best coverage and rates that meet your needs.

Is car insurance required in Michigan?

Michigan does require car insurance for drivers to be able to operate a vehicle legally.

Is comprehensive insurance required in Michigan?

Insurance laws in Michigan do not require comprehensive insurance, but it may be required by a lender if you have a car loan or lease.

How much third-party car insurance do I need in Michigan?

Third-party car insurance in Michigan generally follows Michigan’s liability insurance requirements. This means you may need third-party liability car insurance with the minimum coverage limits required by MI auto insurance laws.

Read more: Can a private auto insurance company meet my needs?

Can you insure a car you don’t own in Michigan?

Yes, you can insure a car you don’t own in Michigan. You’ll need to show an insurable interest in the vehicle.

How much car insurance do I need in Michigan?

Do you need insurance to drive with a learner’s permit in Michigan?

Do you need third-party insurance if you have comprehensive coverage in Michigan?

Do you need insurance for a trailer in Michigan?

How much third-party car liability insurance do I need in Michigan?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.