Best Auto Insurance After a DUI in New York (Top 10 Companies Ranked for 2026)

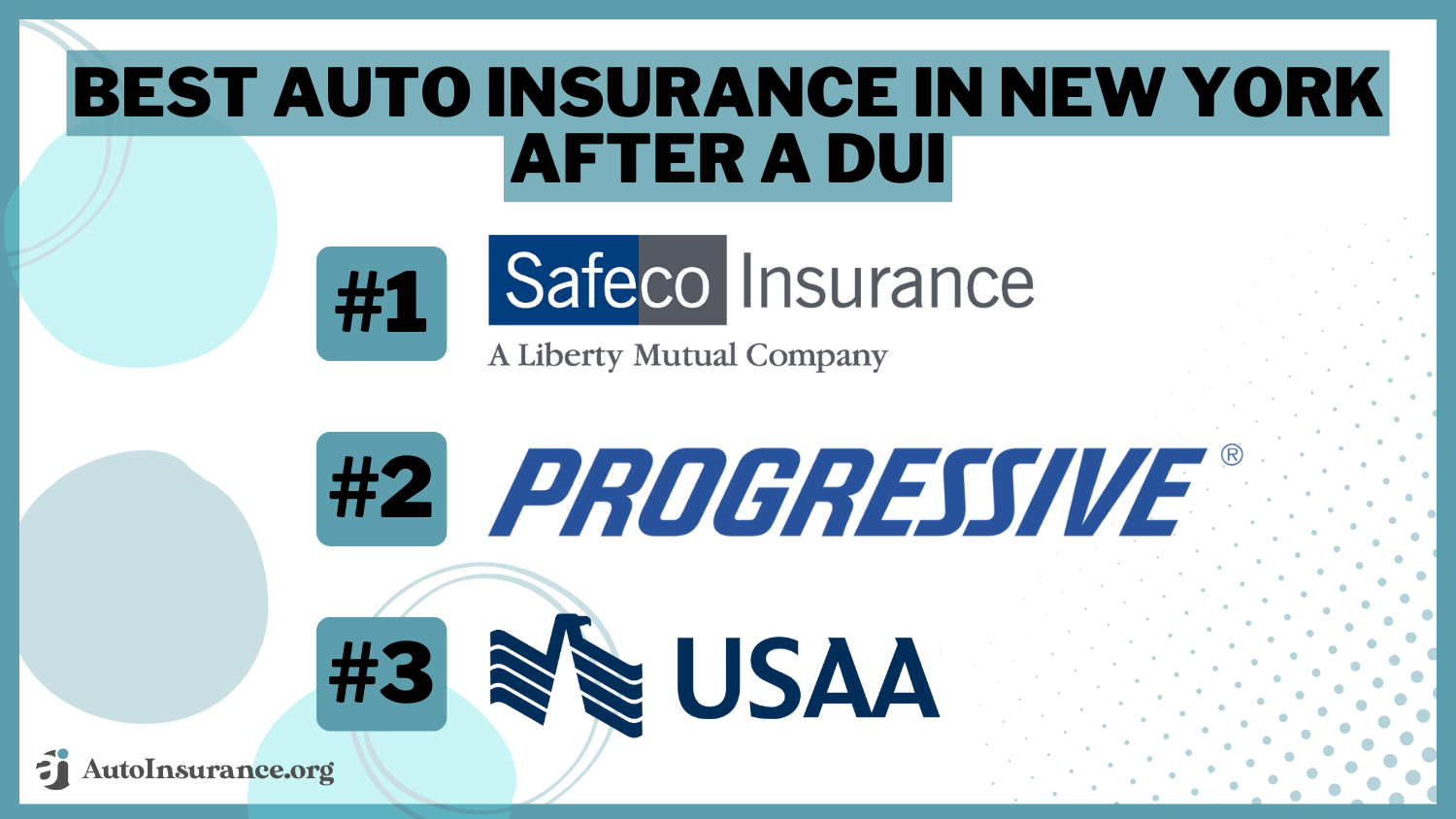

The best auto insurance after a DUI in New York is with Safeco, Progressive, and USAA. Minimum rates start at $47/month with Safeco, which also has excellent claims reviews and financial strength. Drivers can leverage discounts and increase insurance deductibles to lower DUI insurance rates in New York.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated December 2024

Company Facts

Full Coverage After a DUI in New York

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in New York

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in New York

A.M. Best Rating

Complaint Level

Pros & Cons

The top pick for the best auto insurance after a DUI in New York is Safeco, offering the most competitive rates starting at $250/month.

Safeco, along with Progressive and USAA, stands out for its affordable pricing, comprehensive coverage, and efficient claims handling. Choosing among these top options helps drivers find cheap auto insurance after a DUI.

Our Top 10 Company Picks: Best Auto Insurance in New York After a DUI

Company Rank New Car Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A Filing Claims Safeco

#2 15% A+ Cheap Rates Progressive

#3 12% A++ Comprehensive Coverage USAA

#4 18% A+ Multi-Policies Discount Erie

#5 14% A++ Customized Policies Travelers

#6 17% A+ Local Agents Nationwide

#7 16% A Loyalty Rewards Liberty Mutual

#8 13% A Discount Availability American Family

#9 19% A Claims Service Farmers

#10 11% A+ Customer Service Chubb

Compare these companies to strike a balance between affordability and comprehensive coverage. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Safeco offers top rates for New York drivers after a DUI, starting at $47/month

- USAA has the best DUI insurance in New York for military members

- Safeco and USAA have excellent claims reviews from policyholders

#1 – Safeco: Top Overall Pick

Pros

- Swift Digital Claims: Safeco offers a fast and easy digital claim process, ideal for handling claims efficiently in New York after a DUI. Learn more in our Safeco review.

- Streamlined Claim Tracking: Their claim tracking system is user-friendly and keeps DUI drivers updated on any changes in claim status throughout the process, even in New York after a DUI.

- Positive Claim Reviews: New York consistently ranks highly for insurance claim satisfaction in J.D. Power’s annual surveys, especially following a DUI.

Cons

- Higher Initial Costs: Safeco charges higher rates than other companies in New York after a DUI.

- Limited Regional Discounts: Discounts and special offers might not be as prevalent in all areas of New York for DUI insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Cheap Rates

Pros

- Innovative Comparison Tools: Progressive offers advanced online tools to help you compare rates and find cheap DUI auto insurance in New York. Read our Progressive review for a full list.

- Frequent Rate Adjustments: They regularly adjust rates based on market conditions, which can benefit those searching for competitive options in New York after a DUI.

- Great Financial Strength: Progressive holds an A+ rating from A.M. Best and is financially equipped to handle DUI insurance claims in New York.

Cons

- Potential Coverage Gaps: Low rates might come with coverage limitations on auto insurance in New York after a DUI.

- Higher Rates for Young Drivers: Young drivers who have a DUI in New York might experience increased insurance premiums compared to other age groups.

#3 – USAA: Best for Comprehensive Coverage

Pros

- Extensive Policy Choices: USAA offers an extensive range of policy options, providing thorough protection for drivers New York after a DUI.

- Highly Rated Claims Satisfaction: Known for high claims satisfaction, USAA ensures a smooth process for handling insurance after a DUI in New York. Read more in our review of USAA.

- Specialized Military Benefits: USAA offers specialized benefits for military members that can enhance the coverage experience in New York after a DUI.

Cons

- Exclusivity of Membership: USAA DUI insurance is exclusively available to military personnel and their families in New York after a DUI.

- Regional Variability in Coverage: Some regions may not offer the full range of coverage to DUI drivers in New York.

#4 – Erie: Best for Multi-Policies Discount

Pros

- Significant Savings on Bundles: Erie offers substantial bundling discounts up to 25% on DUI insurance in New York. Read our Erie review to learn what else is offered.

- Local Expertise: Their local agents offer deep knowledge of regional insurance needs, which is beneficial for securing in cheap car insurance New York after a DUI.

- Enhanced Customer Support: Erie’s commitment to personalized service ensures that New York drivers with a DUI receive tailored assistance.

Cons

- Higher Deductibles: Erie’s policies could have higher deductibles, potentially impacting the total out-of-pocket expenses for drivers in New York after a DUI.

- Limited Digital Features: Erie’s digital tools might be less advanced, which could be inconvenient for managing DUI insurance in New York online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Customized Policies

Pros

- Flexible Policy Customization: Travelers provides flexible insurance policies, allowing drivers with a DUI to adjust their coverage to fit their specific needs in New York. Check out how in our Travelers review.

- In-Depth Policy Consultation: Local agents offer in-depth policy consultations to help drivers understand their options and choose the best DUI auto insurance in New York.

- Excellent Financial Strength: Travelers holds an excellent A++ rating from A.M. Best and is financially equipped to handle DUI insurance claims in New York.

Cons

- Complex Policy Choices: The vast array of policy options might be overwhelming for some drivers in New York after a DUI.

- Occasional Billing Errors: Travelers has reports of billing inaccuracies, which can be frustrating for drivers managing in New York after a DUI.

#6 – Nationwide: Best for Local Agents

Pros

- Dedicated Local Agent Support: Local agents provide customized, in-person assistance to help drivers handle DUI auto insurance policies, including those in New York after a DUI.

- Community Engagement: Nationwide is engaged with the community, enhancing their understanding of regional requirements in New York after a DUI. Learn more in our Nationwide review.

- Great Financial Strength: Nationwide holds an A+ rating from A.M. Best and is financially equipped to handle insurance claims in New York after a DUI.

Cons

- Potential Rate Increases: Nationwide may increase rates significantly after policy renewal, impacting cheap auto insurance in New York after a DUI.

- Inconsistent Service Quality: The quality of service can differ based on the local agent, which might impact your overall experience when seeking high-risk insurance in New York after a DUI.

#7 – Liberty Mutual: Best for Loyalty Rewards

Pros

- Loyalty Discounts: Liberty Mutual offers rewards and incentives for long-term customers in New York after a DUI. Read more in our review of Liberty Mutual.

- Deductible Fund: Drivers with DUIs in New York can increase their deductible fund, and Liberty Mutual will match this contribution when the policy is renewed.

- Enhanced Coverage Benefits: Their loyalty rewards often come with enhanced coverage benefits, providing better protection for drivers with a DUI in New York.

Cons

- Complicated Discount System: The complexity of Liberty Mutual’s discount structure may make it difficult to fully understand and apply all available savings in New York after a DUI.

- Complex Reward System: The reward system can be intricate, which may complicate efforts to optimize savings on auto insurance in New York after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Discount Availability

Pros

- Extensive Discount Options: American Family offers a wide range of discounts, which can help reduce New York auto insurance rates after a DUI.

- Flexible Discount Combinations: Maximize your DUI insurance savings by combining various discounts in New York after a DUI. For a complete list, read our American Family review.

- Discounts for High-Risk Drivers: American Family offers specialized discounts for high-risk drivers with a DUI, making insurance more affordable in New York after a DUI.

Cons

- Limited Regional Discounts: Discount availability may vary across different areas of New York after a DUI.

- Expensive Rates: Nationwide is the priciest option on our list for high-risk auto insurance in New York after a DUI.

#9 – Farmers: Best for Claims Service

Pros

- Responsive Claims Handling: Farmers is recognized for its quick and efficient claims service in New York after a DUI, which you can learn about in our Farmers review.

- High Claims Satisfaction: Policyholders rate Farmers as better than average for handling claims, noting their clear and transparent communication throughout the process, especially in New York after a DUI.

- Membership Discounts: Federal employees, first responders, and other professionals can receive discounts of up to 18% on their annual rates, including in New York after a DUI.

Cons

- High Costs for New Customers: New customers might face increased expenses initially, which can be a concern when changing auto insurance in New York after a DUI.

- Smaller Discount Savings: While it provides more discounts, the overall savings are less significant compared to other insurance companies in New York after a DUI.

#10 – Chubb: Best for Customer Service

Pros

- Top-Tier Customer Service: Chubb is known for providing exceptional customer service for auto insurance in New York after a DUI. Find out more in our Chubb review.

- Tailored Client Solutions: Chubb provides customized insurance solutions for drivers with a DUI, offering optimal auto insurance coverage in New York after a DUI.

- Excellent Financial Strength: With a superior A++ rating from A.M. Best, Chubb is equipped to cover DUI insurance claims in New York.

Cons

- Expensive Rates: New York auto insurance after a DUI is more expensive with Chubb than other companies on this list.

- Limited Discounts: The range of discounts available may be more restricted than other providers, limiting how much you can save on car insurance in New York after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing DUI Auto Insurance Rates in New York

Finding auto insurance in New York after a DUI can be tough. Most insurers see it as a major risk, leading to higher premiums. Rates for DUI auto insurance vary widely depending on the coverage level and provider. Learn how auto insurance companies check driving records.

Safeco offers the best overall value for auto insurance in New York after a DUI, combining competitive rates with comprehensive coverage.Jeff Root Licensed Insurance Agent

It’s essential to compare rates from different providers to secure the best deal. We’ve compiled a detailed comparison of the best DUI auto insurance companies in New York. Compare DUI insurance per month by coverage level and provider below.

New York DUI Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $118 | $228 |

| Dairyland | $148 | $410 |

| Erie | $42 | $107 |

| Farmers | $119 | $230 |

| Liberty Mutual | $267 | $516 |

| Nationwide | $237 | $457 |

| Progressive | $60 | $115 |

| Safeco | $47 | $122 |

| Travelers | $113 | $219 |

| USAA | $72 | $139 |

Safeco offers the lowest minimum coverage at $47 and full coverage at $122, while Liberty Mutual has the highest rates at $267 for minimum and $516 for full coverage. Other notable providers include Progressive, Erie, and USAA, each offering competitive rates for both minimum and full coverage options.

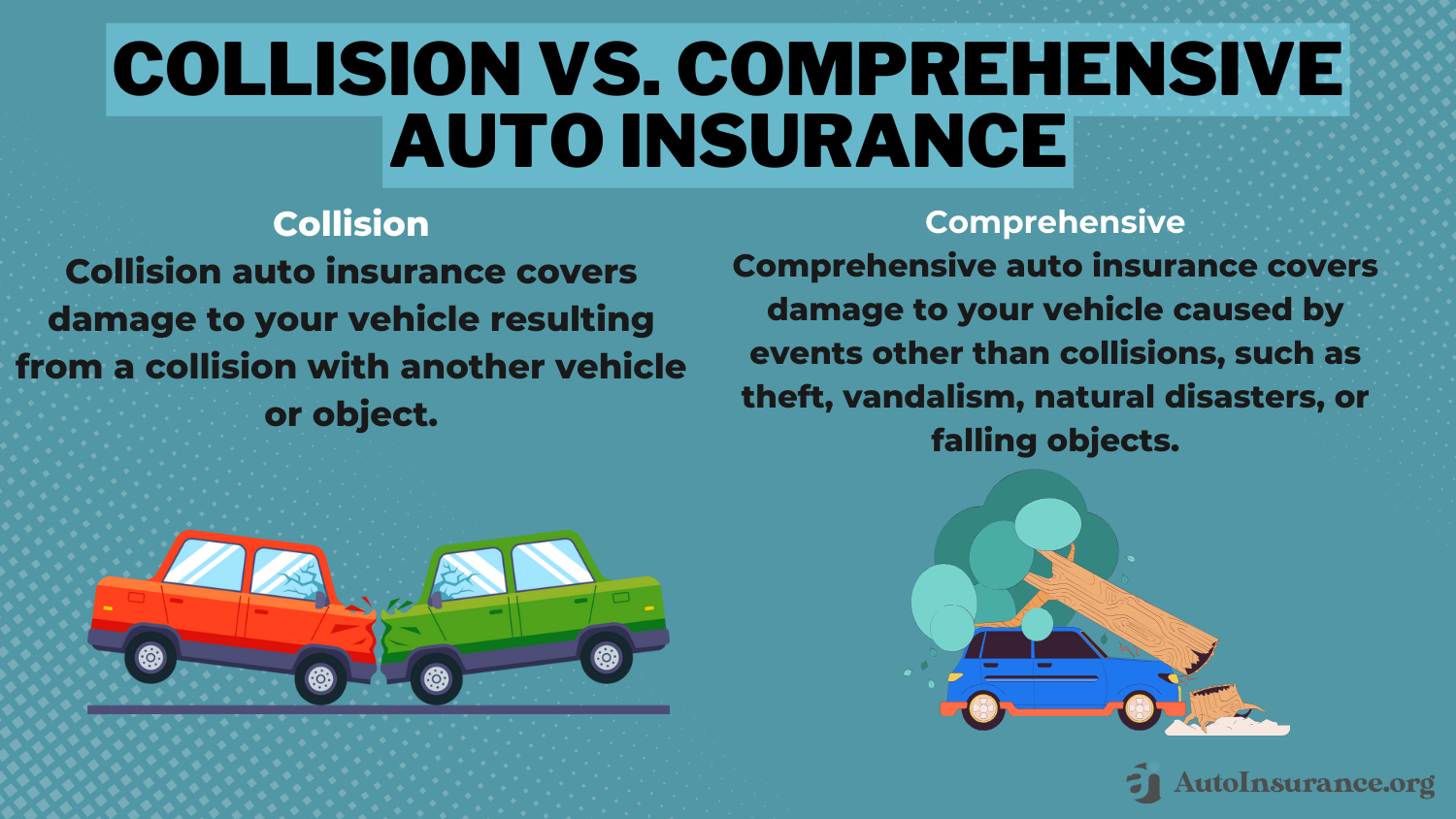

What is full coverage auto insurance? Full coverage includes the minimum liability requirements in New York plus collision and comprehensive coverage for your own vehicle. Full coverage is more expensive, so consider reducing coverage to get cheaper car insurance after a DUI. Keep reading for more ways to save.

Auto Insurance Rate Increases After a DUI

Here are the key factors that insurance companies consider when setting rates for drivers with a DUI on their record:

- Severity of the DUI Offense: Details such as blood alcohol content (BAC) and whether it involved an accident, significantly influence insurance rates. More severe offenses often result in higher premiums.

- Duration Since DUI Conviction: The length of time since the DUI conviction impacts rates. Insurance companies typically offer lower rates as time passes and if there is no further infractions or issues.

- Driving Record and History: A history of traffic violations, accidents, or previous DUIs can lead to higher insurance rates. A clean driving record post-DUI can help mitigate some of these costs.

- Type and Amount of Coverage: The level of coverage chosen, whether minimum or full coverage, affects premiums. More extensive coverage typically costs more but provides better protection.

Different insurance companies have varying policies regarding DUIs. Some may offer specialized programs or discounts for drivers with a DUI on their record, affecting overall rates. Other insurers may refuse to cover drivers with multiple DUIs.

For instance, after a DUI conviction, you may be required to obtain SR-22 insurance. An SR-22 is not a type of insurance policy but rather a certificate that proves you have the minimum required auto insurance coverage. It is typically mandated by the state to ensure that high-risk drivers maintain proper coverage.

However, not all insurance companies offer SR-22 filings, so it’s important to find a provider that does. Furthermore, having an SR-22 can lead to higher insurance rates because it indicates a higher risk to insurers. By understanding these aspects, you can better navigate the impact of your DUI on your auto insurance rates and explore ways to manage them effectively.

Ways to Lower Auto Insurance Rates After a DUI

You’ll face higher auto insurance rates after a DUI conviction. Explore auto insurance discounts from these top providers to lower the cost of high-risk auto insurance in New York.

Available discounts from the best New York insurance companies for DUIs include multi-policy, safe driver, and accident forgiveness discounts. However, understanding your other options is key to finding the best deal on DUI auto insurance.

You can better manage your insurance costs by comparing rates and exploring available discounts, but there are effective strategies you can employ to further mitigate the impact on your finances:

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premium. Just ensure you can comfortably cover the deductible amount in case of a claim.

- Maintain a Clean Driving Record: After your DUI, focus on maintaining a clean driving record to improve your risk profile and qualify for lower rates over time.

- Select Minimum Coverage: If budget constraints are a concern, start with the minimum required coverage and gradually increase it as your situation improves or as you can afford it.

If you don’t want to risk higher deductibles and minimum coverage in case of a claim, start comparing high-risk auto insurance quotes. Use our free tool above to find affordable DUI insurance for every coverage level.

Take control of your insurance journey by comparing quotes, adjusting your coverage, and leveraging discounts to find the best deal for your needs.

Case Studies: Navigating Auto Insurance After a DUI

In New York, DUI insurance rates can be particularly high. These case studies demonstrate how different individuals tackled their unique challenges and found affordable insurance after a DUI.

- Case Study #1 – Affordable Coverage After a DUI: John, a 35-year-old New Yorker with a DUI, found that Safeco offered the most competitive rates for comprehensive coverage, allowing him to secure lower premiums and additional discounts.

- Case Study #2 – Comprehensive Protection with a DUI Conviction: Lisa, a 69-year-old veteran, sought comprehensive auto insurance after a DUI and found USAA military discounts and high customer satisfaction to be the best fit despite slightly higher premiums.

- Case Study #3 – Lowering Premiums with a DUI Record: Tom, a 45-year-old contractor with a DUI, minimized his insurance costs by using Progressive’s discounts and a mix of coverages to balance affordability and protection.

As you embark on your journey to secure comprehensive auto insurance, use these real-world examples as a guide to explore your options.

Consider the recommended auto insurance coverage levels and what you can do to get the best DUI car insurance in New York.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Auto Insurance in New York After a DUI

The best auto insurance in New York after a DUI is with Safeco, Progressive, and USAA. Minimum rates start at $42/month. Safeco leads with affordable pricing and comprehensive coverage, while Progressive and USAA offer attractive alternatives.

Safeco stands out as the top choice for auto insurance in New York after a DUI, delivering exceptional value through a blend of affordable premiums and extensive coverage options tailored to high-risk drivers.Michelle Robbins Licensed Insurance Agent

New York may not be one of the best states for affordable DUI auto insurance, but you can consider comparing quotes from multiple providers, adjusting coverage levels, and leveraging available discounts to get cheaper rates.

Finding affordable New York car insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

What is the best auto insurance for a DUI in New York?

Providers such as Safeco, Progressive, and USAA are highly recommended due to their affordability and extensive coverage options for drivers with a DUI.

What is the cheapest car insurance after a DUI in New York?

The cheapest car insurance for drivers with a DUI in New York starts around $40 per month with providers like Safeco and Erie. However, rates can vary based on individual circumstances and coverage needs.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

How long does a DUI affect your car insurance in New York?

A DUI conviction is one of those factors that affect your auto insurance rates for several years. Typically, a DUI remains on your driving record for 10 years in New York, which can lead to higher premiums throughout this period.

Does auto insurance cover DUI accidents in New York?

Yes, insurance generally covers DUI accidents in New York. However, coverage may be limited or come with higher deductibles and premiums. If you’re convicted of a DUI, your insurance rates will likely increase, and you might face additional penalties from your insurer.

How long does a DUI stay on your record in New York state?

In New York, a DUI conviction stays on your driving record for 10 years. However, the impact on your insurance rates can persist longer, as insurers may consider the DUI when calculating premiums for up to 10 years or more.

How long do accidents stay on insurance in New York?

Accidents typically stay on your insurance record for 3 to 5 years in New York. Insurers may use this information to determine your risk level and set premiums during this period. More severe or frequent accidents may impact your rates for a longer duration. (Learn More: Non-Driving Factors That Affect Auto Insurance Rates)

What is the minimum limit for auto insurance in New York?

New York requires drivers to have minimum liability coverage of $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage. These limits are designed to cover basic expenses in the event of an accident.

What happens when you get your first DUI in New York?

A first DUI offense in New York can result in significant penalties, including fines, license suspension, and mandatory alcohol education programs. Additionally, your car insurance rates will increase, and you may face challenges finding affordable coverage.

How long does an insurance company have to pay a claim in New York?

In New York, insurance companies are generally required to pay a claim within 30 days after receiving notice of the claim, assuming there are no disputes or additional investigations needed. Delays can occur if there are complications or disputes regarding the claim. (Read More: How to File an Auto Insurance Claim)

What happens if you get into an accident without insurance in New York?

Driving without insurance in New York is illegal and can result in severe penalties, including fines, license suspension, and vehicle impoundment. If you’re involved in an accident without insurance, you may face legal consequences and be liable for all damages and injuries out of pocket.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.