Cheap Auto Insurance for Disabled Drivers in 2026 (Save Money With These 10 Companies)

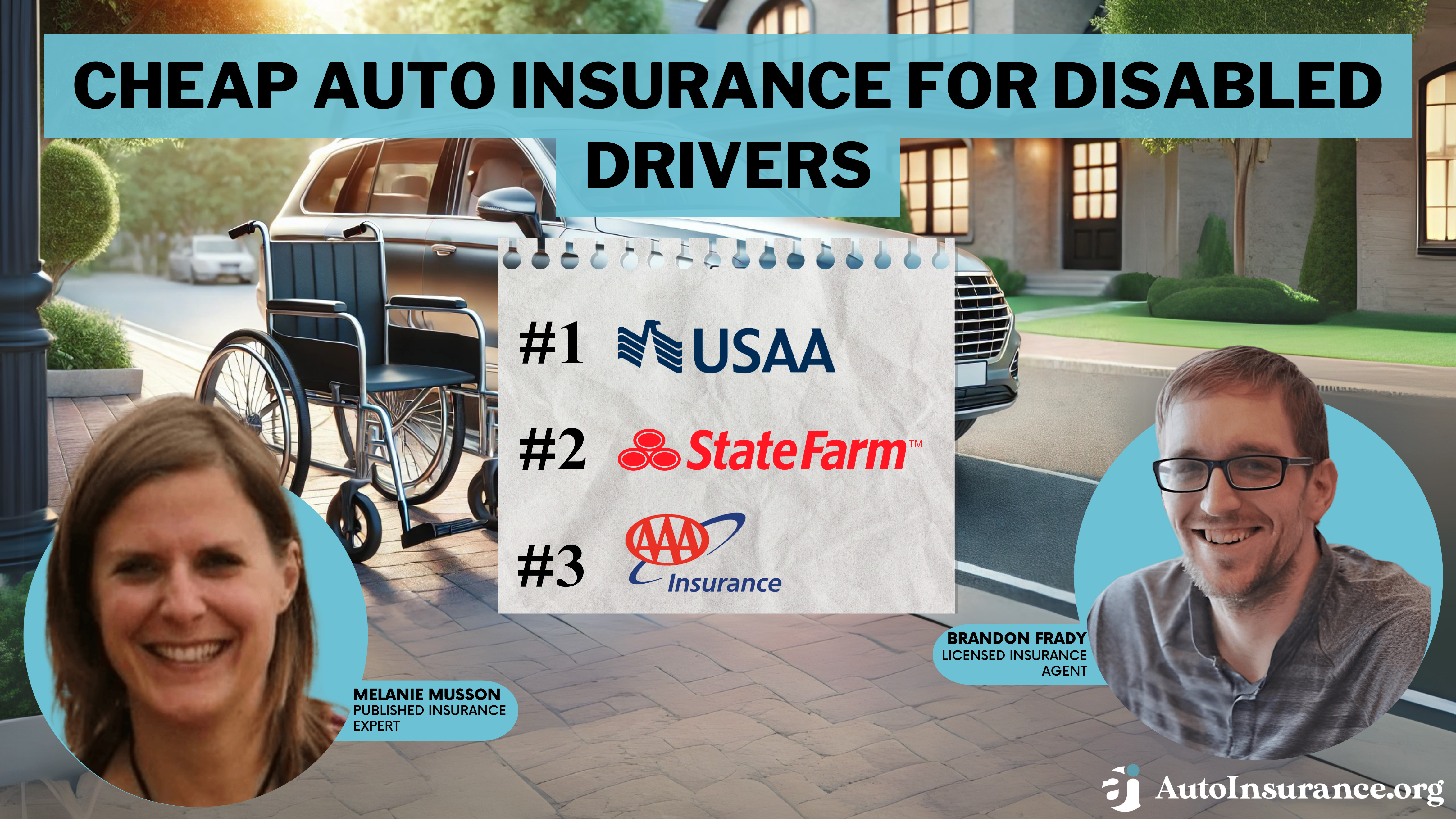

The best cheap auto insurance for disabled drivers will come from USAA, State Farm, and AAA insurance, starting as low as $29/month. Below, we'll help you find the best auto insurance discounts for disabled drivers as well as affordable policies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

Company Facts

Min. Coverage for Disabled Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Disabled Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Disabled Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

The best cheap auto insurance for disabled drivers will come from USAA, State Farm, and AAA insurance, starting as low as $29/month. You might be wondering how to get auto insurance with a disability and whether it affects your rates. You can get cheap auto insurance for disabled drivers, and companies are just as likely to offer coverage to a capable driver with a disability as they are to a driver without one.

However, disabled drivers can earn auto insurance discounts if they’re veterans, first responders, or have made modifications to their vehicles. We’ll help you learn more about where to find the best car insurance for disabled drivers and get auto insurance discounts for disabled veterans.

Our Top 10 Company Picks: Cheap Auto Insurance for Disabled Drivers

Company Rank Monthly Rates AM Best Best For Jump to Pros/Cons

![]()

#1 $29 A++ Military Savings USAA

![]()

#2 $44 B Many Discounts State Farm

#3 $56 A Local Agents AAA

#4 $61 A+ Usage Discount Nationwide

![]()

#5 $65 A++ Accident Forgiveness Travelers

![]()

#6 $66 A Student Savings American Family

![]()

#7 $69 A+ Online Convenience Progressive

![]()

#8 $76 A Local Agents Farmers

![]()

#9 $87 A+ Add-on Coverages Allstate

#10 $91 A Customizable Polices Liberty Mutual

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- Discrimination against disabled drivers is forbidden

- Some insurance companies offer discounts specifically to disabled veterans

- Modifications to a vehicle can sometimes provide additional savings

#1 – USAA: Top Pick Overall

Pros

- Coverage for Military: Veterans, military, and their family pay less than average.

- Availability: USAA offered in all 50 states.

- SR-22 Insurance: Not offered by every auto insurance company.

Cons

- High Rates for DUIs: Drivers will pay more after a DUI.

- SafePilot: Savings program has limited availability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Drivers with Good Credit

Pros

- Customer Satisfaction: Drivers report excellent customer service.

- Financial Strength: A++ rating with A.M. Best.

- Simple Claim Process: Filing a claim can be done online.

Cons

- Limited Options: State Farm doesn’t offer accident forgiveness.

- High Rates for Poor Credit: Drivers with bad credit will pay more than average.

#3 – AAA: Best for AAA Members

Pros

- Variety of Discounts: Drivers can apply for multiple discounts.

- Specialty Perks: Benefits are available for AAA members only.

- Tiered Costs: You can choose the level of membership you want.

Cons

- Poor Customer Service: Drivers report below average ratings for customer service.

- Membership Required: You must have AAA to purchase auto insurance.

#4 – Nationwide: Best for Customized Coverage

Pros

- Teens Pay Less: Affordable rates for young drivers.

- Customizable Policies: Adding young drivers and changing coverage possible.

- Affordability: Nationwide minimum coverage starts at $44/month.

- Customer Service: Positive reviews from drivers.

Cons

- High Rates After Accident: Drivers with an accident on record will pay more.

- Poor Claim Process: Drivers report slow claim handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Discounted Policies

Pros

- Coverage Options: Drivers can get full or minimum coverage.

- Affordable Rates: Average premium rates are below national average.

- Discounts: Over a dozen ways to save money.

Cons

- IntelliDrive Program: Your rates can actually increase after usage.

- Poor Customer Service: One out of five stars on BBB website.

#6 – American Family: Best for Families With Young Drivers

Pros

- High Financial Rating: American Family has an A with both A.M. Best and The BBB.

- GAP Coverage: Helps to pay the remaining balance on a totaled new car.

- Teen Drivers Have Low Rates: Teen drivers pay around 20% less than the national average.

- KnowYourDrive Program: Usage-based app that allows safe drivers to save money.

Cons

- Limited Availability: American Family auto insurance is only available in certain states.

- Increased Rates After an Accident: Drivers will see an increase on their policy after a traffic accident.

#7 – Progressive: Best for Older Drivers

Pros

- Strong Financial Stability: Progressive consistently remains above average when it comes to finances.

- Progressive App: Drivers can make payments and keep a digital copy of insurance cards via the app.

- Snapshot Program: Drivers can save money based on driving habits.

Cons

- High Rates for Teens: Young drivers will pay more than the national average for auto insurance.

- Poor Customer Service: One of the lowest in terms of customer service satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Experienced Drivers

Pros

- Uninsured Motorist Coverage: Protects you against drivers without insurance.

- Farmers Signal: Signing up provides an immediate 5% discount.

- SR-22 Insurance: Not offered by every auto insurance company.

Cons

- Young Drivers Pay More: Rates for teen drivers are higher than average.

- Expensive Minimum Coverage: Farmers minimum auto insurance policy is costly.

#9 – Allstate: Best for Drivers with Clean Record

Pros

- Specialty Insurance: Rideshare is available to include with coverage.

- Drivewise: App that monitors driving and provides discounts up to 40%.

- Deductible Reward Program: Keep a clean record and save on your deductible each year.

Cons

- High Rates: Most drivers will pay more than the national average.

- Expensive for Poor Credit: Drivers with poor credit will pay more than the national average.

#10 – Liberty Mutual: Best for Discount Program

Pros

- RightTrack Program: Liberty Mutual’s discount program that also offers driving feedback.

- New Car Replacement: Provides a new car if the totaled car was less than a year old.

- Lifetime Replacement Guarantee: Provided with any repairs done at a Liberty Mutual approved shop.

- Multi-Policy Discount: If you bundle more than one type of insurance, you can save money.

Cons

- Poor Claim Handling: Drivers report low satisfaction with having claims completed.

- High Full Coverage Rate: Drivers will pay more than the national average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Coverages for Disabled Drivers

We believe disabled drivers should get no less than full-coverage auto insurance to protect themselves from a worst-case accident scenario. Living without a personal vehicle in America can be difficult enough, but for the disabled, it can become exponentially more arduous.

Liability auto insurance is a minimum requirement in most of the United States, but you won’t be covered in the event of an accident or total loss if you don’t have the collision and comprehensive insurance included with full coverage. Therefore, you have no coverage under a liability-only policy for your injuries or damage to your disability-adaptable vehicle.

According to the National Highway Safety Traffic Administration, a new vehicle with adaptive equipment can cost anywhere between $20,000 and $80,000. Because of these extra costs, you’ll need to find an insurance company that offers auto insurance for wheelchair-accessible vehicles and other disability-adapted cars and SUVs.

We also recommend investing in the following coverage options:

- Roadside assistance: Following an accident, roadside assistance will provide a tow, jump, or tire change to get you safely off the road and out of harm’s way.

- Special equipment coverage: Covers specialized mirrors or ramps for wheelchairs but also items like a walker, wheelchair, or motorized scooter that aren’t necessarily attached to your vehicle

- Mobility car insurance: Reimburses you for the cost of interim transportation if your disability-adapted vehicle was in an accident and is undergoing repairs.

There is no such thing as a disability auto insurance policy. Still, with these coverages, you’ll drive with greater peace of mind knowing you’re covered no matter what unforeseen difficulties arise on the road.

Disability Auto Insurance Cost

Insurance companies cannot charge you more simply because you have a disability, but you might end up having higher rates if you require additional coverage. This is often due to the modifications your vehicle may need to accommodate your disability rather than the disability itself.

Despite the Americans with Disabilities Act’s protections, the cost of car insurance for people with disabilities who drive modified vehicles can come with higher rates. You might pay more for auto insurance if your vehicle has any of the following:

- Wheelchair Lifts or Ramps: Includes side-entry and under-vehicle lifts, which are ideal for those who are constantly traveling.

- Automobile Scooter Lifts: Come in various designs, including swing-arm and platform-arm styles.

- Wheelchair Securing: Your wheelchair needs to remain securely in position while driving or riding.

- Modified Steering, Extended Pedals, and Hand Controls: Includes automotive hand controls that make driving for people with impairments simpler and safer.

- Swivel Seats: This type of seating can be utilized in a car of any size.

These are just some examples of assistive technology made for disabled drivers and their vehicles. Other modifications might include ignition switches on the dash or oversized doors to accommodate wheelchairs, so check with your insurer to confirm your policy covers the modifications in your car.

Although some companies may not offer auto insurance discounts for disabled drivers with modified vehicles, remember that some manufacturers may offer a special rebate during your purchase for assistive technologies for disabled drivers and passengers.

How Disabilities Affect Auto Insurance Rates

The only way a car insurance company can charge disabled people higher rates is when the disability poses a direct risk to driving safely. For instance, drivers with obstructed or limited vision may pay more for insurance and have restrictions on their licenses..

Most insurance underwriting decisions are based on claim history and driving record to get an accurate risk profile when choosing to insure a particular driver.

Other reasons why your auto insurance company might refuse to provide coverage includes:

- Multiple traffic violations or claims on your record

- Lying on your auto insurance application

- Making false assertions or claims

Your level of risk may also exceed company policy maximums, especially if you drive a modified van or large SUV. That’s why comparing auto insurance quotes from companies that cover wheelchair-accessible and other types of modified vehicles is important.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Auto Insurance Discounts for Disabled Drivers

While there aren’t outright auto insurance discounts for disabled drivers, there are still plenty of ways to minimize what you pay for coverage. Saving money on disability auto insurance is really as simple as asking your insurer if it offers special discounts. However, don’t be surprised if they say “no.” This is why you should seek to take advantage of other auto insurance discounts for which you may already qualify:

- Discounts Based on Age: Disabled seniors may be eligible for “mature driver” discounts, which result in lower rates for seniors who have finished a driving skills course. (Read More: Cheap Auto Insurance for Drivers Over 60 and Cheap Auto Insurance for Drivers Over 70)

- Affiliate Discounts: If you’re a member of a fraternity, sorority, or another affinity group, see if your organization has any agreements with insurance providers for discounted rates. This also applies if you belong to an association for disabled adults.

- Student Discounts: Many reputable insurance companies offer auto insurance discounts for good students who maintain a B average. College students can earn discounts for living on campus without a vehicle.

- Discounts for Low Mileage: Your car insurance may be less expensive if you drive less than the average person. Think about switching from a standard plan to pay-per-mile auto insurance.

- Discounts for Usage-Based Insurance (UBI): Consider enrolling in a UBI program if you have avoided tickets and accidents. Your rates are modified based on how well you drive during a monitoring period.

You can also earn discounts if you are a disabled veteran or active military member. However, there is no immediately applied disability discount on auto insurance. Ask your current insurer about disabled veteran auto insurance discounts or shop around with companies that cater to military personnel and their families.

How Disabled Veterans Qualify for Auto Insurance Discounts

Due to their service, military personnel frequently qualify for lower insurance rates, including disabled veterans. The issue is that not all auto insurance companies offer discounts to veterans and active military personnel.

Here are some crucial pointers to remember as you look for the best deals:

- Gather car insurance quotes for disabled drivers from the best auto insurance companies.

- Ask insurance agents if you qualify for discounts based on your driving history, where you live, and other considerations.

- When looking for auto insurance as a disabled veteran, prepare the necessary identification documents for inspection.

As drivers age, their auto insurance rates decrease, especially for those with clean driving records. Insurance companies consider older drivers less likely to cause accidents, and this same logic is applied to veterans who need affordable auto insurance.

The insurance company may ask you to prove your status as an honorably discharged or medically discharged veteran. This could entail showing your DD-214 separation documents or getting the Department of Veterans Affairs (VA) to issue an official statement with your name and service-connected disability rating.

Auto Insurance Companies Offering Discounts to Disabled Veterans

While USAA and Geico auto insurance have traditionally been some of the most economical for disabled veterans, it’s always best to compare no less than five companies at a time before making any final decisions.

Post by @geicoView on Threads

It’s also important to remember that if you are a disabled veteran, you might save just as much money through bundling all your insurance needs or qualifying for other discounts like a safe driver or low-mileage auto insurance discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Whether Auto Insurance Companies Can Forbid Disabled People From Driving

An insurance company cannot forbid you from operating a vehicle — that is the DMV’s job. An insurance company can, however, deny you coverage based on your driving record and claims history.

Even with the ADA, discrimination against some drivers is unavoidable. Follow the steps below to file a complaint:

- ADA complaint form. Contact the Federal Coordination and Compliance Section and submit a completed Civil Rights Division Complaint Form if you believe you have been the victim of discrimination.

- Get legal counsel. Talk to a lawyer about your options moving forward. You can get in touch with groups like the Disability Rights Legal Center, which offers free legal aid to disabled people who are victims of discrimination.

- Send a grievance to the insurance commissioner in your state. On the National Association of Insurance Commissioners website, find the local Insurance Commissioner for your state and lodge a complaint. Normally, you must include your policy number and the details of your claim.

- Contact the insurance company’s headquarters. Consider reporting discrimination to the corporate office if you have issues with a specific insurance company or agent.

It is critical to recognize and report discrimination if you believe an insurance company is denying you coverage based on your disability.

More About How to Get Auto Insurance with a Disability

Most of the time, people drive without the DMV or insurance company knowing of their disability. That’s because their disability may not impact their ability to be safe drivers. Exceptions might be vision or cognitive impairment, which would cause a driver to have to seek medical validation to obtain a license.

Even if you need medical validation to receive a driver’s license, the Americans with Disabilities Act (ADA) prohibits insurance companies nationwide from charging disabled drivers and passengers higher premiums solely based on their disability.

There is no such thing as a disability auto insurance policy or free car insurance for disabled motorists, but if you go through a company like USAA auto insurance, you may get cheap coverage for disabled veterans as their policy prices are already the lowest for active-duty military and veterans in general. Tailored car insurance disability coverage is essential, providing specific provisions for modifications, such as a wheel adapted vehicle. This might make finding cheap auto insurance for disabled people difficult, but not impossible.

While auto discounts for disabled drivers might not be outright offered, you can still get cheap insurance for disabled drivers by applying for other discounts offered by your provider.

In your search for disabled driver auto insurance, you’ll find that the cheapest auto insurance for disabled adults will come from companies that offer multiple ways of saving money, such as a monitoring program.

And if you’re looking for disabled veterans auto insurance, there are a few different companies that specialize in offering coverage to military members. If you aren’t a member of the military, you can still earn auto insurance discounts for disabled drivers by taking safe-driving courses and remaining accident and claim-free. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

Can auto insurance companies increase their rates for disabled drivers?

No, companies cannot charge disabled drivers more just because of their impairment. However, drivers who own customized cars due to a disability, such as installing rotating chairs or retractable ramps, will pay more for auto insurance because of the higher expense of replacing their automobile when it is damaged.

What is the best car insurance for drivers with disabilities?

The top auto insurance providers for people with disabilities cover custom or specialty items. Drivers can purchase up to a specific amount of additional protection for their car’s upgraded features. This coverage is provided by numerous companies, but not everywhere.

Do drivers with disabilities qualify for auto insurance discounts?

Although there are no discounts for disabled driver vehicle insurance, this does not mean disabled drivers cannot take advantage of other discounts. Ask for auto insurance discounts based on age, driving history, annual mileage, and membership in any qualifying groups to reduce your overall insurance costs.

Can I get auto insurance if I have a disability?

Yes, individuals with disabilities can obtain auto insurance just like anyone else. Insurance companies are generally prohibited from discriminating against applicants based on disability, thanks to laws such as the Americans with Disabilities Act (ADA).

Will having a disability affect my auto insurance rates?

Auto insurance rates are primarily determined by factors such as driving history, vehicle type, location, and age. While having a disability itself should not directly impact your rates, certain disabilities may affect your ability to drive safely, which can indirectly affect your premiums. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

What information do I need to provide when applying for auto insurance with a disability?

When applying for auto insurance, you will typically need to provide standard information such as your personal details, driver’s license number, and vehicle information. Plus, insurance companies will check your driving record. You may also be required to disclose any medical conditions or disabilities that could potentially affect your driving ability.

Is car insurance cheaper if you are disabled?

This will not always be the case, but cheap auto insurance for SSI recipients does exist. Reviewing which companies offer the best prices is a great way to find affordable insurance for people on disability.

Can you get auto insurance for wheel adapted vehicles?

You can get auto insurance for wheelchair vans and other accessible vehicles, but you will have to tell your provider about any modifications made.

Are you able to find cheap auto insurance for disabled veterans?

Auto insurance for disabled veterans does exist, though you may have to compare quotes between companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.