Geico vs. Travelers Auto Insurance in 2026 (Best Value Revealed)

Comparing Geico vs. Travelers auto insurance shows that Geico is cheaper, with rates starting at $73/mo, compared to Travelers rates that start at $89/mo. However, both companies have great business and customer ratings, and Travelers offers more add-on coverage options than Geico.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsWhen comparing Geico vs. Travelers auto insurance, both are top auto insurance companies with the best customer service, but Geico has more affordable rates for drivers than Travelers.

We’ll compare Geico vs. Travelers auto insurance rates based on age, driving record, and credit history to see which one can give you a better deal.

We’ll also compare available discounts and ratings from agencies with a credible and trustworthy view of Geico vs. Travelers auto insurance companies.

Geico vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.5 | 4.4 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.8 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.4 | 4.3 |

| Customer Satisfaction | 4.5 | 4.1 |

| Digital Experience | 5.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.4 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 4.1 |

| Savings Potential | 4.5 | 4.3 |

| Geico Review | Travelers Review |

Before starting this Geico vs. Travelers auto insurance review, use our tool and enter your ZIP code to compare multiple companies in your area.

- You can usually save by choosing Geico over Travelers

- If you have a bad driving record, Geico is a better choice than Travelers

- Travelers has a wider variety of add-on coverages

Geico vs. Travelers Auto Insurance Rate Comparison

Is Geico auto insurance or Travelers auto insurance cheaper based on age? Generally speaking, the older we get, the more driving experience we have. This is why auto insurance companies use age as one of the most influential factors in determining your auto insurance rates.

It's legal to base auto insurance rates on marital status and gender in most states; however, some states have banned this practice.Daniel Walker Licensed Insurance Agent

Let’s compare how affordable Geico vs. Travelers auto insurance rates are based on age, gender, and marital status.

Geico vs. Travelers Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $298 | $719 |

| Age: 16 Male | $312 | $910 |

| Age: 30 Female | $90 | $99 |

| Age: 30 Male | $87 | $108 |

| Age: 45 Female | $80 | $98 |

| Age: 45 Male | $80 | $99 |

| Age: 60 Female | $73 | $89 |

| Age: 60 Male | $74 | $90 |

Geico has some of the best auto insurance rates for teens (Read More: Companies With the Cheapest Teen Auto Insurance). In comparison, you will pay more with Travelers if you have a young driver in your household.

Is Geico auto insurance or Travelers auto insurance cheaper based on driving record? Speeding tickets, accidents, or DUIs on your driving record will raise your auto insurance rates no matter what company you pick because these infractions make you look like a high-risk driver.

Geico vs. Travelers Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $80 | $99 |

| Not-At-Fault Accident | $132 | $139 |

| Speeding Ticket | $106 | $134 |

| DUI/DWI | $216 | $206 |

If you have a clean driving record, expect to pay more with Travelers than you would with Geico.

It’s also important to take a close look at how punitive each company is if you sign up with a clean driving record but then later get an infraction.

Geico has steeper penalties if you get a speeding ticket, cause an accident, or get a DUI. Your rates with Geico will more than double if you get caught driving under the influence.

Travelers is slightly more lenient, only increasing customers’ rates by 67% for a DUI infraction. If you have a DUI, you may want to get a quote from Travelers to see what you’ll pay for DUI insurance.

Is Geico auto insurance or Travelers auto insurance cheaper based on credit score? A good credit score can drop in a matter of months if you experience some financial trauma, such as incurring medical debt or going through a divorce.

In most states, it is legal for auto insurance companies to base rates on your credit score; however, some are banning this practice along with basing rates on gender and marital status.

Car insurance companies justify using your credit score to determine your rates based on the assumption that those with higher credit scores are more responsible and more likely to pay for damages out of pocket rather than filing a claim.Dani Best Licensed Insurance Producer

You may live in a state, such as California, where basing auto insurance on credit scores is illegal. Check your state’s laws before judging Geico vs. Travelers auto insurance quotes based on credit score alone.

Let’s take a look at Travelers vs. Geico car insurance rates for drivers based on credit score.

Geico vs. Travelers Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $203 | $338 |

| Fair Credit (580-669) | $249 | $362 |

| Poor Credit (300-579) | $355 | $430 |

No matter what your credit score is, a Geico quote will be cheaper than with Travelers. Once you are with Geico and your credit score drops, however, expect your auto insurance rates to increase by 75%, whereas Travelers will increase your rates by only 27%.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico vs. Travelers Auto Insurance Coverage Options

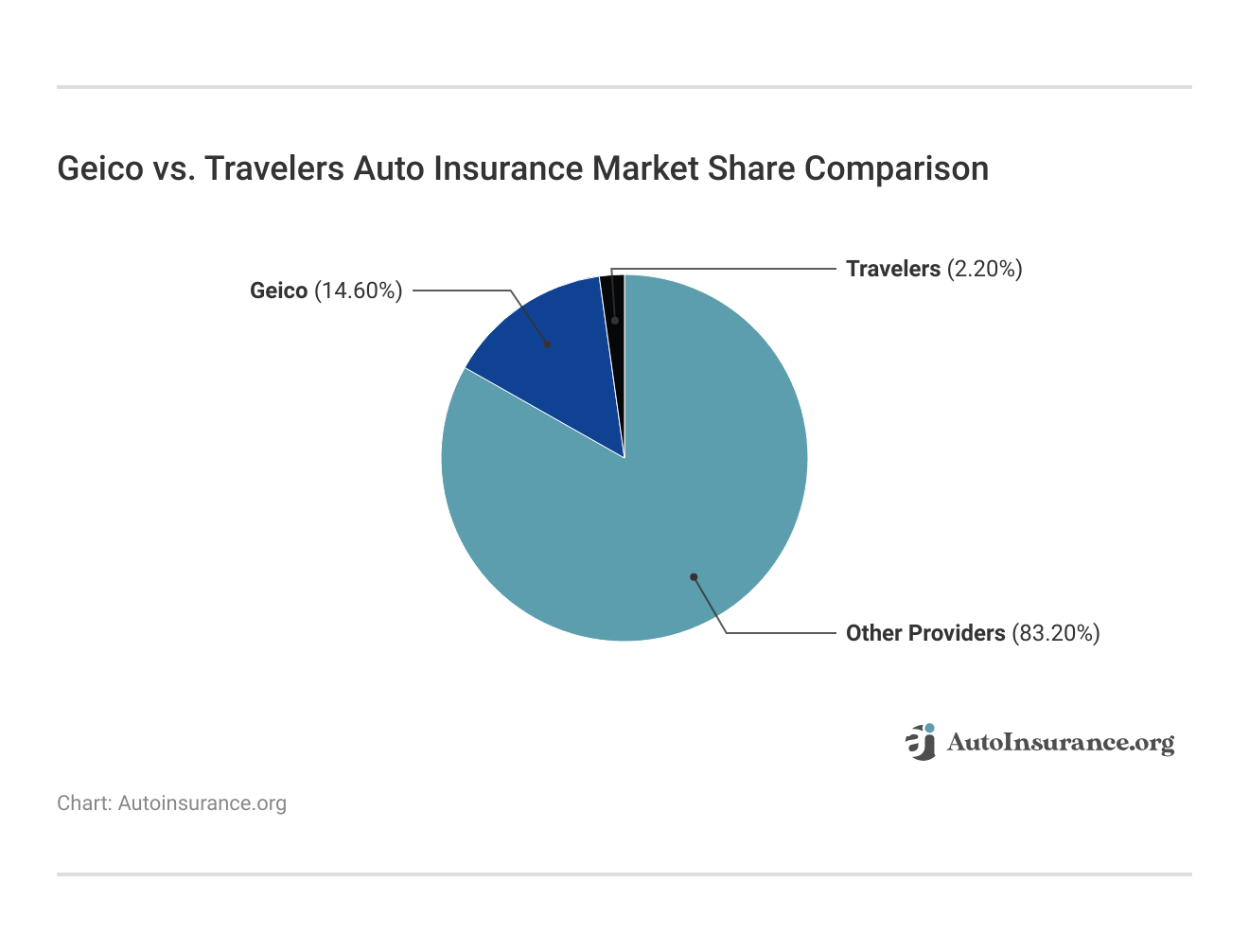

Since Geico and Travelers are two of the 10 companies that make up most of the auto insurance market share, they have the means to offer a wider variety of auto insurance coverages beyond the standard six coverages listed below.

Be sure you understand the various types of auto insurance coverage before purchasing each one:

Geico vs. Travelers Auto Insurance Coverage Options

| Coverage Type | ||

|---|---|---|

| Accident Forgiveness | ❌ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Gap Insurance | ❌ | ✅ |

| Liability | ✅ | ✅ |

| Mechanical Breakdown Insurance | ✅ | ❌ |

| Medical Payments | ✅ | ✅ |

| New Car Replacement | ❌ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Telematics Program | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

Be sure to take a close look at any specialty coverages you might need, such as rental reimbursement, roadside assistance, guaranteed auto protection (GAP), mechanical breakdown, and insurance for recreational vehicles such as ATVs or boats.

Geico vs. Travelers Auto Insurance Discounts

The best auto insurance discounts vary widely. That’s why it pays to shop around, especially if you have a bad driving record or a low credit score. Discounts can help offset high rates.

Geico vs. Travelers Auto Insurance Discounts by Savings Potential

| Discounts | ||

|---|---|---|

| Anti-Lock Brakes | 5% | X |

| Anti-Theft | 23% | X |

| Claim Free | 26% | 23% |

| Continuous Coverage | X | 15% |

| Daytime Running Lights | 3% | X |

| Defensive Driver | 8% | 10% |

| Distant Student | 5% | 7% |

| Driver's Ed | 5% | 8% |

| Driving Device/App | 5% | 30% |

| Early Signing | 5% | 10% |

| Emergency Deployment | 25% | 9% |

| Federal Employee | 12% | 7% |

| Full Payment | 5% | 8% |

| Good Student | 15% | 8% |

| Green Vehicle | 5% | 10% |

| Homeowner | X | 5% |

| Military | 15% | 5% |

| Multiple Policies | 10% | 13% |

| Multiple Vehicles | 25% | 8% |

| Newer Vehicle | 15% | 10% |

| On Time Payments | 5% | 15% |

| Paperless/Auto Billing | 5% | 3% |

| Passive Restraint | 40% | X |

| Safe Driver | 15% | 23% |

| Seat Belt Use | 15% | 5% |

| Vehicle Recovery | 15% | X |

When comparing discounts offered by either company, Travelers has a few more discount options than Geico.

However, Geico also offers excellent discounts, with discounts for for being claim-free, having multiple vehicles on your policy, and having air bags, anti-theft equipment, or a vehicle recovery system.

Travelers offers a claim-free discount and a discount for making on-time payments, having continuous coverage, being a safe driver, and using the Travelers driving app.

The discounts offered by auto insurance companies often target specific types of drivers, so when you get your Travelers or Geico auto quote, be sure to ask if there are any additional discounts.

You can also call the Geico insurance phone number or Travelers insurance phone number to find out more ways to save with discounts.

Geico vs. Travelers Customer Reviews

Travelers and Geico car insurance reviews from customers give insight into issues and advantages that customers might face with Geico and Travelers. For example, Geico insurance reviews on Reddit complain about rate hikes at renewal despite having initially cheap rates.

Rate increases at companies are very common, and Travelers customers on Reddit also have issues with rate hikes at Travelers (Learn More: Why does my auto insurance go up every year?).

Posts from the orangecounty

community on Reddit

Generally, rate hikes will be less if you keep a clean driving record, although location factors can play a roll in price increases.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico vs. Travelers Business Reviews

Buying auto insurance is a big financial responsibility, so you want to make sure you’re choosing the right company that will be there for you when you need it. Both Geico and Travelers have large market shares and are reputable companies. Take a look at Geico insurance ratings and Travelers insurance ratings below.

Before making a decision, you should also examine a company’s financial strength, customer satisfaction with the claims process, and customer complaints.

Insurance Business Ratings & Consumer Reviews: Geico vs. Travelers

| Agency | ||

|---|---|---|

| Score: 857 / 1,000 Above Avg. Satisfaction | Score: 860 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 76/100 Good Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.12 Avg. Complaints |

|

| Score: A++ Superior Financial Strength | Score: A++ Superior Financial Strength |

A.M. Best scores companies based on their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid. The highest score A.M. Best awards is Superior A++. Consumer Reports collects annual data from its subscribers regarding customer satisfaction with the Geico claims process and the Travelers claims process, step by step.

Read More: Best Auto Insurance Companies According to Consumer Reports

The National Association of Insurance Commissioners (NAIC) calculates a complaint ratio based on the total number of customers vs. the total number of complaints, which gives insight into Travelers insurance and Geico.

Pros and Cons of Geico

Pros

- Affordable Rates: Geico car insurance quotes are cheaper on average than Travelers rates for drivers.

- Discount Options: Geico has multiple discounts to help you save further, such as an anti-theft discount (Read More: Best Anti-Theft Auto Insurance Discounts).

- Customer Complaints: Geico’s complaint ratio from NAIC is lower than the average.

Cons

- Fewer Coverages: Geico has fewer add-on coverages than Travelers.

- DUI Rates: Geico is less affordable than Travelers for DUI drivers.

Pros and Cons of Travelers

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros

- Coverage Choices: Travelers offers more add-on car insurance options than Geico.

- DUI Drivers: Travelers rates are slightly cheaper on average for DUI drivers, making it easier to get cheap auto insurance after a DUI at the company.

- Financial Strength: Travelers has the highest possible rating from A.M. Best.

Cons

- Higher Rates: Travelers’ average car insurance rates are higher than those of Geicos.

- Complaint Ratio: Travelers’ complaint ratio from NAIC is higher than Geico’s complaint ratio.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Between Geico vs. Travelers

Before you choose between Travelers Insurance vs. Geico auto insurance, make sure to consider all factors of the companies. Both Geico and Travelers are some of the best auto insurance companies for customer satisfaction with the claims process and have strong ratings for customer service.

Geico is the more economical company for customers, but Travelers has more add-on car insurance options.

If neither company is right for you when comparing Geico and Travelers insurance, or you want more options, enter your ZIP code to compare multiple car insurance companies in your area.

Frequently Asked Questions

What are Geico and Travelers auto insurance?

Geico and Travelers Insurance are both well-known insurance companies that offer auto insurance coverage to individuals and businesses. When comparing Geico vs. Travelers Insurance, both provide a range of policies to protect vehicles and drivers against financial loss in the event of accidents, theft, or other covered incidents.

How do Geico and Travelers compare in terms of reputation?

Both Geico Insurance and The Travelers Indemnity Company have established reputations in the insurance industry. Geico is known for its extensive advertising campaigns and competitive rates, while Travelers is recognized for its financial stability and customer service.

It is advisable to research and compare Travelers and Geico car insurance ratings and reviews to determine which company aligns better with your specific needs.

How can I obtain a quote from Geico and Travelers?

To obtain a quote for Geico car insurance, you can visit their website or contact their customer service directly. You can get a Geico online quote with a free online tool that allows you to enter your information and receive a quote within minutes.

Travelers also provides online quoting capabilities through their website, or you can get in touch with a Travelers agent to request a quote (Learn More: How to Ask an Auto Insurance Company for Quotes).

Which company offers more affordable rates, Geico or Travelers?

The affordability of insurance rates from Travelers vs. Geico can vary depending on several factors, such as your location, driving history, the type of vehicle you own, and the coverage options you select.

It is recommended that you request quotes from both Geico and Travelers to compare their rates based on your individual circumstances and insurance needs. Rates vary widely based on a driver’s profile, whether you are shopping at Geico vs. State Farm or Liberty Mutual vs. Geico car insurance. Shop for affordable car insurance quotes today by entering your ZIP in our free quote finder.

Can I bundle other types of insurance with my auto insurance policy?

Yes, both Geico and Travelers offer the option to bundle other types of insurance policies with your auto insurance. This can include homeowners insurance, renters insurance, motorcycle insurance, and more. Bundling policies with the same company can often lead to discounts and potential cost savings.

Does Geico or Travelers have better mobile apps?

Cheap usage-based auto insurance has become an industry trend in the last decade or so, and all of the bigger auto insurance companies have an app for your phone or a device you can install in your vehicle that will evaluate your driving for a discount.

Both companies offer mobile apps and websites where you can use your Travelers or Geico login to view your ID cards and coverage information, pay your bill, and access Geico or Travelers roadside assistance. Usually, your Geico login or Travelers insurance login will work with both the general app and the driving app.

Are Geico and Travelers the same company?

No, Geico and Travelers are not the same company.

Does Geico own Travelers?

No, Geico does not own Travelers.

Is Travelers insurance cheaper than Geico?

No, Geico is cheaper than Travelers when you compare Geico car insurance rates to Travelers. Want to compare more companies to find the cheapest, like Farmers vs. Travelers, Geico vs. The General, or Geico vs. The Hartford? To find a cheap company, start by reading our guide on the cheapest auto insurance companies.

Can you get Travelers insurance through Geico?

No, you can’t get Travelers insurance through Geico.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.