Best Auto Insurance Discounts for Electric Vehicles in 2026 (Get up to 25% Off With These Companies)

Geico, Progressive, and State Farm have the best auto insurance discounts for electric vehicles. Geico offers the highest discount, with Geico auto insurance discounts for electric vehicles being as high as 25%. Progressive and State Farm follow closely with 22% and 20%, respectively. Learn more here.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Geico, Progressive, and State Farm have the best auto insurance discounts for electric vehicles. You can save up to 25% with these companies.

Finding companies with electric vehicle auto insurance discounts is the best way to buy cheap EV auto insurance rates since electric vehicle insurance policies cost around 33% more than standard coverage.

Our Top 10 Company Picks: Best Auto Insurance Discounts for Electric Vehicles

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| 1 | 25% | A++ | Policyholders with electric or hybrid vehicles | |

| 2 | 22% | A+ | Drivers with energy-efficient cars | |

| 3 | 20% | B | Electric vehicle owners with clean driving records | |

| 4 | 18% | A+ | EV owners with safe driving history | |

| 5 | 17% | A | EV owners with home-auto bundles |

| 6 | 15% | A+ | Electric car owners save with home-auto bundles |

| 7 | 14% | A | Electric Vehicle Drivers with Multi-Policy | |

| 8 | 13% | A++ | Military families owning electric vehicles | |

| 9 | 12% | A++ | Electric vehicle owners with accident-free records | |

| 10 | 10% | A | EV drivers who complete a defensive driving course |

Ask for electric vehicle insurance discounts, such as the State Farm electric vehicle discount, from the best auto insurance companies to get affordable EV insurance coverage in your area.

Don’t let expensive insurance rates hold you back. Enter your ZIP code above and shop for affordable premiums from the top companies.

- The best insurance companies for EVs offer a discount of up to 25%

- On average, electric auto insurance costs $158 monthly

- State Farm offers an electric auto insurance discount of 25%

How to Qualify for Electric Vehicle Auto Insurance Discounts

To qualify for an EV insurance discount in the United States, drivers must meet specific criteria that vary by insurer. Insurance companies often provide discounted rates to EV owners, thanks to the eco-friendly benefits and generally lower risk associated with these cars. Common ways to qualify include:

- Owning a fully electric or plug-in hybrid vehicle.

- Keeping a clean driving record.

- Making use of green incentives like discounts for electric car insurance.

Some insurers may also offer reduced electric car insurance rates for installing anti-theft devices such as a LoJack or charging stations at home. Read more about how LoJack affects auto insurance rates.

Below, we’ll discuss some of these requirements.

Own or Lease an Electric Vehicle

To qualify for discounts for electric vehicles in the U.S., buyers can take advantage of various federal, state, local, and private incentives. The federal government offers EV tax credits of up to $7,500 for new EVs that meet specific battery size requirements, although these credits phase out for manufacturers once they’ve sold 200,000 EVs.

Many states also provide additional rebates, tax credits, or reduced registration fees and may offer perks like access to HOV lanes or discounted tolls. Local incentives vary by region but often include free parking or reduced taxes. Utility companies can help reduce costs through off-peak electricity rates for home charging or rebates for installing home chargers.

Monthly Auto Insurance Rates for EVs by Driving Record

| Insurance Company | One DUI | One Accident | One Ticket | Clean Record |

|---|---|---|---|---|

| $270 | $225 | $188 | $160 | |

| $194 | $176 | $136 | $117 | |

| $193 | $198 | $173 | $139 | |

| $216 | $132 | $106 | $80 | |

| $313 | $234 | $212 | $174 |

| $237 | $161 | $137 | $115 |

| $140 | $186 | $140 | $105 | |

| $112 | $102 | $96 | $86 | |

| $206 | $139 | $134 | $99 | |

| $108 | $78 | $67 | $59 |

Car manufacturers and dealers frequently offer cash-back deals, loyalty programs, or special leasing terms to encourage EV adoption. In addition, some employers may provide EV purchase programs or assistance with installing home charging stations.

You can significantly reduce the cost of owning and operating an electric vehicle by researching and taking advantage of discounts and incentives. You can also lower your insurance costs by choosing policies designed for electric cars, saving you even more.

Be sure to compare electric car insurance options to maximize savings and make EV ownership even more attractive for environmentally conscious drivers.

Provide Vehicle Documentation

If you’re buying or leasing an electric car, you’ll need key documents to keep things smooth and legit. Paperwork like the vehicle title or lease agreement shows that you own or lease the car—essential for registration, insurance, and compliance with the law.

Registration with the Department of Motor Vehicles (DMV) requires these documents and proof of insurance to ensure the vehicle is legally roadworthy. Insurance companies rely on accurate documentation, including registration and lease or ownership agreements, to determine coverage and premium rates, which can also influence eligibility for an EV car insurance discount.

Having the right paperwork is also a must when you’re looking to claim federal or state tax credits and rebates for your EV. To qualify for these perks, you’ll need proof of purchase or lease. If you’re leasing, your agreement will spell out important details—like mileage limits and end-of-lease conditions—which can impact any extra fees or charges down the line.

Learn how mileage affects your auto insurance rates in our article on how annual mileage affects your auto insurance rates.

Maintaining the right paperwork can also help you secure favorable EV vehicle insurance rates by confirming the vehicle's ownership or lease status.Michael Vereecke Commercial Lines Coverage Specialist

Keeping your documentation, like your warranty, in check helps protect you from unexpected repair or maintenance costs. And when you’re ready to end your lease or sell your EV, having everything in order will make the process easier by proving the vehicle’s history and value. In short, vehicle documentation is critical for the smooth operation, financial benefits, and legal compliance of owning or leasing an EV.

Enroll in Eco-Friendly or Green Discount Programs

Enrolling in eco-friendly or green vehicle insurance discount programs can positively impact the ownership or leasing of an electric vehicle in the United States by offering financial benefits and incentivizing sustainable practices. Many insurance companies provide EV insurance discounts to EV owners due to their lower environmental impact, which can result in reduced EV insurance costs.

Some states and cities offer rebates or incentives for buying or leasing an EV, which can help bring down the initial cost. If you join green programs, you might also get lower lease payments or benefits like discounts on charging for leased cars.

Many eco-friendly programs will give you extra perks, such as access to carpool lanes, reduced tolls, or free parking in certain spots. These programs make owning or leasing an EV more affordable while supporting sustainability, so it’s a win for both your wallet and the environment.

You can also take advantage of green vehicle insurance discounts, which reward you for driving fuel-efficient or zero-emission vehicles, promoting a cleaner environment. Utility companies will often offer special rates or discounts when you set up home charging stations, saving you money—especially during off-peak hours.

Maintain a Clean Driving Record

Maintaining a clean driving record significantly affects owning or leasing an electric vehicle in the United States by reducing insurance costs and improving leasing terms. Insurance companies consider a driver’s history when determining premiums, and a clean driving record—free of accidents, tickets, or violations—typically results in lower insurance rates.

This is especially beneficial for EV owners, as some insurance providers already offer discounts for driving eco-friendly vehicles. Having a clean driving record can really pay off, especially when you combine it with discounts.

For leased cars, a good driving history will impact the terms of your lease. Leasing companies typically check your credit and driving background, and if you’re in good standing, you might score better lease deals, like lower interest rates or smaller deposits.

Keeping a clean record can also help you avoid extra charges when you return the car at the end of the lease, as long as it’s in good shape. When you maintain this record, you’ll have continued eligibility for green or eco-friendly discount programs offered by insurance companies, which reward responsible, low-risk driving.

If you don’t have a clean driving record, you can try to shop around for cheap auto insurance for a bad driving record. All in all, a clean driving record enhances affordability and provides financial incentives when owning or leasing an EV while ensuring smoother, hassle-free transactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Companies for Electric Vehicle Auto Insurance Discounts

Owning an electric vehicle comes with some great perks, including insurance discounts that can help lower your electric car insurance cost. Many top insurers offer special deals to reward eco-friendly drivers like you. Let’s take a look at some of the best companies offering these discounts for electric vehicles.

Geico

Geico stands out with one of the most generous discounts for electric vehicle owners. Offering a Geico EV discount of 25%, Geico encourages drivers to make environmentally conscious choices.

The company is known for its competitive rates, and adding this significant Geico electric car discount makes it an attractive option for eco-minded drivers.

Geico’s 25% discount can result in substantial savings throughout your policy. If you’re driving a hybrid or a fully electric car, Geico’s EV insurance discounts can make going green a lot more affordable. With a nice discount in place, you can save some money while doing your part for the environment.

Progressive

Progressive is another great option, offering a 22% discount for electric vehicle owners. Their “Name Your Price” tool has made it easier for drivers to find the right coverage at a price that works for them. Progressive is committed to supporting green driving, and their discount is a great way to save on your insurance while going green.

This discount applies to a range of electric and hybrid vehicles, helping you save big on your premiums while supporting eco-friendly transportation.

State Farm

State Farm provides a 20% discount for electric vehicle insurance. As one of the largest auto insurers in the country, State Farm is known for its customer service and personalized coverage options.

State Farm offers a 20% discount for electric vehicles, so you can save on insuring your eco-friendly car. With a solid reputation and coverage available in many areas, State Farm is a reliable choice if you’re looking for affordable, trustworthy coverage for your EV.

These discounts show how insurers are supporting the move to electric vehicles while helping you keep your premiums low.

When searching for the best insurance for electric cars, Reddit users say their experiences vary based on location, vehicle model, and insurer. For example, one user mentioned that switching to a Model Y only raised their USAA premium slightly, while another found AAA’s rates significantly higher in California. Here’s a Reddit post where EV owners share insights on insurers they’ve tried:

From the Reddit comments, it’s clear that while some users prefer USAA, State Farm, or Progressive for their EVs, rates can vary widely based on repair costs and regional pricing. This feedback can be helpful if you’re shopping for the best auto insurance for electric vehicles, especially when paired with our reviews of top providers.

Learn More:

- Geico Auto Insurance Discounts

- State Farm Auto Insurance Discounts

- Progressive Auto Insurance Discounts

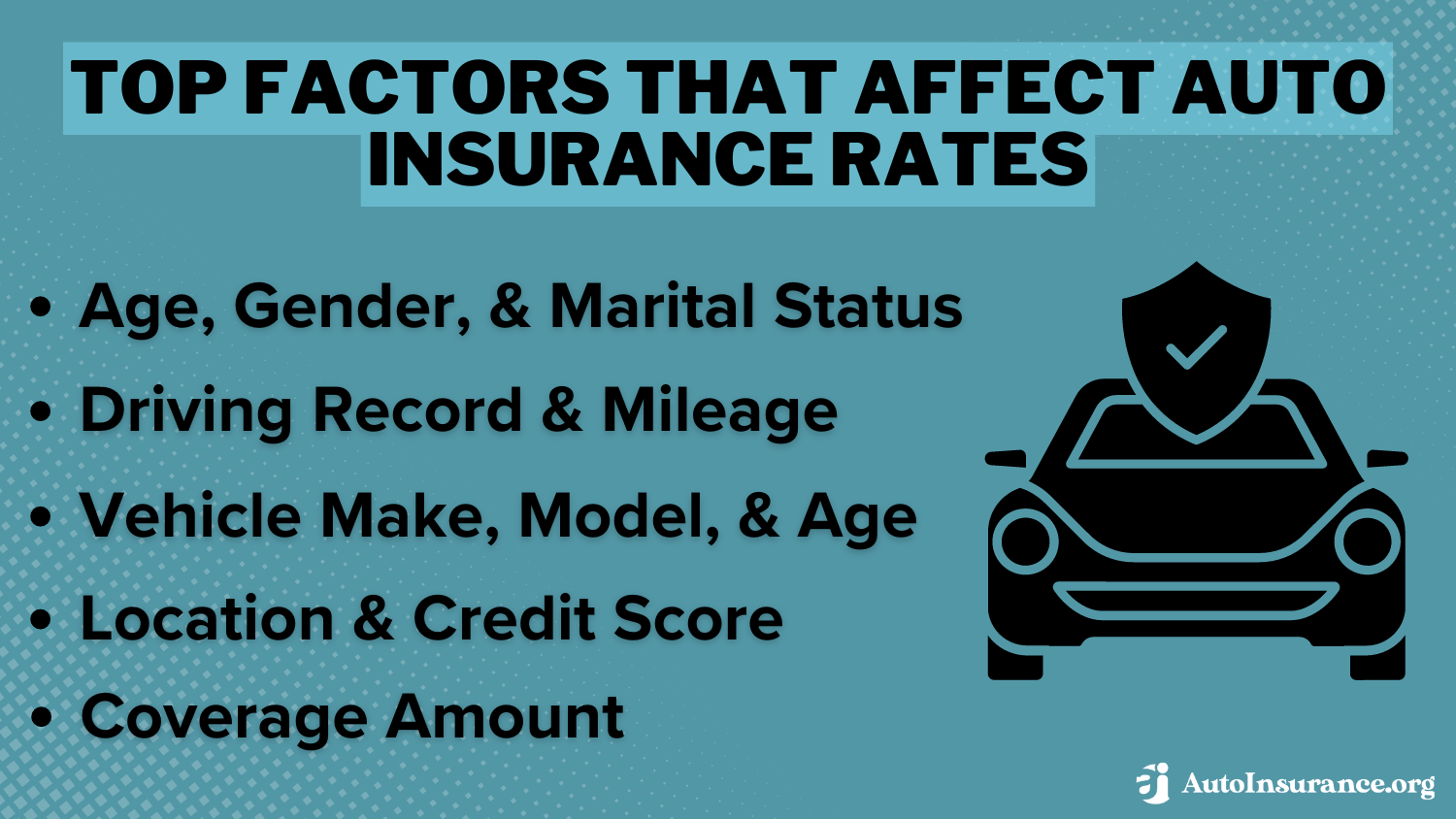

Why Electric Vehicle Auto Insurance Costs More

There are various factors that affect auto insurance rates for EVs. Electric vehicle auto insurance costs more than coverage for gas-powered cars because electric and hybrid vehicles have specialized parts and advanced technology, meaning insurers will pay out more for claims.

You’ll pay around $158 per month for an EV insurance policy. Check out the table below to compare auto insurance rates by vehicle make and model for electric cars:

Electric Car Insurance Monthly Rates by Model

| Model | Cost |

|---|---|

| Audi E-tron | $210 |

| Fiat 500c | $122 |

| Ford Focus | $136 |

| Ford Fusion | $140 |

| Hyundai Ioniq | $149 |

| Jaguar I-PACE | $153 |

| Nissan Leaf | $153 |

| Smart EQ Fortwo Prime | $130 |

| Smart EQ Fortwo Pure | $125 |

| Tesla Model 3 | $180 |

| Tesla Model S | $222 |

| Tesla Model X | $219 |

| Toyota Prius | $145 |

As shown, Toyota Prius auto insurance prices are relatively affordable, averaging $145 monthly — you can also get a hybrid vehicle auto insurance discount for your Prius. On the other hand, you’ll pay around $180/mo for Tesla Model 3 auto insurance.

How to Qualify for Electric Vehicle Auto Insurance Discounts

You might be wondering how to get a discount on your electric auto insurance if you recently purchased an electric or hybrid vehicle. Simply ask your insurance company if they offer any electric car insurance discounts specifically or discounts for having an EV home charging station.

Electric vehicles have higher price tags and may require specialized repair facilities. So, insurers consider this when setting rates.Tracey L. Wells LICENSED INSURANCE AGENT AND AGENCY OWNER

Green vehicle owners may also be more likely to qualify for other discounts, such as a safety feature or low-mileage discount.=

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hybrid vs. Electric Vehicle Auto Insurance Discounts

Most of the top auto insurance providers offer the discounts listed below to make your EV insurance policy cheaper:

- Green Vehicle Auto Insurance Discount

- Low Mileage Auto Insurance Discount

- Anti-Lock Brakes Auto Insurance Discount

- Good Driver Auto Insurance Discount

Finding the best car insurance for electric vehicles involves comparing good hybrid and electric auto insurance discounts from various companies.

Companies Offering Electric Vehicle Auto Insurance Discounts

Some companies offer EV owners an electric and/or hybrid vehicle auto insurance discount for simply owning an electric or hybrid car. Other discounts, such as a safety features discount, aren’t specific to EVs but may apply to them. See the table below to compare auto insurance discounts for electric vehicles from the top insurers:

Top Electric Vehicle Insurance Discounts by Provider

| Insurance Company | Energy Efficiency | Green Vehicle | Home Charging | Low Mileage | Safety Features |

|---|---|---|---|---|---|

| 0% | 5% | 10% | 0% | 5% | |

| 0% | 5% | 10% | 10% | 5% | |

| 5% | 5% | X | 0% | 5% | |

| 10% | 10% | X | 10% | 10% | |

| 0% | 5% | 10% | 10% | 5% |

| X | 10% | X | 10% | 10% |

| 0% | 5% | X | 10% | 5% | |

| X | 10% | X | 10% | 10% | |

| 5% | 5% | X | 0% | 5% | |

| X | 10% | X | X | 10% |

USAA, Nationwide, State Farm, and Geico auto insurance’s electric car discount for green vehicles offers savings of up to 10%. Our Geico auto insurance review breaks it down. Read more about the best auto insurance companies for eco-friendly drivers.

EV Federal Tax Incentives and Other Auto Insurance Discounts

If your income isn’t too high, you could qualify for a $7,500 federal EV tax credit for new clean vehicles purchased in 2023 or after. You must meet certain IRS requirements for manufacturing, and if the electric car you buy is too expensive, you may only get a partial credit.

For example, certain vehicles, including the Chevrolet Bolt and the Tesla Model Y, qualify for the full $7,500 credit — learn how to find cheap Tesla auto insurance.

It’s tax season: owning an EV could mean qualifying for a💲7,500 tax credit?! Cha-Ching!💵 Want to continue the trend of putting money back into your wallet? check out 👉https://t.co/27f1xf131D for our free auto insurance comparison tool.🚗EV review: https://t.co/zpSqHn8Sf8 pic.twitter.com/5QfhNjSrIE

— AutoInsurance.org (@AutoInsurance) February 25, 2023

Other possible auto insurance discounts for electric vehicles include usage-based auto insurance, which monitors driving habits and offers a sizeable discount if you drive safely. A usage-based policy is an excellent way to find the best insurance for EVs if you’re a safe driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Ways to Save on Electric Vehicle Auto Insurance

There are always tips you can follow to get the best car insurance for electric cars. Read the list below to learn how to lower your auto insurance cost for electric vehicles:

- Increase your auto insurance deductible.

- Shop around with various companies.

- Ask your insurer how to save money by bundling insurance policies.

Of course, you could also find an older EV to insure for lower rates. Learn more about auto insurance for older cars.

More About How to Find Electric Vehicle Auto Insurance Discounts

You can get EV insurance discounts of up to 10% from the best auto insurance companies for EVs — all you have to do is ask.

In addition, it’s important to compare cheaper auto insurance vs. fuel efficiency savings when shopping around for affordable electric vehicle auto insurance rates.

Insert your ZIP code into our free quote comparison tool below to find affordable electric auto insurance in your area.

Frequently Asked Questions

Is car insurance cheaper for electric vehicles?

A common question we get is, “Is car insurance cheaper for electric cars?” The answer is yes, but it depends on a few factors. For electric cars, insurance costs can sometimes be higher due to the cost of repairs and replacement parts and the specialized technology involved. However, many insurance companies offer discounts for electric vehicles, which can help lower your EV car insurance cost.

What is the cheapest auto insurance for EV?

Your EV insurance price will depend on various factors. However, State Farm auto insurance and Geico generally offer excellent electric vehicle rates.

How much more is EV auto insurance?

Electric vehicle auto insurance costs around 33% more than standard policies. However, you can save up to 10% with a State Farm or Geico electric auto insurance discount.

What are the auto insurance discounts for having an electric car?

Many of the top auto insurance companies offer discounts ranging from 5% to 10% for electric car drivers, including State Farm, Geico, and Nationwide.

How much is insurance for an electric car?

On average, EV auto insurance costs $158 monthly. However, quotes vary, so shop around for discounts and coverage options and find the cheapest rates for your electric car.

Is any special auto insurance required for electric cars?

Buying auto insurance for an EV is the same as buying it for a gas-powered car. You must carry liability auto insurance coverage to drive legally in most states.

Is EV auto insurance more expensive for Tesla cars?

Yes, Teslas are more expensive to insure than other car makes, even electric cars. While the average EV insurance cost is $158/mo, auto insurance for a Tesla averages over $200 monthly.

What is the cheapest electric car to insure?

You’ll find the cheapest EV insurance rates with the Fiat 500c, averaging $122 monthly.

Read More: Cheap Fiat Auto Insurance

Do electric vehicles cost more to maintain?

EVs don’t need as much repair and maintenance as gas cars, so they’re cheaper to maintain.

Does owning an EV save you money?

According to a 2020 Consumer Reports study, maintenance costs for electric cars are 50% cheaper than standard cars. So not only can you find affordable EV insurance coverage, but you can also save on regular maintenance.

Are electric cars covered by insurance?

Which Tesla model is the cheapest to insure?

Are there disadvantages to owning an electric vehicle?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.