Kentucky Minimum Auto Insurance Requirements in 2026 (Coverage You Need in KY)

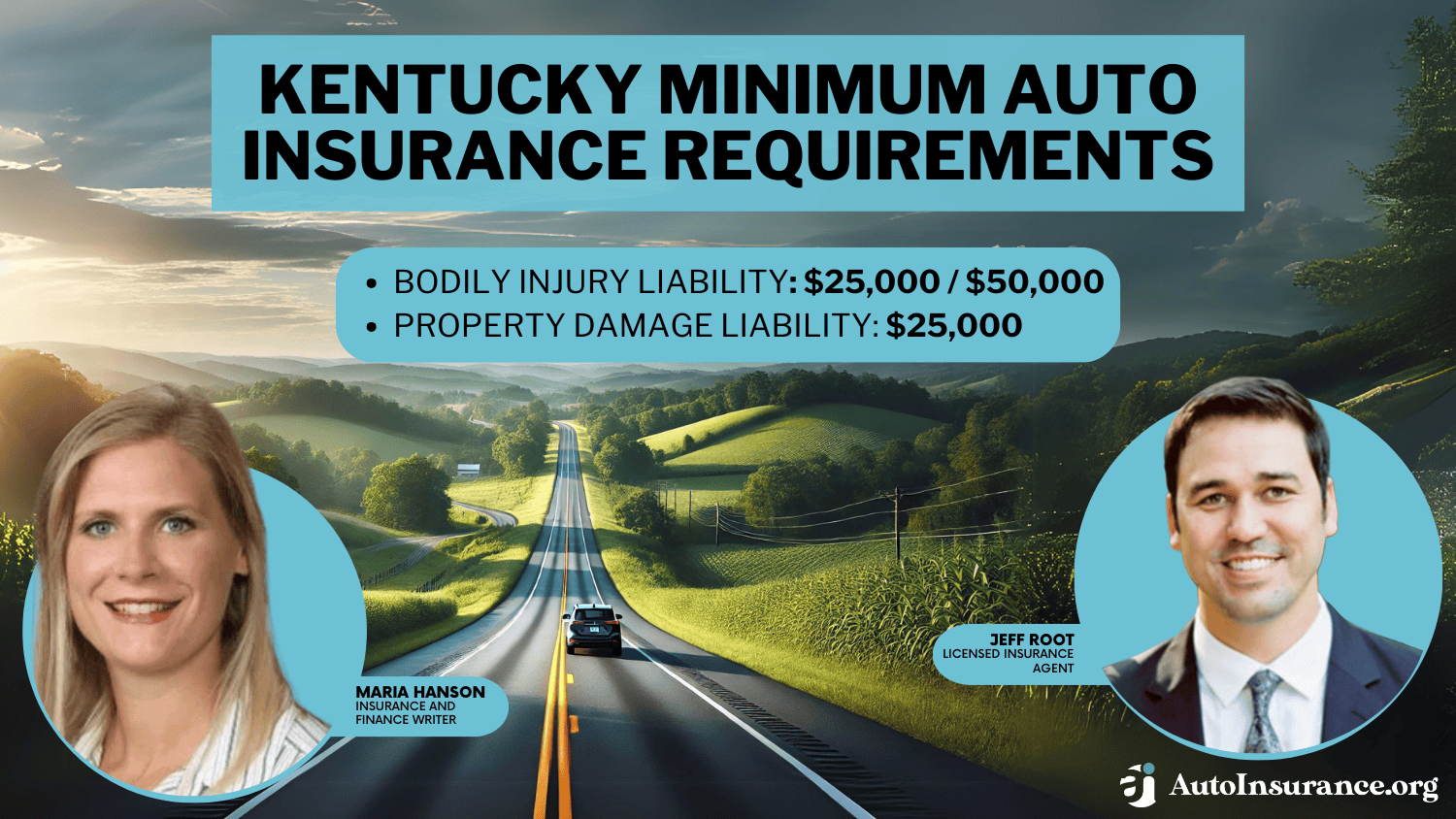

Kentucky minimum auto insurance requirements are 25/50/25, meaning drivers must carry $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. Kentucky auto insurance rates start at $26/mo. Comparing quotes can help KY drivers save on premiums.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated November 2024

Kentucky minimum auto insurance requirements specify that drivers must carry liability coverage of at least $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

Meeting these requirements is essential to comply with state law and avoid penalties. Many drivers, however, prefer to purchase more coverage to avoid the financial risks of significant accident costs that come with the minimum coverage.

Kentucky Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

USAA offers the lowest prices, starting at $26 per month, followed by Geico and State Farm. By comparing quotes, drivers can ensure they meet Kentucky minimum auto insurance requirements while saving on premiums and securing better financial protection in the event of an accident.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

- Kentucky minimum auto insurance requirements are 25/50/25 for injury and damage

- Meeting Kentucky’s minimum insurance limits is essential to avoid penalties

- USAA offers the lowest prices, starting at $26 per month for coverage

Kentucky Minimum Coverage Requirements & What They Cover

In Kentucky, drivers must meet specific coverage requirements outlined by Kentucky insurance laws. These Kentucky auto insurance requirements are mandatory for anyone operating a vehicle for personal use and include the following:

- Bodily Injury Liability: Bodily injury liability auto insurance is a required type of car insurance in Kentucky, and it is designed to pay another party’s medical expenses up to the coverage limit if you cause an accident. The requirements are $25,000 per person and $50,000 per accident for bodily injury liability.

- Property Damage Liability: Property damage liability auto insurance is the final type of required car insurance in this state, and it pays for the vehicle repair bills or other property damage repair expenses up to the coverage limits for another person if you cause the accident. The requirements are $25,000 per incident for property damage liability.

These limits represent the Kentucky minimum general liability, ensuring that drivers have basic financial protection in case of an accident. Meeting the Kentucky minimum car insurance requirements is essential for legal driving and provides coverage for injuries and damages to others in an accident.

Meeting Kentucky's minimum auto insurance requirements is essential to stay compliant, but opting for higher coverage can provide better financial protection in case of an accident.Joel Ohman Certified Financial Planner

However, if a car is used for commercial purposes, stored in a garage without being driven, or used in other special situations, additional coverage may be required to comply with Kentucky insurance laws.

It is crucial to review your policy to ensure it meets the specific requirements for your situation.

Read more: When to Buy More Than Minimum Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Kentucky

When searching for the cheapest car insurance in Kentucky, several providers offer competitive rates that meet the Kentucky state minimum car insurance requirements. USAA is the most affordable, starting at $26 per month, followed by Geico at $29 per month and State Farm at $36 per month.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThese companies provide coverage that meets the KY state minimum car insurance requirements, which include $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. These are the Kentuckys’ auto insurance requirements for personal vehicles.

Kentucky Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Bowling Green | $160 |

| Covington | $150 |

| Florence | $149 |

| Georgetown | $142 |

| Hopkinsville | $148 |

| Lexington | $190 |

| Louisville | $208 |

| Nicholasville | $147 |

| Owensboro | $157 |

| Richmond | $145 |

The car insurance rates in Kentucky vary depending on the city, from as high as $208 per month in Louisville to as low as $160 in Bowling Green and $142 in Georgetown. Drivers are required to ensure that they meet the minimum coverage requirements if they want to be compliant with Kentucky car insurance laws.

Compare the rates of USAA, Geico, and State Farm to find an affordable choice that may satisfy the auto insurance requirements in Kentucky.

Read more: What are the recommended auto insurance coverage levels?

Other Coverage Options to Consider in Kentucky

Shopping around for new coverage in Kentucky is a great way to ensure that you have the full amount of insurance that you need. Remember that you are required to buy the minimum amount of coverage, but you also may need to buy optional coverage for an additional fee.

Kentucky drivers need to understand the differences in the various coverage types available before they make a buying decision, and these are a few of the more common types of car insurance that you can choose to buy in this state.

- Personal Injury Protection (PIP)/Medical Payments: Personal injury protection auto insurance is another type of required car insurance in Kentucky, and this coverage pays for your own medical expenses if you are involved in an accident.

- Collision: Collision auto insurance in Kentucky is optional. It pays for your own vehicle repairs if you are in an accident, but it only pays for repairs related to vehicle damage from a collision.

- Comprehensive: Comprehensive auto insurance is optional in this state as well, and it is more inclusive than collision coverage. It also pays for repairs related to a collision as well as damages resulting from theft, fire, weather damage, and more.

- Uninsured and Underinsured Motorist Coverage: Uninsured and underinsured motorist coverage is required in some states, but it is optional in Kentucky. This type of auto insurance provides you with benefits if you are involved in a hit-and-run accident or if you are hit by an uninsured or underinsured motorist.

Kentucky car insurance requirements are written with one of these descriptive terms as well as with a dollar amount.

The dollar amount represents the maximum benefits that the insurance company will pay out for that type of coverage, and any expenses that you incur beyond this coverage limit are your responsibility to pay for out of your own funds.

Some drivers will increase their coverage limits for the required and optional auto insurance types to reduce the chance of paying for expenses out of their own pockets.

Penalties for Driving Without Auto Insurance in Kentucky

Driving without insurance in Kentucky is a serious violation with strict penalties. The state enforces compliance with the minimum car insurance requirements in Kentucky using an electronic verification system to ensure drivers meet the state minimum car insurance requirements in Kentucky.

If you are caught without insurance, the penalties you could face include:

- A Fine of up to $1,000

- Imprisonment for up to 90 Days

- Suspension of Your License Plates

- A Requirement to Purchase High-Risk Insurance

It is crucial to understand the types of liability coverage in Kentucky to avoid these penalties and remain protected. Kentucky law requires KY liability insurance covering at least $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

Meeting these state minimum car insurance requirements in Kentucky not only keeps you legally compliant, but also provides financial protection in the event of an accident. Ensure you stay informed and insured to drive legally and safely in Kentucky.

Read more: Cheapest Liability-Only Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Requirements vs. Recommended Coverage in KY

Many Kentucky drivers consider purchasing only the KY state minimum auto insurance requirements to save on premiums, as this satisfies Kentucky liability insurance requirements and complies with KY insurance laws.

However, relying solely on minimum coverage can leave you financially vulnerable if damages from an accident exceed your policy limits.

Meeting the minimum coverage helps you avoid this penalty for driving in Kentucky without insurance. However, it would also be advisable to have more coverage, as that offers much better financial protection and peace of mind in case something unexpected happens.

In addition, explore Florida minimum auto insurance requirements to understand how different coverage options can impact your protection and help you find the best policy for your needs.

How to Read Car Insurance Requirements in Kentucky

When exploring Kentucky auto insurance options, it is important to understand how KY car insurance laws impact the type and amount of coverage you need.

Before purchasing a policy, decide whether you want coverage beyond the minimum required by law. Use a Kentucky auto insurance guide to explore additional coverage options that might benefit you.

Why You Should Drive with Auto Insurance in Kentucky

📞Dealing with Insurance Companies After an Accident?#InsuranceClaims #PersonalInjury https://t.co/wMfeR9O0FH

Car Accident Lawyer Covington Kentucky

CALL IS FREE / NO FEE UPFRONT / ONLY PAY IF YOU WIN!!!#caraccidentlawyer pic.twitter.com/mlsi6cSRvO— Christopher Jackson (@ChrisJacksonLaw) November 23, 2024

Kentucky auto insurance rates should be matched among the providers you are using. They will also provide a good reputation for customer satisfaction and financial stability.

You can easily get affordable plans for choosing online quotes, but it is also very essential to choose a reliable company that complies with Kentucky auto insurance laws to guarantee ample protection and peace of mind in case of an accident.

Read more: Michigan Minimum Auto Insurance Requirements

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

What are the minimum auto insurance requirements in Kentucky?

In Kentucky, the minimum auto insurance requirements are $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $25,000 for property damage liability per accident, commonly referred to as 25/50/25 coverage.

What is property damage liability coverage?

Property damage liability coverage is a type of insurance that helps cover the costs of damages to someone else’s property caused by an accident for which you are at fault. It can provide compensation for repairs, replacement, or other related costs up to the coverage limits of your policy. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

What does bodily injury liability coverage include?

Bodily injury liability coverage is a type of insurance that helps cover the costs associated with injuries or death caused by an accident for which you are at fault. It can provide compensation for medical expenses, lost wages, and other related damages for the injured party up to the coverage limits of your policy.

Read more: Full Coverage Auto Insurance

Are the minimum liability limits in Kentucky sufficient?

While the minimum liability limits in Kentucky meet the legal requirements, they may not provide enough coverage in certain situations. If the costs resulting from an accident exceed your coverage limits, you could be held personally responsible for the remaining expenses. It’s often recommended to consider higher liability limits to provide better protection for yourself and your assets.

Are there any additional coverage options I should consider besides the minimum requirements?

Yes, it’s advisable to consider additional coverage options beyond the minimum requirements. Some common additional coverages to consider include collision coverage (for damages to your vehicle in an accident), comprehensive coverage (for non-collision-related damages such as theft or vandalism), uninsured/underinsured motorist coverage (to protect against drivers without insurance or with insufficient coverage), and medical payments coverage (to help cover medical expenses for you and your passengers).

Can I choose not to carry auto insurance in Kentucky?

No, auto insurance is required by law in Kentucky. Driving without insurance can result in penalties, including fines, license suspension, and vehicle registration suspension. It’s important to maintain continuous insurance coverage to comply with the state’s requirements. Explore the best auto insurance companies to discover top-rated providers and find the perfect policy to suit your needs and budget.

Can I use my out-of-state auto insurance in Kentucky?

If you are a resident of Kentucky, you are generally required to have auto insurance that meets the state’s minimum requirements. Out-of-state insurance policies must be valid and meet or exceed Kentucky’s minimum requirements. If you move to Kentucky or establish residency, it’s important to update your insurance to comply with the state’s regulations.

What happens if I drive in Kentucky without meeting the state’s minimum auto insurance requirements?

Driving without the required auto insurance in Kentucky can lead to severe penalties. These include fines, suspension of your driver’s license, and suspension of vehicle registration. The state uses an electronic verification system to monitor compliance, making it crucial to maintain valid insurance coverage to avoid legal and financial repercussions.

How do Kentucky’s minimum insurance requirements apply to out-of-state drivers?

Out-of-state drivers must have an auto insurance policy that meets or exceeds Kentucky’s minimum requirements if they are driving within the state. Residents moving to Kentucky or those establishing residency must update their insurance to comply with Kentucky’s laws promptly to avoid penalties. Check out the best auto insurance for out-of-state drivers to ensure you’re fully covered and meet Kentucky’s insurance requirements while driving in the state.

Can I bundle my auto insurance with other policies to save on premiums in Kentucky?

Yes, many insurance providers in Kentucky offer discounts when you bundle auto insurance with other policies, such as home or renter’s insurance. Bundling can simplify policy management and often leads to cost savings. Be sure to compare quotes and evaluate the total coverage and discounts provided before making a decision.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.