Best Yonkers, New York Auto Insurance in 2026

The best cheap auto insurance in Yonkers, NY comes from GEICO, with rates averaging $388 per month or $4,659 annually. However, premiums vary for each person. Yonkers, NY auto insurance must meet the state minimum requirements of 25/50/10 for liability and $50,000 in PIP coverage, along with uninsured motorist coverage that matches liability amounts. Compare Yonkers, NY auto insurance quotes online to get your most affordable rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

- The best cheap auto insurance in Yonkers, NY comes from Geico.

- Yonkers, NY neighbors New York City, one of the world’s most congested cities, causing your insurance rates to increase.

- Yonkers car insurance rates are cheaper than New York City rates but more expensive than in rural parts of New York.

Yonkers, New York auto insurance is higher than average due to its proximity to New York City. Traffic from the Big Apple heavily impacts your annual rates.

Read through our guide to learn how to secure cheap auto insurance in Yonkers, NY by comparing rates online from multiple providers.

Monthly Yonkers, NY Car Insurance Rates by ZIP Code

Check out the monthly Yonkers, NY auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

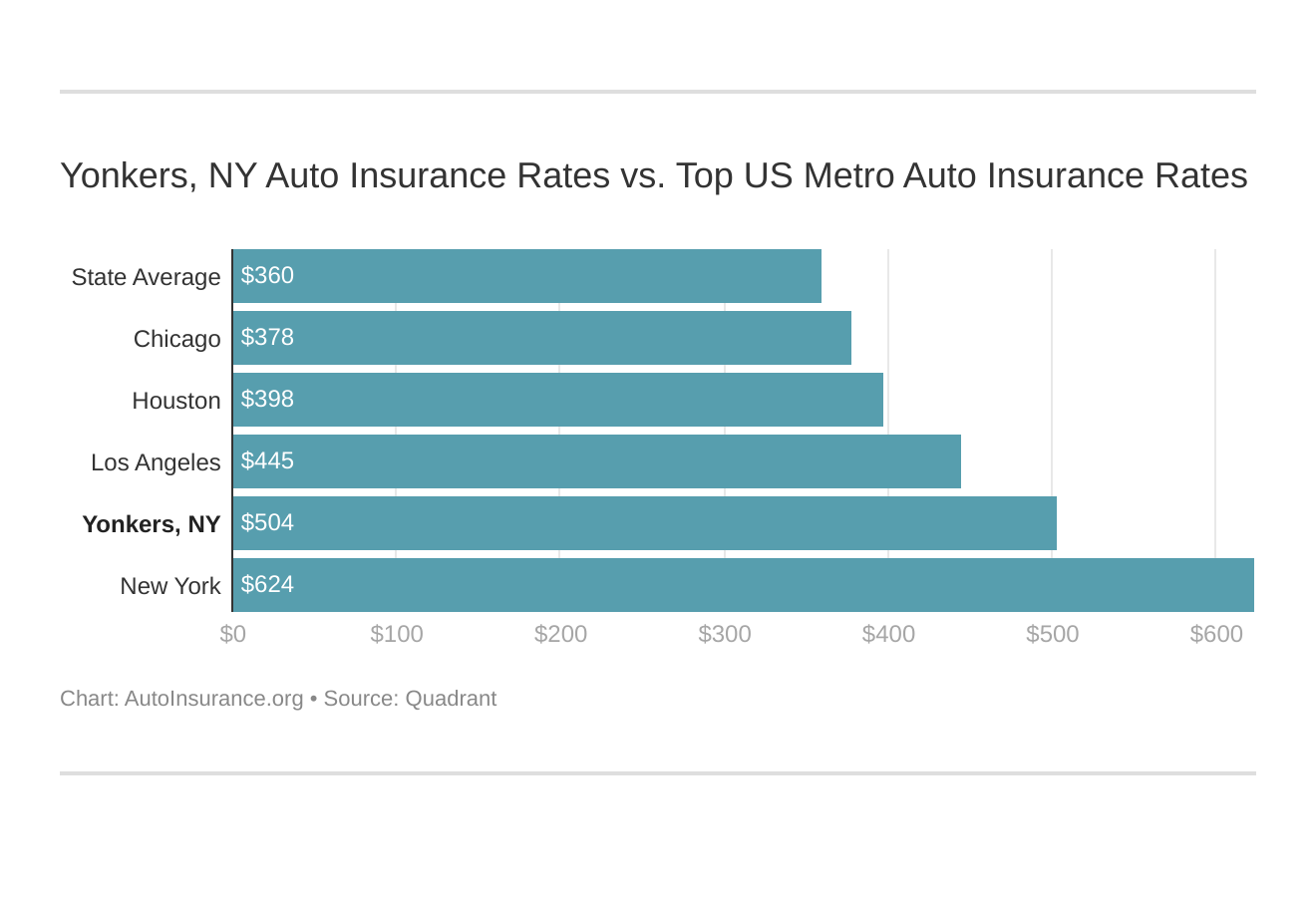

Yonkers, NY Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Yonkers, NY stack up against other top metro auto insurance rates? We’ve got your answer below.

Ready to buy Yonkers, NY car insurance? Enter your ZIP code into our free quote tool above to immediately compare affordable Yonkers, NY auto insurance quotes from reputable companies near you.

What is the cheapest auto insurance company in Yonkers, NY?

The cheapest Yonkers, NY auto insurance company is Geico. Rates average around $388 per month or $4,659 annually. Read this Geico auto insurance review to find out more about what they offer.

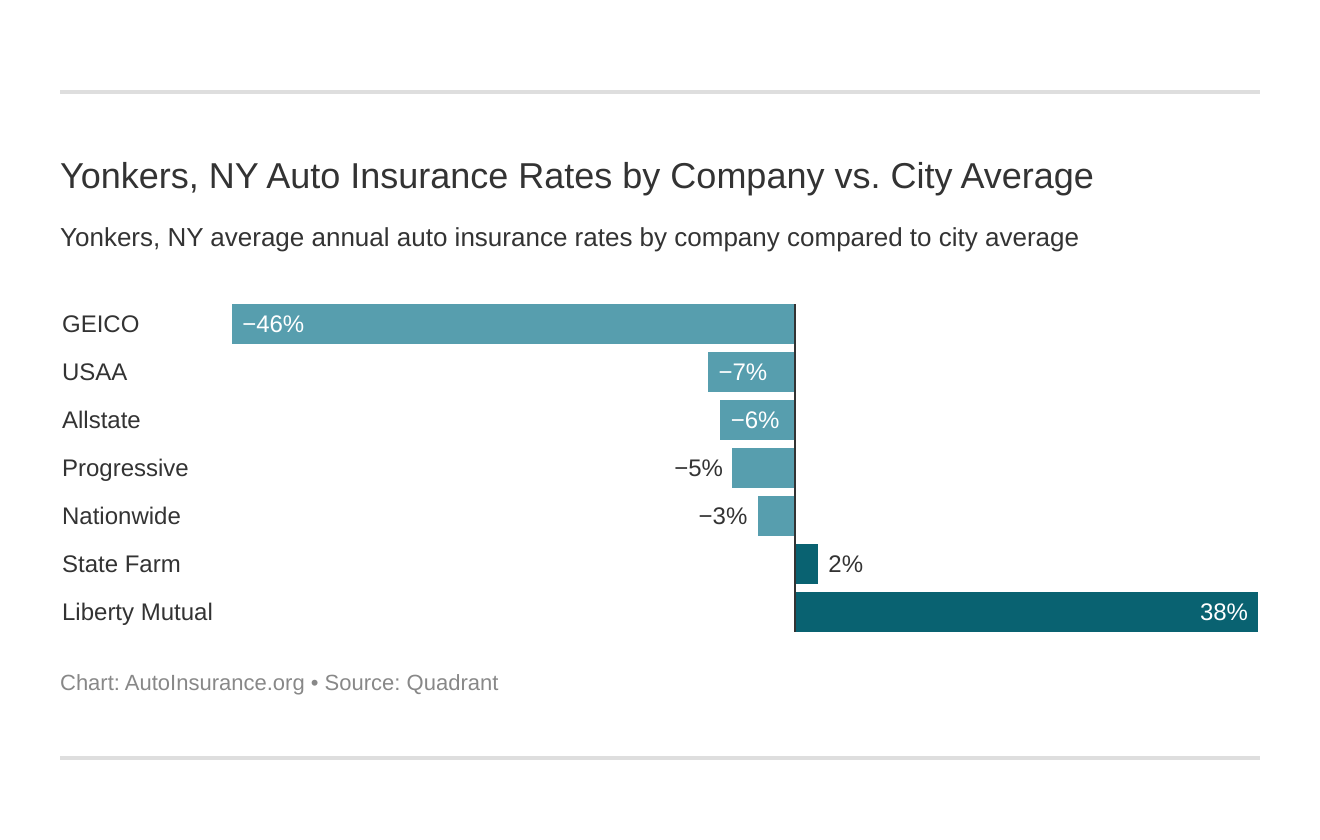

Which Yonkers, NY auto insurance company has the cheapest rates? And how do those rates compare against the average New York auto insurance company rates? We’ve got the answers below.

See a list of the top insurance providers in Yonkers from least to most expensive below:

- Geico – $4,659.27

- Progressive – $6,421.93

- USAA – $7,911.66

- Allstate – $9,409.56

- Travelers – $9,445.50

- Nationwide – $9,635.58

- State Farm – $9,732.52

- Liberty Mutual – $17,137.58

While these totals are higher than rural regions, Yonkers residents pay less than the average costs for auto insurance in New York City, NY.

Your premiums will vary depending on your age, driving record, and even the type of vehicle you drive. You can compare auto insurance rates by make and model. The level of coverage you purchase also affects your insurance costs.

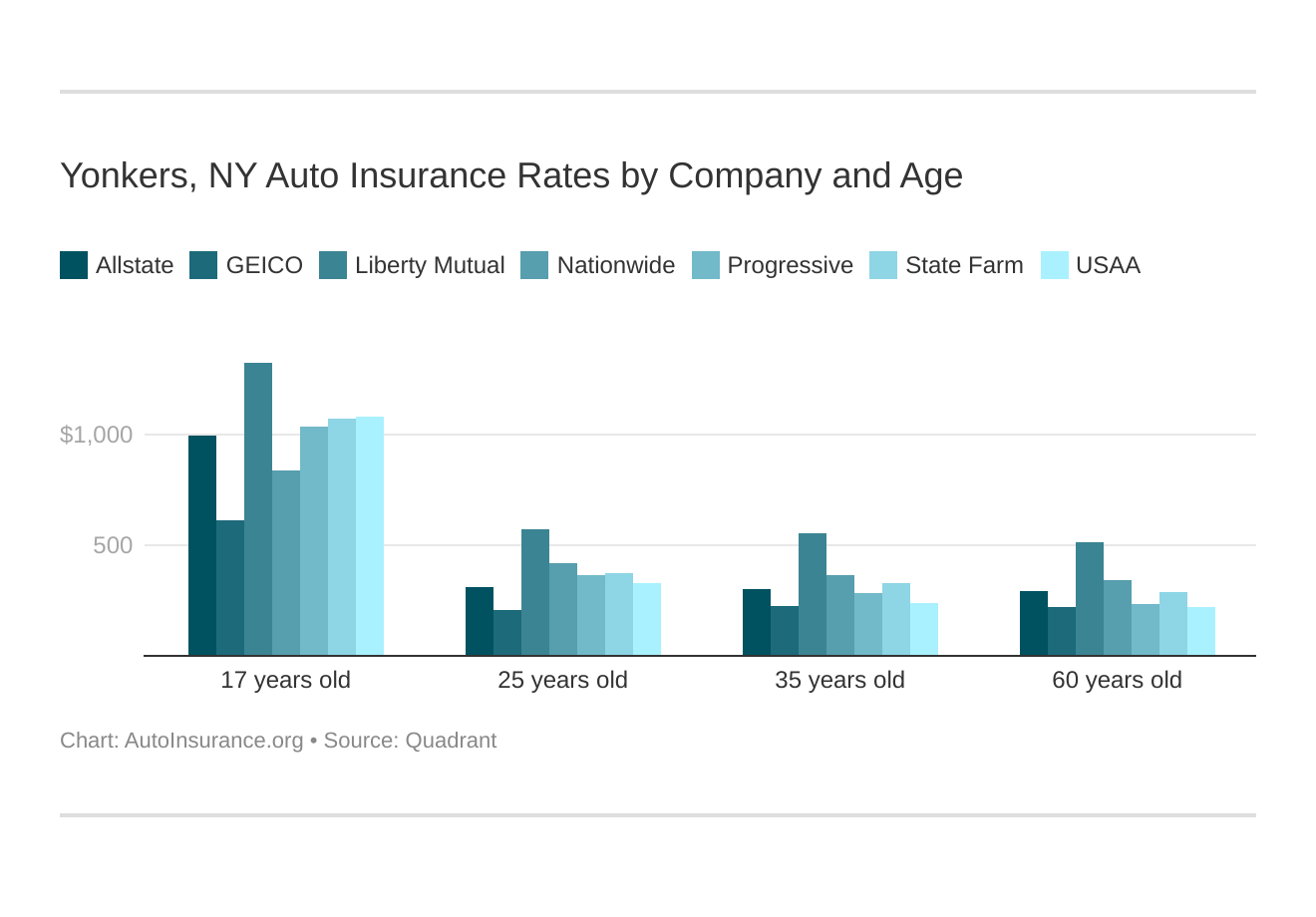

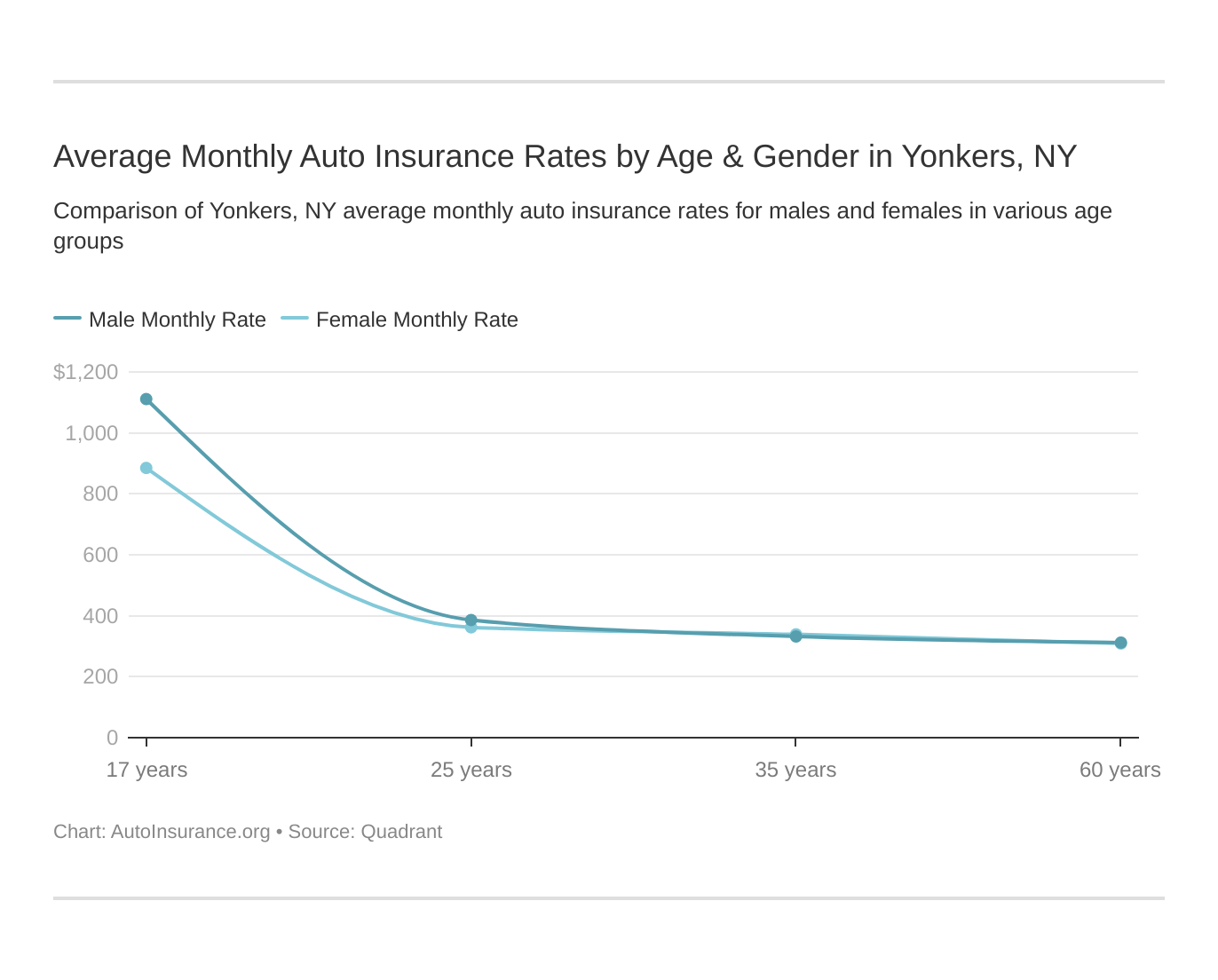

Yonkers, NY auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

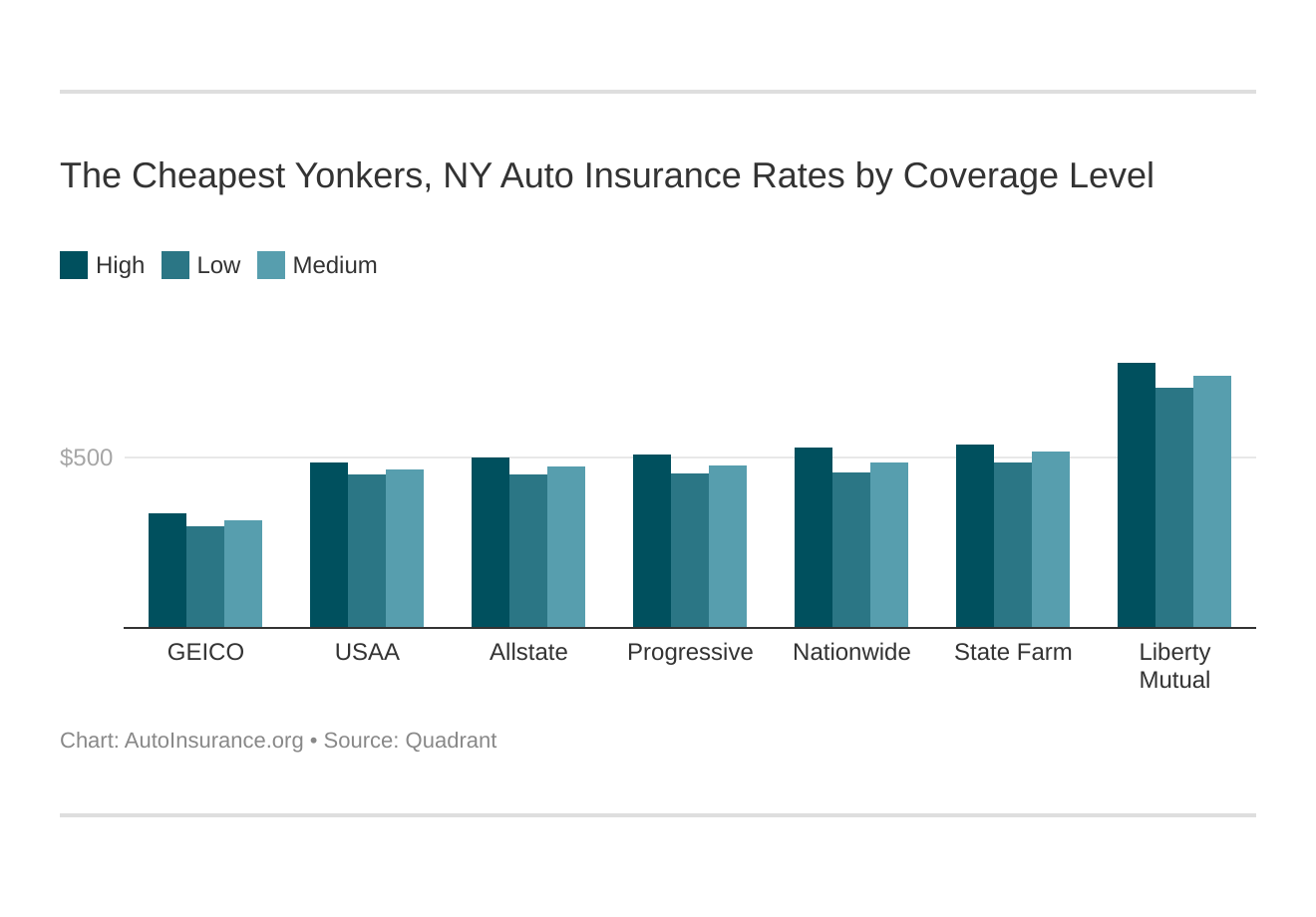

Your coverage level will play a major role in your Yonkers auto insurance rates. Find the cheapest Yonkers, NY auto insurance rates by coverage level below:

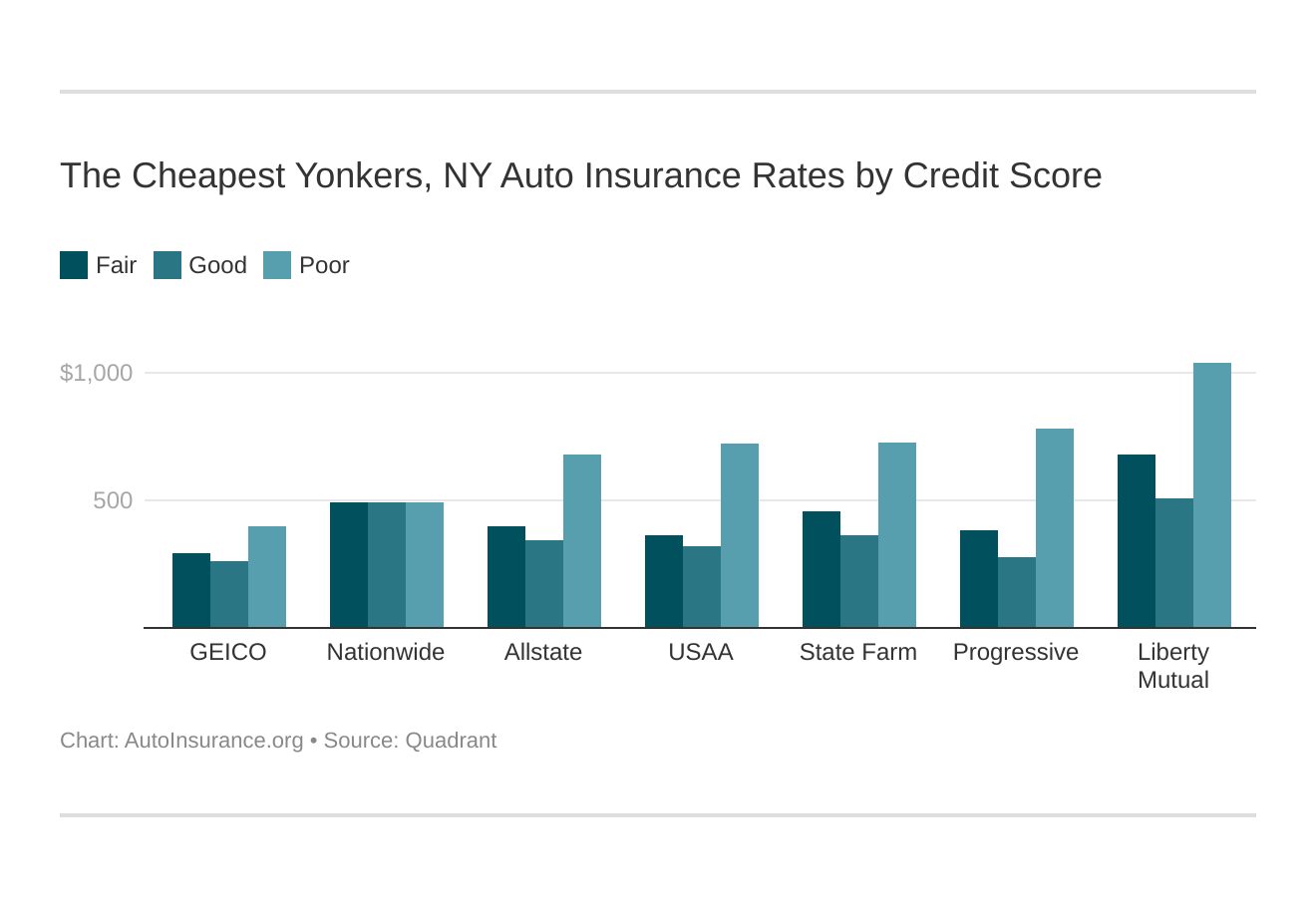

Auto insurance and your credit score are related if you live in Yonkers or many other areas of the country. These states, however, do not allow discrimination based on credit: California, Hawaii, and Massachusetts. Find the cheapest Yonkers, NY auto insurance rates by credit score below.

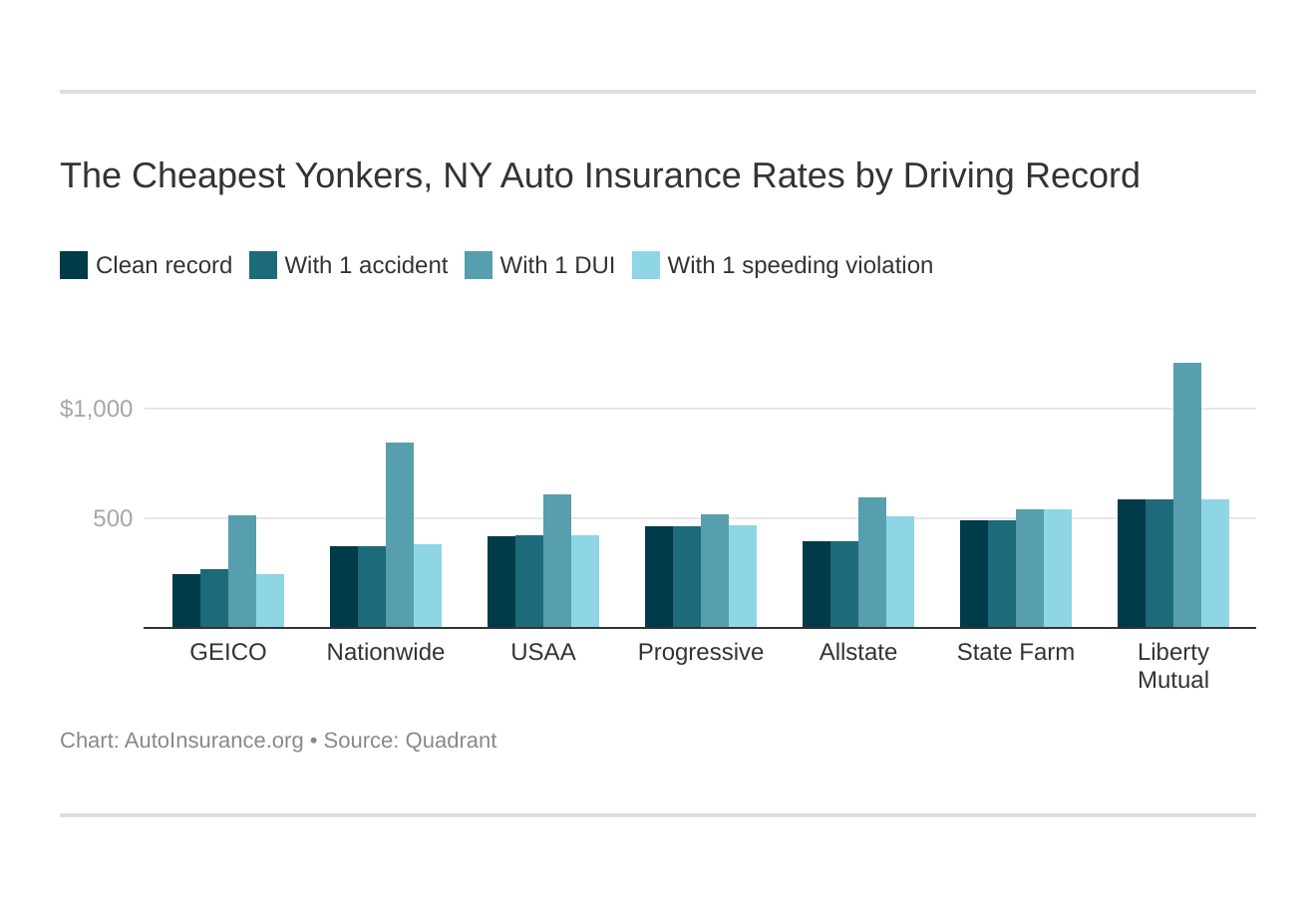

Your driving record will play a major role in your Yonkers auto insurance rates. For example, other factors aside, a Yonkers, NY DUI may increase your auto insurance rates 40 to 50 percent. And it’s interesting to learn how auto insurance companies check driving records. Find the cheapest Yonkers, NY auto insurance rates by driving record.

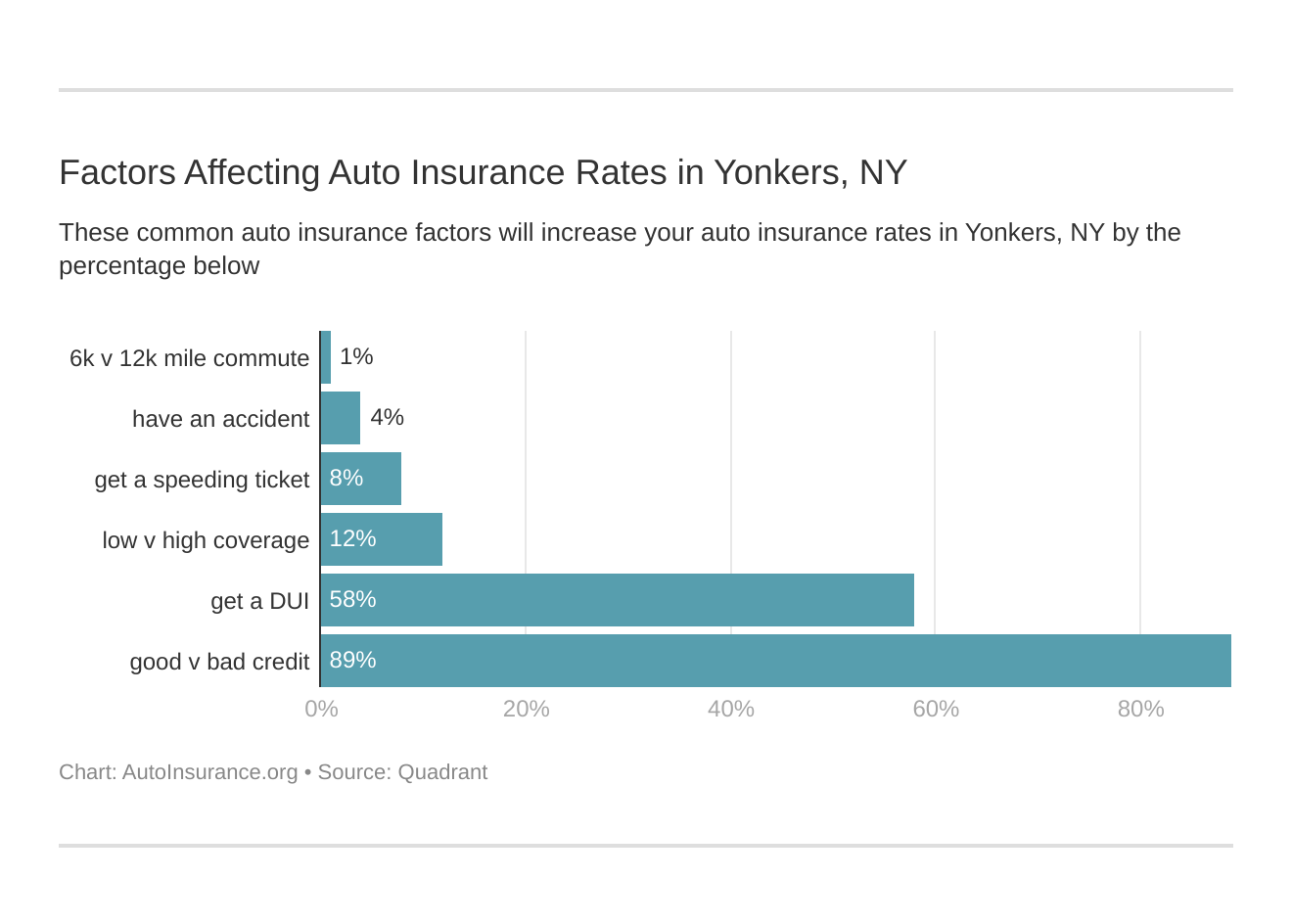

Factors affecting auto insurance rates in Yonkers, NY may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Yonkers, New York auto insurance.

New York does use gender, so check out the average monthly auto insurance rates by age and gender in Yonkers, NY. It’s surprising how male vs. female auto insurance rates stack up.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Average car insurance rates by age can vary greatly.

What auto insurance coverage is required in Yonkers, NY?

If you live in Yonkers, you must meet the New York state auto insurance laws to drive legally.

In the state of New York, you must carry a minimum of:

- $25,000 per person and $50,000 per accident in bodily injury liability coverage.

- $50,000 for death per person and $100,000 for death per accident.

- $10,000 per accident in property damage liability.

- $50,000 in personal injury protection (PIP) coverage.

- Uninsured/underinsured motorist coverage that matches the minimum liability limits.

New York is a no-fault state. If you are involved in an accident, you must rely on your car insurance to pay for any property damages and medical needs.

PIP insurance is a state requirement to ensure you have proper medical coverage. To find out what companies offer cheap PIP auto insurance in Yonkers, compare quotes from the multiple providers listed above.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Yonkers, NY?

Yonkers, NY is only 16 miles away from New York City. According to INRIX, New York City is the fourth most congested city in the country and the world’s 14th most congested city.

Yonkers residents feel the impact of the backed-up traffic both during commutes and in your auto insurance costs.

City-Data reports that the average commute length for a Yonkers resident is 32.9 minutes, much higher than the national average of 26 minutes.

Fortunately, Yonkers’ auto theft rate is low for a city of its size, which helps your car insurance costs. Crime reports from the Federal Bureau of Investigation (FBI) show that in 2017, there were only 182 vehicle theft incidents.

That’s a rate of 90.3 car thefts for every 100,000 residents.

Yonkers, NY Auto Insurance: The Bottom Line

Yonkers, New York is a safe city that experiences heavy traffic flow due to neighboring the city that never sleeps.

Your rates are higher than rural New York, but you can save on those costs by comparing Yonkers auto insurance quotes online.

Enter your ZIP code into our free tool below and receive Yonkers, NY auto insurance rates from reputable providers near you.

Frequently Asked Questions

What factors determine my auto insurance rates in Yonkers, NY?

Several factors influence your auto insurance rates in Yonkers, including your age, gender, marital status, driving experience, type of vehicle, annual mileage, and claims history.

Can I get a discount on my auto insurance in Yonkers, NY?

Yes, many insurance companies offer various discounts that can help lower your auto insurance premiums in Yonkers. These may include multi-policy discounts, good student discounts, safe driver discounts, and discounts for certain safety features installed in your vehicle.

What auto insurance coverage is required in Yonkers, NY?

In Yonkers, NY, you must meet the state’s minimum auto insurance requirements, which include:

- $25,000 per person and $50,000 per accident in bodily injury liability coverage.

- $50,000 for death per person and $100,000 for death per accident.

- $10,000 per accident in property damage liability.

- $50,000 in personal injury protection (PIP) coverage.

- Uninsured/underinsured motorist coverage that matches the minimum liability limits.

Do I need additional coverage beyond the state minimum requirements in Yonkers, NY?

While the state minimum requirements provide the basic coverage, it is often recommended to consider additional coverage options such as comprehensive and collision coverage to protect against theft, vandalism, and damage to your own vehicle.

Are there any special requirements for insuring a new teen driver in Yonkers, NY?

Teen drivers in Yonkers, NY are subject to the same insurance requirements as other drivers. However, adding a teen driver to your policy can significantly increase your premiums due to their lack of driving experience. It’s essential to notify your insurance provider when a teen driver obtains their driver’s license.

Can I use my personal auto insurance for ridesharing services in Yonkers, NY?

Most personal auto insurance policies do not cover commercial activities such as ridesharing services. If you plan to drive for a ridesharing company like Uber or Lyft in Yonkers, you may need additional coverage specifically designed for rideshare drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.