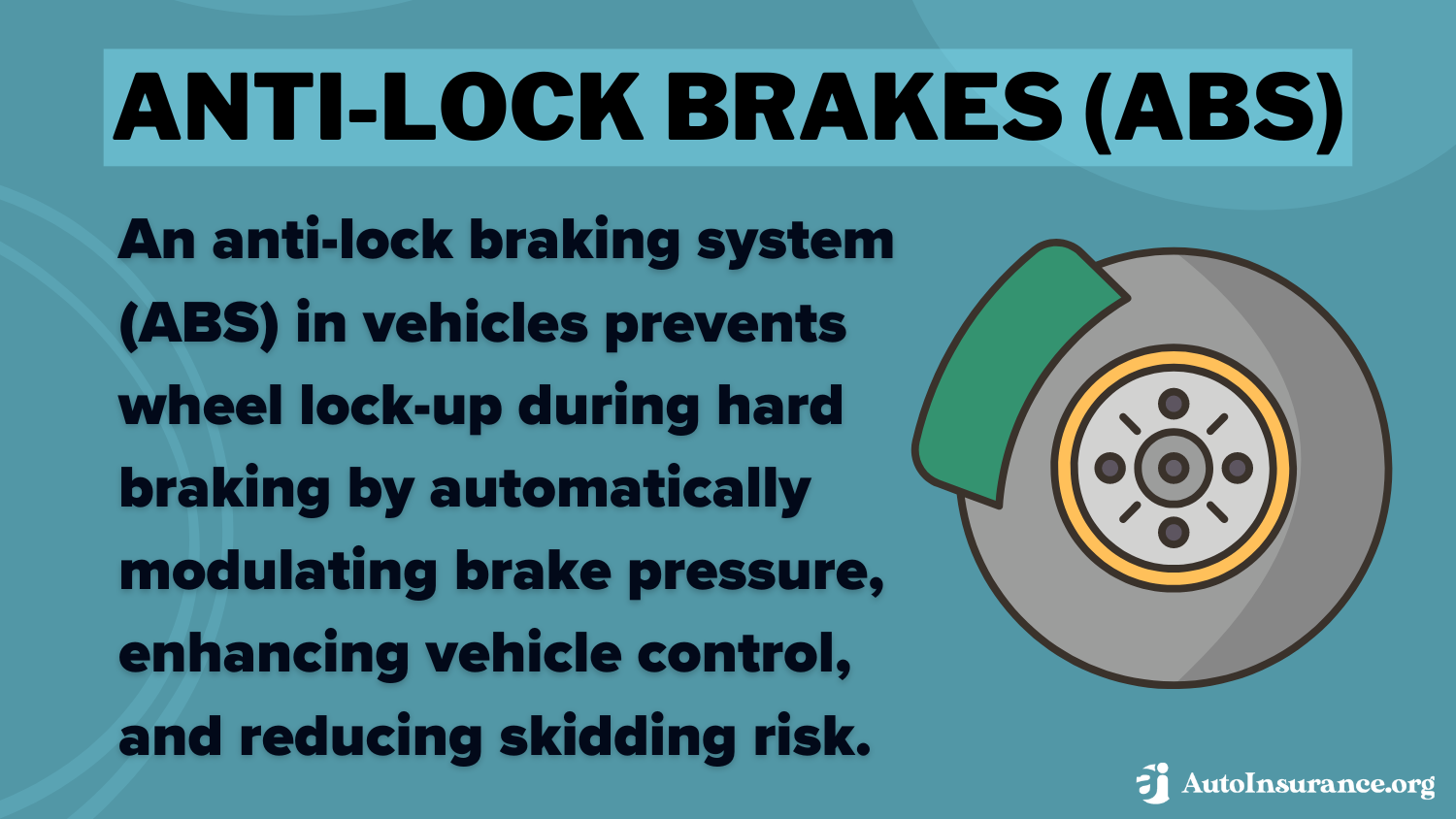

Best Anti-Lock Brakes Auto Insurance Discounts in 2026 (Save up to 10% With These Companies)

The best anti-lock brakes auto insurance discounts are offered by leading insurers such as Geico, State Farm, and Allstate, providing monthly savings of 10% on your premium. They provide competitive auto rates and reward drivers with anti-lock brakes through exclusive discounts for added savings.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

The best anti-lock brakes auto insurance discounts can significantly lower your premiums, and Geico stands out as the top choice for rates and savings. With discounts reaching up to 10% for vehicles equipped with anti-lock brakes, Geico effectively rewards safe driving.

Our Top 10 Company Picks: Best Anti-Lock Brakes Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 10% | A++ | Drivers with anti-lock brakes installed | |

| #2 | 8% | B | Policyholders with cars equipped with ABS | |

| #3 | 7% | A+ | Drivers with ABS on their vehicles | |

| #4 | 5% | A+ | Policyholders with anti-lock braking systems | |

| #5 | 5% | A++ | Active military, veterans, and families with ABS | |

| #6 | 5% | A+ | Drivers with anti-lock brakes |

| #7 | 4% | A | Drivers who have ABS installed in their cars | |

| #8 | 4% | A | Policyholders with ABS-equipped vehicles |

| #9 | 3% | A++ | Customers with anti-lock brakes in their cars | |

| #10 | 3% | A | Drivers with ABS in their vehicles |

Take advantage of the benefits that anti-lock brake discounts provide to enhance your coverage and reduce costs.

Begin saving on your auto insurance by entering your ZIP code and comparing quotes below to find the best anti-lock brakes auto insurance discounts.

- Find the best anti-lock brakes auto insurance discounts to save money

- Learn how anti-lock brake auto insurance discounts benefit drivers

- Enjoy monthly savings of up to 10% with top insurance providers

Best Anti-Lock Brakes Auto Insurance Discounts Overview

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Insurance Companies Offering Discounts

How Anti-Lock Brakes Impact Insurance Premiums

Qualifying for Anti-Lock Brakes Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximizing Your Savings on Auto Insurance

Frequently Asked Questions

What does it mean when the ABS light comes on?

When the ABS light illuminates your dashboard, it indicates that there is a problem with the anti-lock braking system. This could be due to a faulty sensor, low brake fluid, or a malfunctioning ABS module. It’s important to have the vehicle checked by a professional to ensure the braking system functions correctly.

What type of insurance discount might automatic seat belts earn you?

Automatic seat belts may qualify for safety feature discounts, similar to those offered for ABS. Insurers often provide discounts for vehicles with advanced safety features that reduce the risk of injury during accidents. The specific discount varies by insurer, so it’s advisable to check with your provider for details.

How can I find out if my vehicle has anti-lock brakes?

You can check your vehicle’s owner’s manual, look for a sticker or label in the driver’s door jamb, or consult the manufacturer’s website. Additionally, you can visually inspect the braking system or ask a mechanic for confirmation.

Are there any specific insurance companies that offer better discounts for vehicles with anti-lock brakes?

Can I receive a discount for installing an aftermarket anti-lock brake system?

Generally, discounts are more likely for factory-installed ABS. However, some insurers may consider aftermarket installations if you can provide proof of the system’s functionality. It’s best to check with your insurance provider for their specific policies.

Do all vehicles come equipped with anti-lock brakes?

While most modern vehicles are equipped with anti-lock brakes, it is still possible to find older models without them. Always verify the specifications of your vehicle. Check insurance rates now by inputting your ZIP code into our complimentary comparison tool (above/below) to find the best anti-lock brakes auto insurance discounts.

What other safety features can help lower my auto insurance premiums?

Additional safety features that may qualify for discounts include anti-theft devices, airbags, electronic stability control, and advanced driver assistance systems (ADAS).

How do insurance companies verify the presence of anti-lock brakes in a vehicle?

Will my insurance rates increase if I have a history of accidents, even with anti-lock brakes?

Yes, having a history of accidents can lead to increased insurance rates, regardless of safety features like anti-lock brakes. Insurers consider overall driving history when determining premiums.

What should I do if my ABS light is on before applying for an insurance discount?

If your ABS light is on, it’s important to have your vehicle inspected and repaired before applying for an insurance discount. Most insurers require that the ABS is functioning properly to qualify for discounts.

How many hard brakes does Progressive allow?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.