Best Auto Insurance for Classic Cars in 2026 (Your Guide to the Top 10 Companies)

Nationwide, Erie, and Farmers have the best auto insurance for classic cars. Nationwide and Erie both offer guaranteed value on classic cars, but Erie is cheaper at only $22/month for minimum coverage. Minimum classic car insurance is affordable since classic vehicles are driven less frequently.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated December 2024

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Classic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsNationwide, Erie, and Farmers have the best auto insurance for classic cars. Nationwide has no mileage limits, and Erie has the cheapest classic car insurance rates for $22/month.

Does my car qualify for classic auto insurance? Vehicles need to be at least ten years old to qualify for classic car insurance. If you have a car needing classic car insurance, the best companies to look at are listed below.

Our Top 10 Company Picks: Best Auto Insurance for Classic Cars

| Company | Rank | Pay-in-Full Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | Simple Claims | Nationwide |

| #2 | 18% | A+ | Senior Discounts | Erie |

| #3 | 12% | A | Online Convenience | Farmers | |

| #4 | 10% | A+ | Coverage Options | Amica Mutual | |

| #5 | 14% | A++ | Cost Savings | Auto-Owners | |

| #6 | 17% | A++ | Military Members | USAA | |

| #7 | 16% | A | Roadside Assistance | AAA |

| #8 | 13% | B | Local Agents | State Farm | |

| #9 | 19% | A+ | Policy Options | Allstate | |

| #10 | 11% | A | Costco Members | American Family |

To pick the perfect classic car insurance company for you, read on to learn more about each of these providers. You can also start shopping for classic car insurance quotes using our free tool.

- Nationwide has the best classic car auto insurance

- Other great classic car companies include Erie and Farmers

- Classic car insurance is often cheaper than new vehicle car insurance

#1 – Nationwide: Top Pick Overall

Pros

- Simple Claims: Nationwide has a simple claims process for classic cars, as it even allows customers to file online.

- Guaranteed Value Coverage: Nationwide will pay the full classic car value in a total loss.

- No Mileage Limits: Nationwide doesn’t have mileage limits on classic car insurance.

Cons

- Customer Ratings: Ratings could be better from classic car customers overall, as seen in our Nationwide review.

- High-Risk Driver Rates: Nationwide’s classic car insurance isn’t as affordable for DUI drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Senior Discounts

Pros

- Senior Discounts: Erie has discounts for senior customers purchasing classic car insurance. Check out our Erie review for a list of discounts Erie offers.

- Guaranteed Value Coverage: Erie’s guaranteed value ensures totaled car owners get the full worth of their classic vehicle in a claim payout.

- Simple Policy Management: Erie allows customers to add a classic vehicle to their regular insurance policy rather than purchasing a separate one.

Cons

- Availability: Erie classic car insurance isn’t available in every state.

- Limited Add-Ons: As a regional provider, Erie may have fewer customizable options for classic auto insurance.

#3 – Farmers: Best for Online Convenience

Pros

- Online Convenience: Farmers’ customers can use the website or app to check on their classic car coverage and make changes.

- Guaranteed Value Coverage: Farmers guarantees classic car owners will get the full value of their car in a total loss.

- Spare Parts Coverage: Ideal for classic car owners with spare vehicle repair parts.

Cons

- Customer Ratings: Classic car insurance services could be improved, which you can learn about in our Farmers review.

- DUI Rates: Classic car insurance is expensive for DUI drivers.

#4 – Amica: Best for Coverage Options

Pros

- Coverage Options: Amica has a full list of options for classic car owners, which we cover in our Amica review.

- Customer Service: Amica has good customer service reviews for its classic car insurance.

- Discount Variety: Customers can save by applying for Amica car insurance discounts.

Cons

- Availability: Not all classic car insurance coverages are available to Alaska and Hawaii drivers.

- Higher Rates: Amica is one of the more expensive companies for classic car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Cost Savings

Pros

- Cost Savings: Auto-Owners is an affordable company for classic car insurance. Read our Auto-Owners review to learn more.

- Coverage Options: Auto-Owners sell extras like modified parts coverage or roadside assistance, which can be helpful to classic car owners.

- Multi-Car Discount: Insure your regular and classic cars at Auto-Owners for a discount.

Cons

- Online Management: Online services for classic car owners are limited at Auto-Owners.

- Availability: Currently, Auto-Owners doesn’t sell classic car coverage in every state.

#6 – USAA: Best for Military Members

Pros

- Military Members: USAA specializes in classic auto insurance for military and veteran drivers. Learn more in our USAA review.

- Mobile App: Customers can check their classic car policies from their phone.

- Add-On Coverages: Get extra protection for classic cars with add-ons like roadside assistance.

Cons

- Restrictions on Eligibility: Classic car owners must be military or veterans to buy USAA insurance.

- DUI Rates: Classic car insurance will cost more for DUI drivers.

#7 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA has a great roadside assistance program that helps classic cars if they break down.

- AAA Membership Perks: Classic car owners can use their AAA membership for discounts when shopping and traveling. Learn more in our AAA review.

- Bundling Options: AAA sells more than classic car insurance, so there are opportunities to bundle if customers wish.

Cons

- Membership Fee: Classic car owners need an AAA membership to buy car insurance.

- Claim Reviews: AAA doesn’t have great overall reviews for its classic car insurance claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm local agents can help customers directly with classic car insurance.

- Availability: State Farm sells classic car insurance in every U.S. state.

- Discounts: State Farm has plenty of classic car discounts. For a full list of discounts, read our State Farm review.

Cons

- Financial Stability: The company isn’t as stable as its classic car insurance competitors.

- Online Management: Management online can be limited due to local agents handling most classic car policy issues.

#9 – Allstate: Best for Policy Options

Pros

- Policy Options: Allstate has plenty of options to personalize classic auto policies with coverages, deductibles, etc.

- Discount Options: Our Allstate review covers all available discounts on classic car insurance, from good drivers to bundling discounts.

- Online App: Allstate’s free app lets drivers make classic auto policy changes, file claims, and more.

Cons

- Customer Ratings: Allstate has more complaints from customers than other classic car insurance companies.

- Higher Rates: Allstate charges higher rates for classic car insurance, starting at $61/month.

#10 – American Family: Best for Costco Members

Pros

- Costco Members: Costco members with classic vehicles can buy American Family at Costco for a discounted rate.

- Discount Options: Read our American Family review for a full list of classic auto insurance discounts, from good student discounts to good driver discounts.

- Adjustable Deductibles: Customers can choose a classic car deductible that they feel comfortable with.

Cons

- Availability: American Family classic car insurance is not available in every state.

- DUI Rates: American Family classic car insurance rates are less competitive for DUI customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Classic Car Companies Rates by Coverage

Below, you can see the average rates for minimum versus full coverage at the best classic car insurance companies on our list.

Classic Car Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $85 |

| Allstate | $61 | $160 |

| American Family | $45 | $117 |

| Amica Mutual | $46 | $151 |

| Auto-Owners | $34 | $87 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Nationwide | $44 | $115 |

| State Farm | $33 | $86 |

| USAA | $23 | $59 |

Classic car insurance can be purchased in a minimum coverage policy, which includes each state’s minimum auto insurance requirements, or a full coverage policy.

Because classic car insurance is generally more affordable than insurance for non-classic cars, most drivers may want to opt for full coverage insurance.

Full coverage classic car insurance covers accidents with other cars, stationary objects, animals, and much more.Dani Best Licensed Insurance Producer

Some insurance companies might require more or certain types of coverage for classic cars. Policies might also come with mileage restrictions or garaging requirements. Shop around with multiple providers to get the best auto insurance for your classic car.

Read More: Best States for Classic Car Owners

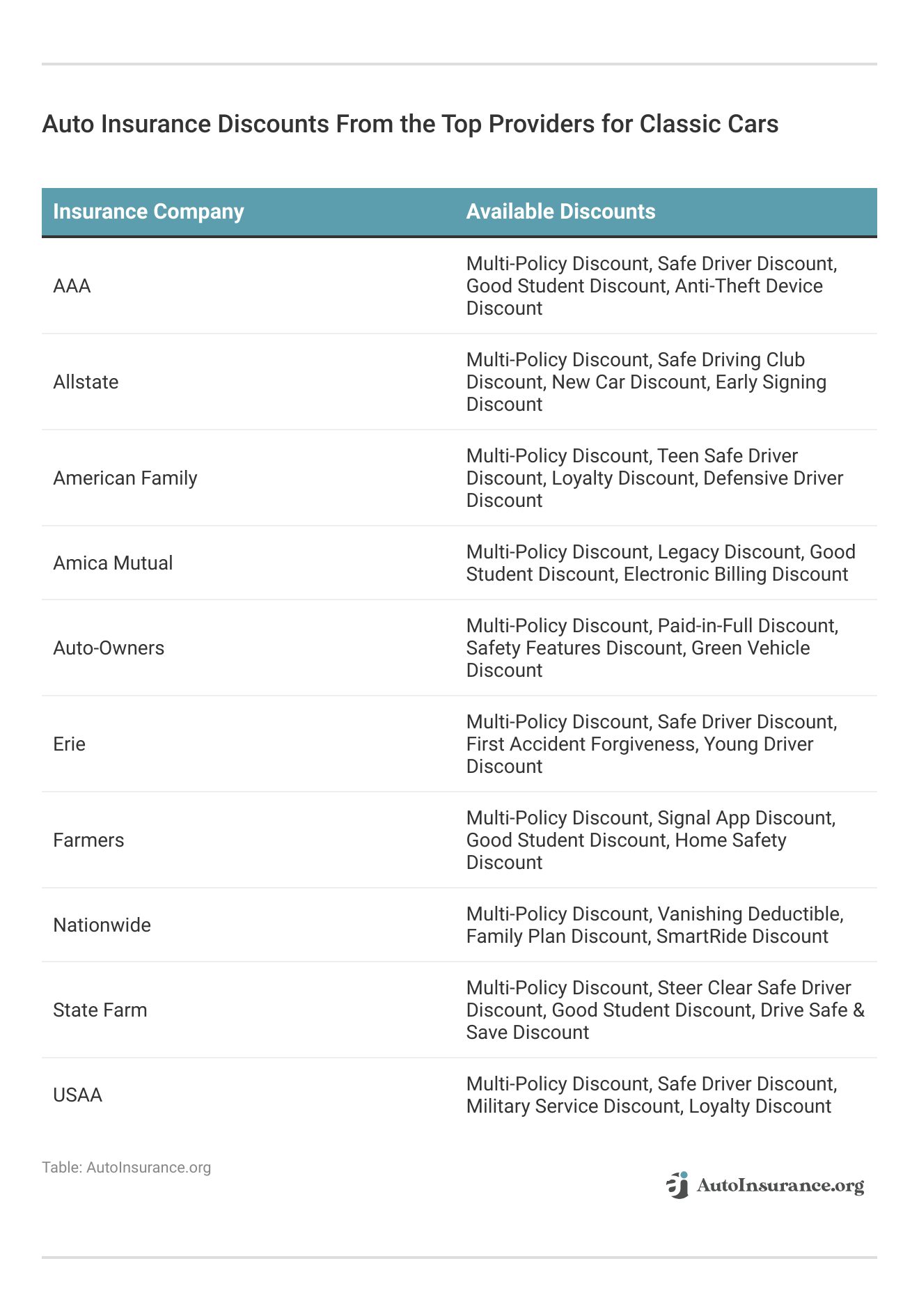

Save Money on Auto Insurance for Classic Cars

Full coverage for classic cars will have higher rates than state minimums, but drivers can save money and shop for discounts at their chosen company.

Classic car insurance is often more affordable than regular car insurance because classic cars are driven less frequently, but customers should also compare classic car quotes from several companies to ensure they are getting the best deal.

Finding the Best Classic Car Auto Insurance For You

Nationwide, Erie, and Farmers are some of the best companies for classic car insurance, with perks like agreed-value coverage and auto insurance discounts for classic car drivers.

If you are ready to shop for classic car insurance, enter your ZIP in our free tool. It will help you find great classic car coverage from companies in your area.

Frequently Asked Questions

What is the best insurance company for classic cars?

Nationwide is the best auto insurance company for classic cars.

What are the limitations of classic car insurance?

Classic car insurance only covers the pleasure use of a classic car. It will not insure cars that are used daily for work, for example. Some insurance companies will place mileage caps on classic car insurance.

Which insurance is best for an old car?

Full coverage classic car insurance is best for old cars that are classic. Old vehicles that are not classics can often carry just minimum coverage for a cheaper rate (Learn More: Cheap Auto Insurance for Older Vehicles).

How many miles can you do on classic car insurance?

It depends on what car insurance company you choose. Some companies will have mileage caps for classic cars, while others don’t set a limit on how much a classic car can be driven.

How old does a car have to be until it’s a classic?

It depends on the car insurance company, but most companies require a car to be at least ten years old to be considered a classic. Compare rates for older cars now with our free quote tool.

Are classic cars more expensive to insure?

Classic cars actually tend to be cheaper to insure, as they are driven less. However, rates can be more expensive if drivers don’t properly store classic cars in garages when not driving (Read More: Best Classic Car Insurance Without a Garage).

How to determine the value of a classic car?

Car insurance companies can appraise your vehicle to determine its value, and you can also research on your own to see what similar vehicles are worth.

What classic car is worth the most money?

Classic Mercedes-Benz are some of the most expensive classic cars on the market.

Is it worth having full coverage on a 10-year-old car?

10-year-old vehicles can often carry minimum coverage rather than full coverage auto insurance.

Is it worth getting insurance on an old car?

Yes, even old cars will need at least minimum car insurance if you plan on driving them.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.