Best Flagstaff, Arizona Auto Insurance in 2026 (Top 9 Companies Ranked)

State Farm, Allstate, and Progressive have the best Flagstaff, Arizona auto insurance. Our expert review finds State Farm has the biggest student auto insurance discount of 25%, but Geico has the best Flagstaff, AZ auto insurance quotes at $30/mo. Scroll down to compare the top nine Flagstaff insurance companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Flagstaff AZ

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Flagstaff AZ

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Flagstaff AZ

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm has the best Flagstaff, Arizona auto insurance with low rates and great customer service reviews.

Drivers get the best Flagstaff, Arizona auto insurance claims experience with Allstate, and Progressive is a Flagstaff favorite for usage-based coverage. Since Flagstaff has one of the shortest commutes in the country, local drivers qualify for low-mileage discounts.

Our Top 9 Company Picks: Best Flagstaff, Arizona Auto Insurance

| Company | Rank | Low-Mileage Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | B | Customer Service | State Farm |

|

| #2 | 25% | A+ | Claims Handling | Allstate |

|

| #3 | 25% | A+ | Usage-Based | Progressive |

|

| #4 | 25% | A++ | Policy Options | Auto-Owners |

|

| #5 | 20% | A++ | Military Families | USAA |

|

| #6 | 25% | A++ | Cheap Rates | Geico |

|

| #7 | 10% | A | Teen Drivers | American Family |

|

| #8 | 10% | A+ | Senior Drivers | The Hartford |

| #9 | 10% | A | Insurance Discounts | AAA |

Many Flagstaff insurance companies cater to certain drivers. For example, The Hartford has the best auto insurance for seniors with exclusive AARP discounts for retired drivers, while American Family has the best discounts and rates for teens and young drivers in Flagstaff.

- State Farm and Allstate are the best auto insurance companies in Flagstaff, AZ

- Progressive is the best usage-based insurance company in Flagstaff

- Drivers get the cheapest Flagstaff insurance rates with USAA and Geico

#1 – State Farm: Top Pick Overall

Pros

- Great Customer Service: Highest customer satisfaction in the region and half the number of complaints than other national insurers. Get more rankings in our State Farm auto insurance review.

- Friendly Local Agents: Yelp reviews praise State Farm agents for being the best auto insurance brokers in Flagstaff, AZ for pricing and claims handling.

- Affordable Rates: Flagstaff drivers pay around $86/mo for full coverage.

- Cheap for Teens and Students: Cheapest auto insurance for students at Northern Arizona University with discounts up to 25% for good grades until they turn 25.

- Rideshare Insurance: Affordable rates for Flagstaff drivers who use their car for delivery.

Cons

- Model Restrictions: State Farm is no longer underwriting policies for certain Kia and Hyundai models.

- Cannot Buy Online: Flagstaff drivers have to buy auto insurance through a local State Farm agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Claims Handling

Pros

- Claims Satisfaction Guarantee: Top ten in customer claim satisfaction with a guarantee that you will earn a six-month premium credit if you’re unsatisfied with your experience.

- Local Agents: Flagstaff, Arizona auto insurance agents are highly rated on Yelp by policyholders.

- Sizeable Discounts: Drivers with short commutes can save up to 30%, and drivers who work at Flagstaff Medical Center can get up to 15% in occupational discounts. (See More: Allstate Auto Insurance Review)

- Rewards for Good Driving: Sign up for Allstate Rewards to get gift cards and more for safe habits every six months.

- Rideshare Insurance: Allstate Ride for Hire covers drivers who use their car for deliveries, Uber, or Lyft.

Cons

- Expensive Rates: Allstate full coverage costs around $160/mo, much more than other Flagstaff insurance companies.

- Expensive for Teen Drivers: Teens pay the most for Flagstaff auto insurance on average, but Allstate is much more expensive than its competitors.

#3 – Progressive: Best Usage-Based Insurance

Pros

- Progressive Snapshot UBI: Most popular UBI program in Arizona that won’t constantly monitor your habits, and drivers save over $100 per year.

- High Usage-Based Satisfaction: Progressive tied as the top UBI program for customer satisfaction in annual J.D. Power survey.

- Affordable Rates: Flagstaff drivers pay around $105/mo for full coverage. Compare more rates in our Progressive auto insurance review.

- Big Low-Mileage Discounts: Drivers with short commute times save up to 30%.

Cons

- Low Customer Satisfaction: Customer service is below average in the region, and it receives nearly 50% more complaints than other national providers.

- Expensive for Teens: Flagstaff drivers under 21 pay more than the national average.

#4 – Auto-Owners: Best Policy and Coverage Options

Pros

- Great Customer Service: Top ten for claims satisfaction and half the number of complaints than other companies its size.

- Policy Perks: Including accident forgiveness, diminished value coverage, and roadside assistance.

- Uncommon Policy Options: Including classic car coverage, modified vehicle insurance, and full glass coverage. (Get more details in our Auto-Owners insurance review.)

- Personal Automobile Plus: This plan covers ten different situations, including identity theft, stereo theft or damage, and supplementary payments if you are unable to work without a vehicle.

Cons

- Cannot Buy Online: Flagstaff drivers have to buy auto insurance through an Auto-Owners agent.

- Expensive Insurance Bundles: High home insurance rates make Auto-Owners home and auto bundles more expensive than average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military and Veterans

Pros

- Excellent Customer Service: Outperforms other national providers in customer service and claims satisfaction rankings.

- Full financial Services: Offers banking and investment opportunities, and you don’t have to buy auto insurance to be eligible.

- Lowest Rates: Flagstaff, AZ auto insurance rates with USAA average at $59/mo for full coverage.

- Competitive Low-Mileage Discounts: Save up to 20% if you drive less than 10,000 miles per year.

Cons

- Exclusive to U.S. Military: Must be active duty or a veteran to buy insurance. Learn how family members qualify in our USAA auto insurance review.

- No Gap Insurance: USAA does not cover auto loans or leases if your vehicle is totaled in a claim.

#6 – Geico: Best for Cheap Rates

Pros

- Cheap Rates for Safe Drivers: Good drivers in Flagstaff can pay as little as $80/mo for full coverage. Compare rates in our Geico auto insurance review.

- Low Rates for Teens and Students: Teens and good students save up to 15% on auto insurance.

- Big Discounts for Low-Mileage Drivers: You could save up to 30%.

- Rideshare Insurance: Policy add-on keeps rates low for Flagstaff drivers working for Uber or Lyft.

Cons

- Poor Customer Service: Low claims satisfaction and below-average customer satisfaction in the region when compared to other local companies.

- Higher Rates With Accidents or Bad Credit: High-risk drivers can find cheaper Flagstaff auto insurance companies.

#7 – American Family: Best for Teens and Young Drivers

Pros

- Competitive Student Discounts: Good students save up to 20% until they turn 25.

- TeenSafeDriver Discount: Teens save an additional 10% for completing the AmFam Teen Safe Driving program online.

- Generational Discount: Young drivers get extra discounts if their parents are also AmFam policyholders.

- Great Customer Service: Top ten for claims satisfaction and top three for customer satisfaction in the region. Get more rankings in our America Family auto insurance review.

Cons

- Average Rates for Older Drivers: If you’re over 40, compare quotes with other companies to get a better price.

- Small Discounts: Other companies offer much bigger low-mileage and student discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Seniors

Pros

- Low Rates for AARP Members: Retired persons unlock low rates and exclusive discounts, including an additional 10% off auto insurance.

- RecoverCare Coverage: Pays for house cleaning and more if you’re injured and unable to manage your home while recovering.

- Policy Perks: Disappearing deductibles, accident forgiveness, and new car replacement. Compare policies in our The Hartford auto insurance review.

- Great Customer Service: Far fewer customer complaints than other providers its size.

Cons

- Expensive for Younger Drivers: Teens and students find lower rates with other companies.

- Below-Average Mobile App Reviews: Insurance app only received 2.6/5 stars on Google Play and 3.7/5 on the Apple Store

#9 – AAA: Best for Discounts

Pros

- Great Customer Service: Far fewer customer complaints than other companies its size.

- Low Rates: Cheaper-than-average Flagstaff full coverage rates at $86/mo.

- Roadside Assistance and Pet Coverage With Every Policy: Automatically included with AAA full coverage.

- Discounts on Car Insurance, Vehicle Repairs, Restaurants, and More: AAA membership perks include additional discounts across multiple industries. (See More: AAA Auto Insurance Discounts)

Cons

- Exclusive to Members: Must join AAA and pay annual fees to buy auto insurance and take advantage of discounts.

- Coverage Varies by State: If you move out of Arizona, your policy options and availability could change.

Auto Insurance Requirements in Flagstaff, Arizona

Required auto insurance in Arizona is relatively low, which is why most drivers can find cheap auto insurance in Flagstaff if they buy liability auto insurance.

In Flagstaff, you need 25/50/15 in liability insurance to drive legally. Arizona is an at-fault insurance state, so unless you can afford to pay for the excess costs after an accident, you’ll want to increase these limits.Michelle Robbins Licensed Insurance Agent

Carrying more than the minimum auto insurance requirements by state will increase your rates, and so will adding collision and comprehensive insurance for a full coverage policy.

Flagstaff, Arizona Auto Insurance Monthly Rates by Provider & Coverage Level

Company Minimum Coverage Full Coverage

$65 $122

$94 $250

$60 $158

$47 $124

$34 $91

$44 $117

$42 $112

$61 $161

$33 $88

Use the tables below to compare these company rates to the average Flagstaff, Arizona auto insurance costs to get the right coverage at the best price.

Read More: Cheap Liability-Only Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Affects Flagstaff, Arizona Auto Insurance Costs

Along with coverage levels, Arizona auto insurance providers consider your age, gender, driving record, and ZIP code to set monthly premiums.

Flagstaff Auto Insurance by Age and Gender

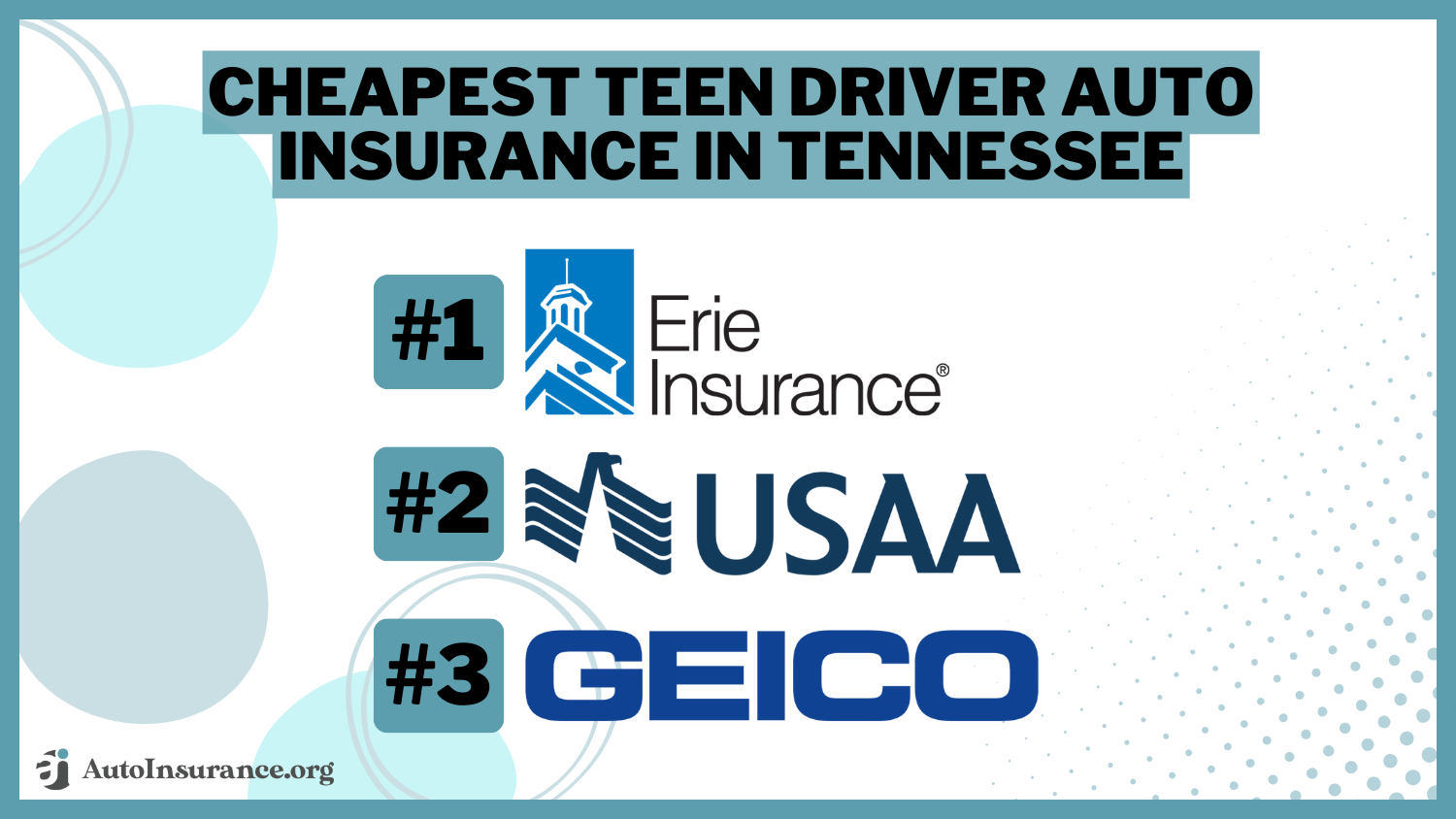

Teen males pay the most for Flagstaff auto insurance, but monthly rates drop by $100 or more after they turn 20. Learn more in our article: Cheapest Teen Driver Auto Insurance in Arizona.

Flagstaff, Arizona Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

16-Year-Old Male $355 $600

16-Year-Old Female $325 $575

20-Year-Old Male $245 $505

20-Year-Old Female $215 $475

30-Year-Old Male $185 $405

30-Year-Old Female $165 $385

40-Year-Old Male $155 $355

40-Year-Old Female $145 $345

50-Year-Old Male $135 $325

50-Year-Old Female $125 $315

60-Year-Old Male $115 $305

60-Year-Old Female $105 $295

70-Year-Old Male $125 $315

70-Year-Old Female $115 $305

Our experts found that American Family and Geico auto insurance in Arizona offers additional incentives and discounts to Flagstaff students with good grades and safe driving habits to lower rates.

Read More:

- Best Auto Insurance Companies for College Students

- Best Auto Insurance for a Student Away at College

Flagstaff Auto Insurance by Driving Record

One at-fault accident or speeding ticket can double or triple your rates in Flagstaff.

Flagstaff, Arizona Auto Insurance Monthly Rates by Driving Record & Coverage Level

Driving Record Minimum Coverage Full Coverage

DUI $320 $550

Speeding Ticket $180 $400

At-Fault Accident $250 $480

Clean Record $120 $320

Some Arizona auto insurance companies are more forgiving than others, so compare quotes after an accident to find more affordable Flagstaff, Arizona auto insurance coverage.

Flagstaff Auto Insurance by Location

Where you live in Flagstaff has a big impact on how much you pay for auto insurance based on traffic and accident rates.

Flagstaff, Arizona Auto Insurance Monthly Rates by ZIP Code & Coverage Level

ZIP Code Minimum Coverage Full Coverage

86001 $180 $400

86004 $200 $420

86005 $220 $440

86015 $190 $410

86024 $210 $430

86038 $180 $400

The average age of the drivers living and working in your ZIP code also affects costs since more young drivers on the road could increase the likelihood of getting into an accident.

We recommend comparing Flagstaff auto insurance rates to neighboring cities to see how costs vary.

Cities Near Flagstaff, Arizona Auto Insurance Monthly Rates by Provider & Coverage Level

AZ Cities Minimum Coverage Full Coverage

Flagstaff $120 $320

Phoenix $106 $248

Prescott $112 $268

Sedona $115 $255

Tucson $99 $208

Larger urban cities like Phoenix and Tucson typically have higher costs than small cities like Flagstaff, but young drivers and college students, along with intense winter weather, make auto insurance in Flagstaff, AZ slightly more expensive.

Read More:

Easiest Ways to Lower Flagstaff, Arizona Auto Insurance Rates

Follow these tips to find cheap full coverage auto insurance in Arizona:

- Ask for auto insurance discounts. The best Flagstaff auto insurance discounts are for students, seniors, and those who work at the Flagstaff Medical Center (Allstate offers 15% off).

- Bundle coverage. Shop with companies that offer affordable Flagstaff, Arizona auto insurance bundles with home or renters insurance.

- Take a defensive driving course. Young drivers especially can lower their rates with American Family by taking driving courses geared towards teens and students.

- Practice safe driving habits. Good drivers get the lowest Flagstaff insurance rates, especially with usage-based programs like Progressive Snapshot. Learn more in our Progressive Snapshot review.

Buying liability-only auto insurance will get you the lowest rates on Flagstaff, AZ auto insurance, but these tips will help you save money without sacrificing coverage.

Bottom Line on The Best Auto Insurance Companies in Flagstaff, AZ

Drivers get the best Flagstaff, AZ auto insurance with State Farm and Allstate when it comes to claims and customer service. Geico and USAA have the lowest rates, but Progressive is the cheapest if you’re a safe driver who signs up for Progressive Snapshot UBI (learn more: Geico vs. Progressive Auto Insurance Review).

Remember to ask for all the auto insurance discounts you qualify for, including good student, senior, and low-mileage discounts, to get the absolutely best auto insurance policy in Flagstaff.

Frequently Asked Questions

Who has the lowest Flagstaff, AZ auto insurance rates?

USAA has the lowest rates for military drivers, while Geico is the cheapest for everyone else.

Is auto insurance cheaper in Flagstaff?

No, Flagstaff auto insurance rates are more expensive than other cities in Arizona. Enter your ZIP code to find cheap quotes in your Arizona location.

What is full coverage insurance in Flagstaff, Arizona?

Arizona full coverage includes minimum liability insurance, comprehensive coverage, and collision insurance. You can also add uninsured/underinsured motorist protection.

Is auto insurance more expensive in Texas or Arizona?

Auto insurance is more expensive in Texas than Arizona due to the high number of auto accidents and increased highway speeds in Texas.

Who has the cheapest auto insurance in Arizona?

Geico, State Farm, and USAA have the cheapest Arizona auto insurance.

Can I have out of state auto insurance in Flagstaff?

Yes, you can have out-of-state insurance as long as you are not a permanent resident of Flagstaff. If you want to register your vehicle in Arizona, you will need in-state insurance. Learn more in our guide to auto insurance for out-of-state drivers.

What is the average cost of auto insurance in Flagstaff, Arizona?

The average liability-only auto insurance rates in Flagstaff are $120/mo.

What is the recommended auto insurance coverage in Arizona?

In Arizona, you need 25/50/15 in liability insurance to drive legally.

Is it cheaper to insure a car in Arizona or California?

California auto insurance is more expensive than Arizona due to increased weather risks and traffic (learn more: California Auto Insurance).

What is the best auto insurance for new drivers in Flagstaff, Arizona?

American Family is the best auto insurance for new drivers in Flagstaff.

Do you need proof of insurance to register a car in Arizona?

How much is the fine for driving without insurance in Arizona?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.