Best Jeep Gladiator Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Chubb, Allstate, and AAA offer the best Jeep Gladiator auto insurance, with rates around $125/month. These companies provide competitive pricing, comprehensive coverage, and exceptional roadside assistance, making them the best choices for Jeep Gladiator owners seeking affordable and reliable auto insurance options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated October 2024

Company Facts

Full Coverage for Jeep Gladiator

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jeep Gladiator

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jeep Gladiator

A.M. Best Rating

Complaint Level

Pros & Cons

Chubb, Allstate, and AAA are the best Jeep Gladiator auto insurance providers, with rates starting at $125 monthly. These top providers are known for their competitive pricing, comprehensive auto insurance, and exceptional roadside assistance.

Buying a new car is both fun and a lot of work. If the Jeep Gladiator is on your list (or if you’ve already made your choice) you need all of the information before you move forward. We’ve gathered what you need to know when you buy a Jeep Gladiator right here.

Our Top 10 Company Picks: Best Jeep Gladiator Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 12% A++ Custom Coverage Chubb

![]()

#2 25% A+ Customer Service Allstate

#3 25% A Membership Perks AAA

#4 20% B Nationwide Presence State Farm

#5 25% A++ Low Rates Geico

#6 25% A+ Senior Focused The Hartford

#7 20% A+ Comprehensive Policies Nationwide

#8 8% A++ Multiple Discounts Travelers

#9 20% A Personal Agent Farmers

#10 10% A+ Competitive Rates Erie

If you need insurance for a Jeep Gladiator right now, we can help. Enter your ZIP code for free Jeep Gladiator car insurance quotes from top companies.

- Crash test ratings have an impact on Jeep Gladiator auto insurance rates

- Safety features of the Jeep Gladiator can earn you a car insurance discount

- The cost of insurance for a Jeep Gladiator depends on the trim level

#1 – Chubb: Top Overall Pick

Pros

- Comprehensive Coverage: Chubb offers extensive coverage options, including higher liability limits and comprehensive protection, ensuring Jeep Gladiator owners have robust insurance.

- Exceptional Claims Service: As mentioned in our Chubb auto insurance review, they are renowned for its superior claims service, providing quick and fair resolutions, which is crucial for Jeep Gladiator owners seeking peace of mind.

- Unique Benefits: With Chubb, Jeep Gladiator owners can enjoy unique benefits like agreed value coverage and repair shop flexibility, enhancing overall satisfaction.

Cons

- Higher Premiums: Chubb’s premiums, at $250 per month, are among the highest, which may not be suitable for budget-conscious Jeep Gladiator owners.

- Limited Discounts: Chubb offers fewer discounts compared to other insurers, making it harder for Jeep Gladiator owners to reduce their insurance costs significantly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Customer Service

Pros

- Competitive Rates: Allstate offers competitive rates at $240 per month, making it a cost-effective choice for Jeep Gladiator owners looking for affordability and reliability.

- Extensive Discount Options: Allstate auto insurance review provides various discounts, such as safe driver and multi-policy discounts, helping Jeep Gladiator owners save on their premiums.

- Strong Customer Service: Allstate’s robust customer service ensures that Jeep Gladiator owners receive timely and helpful support for their insurance needs.

Cons

- Average Claims Handling: Allstate’s claims process is often rated as average, which might be a concern for Jeep Gladiator owners needing efficient claims resolution.

- Complex Policy Structures: Allstate’s policies can be complex and may require careful scrutiny to ensure Jeep Gladiator owners understand their coverage.

#3 – AAA: Best for Membership Perks

Pros

- Affordable Rates: AAA offers Jeep Gladiator auto insurance at $235 per month, providing a balance of affordability and comprehensive coverage.

- Exceptional Roadside Assistance: AAA is renowned for its top-tier roadside assistance, an essential benefit for Jeep Gladiator owners who enjoy off-roading or long trips.

- Member Benefits: As mentioned in our AAA auto insurance review, members can enjoy additional perks and discounts, adding value to Jeep Gladiator insurance policies beyond just coverage.

Cons

- Limited Coverage Options: AAA’s insurance offerings may have fewer coverage options compared to specialized insurers, potentially limiting choices for Jeep Gladiator owners.

- Membership Requirement: AAA insurance often requires membership, which could be an extra cost and hassle for Jeep Gladiator owners who are not already members.

#4 – State Farm: Best for Nationwide Presence

Pros

- Lowest Premiums: State Farm auto insurance review offers the lowest premiums at $220 per month, making it an excellent choice for Jeep Gladiator owners seeking budget-friendly insurance.

- Extensive Local Agent Network: State Farm has a vast network of local agents, providing Jeep Gladiator owners with personalized service and local expertise.

- Discounts: They offer a variety of discounts, including multi-policy and safe driver discounts, which can further lower premiums.

Cons

- Average Customer Satisfaction: State Farm’s customer satisfaction ratings are average, which may not meet the expectations of some Jeep Gladiator owners.

- Basic Coverage Options: State Farm’s coverage options might be more basic, lacking some of the specialized options available with other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Low Rates

Pros

- Lowest Rates: Geico offers some of the lowest rates at $210 per month, making it a top choice for cost-conscious Jeep Gladiator owners.

- User-Friendly Online Services: Geico’s online tools and mobile app make managing policies and filing claims easy for tech-savvy Jeep Gladiator owners.

- Good Driver Discounts: As mentioned in our Geico auto insurance discounts, they offer substantial discounts for good drivers, further lowering the cost of insurance for Jeep Gladiator owners with a clean driving record.

Cons

- Limited Local Agent Presence: Geico has fewer local agents, which might be a drawback for Jeep Gladiator owners preferring in-person service.

- Average Claims Handling: Geico’s claims handling is often rated as average, which might be a concern for Jeep Gladiator owners requiring prompt and efficient claims service.

#6 – The Hartford: Best for Senior Focused

Pros

- Specialized Programs for Seniors: The Hartford auto insurance review offers specialized programs and discounts for senior drivers, making it ideal for older Jeep Gladiator owners.

- AARP Endorsement: Endorsed by AARP, The Hartford provides trusted and tailored coverage options for Jeep Gladiator owners in retirement.

- Robust Customer Support: The Hartford is known for its strong customer support, ensuring that Jeep Gladiator owners receive personalized and attentive service.

Cons

- Higher Rates: With premiums at $225 per month, The Hartford’s rates are higher, which may not be suitable for all Jeep Gladiator owners.

- Limited Availability: The Hartford’s insurance products are not available in all states, which could restrict access for some Jeep Gladiator owners.

#7 – Nationwide: Best for Comprehensive Policies

Pros

- Usage-Based Discounts: Nationwide offers usage-based insurance options, such as SmartRide, providing significant discounts for low-mileage Jeep Gladiator owners.

- Wide Range of Coverage Options: Nationwide auto insurance review provides a wide range of coverage options, allowing Jeep Gladiator owners to customize their policies to fit their needs.

- Strong Financial Ratings: Nationwide’s strong financial stability ensures that Jeep Gladiator owners can rely on the company’s ability to pay claims promptly.

Cons

- Moderate Premiums: At $230 per month, Nationwide’s premiums are moderate, which may not be the lowest available for Jeep Gladiator owners.

- Complex Discount Structures: Nationwide’s discount structures can be complex and may require careful navigation to maximize savings for Jeep Gladiator owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multiple Discounts

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, protecting Jeep Gladiator owners from rate increases after their first at-fault accident.

- Competitive Rates: With premiums at $225 per month, Travelers provides competitive rates that balance cost and comprehensive coverage for Jeep Gladiator owners.

- Extensive Coverage Options: Travelers auto insurance review provides a variety of coverage options, allowing Jeep Gladiator owners to tailor their insurance to their specific needs.

Cons

- Mixed Customer Reviews: Travelers has mixed customer reviews, which could be a concern for Jeep Gladiator owners seeking consistently high service quality.

- Limited Online Tools: Travelers’ online tools and mobile app are less advanced compared to other insurers, which might be a drawback for tech-savvy Jeep Gladiator owners.

#9 – Farmers: Best for Personal Agent

Pros

- Strong Online Presence: Farmers offers a robust online platform, making it convenient for Jeep Gladiator owners to manage their policies and claims online.

- Various Discount Options: Farmers auto insurance review provides multiple discounts, such as multi-policy and safe driver discounts, helping Jeep Gladiator owners save on their premiums.

- Comprehensive Coverage: Farmers offers comprehensive coverage options, ensuring that Jeep Gladiator owners have access to extensive protection for their vehicles.

Cons

- Higher Premiums: With rates at $230 per month, Farmers’ premiums are on the higher side, which might not be ideal for budget-conscious Jeep Gladiator owners.

- Inconsistent Customer Service: Farmers’ customer service experiences can be inconsistent, which could be a concern for Jeep Gladiator owners needing reliable support.

#10 – Erie: Best for Competitive Rates

Pros

- Top Customer Satisfaction: Erie consistently receives high ratings for customer satisfaction, making it a preferred choice for Jeep Gladiator owners seeking excellent service.

- Competitive Rates: Erie auto insurance review offers competitive rates at $210 per month, providing affordable insurance options for Jeep Gladiator owners.

- Comprehensive Coverage Options: Erie’s comprehensive coverage options ensure that Jeep Gladiator owners have access to extensive protection for their vehicles.

Cons

- Regional Availability: Erie’s insurance products are only available in certain regions, which could limit access for some Jeep Gladiator owners.

- Limited Online Tools: Erie’s online tools and mobile app are less advanced compared to other insurers, which might be a drawback for tech-savvy Jeep Gladiator owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeep Gladiator Insurance Rates

When considering insurance for your Jeep Gladiator, it is essential to ask, “What are the recommended auto insurance coverage levels?” The following table provides a detailed breakdown of monthly rates for both minimum and full coverage from top insurance companies like AAA, Allstate, Chubb, and more.

Jeep Gladiator Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $140 $235

Allstate $145 $240

Chubb $150 $250

Erie $125 $210

Farmers $140 $230

Geico $125 $210

Nationwide $140 $230

State Farm $130 $220

The Hartford $135 $225

Travelers $135 $225

This table highlights the insurance costs for various pickup trucks, including models like the GMC Sierra, Cadillac Escalade EXT, and Ford Ranger.

By examining comprehensive, collision, and liability coverage costs, Jeep Gladiator owners can better gauge where their vehicle stands in terms of insurance expenses.

Jeep Gladiator Auto Insurance Monthly Rates by Coverage Level

| Coverage | Rates |

|---|---|

| Comprehensive | $26 |

| Collision | $44 |

| Minimum Coverage | $37 |

| Full Coverage | $121 |

The insurance rates for vehicles similar to the Jeep Gladiator provide valuable insights for owners. While the Ford Ranger and Dodge Dakota offer more affordable options, high-end models like the Cadillac Escalade EXT and Ford F-350 Super Duty come with higher insurance costs.

Jeep Gladiator Auto Insurance Monthly Rates vs. Other Pickup Trucks

| Vehicle | Rates |

|---|---|

| Cadillac Escalade EXT | $131 |

| Chevrolet Silverado 2500HD | $138 |

| Dodge Dakota | $102 |

| Ford F-350 Super Duty | $137 |

| Ford Ranger | $105 |

| GMC Sierra | $122 |

| GMC Sierra 3500HD | $136 |

| Toyota Tundra | $122 |

This comparison allows Jeep Gladiator owners to see how their insurance rates align with those of other pickup trucks and make more informed choices about their coverage.

Factors that Impact the Cost of Jeep Gladiator Insurance

Your Jeep Gladiator insurance costs will be influenced by factors like your location, driving record, and habits. The trim level you choose affects insurance rates due to varying vehicle values and repair costs. Advanced safety features and high safety ratings can lower premiums by reducing accident risks.

Frequent and long-distance driving can increase costs, as can living in high-traffic or high-crime areas. Demographics such as age, gender, marital status, and credit score also play roles, with younger drivers and those with lower credit scores often facing higher premiums.

Understanding these factors can help you secure the best insurance coverage for your Jeep Gladiator at a competitive price.Scott W. Johnson LICENSED INSURANCE AGENT

Your claims history impacts rates, with frequent claims or at-fault accidents resulting in higher costs. Discounts, such as for safe driving or bundling policies, can help reduce premiums. Modifications to your Jeep Gladiator, especially performance enhancements, can increase insurance costs by raising the vehicle’s value and risk profile.

Read More: Does a criminal record affect auto insurance rates?

Jeep Gladiator Crash Test Ratings

Jeep Gladiator crash test ratings can impact the cost of your Jeep Gladiator car insurance. See Jeep Gladiator crash test results here.

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Jeep Gladiator 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2021 Jeep Gladiator 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2022 Jeep Gladiator 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2023 Jeep Gladiator 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2024 Jeep Gladiator 4WD | 4 stars | 4 stars | 5 stars | 3 stars |

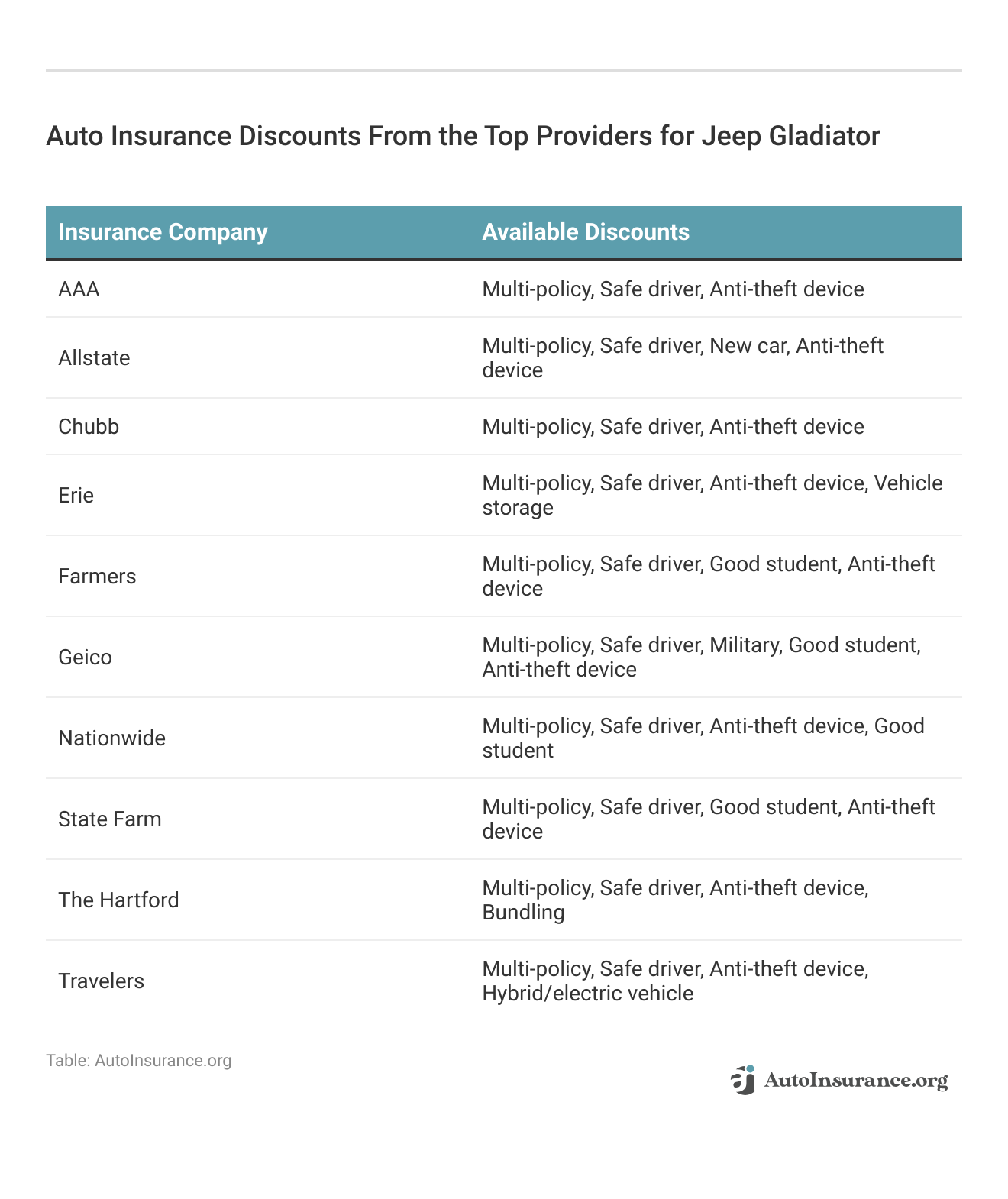

Ways to Save on Jeep Gladiator Insurance

Save more on your Jeep Gladiator car insurance rates. Take a look at the following five strategies that will get you the best Jeep Gladiator auto insurance rates possible.

- Ask about a student away from home discount

- Consider using a tracking device on your Jeep Gladiator

- Ask about usage-based insurance for your Jeep Gladiator

- Ask for a new Jeep Gladiator auto insurance rate based on your improved credit score

- Check Jeep Gladiator auto insurance rates through Costco

Remember to regularly review your insurance options and speak with your insurance provider about any available discounts to keep your rates as low as possible.

Taking advantage of these auto insurance discounts can help you save significantly on your Jeep Gladiator auto insurance. Be sure to discuss these options with your insurance provider to maximize your savings and get the best coverage at the most affordable rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Jeep Gladiator Insurance Companies

Several insurance companies offer competitive rates for the Jeep Gladiator based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Jeep Gladiator drivers organized by market share.

Jeep Gladiator Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Allstate | $39.2 million | 5% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Choosing the right insurance provider for your Jeep Gladiator involves considering factors such as market share, available discounts, and customer satisfaction.

Read More: Are major auto insurance companies better than smaller ones?

These top insurers, known for their competitive rates and comprehensive coverage options, can provide peace of mind and financial protection. Save money by comparing Jeep Gladiator insurance rates with free quotes online now.

Frequently Asked Questions

What coverage options are essential for Jeep Gladiator insurance?

Essential coverage options for Jeep Gladiator insurance include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Additionally, Jeep Gladiator owners may benefit from add-ons like roadside assistance, rental reimbursement, and gap insurance to ensure comprehensive protection.

Read More: Auto Insurance Comprehensive Claim Defined

How do modifications to my Jeep Gladiator affect insurance rates?

Modifications to your Jeep Gladiator, such as performance enhancements, custom parts, or off-road modifications, can impact insurance rates. These changes often increase the vehicle’s value and risk profile, leading to higher premiums. It’s important to inform your insurer about any modifications to ensure proper coverage.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Are there any special insurance considerations for off-roading with a Jeep Gladiator?

Yes, if you plan to use your Jeep Gladiator for off-roading, you should consider additional coverage options. Some insurers offer specific policies or endorsements for off-road activities that cover damage not typically included in standard policies. Ensure your policy covers off-road use to avoid unexpected expenses.

What are some tips for lowering Jeep Gladiator insurance costs?

To lower Jeep Gladiator insurance costs, consider increasing your deductible, maintaining a clean driving record, and utilizing available discounts such as multi-policy, good driver, and anti-theft device discounts. Shopping around and comparing quotes from multiple insurers can also help you find the best rates.

How does the Jeep Gladiator’s safety rating influence insurance premiums?

The Jeep Gladiator’s safety rating plays a significant role in determining insurance premiums. Vehicles with high safety ratings are less likely to be involved in severe accidents, leading to lower insurance costs. Insurers often offer discounts for vehicles with advanced safety features and high crash test ratings.

What are the best insurance companies for Jeep Gladiator owners?

Chubb, Allstate, and AAA are considered some of the best insurance companies for Jeep Gladiator owners due to their competitive rates, comprehensive coverage options, and excellent roadside assistance. These providers offer policies around $125/month, making them affordable and reliable choices for Jeep Gladiator drivers.

What factors affect Jeep Gladiator insurance costs the most?

Several factors significantly impact the cost of insuring a Jeep Gladiator. These include the driver’s location, driving record, usage patterns, and the vehicle’s trim level. Safety features, credit score, age, and gender also play a role. Additionally, insurers consider the Jeep Gladiator’s crash test ratings and the owner’s claims history when determining premiums.

How can I find the cheapest Jeep Gladiator auto insurance rates?

To find the cheapest Jeep Gladiator auto insurance rates, it’s crucial to compare quotes from multiple insurers. Utilize online comparison tools and consider asking about available discounts such as multi-policy, safe driver, and anti-theft device discounts. Checking rates from providers like AAA, Allstate, Chubb, and others can help you secure the most affordable coverage.

Read More: Cheap Jeep Auto Insurance

Are there specific discounts available for Jeep Gladiator insurance?

Yes, many insurers offer specific discounts that can lower your Jeep Gladiator insurance costs. Common discounts include those for safe driving, bundling multiple policies, installing anti-theft devices, and having a good student in the household. Some companies, like Geico and Nationwide, also offer military discounts and incentives for hybrid or electric vehicle owners.

How do Jeep Gladiator crash test ratings influence insurance premiums?

Jeep Gladiator crash test ratings impact insurance premiums as they reflect the vehicle’s safety performance in various tests. Higher safety ratings can lead to lower premiums since they indicate a reduced risk of accidents and injuries. Insurers use these ratings to assess risk levels and determine the appropriate coverage costs for Jeep Gladiator owners.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.