Cheap 2-Month Auto Insurance in 2026 (Save Big With These 9 Companies!)

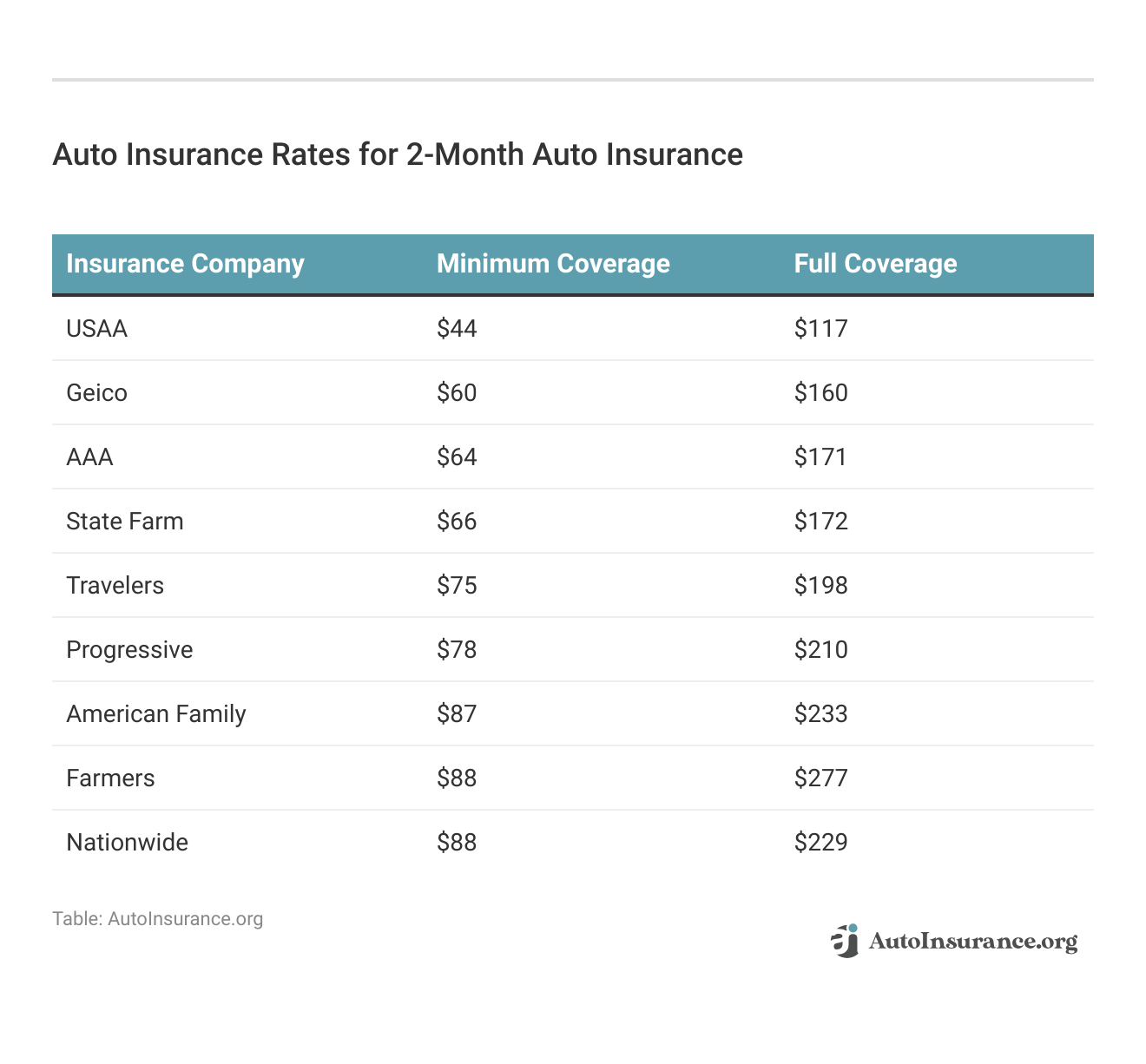

USAA has the cheapest 2-month car insurance, followed by Geico and AAA. At USAA, cheap 2-month auto insurance is only $44 for two months of coverage. However, non-military drivers won't qualify for USAA, so Geico and AAA will be the next best affordable companies for temporary auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated January 2025

Company Facts

Min. Coverage for 2 Months

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 2 Months

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 2 Months

A.M. Best Rating

Complaint Level

Pros & Cons

USAA, Geico, and AAA have the lowest possible rates for cheap 2-month auto insurance.

Whether you need auto insurance for 2 months or just 30-day car insurance, it is still important to ensure you carry the appropriate coverage.

In addition to cheap temporary auto insurance rates, the top companies also offer great coverage.

However, carrying more coverage to be fully protected doesn’t mean you have to break the bank. Below are some other great companies that offer cheap 2-month auto insurance coverage.

Our Top 9 Company Picks: Cheap 2-Months Auto Insurance

Company Rank Monthly Rates Good Driver Discount Best For Jump to Pros/Cons

![]()

#1 $32 30% Military Members USAA

#2 $43 26% Good Drivers Geico

#3 $65 30% Roadside Assistance AAA

#4 $47 25% Customer Service State Farm

#5 $53 10% Coverage Options Travelers

#6 $56 30% Tight Budgets Progressive

#7 $62 25% Costco Members American Family

#8 $76 30% Signal App Farmers

#9 $63 40% Simple Claims Nationwide

To find a cheap 2-month auto insurance policy, enter your ZIP code into our free rate comparison tool above.

- USAA has the cheapest car insurance for 2 months

- Geico and AAA also have affordable two-month auto insurance

- Saving on short-term policies begins with sound comparison shopping

#1 – USAA: Top Pick Overall

Pros

- Perks for Military Members: USAA members can get discounts on shopping, traveling, and more.

- Good Customer Service: USAA’s customer service is well-rated. Learn more in our USAA review.

- Coverage Selection: USAA offers a good array of auto insurance coverages to choose from for a cheap 2-month auto policy.

Cons

- Eligibility Exclusive: Non-military and non-veteran drivers can’t qualify for USAA.

- Few In-Person Agents: Most customer service is conducted virtually, not in person.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Good Drivers

Pros

- Discounts for Safe Drivers: Safe drivers will have the most affordable rates at Geico. Read more in our review of Geico.

- Easy Online Quotes: You can easily get quotes from Geico to see how much you would pay for two months of auto insurance.

- Stong Financial Stability: Geico’s great financial standing helps keep its basic rates level for Geico temporary car insurance.

Cons

- Some Mixed Reviews: Like most large insurance companies, Geico has some negative reviews from customers.

- Communication Is Mostly Virtual: Geico doesn’t have a wide network of in-person agents in most areas.

#3 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers great roadside assistance to AAA policyholders. Find out more in our AAA auto insurance review.

- Discount Perks: AAA members get discounts on shopping, traveling, and more.

- Coverage Options: AAA has a good selection of auto insurance coverages to choose from.

Cons

- Additional Membership Fee: AAA auto insurance holders will need to pay a fee to be members of AAA.

- Different AAA Providers: If you move states, you may need to change to a different AAA auto insurance provider.

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: State Farm’s local agents provide great in-person assistance to customers, which we cover in our State Farm review.

- Discount Variety: State Farm has good student discounts, good driver discounts, and more.

- Coverage Options: Drivers can choose from minimum to full coverage policies and add-on extra protection for specific needs.

Cons

- Younger Drivers May Pay More: State Farm’s rates for teenage drivers may not be as cheap as at other companies.

- Purchases Are Through an Agent: After getting a State Farm quote, you must contact an agent to complete your purchase.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Coverage Options

Pros

- Strong Financial Ratings: Travelers has high ratings for financial strength, helping keep rates low.

- Coverage Options: Travelers has plenty of coverage options to chose among, which you can learn more about in our review of Travelers.

- Discounts: Travelers offers discounts that drivers can take advantage of.

Cons

- Not in Every State: Travelers’ auto insurance isn’t sold in a handful of states.

- Mixed Customer Satisfaction: Travelers has some negative customer satisfaction reviews.

#6 – Progressive: Best for Tight Budgets

Pros

- Tight Budgets: Progressive has a Name Your Price tool that can help drivers see how much coverage they can afford on their budget.

- User-Friendly: Progressive’s website and app are easy to navigate.

- Coverage Options: Progressive has a good selection to choose from, which we go over in our Progressive auto insurance review.

Cons

- Mixed Reviews: Progressive has some negative customer satisfaction reviews.

- High Rates for Some Demographics: Young drivers often won’t have the cheapest rates at Progressive.

#7 – American Family: Best for Costco Members

Pros

- Costco Members: Costco members who purchase American Family auto insurance through Costco may have cheaper, discounted rates.

- Coverage Options: American Family offers rideshare insurance and more. Learn more about coverage in our American Family review.

- Local Agents: American Family has local agents for personalized assistance.

Cons

- Limited Availability: American Family is not available in every state.

- Mixed Reviews: Some customers gave American Family negative customer service reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Signal App

Pros

- Signal App: Safe drivers who use the Signal app can save. Learn more in our Farmers’ Signal Review.

- Strong Financial Stability: Farmers can keep rates reasonable due to its financial strength.

- Discount Options: Farmers offers plenty of discounts to reduce rates. Learn more about rates in our Farmers review.

Cons

- Mixed Reviews: Farmers’ customers service has some negative reviews from drivers.

- Higher Rates for Some Demographics: Drivers with poor credit scores or high-risk driving records may not have cheap rates.

#9 – Nationwide: Best for Simple Claims

Pros

- Simple Claims: Nationwide’s claims process is simple, whether you call or file online.

- Strong Financial Stability: Nationwide is able to pay out cliams without having to compensate with rate increases.

- Coverage Options: Nationwide has plenty of coverage options available. Read more in our review of Nationwide.

Cons

- Not Sold in Some States: You can’t get Nationwide auto insurance in three states.

- Mixed Reviews: Nationwide has just average customer satisfaction ratings.

Policy Options Useful for Short-Term Auto Insurance Shoppers

Can you buy car insurance for a month? The answer is yes. You may need more coverage if you’re using a temporary auto insurance option. Temporary auto insurance usually covers state minimum limits. Every state carries different liability-only auto insurance limits. While minimum coverage is the cheapest option at our top companies for temporary auto insurance, it often leaves drivers open to financial difficulties after an accident.

You may be in a state where a little more is needed to be considered covered, or you want to carry full coverage for better protection. Review the sub-sections below to learn more.

Underinsured and Uninsured Driver Coverage

The issue of drivers operating their vehicles without adequate insurance coverage is an ongoing one and presents a clear and present danger to other drivers. Drivers who may be on the road for only a month or two stand a lot to gain from carrying underinsured and uninsured motorist insurance on their auto insurance portfolios.

Learn more: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage

These options protect customers by paying for damages caused by an accident involving an uninsured or underinsured vehicle. This coverage can be especially useful in no-fault jurisdictions. If the cause of the accident is ambiguous, each of the parties may have to pay for their damages. In cases like these, having uninsured driver coverage can make all of the difference.

Towing Coverage

If the worst does happen and an accident does occur, individuals who are on the road for a couple of months can be well-served by towing coverage. This can allow for the damaged vehicle to be moved to a shop for repair without extra cost to policyholders.

Short-term auto insurance policies truly offer drivers more freedom of choice than ever. Comparison shoppers who make use of the information presented in this article may find that they can provide extraordinary savings opportunities as well.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

2-Month Auto Insurance Coverage Options

Automobile insurance comes in two main varieties that include mandatory coverage and optional coverage.

Mandatory coverage can be divided into two subgroups, including bodily injury liability and property damage liability.

- Bodily injury liability (BIL) auto insurance mandate provides medical compensation for anyone injured in an accident involving the insured vehicle. For example, if the policyholder rear-ends someone else, bodily injury liability would cover the medical bills.

- Property damage liability (PDL) provides payments for property damage resulting from a collision with the insured vehicle. This includes coverage against damage to structures such as homes.

- Personal injury protection (PIP) is mandatory in many jurisdictions, and with good reason. Personal injury protection provides medical payments for anyone who is injured inside of the insured vehicle during an accident.

Furthermore, personal injury protection can provide support in a variety of other situations.

A good PIP plan would cover for lost wages and even rehabilitation costs.

Considering the high cost of health care and the steep costs of personal insurance deductibles, PIP is a smart choice for addition to any auto insurance portfolio.

Optional Auto Insurance Coverage

Even though the decision whether or not to carry these coverages rests with the individual, they can be especially useful to someone who will be driving for a limited time.

- Collision auto insurance covers any accident-related damages sustained by the vehicle of the policyholder. In an age of hit-and-run incidents in parking lots, this is the right choice.

- Comprehensive coverage insurance provides payments for damages sustained by the client’s vehicle due to hailstorms, vandalism, theft, and more. A little of this kind of protection can go a long way toward protecting personal bank accounts.

- Glass coverage can automatically pay for the replacement of any cracked or otherwise compromised glass in an insured vehicle. (Learn more: Does car insurance cover windshield damage or replacement?)

The National Association of Insurance Commissioners (NAIC) reports the average coverage rates of car insurance each year. Let’s look at the latest average car insurance rates of basic coverage types.

Kemper Direct Auto Insurance Monthly Rates by Coverage Type

| Coverage | |

|---|---|

| Collision | $27 |

| Comprehensive | $12 |

| Full Coverage | $86 |

| Liability | $46 |

| Medical Payments | $40 |

| Personal Injury Protection | $35 |

| Uninsured/Underinsured Motorist Coverage | $30 |

Comprehensive coverage is the cheapest out of the four auto insurance options. However, your temporary car insurance coverage rates will change once you enter specific information when getting a quote from the cheapest companies like USAA, Geico, and AAA.

How to Save on Auto Insurance Coverage Costs

There are a large number of car insurance companies vying for customers, and this presents possibilities for those who are willing to shop around a little. Luckily, comparing auto insurance shopping websites can take all the hassles out of determining a two-month auto insurance cost.

Discounts are another great way to save on auto insurance costs, and the top 9 companies offer plenty of ways to save.

Auto Insurance Discounts From the 9 Cheapest Companies

Insurance Company Discount Type Saving Potential

Accident-Free 15%

Mature Driver 30%

Senior Citizen Discount 12%

Low Mileage 30%

Accident Forgiveness 10%

Safe Driver 30%

Multi-Car 20%

Anti-Theft 15%

Defensive Driving 5%

You can be eligible for a Safe Vehicle Discount if the vehicle is on the newer side. New vehicles have many built-in safety features like anti-lock brakes. You may also be able to get a bundling discount.

Bundling may sound complicated, but it simply involves purchasing multiple types of coverage from the same company. For example, an individual might source their car and their home insurance from the same firm and receive a discount as a result.Daniel Walker Licensed Auto Insurance Agent

Most drivers will qualify for discounts and should be factored in when comparison shopping for cheap month-to-month car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Cheap 2-Month Auto Insurance Coverage Today

Plenty of companies offer affordable 2-month auto insurance, from USAA to Nationwide. Knowing how to compare auto insurance quotes from the best companies will ensure that you get the best deal on temporary auto insurance. You can start comparison shopping for cheap two-month auto insurance right now by entering your ZIP code in our free comparison tool.

Frequently Asked Questions

What is two-month auto insurance?

Two-month auto insurance refers to a short-term insurance policy that provides coverage for your vehicle for a duration of two months. It offers a temporary solution for individuals who need coverage for a specific period, such as when they are borrowing a car or need insurance for a short-term trip.

Can I purchase two-month auto insurance for any vehicle?

Two-month auto insurance is typically available for a wide range of vehicles, including cars, trucks, motorcycles, and recreational vehicles (RVs). However, specific eligibility may vary depending on the insurance provider and their underwriting guidelines.

When might I need two-month auto insurance?

There are several scenarios where two-month auto insurance may be useful. Some common situations include:

- Borrowing a car: If you plan to borrow a friend or family member’s vehicle for a couple of months, obtaining two-month auto insurance can provide coverage during that period.

- Short-term trips: If you are going on a vacation or a road trip for two months or less and need insurance for the duration of your trip, two-month auto insurance can be a suitable option.

- Temporary vehicle ownership: If you have recently purchased a vehicle and are in the process of finding a long-term insurance policy, two-month auto insurance can offer coverage until you secure a more permanent solution.

How much does two-month auto insurance cost?

The cost of two-month auto insurance can vary based on several factors, including your location, driving history, the type of vehicle you want to insure, and the coverage options you select. It’s best to request quotes from different insurance providers to get an accurate idea of the cost for your specific circumstances (learn more: How to Get Multiple Auto Insurance Quotes).

Can I renew my two-month auto insurance if needed?

Renewing two-month auto insurance depends on the insurance provider’s policies. Some insurers may offer the option to renew for an additional two months, while others may require you to purchase a new policy. It’s essential to clarify the renewal options with your insurance company before obtaining the initial policy.

Are there any drawbacks to two-month auto insurance?

Two-month auto insurance can be a convenient option for short-term coverage, but it’s important to consider the potential drawbacks. These policies may have higher premiums compared to long-term insurance plans. Additionally, if you plan to continue using the vehicle beyond the two-month period, you may need to find a longer-term insurance solution to maintain continuous coverage.

Can I customize the coverage on my two-month auto insurance policy?

Many insurance providers offer options to customize the types of auto insurance on two-month auto insurance policies. You can typically choose the coverage types you want, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. However, specific customization options may vary depending on the insurance company.

Can I get car insurance for 2 months?

Yes, you can get auto insurance for two months. You can get quotes quickly using our free quote tool.

How can I purchase two-month auto insurance?

To purchase two-month auto insurance, you can follow these general steps:

- Research insurance providers: Look for insurance companies that offer short-term policies or have flexible options.

- Obtain quotes: Contact the insurance providers and request quotes for two-month coverage based on your vehicle and personal details.

- Compare coverage and prices: Evaluate the quotes you receive, considering the coverage options, premiums, and any additional features or benefits.

- Choose a policy: Select the two-month auto insurance policy that best fits your needs and budget.

- Complete the application: Provide the necessary information and complete the application process as instructed by the insurance provider.

- Make payment: Pay the premium for the two-month coverage as specified by the insurance company.

- Receive proof of insurance: Once the payment is processed, you will receive proof of insurance, such as an insurance card or policy documents, from the insurance provider.

- Understand the terms and conditions: Review the policy documents carefully to understand the coverage details, policy duration, any exclusions or limitations, and any additional requirements or responsibilities.

- Contact the insurer for any questions: If you have any questions or need clarification about your two-month auto insurance policy, contact the insurance company’s customer service or your insurance agent for assistance.

- Maintain a copy of the policy: Keep a copy of your two-month auto insurance policy and proof of insurance in your vehicle or a safe place for easy access and reference during the coverage period.

How can you get cheap car insurance for 2 months?

Shopping around for cheap 2-month car insurance is the best way to find the most affordable rates. Use our free quote tool to find affordable quotes in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.