Cheap Gap Insurance in Colorado (Top 9 Low-Cost Companies for 2026)

The top picks for cheap gap insurance in Colorado are State Farm, Liberty Mutual, and Progressive with rates starting at $31 monthly. These companies offer affordable Colorado gap insurance options for drivers seeking comprehensive coverage and stand out for their reliable service and strong customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated September 2024

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Gap in Colorado

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage for Gap in Colorado

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Gap in Colorado

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks for cheap gap insurance in Colorado are State Farm, Liberty Mutual, and Progressive. State Farm stands out as the best overall, offering rates as low as $31 per month.

State Farm is the cheapest company for gap and comprehensive auto insurance in Colorado.

Liberty Mutual and Progressive also provide competitive rates, along with strong customer service and additional discounts.

Our Top 9 Company Picks: Cheap Gap Insurance in Colorado

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $31 | B | Comprehensive Coverage | State Farm | |

| #2 | $34 | A | Custom Policies | Liberty Mutual |

| #3 | $41 | A+ | Online Tools | Progressive | |

| #4 | $63 | A | Young Drivers | American Family | |

| #5 | $68 | A | Added Benefits | Farmers | |

| #6 | $70 | A+ | Customer Service | Allstate | |

| #7 | $72 | A++ | Accident Forgiveness | Travelers | |

| #8 | $76 | A+ | Bundling Discounts | Nationwide |

| #9 | $80 | A+ | Senior Drivers | The Hartford |

In this article, we’ll explore how these providers compare, considering factors like coverage levels, customer satisfaction, and available discounts, so you can choose the best option for your needs. Start saving on your Colorado auto insurance by entering your ZIP code above and comparing quotes.

- State Farm offers the best cheap gap insurance in Colorado starting at $31/month

- Liberty Mutual and Progressive provide competitive gap insurance options

- Gap insurance protects drivers from losses when their vehicle is totaled

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm excels in providing comprehensive coverage options, making it an ideal choice for vehicle gap insurance in Colorado.

- Low Monthly Rates: Competitive monthly rates at $31 for minimum coverage provide great value for customers seeking Colorado gap insurance. Compare free quotes in our State Farm insurance review.

- Usage-Based Savings: Drivers looking for cheap gap insurance in Colorado can save 30% with State Farm Drive Safe & Save usage-based insurance.

Cons

- Limited Availability: Gap insurance in Colorado is only available to policyholders who finance their auto loans through State Farm.

- Limited Multi-Policy Discount: At 17%, State Farm’s multi-policy discount is smaller compared to other Colorado auto insurance companies selling gap coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Cheapest Custom Policies

Pros

- Tailored Coverage Options: Liberty Mutual stands out for offering customizable policies, ensuring options align with your needs for gap insurance in Colorado.

- Affordable Monthly Rates: With a monthly rate of $34 for minimum coverage, Liberty Mutual provides affordable Colorado gap insurance. Compare costs in our Liberty Mutual review.

- Extensive Add-Ons: Various add-ons give flexibility to enhance your gap insurance coverage in Colorado.

Cons

- Higher Deductibles: Some plans come with higher deductibles, which might affect the overall affordability of Colorado gap insurance.

- Complexity in Policy Selection: The variety of options may make it challenging for customers to navigate and select the best gap insurance coverage in Colorado.

#3 – Progressive: Cheapest Flexible Options

Pros

- Wide Range of Coverage Choices: Progressive excels in offering a flexible range of coverage options, including gap insurance in Colorado. Learn more about options in our Progressive review.

- Competitive Rates: Monthly rates start at $41 for minimum coverage that includes Colorado gap insurance.

- User-Friendly Digital Tools: Progressive’s user-friendly online tools make it easy to manage and customize gap insurance in Colorado.

Cons

- Customer Service Issues: Some customers report challenges with customer service responsiveness, which can impact the experience when dealing with Colorado gap insurance inquiries.

- Higher Rates for Full Coverage: While minimum rates are competitive, full coverage options may be higher, affecting those who prioritize vehicle gap insurance in Colorado.

#4 – American Family: Cheapest for Young Drivers

Pros

- Affordable Teen Driver Rates: AmFam offers the lowest teen auto insurance rates in Colorado, including gap insurance.

- Comprehensive Policies: A variety of coverage options ensure adequate protection under Colorado gap insurance.

- Strong Customer Service: Known for its customer support, American Family is a reliable choice for those with gap insurance inquiries in Colorado. Find out more in our American Family review.

Cons

- Limited Discounts: Compared to other companies, American Family may have fewer discount opportunities for Colorado gap insurance.

- Higher Premiums for Full Coverage: Premiums can increase significantly when opting for full coverage, which might deter some customers who need affordable gap insurance in Colorado.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Added Benefits

Pros

- Comprehensive Benefits: Farmers offers added benefits such as roadside assistance, enhancing vehicle gap insurance in Colorado coverage options.

- Long List of Discounts: Farmers has more discounts on Colorado gap insurance than other companies. Take a look at the best Farms auto insurance discounts.

- Flexible Policy Customization: Farmers allows policy customization, ensuring you get the right coverage for gap insurance in Colorado.

Cons

- Premium Pricing: Some customers may find Farmers’ premiums to be on the higher side compared to competitors for Colorado gap insurance.

- Limited Online Features: Online tools may not be as comprehensive as some competitors, which can affect Colorado gap insurance management.

#6 – Allstate: Best Customer Service

Pros

- Excellent Customer Service: Allstate is recognized for high-quality customer service, offering support for those needing gap insurance in Colorado.

- Comprehensive Coverage Options: A variety of coverage options are available, ensuring sufficient protection under Colorado gap insurance.

- Mileage Discounts: Even high-mileage drivers can get cheap gap insurance in Colorado by signing up for Allstate Milewise or Milewise Unlimited. Read our Milewise review to learn more.

Cons

- Higher Average Premiums: Colorado gap insurance premiums can be higher than some competitors, which may be a drawback for budget-conscious consumers.

- Poor Shopping Experience: Other Colorado gap insurance companies have more convenient websites that make it easier to get quotes online than Allstate.

#7 – Travelers: Cheapest Accident Forgiveness

Pros

- Accident Forgiveness Policy: Travelers offers accident forgiveness, providing peace of mind for those needing vehicle gap insurance in Colorado.

- Strong Financial Ratings: With an A++ rating, Travelers is a reliable choice for customers seeking gap insurance in Colorado. Read our full review of Travelers insurance for more information.

- Industry Experience: Along with strong financial ratings, Travelers has many years of experience providing affordable gap insurance in Colorado.

Cons

- Limited Customization Options: May not offer as many customization options for Colorado gap insurance policies compared to competitors.

- Customer Service Concerns: Some customers report issues with customer service responsiveness, which can affect the Colorado gap insurance experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Cheapest With Bundling Discounts

Pros

- Bundling Discounts Available: Nationwide provides attractive bundling discounts of up to 20% for customers looking to lower gap insurance costs in Colorado.

- Usage-Based Savings: Nationwide has the biggest usage-based discount of up to 40% on Colorado gap insurance. Read our Nationwide SmartRide app review to learn more.

- Comprehensive Coverage: Nationwide offers comprehensive coverage options, ensuring sufficient protection under gap insurance in Colorado.

Cons

- Higher Premiums for Full Coverage: The premiums for full coverage can be higher, which may deter some customers needing Colorado gap insurance.

- Complex Policy Structure: Some customers may find the policy structure to be complex, complicating their Colorado gap insurance decisions.

#9 – The Hartford: Cheapest for Seniors

Pros

- Senior Discounts: The Hartford offers special discounts for seniors, making it a favorable choice for gap insurance in Colorado. Learn more about The Hartford in our review of The Hartford auto insurance.

- Comprehensive Benefits: The Hartford offers a variety of benefits tailored for senior drivers, enhancing coverage options under Colorado gap insurance.

- Excellent Customer Service: The Hartford consistently ranks among the top Colorado gap insurance companies for customer satisfaction in J.D. Power annual surveys.

Cons

- Higher Monthly Rates: Rates can be higher than some competitors, which may be a concern for budget-conscious customers looking for cheap Colorado gap insurance.

- Limited Availability: Only AARP members can buy The Hartford gap insurance in Colorado.

How Much Gap Insurance Costs in Colorado

Guaranteed auto protection, or gap insurance, covers the difference between a car’s depreciated value and the outstanding loan or lease balance in the event of a total loss. Colorado gap insurance costs more than average, up to $700 annually depending on the vehicle.

Vehicle gap insurance in Colorado is an add-on to your minimum or full coverage insurance policy. Here is how gap insurance rates vary with the cheapest companies:

Colorado Gap Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $23 | |

| $21 | |

| $23 | |

| $11 |

| $25 |

| $14 | |

| $10 | |

| $21 |

| $24 | |

| U.S. Average | $21 |

As the table illustrates, minimum coverage rates range from $31 with State Farm to $76 with Nationwide, while full coverage auto insurance can range from $102 with State Farm to $253 with Nationwide.

The differences in these rates are influenced by several factors, including the insurer’s assessment of risk, the driver’s personal history, and the specifics of the policy offered.

The make, model, and age of the vehicle also play a role in determining the cost of gap insurance, as does the insurer’s competitive positioning within the Colorado market.

For example, Nationwide charges some of the highest rates in both categories, likely reflecting broader coverage options or additional benefits compared to more budget-friendly alternatives like State Farm or Liberty Mutual.

Compare Now: State Farm vs. Nationwide Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

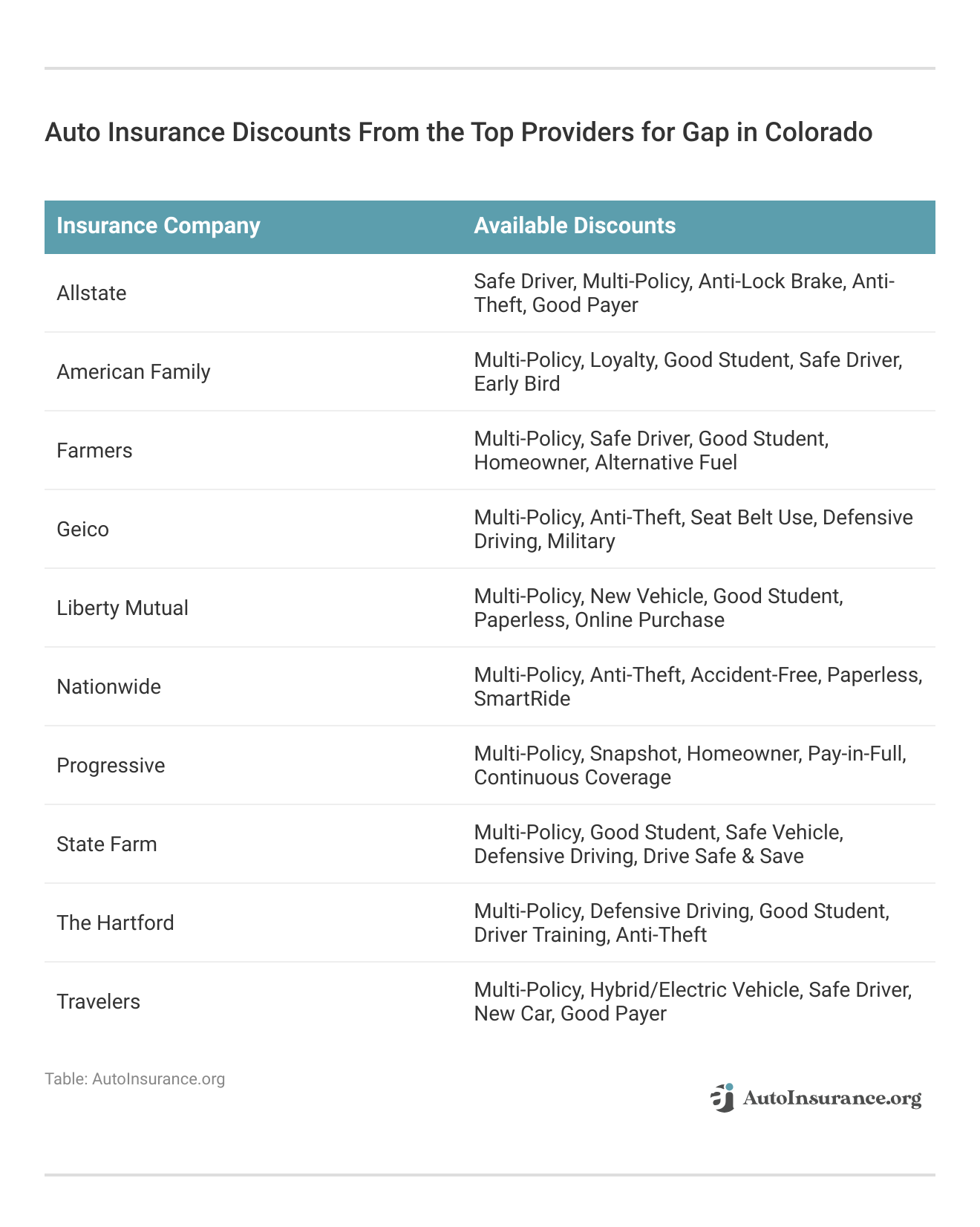

Uncovering Colorado Gap Insurance Discounts

Securing gap insurance at a lower rate is possible through various discounts offered by the cheapest Colorado auto insurance companies:

As you can see, these discounts can be tied to saving money by bundling policies, maintaining a safe driving record, or even membership in certain organizations.

Although more expensive than our top three companies, insurers like Travelers and Liberty Mutual offer discounts for loyalty, automatic payments, or paying your auto insurance premium in full upfront.

Safe drivers can benefit the most from lower rates with companies such as State Farm, which often provide discounts and usage-based programs for those with a history of responsible driving.

By exploring these discounts, Colorado drivers can find affordable gap insurance that fits their budget without compromising on coverage.

Steps to Get Cheap Colorado Gap Insurance Quotes

Obtaining online quotes is an essential step in finding the right gap insurance policy. You can start by visiting the websites of major providers like State Farm, Liberty Mutual, or Progressive, where you can use their online tools to get an instant quote.

You’ll have to enter your vehicle’s information, including the year, make, and model, as well as your personal details to get accurate gap insurance quotes in Colorado.

If you’re curious how gap insurance can impact different Colorado drivers, take a look at these case studies that explore popular Colorado gap insurance providers:

- Case Study #1 – Young Professional With a New Car: Jessica, a recent graduate, purchased a new car worth $25,000 and financed it through her insurer, which saved her $40 a month compared to other providers, ensuring she was covered in case of a total loss.

- Case Study #2 – Family With Multiple Vehicles: The Martinez family owns three vehicles, each with varying values, and they decided to bundle their gap insurance with Liberty Mutual. By bundling, they not only secured lower rates but also benefited from an additional 25% discount.

- Case Study #3 – Rideshare Driver: Michael, a rideshare driver, needed gap insurance for his $30,000 vehicle. He chose Progressive for its flexible coverage options, allowing him to customize his policy based on his driving patterns and saving him $25 monthly.

- Case Study #4 – Retired Couple With a Luxury Vehicle: The Thompson couple, retired and owning a luxury vehicle valued at $50,000, opted for gap insurance through The Hartford for its personalized service and senior-friendly policies with additional discounts for their AARP membership.

When selecting a policy, it’s essential to assess personal circumstances and explore available discounts to find the best fit. By understanding these real-life examples, Colorado drivers can make informed decisions that align with their financial situations and insurance needs.

Read More: Best Auto Insurance for New Drivers

Bottom Line: The Cheapest Gap Insurance in Colorado

Choosing the best cheap gap insurance in Colorado is essential to protect yourself from the potential financial stress of a total loss auto claim. State Farm, Liberty Mutual, and Progressive have the cheapest Colorado gap insurance with minimum rates starting at $31/month.

State Farm offers the best overall gap insurance in Colorado, with rates starting as low as $31 per month.Daniel Walker Licensed Auto Insurance Agent

It’s crucial to compare rates and coverage levels to find the best fit for your needs. Also, exploring available discounts can significantly lower your premium, making coverage more affordable. Remember that pay-as-you-go auto insurance in Colorado, like State Farm Drive Safe and Save, can help you secure cheaper gap insurance rates if you’re a safe or low-mileage driver.

Comparing multiple quotes from Colorado auto insurance companies can provide a clearer picture of the options available to you. By doing your research, you can secure the most suitable gap insurance policy to safeguard your investment.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Does Colorado require gap insurance?

Gap insurance in Colorado works the same way as gap insurance in the rest of the U.S., by paying the balance remaining on your car loan or lease after a liability, comprehensive, or collision claim pays out the actual cash value of your totaled vehicle. Colorado doesn’t require any driver to carry gap insurance.

How much is gap insurance in Colorado?

The average cost of gap insurance in Colorado is $171 per month. Gap insurance pays the difference between the amount you owe on a car loan and the car’s actual cash value, which could prove extremely valuable if you owe more on your car than it is worth.

Will gap insurance in Colorado cover a blown engine?

Does auto insurance cover engine failure? The simple answer is no, gap insurance doesn’t cover engine failure. One of the most expensive breakdowns a car owner can have is engine failure. An engine that needs to be replaced can cost thousands of dollars, so you want to protect yourself and your finances if you can.

How many claims can you make on gap insurance?

Gap insurance only covers one vehicle auto loan, so you can only make one Colorado gap insurance claim per policy.

What is the most gap insurance will pay in Colorado?

When you file a total loss claim, your insurer will pay you up to the actual cash value (ACV) of your vehicle. Colorado gap insurance will cover the remaining balance you have left on your loan or lease. Without gap coverage, you may find yourself in a situation known as negative equity or being upside down on your loan. Enter your ZIP code to find out if you can get a better deal.

How much is auto insurance in Colorado per month?

The average auto insurance cost in Colorado is $212 per month for a full coverage policy. That’s more expensive than the national average of $48 per month. Compare auto insurance rates by state here.

Why is auto insurance so high in Colorado?

A majority of Colorado’s population lives in urban neighborhoods, which increases auto insurance rates in the state. Densely populated areas tend to have higher rates of vehicle theft and vandalism. More people also increase the likelihood of injuries or fatalities from car accidents.

Can you go to jail for driving without insurance in Colorado?

Penalties for driving without auto insurance in Colorado depending on the conviction, you could be looking at a fine of anywhere from $500 to $1,000. Additionally, for a second, third, or subsequent offense, you could face anywhere from 10 days to 1 year in jail.

What is the minimum auto insurance in Colorado?

Colorado minimum auto insurance requirements are $25,000 for bodily injury or death to any one person in an accident, $50,000 for bodily injury or death to all persons in any one accident, and $15,000 for property damage in any one accident.

What is the cheapest auto insurance for a DUI in Colorado?

The cheapest car insurance after a DUI in Colorado is with State Farm, Progressive, or Allstate.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.