Cheapest Teen Driver Auto Insurance in Louisiana (Top 8 Companies for Savings in 2026)

USAA, Geico, and Allstate provide the cheapest teen driver auto insurance in Louisiana. USAA has the best rates for teens in the military at $93/month, but Geico is available to all teen drivers in Louisiana starting at $143/month. Leverage discounts to get the cheapest Louisiana teen auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe top pick overall for the cheapest teen driver auto insurance in Louisiana is USAA, with Geico and Allstate also ranked among the best providers for various types of auto insurance.

These companies are recognized for their specialized coverage options, organizational discounts, and flexible policies tailored to young drivers. By comparing these top choices, families can make well-informed decisions to secure the best coverage for their teen drivers.

Our Top 8 Company Picks: Cheapest Teen Driver Auto Insurance in Louisiana

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $93 A++ Specialized Coverage Geico

![]()

#2 $143 A++ Small Businesses USAA

![]()

#3 $153 A+ Organization Discount Allstate

#4 $162 A Comprehensive Coverage AAA

#5 $185 A+ Customer Service Nationwide

![]()

#6 $204 A+ Coverage Options Amica

![]()

#7 $316 A Bundling Policies The General

![]()

#8 $343 A+ Tailored Policies Progressive

Affordable car insurance for teen drivers is just a click away. Enter your ZIP code into our free quote tool above to find the best teen auto insurance in Louisiana.

- USAA offers the best teen insurance rates starting at $93/month

- Geico has affordable teen car insurance for $143/month

- Student discounts for teens help lower auto insurance rates

#1 – Geico: Top Overall Pick

Pros

- Customizable Teen Coverage: Provides extensive customization options tailored to the unique requirements of teen driver auto insurance in Louisiana.

- Innovative Features: Includes Geico DriveEasy usage-based insurance and educational programs focused on promoting safe driving habits among teen drivers in Louisiana.

- Wide Range of Add-Ons: In our Geico auto insurance review, we outline the various additional options that offer increased protection for teen driver auto insurance in Louisiana.

Cons

- No Gap Insurance: Teen drivers in Louisiana with new cars are unable to obtain auto loan coverage from Geico.

- Variable Customer Feedback: Some teen drivers in Louisiana report varying experiences with auto insurance claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Teens

Pros

- Military Discounts: USAA offers unique benefits and discounts specifically designed for teen driver auto insurance in Louisiana for military families.

- Discounts for Small Business Families: Provides discounts advantageous to small business owners and their teen driver auto insurance in Louisiana.

- Consistent Service: Discover our USAA review, emphasizing dependable customer service for teen driver auto insurance in Louisiana.

Cons

- Eligibility Restrictions: Teen driver auto insurance in Louisiana is exclusively available to military families.

- Expensive High-Risk Rates: In Louisiana, teen drivers with accidents will face higher premiums with USAA compared to other auto insurance companies.

#3 – Allstate: Best for Organization Discounts

Pros

- Substantial Organization Discounts: Provides substantial discounts on teen driver auto insurance in Louisiana for members of affiliated organizations.

- Teen Smart Discounts: Explore our Allstate auto insurance review to learn how the company discounts teen driver auto insurance in Louisiana for safe driving.

- Extensive Agent Network: A wide network of agents offers tailored service for families with teen drivers, including those seeking auto insurance in Louisiana.

Cons

- Premium Fluctuations: Discounts for teen driver auto insurance in Louisiana can fluctuate by city, leading to unexpected changes in premiums.

- Eligibility for Discounts: Certain discounts for teen driver auto insurance in Louisiana may have qualifications that not all teenagers can meet.

#4 – AAA: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Provides extensive coverage options and add-ons for complete teen driver auto insurance in Louisiana.

- Roadside Assistance: View our AAA auto insurance review, their policies provide excellent roadside assistance, ideal for new teen drivers in Louisiana.

- Travel Discounts: Provides extra travel-related discounts, which can benefit Louisiana families with teen driver auto insurance.

Cons

- Membership Required: Teen driver auto insurance in Louisiana necessitates an AAA membership, which incurs an additional expense.

- Higher Premiums: Including comprehensive coverage options will raise auto insurance rates for teen drivers in Louisiana.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Customer Service

Pros

- Dedicated Support for Teens: Renowned for outstanding customer service, particularly in managing teen driver auto insurance in Louisiana.

- Accident Forgiveness: Check out our Nationwide auto insurance review to see how they offer crucial accident forgiveness for teen driver auto insurance in Louisiana.

- Easy Claim Process: Nationwide simplifies claims for teen driver auto insurance in Louisiana, easing the process for teens and their families.

Cons

- Pricing Disparities: Teen driver auto insurance rates in Louisiana can vary significantly from one region to another.

- Limited Policy Customization: Less flexibility in customizing policies compared to more affordable options for teen driver auto insurance in Louisiana.

#6 – Amica: Best for Coverage Options

Pros

- Flexible Coverage Choices: Enables families to customize teen driver auto insurance in Louisiana extensively to meet their adolescent driver’s specific needs.

- High Customer Satisfaction: Consistently praised for excellent customer service and high satisfaction levels with teen driver auto insurance in Louisiana.

- Good Driver Rewards: In line with our Amica auto insurance review, the company offers various discounts to teen drivers in Louisiana who keep a clean driving record.

Cons

- Limited Local Agents: Fewer local agents may affect personalized service for teen driver auto insurance in Louisiana.

- Cost Variability: The cost of teen driver auto insurance in Louisiana depends on how customized the policy is.

#7 – The General: Best for Bundling Policies

Pros

- Attractive Bundling Discounts: Provides substantial savings when you bundle teen driver auto insurance in Louisiana with other policies.

- Acceptance of High-Risk Drivers: Offers broader accessibility for teen drivers with less-than-perfect driving records, specifically for auto insurance in Louisiana.

- Rapid Policy Approval: Read our The General auto insurance review to see how their fast processing benefits new teen drivers in Louisiana needing quick auto insurance coverage.

Cons

- Basic Coverage Options: Although it is cost-effective, it typically offers more basic coverage for Louisiana insurance, which might not fully meet the needs of your teen driver.

- Reputation Variability: Some customers report inconsistency in customer service and claim satisfaction for teen driver auto insurance in Louisiana.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Tailored Policies

Pros

- Custom Policies for Teens: Specializes in developing tailored auto insurance policies for teen drivers in Louisiana, designed to match their unique driving habits.

- Snapshot Program: Read our Progressive Snapshot review to discover how to substantially reduce teen driver auto insurance rates in Louisiana by focusing on real driving habits.

- Wide Coverage Range: Offers a variety of teen driver auto insurance options in Louisiana, including everything from basic liability coverage to comprehensive plans.

Cons

- Inconsistent Claims Experience: Some customers have reported inconsistencies in the handling of insurance claims for teen driver auto insurance in Louisiana.

- Rate Increases: Teen driver auto insurance in Louisiana can see sudden rate increases at renewal, despite initially low rates.

Teen Auto Insurance Rates in Louisiana

Teens are considered high-risk by insurance companies due to their inexperience, leading to more expensive Lousiana car insurance rates. Compare monthly rates for teen driver auto insurance in Louisiana from the cheapest companies for both minimum and full coverage costs.

Louisiana Teen Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $162 | $378 |

| Allstate | $153 | $507 |

| Amica | $204 | $597 |

| Geico | $93 | $309 |

| Nationwide | $185 | $612 |

| Progressive | $343 | $1,138 |

| The General | $316 | $734 |

| USAA | $143 | $474 |

USAA offers the most affordable rates, with $93 for minimum coverage and $309 for full coverage. Geico also provides competitive pricing at $143 for minimum and $474 for full coverage. On the higher end, Progressive charges $343 for minimum and $1,138 for full coverage.

USAA offers unbeatable rates and comprehensive coverage, making it the top choice for teen driver auto insurance in Louisiana.Brandon Frady Licensed Insurance Producer

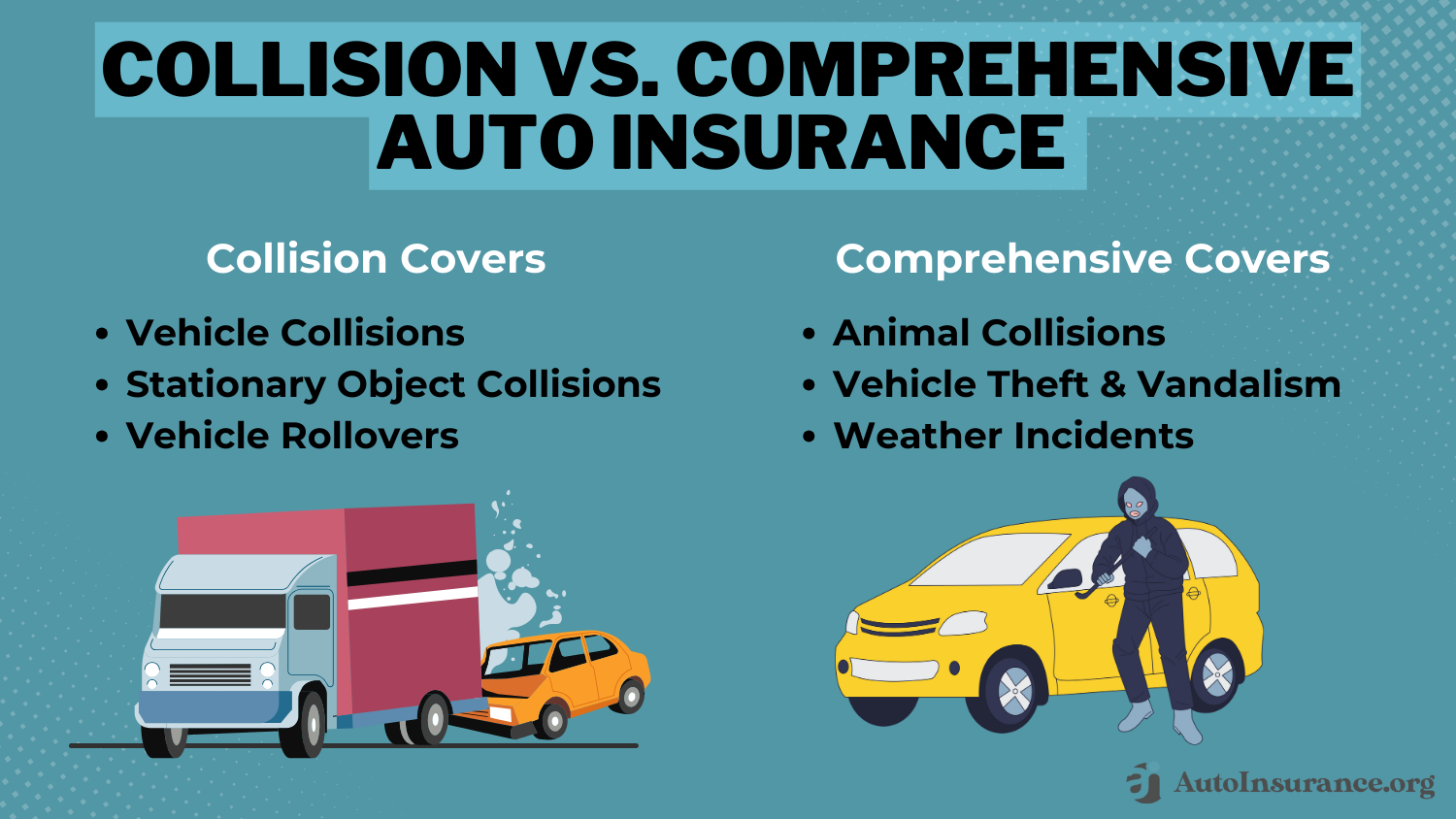

The choice between comprehensive full coverage vs. minimum liability coverage is crucial to protect young drivers. Louisiana minimum auto insurance requirements are very low and do not protect teen drivers or their property. If you want to add full coverage or increase policy limits, it will increase your teen insurance costs.

Discount Strategies for Teen Drivers in Louisiana

In Louisiana, obtaining affordable auto insurance for teen drivers involves leveraging a variety of auto insurance discounts offered by insurers. These discounts are crucial in managing the typically higher premiums associated with insuring younger drivers.

Discounts for teen drivers can reduce costs, with the best Louisiana insurance companies offering savings for good grades, defensive driving courses, or using telematics devices that monitor driving behavior. Scroll through this list of teen auto insurance discounts available from Louisiana insurers:

USAA offers military and annual mileage discounts, while Geico provides discounts for good drivers and federal employees. Progressive includes Snapshot usage-based discounts, and Allstate offers discounts for early signing and new cars.

data-media-max-width=”560″>

These head-to-head comparisons from @usnews are helpful, but we feel like they buried the lead: USAA is No. 1 in car insurance. https://t.co/wEv0rBGSGD pic.twitter.com/u3QSfpPh39

— USAA (@USAA) March 6, 2019

Understanding high-risk auto insurance is also critical to securing cheap teen auto insurance in Louisiana. Consider these strategic points to enhance safety and manage costs:

- Choose the Right Vehicle: Compare auto insurance by vehicle. Vehicles with high safety ratings and those that are less expensive to repair typically carry lower teen insurance premiums.

- Increase Deductibles: Consider choosing a higher deductible to lower the monthly teen insurance rate, but keep deductibles affordable in case of an accident.

- Pick the Right Coverage: While liability coverage is mandatory in Louisiana, adding collision and comprehensive coverage provides better protection.

- Practice Safe Driving: Encourage teens to engage in safe driving habits. Safer driving reduces the likelihood of accidents and, consequently, the potential for premium increases.

- Add a Teen Driver: Adding a teenager to your auto insurance policy will cut premiums in half.

Location within Louisiana also influences teen auto insurance due to varying traffic density, road conditions, and accident rates in different cities.

Rates can vary significantly between companies so regularly compare insurance rates from different providers to find the best deal.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Auto Insurance Solutions for Louisiana Teen Drivers

These case studies are based on real-world scenarios and illustrate how families can navigate auto insurance choices for teen drivers in Louisiana using the top three insurance providers.

- Case Study #1 – Comprehensive Coverage: Jake, a 17-year-old in Baton Rouge, just received his driver’s license. His parents chose USAA for its affordable rates and military family discounts since Jake’s mother is a veteran. They selected comprehensive auto insurance, using USAA discounts for Jake’s good grades and safe driving courses.

- Case Study 2 – Specialized Coverage: Emily, a college freshman from Shreveport, drives to school daily. Her parents chose Geico for its specialized coverage for young drivers and competitive rates. They capitalized on Geico good student discounts, securing coverage that includes roadside assistance and rental reimbursement.

- Case Study #3 – Organization Discounts: Dylan, a 19-year-old entrepreneur from New Orleans, uses his car for personal and business deliveries. He selected Allstate for its organizational discounts and flexible policies for small business owners. Dylan’s policy covers both uses, enhanced by discounts linked to his local business network affiliation and clean driving record.

These case studies illustrate the range of insurance options for teen drivers in Louisiana, showing how tailored coverage and strategic discounts meet the specific needs of young drivers. Compare auto insurance rates by age to learn more.

Final Thoughts on Teen Driver Auto Insurance in Louisiana

The cheapest options from prominent insurers offer a starting point. However, consider more than price. Specialized coverage, organization discounts, and adaptable policies for young drivers are important to lock in the best teen driver auto insurance in Louisiana.

With customer review ratings of 95%, USAA stands out as the best provider for affordable and comprehensive teen driver auto insurance in Louisiana.Kristen Gryglik Licensed Insurance Agent

By leveraging good student discounts and multi-policy discounts, families with teens can save money on auto insurance. Start comparing companies with the cheapest teen auto insurance to get the lowest rates.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How much is car insurance in Louisiana for a 16-year-old?

Cheap auto insurance for 16-year-olds in Louisiana typically ranges from $250 to $417 per month, depending on factors like the insurer, coverage options, and the teen’s driving record.

How much does auto insurance cost for high school drivers in Louisiana?

Auto insurance for high school drivers in Louisiana generally costs between $250 and $400 per month, varying based on the insurer and coverage selected.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What is the minimum auto insurance in Louisiana?

The minimum auto insurance in Louisiana includes $15,000 per person and $30,000 per accident for bodily injury liability, and $25,000 per accident for property damage liability.

Who has the cheapest auto insurance in Louisiana?

The cheapest auto insurance companies in Louisiana include USAA, Geico, and Allstate, with rates starting at $93 per month for teen drivers.

Is it illegal to not have car insurance in Louisiana?

Yes, it is illegal to not have car insurance in Louisiana. Drivers must carry at least the state-mandated minimum liability coverage to legally operate a vehicle.

How to lower car insurance in Louisiana?

To lower your auto insurance rates in Louisiana, consider raising deductibles, taking advantage of discounts for good students and safe drivers, bundling policies, and maintaining a clean driving record.

Are Louisiana insurance rates going up?

Yes, Louisiana insurance rates have been rising due to factors like high accident rates, severe weather conditions, and increased repair costs.

What is the average cost of auto insurance in Louisiana?

The average cost of auto insurance in Louisiana is about $192 per month, but rates can vary significantly based on driver demographics and coverage levels.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Who has the best car insurance rates in Louisiana?

USAA and Geico are often rated as the best auto insurance companies in Louisiana due to their competitive pricing and extensive discount programs.

Why is Louisiana car insurance so expensive?

Louisiana car insurance is expensive due to high accident rates, severe weather impacts, a high number of uninsured drivers, and state-specific legal and medical costs associated with claims. (Read More: Does car insurance cover hurricane damage?)

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.