Best Volkswagen Passat Auto Insurance in 2026 (Top 10 Companies Ranked)

USAA, Dairyland, and Erie offer the best Volkswagen Passat auto insurance, starting at just $22 monthly. These providers excel in coverage options, customer satisfaction, and affordability for Volkswagen Passat owners, making them top choices for comprehensive vehicle protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

Company Facts

Full Coverage for Volkswagen Passat

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volkswagen Passat

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volkswagen Passat

A.M. Best Rating

Complaint Level

Pros & Cons

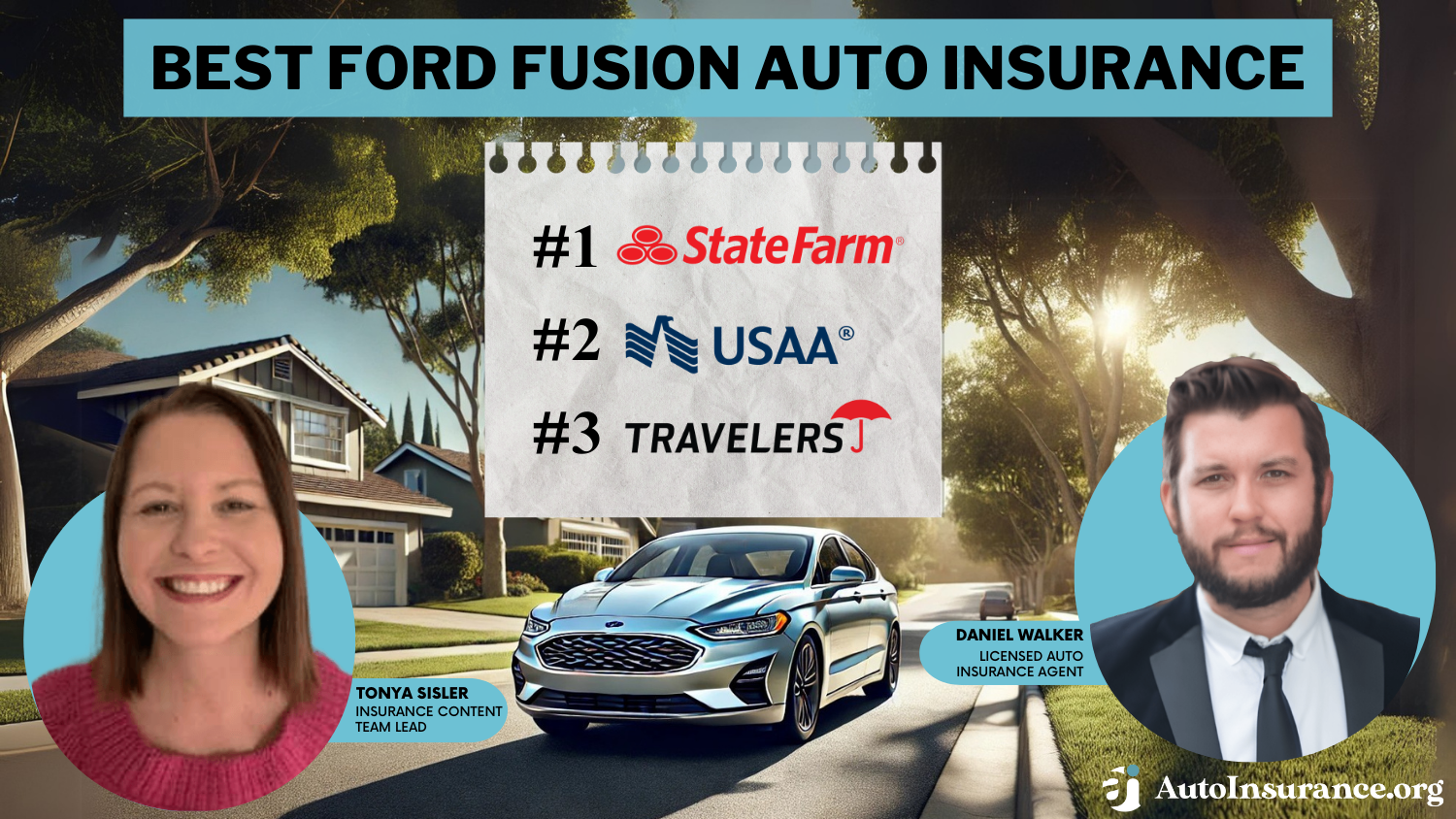

The top picks for the best Volkswagen Passat auto insurance are USAA, Dairyland, and Erie, known for their exceptional coverage and customer service.

These companies provide robust policies tailored specifically for the Volkswagen Passat, ensuring that owners receive comprehensive protection tailored to their needs. With a focus on affordability and reliability, these insurers stand out in the competitive market.

Our Top 10 Company Picks: Best Volkswagen Passat Auto Insurance

Company Rank Pay-in-Full Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A++ Personalized Policies USAA

#2 18% A+ Filing Claims Dairyland

#3 12% A+ Safe-Driving Discounts Erie

#4 10% A++ Customizable Policies Geico

#5 14% A+ First-Responder Discount Nationwide

#6 17% A Safe Drivers Liberty Mutual

#7 16% A Group Discounts Safeco

#8 13% A Safety Discounts AAA

#9 19% A+ Family Plans Progressive

#10 11% A Cheap Rates Farmers

Additionally, the article offers insights into factors influencing insurance costs and tips for securing the best rates, making it a valuable resource for Volkswagen Passat owners looking to optimize their insurance coverage. See details in our article titled “Volkswagen Auto Insurance.”

Use our free comparison tool to see what auto insurance quotes look like in your area.

- USAA is the top pick for Volkswagen Passat auto insurance

- Tailored coverage options meet specific needs of Volkswagen Passat owners

- Insights on factors affecting insurance costs for Volkswagen Passat

#1 – USAA: Top Overall Pick

Pros

- Bundling Policies: USAA offers discounts for bundling multiple policies, beneficial for Volkswagen Passat owners. Find out why USAA ranks among the cheapest providers in our article titled USAA auto insurance review.

- Top-Rated Customer Service: With an A++ A.M. Best rating, USAA provides excellent service and reliability for Volkswagen Passat insurance.

- Military Discounts: Special rates for military personnel, ideal for Volkswagen Passat owners serving in the armed forces.

Cons

- Membership Restrictions: USAA services are only available to military members and their families, limiting access for general Volkswagen Passat owners.

- Geographic Availability: Some USAA coverages for the Volkswagen Passat may not be available in all areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Dairyland: Best for Filing Claims

Pros

- High Claim Satisfaction: Dairyland is known for efficient claim processing, crucial for Volkswagen Passat accidents.

- Affordable Policies: Competitive rates with an 18% pay-in-full discount beneficial for Volkswagen Passat owners. See if Dairyland offers affordable rates near you in our article titled Dairyland auto insurance review.

- Flexible Payment Options: Offers various payment plans that can ease the financial burden on Volkswagen Passat owners.

Cons

- Limited Availability: Dairyland’s coverage for the Volkswagen Passat may not be available nationwide.

- Basic Coverage Options: Some Volkswagen Passat owners might find the coverage options less comprehensive compared to larger insurers.

#3 – Erie: Best for Safe-Driving Discounts

Pros

- Accident Forgiveness: Erie offers accident forgiveness policies, an advantage for safe-driving Volkswagen Passat owners.

- Rate Lock Feature: Ensures that your Volkswagen Passat insurance rates won’t increase unexpectedly.

- 12% Safe Driving Discount: Rewarding Volkswagen Passat drivers who have a clean driving record. See our review of Erie car insurance to compare rates and learn more about this provider.

Cons

- Limited State Coverage: Erie does not offer Volkswagen Passat insurance in all states, which might be restrictive for some owners.

- No Online Claims: Volkswagen Passat owners must file claims via phone or agent, which might be inconvenient for some.

#4 – Geico: Best for Customizable Policies

Pros

- Wide Range of Coverages: Geico offers a variety of customizable policies suitable for any Volkswagen Passat owner’s needs.

- Strong Financial Stability: With an A++ A.M. Best rating, Geico is a reliable choice for insuring your Volkswagen Passat.

- 10% Multi-Policy Discount: Encourages savings for Volkswagen Passat owners who bundle policies. Learn more about Geico’s rates in our article titled Geico auto insurance company review.

Cons

- Customer Service Variability: Some customers report varied experiences with service, which might affect Volkswagen Passat owners.

- Premium Fluctuations: Volkswagen Passat insurance premiums may fluctuate based on geographic and demographic factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for First-Responder Discount

Pros

- Special Discounts for First Responders: Offers a 14% discount for first responders, beneficial for those Volkswagen Passat owners.

- Wide Coverage Options: Provides extensive insurance options for various needs of Volkswagen Passat owners. Find out if Nationwide might have the lowest rates for you in our article titled Nationwide auto insurance review.

- Free Accident Forgiveness: Nationwide offers accident forgiveness policies, which can prevent rate increases after your first at-fault accident involving a Volkswagen Passat.

Cons

- Higher Premiums Without Discounts: For Volkswagen Passat owners not qualifying for discounts, Nationwide’s rates might be higher.

- Customer Satisfaction Variability: Some Volkswagen Passat owners might experience less than ideal interactions based on location.

#6 – Liberty Mutual: Best for Safe Drivers

Pros

- Tailored Discounts for Safe Drivers: Liberty Mutual rewards safe Volkswagen Passat drivers with up to a 17% discount.

- Multiple Policy Discounts: Offers significant savings for Volkswagen Passat owners who bundle their auto insurance with other policies.

- Online Policy Management: Easy online access to manage and customize your Volkswagen Passat insurance policy. Learn more about this provider in our thorough Liberty Mutual company review.

Cons

- Variable Premiums: Premium costs for Volkswagen Passat insurance may vary significantly based on personal driving history and location.

- Claims Process: Some customers report a lengthy claims process, which could delay resolutions for Volkswagen Passat owners.

#7 – Safeco: Best for Group Discounts

Pros

- Competitive Group Rates: Safeco offers a 16% discount for Volkswagen Passat owners through group insurance plans. Compare Safeco’s rates to other providers in our article titled Safeco auto insurance review.

- Customizable Coverage: Allows Volkswagen Passat owners to tailor their insurance policies to fit their specific needs and budget.

- Online Claims and Support: Provides 24/7 online support and a straightforward claims process for Volkswagen Passat owners.

Cons

- Coverage Limitations: Some regions may have limited coverage options available for Volkswagen Passat owners.

- Policy Costs: Base rates can be higher unless discounts apply, potentially making it less competitive for some Volkswagen Passat owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Safety Discounts

Pros

- Comprehensive Safety Discounts: AAA offers up to a 13% discount for Volkswagen Passat owners who meet safety standards.

- Roadside Assistance: Excellent roadside support, adding value for Volkswagen Passat owners who travel frequently. Learn more about AAA roadside assistance in our review of AAA insurance.

- Policy Flexibility: Offers flexibility in coverage adjustments and policy terms for Volkswagen Passat insurance.

Cons

- Membership Required: Requires a membership fee, which adds to the overall cost for Volkswagen Passat insurance.

- Limited Availability: Not all services and discounts may be available in every area for Volkswagen Passat owners.

#9 – Progressive: Best for Family Plans

Pros

- Multi-Car Discounts: Progressive provides substantial discounts for Volkswagen Passat families insuring multiple vehicles. Our complete Progressive review goes over this in more detail.

- Loyalty Rewards: Offers loyalty rewards and discounts that increase the longer you insure your Volkswagen Passat with them.

- Customizable Deductibles: Allows Volkswagen Passat owners to choose their deductible amounts, influencing premium costs.

Cons

- Premium Variability: Premiums for Volkswagen Passat insurance can vary greatly depending on numerous factors including driving history.

- Customer Service Experiences: Some customers report inconsistent customer service experiences, which could impact Volkswagen Passat owners.

#10 – Farmers: Best for Cheap Rates

Pros

- Competitive Pricing for Volkswagen Passat: Farmers offers some of the most affordable rates for Volkswagen Passat insurance. Check out our online Farmers review for more information.

- Incident Forgiveness: Policies that include accident forgiveness can prevent rate increases after a Volkswagen Passat’s first accident.

- Customizable Coverage Levels: Provides various coverage options allowing Volkswagen Passat owners to fine-tune their policies based on their needs.

Cons

- Coverage Restrictions: Certain features and benefits might not be available in all states for Volkswagen Passat insurance.

- Claims Satisfaction: Some Volkswagen Passat owners might find the claims process less satisfactory compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for Volkswagen Passat

The following details provide a snapshot of monthly auto insurance rates for the Volkswagen Passat, segmented by insurance provider and level of coverage.

Volkswagen Passat Auto Insurance Monthly Rates for Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $46 | $86 |

| Dairyland | $85 | $237 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| USAA | $22 | $59 |

For Volkswagen Passat owners, the cost of insurance varies significantly between minimum and full coverage options across different insurance companies. For instance, Erie and USAA offer the most affordable rates for both minimum and full coverage, priced at $22 and $58 for Erie, and $22 and $59 for USAA respectively.

In contrast, Dairyland presents the highest rates, with minimum coverage at $85 and full coverage escalating to $237. Other notable providers include Geico and Safeco, offering competitive rates at $30 and $80 for full coverage and $27 and $71 respectively. More company details are available in our article titled “Safeco Auto Insurance Discounts.”

This range demonstrates the diversity in pricing, emphasizing the importance of comparing rates to find the best insurance solution for individual needs and budget constraints.

Volkswagen Passat Insurance Cost

Volkswagen Passat Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $125 |

| Discount Rate | $74 |

| High Deductibles | $108 |

| High Risk Driver | $267 |

| Low Deductibles | $158 |

| Teen Driver | $458 |

To optimize your Volkswagen Passat insurance costs, comparing rates and considering various deductibles and discounts is essential. Learn more in our article titled “Is auto insurance tax deductible?”

Are Volkswagen Passats Expensive to Insure

The chart below details how Volkswagen Passat insurance rates compare to other sedans like the Subaru Impreza, Ford Focus, and Toyota Camry. See more details on our article titled “Best Toyota Camry Auto Insurance.”

Volkswagen Passat Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Volkswagen Passat | $29 | $52 | $31 | $125 |

| Subaru Impreza | $27 | $45 | $33 | $118 |

| Ford Focus | $20 | $45 | $33 | $111 |

| Toyota Camry | $25 | $48 | $33 | $118 |

| Nissan Maxima | $31 | $53 | $33 | $129 |

| Nissan Altima | $26 | $48 | $33 | $119 |

| Kia Forte | $27 | $42 | $31 | $113 |

To find the most affordable Volkswagen insurance rates online, start by comparing quotes from multiple providers. Additionally, consider taking advantage of discounts for things like safe driving, multiple vehicles, or bundling policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Impacts the Cost of Volkswagen Passat Insurance

The cost of insuring a Volkswagen Passat varies due to several factors. Vehicle-specific elements like the model year and trim can raise premiums because newer or higher-spec models have greater value and repair costs. Insurance rates are influenced by driver age and history, with younger drivers and those with violations paying more. Urban locations also see higher rates due to increased risks compared to rural areas.

Furthermore, the amount of coverage purchased profoundly impacts insurance costs. Opting for comprehensive and collision insurance will increase premiums but provide more extensive coverage compared to minimal liability coverage. Insurance rates for models like the Volkswagen Passat may be lower if they historically show fewer claims. Unlock details in our guide titled “Collision vs. Comprehensive Auto Insurance.”

Lastly, discount opportunities can reduce insurance costs. Many insurers offer discounts for safe driving, good student records, and vehicle safety features, which can all contribute to lowering the overall cost of insuring a Volkswagen Passat. Understanding these factors helps Volkswagen Passat owners and buyers choose the right insurance coverage at the best price.

Age of the Vehicle

Older Volkswagen Passat models generally cost less to insure. For example, monthly auto insurance rates for a 2020 Volkswagen Passat are approximately $125, while 2010 Volkswagen Passat rates are about $101, reflecting a monthly difference of $24.

Volkswagen Passat Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Volkswagen Passat | $30 | $53 | $32 | $127 |

| 2023 Volkswagen Passat | $30 | $53 | $32 | $126 |

| 2022 Volkswagen Passat | $29 | $53 | $31 | $126 |

| 2021 Volkswagen Passat | $29 | $52 | $31 | $126 |

| 2020 Volkswagen Passat | $29 | $52 | $31 | $125 |

| 2019 Volkswagen Passat | $28 | $50 | $33 | $123 |

| 2018 Volkswagen Passat | $27 | $50 | $33 | $123 |

| 2017 Volkswagen Passat | $26 | $49 | $35 | $122 |

| 2016 Volkswagen Passat | $25 | $47 | $36 | $120 |

| 2015 Volkswagen Passat | $24 | $45 | $37 | $118 |

| 2014 Volkswagen Passat | $23 | $42 | $38 | $115 |

| 2013 Volkswagen Passat | $22 | $39 | $38 | $112 |

| 2012 Volkswagen Passat | $21 | $35 | $38 | $107 |

| 2011 Volkswagen Passat | $20 | $33 | $39 | $104 |

| 2010 Volkswagen Passat | $19 | $30 | $39 | $101 |

As the age of the Volkswagen Passat increases, the overall cost to insure it decreases, highlighting the potential for significant insurance savings on older models.

Driver Age

Driver age can significantly impact Volkswagen Passat auto insurance rates. For instance, 30-year-old drivers pay approximately $6 more per month for Volkswagen Passat auto insurance than 40-year-old drivers.

Volkswagen Passat Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $600 |

| Age: 18 | $458 |

| Age: 20 | $284 |

| Age: 30 | $131 |

| Age: 40 | $125 |

| Age: 45 | $120 |

| Age: 50 | $114 |

| Age: 60 | $112 |

The data clearly shows that younger drivers, such as those around 30 years old, typically face higher Volkswagen Passat auto insurance rates compared to older, more experienced drivers. Check out insurance savings in our complete guide titled “Reasons Auto Insurance Costs More for Young Drivers.”

Driver Location

Where you live can have a large impact on Volkswagen Passat insurance rates. For example, drivers in New York may pay about $76 more per month than drivers in Seattle.

Volkswagen Passat Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $214 |

| New York, NY | $198 |

| Houston, TX | $196 |

| Jacksonville, FL | $182 |

| Philadelphia, PA | $168 |

| Chicago, IL | $165 |

| Phoenix, AZ | $145 |

| Seattle, WA | $122 |

| Indianapolis, IN | $107 |

| Columbus, OH | $104 |

The geographic location significantly influences Volkswagen Passat insurance premiums, with variances as marked as New York and Seattle showing a noticeable difference in monthly costs.

Your Driving Record

Your driving record can have an impact on the cost of Volkswagen Passat auto insurance. Teens and drivers in their 20’s see the highest jump in their Volkswagen Passat auto insurance rates with violations on their driving record.

Volkswagen Passat Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $600 | $750 | $1,050 | $720 |

| Age: 18 | $458 | $610 | $860 | $530 |

| Age: 20 | $284 | $420 | $650 | $380 |

| Age: 30 | $131 | $190 | $310 | $170 |

| Age: 40 | $125 | $180 | $300 | $160 |

| Age: 45 | $120 | $175 | $290 | $155 |

| Age: 50 | $114 | $165 | $280 | $150 |

| Age: 60 | $112 | $160 | $270 | $145 |

Maintaining a clean driving record is crucial as violations and accidents can significantly escalate Volkswagen Passat auto insurance costs, especially for younger drivers.

Volkswagen Passat Safety Ratings

Your Volkswagen Passat auto insurance rates are influenced by the Volkswagen Passat’s safety ratings. See the breakdown below:

Volkswagen Passat Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The consistently good safety ratings across multiple test types underscore the reliability of the Volkswagen Passat, potentially leading to more favorable auto insurance rates.

Volkswagen Passat Crash Test Ratings

Poor crash test ratings for the Volkswagen Passat could lead to higher auto insurance rates for this model. Insurance companies often adjust premiums based on a vehicle’s safety performance.

Volkswagen Passat Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Volkswagen Passat 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

Owners of newer Volkswagen Passat models may enjoy lower insurance rates due to their generally higher safety ratings, which are reflected in varied crash test results. These improved safety features can lead to more favorable insurance premiums.

Volkswagen Passat Safety Features

Good Volkswagen Passat safety features can result in insurers giving you auto insurance discounts. The safety features for the 2020 Volkswagen Passat are:

- Air Bags: Driver, Passenger, Front Head, Rear Head, Front Side

- Brakes: 4-Wheel ABS, 4-Wheel Disc Brakes, Brake Assist

- Safety Features: Electronic Stability Control, Traction Control, Daytime Running Lights

- Child Safety: Child Safety Locks, Integrated Turn Signal Mirrors

- Monitoring Systems: Blind Spot Monitor, Cross-Traffic Alert

Leveraging the comprehensive safety features of the 2020 Volkswagen Passat can significantly reduce your auto insurance rates through available discounts.

Volkswagen Passat Insurance Loss Probability

Another contributing factor that affects Volkswagen Passat auto insurance rates is the loss probability for each type of coverage. Discover more about offerings in our guide titled “What are the recommended auto insurance coverage levels?”

Volkswagen Passat Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | 1% |

| Property Damage | -1% |

| Comprehensive | -1% |

| Personal Injury | 11% |

| Medical Payment | 13% |

| Bodily Injury | 2% |

The varying loss rates across different insurance coverage categories highlight the importance of choosing the right Volkswagen Passat auto insurance tailored to specific risk factors.

Volkswagen Passat Finance and Insurance Cost

Financing a Volkswagen Passat requires managing monthly car payments and considering variable insurance costs based on several factors. The insurance rates for a Volkswagen Passat depend on the chosen level of coverage, the driver’s history, and even the region in which the vehicle is registered. Discover insights in our article titled “Does your car need to be registered to get auto insurance?”

Typically, drivers can expect to pay between $22 and $237 per month for insurance, depending on whether they opt for minimum or full coverage and their choice of insurer. When financing a Passat, it’s crucial to factor in these costs to get a complete picture of the monthly expenses.

Moreover, purchasing insurance through the dealership might be more convenient at the time of sale, but comparing rates from various providers could result in substantial savings over the term of the vehicle loan. Therefore, prospective buyers should invest time in researching and comparing insurance quotes to ensure they are getting the best possible deal tailored to their needs.

5 Ways to Save on Volkswagen Passat Insurance

To lower your Volkswagen Passat insurance rates, consider implementing the following tips. These strategies can help you achieve more affordable premiums and better manage your insurance expenses.

- Remove young drivers from your Volkswagen Passat insurance when they move out or go to school.

- Get Volkswagen Passat auto insurance through Costco.

- If you’re a young driver living at home, add yourself to your parents’ plan.

- Ask for a higher deductible for your Volkswagen Passat insurance policy.

- Audit your Volkswagen Passat driving when you move to a new location or start a new job.

By implementing these strategies, you can effectively lower your Volkswagen Passat insurance costs and secure more affordable coverage. Access comprehensive insights into our guide titled “Which cars have the lowest auto insurance premiums?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Volkswagen Passat Insurance Companies

Who is the best company for Volkswagen Passat insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Volkswagen Passat insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Volkswagen Passat offers.

Top Volkswagen Passat Auto Insurance Providers by Market Share

| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Choosing the best insurance provider for your Volkswagen Passat involves considering several factors, including market share and offered discounts.

State Farm leads the pack with the highest market share, indicating a strong preference among consumers, followed by other major players like Geico and Progressive, each providing competitive rates and various incentives for security-enhanced vehicles. Delve into our evaluation of our guide titled “Geico Auto Insurance Discounts.”

Compare Free Volkswagen Passat Insurance Quotes Online

Finding the right insurance for your Volkswagen Passat doesn’t have to be a daunting task. With our online comparison tool, you can easily access and compare insurance quotes from top providers, all in one place. This service allows you to evaluate various coverage options, ensuring you find a policy that fits your specific needs and budget.

USAA stands out with a 15% pay-in-full discount, rewarding Volkswagen Passat owners who manage their insurance costs upfront.Justin Wright Licensed Insurance Agent

Simply enter your ZIP code and a few basic details about your Volkswagen Passat to get started. You’ll receive personalized quotes from multiple insurers, allowing you to see side-by-side how different policies stack up in terms of cost, coverage, and customer service. By comparing these quotes, you empower yourself to make an informed decision, potentially saving money and enhancing your coverage.

Take advantage of this free service today and secure the insurance that’s right for you and your Volkswagen Passat. It’s quick, easy, and could lead to significant savings. Learn more in our guide titled “Where to Compare Auto Insurance Rates.”

Frequently Asked Questions

How much does Volkswagen Passat insurance cost?

On average, Volkswagen Passat insurance rates are around $125 per month for full coverage. If you opt for liability-only coverage, you can expect to pay approximately $50 per month.

Are there ways to save money on Volkswagen Passat insurance?

To save on Volkswagen Passat insurance, consider these strategies: Remove young drivers from your policy once they move out or go to school, explore auto insurance options through Costco, and young drivers at home should join their parents’ plan. Opting for a higher deductible can also reduce premiums. Finally, reassess your driving habits if you relocate or start a new job, as this can impact your rates.

How does the loss probability of the Volkswagen Passat affect insurance rates?

The loss probability for different types of coverage can impact Volkswagen Passat insurance rates. For example, comprehensive and property damage coverage have a lower loss rate, while personal injury and medical payment coverage have higher loss rates.

Access comprehensive insights into our guide titled “Do you need medical payment coverage on auto insurance?”

What factors determine the cost of Volkswagen Passat insurance?

The cost of Volkswagen Passat insurance is influenced by factors such as your location, driving record, age, model year of the vehicle, coverage options, and selected insurance company.

Is Volkswagen Passat insurance more expensive for younger drivers?

Yes, younger drivers, especially teenagers, typically face higher insurance rates due to their limited driving experience and higher risk of accidents. However, there are ways for young drivers to save on insurance, such as taking driver’s education courses or being added to their parents’ policy.

Does the color of my Volkswagen Passat affect insurance rates?

No, the color of your vehicle does not typically impact insurance rates. Insurers primarily consider factors like the make, model, age, engine size, and safety features of your Volkswagen Passat.

Learn more by reading our guide titled “Does auto insurance cover engine failure?”

What is the typical Volkswagen Passat insurance cost?

The cost of insuring a VW Passat varies based on factors like model year, driver history, and location, but generally ranges from $100 to $208 monthly.

How much does it cost to insure a 2005 Volkswagen Passat?

Insurance for a 2005 Volkswagen Passat typically costs less than newer models due to its lower current market value and decreased replacement costs, making monthly rates more affordable.

What are the insurance rates for a 2006 Volkswagen Passat?

The 2006 Volkswagen Passat may have slightly higher insurance rates than older models but is generally more affordable than newer versions due to depreciation.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Are Volkswagens expensive to insure?

Volkswagens, including the Passat, are not typically more expensive to insure than comparable vehicles, but specific model features and performance can influence rates.

Where can I find a car insurance comparison chart for different vehicles?

What should I know about Volkswagen auto insurance?

How much is insurance for a Volkswagen Passat 2019?

What factors affect Volkswagen Passat car insurance costs?

Which Volkswagen Passat insurance group does the vehicle fall into?

Where can I find cheap car insurance for Volkswagen Passat?

How can I compare Volkswagen Passat insurance quotes online?

How can I save on Volkswagen Passat insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.