Best Windshield Replacement Coverage in Alabama (Top 10 Companies Ranked for 2026)

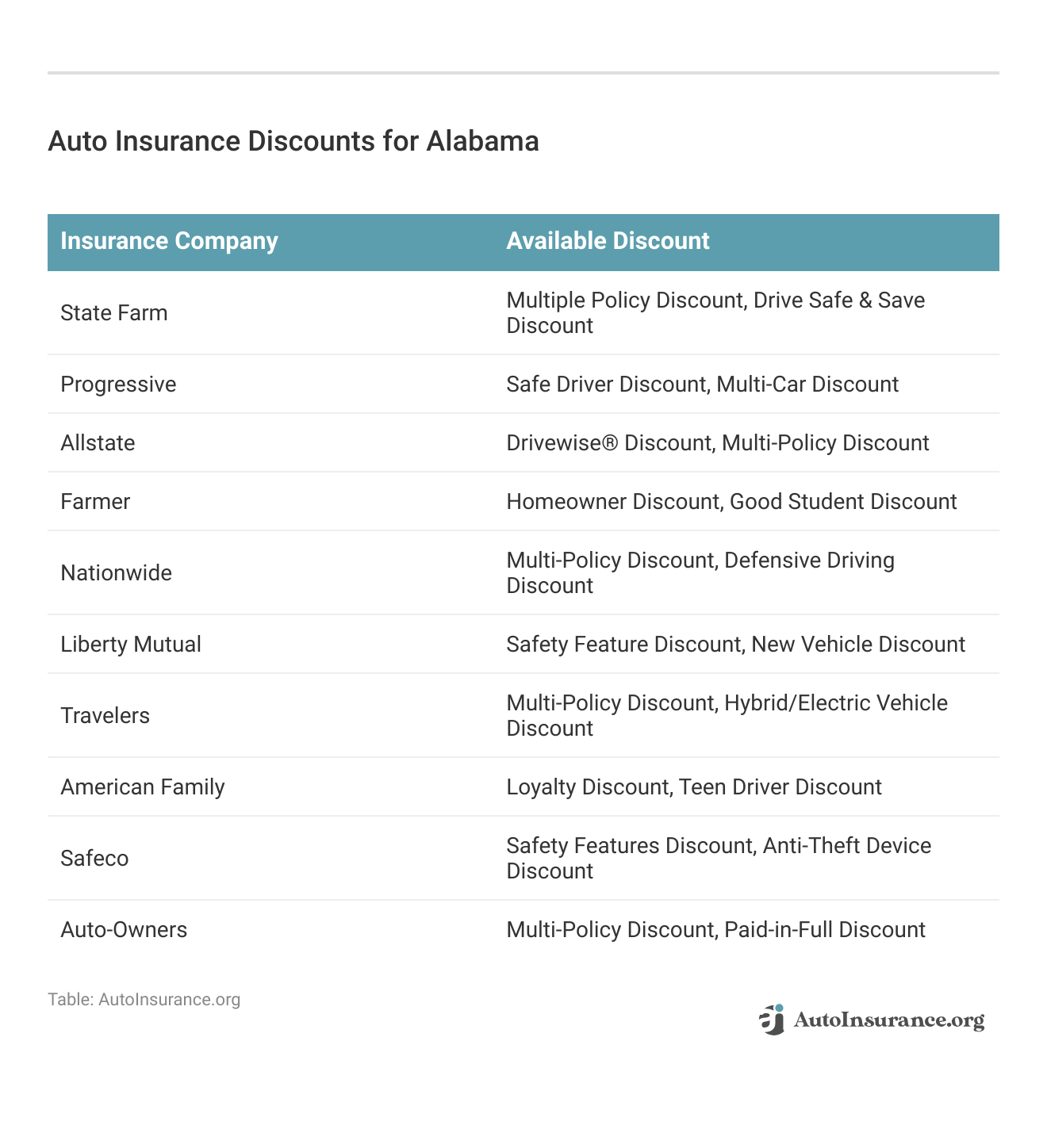

State Farm, Progressive, and Allstate provide the best windshield replacement coverage in Alabama, with monthly premiums starting at $80. Our goal is to help you compare quotes from these reliable insurers, ensuring you obtain the best coverage and personalized discounts suited to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews- State Farm provides competitive rates beginning at $80 per month

- Top insurance providers present options for windshield replacements

- There are various discount opportunities for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Strong Financial Stability: State Farm is known for its financial stability, ensuring they can reliably cover claims. Find out more in our State Farm auto insurance review.

- Extensive Network: State Farm has a wide network of agents and service centers, making it convenient for policyholders to access support.

- Discount Opportunities: They offer various discounts for policyholders, such as multi-policy discounts, good driver discounts, and more.

Cons

- Higher Premiums: Compared to some other providers, State Farm’s premiums may be slightly higher.

- Limited Online Tools: Their online tools and digital services may not be as robust as some competitors, which could be inconvenient for tech-savvy customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Comprehensive Coverage

Pros

- Innovative Technology: In our Progressive auto insurance review, Progressive is known for its innovative technology, such as Snapshot, which tracks driving habits to potentially lower premiums.

- Wide Range of Coverage Options: They offer a diverse range of coverage options, allowing customers to tailor their policies to their specific needs.

- Discounts for Safe Driving: Progressive offers significant discounts for safe driving habits, making it attractive for cautious drivers.

Cons

- Average Customer Service: Some customers have reported average satisfaction with Progressive’s customer service, citing long wait times and difficulty reaching representatives.

- Limited Agent Network: Compared to traditional insurers like State Farm, Progressive’s agent network may be less extensive, which could be a downside for those who prefer in-person assistance.

#3 – Allstate: Best for Generous Limits

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including add-ons like roadside assistance and rental reimbursement.

- User-Friendly Mobile App: Their mobile app is highly rated and offers convenient features like digital ID cards, claims tracking, and roadside assistance.

- Strong Financial Ratings: Allstate boasts strong financial ratings, providing peace of mind to policyholders about their ability to pay claims.

Cons

- Higher Premiums for Some: Allstate’s premiums may be higher for some drivers compared to other providers, particularly for younger or higher-risk drivers.

- Mixed Customer Service Reviews: While some customers praise Allstate’s customer service, others have reported issues with claims processing and communication. Use our Allstate auto insurance review as your guide.

#4 – Farmers: Best for Flexible Options

Pros

- Customizable Policies: Farmers offers customizable policies, allowing customers to tailor coverage to their specific needs and budget. Read more through our Farmers auto insurance review.

- Additional Coverage Options: They provide a variety of additional coverage options, such as rideshare insurance and equipment breakdown coverage, catering to diverse needs.

- Strong Agent Network: Farmers has a strong network of agents who can provide personalized assistance and guidance.

Cons

- Limited Online Tools: Farmers’ online tools and digital services may not be as advanced or user-friendly as some competitors, which could be a drawback for tech-savvy customers.

- Potentially Higher Premiums: Some customers may find that Farmers’ premiums are higher compared to other providers, especially for certain demographics or coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Competitive Pricing

Pros

- Multi-Policy Discounts: Nationwide offers significant discounts for bundling multiple policies, such as auto and home insurance, helping customers save money. Read more through our Nationwide auto insurance review.

- Wide Range of Coverage: They provide a wide range of coverage options, including unique offerings like gap insurance and accident forgiveness.

- Strong Financial Stability: Nationwide has strong financial stability and high ratings, giving policyholders confidence in their ability to fulfill claims.

Cons

- Limited Availability: Nationwide may not be available in all areas, limiting options for some potential customers.

- Mixed Customer Service Reviews: While some customers report positive experiences with Nationwide’s customer service, others have encountered issues with claims processing and responsiveness.

#6 – Liberty Mutual: Best for Quick Claims

Pros

- Discount Opportunities: Liberty Mutual offers various discounts for policyholders, such as bundling discounts, good student discounts, and more. For further insights, refer to our Liberty Mutual auto insurance review.

- Online Tools and Resources: They provide a range of online tools and resources, including a user-friendly website and mobile app, making it easy for customers to manage their policies.

- Quick Claims Processing: Liberty Mutual is known for its efficient claims processing, ensuring timely resolution for policyholders.

Cons

- Higher Premiums for Some: Some customers may find Liberty Mutual’s premiums to be higher compared to other providers, particularly for certain coverage options or demographics.

- Limited Agent Network: Liberty Mutual’s agent network may be less extensive compared to traditional insurers, which could be a downside for those who prefer in-person assistance.

#7 – Travelers: Best for Enhanced Options

Pros

- Customizable Coverage: Our Travelers auto insurance review reveals that Travelers offers customizable coverage options, allowing customers to tailor their policies to their specific needs.

- Strong Financial Stability: Travelers has a long-standing reputation for financial stability and reliability, providing peace of mind to policyholders.

- Enhanced Options: They provide additional coverage options such as roadside assistance and rental car reimbursement, enhancing the overall value of their policies.

Cons

- Limited Availability: Travelers may not be available in all areas, restricting options for potential customers.

- Mixed Customer Service Reviews: While some customers praise Travelers’ customer service, others have reported issues with claims processing and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for High Satisfaction

Pros

- High Customer Satisfaction: American Family consistently receives high marks for customer satisfaction, with many policyholders praising their attentive service and claims handling. Read more through our American Family auto insurance review.

- Discount Opportunities: They offer various discounts, including multi-policy discounts and safe driving discounts, helping customers save on premiums.

- Community Involvement: American Family is known for its community involvement and support, which may resonate with customers seeking an insurer with strong values.

Cons

- Limited Availability: American Family may not be available in all areas, limiting options for some potential customers.

- Potentially Higher Premiums: Some customers may find American Family’s premiums to be higher compared to other providers, especially for certain demographics or coverage options.

#9 – Safeco: Best for Extra Benefits

Pros

- Flexible Coverage Options: Safeco offers flexible coverage options, allowing customers to customize their policies to meet their individual needs. Read more through our Safeco auto insurance review.

- Competitive Pricing: They provide competitive pricing, making them an attractive option for budget-conscious customers.

- Quick Claims Processing: Safeco is known for its efficient claims processing, ensuring prompt resolution for policyholders.

Cons

- Limited Availability: Safeco may not be available in all areas, limiting options for potential customers.

- Mixed Customer Service Reviews: While some customers report positive experiences with Safeco’s customer service, others have encountered issues with claims processing and responsiveness.

#10 – Auto-Owners: Best for Personalized Assistance

Pros

- Highly Rated Customer Service: Auto-Owners consistently receives high ratings for customer service, with many policyholders praising their responsiveness and personalized assistance.

- Wide Range of Coverage Options: They offer a wide range of coverage options, including specialized coverage for classic cars, motorcycles, and more, catering to diverse needs.

- Stable Financial Standing: Auto-Owners has a stable financial standing and strong ratings, providing assurance to policyholders about their ability to handle claims. Read more through our Auto-Owners auto insurance review.

Cons

- Limited Availability: Auto-Owners may not be available in all states or areas, limiting options for some potential customers.

- Potentially Higher Premiums: Some customers may find Auto-Owners’ premiums to be higher compared to other providers, particularly for certain demographics or coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Glass Coverage Laws in Alabama

Regulating Replacement Parts for Glass

Getting Cheap Auto Insurance Coverage in Alabama

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Alabama Full Glass Laws and Car Insurance

Frequently Asked Questions

Does auto insurance in Alabama cover windshield replacement?

Yes, auto insurance policies in Alabama typically provide coverage for windshield replacement. The specific coverage and terms may vary depending on your insurance company and policy. It’s important to review your policy or contact your insurance provider to understand the details of your coverage.

What type of coverage usually includes windshield replacement in Alabama auto insurance policies?

Windshield replacement is often included under comprehensive coverage in Alabama auto insurance policies. Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, fire, and certain types of damage caused by natural disasters, including damage to your windshield. Enter your ZIP code now to begin.

Is windshield replacement covered under my liability insurance in Alabama?

No, windshield replacement is not typically covered under liability insurance in Alabama. Liability auto insurance covers damages you may cause to others in an accident. It does not generally cover damages to your own vehicle, including windshield damage. You would need comprehensive coverage for windshield replacement coverage.

Are there any deductible requirements for windshield replacement claims in Alabama?

Deductible requirements for windshield replacement claims in Alabama may vary depending on your insurance policy. Some policies have a specific deductible for windshield replacement, while others may offer a separate windshield deductible that is lower than the comprehensive deductible. It’s essential to review your policy or contact your insurance provider to understand the deductible requirements for windshield replacement claims.

Will filing a windshield replacement claim impact my insurance rates in Alabama?

In many cases, filing a windshield replacement claim will not directly impact your insurance rates in Alabama. Windshield claims are often considered “no-fault” or “comprehensive” claims, which generally do not result in surcharges or rate increases. It’s always a good idea to check with your insurance provider to understand their specific policy regarding windshield replacement claims. Enter your ZIP code now to start.

Are there any restrictions or limitations on windshield replacement coverage in Alabama?

How do I file a windshield replacement claim with my insurance company in Alabama?

To file a windshield replacement claim with your insurance company in Alabama, you should contact your insurance provider’s claims department. They will guide you through the process and provide you with the necessary forms and information required for the claim. It’s important to have relevant details about the incident, such as the date, time, and location of the damage, as well as any supporting documentation or photographs.

Can I choose any windshield repair shop for the replacement in Alabama?

In many cases, you have the freedom to choose any windshield repair shop for the replacement in Alabama. Some insurance policies may have a list of approved or preferred repair facilities. Choosing an approved facility may streamline the process and ensure that the repairs are done to the insurer’s standards. It’s advisable to check with your insurance provider or review your policy for any specific requirements regarding the choice of repair shop for windshield replacement. Enter your ZIP code now to start.

How do the deductible requirements for windshield replacement claims in Alabama vary among the listed insurance providers?

The deductible requirements for windshield replacement claims in Alabama may vary among the listed insurance providers and the types of auto insurance, with some policies having specific deductibles for windshield replacement, while others offer a separate windshield deductible that could be lower than the comprehensive deductible.

What are the key factors contributing to State Farm emerging as the top choice for windshield replacement coverage in Alabama?

State Farm is identified as the top choice for windshield replacement coverage in Alabama due to its comprehensive protection at affordable rates starting at just $125 per month. Additionally, State Farm collaborates with Progressive and Allstate to provide budget-friendly rates and a range of comprehensive coverage options customized to fit specific driving needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.