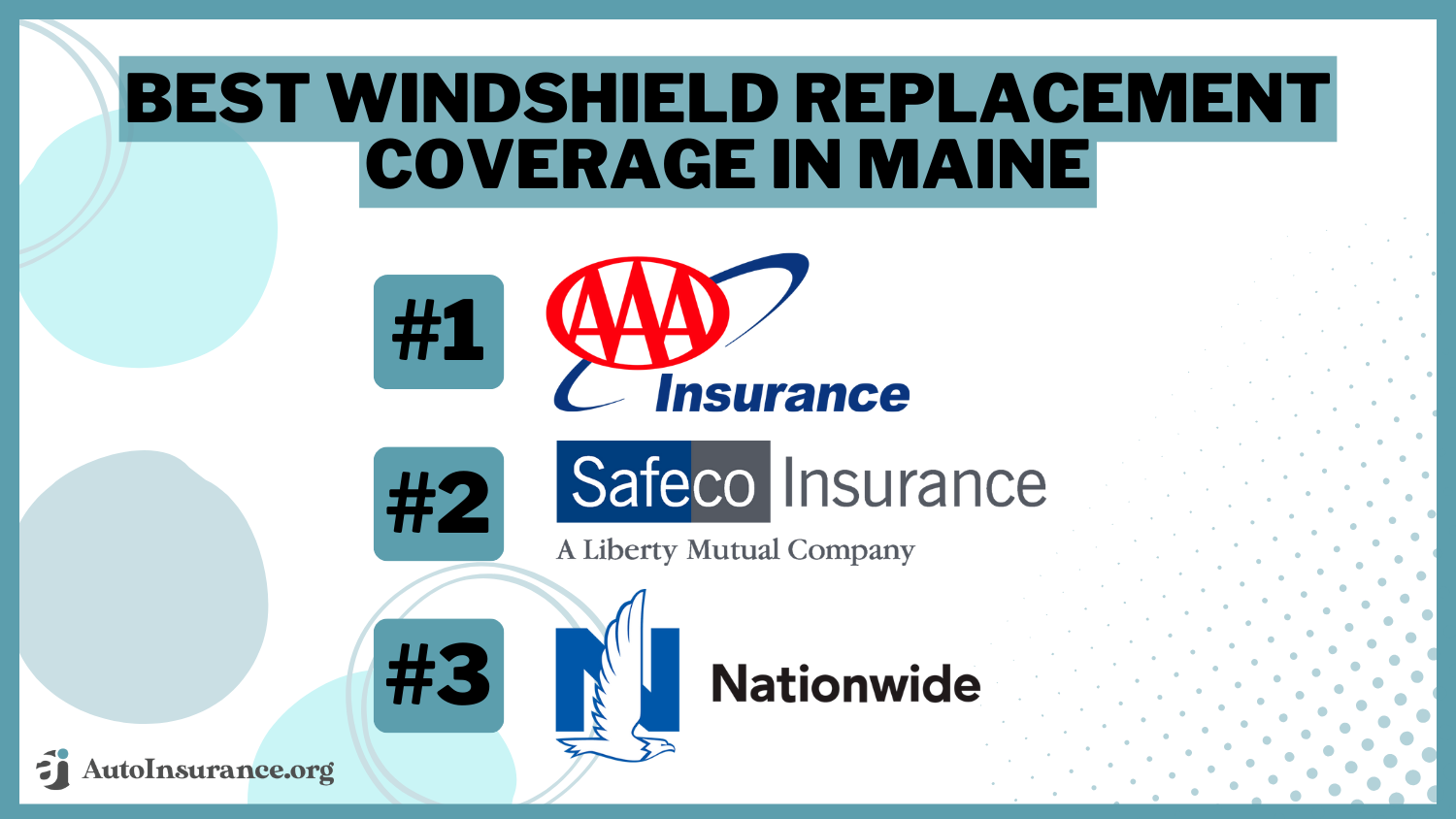

Best Windshield Replacement Coverage in Maine (Top 10 Companies Ranked for 2024)

AAA, Safeco, and Nationwide offer the best windshield replacement coverage in Maine, starting at only $40 per month, making it affordable. We aim to help you compare quotes from these providers to ensure you get the optimal coverage and customized discounts for your vehicle and your peace of mind.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: May 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,934 reviews

2,934 reviewsCompany Facts

Full Coverage Windshield Replacement in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

2,934 reviews

2,934 reviews 1,171 reviews

1,171 reviewsCompany Facts

Full Coverage Windshield Replacement in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

1,171 reviews

1,171 reviews 3,019 reviews

3,019 reviewsCompany Facts

Full Coverage Windshield Replacement in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

3,019 reviews

3,019 reviews- AAA provides affordable rates beginning at $40 per month

- Leading insurance companies offer options for windshield replacements

- There are numerous opportunities to save on windshield replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Pros

- Extensive Coverage Options: AAA offers a wide range of coverage options beyond just windshield replacement, ensuring comprehensive protection for your vehicle.

- Strong Reputation for Customer Service: AAA is renowned for its excellent customer service, providing prompt assistance and support to policyholders.

- Affordable Premiums: AAA’s windshield replacement coverage is often competitively priced, making it an attractive option for budget-conscious drivers.

Cons

- Limited Availability: AAA’s coverage may not be available in all areas, limiting accessibility for some drivers. Read more through our AAA auto insurance review.

- Potential Membership Requirements: To access AAA’s insurance products, you may need to become a member, which could entail additional fees or requirements.

#2 – Safeco: Best for Windshield Benefit

Pros

- Generous Windshield Benefit: Safeco offers robust windshield replacement coverage, often with low deductibles and hassle-free claims processing.

- Flexible Policy Options: Safeco allows policyholders to customize their coverage to suit their specific needs, providing flexibility and tailored protection.

- Strong Financial Stability: Safeco is backed by strong financial stability, ensuring that claims are paid promptly and reliably.

Cons

- Average Customer Service: While Safeco’s coverage is solid, its customer service reputation may not be as strong as some competitors, leading to potential frustrations with claims processing or support.

- Limited Availability in Certain Regions: Safeco’s coverage may not be available in all areas, restricting options for drivers in certain regions. Read more through our Safeco auto insurance review.

#3 – Nationwide: Best for Glass Repair

Pros

- Nationwide Network of Service Providers: Nationwide has a vast network of service providers for windshield replacement, making it convenient for policyholders to find quality repair services.

- Comprehensive Coverage Options: Nationwide offers comprehensive coverage options beyond just windshield replacement, ensuring holistic protection for your vehicle.

- Strong Reputation for Claims Handling: Nationwide is known for its efficient and reliable claims handling, providing peace of mind to policyholders during the claims process.

Cons

- Potentially Higher Premiums: Nationwide’s premiums for windshield replacement coverage may be higher compared to some competitors, potentially impacting affordability for some drivers. Learn more through our Nationwide auto insurance review.

- Mixed Customer Service Reviews: While Nationwide has many satisfied customers, some reviews highlight inconsistencies in customer service quality, which could lead to frustrations for policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Repair Coverage

Pros

- Repair Coverage Benefits: Liberty Mutual offers extensive coverage for windshield repairs, often with low deductibles or even zero deductibles, minimizing out-of-pocket expenses for policyholders.

- Strong Financial Stability: Liberty Mutual has a solid financial standing, providing reassurance to policyholders that their claims will be paid promptly and reliably.

- Variety of Policy Discounts: Liberty Mutual offers various policy discounts, helping policyholders save money on their premiums while still receiving comprehensive coverage.

Cons

- Limited Availability of Glass Coverage: Liberty Mutual’s glass coverage options may not be as comprehensive as some competitors, potentially leaving policyholders with gaps in coverage for certain types of damage.

- Potential for Higher Premiums: While Liberty Mutual provides robust coverage, it may come at a higher premium compared to some other insurers, potentially impacting affordability for some drivers. Find out more through our Liberty Mutual auto insurance review.

#5 – State Farm: Best for Comprehensive Coverage

Pros

- Exceptional Customer Service: State Farm is known for its outstanding customer service, with dedicated agents and prompt claims processing, ensuring a smooth experience for policyholders. Find out more in our State Farm auto insurance review.

- Flexible Deductible Options: State Farm offers flexible deductible options for windshield replacement coverage, allowing policyholders to choose a deductible that fits their budget and preferences.

- Wide Range of Coverage Options: State Farm provides a comprehensive selection of coverage options beyond just windshield replacement, allowing policyholders to tailor their policies to their specific needs.

Cons

- Limited Glass Repair Coverage: State Farm’s coverage for glass repairs may be more limited compared to some competitors, potentially requiring policyholders to pay out-of-pocket for certain types of damage.

- Potentially Higher Premiums for Full Coverage: While State Farm’s premiums are competitive for basic coverage, opting for full windshield replacement coverage may lead to higher premiums, impacting affordability for some drivers.

#6 – Farmers: Best for Glass Replacement

Pros

- Customizable Coverage Options: Farmers offers customizable coverage options, allowing policyholders to tailor their policies to their specific needs and preferences.

- Strong Financial Stability: Farmers, as mentioned in our Farmers auto insurance review, boasts strong financial stability, ensuring that claims are paid promptly and reliably.

- Discount Opportunities: Farmers provides various discount opportunities, helping policyholders save money on their premiums while still maintaining comprehensive coverage.

Cons

- Potentially Complex Claims Process: Farmers claims process may be more complex compared to some competitors, potentially leading to longer processing times and frustrations for policyholders.

- Limited Availability in Certain Areas: Farmers may not be available in all areas, limiting options for drivers in certain regions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Repair Benefit

Pros

- Innovative Coverage Options: Progressive offers innovative coverage options, such as its “glass deductible buyback” program, providing flexibility and value to policyholders.

- User-Friendly Online Tools: In our Progressive auto insurance review, Progressive provides user-friendly online tools and resources, making it easy for policyholders to manage their policies and file claims.

- Competitive Rates: Progressive often offers competitive rates for windshield replacement coverage, making it an attractive option for cost-conscious drivers.

Cons

- Mixed Customer Service Reviews: Progressive’s customer service reputation varies, with some policyholders reporting dissatisfaction with claims handling and support.

- Complex Policy Options: Progressive’s wide range of policy options may be overwhelming for some customers, leading to confusion when selecting coverage.

#8 – Allstate: Best for Replacement Coverage

Pros

- Wide Range of Coverage Options: Allstate offers a diverse range of coverage options, allowing policyholders to tailor their policies to their specific needs and preferences. Use our Allstate auto insurance review as your guide.

- Innovative Features and Tools: Allstate provides innovative features and tools, such as the Drivewise program, which can help policyholders save money on their premiums.

- Strong Financial Stability: Allstate has a strong financial standing, ensuring that claims are paid promptly and reliably.

Cons

- Potentially Higher Premiums: Allstate’s premiums may be higher compared to some competitors, particularly for comprehensive coverage options, impacting affordability for some drivers.

- Mixed Customer Service Reviews: While Allstate has many satisfied customers, some reviews highlight inconsistencies in customer service quality, which could lead to frustrations for policyholders.

#9 – Amica: Best for Replacement Protection

Pros

- Exceptional Customer Service: Amica is renowned for its exceptional customer service, with dedicated agents and prompt claims processing, ensuring a positive experience for policyholders. Find out more through our Amica auto insurance review.

- Generous Coverage Options: Amica offers generous coverage options, including comprehensive windshield replacement coverage, providing peace of mind to policyholders.

- Policyholder Satisfaction: Amica consistently receives high marks for customer satisfaction, reflecting its commitment to providing quality service and coverage.

Cons

- Potentially Limited Availability: Amica’s coverage may not be available in all areas, limiting options for drivers in certain regions.

- Higher Premiums for Comprehensive Coverage: While Amica’s coverage is comprehensive, it may come at a higher premium compared to some other insurers, potentially impacting affordability for some drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Glass Coverage

Pros

- Specialized Coverage Options: The Hartford offers specialized coverage options tailored to the needs of older drivers, providing comprehensive protection and peace of mind.

- Dedicated Customer Support: The Hartford provides dedicated customer support for policyholders, including specialized assistance for claims related to windshield damage.

- Discount Opportunities: The Hartford offers various discount opportunities, helping policyholders save money on their premiums while still maintaining comprehensive coverage. Find out more through our The Hartford auto insurance review.

Cons

- Limited Availability: The Hartford’s coverage may not be available in all areas, restricting options for drivers in certain regions.

- Potentially Higher Premiums for Specialized Coverage: The Hartford’s specialized coverage options may come at a higher premium compared to standard policies, impacting affordability for some drivers.

Driving with a Damaged Windshield in Maine

Zero Deductible Glass Coverage in Maine

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Decision to File a Claim

Glass Replacement Laws in Maine

Frequently Asked Questions

Does auto insurance in Maine cover windshield replacement?

Yes, auto insurance in Maine typically covers windshield replacement. However, whether it is covered or not depends on the specific terms and conditions of your insurance policy. Some policies may require a comprehensive coverage add-on or a separate glass coverage endorsement to cover windshield replacement.

What is comprehensive coverage?

Comprehensive coverage is an optional auto insurance coverage that helps protect you against damage to your vehicle that is not caused by a collision. It typically covers events such as theft, vandalism, fire, falling objects, and damage from severe weather conditions. Comprehensive coverage often includes coverage for windshield damage and replacement. Enter your ZIP code now to start.

Do I need to pay a deductible for windshield replacement in Maine?

Is there a limit on the number of windshield replacements covered by auto insurance in Maine?

The limit on the number of windshield replacements covered by auto insurance can vary depending on your policy. Some insurance policies may have a specific limit, such as two windshield replacements per year, while others may not impose any restrictions. Check your policy documents or contact your insurance provider to determine if there are any limits on windshield replacements.

Can I choose any windshield replacement service provider in Maine?

Insurance policies may have preferred or approved service providers for windshield replacements. It is recommended to check with your insurance company to see if they have a list of authorized service providers or if they require you to use a specific network of repair shops. However, even if you have the freedom to choose, it’s advisable to select a reputable and certified windshield replacement service provider. Enter your ZIP code now to start.

Will filing a windshield replacement claim affect my insurance rates in Maine?

What are the top three providers offering windshield replacement coverage in Maine, and what are their starting rates?

The top three providers offering windshield replacement coverage in Maine are AAA, Safeco, and Nationwide, with starting rates as low as $40 per month.

How do Maine’s windshield repair laws impact insurance coverage and policyholder responsibilities?

Maine’s windshield repair laws mandate prompt repair or replacement for chips or cracks within the wipers’ range, and special coverage or policy riders for glass are not required. Enter your ZIP code now to start.

What factors should Maine drivers consider before filing a windshield replacement claim?

How do different insurance companies handle windshield replacement claims, and what are some considerations for policyholders when choosing a provider?

Different insurance companies handle windshield replacement claims differently, with factors such as deductible, coverage options, and service provider selection varying. Policyholders should consider their coverage needs and preferences when choosing a provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.