Best Auto Insurance for Seniors in Louisiana (Top 10 Companies Ranked for 2026)

With average rates starting at $33 per month and a multi-policy discount of 29%, Allstate, State Farm, and Liberty Mutual offer the best auto insurance for seniors in Louisiana. Allstate stands out as the top pick, while State Farm and Liberty Mutual provide competitive options for senior drivers in Louisiana.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

11,638 reviews

11,638 reviewsCompany Facts

Full. Coverage for Seniors in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Seniors in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Seniors in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Allstate stands out overall for its comprehensive senior auto insurance policies and superior customer service. State Farm and Liberty Mutual follow closely, offering reliable coverage and excellent claims handling.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Louisiana

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #2 | 17% | B | Local Agents | State Farm | |

| #3 | 20% | A | Customizable Policies | Liberty Mutual |

| #4 | 20% | A+ | Vanishing Deductible | Nationwide |

| #5 | 12% | A+ | Usage-Based Savings | Progressive | |

| #6 | 15% | A | Personalized Service | Farmers | |

| #7 | 29% | A | Senior Discounts | American Family | |

| #8 | 10% | A+ | AARP Members | The Hartford |

| #9 | 13% | A++ | Competitive Rates | Travelers | |

| #10 | 15% | A | Safe Driving Discounts | Safeco |

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Allstate is the top pick for senior car insurance in Louisiana

- State Farm is the cheapest Louisiana senior auto insurance company at $33/month

- Seniors can lower Lousiana insurance rates with bundling and safe driver discounts

#1 – Allstate: Top Overall Pick

Pros

- Generous Multi-Policy Discount: Allstate offers a significant 25% discount for Louisiana seniors who bundle multiple policies, resulting in substantial savings. Get a full discount list in our Allstate review.

- Excellent Customer Service: Known for its superior customer support, Allstate is particularly appreciated by seniors in Louisiana who value attentive service.

- Robust Roadside Assistance: Allstate includes comprehensive roadside assistance services, an essential feature for seniors in Louisiana who require reliable support on the road.

Cons

- Higher Premiums: Allstate’s premiums can be higher compared to other providers, which may be a concern for budget-conscious seniors in Louisiana.

- Additional Costs for Add-Ons: Important coverage options like rental reimbursement come at an extra cost, potentially increasing overall expenses for seniors in Louisiana.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

Cons

- Lower Multi-Policy Discount: The 17% discount for bundling policies is lower compared to competitors, which might be less appealing to seniors in Louisiana looking for maximum savings.

- Slower Claims Response: Some seniors in Louisiana have reported that State Farm’s claims process can be slower than expected, which could be a drawback in urgent situations.

#3 – Liberty Mutual: Best for Customizable Policies

Pros

- Decent Multi-Policy Discount: Liberty Mutual provides a 20% discount for bundling policies, which can lead to meaningful savings for seniors in Louisiana.

- Wide Range of Discounts: Liberty Mutual offers various discounts to senior drivers in Louisiana looking to lower their insurance rates. Explore more discounts in our Liberty Mutual review.

- User-Friendly Online Tools: Liberty Mutual’s digital platforms are easy to use, allowing tech-savvy seniors in Louisiana to manage their policies efficiently online.

Cons

- Slower Claim Processing: Some seniors in Louisiana have reported that Liberty Mutual’s claim processing times could be improved, which might be an issue for those needing timely resolutions.

- Basic Roadside Assistance: The included roadside assistance might not be as comprehensive as other providers, which could be a concern for seniors in Louisiana who need reliable help on the road.

#4 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductible Program: Senior drivers who avoid claims can reduce their deductibles over time and save money on Louisiana car insurance.

- Decent Multi-Policy Discount: A 20% discount for bundling policies helps seniors save money on Louisiana auto insurance. Learn more in our detailed Nationwide insurance review.

- Local Agent Access: Nationwide’s network of local agents provides personalized service, making it convenient for seniors in Louisiana to get the help they need.

Cons

- Complex Discount Structures: The criteria for eligibility in some of Nationwide’s discount programs might be difficult for seniors in Louisiana to navigate.

- Additional Costs for Add-Ons: Optional coverages, such as rental car reimbursement, often come with extra fees, which can increase costs for seniors in Louisiana.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best Usage-Based Insurance for Seniors

Pros

- Snapshot Program: Progressive’s usage-based Snapshot program grants discounts to seniors in Louisiana who demonstrate safe driving. Learn how in our Progressive Snapshot review.

- Customizable Coverage Choices: Progressive provides an extensive selection of coverage plans that can be tailored to suit the individual needs of seniors in Louisiana.

- Easy-to-Use Digital Tools: Progressive’s online platforms are designed to help tech-savvy seniors in Louisiana effortlessly manage their insurance policies.

Cons

- Complex Snapshot Details: The Snapshot program’s intricacies might be challenging for some seniors in Louisiana to fully understand and navigate.

- Higher Initial Rates: Progressive’s base rates can be higher before discounts are applied, which could be a concern for seniors in Louisiana on a tight budget.

#6 – Farmers: Best for Personalized Service

Pros

-

Personalized Support: Farmers is highly regarded for its committed agents who offer tailored advice, making it especially advantageous for seniors in Louisiana.

- Flexible Payment Plans: Seniors in Louisiana can benefit from Farmers’ flexible payment options, helping them manage their insurance expenses more effectively.

- Usage-Based Discounts: Farmers Signal can lower senior auto insurance rates in Louisiana for safe drivers. See how much you can save in our Signal review.

Cons

- Inconsistent Agent Availability: While Farmers is known for personalized service, the availability of agents may vary, which could be inconvenient for seniors in Louisiana.

- Extra Costs for Additional Coverage: Optional coverages often come with extra fees, which could increase the overall cost for seniors in Louisiana.

#7 – American Family: Best Senior Auto Insurance Discounts

Pros

- Significant Senior Discounts: American Family offers substantial discounts specifically for seniors in Louisiana, making it a top choice for those looking to save.

- High Multi-Policy Discount: With a 29% discount for bundling, seniors in Louisiana can enjoy considerable savings on their insurance costs.

- Strong Financial Security: With an A rating from A.M. Best, American Family provides financial stability for senior insurance claims in Louisiana. Get full ratings in our American Family auto insurance review.

Cons

- Higher Premium Costs: The premiums for American Family insurance may be higher compared to other providers, which could be a concern for seniors in Louisiana on a budget.

- Limited Online Management Tools: The digital tools available for managing policies are not as robust, which could be a drawback for tech-savvy seniors in Louisiana.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for AARP Members

Pros

- Exclusive AARP Benefits: The Hartford’s partnership with AARP offers tailored benefits and discounts specifically for AARP members, including seniors in Louisiana.

- Superior Financial Security: Boasting an A+ rating from A.M. Best, The Hartford delivers robust financial stability, offering peace of mind to seniors in Louisiana.

- Safe Driver Discounts: Seniors in Louisiana with good driving records can benefit from additional discounts. Compare insurance rates and discounts in The Hartford auto insurance review.

Cons

- Extra Costs for Additional Coverage: Important coverages like rental reimbursement often come with additional fees, which could increase costs for seniors in Louisiana.

- Longer Claims Processing: There have been reports that The Hartford’s claims processing can be slower than expected, which might be frustrating for seniors in Louisiana.

#9 – Travelers: Best for Competitive Rates

Pros

- Exceptional Financial Stability: With an A++ rating from A.M. Best, Travelers ensures top-tier financial security, giving confidence to seniors in Louisiana.

- Cheap Senior Insurance Rates: Travelers auto insurance for seniors is competitive in Louisiana, starting at $41/month. Compare free quotes in our Travelers insurance review.

- Strong Customer Support: Travelers is well-regarded for its responsive customer service, which is particularly appreciated by seniors in Louisiana.

Cons

- Fluctuating Premiums: The rates with Travelers can vary, which might be concerning for seniors in Louisiana who prefer stable pricing.

- Extra Costs for Optional Coverage: Optional coverages, such as rental car reimbursement, often come with extra fees, potentially increasing overall costs for seniors in Louisiana.

#10 – Safeco: Best Safe Driving Discounts

Pros

- Big Discounts for Safe Drivers: Safeco offers up to 40% off senior auto insurance in Louisiana for safe drivers. Compare Safeco’s rates to other providers in our Safeco auto insurance review.

- Reliable Financial Strength: With an A rating from A.M. Best, Safeco provides financial stability, making it a trustworthy choice for seniors in Louisiana.

- Flexible Coverage Options: Safeco offers a variety of coverage plans that can be customized to meet the specific needs of seniors in Louisiana.

Cons

- Smaller Multi-Policy Discount: While still competitive, Safeco’s 15% bundling discount is smaller than other Lousiana senior auto insurance companies.

- Limited Availability of Local Agents: The availability of local agents may be limited, which could be inconvenient for seniors in Louisiana who prefer in-person service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Louisiana Senior Auto Insurance Rates by Coverage Level

The table below outlines senior auto insurance rates for minimum and full coverage policies from leading Louisiana companies. Compare now to find the best auto insurance for drivers over 60.

Louisiana Senior Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $54 | $201 |

| American Family | $46 | $172 |

| Farmers | $56 | $208 |

| Liberty Mutual | $72 | $269 |

| Nationwide | $48 | $177 |

| Progressive | $42 | $157 |

| Safeco | $79 | $158 |

| State Farm | $33 | $122 |

| The Hartford | $95 | $185 |

| Travelers | $41 | $152 |

State Farm emerges as the most budget-friendly option, with monthly rates starting at $33 for minimum coverage and $122 for full coverage. On the other end, Liberty Mutual presents the highest premiums, with $72 for minimum and $269 for full coverage.

Allstate is the top choice for seniors in Louisiana, offering comprehensive coverage with rates as low as $54 for minimum coverage and robust 24/7 roadside assistance.Justin Wright Licensed Insurance Agent

For those looking to strike a balance between cost and coverage, Progressive offers competitive monthly senior insurance rates of $42 for minimum coverage and $157 for full coverage. Check out our Progressive Snapshot Review to learn how to get cheaper insurance with this usage-based tracking program.

How to Get Cheaper Louisiana Auto Insurance for Seniors

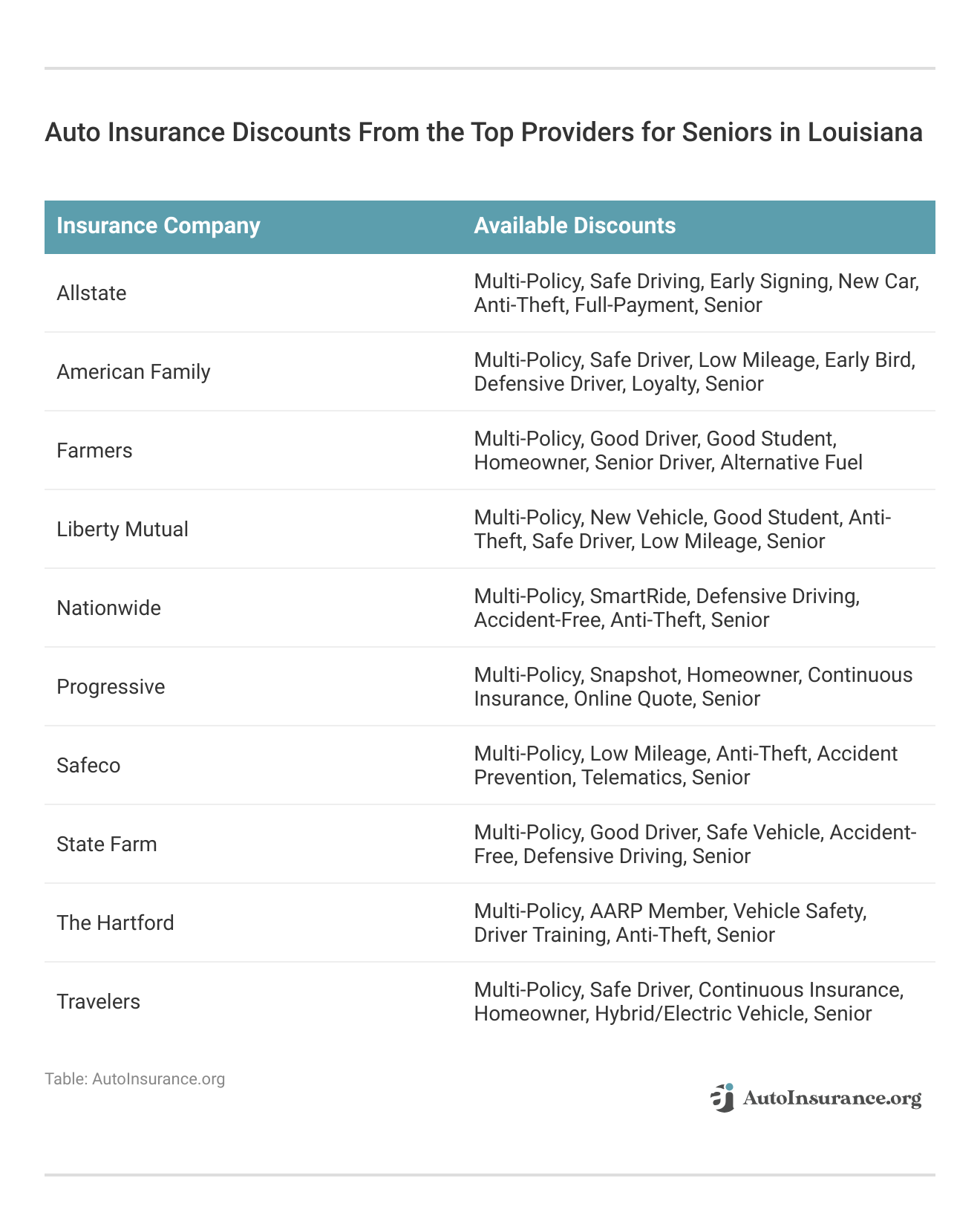

Maintaining a clean driving record is another powerful way to keep senior driving insurance costs low. Not only do you avoid high-risk insurance rate increases, but insurers often reward safe drivers with more discounts. The most common discounts from Louisiana auto insurance companies are listed below:

Seniors should also explore usage-based programs for more discounts. Cheap usage-based auto insurance, like Progressive Snapshot and State Farm Drive Safe & Save, offers senior discounts based on actual driving habits and mileage.

Additionally, opting for a higher deductible can lead to reduced monthly payments, though it’s important to ensure the deductible remains affordable in case of a claim.

Finally, regularly comparing quotes from multiple insurers allows seniors to stay competitive in the market and switch to a more affordable provider if they find better Louisiana car insurance rates somewhere else.

Customized Auto Insurance Case Studies for Seniors in Louisiana

Here are three real-world examples that showcase how leading auto insurance companies in Louisiana address the unique needs of seniors:

- Case Study #1 – Allstate’s Local Agent Advantage: Robert, a 72-year-old resident of Baton Rouge, sought personalized guidance. Allstate’s extensive network of local agents allowed him to receive tailored advice and find the best coverage options suited to his specific circumstances.

- Case Study #2 – State Farm to Fit Any Budget: Diane, a 70-year-old senior on a fixed income, needed flexible coverage that didn’t break the bank. State Farm offered her a policy with customizable options with the cheapest senior auto insurance rates in Louisiana.

- Case Study #3 – Liberty Mutual’s Comprehensive Coverage for Peace of Mind: Mary, a 68-year-old retiree, wanted an insurance policy that offered extensive coverage and customer support. Liberty Mutual provided her with a comprehensive plan that included 24/7 customer and claims service.

These top providers — Allstate, State Farm, and Liberty Mutual — offer exceptional coverage and personalized service, ensuring Louisiana seniors receive the protection and support they require.

Case studies like these address the distinct insurance needs of older drivers in Louisiana as their habits change after retirement. Fixed incomes and fewer miles can help seniors qualify for cheaper Louisiana auto insurance rates. Learn more by reading our guide titled, “Cheap Auto Insurance for High-Risk Drivers in Louisiana.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leading Senior Auto Insurance Providers in Louisiana

For senior drivers in Louisiana searching for dependable car insurance, three providers consistently rank as top picks. Allstate, State Farm, and Liberty Mutual have the best auto insurance for seniors in Louisiana.

Louisiana auto insurance is more expensive than in other states, but Allstate sets itself apart with affordable and thorough coverage options that include key extras like roadside assistance. State Farm is also a strong contender, providing the benefit of an extensive network of local representatives at low monthly rates.

Enter your ZIP code below to find the most affordable Louisiana senior car insurance quotes in your area.

Frequently Asked Questions

Who has the cheapest auto insurance for seniors in Louisiana?

State Farm typically offers the cheapest car insurance for seniors in Louisiana, with rates as low as $33 per month for minimum coverage.

Which insurance company is best for seniors in Louisiana?

Allstate is considered the best insurance company for seniors in Louisiana due to its comprehensive coverage options and robust customer service. Compare Allstate vs. Progressive auto insurance.

Is AARP auto insurance cheaper than Progressive for seniors in Louisiana?

AARP auto insurance through The Hartford may be cheaper than Progressive for seniors in Louisiana, depending on individual circumstances and coverage needs.

What color car is the most expensive to insure for seniors in Louisiana?

The color of your car does not affect insurance rates for seniors in Louisiana. Factors like driving history and vehicle type are among the top seven factors that affect auto insurance rates.

How much auto insurance should seniors have in Louisiana?

Seniors in Louisiana should consider at least the state minimum liability coverage, but full coverage, including comprehensive and collision, is often recommended for added protection.

Does Allstate offer an AARP discount for seniors in Louisiana?

Allstate does not offer a specific AARP discount, but seniors in Louisiana can benefit from other discounts, including multi-policy and safe driving discounts.

Is USAA auto insurance really cheaper for seniors in Louisiana?

USAA often provides competitive rates for seniors in Louisiana, especially for those with military affiliations, but it’s essential to compare quotes to determine if it’s cheaper for your specific needs.

Why is Progressive so expensive for seniors in Louisiana?

Check out our Progressive auto insurance review may be higher for seniors in Louisiana due to factors like driving history, location, and the chosen coverage options, but comparing quotes can help find the best rate.

Does Progressive raise rates after six months for seniors in Louisiana?

Progressive may adjust rates after the initial six-month policy period for seniors in Louisiana based on factors such as claims history, but this is not guaranteed.

Is it worth having full coverage on a paid-off car for seniors in Louisiana?

For seniors in Louisiana, maintaining full coverage on a paid-off car can be worth it if the vehicle is valuable or if additional financial protection is desired. Get affordable auto insurance by entering your ZIP code below in our free quote comparison tool.

Does Louisiana auto insurance go up as you age?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.