Best San Diego, California Auto Insurance in 2024 (Check Out the Top 10 Companies)

State Farm, Geico, and AAA are the top companies providing the best San Diego, California auto insurance, with rates starting at $33/mo. These providers are known for their affordability, extensive coverage options, and customer satisfaction. Select the ideal coverage for your vehicle in San Diego, California.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,760 reviews

17,760 reviewsCompany Facts

Full Coverage in San Diego California

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in San Diego California

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 2,934 reviews

2,934 reviewsCompany Facts

Full Coverage in San Diego California

A.M. Best Rating

Complaint Level

Pros & Cons

2,934 reviews

2,934 reviews

Compare the types of auto insurance available in San Diego with those in other California cities like Long Beach and Oakland to see how San Diego fares.

Our Top 10 Company Picks: Best San Diego, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 15% A Membership Perks AAA

#4 10% A+ High Coverage Allstate

#5 15% A Local Agents Farmers

#6 10% A++ Military Families USAA

#7 12% A Custom Coverage Liberty Mutual

#8 20% A+ Flexible Plans Progressive

#9 10% A Teen Drivers Mercury

#10 10% A+ Broad Coverage Nationwide

Before purchasing auto insurance in San Diego, ensure you’ve compared quotes from various providers.

Enter your ZIP code above to receive free auto insurance quotes for San Diego and understand the differences in coverage options and rates.

- State Farm offers competitive rates in San Diego, California

- Top choices include Geico and AAA

- High customer satisfaction and varied coverage options

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: With many local agents providing personalized service, State Farm stands out as a top choice for the best San Diego, California auto insurance. This local touch allows for direct and tailored advice. Discover insights in our guide titled, State Farm auto insurance review.

- Customer Satisfaction: High ratings for customer service and claims handling reflect their strong performance in the best San Diego, California auto insurance market. This is supported by their A.M. Best rating of B, suggesting reliable support when needed.

- Generous Bundling Discount: A 17% discount for bundling auto insurance with other policies makes State Farm a competitive choice for the best San Diego, California auto insurance, offering substantial savings for multi-policy holders.

Cons

- Higher Rates for Some Drivers: State Farm’s rates might be higher compared to competitors for certain demographics or driving records. This can be a drawback when seeking the most affordable option among the best San Diego, California auto insurance providers.

- Limited Discount for New Drivers: New or young drivers may face fewer opportunities to save on premiums, which can be a disadvantage if you’re looking for cost-effective options within the best San Diego, California auto insurance market.

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico is known for offering some of the lowest rates in the industry, making it a standout in the best San Diego, California auto insurance landscape. Their A++ rating from A.M. Best highlights their strong financial stability.

- User-Friendly Online Tools: Geico provides an easy-to-use app and website for managing policies and filing claims, positioning it as one of the best San Diego, California auto insurance choices for digital convenience. Their 25% bundling discount enhances overall value.

- Excellent Financial Stability: Geico’s A++ rating indicates strong financial health, ensuring reliability and trustworthiness in coverage, which is crucial for anyone looking for the best San Diego, California auto insurance. Find more details through our Geico auto insurance review.

Cons

- Inconsistent Customer Service: Customer service experiences with Geico can vary significantly, which might impact overall satisfaction despite competitive rates. This inconsistency can be a drawback for those seeking the best San Diego, California auto insurance.

- Limited Local Agents: Geico has fewer physical locations compared to some competitors, which may affect in-person support and personalized assistance, a factor important in evaluating the best San Diego, California auto insurance.

#3 – AAA: Best for Membership Perks

Pros

- Membership Perks: AAA offers additional benefits like roadside assistance and travel discounts, adding extra value to their policies. This makes AAA a notable choice for the best San Diego, California auto insurance with added perks. Learn more through our AAA auto insurance review.

- Comprehensive Coverage Options: AAA provides a wide range of coverage options and add-ons, making it a top contender for the best San Diego, California auto insurance. The 15% bundling discount further enhances their appeal.

- Discounts for Bundling: A 15% discount for bundling auto insurance with other AAA services can lead to significant savings, making AAA a leading option in the best San Diego, California auto insurance market.

Cons

- Membership Requirement: Full benefits often require AAA membership, which could be an additional cost. This membership requirement might not be ideal for everyone seeking the best San Diego, California auto insurance.

- Higher Premiums for Some: Insurance premiums with AAA can be higher compared to other providers, especially for certain drivers. This could be a concern if affordability is a key factor in finding the best San Diego, California auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for High Coverage

Pros

- Bundling Discounts: Allstate provides a 10% discount when bundling multiple policies, which can be beneficial for those seeking the best San Diego, California auto insurance while saving on premiums.

- Personalized Service: Local agents offer tailored insurance solutions, enhancing the experience of those looking for the best San Diego, California auto insurance with personalized attention. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Numerous Discounts: Discounts available for safe driving, multiple vehicles, and more make Allstate an appealing choice for the best San Diego, California auto insurance. These discounts can significantly reduce premiums.

Cons

- Complex Policy Options: The range of coverage options can be overwhelming and difficult to navigate. This complexity might require additional time to fully understand, which could be a drawback when looking for the best San Diego, California auto insurance.

- Potentially Higher Rates: Premiums with Allstate may be higher than some competitors, particularly for drivers with less-than-ideal records. This could impact affordability for those seeking the best San Diego, California auto insurance.

#5 – Farmers: Best for Local Agents

Pros

- Customizable Coverage: Farmers offers options to tailor coverage to specific needs, aligning with the best San Diego, California auto insurance criteria for those requiring personalized solutions. Their A.M. Best rating of A underscores their reliability.

- Good for Diverse Needs: Farmers caters to various coverage requirements with a wide range of insurance products, making it a top choice for the best San Diego, California auto insurance. More information is available in our Farmers auto insurance review.

- Strong Community Presence: Known for community involvement and support, Farmers adds an extra layer of customer care, making it a solid contender in the best San Diego, California auto insurance market.

Cons

- Higher Rates: Insurance rates with Farmers can be higher compared to some other providers. This could be a concern for those focused on finding the most affordable option among the best San Diego, California auto insurance providers.

- Limited Discounts: Fewer discount opportunities compared to competitors could mean less chance to lower overall premiums, which might be a drawback for those seeking the best San Diego, California auto insurance with significant savings.

#6 – USAA: Best for Military Families

Pros

- Excellent Customer Service: USAA is known for high ratings in customer support and claims satisfaction, aligning with the best San Diego, California auto insurance providers. Their commitment to service is well-regarded.

- Comprehensive Coverage Options: With extensive coverage options tailored for military needs, USAA is a top choice for the best San Diego, California auto insurance. The 10% bundling discount further enhances their value.

- Generous Discounts: USAA provides discounts for bundling, safe driving, and more, making it a leading option for the best San Diego, California auto insurance. These discounts can further reduce costs. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members, veterans, and their families, which limits access for those outside this community. This restriction might be a drawback for those seeking the best San Diego, California auto insurance.

- Limited Local Presence: Fewer physical locations for in-person assistance could impact those who prefer face-to-face service, a factor to consider when looking for the best San Diego, California auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Custom Coverage

Pros

- Customizable Policies: Liberty Mutual offers various options to tailor coverage to specific needs, making it a competitive option for the best San Diego, California auto insurance. Their A rating from A.M. Best reflects strong financial health.

- Flexible Coverage Options: A variety of coverage options and add-ons are available, offering flexibility to those seeking the best San Diego, California auto insurance. This allows for personalized insurance solutions.

- Strong Financial Ratings: High financial stability ratings ensure confidence in their ability to meet claims, which is crucial for anyone considering the best San Diego, California auto insurance. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Inconsistent Customer Service: Customer service experiences with Liberty Mutual can vary, which might affect overall satisfaction despite the strong financial stability. This inconsistency could be a drawback in the search for the best San Diego, California auto insurance.

- Limited Local Agents: Fewer local agents compared to some competitors might impact the availability of personalized support, which can be an important factor when choosing the best San Diego, California auto insurance.

#8 – Progressive: Best for Flexible Plans

Pros

- Flexible Plans: Progressive offers a range of flexible insurance plans, catering to different needs and budgets, making it a prominent option for the best San Diego, California auto insurance. Their A+ rating from A.M. Best reflects strong financial stability.

- Competitive Pricing: Known for its competitive rates and innovative pricing models, Progressive stands out in the best San Diego, California auto insurance market. The 20% bundling discount further enhances affordability. Delve into our evaluation of Progressive auto insurance review.

- Numerous Discounts: Offers a variety of discounts, including for safe driving and bundling, which can lower overall costs, positioning Progressive as a leading provider in the best San Diego, California auto insurance market.

Cons

- Inconsistent Customer Service: Customer service can vary, impacting overall satisfaction despite competitive pricing. This inconsistency might be a concern for those seeking the best San Diego, California auto insurance experience.

- Limited Personalized Coverage: While flexible, some users may find that coverage options are less personalized compared to competitors. This could be a drawback for those looking for the most tailored insurance solutions in the best San Diego, California auto insurance market.

#9 – Mercury: Best for Teen Drivers

Pros

- Strong Discounts: Offers a range of discounts, including for good students and safe driving. The 10% bundling discount further enhances its appeal as a leading option in the best San Diego, California auto insurance market.

- Local Agent Support: Provides personalized service through local agents, which can be advantageous for those seeking the best San Diego, California auto insurance with tailored advice.

- Comprehensive Coverage: Offers a range of coverage options to suit different needs, making it a versatile choice for the best San Diego, California auto insurance. Read more through our Mercury auto insurance review.

Cons

- Limited National Presence: Mercury may have fewer national locations compared to larger providers, which could impact access to in-person support for those seeking the best San Diego, California auto insurance.

- Potentially Higher Rates for Some: While rates are competitive for certain drivers, others may find premiums to be higher. This could be a concern for those seeking the most affordable option in the best San Diego, California auto insurance market.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Broad Coverage

Pros

- Competitive Bundling Discounts: A 10% discount for bundling auto insurance with other Nationwide policies provides significant savings, enhancing its position in the best San Diego, California auto insurance market.

- Good Customer Service: Known for solid customer service and claims handling, which contributes to its reputation as one of the best San Diego, California auto insurance providers. Find out more through our Nationwide auto insurance review.

- Flexible Payment Options: Offers a variety of payment plans and options, making it easier to manage your budget while enjoying the best San Diego, California auto insurance coverage.

Cons

- Limited Local Agents: Fewer local agents compared to some competitors may affect the availability of personalized support, which can be important for those seeking the best San Diego, California auto insurance.

- Potentially Higher Premiums: Premiums might be higher for certain drivers, which could impact affordability if you’re seeking the most cost-effective option among the best San Diego, California auto insurance providers.

The Cost of Car Insurance in San Diego

Part of finding the best price for your car insurance policy in the City in Motion depends on your ability to understand the factors that car insurance providers use to set your rates.

What city you reside in will impact your car insurance. That’s why it’s essential to compare San Diego, CA against other top US metro areas’ auto insurance costs.

San Diego, California Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $40 $118

Allstate $50 $130

Farmers $48 $127

Geico $35 $110

Liberty Mutual $47 $128

Mercury $42 $122

Nationwide $46 $125

Progressive $39 $115

State Farm $45 $120

USAA $33 $105

When most people think about these things they automatically assume that these factors only include their age and driving record. Nothing could be further from the truth. Check out how auto insurance companies check your driving record.

In fact, car insurance providers also look at things like your gender, the zip code you live in, and in some cases even your credit score. That’s not all they look at either.

Not to worry. We will help you go through each of the factors that determine your car insurance rates so that you will in a better position to get a great deal on car insurance when it comes time to spend your hard-earned money.

Best by Category: Cheapest Auto Insurance in San Diego, California

This approach ensures you find an insurance policy that not only fits your budget but also meets your personal requirements, ultimately helping you secure the most affordable and effective auto insurance coverage available in the San Diego area. Enter your ZIP code now to begin.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

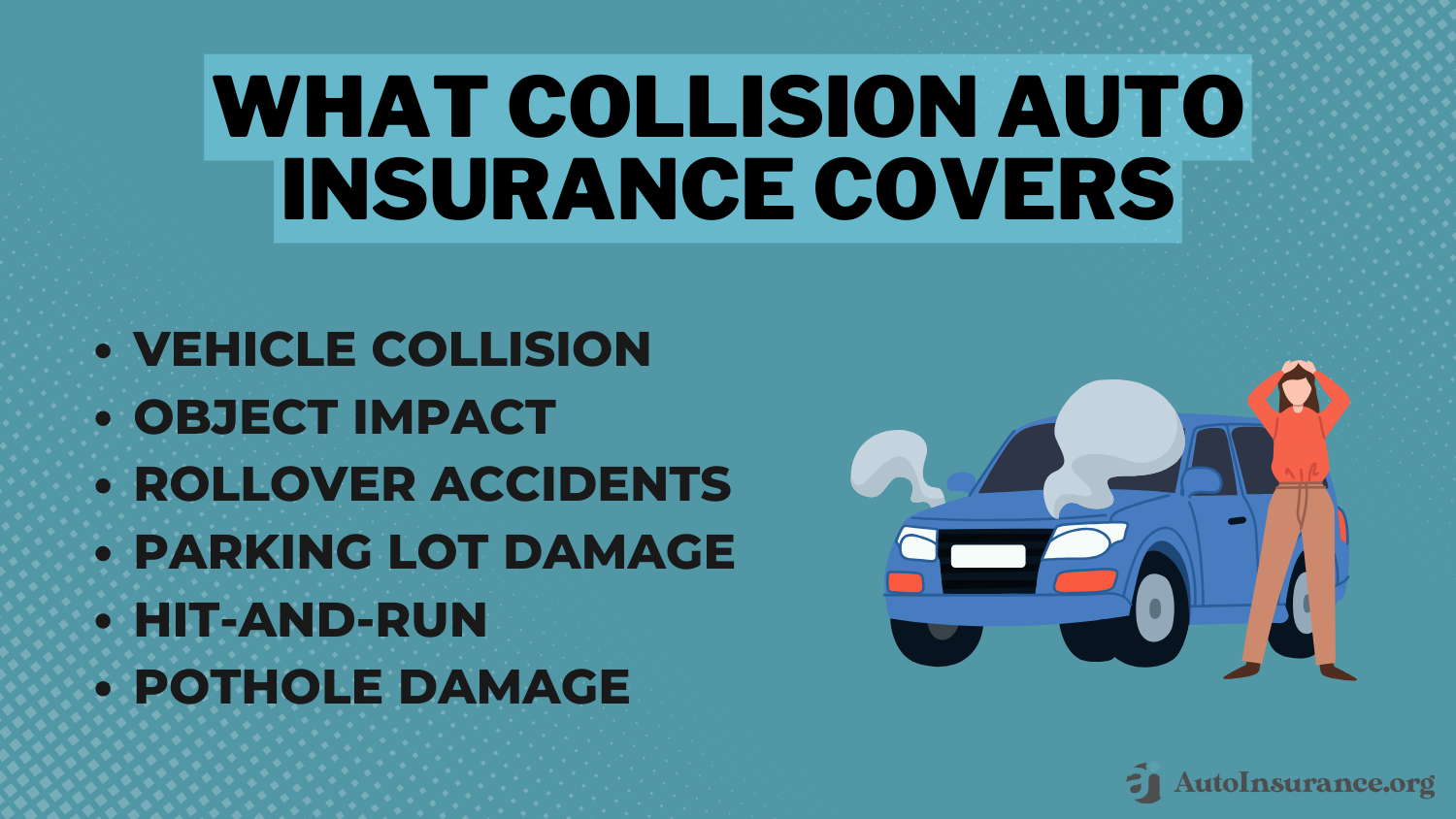

Driving in San Diego, California

Driving in San Diego involves more than just considering the geography and demographics of the area when determining your car insurance rates.

To ensure you’re adequately protected, it’s important to consider full coverage auto insurance, which provides comprehensive protection against a wide range of risks.

The city’s unique road conditions, including the types and maintenance of its roads, can significantly impact your premiums. For example, well-maintained highways may pose less risk compared to poorly maintained ones with more potholes and hazards.

Additionally, how San Diego enforces traffic laws, such as red light violations and speeding, can affect insurance rates. Stringent enforcement might lead to fewer accidents and lower premiums, while lenient policies could contribute to higher rates due to increased risk of collisions.

Understanding these elements, along with choosing full coverage auto insurance, can provide valuable insight into how your insurance premiums are calculated in San Diego, highlighting the interplay between local driving conditions and insurance costs.

Compare San Diego, California Auto Insurance Quotes

The cost of auto insurance can vary significantly between companies due to differences in coverage options, discounts, and risk assessments. Several factors that affect auto insurance rates include your driving history, location, vehicle type, and coverage limits.

Jeff Root

Licensed Insurance Agent

When purchasing auto insurance in San Diego, California, it’s essential to compare quotes from multiple insurance providers to ensure you're getting the best deal.

By comparing rates, you can identify the most affordable policy that meets your coverage needs. This will give you a clearer picture of your options and help you make an informed decision about your auto insurance coverage.

To start, simply enter your ZIP code below to receive free auto insurance quotes from various companies in San Diego.

Frequently Asked Questions

What is the average bundling discount offered by State Farm?

State Farm offers a 17% discount for bundling multiple policies.

This discount can make their coverage more affordable for customers looking for the best San Diego, California auto insurance.

Which insurance provider has the highest A.M. Best rating among the top 10?

Geico has the highest A.M. Best rating of A++, indicating superior financial strength and stability. This rating reflects Geico’s ability to reliably meet its insurance obligations. Enter your ZIP code now to begin.

How does Geico’s bundling discount compare to that of AAA?

Geico offers a 25% bundling discount, which is higher than AAA’s 15% discount.

This substantial discount can be a significant factor for those interested in lowering your auto insurance rates by combining multiple policies with one provider.

As a result, Geico becomes a more attractive option for customers aiming to save on their overall insurance costs.

What are the main benefits of choosing AAA for auto insurance?

AAA is known for its membership perks, including roadside assistance and discounts on travel services.

It also provides solid coverage options and benefits that enhance the value of their auto insurance policies.

Which provider is noted for offering customizable coverage options?

Liberty Mutual is noted for its customizable coverage options, allowing customers to tailor their policies to specific needs.

This flexibility makes it a strong contender for the best San Diego, California auto insurance. Enter your ZIP code now to begin.

What discount does Liberty Mutual offer for bundling policies?

Liberty Mutual offers a 12% discount for bundling multiple policies. This discount can help reduce overall insurance costs while providing comprehensive auto insurance coverage.

How does Progressive’s flexible plans benefit customers in San Diego?

Progressive’s flexible plans allow customers to adjust their coverage to fit their specific needs and budgets.

This adaptability helps ensure that customers get the best San Diego, California auto insurance for their circumstances.

Which provider is recommended for affordable rates for teen drivers?

Mercury is recommended for its competitive rates specifically designed for teen drivers.

This makes it an ideal choice for families looking for affordable coverage for younger drivers. Enter your ZIP code now to begin.

What additional perks does AAA provide beyond auto insurance coverage?

In addition to auto insurance, AAA offers membership perks such as roadside assistance coverage, travel discounts, and exclusive offers. These benefits add significant value to their insurance policies.

What financial stability rating does USAA hold according to A.M. Best?

USAA holds an A++ rating from A.M. Best, indicating exceptional financial strength and stability. This high rating underscores USAA’s reliability in meeting its insurance obligations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.