Best Bensalem, Pennsylvania Auto Insurance in 2026 (Top 10 Companies Ranked)

Starting at just $26/month, Nationwide, Geico, and State Farm provide the best Bensalem, Pennsylvania auto insurance. The top firms offer policies that bend and adapt to your needs, with plenty of chances to save. Stack up the quotes and find the best auto insurance in Bensalem, that fits just right for your ride.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

Company Facts

Full Coverage in Bensalem Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Bensalem Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Bensalem Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

For the best Bensalem, Pennsylvania auto insurance rates, turn to Nationwide, Geico, and State Farm, starting at $26 a month. Nationwide offers affordable premiums and solid protection.

Our in-depth analysis uncovers the best car insurance in Bensalem, PA, featuring top-rated providers and money-saving strategies. Learn what are the benefits of auto insurance beyond basic coverage.

Our Top 10 Company Picks: Best Bensalem, Pennsylvania Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ Broad Coverage Nationwide

![]()

#2 25% A++ Affordable Rates Geico

#3 17% B Customer Service State Farm

#4 15% A++ Military Families USAA

#5 12% A+ Customizable Plans Progressive

#6 10% A+ High-Risk Drivers Allstate

#7 15% A++ New Cars Travelers

#8 10% A+ Customer Satisfaction NJM

#9 14% A++ Overall Service Auto-Owners

#10 15% A Personalized Service Farmers

We break down how insurers like Nationwide, Geico, and State Farm customize policies to fit Bensalem drivers’ specific requirements and budgets. Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

- Nationwide is recognized as the premier choice in Bensalem

- Uncover hidden savings with local insurance discounts

- Decode the mystery behind your premiums

#1 – Nationwide: Top Overall Pick

Pros

- Cost-Effective Premiums: Nationwide’s $100 monthly rate in Bensalem offers residents an affordable option for vehicle protection without compromising on essential coverage.

- Flexible Policy Design: Bensalem drivers can adjust their Nationwide policies to align with specific needs, whether commuting to Philadelphia or navigating local streets.

- Multiple Discount Options: Nationwide provides Bensalem policyholders various opportunities to reduce costs through safe driving incentives and multi-policy arrangements. Check out this page “Nationwide auto insurance review” for more details.

Cons

- Limited Physical Presence: The scarcity of Nationwide offices in Bensalem may inconvenience residents who prefer in-person consultations for their insurance matters.

- Credit-Based Pricing: Bensalem drivers with lower credit scores might encounter higher premiums, potentially impacting the overall affordability of Nationwide’s offerings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Quick Quote Process: Geico offers a fast and efficient quote process, allowing Bensalem residents to obtain insurance estimates quickly. This streamlined process facilitates easier comparison shopping and faster decision-making.

- Extensive Savings Opportunities: Bensalem drivers can access a wide array of discounts through Geico, potentially lowering their insurance expenses significantly.

- Advanced Digital Interface: Geico’s user-friendly online platform and mobile application cater to Bensalem’s tech-savvy population, streamlining policy management. Check out this page “Geico auto insurance review” for more details.

Cons

- Absence of Local Offices: Bensalem residents who value in-person consultations may find Geico’s primarily digital presence less accommodating to their preferences.

- Support Quality Fluctuations: Some Bensalem policyholders report intermittent challenges with Geico’s assistance services, potentially impacting overall satisfaction levels.

#3 – State Farm: Best for Customer Service

Pros

- Individualized Protection: State Farm empowers Bensalem motorists to craft policies aligned with their unique risk profiles and driving behaviors. Check out this page “State Farm auto insurance review” for more details.

- Diverse Savings Initiatives: Bensalem residents can capitalize on State Farm’s multifaceted approach to premium reduction, enhancing overall policy value.

- Community-Centric Representation: State Farm’s established presence in Bensalem ensures access to agents well-versed in local insurance nuances and driving conditions.

Cons

- Premium Considerations: State Farm’s $206 monthly rate in Bensalem may present challenges for residents prioritizing budget-friendly insurance solutions.

- Technological Infrastructure: Bensalem’s tech-savvy demographic might find State Farm’s digital tools less advanced compared to some industry counterparts.

#4 – USAA: Best for Military Families

Pros

- Military-Centric Pricing: In Bensalem, USAA charges $110 a month. For military families, it is a good price for strong auto insurance.

- Exemplary Member Support: Bensalem’s service members value USAA’s dedicated assistance, which addresses the unique aspects of military lifestyles.

- Tailored Military Policies: USAA provides Bensalem’s armed forces community with coverage options specifically designed to accommodate service-related circumstances. Check out this page “USAA auto insurance review” for more details.

Cons

- Exclusive Membership Model: USAA’s services are confined to Bensalem’s military community, limiting accessibility for the general populace.

- Physical Presence Limitations: The lack of USAA offices in Bensalem may pose a challenge for members who favor engaging in face-to-face discussions regarding their policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Customizable Plans

Pros

- Balanced Rate Structure: Progressive’s $183 monthly premium in Bensalem strikes an equilibrium between affordability and comprehensive vehicular protection.

- Expansive Policy Spectrum: Bensalem motorists have the opportunity to choose from Progressive’s extensive array of insurance plans, enabling tailored and individualized coverage solutions.

- Multifaceted Savings Opportunities: Progressive offers Bensalem residents various pathways to reduce insurance costs, enhancing overall policy attractiveness. Check out this page “Progressive auto insurance review” for more details.

Cons

- Inconsistent Support Experiences: Some Bensalem policyholders report varying levels of satisfaction with Progressive’s assistance, potentially affecting customer loyalty.

- Decision Paralysis Risk: Bensalem residents might find Progressive’s abundance of options overwhelming when constructing an appropriate policy.

#6 – Allstate: Best for High-Risk Drivers

Pros

- Accident Forgiveness Program: For Bensalem drivers, Allstate offers an accident forgiveness program that helps prevent rate increases after a first accident, maintaining affordable premiums despite occasional driving mishaps.

- Robust Incentive Programs: Bensalem residents can access multiple premium reduction opportunities through Allstate, optimizing their insurance investments.

- Established Local Network: Allstate’s strong presence in Bensalem facilitates personalized insurance guidance tailored to the township’s specific driving landscape. Check out this page “Allstate auto insurance review” for more details.

Cons

- Rate Competitiveness: Allstate’s $209 monthly premium in Bensalem may pose challenges for residents seeking more economical insurance alternatives.

- Service Consistency Concerns: Some Bensalem policyholders note fluctuating experiences with Allstate’s customer support, potentially impacting overall satisfaction.

#7 – Travelers: Best for New Cars

Pros

- Market-Leading Rates: Travelers’ $79 monthly premium in Bensalem represents a significant cost advantage for residents seeking affordable auto protection.

- Flexible Policy Construction: Bensalem motorists have the ability to customize their Travelers insurance to meet distinct requirements, ranging from fundamental liability protection to more comprehensive coverage options.

- Extensive Discount Catalog: Travelers provides Bensalem policyholders with numerous avenues for premium reduction through various incentive programs. Check out this page “Travelers auto insurance review” for more details.

Cons

- Limited Local Infrastructure: Bensalem residents may find Travelers’ minimal physical presence in the area challenging when seeking in-person consultations.

- Customer Care Variability: Some Bensalem drivers report occasional difficulties with Travelers’ support services, potentially affecting overall satisfaction levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – NJM: Best for Customer Satisfaction

Pros

- Competitive Pricing Model: NJM’s $102 monthly rate in Bensalem provides residents with an economically viable option for maintaining adequate vehicle protection.

- Acclaimed Support Services: Bensalem policyholders frequently praise NJM’s assistance, highlighting the company’s dedication to customer satisfaction. Check out this page “NJM Car Insurance Review” for more details.

- Adaptable Coverage Framework: NJM offers Bensalem drivers various policy options, enabling tailored protection aligned with individual requirements.

Cons

- Geographic Service Limitations: NJM’s coverage may not be universally available throughout Bensalem, potentially restricting access for some residents.

- Limited Cost-Saving Programs: Bensalem drivers might find NJM’s discount opportunities less extensive compared to those offered by some industry counterparts.

#9 – Auto-Owners: Best for Overall Service

Pros

- Competitive Rate Structure: Auto-Owners’ $95 monthly premium in Bensalem presents an appealing option for residents seeking affordable yet comprehensive coverage.

- Diverse Policy Options: Bensalem motorists can choose from Auto-Owners’ range of coverage types to create protection plans suited to their specific circumstances. Check out this page “Auto-Owners auto insurance review” for more details.

- Lauded Customer Assistance: Auto-Owners’ reputation for exceptional policyholder support instills confidence among Bensalem insurance seekers.

Cons

- Limited Physical Presence: Bensalem residents may find Auto-Owners’ scarce local offices inconvenient for face-to-face policy discussions.

- Variable Discount Accessibility: The availability of Auto-Owners’ cost-saving initiatives in Bensalem may fluctuate, potentially limiting opportunities for premium reductions.

#10 – Farmers: Best for Personalized Service

Pros

- Strong Claims Handling: Farmers is known for its efficient claims handling process, which can provide peace of mind to policyholders in Bensalem who may need to file a claim.

- Comprehensive Savings Structure: Bensalem residents can utilize Farmers’ diverse range of cost-reduction opportunities to potentially lower their insurance expenses.

- Strong Community Presence: Farmers’ established network in Bensalem offers residents access to agents familiar with the township’s specific insurance landscape. Check out this page “Farmers auto insurance review” for more details.

Cons

- Variable Coverage Availability: Certain specialized coverage options might not be available in all areas of Bensalem, which could limit the flexibility of policyholders looking for niche insurance solutions.

- Support Quality Variations: Some Bensalem policyholders report inconsistent experiences with Farmers’ customer assistance, potentially influencing overall satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bensalem, Pennsylvania Insurance Minimums to Savings

Attention Bensalem motorists. We’ve dissected premium costs from leading insurers, covering basic to comprehensive plans. Whether you’re zipping down Hulmeville Road or parked at Neshaminy Mall, our breakdown helps you get the best car insurance in Bensalem without draining your wallet.

Bensalem, Pennsylvania Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $209

Auto-Owners $33 $95

Farmers $39 $180

Geico $26 $192

Nationwide $88 $100

NJM $38 $102

Progressive $34 $183

State Farm $36 $206

Travelers $29 $79

USAA $27 $110

Before you hit the gas on Street Road or cruise down Bristol Pike, let’s talk about keeping your wheels legally covered. Pennsylvania’s got some rules of the road when it comes to insurance, and we’re here to break it down Bucks County style.

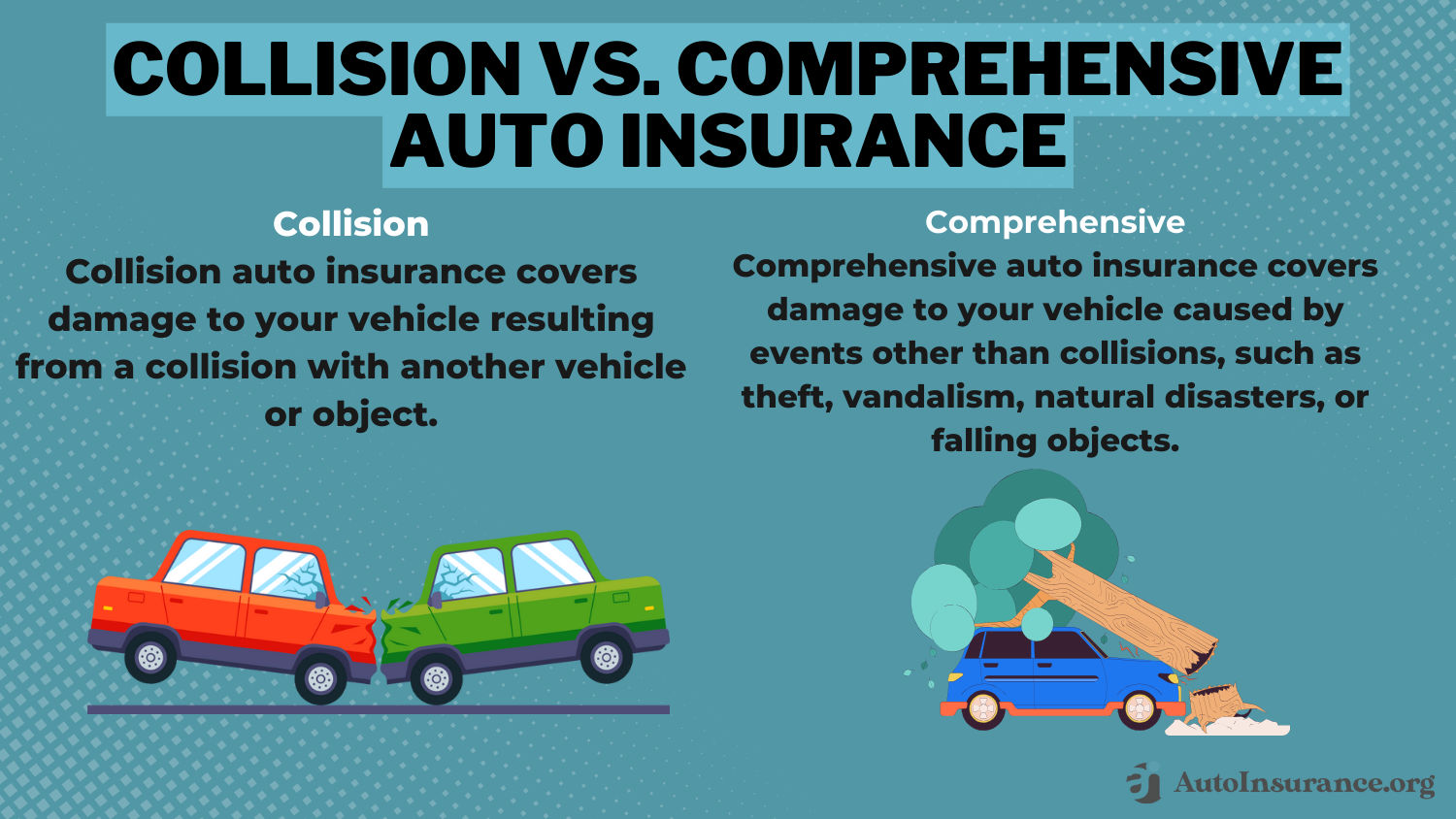

Think of the state’s minimum requirements as your insurance starter pack. It’s like ordering a cheesesteak “wit” – you’ve got the basics, but you might want to add some extras for the full experience. To enhance your protection, consider adding collision and comprehensive auto insurance coverage.

Here’s what you need to stay on the right side of the law:

- $5,000 for property damage liability coverage

- $15,000 for bodily injuries per person

- $30,000 for total bodily injury per accident

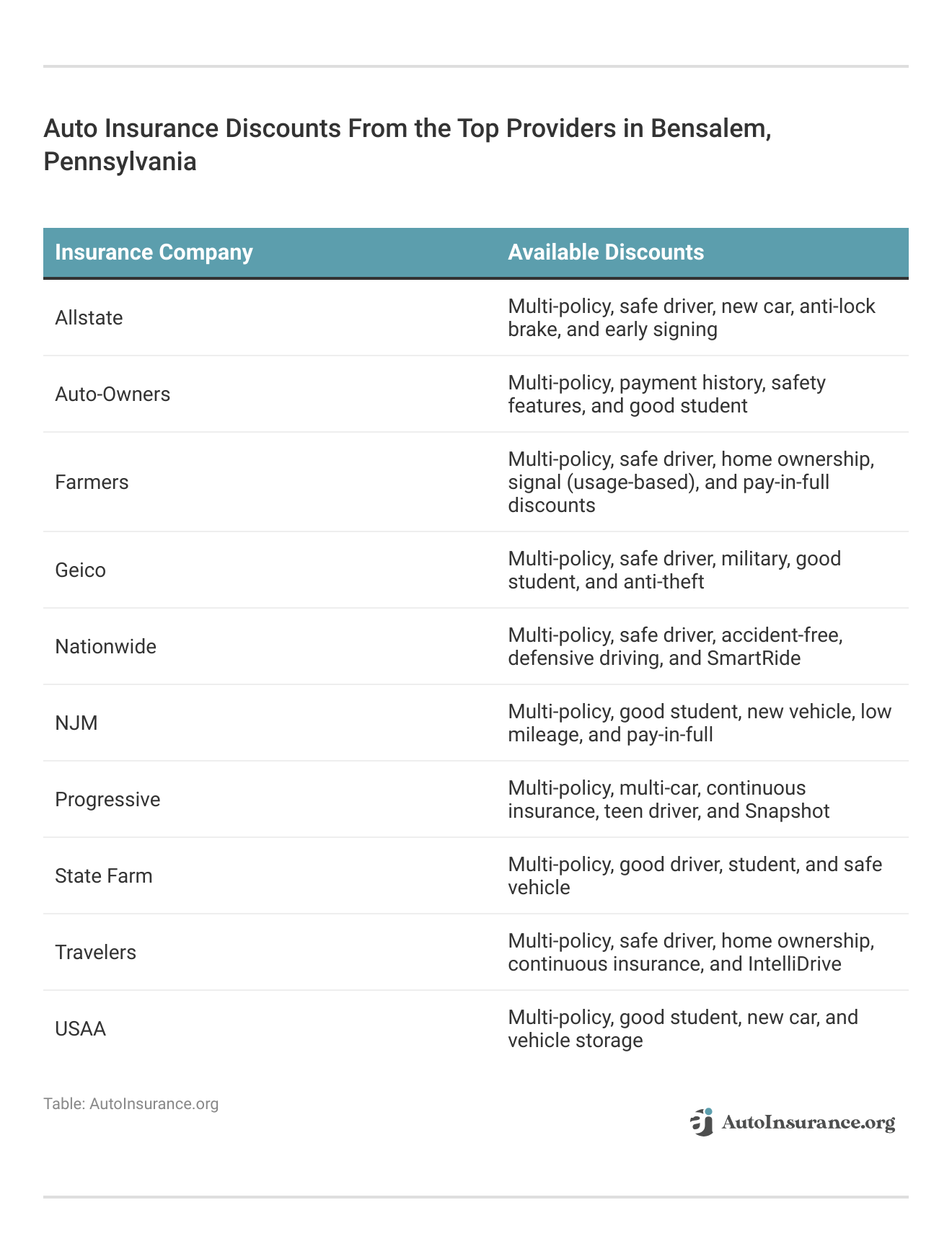

Table below, though centered on discount choices for policyholders, also sheds light on finding the best cheap car insurance in Bensalem. The assortment of discounts from different insurers shows how one can cut premiums significantly by choosing wisely and driving carefully.

Programs like Progressive’s Snapshot and Travelers’ IntelliDrive bring a fresh approach to pricing based on usage. When considering insurance, it’s wise to talk in detail with car insurance agents in Bensalem, PA about possible discounts. Combining various savings can significantly reduce premiums and increase the value of your coverage.

Auto Insurance Costs by ZIP Code in Bensalem, Pennsylvania

Interested in finding out the cost of auto insurance in Bensalem based on ZIP code? On average, the monthly cost for full coverage would be approximately $607. When obtaining quotes, some may wonder, “can I use a P.O. box for my auto insurance?” It’s crucial to consult with providers directly on this matter, as most require a physical address for accurate risk assessment and policy issuance.

Auto Insurance Costs by Commute in Bensalem, Pennsylvania

Rev your engines, Bensalem drivers. We’re about to take a road trip through mileage and insurance premiums. Our handy table is like a GPS for your wallet, showing how your annual odometer reading can send your rates on a wild ride – or sometimes, surprisingly, keep them steady as a Sunday drive down Street Road.

Bensalem, Pennsylvania Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $545 | $570 |

| Geico | $293 | $302 |

| Liberty Mutual | $678 | $713 |

| Nationwide | $306 | $306 |

| Progressive | $502 | $502 |

| State Farm | $291 | $311 |

| Travelers | $1,025 | $1,025 |

| USAA | $155 | $164 |

Remember, finding the best car insurance rates in Bensalem isn’t just about price – it’s about finding a policy that fits you. Explore cheap usage-based auto insurance options, and find your perfect coverage match for the best Bensalem, Pennsylvania auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Credit History on Bensalem, PA Auto Insurance

It shows the average monthly auto insurance premium for the main ZIP code in Bensalem. Though it’s not comprehensive, it gives residents a starting point when looking for auto insurance quotes in Bensalem, setting a practical expectation of what they might pay.

Bensalem, Pennsylvania Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $711 | $534 | $429 |

| Geico | $448 | $251 | $193 |

| Liberty Mutual | $886 | $637 | $563 |

| Nationwide | $358 | $295 | $263 |

| Progressive | $664 | $468 | $375 |

| State Farm | $427 | $266 | $211 |

| Travelers | $1,114 | $1,008 | $952 |

| USAA | $200 | $147 | $130 |

The gap between poor and good credit rates shows how much you gain from keeping your credit score healthy. When looking for insurance, check your credit report for mistakes and seek out companies that don’t weigh credit scores heavily. You might find better rates even if your credit isn’t perfect.

Read More: Does not paying your auto insurance affect credit?

Impact of Driving History on Auto Insurance in Bensalem, PA

In Bensalem, Pennsylvania, one must look hard at the monthly premiums. A man with a clean record pays his dues, but a man with a poor record pays dearly. This tells a simple truth: infractions come with a price, and keeping the slate clean keeps money in your pocket.

Bensalem, Pennsylvania Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $531 | $637 | $531 | $531 |

| Geico | $217 | $380 | $300 | $292 |

| Liberty Mutual | $632 | $730 | $710 | $710 |

| Nationwide | $223 | $297 | $294 | $409 |

| Progressive | $453 | $630 | $456 | $469 |

| State Farm | $273 | $329 | $301 | $301 |

| Travelers | $720 | $1,032 | $1,032 | $1,315 |

| USAA | $128 | $177 | $143 | $189 |

USAA and Geico emerge as the most cost-effective options for drivers with unblemished records, while Travelers imposes the most severe penalties for infractions.

Insurance companies assess your driving history to gauge risk, so even minor infractions can lead to higher premiums.Eric Stauffer LICENSED INSURANCE AGENT

When seeking car insurance quotes in Bensalem, it’s important to inquire about good driver auto insurance discounts, as these can significantly offset premiums and incentivize continued safe driving practices.

Auto Insurance Costs in Bensalem, Pennsylvania With a DUI

This reveals the striking price differences between basic and comprehensive auto coverage across top insurers. While not Bensalem-specific, these figures offer a solid starting point for local drivers seeking affordable protection.

Bensalem, Pennsylvania Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $531 |

| Geico | $292 |

| Liberty Mutual | $710 |

| Nationwide | $409 |

| Progressive | $469 |

| State Farm | $301 |

| Travelers | $1,315 |

| USAA | $189 |

The best Bensalem, Pennsylvania auto insurance isn’t always the cheapest. When comparing policies, consider your unique needs, assets, and risk tolerance alongside state requirements to find the ideal balance of coverage and cost.

Age and Gender Breakdown for Bensalem, PA Auto Insurance

This comprehensive rate comparison elucidates the pricing dynamics for diverse demographic segments in Bensalem’s auto insurance market. The table particularly highlights the substantial premium differentials for auto insurance for drivers under 25, reflecting the heightened risk associated with less experienced motorists.

Bensalem, Pennsylvania Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $102 | $102 | $30 | $30 | $28 | $28 | $26 | $26 |

| Geico | $49 | $42 | $19 | $16 | $19 | $17 | $19 | $16 |

| Liberty Mutual | $110 | $110 | $48 | $48 | $38 | $38 | $35 | $35 |

| Nationwide | $48 | $48 | $19 | $19 | $17 | $17 | $17 | $17 |

| Progressive | $84 | $84 | $33 | $33 | $26 | $26 | $24 | $24 |

| State Farm | $54 | $54 | $17 | $17 | $16 | $16 | $14 | $14 |

| Travelers | $283 | $283 | $21 | $21 | $18 | $18 | $20 | $20 |

| USAA | $310 | $310 | $133 | $133 | $101 | $101 | $92 | $92 |

Interestingly, several providers maintain consistent rates across genders within age groups, while others show slight variations.

For personalized guidance on navigating these complex pricing structures, consulting with experienced car insurance agents in Bensalem can prove invaluable, potentially uncovering additional savings opportunities beyond those apparent in standardized rate tables.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the car insurance quotes in Bensalem, PA.

Frequently Asked Questions

Is auto insurance mandatory in Bensalem, PA?

Yes, auto insurance is mandatory in Bensalem, PA, as it is in most states in the United States. Pennsylvania law requires all drivers to carry a minimum amount of liability coverage to legally operate a motor vehicle.

Read More: When did auto insurance become mandatory?

What are the minimum auto insurance requirements in Bensalem, PA?

In Bensalem, PA, the minimum auto insurance requirements are as follows: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, and $5,000 property damage liability.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What other types of coverage can I consider adding to my auto insurance policy?

In addition to the minimum liability coverage, you can consider adding collision coverage, comprehensive coverage, medical payments coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). These optional coverages provide additional protection for your vehicle, medical expenses, and other potential risks.

How are auto insurance premiums determined in Bensalem, PA?

Auto insurance premiums in Bensalem, PA are determined by several factors, including your driving record, age, gender, marital status, type of vehicle, coverage limits, deductibles, and the insurance company’s rating system. Other factors, such as your credit history and the average cost of claims in your area, may also influence your premium.

Can I get discounts on my auto insurance in Bensalem, PA?

Yes, many car insurance companies in Bensalem, PA offer various discounts that can help lower your auto insurance premiums. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles with safety features such as anti-lock brakes or anti-theft devices. Check with your insurance provider to see which discounts you may qualify for.

What should I do if I get into an accident in Bensalem, PA?

If you get into an accident in Bensalem, PA, it’s important to prioritize safety first. If anyone is injured, call for medical assistance immediately. Then, contact the police to report the accident. Exchange information with the other parties involved, including their names, contact details, insurance information, and vehicle details.

Can I change my auto insurance coverage or provider in Bensalem, PA?

Yes, you can change your auto insurance coverage or provider in Bensalem, PA. If you want to switch insurance companies, compare auto insurance quotes in Bensalem, PA from different providers to find the best coverage and rates for your needs. Before making any changes, make sure you understand the terms and conditions of your current policy and any potential penalties for cancellation or changes.

Read More: How to Switch Auto Insurance Companies

Are there any specific auto insurance requirements for new drivers in Bensalem, PA?

In Bensalem, PA, new drivers are subject to the same auto insurance requirements as all other drivers. However, insurance premiums for new drivers may be higher due to their limited driving experience. It’s important for new drivers to maintain a clean driving record and consider taking a driver’s education course to potentially qualify for discounts.

Where can I find more information about auto insurance in Bensalem, PA?

For more information about auto insurance in Bensalem, PA, you can contact local insurance agents or brokers who specialize in auto insurance. Additionally, you can visit the official website of the Pennsylvania Department of Insurance for relevant resources and guidelines.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

What is auto insurance?

Auto insurance is a type of insurance coverage that protects you financially in case of accidents or damages involving your vehicle. It typically provides coverage for liability, collision, comprehensive, medical expenses, and uninsured/underinsured motorist protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.