Best Auto Insurance After a DUI in Mississippi (Find the Top 10 Companies Here for 2026)

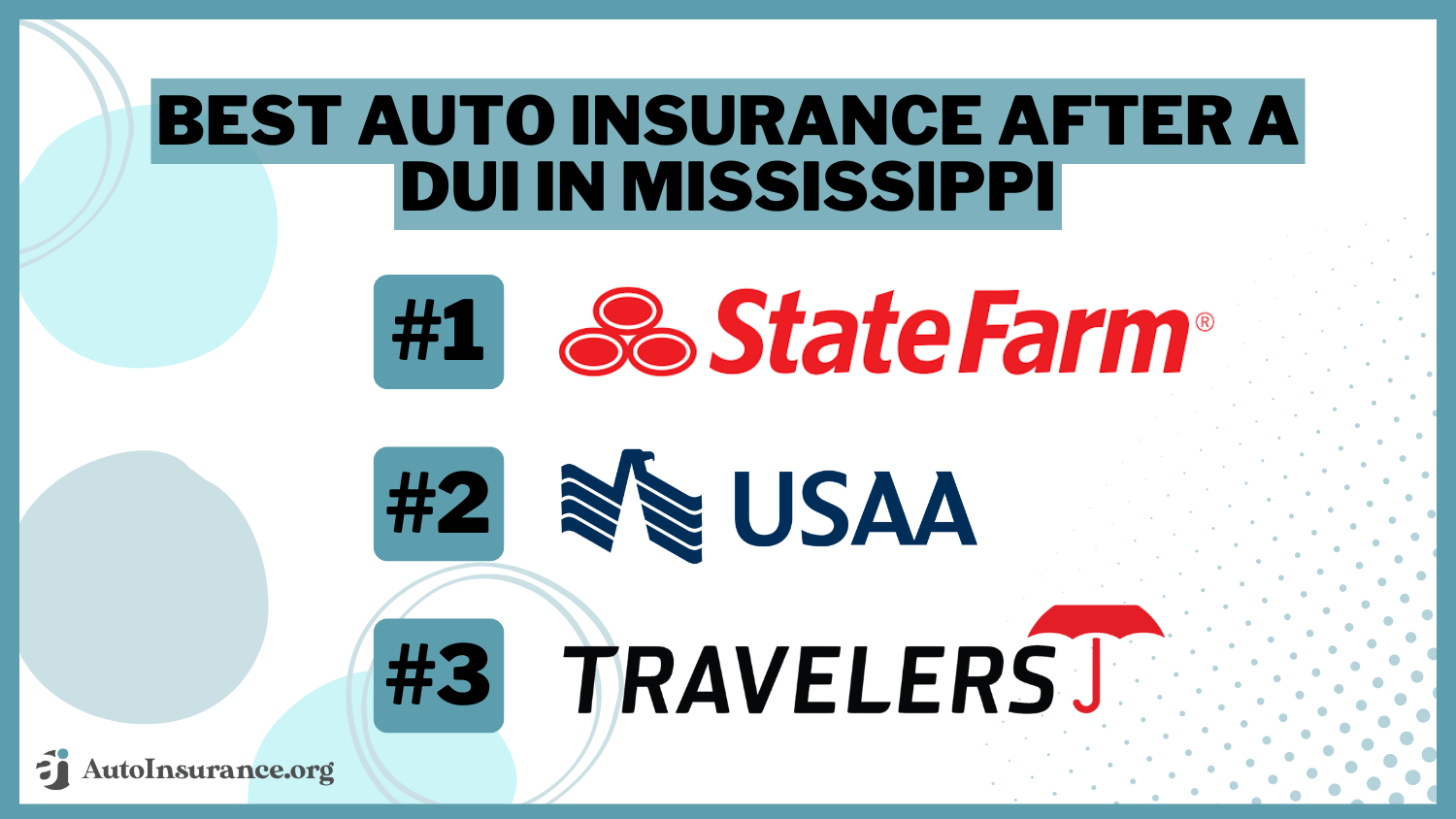

State Farm, USAA, and Travelers are the best auto insurance after a DUI in Mississippi, with State Farm offering the lowest rate at $33 per month. These companies stand out for their competitive rates, robust coverage, and specialized support designed for those dealing with a DUI in Mississippi.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated August 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage After a DUI in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage After a DUI in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage After a DUI in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsState Farm, USAA, and Travelers have the best auto insurance after a DUI in Mississippi, offering top-tier coverage and responsive customer service.

State Farm and USAA have cheap auto insurance after a DUI, with full coverage under $100/month. Travelers has a strong track record and tailored offerings to ensure high-risk Mississippi drivers get the protection they need.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Mississippi

| Company | Rank | Accident Forgiveness Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | B | Customer Service | State Farm | |

| #2 | 8% | A++ | Military Members | USAA | |

| #3 | 7% | A++ | Industry Experience | Travelers | |

| #4 | 7% | A+ | Usage-Based Savings | Progressive | |

| #5 | 9% | A+ | Vanishing Deductible | Nationwide |

| #6 | 9% | A | Bundling Policies | Liberty Mutual |

| #7 | 8% | A | Loyalty Rewards | American Family | |

| #8 | 8% | A | Safe-Driving Discounts | Farmers | |

| #9 | 11% | A+ | Infrequent Drivers | Allstate | |

| #10 | 10% | A++ | Online Service | Geico |

This article explores why these companies stand out as the best choices for DUI auto insurance in Mississippi.

Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- Affordable auto insurance helps Mississippi drivers recover after a DUI

- State Farm is the top pick for DUI auto insurance in Mississippi at $33/month

- USAA is the best insurer for military drivers in Mississippi with DUIs

#1 – State Farm: Top Overall Pick

Pros

- Top-Rated Customer Support: State Farm is renowned for exceptional customer service, especially critical after a DUI in Mississippi, ensuring drivers receive the guidance and support they need.

- Flexible Payment Plans: State Farm allows flexible payment options, making it easier for drivers in Mississippi to manage the increased premiums that often follow a DUI.

- Cheapest DUI Insurance Rates: State Farm DUI auto insurance costs start at $33/month, cheaper than any other MS auto insurance company on this list. Compare quotes for free in our State Farm review.

Cons

- Limited Discount Availability: State Farm’s discount options beyond accident forgiveness are somewhat limited, particularly for drivers with a DUI in Mississippi.

- Low Financial Ratings: A.M. Best recently reduced State Farms’ financial standing to a B, which is lower than other Mississippi DUI insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Members

Pros

- Exclusive Military Perks: USAA offers specialized coverage and discounts for military members and veterans, particularly beneficial for those with a DUI in Mississippi.

- Comprehensive Roadside Assistance: USAA provides robust roadside assistance, crucial for military members navigating the challenges of a DUI in Mississippi.

- Loyalty Benefits: Long-term military members with a DUI in Mississippi can benefit from USAA’s loyalty rewards to reduce overall insurance costs. More information is in our USAA review.

Cons

- Digital-First Approach: USAA’s emphasis on digital services may not suit all drivers in Mississippi, particularly those who prefer more personalized, in-person interaction after a DUI.

- Modest Accident Forgiveness: The 8% accident forgiveness discount, while helpful, may not be as significant as some other Mississippi DUI auto insurance providers.

#3 – Travelers: Best Industry Experience

Pros

- Over a Century of Experience: Travelers has been selling insurance for over 100 years, making it one of the most reliable Mississippi high-risk auto insurance companies.

- Highly Rated Financial Strength: With an A++ A.M. Best rating, Travelers provides a solid financial foundation for Mississippi drivers with a DUI, ensuring reliable claim payouts.

- Flexible Payment Options: Travelers offers flexible payment plans for drivers in Mississippi to manage increased insurance costs after a DUI. Compare quotes in our review of Travelers Insurance.

Cons

- Limited Discount Variety: Travelers auto insurance discount offerings are somewhat limited, which might not fully address the needs of all DUI drivers in Mississippi.

- Slower Claims Processing: Travelers’ claims processing speed may not be as fast as some DUI drivers in Mississippi would prefer, leading to potential delays in receiving payouts.

#4 – Progressive: Best for Usage-Based Savings

Pros

- Snapshot Program: Progressive Snapshot rewards safe driving, which can be especially beneficial for drivers in Mississippi seeking to lower DUI premiums. Learn more in our Snapshot review.

- Solid Financial Rating: With an A+ A.M. Best rating, Progressive offers reliable financial backing, ensuring that Mississippi drivers with a DUI can trust their coverage.

- User-Friendly Digital Tools: Progressive provides an array of digital tools that make managing policies easy for drivers in Mississippi, even after a DUI.

Cons

- Variable Premium Increases: Progressive may impose significant premium increases for drivers in Mississippi after a DUI, despite their competitive base rates.

- Discount Qualification Challenges: Earning Progressive’s discounts can be more challenging for DUI drivers in Mississippi, limiting potential savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Vanishing Deductible: Nationwide’s vanishing deductible feature gradually reduces deductibles over time, offering long-term savings for DUI drivers in Mississippi.

- Generous Accident Forgiveness: Nationwide provides a 9% accident forgiveness discount, helping to mitigate the financial impact of a DUI in Mississippi.

- Strong Financial Standing: With an A+ A.M. Best rating, Nationwide assures reliable coverage and claim payouts for DUI drivers in Mississippi. Find full ratings in our Nationwide auto insurance review.

Cons

- Limited Customization: Nationwide’s policies may offer less flexibility compared to other providers, which can be a drawback for drivers in Mississippi with specific needs after a DUI.

- Inconsistent Customer Service: Some DUI drivers in Mississippi have reported variability in Nationwide’s customer service quality, which can be critical during stressful times.

#6 – Liberty Mutual: Best for Bundling Policies

Pros

- Biggest Bundling Discount: DUI drivers in Mississippi who bundle home and auto insurance with Liberty Mutual save 25% on rates.

- High Accident Forgiveness: Liberty Mutual provides a 9% accident forgiveness discount, which can help alleviate the financial burden for Mississippi drivers with a DUI.

- 24/7 Claims Assistance: Liberty Mutual’s around-the-clock claims service ensures that DUI drivers in Mississippi can get the help they need anytime. Read our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for DUI Drivers: Liberty Mutual’s premiums can be relatively high for drivers in Mississippi after a DUI, despite available discounts.

- Limited Local Agent Access: Fewer physical locations in Mississippi may make it harder for DUI drivers to receive personalized, in-person support.

#7 – American Family: Best Loyalty Rewards

Pros

- Generous Loyalty Discounts: American Family rewards long-term customers, offering significant savings to DUI drivers in Mississippi who maintain continuous coverage.

- Flexible Payment Options: American Family offers flexible payment plans, making managing Mississippi DUI car insurance costs easier. Read our AmFam auto insurance review to find out more.

- Dedicated Support: American Family is known for providing attentive and personalized customer service, which is especially valuable for DUI drivers in Mississippi.

Cons

- Higher Premiums Despite Loyalty Discounts: Even with loyalty rewards, American Family DUI insurance rates may still be relatively high for drivers in Mississippi.

- Limited Coverage Customization: American Family’s policy options may not offer the same level of flexibility as other insurers, which can be a drawback for DUI drivers in Mississippi.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best Safe-Driving Discounts

Pros

- Strong Safe-Driving Discounts: Farmers offers substantial 30% discounts for safe driving, which can help DUI drivers in Mississippi reduce their premiums over time.

- Accident Forgiveness: Farmers provides an 8% accident forgiveness discount, offering financial relief for Mississippi drivers with a DUI. Take a look at our Farmers insurance company review to learn more.

- A-Rated Financial Strength: With an A rating from A.M. Best, Farmers provides dependable coverage and reliable claim payouts for DUI drivers in Mississippi.

Cons

- Higher Premiums for DUI Drivers: Farmers’ premiums can be relatively high for Mississippi drivers after a DUI, even with safe-driving discounts.

- Complex Discount Qualification: Qualifying for Farmers’ discounts can be challenging for DUI drivers in Mississippi, limiting potential savings.

#9 – Allstate: Best for Infrequent Drivers

Pros

- Low-Mileage Discounts: Allstate offers significant discounts for Mississippi drivers who sign up for Allstate Milewise to reduce DUI insurance costs. Read our Milewise review for more information.

- High Accident Forgiveness: Allstate provides an 11% accident forgiveness discount, one of the highest available for DUI drivers in Mississippi, helping to lower overall costs.

- A+ Financial Rating: Allstate’s strong A+ rating from A.M. Best ensures financial stability and reliable coverage for DUI drivers in Mississippi.

Cons

- Complex Discount Structures: Qualifying for Allstate’s various discounts can be complicated, potentially limiting immediate savings for DUI drivers in Mississippi.

- Mixed Customer Service: Some DUI drivers in Mississippi have reported inconsistent experiences with Allstate’s customer service, which can affect overall satisfaction.

#10 – Geico: Best Online Service

Pros

- Convenient Mobile Service: Mississippi drivers can manage DUI auto insurance policies and claims online through the Geico website or mobile app. Learn how in our Geico insurance review.

- High Accident Forgiveness: Geico provides a 10% accident forgiveness discount, helping DUI drivers in Mississippi keep their premiums more affordable.

- A++ Financial Rating: Geico’s A++ rating from A.M. Best ensures strong financial stability and dependable coverage for DUI drivers in Mississippi.

Cons

- Limited Personal Interaction: Geico’s emphasis on digital services may lack the personalized support that some DUI drivers in Mississippi might prefer.

- Strict Underwriting Process: Geico’s underwriting criteria can be stringent, making it difficult for some DUI drivers in Mississippi to qualify for the best rates.

State Farm emerges as the most affordable option, offering minimum coverage at just $33 per month and full coverage at $89 per month. In contrast, Geico has the highest rates, with $86 for minimum coverage and $230 for full coverage.

Mississippi DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $77 | $206 |

| American Family | $75 | $200 |

| Farmers | $75 | $202 |

| Geico | $86 | $230 |

| Liberty Mutual | $71 | $189 |

| Nationwide | $66 | $176 |

| Progressive | $56 | $150 |

| State Farm | $33 | $89 |

| Travelers | $51 | $137 |

| USAA | $37 | $99 |

Progressive and Travelers also provide competitive options, particularly for full coverage, with rates of $150 and $137 per month, respectively. Other providers, such as USAA, Liberty Mutual, and Nationwide, offer a range of rates that might suit different budgetary needs.

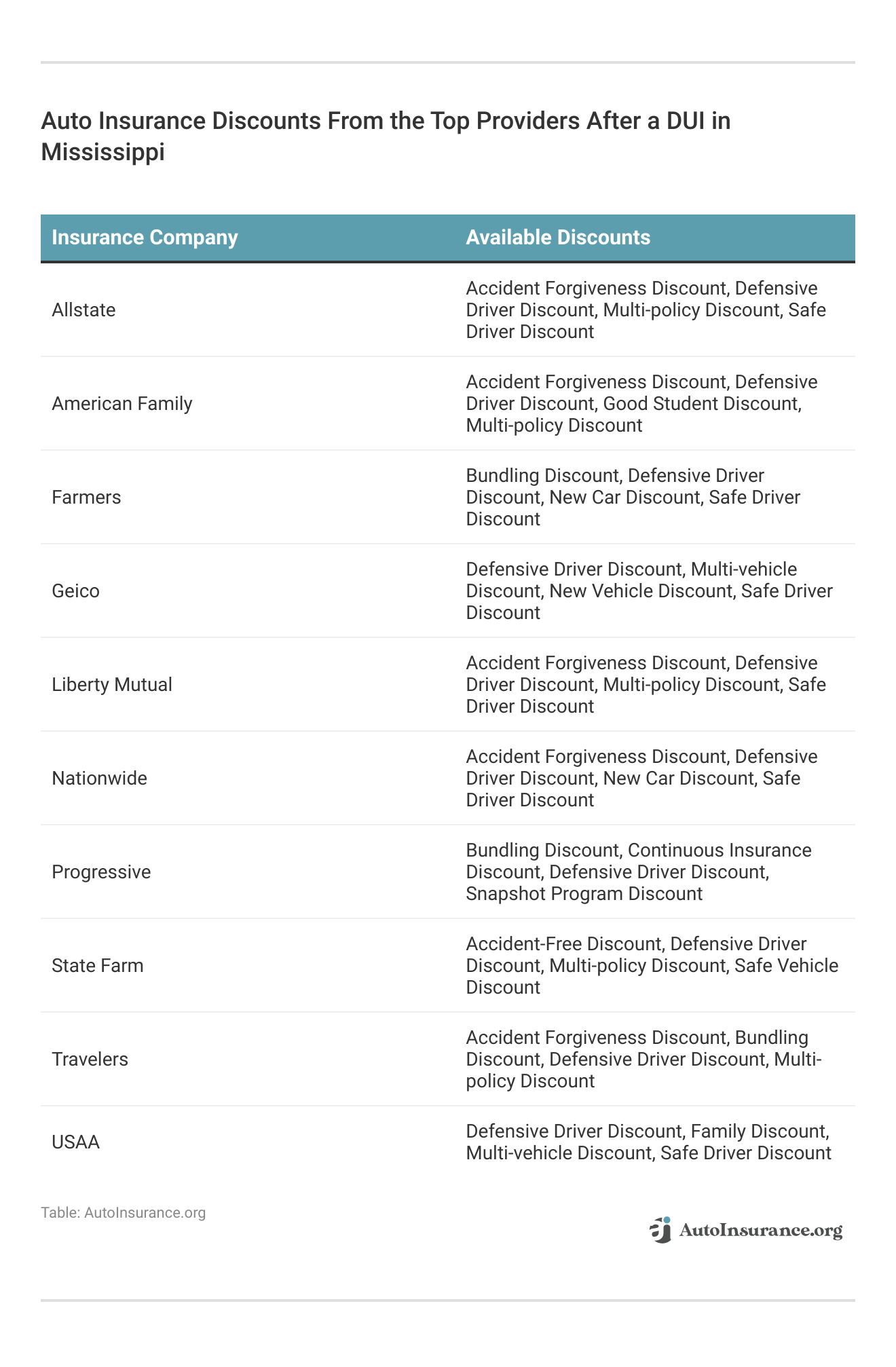

The cost of auto insurance after a DUI in Mississippi is influenced by several nuanced factors — first and foremost, your driving record. Auto insurance companies check driving records, and a DUI signals higher risk to insurers, leading to substantial increases in your premium.

Mississippi insurance providers vary in how they assess DUI drivers, meaning that premium rates and discount opportunities can differ significantly from one company to another.

The level of coverage you select is also a major determinant. Choosing full coverage, which includes not only liability but also collision, comprehensive, and personal effects coverage, will naturally result in a higher monthly Mississippi insurance rate.

Comprehensive auto insurance protection ensures that you’re covered in a wide range of situations when driving in Mississippi, offering peace of mind despite the higher cost.Scott W. Johnson Licensed Insurance Agent

Other non-driving factors affect auto insurance rates, including your geographical location within Mississippi. Areas prone to higher accident rates or theft incidents typically see steeper insurance costs. Additionally, your credit score is another important factor. Bad credit often translates to higher premiums, particularly in the wake of a DUI.

Cost-Saving Tips After a DUI in Mississippi

When faced with the higher premiums that come with a DUI in Mississippi, there are several strategic steps you can take to reduce your auto insurance costs.

First, consider taking a defensive driving course. Many insurers offer discounts to drivers who complete these programs. You can also bundle home and auto insurance with the same company to take advantage of multi-policy discounts.

Increasing your deductible is another effective strategy. While this means you’ll pay more out-of-pocket in the event of a claim, it can significantly lower your monthly premium.

Additionally, maintaining a clean driving record post-DUI over time can lead to lower rates. You can sign up for cheap pay-as-you-go auto insurance in Mississippi to track mileage and driving habits, which will help lower DUI insurance costs if you practice safe habits and avoid driving long distances or at night.

Regularly shopping around and comparing quotes from different insurers ensures you’re getting the best possible deal, as rates can vary widely between companies, especially for high-risk drivers with a DUI in Mississippi.

Specialized Auto Insurance Case Studies for DUIs in Mississippi

Securing the right auto insurance after a DUI in Mississippi can be challenging, but the following case studies, based on real-world scenarios, highlight how State Farm, USAA, and Travelers provide exceptional coverage and service tailored to high-risk drivers.

- Case Study #1 – Affordable Protection With State Farm: John faced steep premium hikes after his DUI, but State Farm’s accident forgiveness program helped lower his costs. Despite the DUI, he secured comprehensive coverage, allowing him to stay on the road with confidence.

- Case Study #2 – Military Focused Support With USAA: Sarah, a veteran, struggled to find affordable insurance after her DUI, but USAA offered her specialized rates and benefits. Their understanding of military needs ensured she received comprehensive coverage at a competitive rate.

- Case Study #3 – Bundled Savings With Travelers: Mike needed both auto and home insurance after his DUI, and Travelers provided significant discounts through policy bundling. This helped him manage his insurance expenses effectively while maintaining full coverage for his car and home.

These scenarios illustrate how the right insurance provider can make a substantial difference for drivers dealing with the aftermath of a DUI in Mississippi. Find more details in our guide to the best Mississippi auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leading Choices for DUI Auto Insurance in Mississippi

Finding the best auto insurance after a DUI in Mississippi can be a daunting task, but three companies consistently come out on top: State Farm, USAA, and Travelers.

State Farm offers the most affordable rates after a DUI in Mississippi, starting as low as $33 for minimum coverage.Kristen Gryglik Licensed Insurance Agent

State Farm is highly regarded for its robust accident forgiveness program, providing competitive pricing and extensive coverage options, even for drivers labeled as high-risk.

USAA, crafted specifically for military members and veterans, offers tailored support and attractive rates, ensuring that those who have served are not saddled with excessive premiums post-DUI. Travelers sets itself apart by being one of the oldest and most reliable high-risk auto insurance companies in Mississippi after a DUI.

Get the best DUI auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

How long does a DUI affect your insurance in Mississippi?

A DUI can affect your insurance in Mississippi for up to five years, leading to higher premiums during this period.

How much does Mississippi insurance go up after a DUI with USAA?

After a DUI, USAA may increase your insurance rates by as much as 50% to 80%, depending on various factors.

How long does it take a DUI to fall off your record in Mississippi?

In Mississippi, a DUI typically stays on your driving record for five years before it is removed. Learn how auto insurance companies check driving records.

Does a DUI stay on your record forever in Mississippi?

No, a DUI does not stay on your record forever in Mississippi; it typically remains on your record for five years.

What is the fine for a second DUI offense in Mississippi?

The fine for a 2nd offense DUI in Mississippi can range from $600 to $1,500, along with other penalties like jail time and license suspension.

How do I get my license back after a DUI in Mississippi?

To get your license back after a DUI in Mississippi, you must complete an alcohol safety education program, pay reinstatement fees, and possibly install an ignition interlock device.

Learn More: What an Alcohol Detection Systems Mandate Would Mean

How long do you lose your license for your first DUI in Mississippi?

For a first DUI in Mississippi, you can lose your license for 90 days, though you may be eligible for a hardship license.

Can a DUI be dismissed in Mississippi?

Yes, a DUI can be dismissed in Mississippi, but it usually requires strong legal defense and specific circumstances.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Which actions will many insurance companies take if you receive a DUI?

Many insurance companies will increase your premiums, cancel your policy, or require you to file an SR-22 insurance form if you receive a DUI.

What is the statute of limitations on a DUI in Mississippi?

The statute of limitations for a DUI in Mississippi is two years from the date of the offense.

What are the new DUI laws in Mississippi?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.