10 Best Auto Insurance Companies That Offer Cash Back for Safe Drivers in 2026

The best auto insurance companies that offer cash back for safe drivers are Allstate, USAA, and Progressive, with rates starting as low as $70 per month. These companies reward safe driving with cash back incentives, making them top picks for affordable and rewarding auto insurance options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Safe Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Safe Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Safe Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best auto insurance companies that offer cash back for safe drivers are Allstate, USAA, and Progressive, with affordable rates and range of policy features and discounts tailored to safe drivers.

These companies not only provide competitive rates starting as low as $70 per month but also offer innovative rewards that promote responsible driving.

Our Top 10 Picks: Best Auto Insurance Companies That Offer Cash Back for Safe Drivers

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Customizable Rewards | Allstate | |

| #2 | 10% | A++ | Military Drivers | USAA | |

| #3 | 10% | A+ | Usage Discounts | Progressive | |

| #4 | 17% | B | Safe Driving | State Farm | |

| #5 | 20% | A+ | Accident Forgiveness | Nationwide |

| #6 | 12% | A | Deductible Rewards | Liberty Mutual |

| #7 | 10% | A++ | Driver Discounts | Travelers | |

| #8 | 15% | A | Telematics Savings | Farmers | |

| #9 | 25% | A | Loyalty Rewards | American Family | |

| #10 | 15% | A | Driver Perks | Safeco |

Their customer service teams are renowned for their responsiveness and support, ensuring that policyholders feel valued and well-cared for throughout their insurance journey.

Enter your ZIP code to explore rates and discover how you can benefit from auto insurance with safe driving rewards.

- Allstate as the top pick providers, rates start at $70/month

- Safe driving rewards promote road safety while saving money on insurance rates

- Safe drivers can enjoy lower premiums and comprehensive auto insurance

#1 – Allstate: Top Overall Pick

Pros

- Wide Range of Coverage Options: Allstate auto insurance review highlights the various coverage options available to suit different needs.

- Diverse Discounts: Allstate offers a variety of driver-based, vehicle-based, and policy-based discounts.

- Bonus Refund Check for Safe Driving: Drivers who maintain a clean driving record with no accidents receive a safe driver refund check every six months.

Cons

- Higher Rates: Some customers may find Allstate’s rates to be higher compared to other auto insurance companies.

- Poor Customer Service Ratings: Allstate auto insurance has been reported to have lower-than-average customer service ratings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Drivers

Pros

- Outstanding Customer Service: USAA is known for its exceptional customer service and responsiveness.

- Competitive Rates: USAA auto insurance review highlights that the company showcases lower rates for its members compared to other auto insurance providers.

- Financial Stability: USAA has a strong financial standing, providing peace of mind to policyholders.

Cons

- Limited Eligibility: USAA membership is restricted to military personnel, veterans, and their families.

- SafePilot not Available in all States: The USAA SafePilot program is only available in 37 states.

#3 – Progressive: Best for Usage Discounts

Pros

- Usage-Based Discount: Progressive auto insurance review highlights discounts offered through programs like Snapshot that showcase driving behavior.

- Variety of Discounts: A wide range of discounts are available, including for safe driving and multi-policy bundling.

- User-Friendly Technology: Progressive’s website and mobile app are easy to use for managing policies and claims.

Cons

- Limited Agent Support: Progressive primarily relies on online and phone interactions, lacking in-person agent support for some customers.

- Expensive Coverage for Teen Drivers: Progressive has expensive rates for full coverage for teen drivers.

#4 – State Farm: Best for Safe Driving

Pros

- Safe Driving Rewards: State Farm offers discounts and rewards for safe driving habits through programs like Drive Safe & Save.

- Extensive Network of Agents: With a vast network of agents, State Farm provides personalized service and support.

- Customizable Policies: State Farm auto insurance review highlights the customizable policies that showcase coverage tailored to individual needs.

Cons

- Higher Rates for Certain Drivers: Rates may be higher for certain demographics or regions compared to other insurers.

- Limited Digital Tools: State Farm’s online platform may not offer as many features and functionalities as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness to qualifying customers, preventing rate increases after an accident.

- Extensive Coverage Options: Provides a wide range of coverage options to meet different needs.

- Multi-Policy Discounts: Nationwide auto insurance review highlights discounts that showcase savings when bundling auto insurance with other policies like home or life insurance.

Cons

- Mixed Customer Reviews: Some customers report challenges with claims processing and customer service experiences.

- Rideshare Coverage not Available: Rideshare coverage is not an option with Nationwide.

#6 – Liberty Mutual: Best for Deductible Rewards

Pros

- Deductible Rewards: Liberty Mutual offers deductible rewards, reducing deductibles for every claim-free policy period.

- Nationwide Coverage: Liberty Mutual auto insurance review highlights customizable policies available in all 50 states, showcasing their extensive coverage options.

- User-Friendly Technology: Liberty Mutual’s website and mobile app are easy to navigate for policy management.

Cons

- Higher Rates for Younger Drivers: Rates may be higher for drivers under 25 compared to other insurers.

- Poor Credit can Negatively Impacts Rates: Drivers with poor credit scores will likely see high rates with Liberty Mutual

#7 – Travelers: Best for Driver Discounts

Pros

- Driver Discounts: Travelers auto insurance review highlights various discounts for safe driving, showcasing benefits for good students and defensive driving.

- A++ A.M. Best Rating: Travelers has a strong financial standing, ensuring stability and reliability.

- Nationwide Availability of Auto Insurance Coverage: Travelers offers coverage in all 50 states and Washington, D.C.

Cons

- Rate Increases for Poor Driving Habits: Participating in Travelers’ IntelliDrive Program has the potential to raise rates if drivers receive low scores on the app.

- Limited Rideshare Coverage Availability: Travelers rideshare insurance is only available in two states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Telematics Savings

Pros

- Signal Discount: Farmers offers savings opportunities through telematics programs like Signal, allowing drivers to save 15% when signing up and an additional discount of up to 20%.

- User-Friendly Technology: Farmers auto insurance review highlights how the website and mobile app showcase user-friendly navigation for managing policies and filing claims.

- Multi-Policy Discounts: Offers discounts for bundling auto insurance with other policies like home or renters insurance.

Cons

- Higher Than Average Rates: Farmers has the most expensive average monthly rates for full and minimum coverage.

- Coverage Unavailable in Select States: Farmers offers car insurance coverage across the majority of states.

#9 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers various rewards and discounts specifically for long-term policyholders.

- Diverse Coverage Options: American Family provides a comprehensive range of coverage options designed to meet the diverse needs of their customers.

- Low Rates for Safe Drivers: American Family auto insurance review highlights competitive rates for drivers with clean records, showcasing their attractive pricing.

Cons

- Unfavorable Reviews for Claims Handling: Customers consistently report difficulties with the claims handling process.

- Only Offers Coverage in 19 States: American Family Insurance operates exclusively in 19 states, limiting its availability and accessibility.

#10 – Safeco: Best for Driver Perks

Pros

- Driver Perks: Safeco offers various perks for policyholders, such as roadside assistance and rental car coverage.

- Add-on Coverage Options: Safeco auto insurance discounts highlight various add-on coverage options, showcasing features like rental reimbursement, pet coverage, and new vehicle replacement.

- Safeco RightTrack Program: Safeco’s RightTrack program offers up to 25% savings by tracking driving habits.

Cons

- Limited Discounts: Compared to other auto insurance companies,Safeco offers fewer discounts.

- Online Quotes Require an Agent: To obtain an online quote, customer must work with an auto insurance agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Companies for Safe Drivers: Finding the Best Rates and Benefits

Car insurance rates are calculated differently from company to company. It can sometimes be difficult to discern exactly which company is the best choice within your budget.

Allstate is the best auto insurance company for safe drivers, offering competitive rates and up to 5% cash back for accident-free driving.Tracey L. Wells Licensed Auto Insurance Agent & Agency Owners

Securing cheap auto insurance rates is sometimes easier said than done. However, comparing the leading insurance providers in the country can help demystify the process.

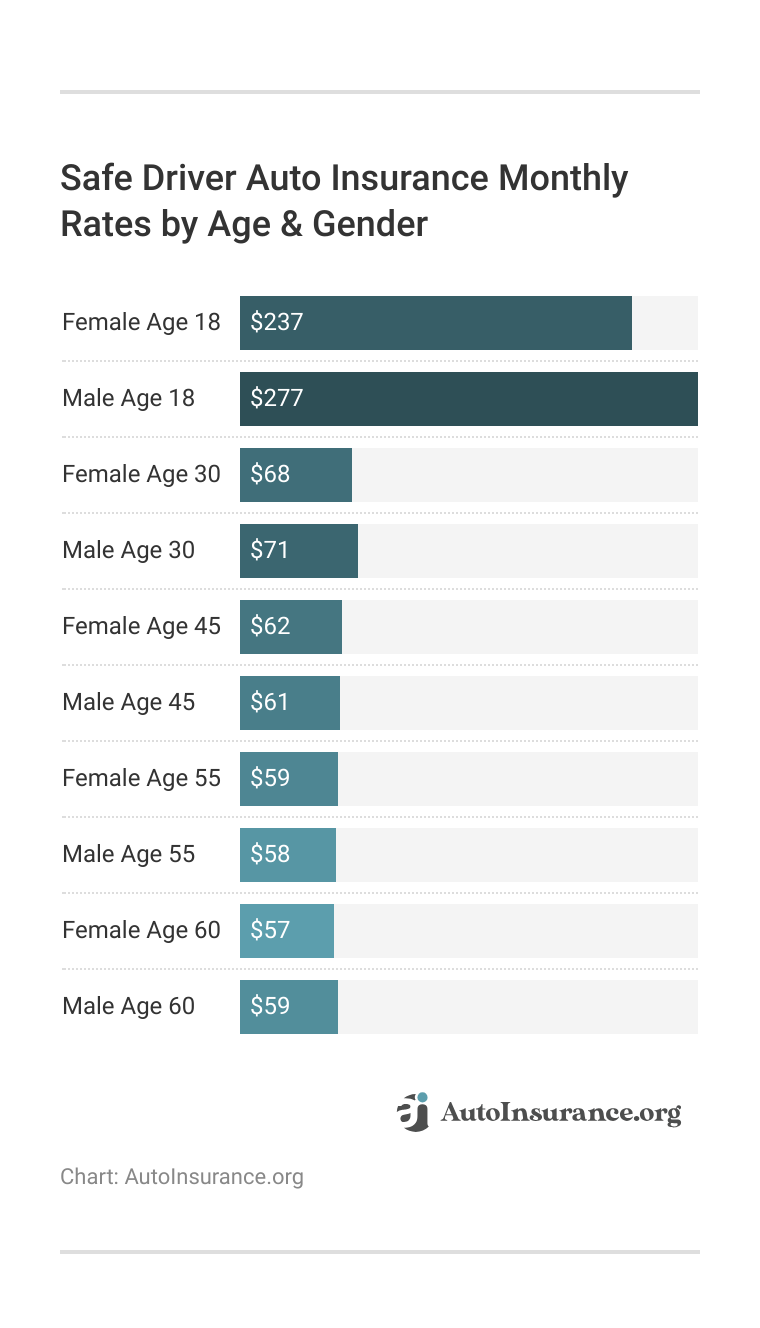

Auto Insurance Monthly Rates With a Clean Record by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $150

American Family $75 $145

Farmers $85 $160

Liberty Mutual $95 $180

Nationwide $90 $170

Progressive $75 $140

Safeco $90 $165

State Farm $85 $160

Travelers $80 $155

USAA $70 $120

According to this data, USAA and State Farm typically offer the cheapest rates for good drivers. Remember, your personal rates may vary. This information does not take other additional discounts and cash back programs into account. Slightly higher auto insurance rates from companies that offer cash back for safe drivers can be excused in favor of later cash back payouts.

For example, Allstate does not have the lowest rates upon first glance, but safe drivers can enjoy cash back in the form of a safe drivers bonus refund. Auto insurance quotes from companies that offer cash back for safe drivers do not include the savings you can make over time. With these added bonuses, it’s easy to lower your monthly rates with just your safe driving habits.

Earn Cash Back for Safe Driving: Allstate’s Safe Drivers Bonus Refund Explained

Allstate is one of the few auto insurance companies that offer cash back for safe drivers through the safe drivers bonus refund. The safe drivers bonus refund is a program for Allstate customers who do not file a claim within a certain period of time.

Essentially, drivers will receive a bonus check for every six months they go without an accident. Allstate customers can opt into the safe drivers bonus refund program online or through their agent.

The safe drivers bonus refund does have some limits and restrictions. Through the program, a safe driver can receive up to 5% of their policy insurance premium. This amount is then applied to their renewal policy. To broaden your understanding, explore our comprehensive resource titled “Auto Insurance Premium Defined.”

Insurers Without Cash Back Programs for Safe Drivers: Discounts Over Direct Rewards

Many car insurance companies offer substantial benefits for safe drivers, though not all include direct cash back programs. According to the Insurance Information Institute, securing a good discount on your car insurance can significantly reduce your premiums.

Allstate stands out as the premier choice for safe drivers, delivering unbeatable rates and rewarding up to 5% cash back for maintaining an accident-free record.Jeff Root Licensed Insurance Agent

Insurers such as Farmers, Liberty Mutual, and Nationwide, among others, provide discounts for safe driving rather than direct cash rewards. While these discounts may not be as immediately gratifying as receiving a check, they can still result in considerable savings over time. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exclusive Auto Insurance Discounts for Safe Drivers

Good drivers can secure significant discounts on auto insurance premiums through various programs. Safe Driver and Accident-Free Discounts offer up to 30% off for maintaining a clean driving record, available from companies like Geico, Progressive, and State Farm.

Young drivers with good grades can benefit from Good Student Discounts, saving 10-20% with insurers such as State Farm and Geico. Usage-Based Insurance Programs monitor driving habits and can provide up to 30% savings with Progressive and Allstate. To gain in-depth knowledge, consult our comprehensive resource titled “How Auto Insurance Companies Check Driving Records.”

Loyalty Discounts, Defensive Driving Course Discounts, Bundling Discounts, and New Car Discounts are additional ways to save, with potential savings ranging from 5-25%. Taking advantage of these programs can help good drivers significantly reduce their auto insurance costs.

Case Studies: Maximizing Savings Through Tailored Insurance Programs

These five case studies showcase how different individuals and families have leveraged specific insurance programs to maximize their savings and enhance their driving habits.

- Case Study #1 – Safe Driver With Allstate: John, a 35-year-old IT professional, switched to Allstate and saved $180 in bonuses and reduced his premium from $600 to $570 using the Safe Drivers Bonus Program and Drivewise app. He also earned an extra 10% discount for safe driving.

- Case Study #2 – Military Member With USAA: Mary, a 28-year-old military officer in Texas, joined USAA with a $70 monthly premium, receiving $15 quarterly cashback and military discounts. Participating in SafePilot earned her an extra 20% discount, maximizing her savings.

- Case Study #3 – Family Policy With Progressive: Steve and Laura in Florida saved 25% on premiums with Progressive’s Snapshot program, and their teens earned $100 annually for safe driving. Real-time feedback helped improve their driving habits.

- Case Study #4 – Small Business Owner With State Farm: Mike, 45, from Ohio, cut his $120 premium by joining State Farm’s Drive Safe & Save, gaining discounts up to 30% for safe driving. The program also offered insights into his driving habits.

- Case Study #5 – New Driver With Liberty Mutual: Sara, a 23-year-old in New York, saved 15% on her premium with Liberty Mutual’s RightTrack program and earned up to $500 off her deductible for safe driving.

These case studies illustrate the diverse benefits of choosing auto insurance companies that offer cash back and rewards for safe driving. By examining real-life examples, we can see how different drivers have maximized their savings through tailored insurance programs. For detailed information, refer to our comprehensive report titled “Replacement Cost vs. Actual Cash Value: Car Insurance.”

Allstate excels as the top choice for safe drivers, offering up to 5% cash back on premiums and exceptional customer service.Michelle Robbins Licensed Insurance Agent

Each driver’s unique situation demonstrates the potential for substantial savings and improved driving habits through these tailored insurance programs, highlighting their comprehensive benefits.

Summary: Best Auto Insurance Companies Offering Cash Back for Safe Drivers

This article reviews top auto insurers offering cashback for safe drivers, including Allstate, USAA, and Progressive, with rates starting at $70 per month. Allstate provides up to 5% cashback, USAA excels in customer service, and Progressive offers discounts through its Snapshot program. State Farm and Nationwide also offer significant safe driving discounts.

To qualify, drivers should enroll in cashback programs, maintain a clean driving record, and use telematics. Comparing quotes from top insurers can help find the best rates and benefits, reducing insurance costs for safe drivers. To enhance your understanding, explore our comprehensive resource titled “Where to Compare Auto Insurance Rates.”

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

How much is the safe driving bonus check from Allstate?

The safe driving bonus check from Allstate typically offers up to 5% of the policy premium as a refund for maintaining a clean driving record over a six-month period.

What are insurance cashback offers?

Insurance cashback offers reward policyholders with a portion of their premium back as cash for demonstrating safe driving habits and avoiding accidents.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

What are the benefits of auto insurance for good drivers?

Auto insurance for good drivers often includes lower premiums, discounts, and cashback rewards for maintaining a clean driving record.

Check out our ranking of the top providers: Best Auto Insurance for Good Drivers

What is the best auto insurance for a bad driving record?

While rates may be higher for those with a bad driving record, companies like The General and SafeAuto specialize in providing coverage options tailored for high-risk drivers.

What is the best auto insurance for good drivers?

The best auto insurance for good drivers includes companies like Allstate, USAA, and Progressive, which offer discounts and rewards for safe driving behaviors.

What is a budget insurance cashback bonus?

A budget insurance cashback bonus is a cost-effective incentive offered by some insurers, providing cashback rewards to policyholders who maintain safe driving habits without significantly increasing premiums.

For a comprehensive overview, explore our detailed resource titled “Auto Insurance Policyholder Defined.”

What is Allstate Bonus Drive?

Allstate Bonus Drive is a program that rewards policyholders with cashback or discounts for participating in safe driving initiatives and maintaining a clean driving record.

What types of insurance with cash back are available?

Insurance with cash back is available in various forms, including auto insurance, health insurance, and home insurance, where policyholders receive financial rewards for responsible behavior.

Does Liberty Mutual offer insurance cash back?

Yes, Liberty Mutual offers a variety of cashback incentives and rewards for policyholders who demonstrate safe driving habits through programs like RightTrack.

To gain profound insights, consult our extensive guide titled “Liberty Mutual RightTrack Review.”

What is a safe driver bonus?

A safe driver bonus is a financial reward provided by insurance companies to policyholders who maintain a clean driving record, often in the form of discounts or cashback.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.