Best Auto Insurance for Seniors in California (Top 10 Companies Ranked for 2026)

The top providers for the best auto insurance for seniors in California are AAA, State Farm, and Allstate, with rates starting at $35/month. These top three senior auto insurance companies combine affordable rates with excellent roadside assistance and top-notch customer service through local agents in California.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

Company Facts

Full Coverage for Seniors in CA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in CA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in CA

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best auto insurance for seniors in California are AAA, State Farm, and Allstate. State Farm has the cheapest rates at $35/month, but AAA is the best overall for its excellent coverage tailored for seniors.

These companies are noted for their superior customer service, local agents, and reliable roadside assistance coverage. They provide personalized support through knowledgeable local agents who understand the unique needs of seniors.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in California

Company Rank Usage-Based A.M. Best Best For Jump to Pros/Cons

#1 20% A Roadside Assistance AAA

![]()

#2 30% B Customer Service State Farm

#3 40% A+ Local Agents Allstate

#4 30% A Insurance Discounts Farmers

#5 30% A+ Qualifying Coverage Progressive

#6 30% A Customizable Policies Liberty Mutual

#7 40% A+ Widespread Availability Nationwide

#8 30% A++ Bundling Policies Travelers

#9 30% A Costco Members American Family

#10 50% A Many Discounts Mercury

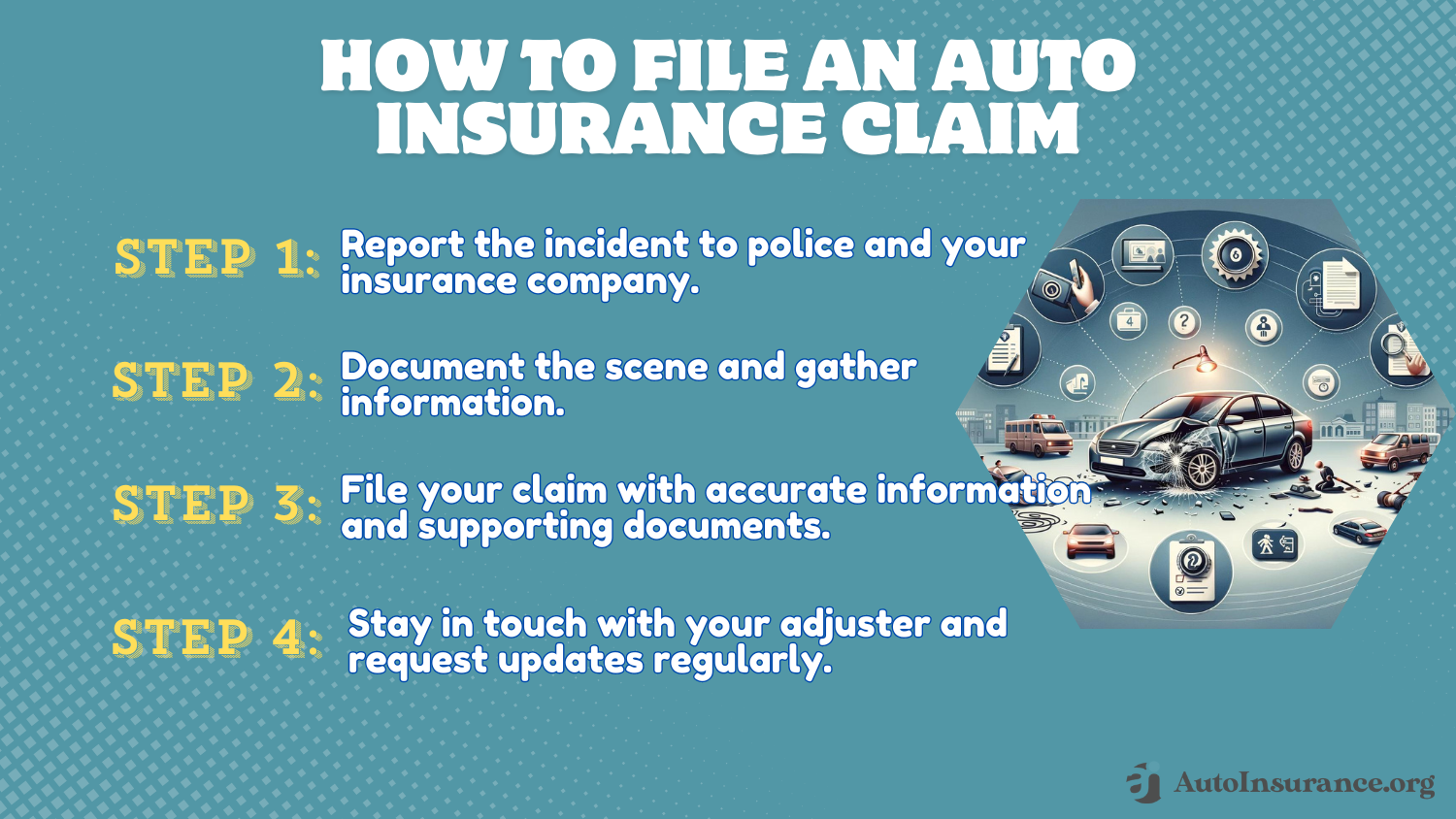

AAA customer service is highly responsive and dedicated to addressing any concerns promptly. Additionally, their robust roadside assistance ensures peace of mind with quick and efficient help whenever it’s needed.

Avoid expensive auto insurance premiums by entering your ZIP code above to see the cheapest rates for you.

- State Farm offers the best rates for seniors in California, starting at $35/month

- AAA has better customer service and policy options for senior auto insurance

- Older drivers qualify for senior car insurance discounts in California

#1 – AAA: Top Overall Pick

Pros

- Exceptional Emergency Response: AAA provides rapid and efficient emergency services tailored to the needs of seniors in California, ensuring quick assistance when it’s most needed.

- Specialized Roadside Assistance for Seniors: AAA offers senior-friendly services tailored for mobility issues and medical emergencies for seniors in California. Learn more in our AAA review.

- Comprehensive Towing and Repair Coverage: Seniors in California benefit from AAA’s all-encompassing towing and roadside repair services, covering a wide range of breakdown situations.

Cons

- Limitations for High-Mileage Seniors: AAA’s roadside assistance may have limitations or longer wait times for seniors in California who drive high-mileage vehicles.

- Coverage Limitations in Remote Areas: AAA’s roadside assistance might have limitations or longer wait times for seniors in California living in very remote areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Proactive Service Approach for Seniors: State Farm supports seniors in California by offering proactive policy management services. Read our State Farm review for more information.

- Dedicated Support for Senior Policyholders: State Farm provides dedicated support channels designed to assist seniors in California with any insurance-related issues.

- Streamlined Communication: The company’s customer service team is adept at addressing the concerns of seniors in California efficiently and empathetically.

Cons

- Complex Claims Process: Seniors in California might find the claims process with State Farm to be more complicated and time-consuming compared to other insurers.

- Limited In-Person Office Availability: Some seniors in California may struggle with State Farm’s limited number of physical offices for in-person assistance, especially in rural areas.

#3 – Allstate: Best for Local Agents

Pros

- In-Depth Local Knowledge: Allstate’s local agents offer personalized guidance for seniors in California, taking into account the specific driving conditions in the region, which you can read more about in our review of Allstate.

- Customized Insurance Planning for Seniors: Seniors in California get customized insurance plans from local agents who understand their unique needs.

- Enhanced Personal Interaction: The face-to-face interaction with local agents provides seniors in California with a more personal and tailored insurance experience.

Cons

- Variability in Agent Competency: The quality of service can vary significantly between different local agents, which might lead to inconsistent experiences for seniors in California.

- Potentially Slow Response Times: Some seniors in California might experience slower response times for policy adjustments or claims due to varying efficiency among local agents.

#4 – Farmers: Best for Insurance Discounts

Pros

- Broad Range of Senior Discounts: Farmers offers numerous discounts for seniors in California, including safe driving and reduced mileage. Read our Farmers review to learn what else is offered.

- Senior-Focused Savings Programs: Seniors in California can benefit from targeted savings programs, including discounts for safe driving and policy bundling.

- Easy Access to Discount Programs: Farmers provides straightforward access to their discount programs, making it easy for seniors in California to benefit from available savings.

Cons

- Base Rates May Remain High: Despite discounts, the base insurance rates with Farmers might still be higher for some seniors in California.

- Complex Discount Application: Navigating the numerous discount options can be complicated for seniors in California, potentially leading to confusion.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Qualifying Coverage

Pros

- Affordable Options for Qualifying Seniors: Progressive offers competitive rates for qualifying coverage, which can be particularly cost-effective for seniors in California.

- Name-Your-Price Online Tools: Progressive’s online tools help seniors in California easily compare and choose coverage options, which you can check out in our Progressive review.

- Competitive Auto Insurance Rates: Auto insurance for seniors in California is priced at just $42 per month, making it more affordable than many other options available.

Cons

- Service Variability: The quality of customer service may vary, which could affect seniors in California depending on their location and specific needs.

- Possible Gaps in Coverage: Seniors in California may encounter gaps in coverage if they don’t fully understand the nuances of Progressive’s policy options.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Adaptable Policies for Seniors: Liberty Mutual allows seniors in California to design policies that fit their unique insurance needs and preferences, which you can learn about in our Liberty Mutual review.

- Discounts for Custom Coverage: Seniors in California can benefit from discounts when opting for customized coverage plans with Liberty Mutual.

- Ease of Adjusting Coverage: The ability to modify coverage levels easily is beneficial for seniors in California whose needs may change over time.

Cons

- Higher Costs for Comprehensive Customization: Seniors in California might find that highly customized policies result in higher costs compared to standard insurance options.

- Complex Customization Process: The process of customizing insurance policies might be complex and confusing for some seniors in California.

#7 – Nationwide: Best for Widespread Availability

Pros

- Wide Network Accessibility: Nationwide’s extensive network ensures that seniors in California have access to insurance services no matter where they live. Read more in our review of Nationwide.

- Consistent Coverage Options Statewide: Seniors in California receive uniform coverage options and service quality across the entire state with Nationwide.

- Reliable Local Agent Support: Nationwide’s network of local agents offers personalized assistance to seniors in California, addressing their specific insurance needs.

Cons

- Regional Rate Variations: Insurance rates might vary significantly based on location, which could affect seniors in California depending on their specific area.

- Inconsistent Service Levels: Service levels can vary between Nationwide’s regional offices, leading to a potentially uneven experience for seniors in California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Policies

Pros

- Savings on Bundled Policies for Seniors in California: Travelers offers significant discounts for seniors in California who bundle auto insurance with other types of coverage.

- Comprehensive Coverage Through Bundling: Bundling policies with Travelers provides seniors in California with a comprehensive insurance package that covers various needs.

- Simplified Insurance Management: Seniors in California streamline policy management by handling all their insurance needs with one provider. For a complete list, read our Travelers review.

Cons

- Bundling Might Not Suit All Seniors: Seniors in California who do not require multiple types of coverage may not fully benefit from Travelers’ bundling discounts.

- Limited Customization Within Bundles: Bundled policies may offer less flexibility for customization, which might not fully meet the specific needs of all seniors in California.

#9 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Costco Members in California: American Family offers special discounts for seniors in California who are Costco members, providing additional savings.

- Senior-Friendly Insurance Options: The insurance plans offered by American Family are tailored to the needs of seniors in California, with customized coverage options.

- Costco Partnership: Seniors in California can easily access American Family’s insurance services and benefits if they are Costco members, which you can learn about in our American Family review.

Cons

- Limited to Costco Membership: Discounts and benefits are only available to seniors in California who are also Costco members, which may exclude some potential customers.

- Higher Premiums for Non-Members: Seniors in California who are not Costco members might find American Family’s premiums less competitive.

#10 – Mercury: Best for Many Discounts

Pros

- Diverse Discounts: Mercury provides a variety of discounts for seniors in California, making it simpler to discover savings tailored to their specific situations.

- Discounts for Low Mileage and Safe Driving: Seniors in California can benefit from discounts related to low mileage and a clean driving record with Mercury. Find out more in our Mercury review.

- Bundling and Safety Discounts: Mercury provides additional discount options for seniors in California who bundle their policies or install advanced safety features.

Cons

- Base Rates Might Be High for Some Seniors: Even with multiple discounts, seniors in California may find that Mercury’s base rates are higher compared to some competitors.

- Challenges in Maximizing All Discounts: Seniors in California might struggle to take full advantage of all available discounts due to complex eligibility criteria.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Senior Auto Insurance Rates in California

Getting affordable auto insurance as a senior in California involves understanding the varying costs and coverage levels offered by different providers. For instance, full coverage with collision and comprehensive auto insurance costs more than minimum liability:

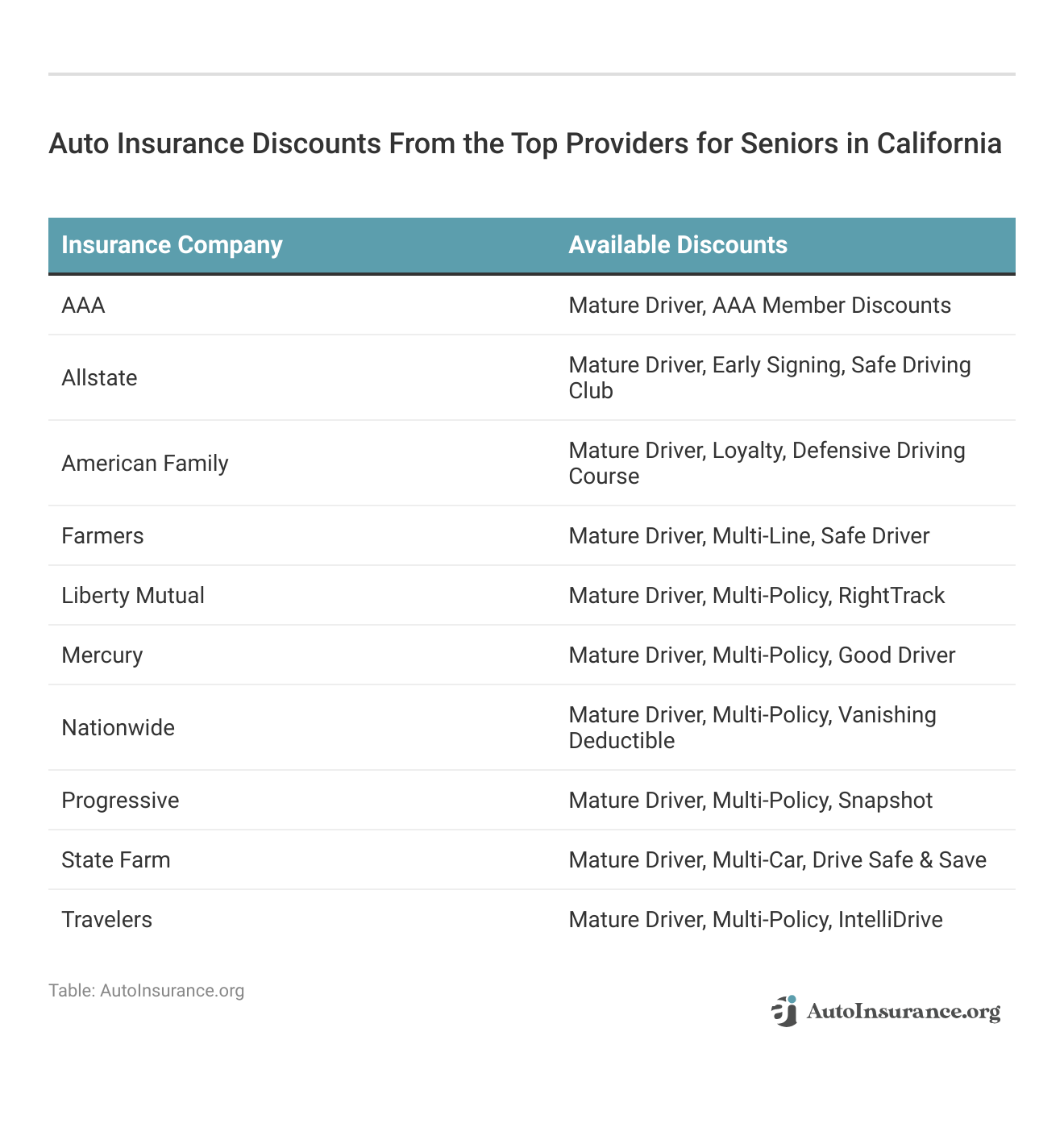

California Senior Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $60 $200

Allstate $64 $195

American Family $44 $135

Farmers $54 $163

Liberty Mutual $69 $211

Mercury $50 $160

Nationwide $46 $139

Progressive $42 $129

State Farm $35 $105

Travelers $39 $120

Monthly rates for minimum and full coverage show significant variability across insurers. For minimum coverage, options like AAA at $60 and State Farm at $35 offer budget-friendly choices, while Liberty Mutual stands out with higher premiums at $69.

AAA stands out as the top choice for seniors in California with competitive rates, superior customer service, and extensive roadside assistance.Jeff Root Licensed Insurance Agent

For those seeking more comprehensive protection, Allstate and Liberty Mutual offer full coverage plans at $195 and $211 respectively, reflecting their broader insurance packages.

How California Auto Insurance Laws Impact Rates

In California, all drivers, including seniors, are required to carry liability insurance with specific minimum coverage limits. This includes $15,000 for bodily injury or death per person, $30,000 per accident for all injured parties, and $5,000 for property damage.

These coverage limits are carefully established to ensure that drivers have adequate financial protection in case they are involved in an accident and are held responsible for damages.

While uninsured/underinsured motorist coverage isn’t mandatory for drivers, California law requires insurers to offer it to protect against insufficiently insured drivers.

Seniors also have renewal and cancellation rights ensuring adequate notice from insurers, which can help older drivers avoid missed payments and late fees. Understanding these laws and factors is crucial for seniors selecting auto insurance coverage in California.

Read More: California Driving Laws for Seniors

Other Critical Factors Affecting Senior Insurance Rates

Other factors influencing senior insurance rates include driving record, vehicle type, mileage, and chosen coverage limits.

For instance, senior drivers’ age and years of driving experience significantly impact insurance rates, with older drivers generally facing higher premiums due to perceived increased risk. Learn more in our comprehensive analysis: What age group has the most fatal crashes?

Seniors in California can navigate their auto insurance costs by considering these critical factors like age and driving experience, driving record, vehicle type and safety features, annual mileage, and insurance coverage level:

- Driving Record: A clean driving history with no accidents or traffic violations can lead to lower insurance premiums, while incidents such as accidents or tickets may raise costs.

- Vehicle Type and Safety Features: Newer vehicles with advanced safety technologies often qualify for lower premiums.

- Annual Mileage: Seniors who drive fewer miles annually may qualify for lower insurance rates.

- Insurance Coverage Level: The extent of coverage chosen greatly influences premiums. Seniors should select coverage that aligns with their driving habits and financial considerations.

By assessing these factors and comparing quotes from different insurers, seniors can make informed decisions to secure the most suitable and affordable auto insurance coverage for their needs.

How to Lower Auto Insurance Rates for Seniors in California

Senior auto insurance discounts are the easiest way to lower rates. Each discount reflects a different aspect of your insurance profile, allowing you to customize your coverage to fit your needs and budget.

These discounts cater specifically to seniors, offering a variety of savings opportunities based on factors like driving experience, loyalty, and policy bundling.

Inquire about senior, safety features, defensive driving, and low-mileage auto insurance discounts to maximize your savings. AAA, State Farm, and Allstate each offer mature driver and safe driver discounts to help seniors save money.

AAA earns top marks for California seniors, offering competitive rates, stellar customer service, and robust roadside assistance.Michelle Robbins Licensed Insurance Agent

When shopping for senior car insurance in California, taking advantage of available discounts is one way to save. Here’s a straightforward outline of more effective strategies to lower your auto insurance rates.

- Compare Multiple Quotes: Obtain quotes from several insurance companies to compare premiums and coverage options.

- Review and Adjust Coverage: Assess whether full coverage aligns with your vehicle’s value and financial situation, and adjust deductibles and limits accordingly to balance protection and affordability.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to maintain a good driving record.

- Bundle Policies: Many insurers offer discounts when you bundle multiple policies, such as auto and home insurance.

By implementing these practical strategies, seniors in California can effectively reduce their auto insurance premiums while ensuring they have adequate coverage.

For personalized advice and further assistance, consider consulting with a licensed insurance agent to optimize your insurance choices based on your specific circumstances.

Case Studies: Auto Insurance for Seniors in California

From finding reliable coverage that fits specific needs to optimizing savings without sacrificing essential protections, seniors face unique challenges and opportunities in the insurance marketplace.

- Case Study #1 – Navigating Insurance Needs in Retirement: John, 65, retired in California seeks affordable, comprehensive auto insurance with personalized service. He chooses State Farm for its local agents, reliable customer support, and competitive rates after comparing AAA and Allstate.

- Case Study #2 – Optimizing Coverage for Long-Term Savings: Sarah and Tom, both 70 and retired, aim to cut auto insurance costs in California while maintaining sufficient coverage. They consult Farmers Insurance, bundling policies and adjusting coverage to save over 20% annually.

- Case Study #3 – Covering High-Risk Areas as a Senior Driver: Emily, 68, seeks LA auto insurance for comprehensive protection, focusing on uninsured drivers and roadside assistance. She compares Progressive and Liberty Mutual, choosing Progressive for competitive rates and strong customer service, ensuring robust coverage in metropolitan driving.

Whether you value customer service, insurance discounts, policy bundling, or comprehensive coverage, older drivers can find specialized senior auto insurance that fits their unique needs and assists with filing claims.

By leveraging available resources and understanding the factors that impact insurance rates, seniors can confidently navigate their auto insurance decisions to secure both protection and peace of mind on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bottom Line on Senior Auto Insurance in California

AAA, State Farm, and Allstate have the best auto insurance for seniors in California and competitive rates starting at $35/month. Each insurer is praised for excellent customer service, local agent support, and robust roadside assistance, but AAA is our top pick for its personalized emergency roadside services for seniors.

The cheapest auto insurance companies aren’t always the best pick for senior drivers, so compare quotes to find affordable coverage and get insights into factors affecting insurance rates for seniors. Enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Who has the cheapest auto insurance for Seniors in California?

The cost of auto insurance can vary based on individual circumstances and coverage needs. Companies like AAA, State Farm, and Allstate often offer competitive rates for seniors in California starting at $35/month.

Who has the cheapest auto insurance in California?

Auto insurance rates can differ depending on factors like location, driving history, and coverage requirements. Comparing quotes from multiple insurers is the best way to find the cheapest option tailored to your needs.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool below.

What state has the best insurance for seniors?

Location is one of the biggest factors that affect auto insurance rates. Costs and coverage can vary significantly by state. States with generally lower insurance rates for seniors include Florida, Hawaii, and Idaho, but it’s essential to compare specific options in each state.

Which insurance company is best for senior citizens?

AAA, State Farm, Allstate, and other providers known for excellent customer service, senior-specific discounts, and comprehensive coverage options are often recommended for senior citizens in California.

What is the recommended auto insurance coverage in California?

California law requires drivers to carry liability insurance. Recommended coverage typically includes liability, uninsured motorist coverage, and comprehensive coverage to protect against various risks on the road.

Does car insurance go up at age 70 in California?

Age can affect auto insurance rates, but it varies by insurer. These are the cheapest auto insurance companies for drivers over 70 with discounts for safe driving and experience.

What is the cheapest senior citizen insurance?

The cost of senior citizen insurance depends on factors like driving history, location, and coverage needs. Discounts for seniors, such as safe driver discounts or bundling policies, can help reduce costs.

Who has the best auto insurance in California?

The best auto insurance company can vary based on individual preferences and needs. Providers like AAA, State Farm, Allstate, and others often rank highly for customer satisfaction, coverage options, and affordability.

Which plan is best for senior citizens?

Senior citizens may benefit from plans offering comprehensive coverage, senior-specific discounts, and excellent customer service. The best auto insurance for seniors includes roadside assistance and accident forgiveness.

What discounts are available for senior citizens in California?

Senior citizens in California may qualify for discounts such as safe driver discounts, low-mileage discounts, and discounts for completing defensive driving courses. Bundling multiple policies with the same insurer can also lead to savings.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.