Best Auto Insurance for Seniors in Pennsylvania (Top 9 Companies for 2026)

The best auto insurance for seniors in Pennsylvania is provided by The Hartford, USAA, and State Farm, with rates starting at $19/month. AARP members and military vets can access low rates and discounts, while unaffiliated drivers should consider State Farm for top senior auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

765 reviews

765 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Seniors in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe Hartford, USAA, and State Farm have the best auto insurance for seniors in Pennsylvania. USAA and State Farm have the lowest rates, but The Hartford takes our top spot with unique benefits for senior drivers.

The Hartford is the best Pennsylvania auto insurance for seniors because of its partnership with AARP.

While you have to be an AARP member to purchase coverage, seniors find low rates and unique discounts when they shop at The Hartford.

Our Top 9 Company Picks: Best Auto Insurance for Seniors in Pennsylvania

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | A+ | AARP Benefits | The Hartford |

| #2 | 10% | A++ | Superior Service | USAA | |

| #3 | 17% | B | Local Agents | State Farm | |

| #4 | 10% | A | Customized Policies | Liberty Mutual |

| #5 | 10% | A+ | Safe Driver | Allstate | |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 5% | A+ | Snapshot Program | Progressive | |

| #8 | 13% | A++ | Customer Service | Travelers | |

| #9 | 10% | A | Senior Discounts | Farmers |

Read on to explore more options for the best car insurance in Pennsylvania for seniors. Then, enter your ZIP code into our free tool to see personalized quotes today.

- The Hartford and USAA are the best Pennsylvania insurance companies for seniors

- Most older drivers get affordable car insurance quotes in Pennsylvania

- Some Pennsylvania auto insurance companies offer senior discounts

#1 – The Hartford: Top Overall Pick

Pros

- AARP Partnership: The Hartford offers exclusive benefits and senior discounts for AARP members. Learn more in our review of The Hartford auto insurance.

- RecoverCare: Add The Hartford RecoverCare to cover costs for home services if senior drivers are injured in an accident.

- Lifetime Renewability: So long as you meet basic requirements, The Hartford guarantees that senior drivers can renew your policy for the rest of your life.

Cons

- Membership Required: The Hartford only sells AARP car insurance for seniors, so you’ll need an AARP membership to purchase a policy.

- Expensive Rates: Senior auto insurance is more expensive at The Hartford at $89/month.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Miltary Veterans

Pros

- Military-Focused Benefits: USAA provides specialized services and senior insurance discounts for military members and veterans.

- Exceptional Customer Service: USAA offers some of the best senior auto insurance customer service in Pennsylvania, particularly for claims handling.

- Comprehensive Coverage: With a wide range of coverage options tailored for military needs, USAA offers comprehensive senior auto insurance quotes in Pennsylvania.

Cons

- Eligibility Restrictions: Senior nsurance is only available to military members and their families. See if you qualify for membership in our USAA auto insurance review.

- Limited Local Branches: There are fewer USAA insurance offices in Pennsylvania compared with other top providers.

#3 – State Farm: Best for Access to Local Agents

Pros

- Extensive Network of Local Agents: State Farm maintains a strong local presence in Pennsylvania, offering personalized service and support for senior auto insurance.

- Policy Customization Options: Customize senior insurance with add-ons like roadside assistance and rideshare insurance. See how in our State Farm auto insurance review.

- Good Driver Discounts: Get affordable State Farm senior car insurance with multiple discounts for safe driving and vehicle safety features.

Cons

- Average Digital Experience: Tech-savvy seniors report being unimpressed with State Farm’s online tools and mobile app.

- Financial Rating Dropped: A. M. Best recently downgraded State Farm’s financial rating to a B, indicating the company may be struggling in Pennsylvania.

#4 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Unique Coverage Options: Liberty Mutual offers add-ons for senior auto insurance that can be hard to find elsewhere. Explore your options in our Liberty Mutual auto insurance review.

- RightTrack: Senior drivers who sign up for Liberty Mutual’s usage-based insurance (UBI) program RightTrack to save up to 30% for safe driving habits.

- 24/7 Customer Support: Get the best senior car insurance experience with Liberty Mutual’s 24/7 claims support, available over the phone and online.

Cons

- Expensive Rates: Libert Mutual is one of the more expensive senior auto insurance companies.

- Limited Digital Tools: Liberty Mutual’s online tools are less user-friendly than most senior drivers like.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for UBI Savings

Pros

- Drivewise Program: Allstate offers one of the best UBI discounts of up to 40% for senior drivers who sign up for Drivewise. Learn more in our Allstate Drivewise review.

- Retirement Discounts: Get the cheapest car insurance for seniors over 60 with Allstate’s special discounts for retired drivers.

- Full Coverage Options: Allstate offers a wide range of policies and add-ons to help you get the best car insurance in Pennsylvania for seniors.

Cons

- Higher Premiums: No matter what type of driver you are, Allstate is usually one of the most expensive options for senior car insurance, especially full coverage policies.

- Inconsistent Customer Service: Senior drivers with Allstate report varying experiences with customer support.

#6 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible Program: Earn up to $500 off your senior insurance deductible by staying claims-free. Learn how in our Nationwide auto insurance review.

- Comprehensive Coverage Options: Get the best car insurance for seniors over 70 with Nationwide’s range of coverage options, including gap coverage and accident forgiveness.

- Good Customer Support: Nationwide senior insurance coverage generally receives high ratings for its customer service.

Cons

- Limited Local Offices: Senior drivers who prefer speaking to a local agent will have a hard time finding Nationwide offices in Pennsylvania.

- Higher Rates for High-Risk Drivers: Some senior drivers in Pennsylvania will see higher rates from Nationwide, particularly if they have a less-than-perfect driving record.

#7 – Progressive: Best for Innovative Digital Tools

Pros

- Snapshot: Progressive’s user-friendly UBI program Snapshot makes it easy to get cheap car insurance for seniors in Pennsylvania, as long as you’re a safe driver.

- Advanced Digital Tools: Find affordable Pennsylvania insurance for seniors with its user-friendly online tools, like the Name Your Price tool. See how it works in our Progressive insurance review.

- Multiple Discounts: One way Progressive offers the cheapest car insurance in Pennsylvania is through its discount opportunities.

Cons

- Unexpected Rate Increases: Many senior drivers report that their rates unexpectedly increased despite nothing having changed about their policies.

- Customer Loyalty: Despite offering some of the best Pennsylvania auto insurance for seniors, Progressive struggles to keep its customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customer Service

Pros

- Discount Variety: Travelers offers a wide range of discounts beneficial for Pennsylvania seniors with multiple vehicles and safe driving habits.

- Superior Customer Service: Travelers isn’t just one of our cheapest car insurance recommendations in Pennsylvania – it’s also a great choice for drivers who want an excellent customer service experience.

- Financial Stability: With an A++ from A.M. Best, Travelers’ strong financial ratings ensure reliability for Pennsylvania seniors.

Cons

- Limited Coverage Options: Senior drivers earning extra cash with apps like Uber may not be able to buy rideshare insurance in Pennsylvania.

- Higher Premiums: Travelers senior auto insurance policies may be more expensive than some competitors. Read our Travelers auto insurance review to see how much you might pay.

#9 – Farmers: Best Selection of Pennsylvania Discounts

Pros

- Strong Local Presence: A massive network of local agents in Pennsylvania allows Farmers to offer personalized service and support for senior drivers.

- Comprehensive Support for Seniors: The company provides dedicated support and advice for seniors in Pennsylvania. See how many you might qualify for in our Farmers auto insurance review.

- Solid Customer Service Ratings: Most seniors in Pennsylvania agree that Farmers offers excellent customer service, especially for the speed of its claims handling process.

Cons:

- Higher Quotes: Depending on your driving history, Farmers may be an expensive option for senior auto insurance in Pennsylvania.

- Limited Availability: Farmers sells senior insurance in Pennsylvania, but it doesn’t cover every state. If you move, you may need to find a different car insurance company.

Unlocking the Best Auto Insurance Deals for Pennsylvania Seniors

There’s significant variation between quotes from different companies. It’s helpful to look at average quotes to get an idea of where to start your search. Check below to see senior auto insurance rates from our top providers.

Senior Auto Insurance Monthly Rates in Pennsylvania by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $49 | $145 |

| Farmers | $43 | $128 |

| Liberty Mutual | $72 | $214 |

| Nationwide | $28 | $84 |

| Progressive | $49 | $145 |

| State Farm | $25 | $74 |

| The Hartford | $89 | $183 |

| Travelers | $25 | $74 |

| USAA | $19 | $56 |

Comparing quotes from multiple companies is crucial to avoid overpaying for car insurance — without comparison, there’s no way of knowing which company has the lowest rates.

When it comes to auto insurance, understanding how much you might have to pay can be confusing. There are many factors that affect auto insurance rates, including your gender, location, and age.

Other factors that influence insurance rates are obvious, like the kind of car you drive and your driving record. Other factors — like credit scores and marital status — often surprise drivers.Travis Thompson Licensed Insurance Agent

Luckily, the best Pennsylvania company for seniors makes it easy to get quotes. Most forms take about 10 minutes to fill out and require information like your driver’s license number and the make and model of your vehicle.

If you don’t want to spend the time to fill out multiple forms, you can use our free online tool to compare multiple insurance quotes at once.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Strategies for Seniors to Slash Pennsylvania Auto Insurance Costs

While Pennsylvania senior car insurance rates often run on the high side, there are plenty of ways to save. Consider the following tips to lower your insurance rates:

- Lower your coverage levels.

- Increase your deductible.

- Keep your driving record clean.

- Choose the best usage-based insurance.

- Improve your credit score.

An easier step to take is to look for auto insurance discounts. Most companies offer a variety of discounts to help drivers save. Finding the company that offers the most discounts you qualify for takes a little research, but the savings are worth it.

Below, we’ve compiled a list of some of the most popular senior car insurance discounts from our top companies in Pennsylvania.

The final — and most important — step in saving on your insurance is to compare quotes. Skipping this crucial step all but guarantees you’ll overpay for senior car insurance.

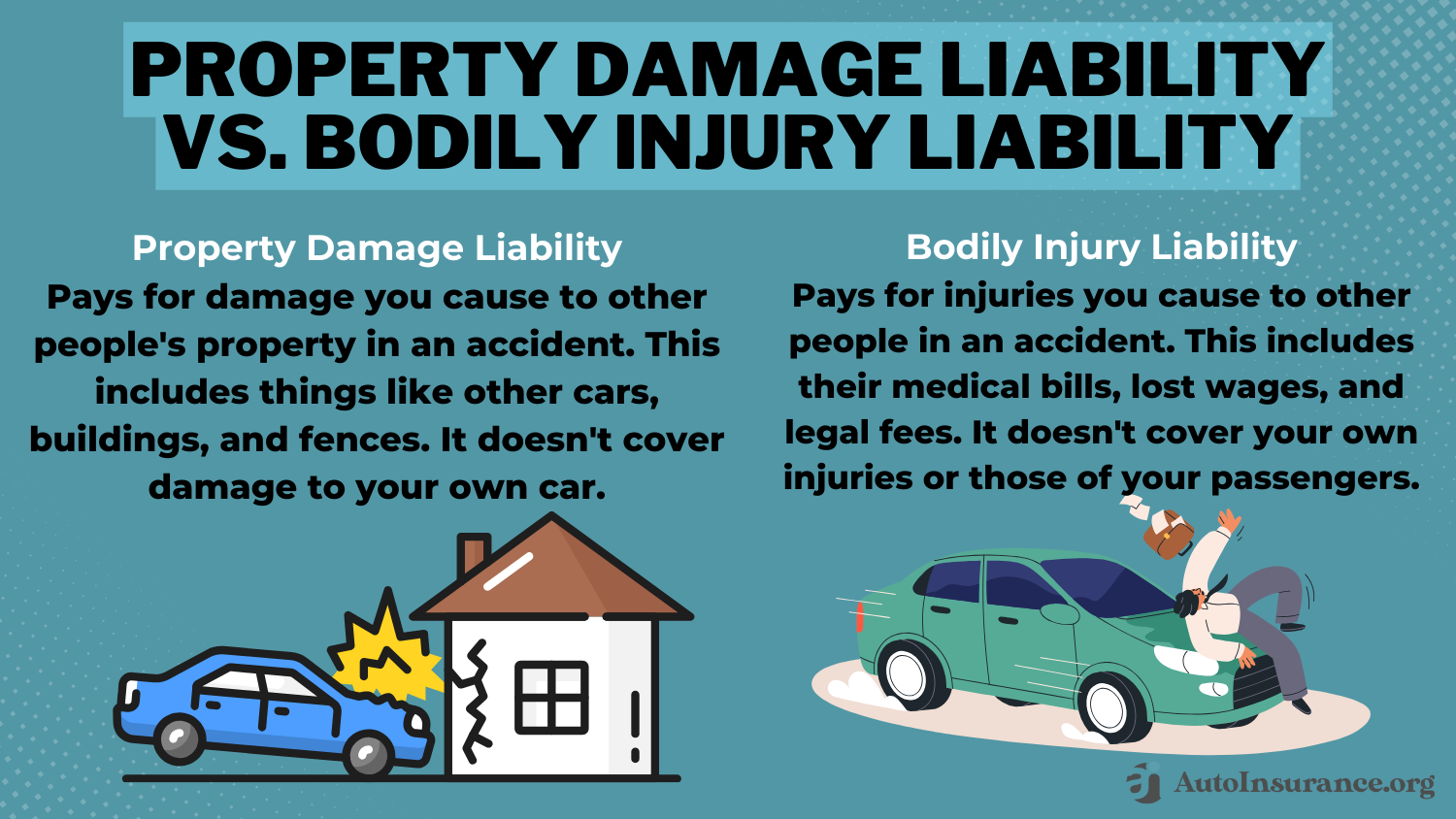

Pennsylvania Auto Insurance Requirements for Seniors

The insurance requirements for seniors in Pennsylvania are the same as they are for every driver. Before you can drive on a Pennsylvania street, you’ll need the following:

- Bodily Injury Liability: $15,000 per person, $30,000 per accident

- Property Damage Liability: $5,000 per accident

- First Party Benefits: $5,000

Insurance companies are also required to offer uninsured/underinsured motorist coverage, but you can choose to reject the coverage.

The minimum insurance requirements in Pennsylvania don’t cover damage to your car. Many senior drivers have new or collectible vehicles that would benefit from a full coverage policy. If you’re unsure about what coverage would work best for you, an insurance representative can help.

In today’s #AARPMinute, three things your car insurance policy probably won’t cover, plus use your next family gathering to share health-history information. pic.twitter.com/mU52NScYF6

— AARP (@AARP) July 17, 2022

Even if your car isn’t worth much, you should always carry the minimum amount of insurance Pennsylvania requires before driving. Driving without insurance in the Keystone State can have serious consequences, including fines, license suspension, and registration suspension.

Unlock the Best Auto Insurance Deals for Pennsylvania Seniors

Now that you know how to evaluate auto insurance quotes, you’ll have a much easier time finding cheap car insurance for seniors in Pennsylvania. While it’s important to look at as many companies as possible, our top picks for senior auto insurance quotes in Pennsylvania are a great place to start.

The Hartford, USAA, and State Farm have the best car insurance for seniors in Pennsylvania. USAA is the best for military members, and The Hartford caters to AARP members. All seniors qualify for State Farm auto insurance, and rates start at $25/month.

While comparing quotes is important, visiting individual websites and filling out forms is time-consuming. Streamline the process by entering your ZIP code into our free comparison tool to skip the endless forms and get straight to saving.

Frequently Asked Questions

How much does Pennsylvania auto insurance cost for seniors?

While there are several factors that affect rates — including many non-driving factors that impact auto insurance — the average senior driver in Pennsylvania pays $43 per month for minimum insurance. For full coverage, they pay $120.

What are the best auto insurance companies in Pennsylvania for seniors?

Our research shows that the best auto insurance companies for seniors in Pennsylvania are The Hartford, USAA, and State Farm.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool below.

How can seniors save on their car insurance?

To save on their insurance, seniors should look for discounts, choose the right amount of coverage, consider a higher deductible, and compare quotes from multiple companies.

Are there auto insurance discounts for seniors in Pennsylvania?

Finding auto insurance discounts for seniors can be difficult, as there aren’t many companies that offer specific savings for older drivers. However, some companies offer discounts to retired drivers.

For example, The Hartford’s car insurance discounts include several ways for older drivers to save. You can also save with non-senior-specific discounts, like savings for being a safe driver or paying for your policy in full.

Is auto insurance more expensive for seniors?

For the most part, seniors see affordable car insurance rates until about the age of 75. Once you turn 75, you’ll notice that your insurance rates slowly start to increase.

Seniors also get lower rates because they often qualify for a variety of discounts. For example, seniors who don’t drive frequently can get very affordable car insurance with low-mileage discounts.

Why do insurance rates increase as you age?

Insurance rates increase with age for a few reasons, including worsening eyesight, slower reaction speeds, and an increased likelihood of being injured in an accident. However, your rates won’t start to increase until you are 75, and you won’t see prices higher than what younger drivers pay.

To see how much you might pay today for your car insurance, enter your ZIP code into our free comparison tool.

What car insurance does AARP recommend for seniors?

AARP recommends that its members buy car insurance from The Hartford.

What are the minimum insurance requirements in Pennsylvania?

Pennsylvania’s car insurance requirements include a 15/30/5 liability insurance plan and $5,000 worth of first-party benefits.

What happens if you drive without car insurance in Pennsylvania?

Driving without insurance in Pennsylvania comes with serious consequences. These include fines that can easily exceed $1,000 and the suspension of your license and registration.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.