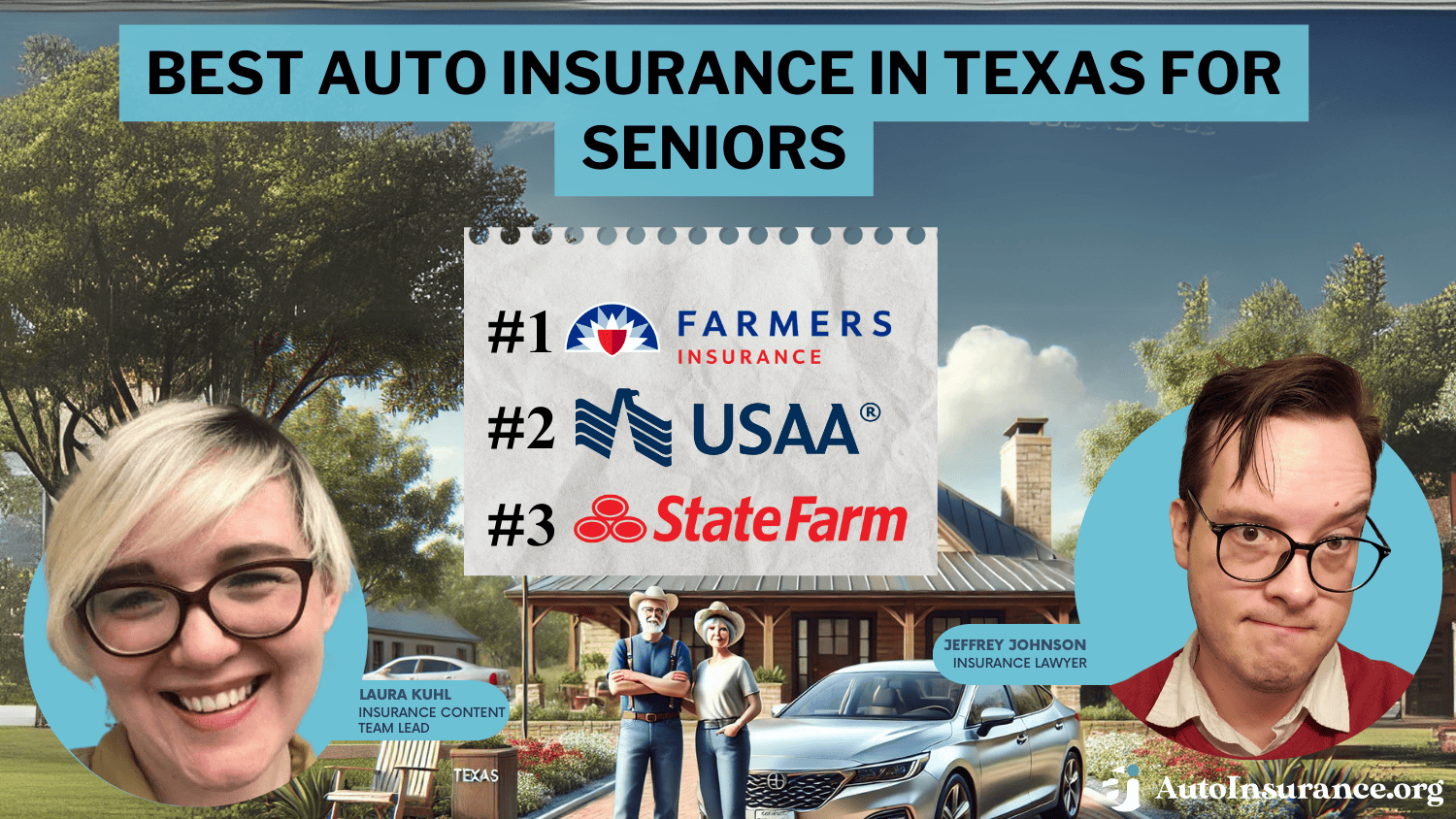

Best Auto Insurance for Seniors in Texas 2026 (Top 10 Providers)

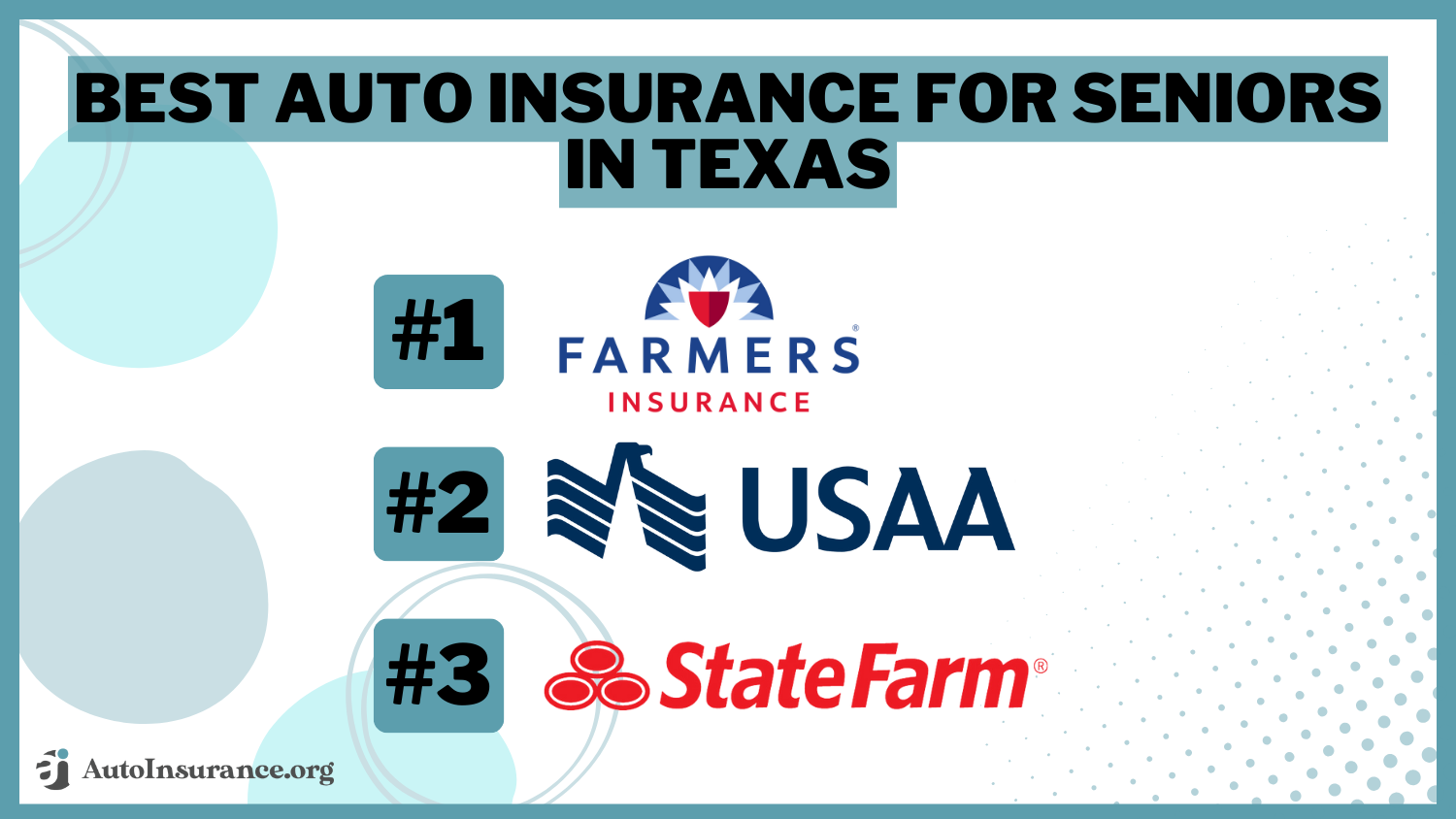

Farmers, USAA, and State Farm have the best auto insurance for seniors in Texas. Cheap car insurance for seniors starts at $23 monthly with USAA, but Farmers and State Farm have great senior car insurance discounts that reward safe driving. Compare average auto insurance rates by age in Texas for the best policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Jeffrey Johnson

Updated August 2025

Company Facts

Full Coverage for Seniors in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

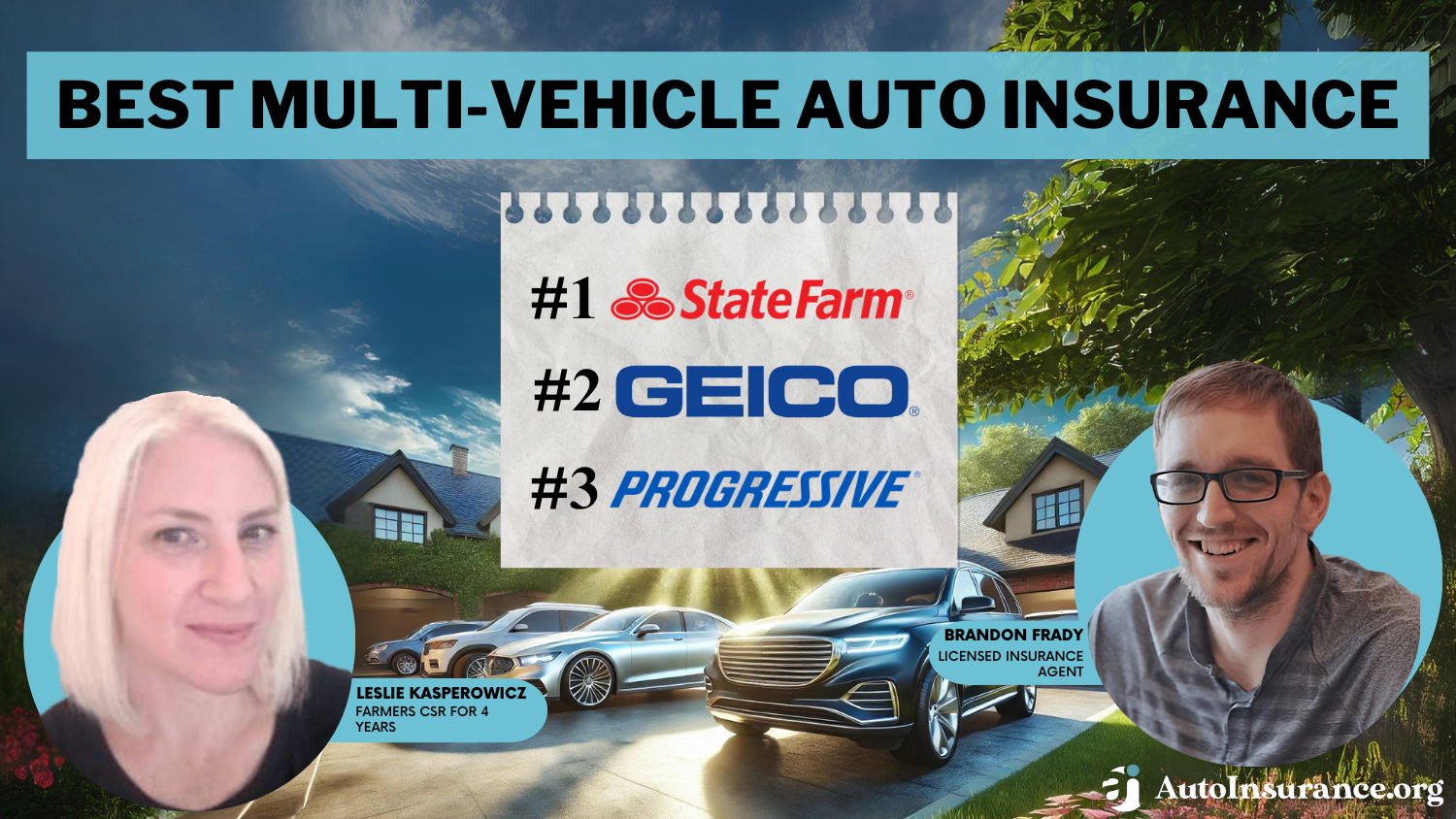

Farmers, USAA, and State Farm have the best auto insurance for seniors in Texas. Farmers is the top pick, with cheap auto insurance for drivers over 70 and more discounts than any other provider.

What is the best car insurance for seniors in Texas? These top ten companies stand out for offering comprehensive coverage options, higher medical coverage limits, and affordable add-ons like roadside assistance.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Texas

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 20% A Safe-Driving Discounts Farmers

![]()

#2 10% A++ Military Savings USAA

![]()

#3 20% B Customer Service State Farm

#4 25% A 24/7 Claims Liberty Mutual

![]()

#5 8% A++ Eco-Friendly Travelers

![]()

#6 25% A+ Pay-Per-Mile Allstate

![]()

#7 12% A+ Online Tools Progressive

#8 20% A+ Usage-Based Insurance Nationwide

#9 20% A Costco Members American Family

#10 25% A++ Cheap Rates Geico

USAA specializes in senior discount insurance for military members, and State Farm local agents have high customer service ratings.

If you need cheap Texas auto insurance, seniors can start comparing local providers with our free quote tool. Enter your ZIP code to get started.

- Farmers is the top pick for seniors’ car insurance and discounts

- Farmers senior car insurance rates start at $50 per month

- USAA is the best car insurance in Texas for seniors retired from the military

#1 – Farmers: Top Overall Pick

Pros

- Customizable Coverage Options: Farmers auto insurance for seniors in Texas includes flexible coverage like accident forgiveness and new car replacement.

- Discounts for Safety Features: Our Farmers auto insurance review shows how seniors in Texas can benefit from discounts for vehicles equipped with safety features, lowering premium costs.

- Dedicated Claims Service: Responsive claims process in Texas, ensuring timely support for seniors.

Cons

- Higher Premiums: Farmers’ auto insurance for seniors in Texas may be costly for those on fixed incomes.

- Variable Customer Satisfaction: The quality of service in Texas can vary, impacting seniors’ experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Cheapest Rates: What is the cheapest car insurance for seniors in Texas? USAA minimum coverage starts at $23 per month, the cheapest on this list. Get quotes in our USAA auto insurance review.

- Exceptional Customer Service: USAA excels in customer service, crucial for seniors in Texas seeking reliable auto insurance.

- Military Discounts: Its coverage is specifically beneficial for seniors in Texas who are veterans or from military families.

Cons

- Limited Eligibility: Cheap insurance for seniors is restricted to military members and their immediate families, limiting broader access for some Texas drivers.

- No Gap Insurance: USAA does not sell gap insurance for seniors to cover new or leased cars.

#3 – State Farm: Best Local Agent Support

Pros

- Customer Service: State Farm provides personalized auto insurance services for seniors in Texas through local agents with above-average satisfaction reviews in J.D. Power surveys.

- Discounts for Safe Drivers: Our State Farm Drive Safe & Save review explains how seniors in Texas can get discounts for safe driving habits.

- Bundling Discounts: Get the best auto and home insurance for seniors from State Farm with a 17% multi-policy discount.

Cons

- Low Financial Strength: State Farm is ranked lower for financial strength by A.M. Best than other senior auto insurance companies in Texas.

- Inconsistent Experience Across Agents: Varied service quality across agents in different parts of Texas may affect satisfaction for some senior drivers.

#4 – Liberty Mutual: Best for 24/7 Claims Handling

Pros

- 24/7 Claims Support: Liberty Mutual agents are available 24/7 by phone or online for seniors who need to file auto insurance claims.

- Customization of Policies: Extensive customization options for senior auto insurance in Texas.

- Accident Forgiveness: According to our Liberty Mutual auto insurance review, it protects seniors in Texas from premium hikes after the first accident.

Cons

- Higher Price Point: More expensive car insurance for elderly drivers in Texas starts at $65 a month.

- Customer Service Variability: Service quality can vary, impacting seniors’ experience in Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Eco-Friendly Vehicles

Pros

- Discounts for Hybrid/Electric Cars: Encourages eco-friendly vehicle choices among Texas seniors with specific discounts of up to 10%.

- IntelliDrive Program: The telematics program can lead to discounts for safe-driving seniors in Texas. Learn how in our Travelers IntelliDrive review.

- Industry Experience: Travelers is one of the oldest and most reliable senior car insurance companies in Texas, with a solid A++ financial rating from A.M. Best.

Cons

- Complex Policy Options: The variety of options may be overwhelming for some seniors in Texas.

- Mixed Reviews on Claims Processing: Varied experiences with claims process efficiency for seniors in Texas.

#6 – Allstate: Best Pay-Per-Mile Insurance

Pros

- Best Low-Mileage Rates: Our Allstate Milewise review explains how Texas pay-per-mile insurance can save seniors money by driving less.

- Drivewise UBI Program: Allstate’s usage-based discount can save Texas seniors up to 30%. Get details in our Drivewise review.

- Wide Range of Coverage Options: Comprehensive coverage, including roadside assistance beneficial for seniors in Texas.

Cons

- Higher Rates: If you don’t qualify for Milewise or Drivewise, shop for cheaper auto insurance for seniors at other companies.

- Variable Agent Quality: Senior drivers report different experiences based on the agent in Texas.

#7 – Progressive: Best Online Pricing Tools

Pros

- Name Your Price Tool: Allows seniors in Texas to align auto insurance costs with their budget.

- Loyalty Rewards: Compare discounts and perks for long-term customers in our Progressive auto insurance review.

- Competitive Rates: Cheap auto insurance for seniors starts at $44 monthly in Texas with Progressive.

Cons

- Customer Service Issues: Progressive is dead last for senior car insurance customer satisfaction in Texas, according to J.D. Power surveys.

- Rate Increases: Progressive is more likely to raise senior auto insurance rates higher at renewal than other Texas insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best Usage-Based Insurance Options

Pros

- SmartRide Program: Explore usage-based discounts rewarding safe driving for seniors in Texas in our Nationwide SmartRide review.

- Vanishing Deductible: Senior drivers who avoid filing car insurance claims in Texas will see their deductible decrease as low as $250.

- Accident Forgiveness: Prevents rate hikes for seniors in Texas after an at-fault accident.

Cons

- Inconsistent Pricing: If you don’t sign up for SmartRide, you’ll likely find more affordable auto insurance for seniors with other Texas providers.

- Claims Satisfaction Variability: Mixed experiences with claims process for seniors in Texas cause it to rank below average in J.D. Power surveys.

#9 – American Family: Best for Costco Members

Pros

- Exclusive Costco Perks: Seniors with a Costco member get exclusive discounts and coverage options through American Family.

- My SafetyValet: There is a program promoting safer driving habits, potentially lowering auto insurance rates for seniors in Texas. Learn more in our American Family auto insurance review.

- Generous Discounts: AmFam auto insurance discounts for seniors are bigger than other companies, including up to 20% multi-vehicle discounts and 25% multi-policy discounts.

Cons

- Membership Required: AmFam senior auto insurance rates might be higher without a Costco membership.

- Customer Service Variations: Varied service quality could negatively affect seniors in Texas.

#10 – Geico: Best for Overall Affordability

Pros

- Competitive Rates: Cheap car insurance for senior citizens in Texas starts at $38 per month with Geico.

- Extensive Discounts: Our Geico auto insurance review breaks down a variety of discounts seniors in Texas, including for safe driving and vehicle safety features.

- Robust Mobile App: Easy management of policies and claims in Texas via its app and website.

Cons

- Impersonal Customer Service: Some seniors in Texas might find the service less personal since Geico relies heavily on digital and online experiences.

- Coverage Options: Basic coverage may not meet all the needs of seniors in Texas seeking more comprehensive options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Texas Auto Insurance Rates for Seniors

What is the best auto insurance for seniors? For minimum coverage, USAA offers the lowest rate at $23, followed by State Farm at $33 and Geico at $38.

Texas Senior Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

![]()

$73 $197

$64 $172

![]()

$50 $135

$38 $104

$65 $174

$56 $151

![]()

$44 $118

$33 $88

![]()

$37 $99

![]()

$23 $61

For full coverage, USAA also provides the most affordable option at $61, with State Farm at $88 and Geico at $104. Farmers isn’t the cheapest car insurance in Texas for seniors, but drivers can lower rates with the provider’s long list of discounts.

Farmers stands out as the top choice for seniors in Texas, providing personalized policies, exceptional discounts, and outstanding service.Laura Berry Former Licensed Insurance Producer

Auto insurance rates by age and city can significantly influence Texas premiums. Many insurers offer cheap auto insurance for senior citizens due to their extensive driving histories and typically safer driving behaviors, but insurance still costs more in cities with traffic and higher theft rates.

Texas Auto Insurance Minimum Monthly Rates by Age, Gender, & City

Age & Gender Austin Dallas El Paso Houston San Antonio

16-Year-Old Female $33 $34 $32 $37 $32

16-Year-Old Male $35 $38 $33 $39 $35

20-Year-Old Female $18 $19 $17 $20 $18

20-Year-Old Male $20 $22 $19 $23 $21

30-Year-Old Female $12 $13 $11 $14 $13

30-Year-Old Male $13 $14 $12 $15 $13

40-Year-Old Female $11 $12 $10 $13 $12

40-Year-Old Male $12 $13 $11 $13 $12

50-Year-Old Female $10 $11 $9 $12 $11

50-Year-Old Male $11 $12 $10 $13 $11

Senior car insurance is cheaper in every city, but a clean driving record is key to lower rates if you live in Houston or Dallas. Senior drivers with no recent accidents or traffic violations often qualify for better rates.

Senior Auto Insurance Discounts

Texas insurance companies offer various discounts that can significantly reduce premiums for seniors. These include age-related discounts acknowledging safer driving habits associated with older adults, often starting at age 55.

What are the most popular auto insurance discounts for senior citizens? The table highlights the car insurance discounts available in Texas, including multi-policy, safe driving, and special program discounts.

Auto Insurance Discount Savings Potential by Provider

Discount Name ![]()

Adaptive Cruise Control 10% 8% 5% X 5% 8% 7% 10% 9% 15%

Adaptive Headlights 5% 5% 3% X 5% 6% 4% 7% 5% 8%

Anti-lock Brakes 10% 5% 5% 5% 5% 5% 5% 5% X X

Anti-Theft 10% 15% X 23% 20% 25% 5% 15% X X

Claim Free 35% 5% 5% 26% 8% 10% 7% 15% 23% 12%

Continuous Coverage X 5% 5% X 8% 10% 8% 12% 15% 7%

Daytime Running Lights 2% X 5% 3% 5% 5% 5% 5% X X

Defensive Driver 10% 10% 8% 8% 10% 5% 10% 5% 10% 3%

Distant Student 35% 5% 8% 5% 6% 10% 7% 15% 7% X

Driver's Ed 10% 8% 5% 5% 10% 7% 10% 15% 8% 3%

Driving Device/App 20% 40% 15% 5% 30% 40% 20% 50% 30% 5%

Early Signing 10% 5% 5% 5% 6% 8% 5% 5% 10% 12%

Electronic Stability Control 2% 5% 3% 5% 5% 8% 5% 7% 8% 8%

Emergency Deployment 15% 8% 5% 25% 8% 10% X 7% 9% 6%

Engaged Couple 5% 5% 3% 5% 5% 5% 5% 4% 5% 6%

Family Legacy 7% 5% 3% 8% 6% 8% 10% 6% 7% 10%

Family Plan 5% 7% 8% 10% 8% 25% 7% 7% 8% 8%

Farm Vehicle 10% 5% 3% X 7% 8% X 5% 9% 8%

Fast 5 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Federal Employee X 8% X 12% 10% 5% X 6% 7% 5%

Forward Collision Warning 8% 5% 5% 5% 5% 5% 8% 6% 7% 5%

Full Payment 10% 5% 5% 5% 5% 8% 5% 6% 8% 5%

Further Education 3% 5% 5% X 5% 5% 5% 4% 5% 5%

Garaging/Storing 5% 5% 5% X 8% 5% 5% 7% X 10%

Good Credit X X 8% 8% 5% X 7% X 8% 7%

Good Student 20% 8% X 15% 23% 10% 5% 25% 8% 3%

Green Vehicle 10% 5% 5% 5% 10% 7% 8% 10% 10% 7%

Homeowner 5% 8% 5% X 5% 5% 5% 3% 5% 5%

Lane Departure Warning 5% 5% 5% 5% X 5% 5% 5% 5% 5%

Life Insurance 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Low Mileage X 5% X 5% X X 5% 30% X X

Loyalty 7% 8% 6% 5% 8% 5% 8% 6% 9% X

Married 5% 5% 5% 5% X X 5% X 5% X

Membership/Group 5% 5% 5% X 10% 7% X 8% X 5%

Military X 5% 5% 15% 4% 5% X X 5% X

Military Garaging 10% 5% 5% 5% 5% 5% 5% 5% 5% 15%

Multiple Drivers 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Multiple Policies 10% 29% 5% 10% 20% 10% 12% 17% 13% X

Multiple Vehicles X 5% 5% 25% 10% 20% 10% 20% 8% X

New Address 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

New Customer/New Plan 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

New Graduate 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

New Vehicle 30% 8% 5% 15% 6% 8% X 40% 10% 12%

Newly Licensed 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Newlyweds 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Non-Smoker/Non-Drinker 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Occasional Operator 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Occupation X 5% X X 10% 15% 5% 5% X 5%

On-Time Payments 5% 5% X 5% 5% 5% 5% 5% 15% 5%

Online Shopper 5% 5% 5% 5% 5% 5% 7% 5% 5% 5%

Paperless Documents 10% 5% X X 5% 5% $50 5% 5% 5%

Paperless/Auto Billing 5% 5% X 5% 5% 30% 50 20% 3% 3%

Passive Restraint 30% 30% X 40% X 20% 5% 40% X X

Recent Retirees 5% 5% 5% 5% 4% 5% 5% 5% 5% 5%

Renter 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Roadside Assistance 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Safe Driver 45% 8% X 15% 8% 35% 31% 15% 23% 12%

Seat Belt Use 5% 5% 5% 15% 5% 5% X 5% 5% 5%

Senior Driver 10% 5% X 5% 6% 8% 7% 5% 5% X

Stable Residence 5% 5% 5% 5% 5% X 5% 5% 5% 5%

Students & Alumni 5% 5% 5% X 10% 7% X 5% 5% 5%

Switching Provider 5% X X 8% 10% 8% X 8% 8% 10%

Utility Vehicle 15% 5% 5% X 6% 7% X 8% 9% 5%

Vehicle Recovery 10% 5% 5% 15% 35% 25% 5% 5% X X

VIN Etching 5% 5% 5% 5% 5% X 5% 5% X X

Volunteer 5% 5% 5% 5% 5% 5% 5% 5% 5% 5%

Young Driver 15% 5% 8% 8% 8% 6% 7% 8% 8% 50%

Seniors can also save by bundling auto insurance with other policies like homeowners or life insurance, receiving multi-policy discounts. What is the best car and home insurance for seniors? Allstate, American Family, Geico, and Liberty Mutual offer the biggest bundling discount of 25%.

Seniors who drive less benefit from low mileage discounts. A clean driving record without accidents or violations can result in good driver auto insurance discounts, rewarding consistent, safe driving over time. By completing an approved defensive driving course, not only do you boost your safety habits, but you also become eligible for rate reductions.

The type of vehicle insured also affects costs, as models that are less expensive to repair or are less targeted by thieves may result in lower premiums. Having vehicle safety features like anti-lock brakes and anti-theft systems can reduce insurance costs.Travis Thompson Licensed Insurance Agent

Discount auto insurance for seniors reduces Texas premiums while ensuring extensive coverage. Each insurer offers a unique mix of these discounts, so seniors should inquire directly with providers to maximize their savings. When you review different plans, it helps you select the optimal policy tailored to their requirements.

Coverage Options for Senior Drivers in Texas

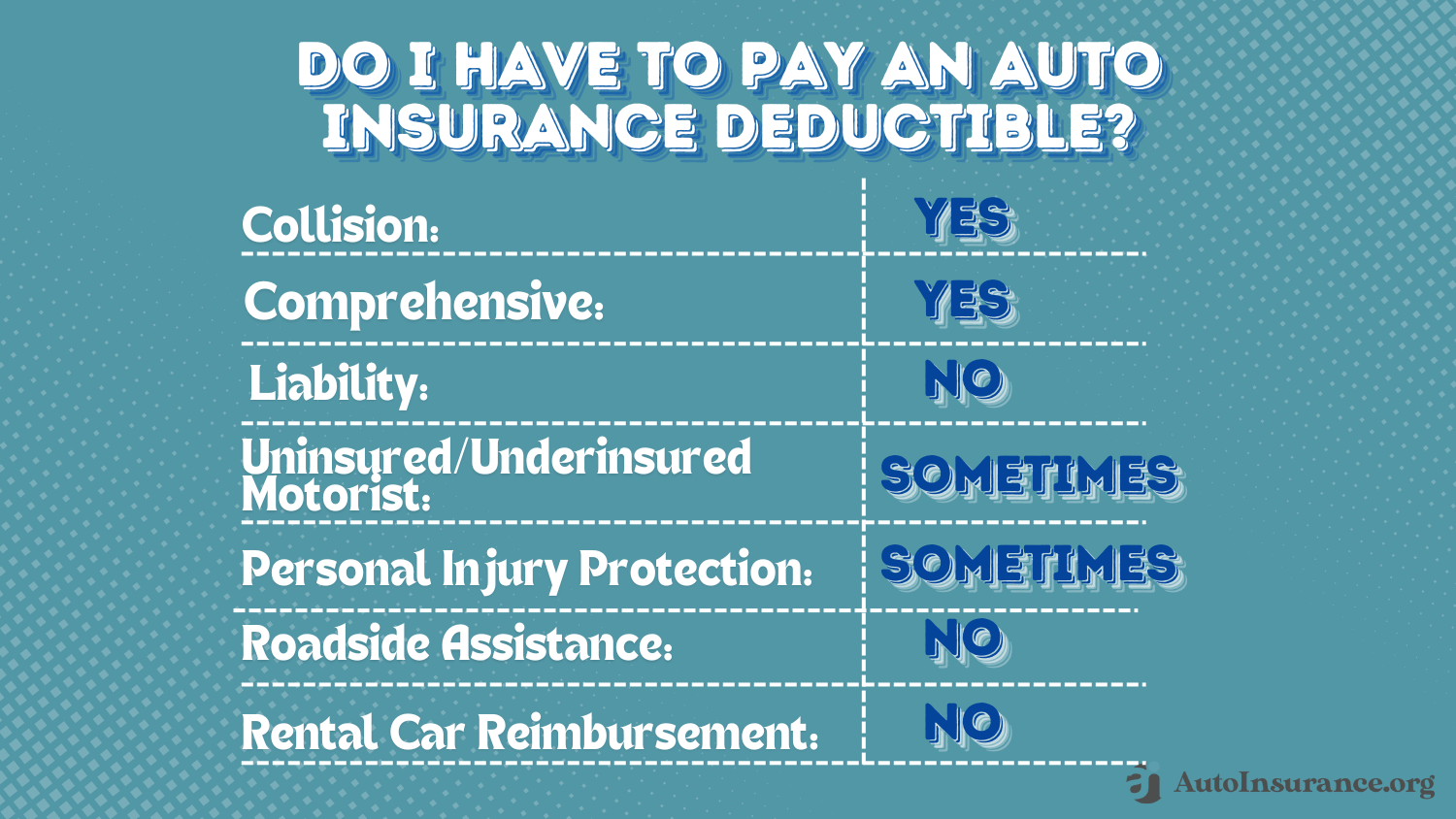

What are the benefits of auto insurance? Insurance providers offer a range of coverage options designed to meet the diverse needs of senior drivers. These options typically include liability coverage, which is mandatory in most states and covers damages to others caused by the insured driver.

The specific coverage needs of seniors, such as higher car insurance, medical coverage, or emergency roadside assistance, can dictate which policies provide the best balance of cost and protection.

For more comprehensive protection, seniors can opt for collision coverage that pays for damages to their own vehicles in the event of an accident, regardless of fault. Comprehensive coverage is another crucial option, protecting against non-collision-related incidents such as theft, vandalism, and natural disasters. Seniors can also benefit from uninsured and underinsured motorist (UM/UIM) coverage, safeguarding them against costs incurred from accidents with drivers who lack sufficient insurance.

Additionally, many insurers provide personal injury protection (PIP) and medical payments coverage (MedPay), which help cover medical expenses regardless of who is at fault. Top Texas providers, such as Farmers, USAA, and State Farm, offer a range of policies, ensuring that seniors have diverse options to choose from based on their coverage needs and budget.

data-media-max-width=”560″>

Sure, you’ve got car insurance. But what about that golf cart? Or that ATV your kids are always begging to drive? Off-road vehicles come with special risks — and require special insurance. Call to find out more. pic.twitter.com/IChCcSHJaS

— Esther Martinez Insurance Agency (@FarmersD43) May 22, 2024

These varied options allow seniors to customize their insurance to their specific driving habits and financial needs, ensuring they have the right level of protection.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save Money on Senior Auto Insurance in Texas

These valuable tips help seniors secure the best auto insurance company coverage at the most affordable rates. One key recommendation is for seniors to review their insurance needs annually, as changes in driving patterns or lifestyle might allow for adjustments that could reduce rates.

Another tip is to maintain a good driving record, which directly impacts rates. Insurance companies reward safe driving with lower costs.Jeffrey Johnson Insurance Lawyer

Seniors are also advised to take advantage of all available discounts, such as those for defensive driving courses, multi-policy bundles, or having safety features installed in their vehicles.

Moreover, comparing quotes from different providers is emphasized as a critical step to ensure seniors are getting the best deal without compromising on coverage quality. Finally, seniors should consider higher deductibles, which can lower monthly premiums, provided they are comfortable with the potential out-of-pocket costs in the event of a claim.

These tips can guide seniors through the process of selecting an insurance plan that offers both financial benefits and comprehensive protection.

Case Studies: Best Auto Insurance for Seniors in Texas

In Texas, seniors seeking auto insurance require policies that offer both affordability and comprehensive coverage. Here are three scenarios that illustrate how providers meet these needs effectively.

- Case Study #1 – Customized Coverage: Helen, a retiree in Austin, chooses Farmers for its customizable policy options. Farmers’ Smart Plan Auto lets her tailor her coverage, including new car replacement and accident forgiveness. This personalized policy ensures she pays only for the coverage she needs, ideal for her limited retirement budget and specific preferences.

- Case Study #2 – Military and Veteran Benefits: Bill, a retired Navy veteran living in El Paso, opts for USAA due to its exceptional services for military personnel and their families. USAA’s comprehensive coverage, coupled with discounts for military families and additional benefits for safe driving, provides Bill with a cost-effective solution that honors his service and meets his specific needs as a senior.

- Case Study #3 – Nationwide Reliability: Susan, a senior who frequently visits her grandchildren in multiple states, chooses State Farm for its nationwide coverage and reliable service. The extensive agent network ensures she receives consistent service wherever she travels. The Drive Safe & Save program offers her discounts based on driving habits, helping manage her insurance costs.

These case studies showcase how these companies provide targeted solutions that address the unique requirements of senior drivers in Texas.

Choosing the Right Auto Insurance for Seniors in Texas

For seniors in Texas, finding the right auto insurance involves considering a blend of affordability and comprehensive coverage. This provides an in-depth analysis of the top insurance options available, highlighting the benefits tailored to meet seniors’ specific needs.

Farmers is the best overall pick for seniors in Texas, with a 95% customer satisfaction rating for its tailored policies and exceptional service.Michelle Robbins Licensed Insurance Agent

Utilizing the free comparison tool simplifies the process, allowing seniors to easily evaluate various policies and select the most suitable types of auto insurance coverage. By focusing on personalized insurance solutions, seniors can ensure optimal protection and financial peace of mind.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

What is the cheapest auto insurance for seniors in Texas?

The cheapest auto insurance companies for seniors in Texas typically offer basic liability coverage, which provides the bare minimum coverage.

How can seniors in Texas reduce their auto insurance premiums?

Reduce your senior car insurance rates by taking advantage of discounts for safe driving, low mileage, and completing defensive driving courses. Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What types of auto insurance coverage are recommended for seniors in Texas?

The recommended Texas car insurance for senior citizens includes liability coverage, comprehensive auto insurance, collision coverage, and uninsured and underinsured motorist (UM/UIM) coverage.

How does age impact auto insurance rates for seniors in Texas?

Texas car insurance rates for seniors are often lower due to their extensive driving experience and typically safer driving habits.

What should seniors in Texas look for in an auto insurance policy?

Seniors in Texas should look for comprehensive coverage options, affordable premiums, good customer service, and available discounts when selecting a car insurance policy.

Are there specific car insurance discounts for seniors in Texas?

Yes, seniors in Texas can access discounts such as multi-policy discounts, safe driver discounts, defensive driving course discounts, and low mileage discounts. Compare more auto insurance discounts.

Are there any specific programs in Texas to help lower auto insurance costs for seniors?

Texas has no state-sponsored car insurance programs, but you can get the cheapest car insurance for seniors with usage-based driving programs, and some drivers may qualify for AARP discounts. Learn how to lower your auto insurance rates.

Can seniors in Texas bundle their auto insurance with other policies for discounts?

Yes, you can bundle home and auto insurance for seniors to receive multi-policy discounts.

Why is uninsured and underinsured motorist (UM/UIM) coverage important for seniors in Texas?

Uninsured and underinsured motorist (UM/UIM) coverage is important for seniors in Texas as it protects them against costs from accidents with drivers who lack sufficient insurance.

How often should seniors in Texas review their auto insurance policies?

Seniors in Texas should review their car insurance policies annually to ensure they have the best coverage at the most affordable rates, taking advantage of any new discounts or changes in their driving habits.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.