Best Cadillac SRX Auto Insurance in 2026 (Find the Top 10 Companies Here)

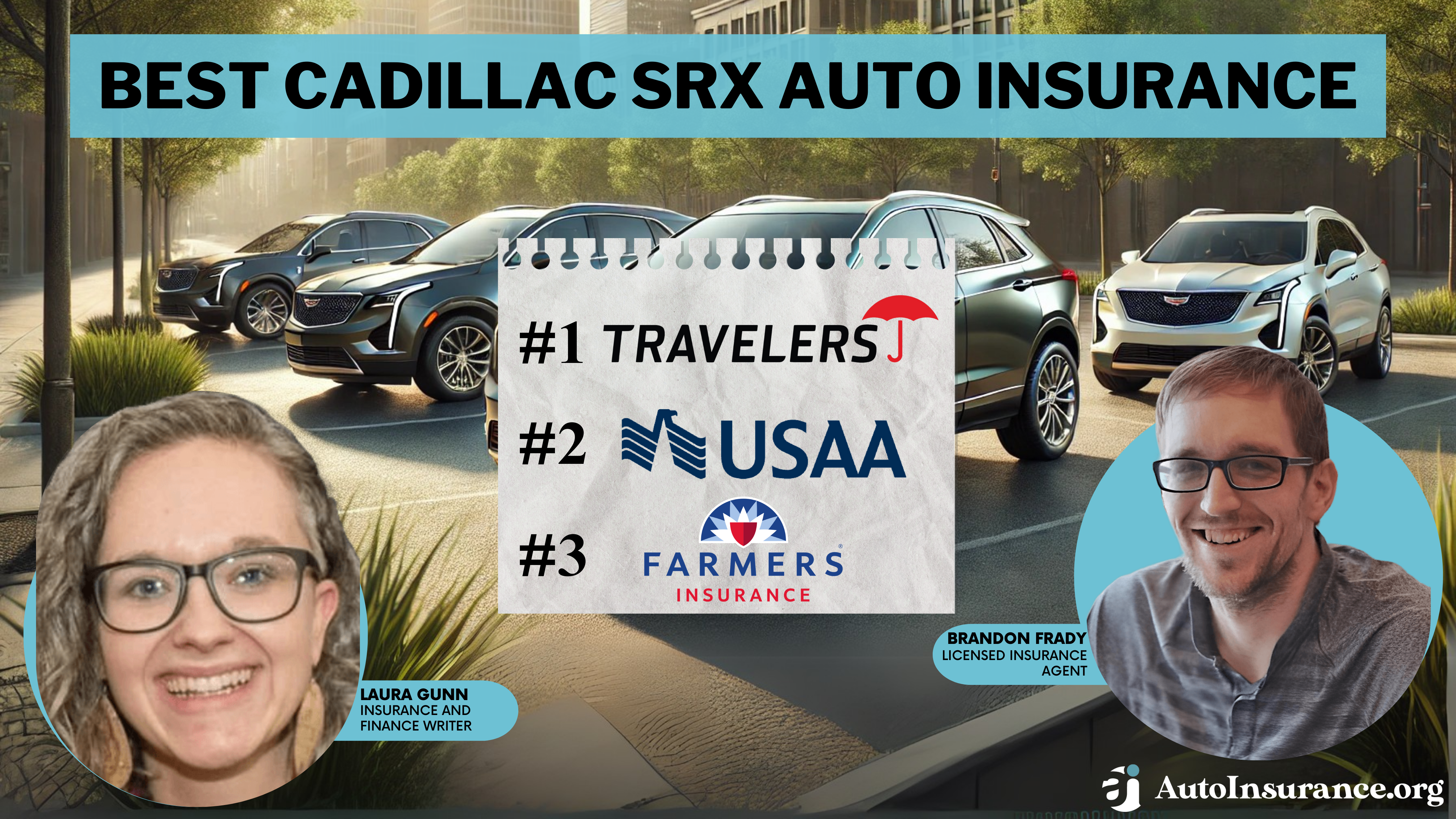

Travelers, USAA, and Farmers are the best Cadillac SRX auto insurance providers, with rates at $105/month. Travelers excel in comprehensive coverage, USAA is ideal for military benefits, and Farmers provides customized plans. These companies offer competitive rates and tailored options for Cadillac SRX owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Cadillac SRX

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Cadillac SRX

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Cadillac SRX

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe top pick overall for the best Cadillac SRX auto insurance are Travelers, USAA, and Farmers, offering rates around $105/month. Travelers excels with comprehensive coverage, USAA provides exceptional military benefits, and Farmers stands out with customized plans.

This article explores why these companies offer the best rates and coverage options for Cadillac SRX owners, considering multiple factors like safety features and driver profiles.

Our Top 10 Company Picks: Best Cadillac SRX Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | A++ | Comprehensive Coverage | Travelers | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 20% | A | Customized Plans | Farmers | |

| #4 | 20% | A+ | Customer Service | Nationwide |

| #5 | 25% | A | Flexible Policies | Liberty Mutual |

| #6 | 25% | A+ | Claim Satisfaction | Allstate | |

| #7 | 10% | A+ | Competitive Rates | Erie |

| #8 | 25% | A | Member Discounts | AAA |

| #9 | 25% | A+ | Bundled Savings | The Hartford |

| #10 | 20% | B | Nationwide Network | State Farm |

Explore Cadillac SRX insurance rates for full coverage and minimum coverage. Get ready to compare and save on your Cadillac SRX insurance. Browse more insights in our guide “How much car insurance do I need?”

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- Travelers is the top pick for the best Cadillac SRX auto insurance

- Customize your coverage to meet your specific needs

- Explore best Cadillac SRX auto insurance providers with rates at $110/month

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Travelers Auto insurance review has emphasize the extensive coverage options, ensuring Cadillac SRX owners have thorough protection.

- Low Monthly Rates: Travelers offers competitive monthly rates at $110 for minimum coverage for the Cadillac SRX.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers offers reliable and stable insurance for Cadillac SRX owners.

Cons

- Limited Multi-Vehicle Discount: The 8% multi-vehicle discount may be lower compared to some competitors for Cadillac SRX owners.

- Premium Costs: Despite comprehensive options, premium costs might still be relatively higher for certain coverage levels for the Cadillac SRX.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military-Specific Benefits: USAA auto insurance review provides unique benefits tailored for military personnel and their families, ideal for Cadillac SRX owners with a military background.

- Low Monthly Rates: USAA offers competitive monthly rates at $105 for minimum coverage for the Cadillac SRX.

- Excellent Customer Service: Renowned for top-notch customer service, USAA supports Cadillac SRX owners with dedicated assistance.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members, veterans, and their families, restricting access for some Cadillac SRX owners.

- Limited Physical Locations: Fewer physical branches may inconvenience some Cadillac SRX owners who prefer in-person interactions.

#3 – Farmers: Best for Customized Plans

Pros

- Customized Insurance Plans: Farmers allows Cadillac SRX owners to tailor their policies to meet specific needs and preferences.

- Low Monthly Rates: Farmers offers competitive monthly rates at $115 for minimum coverage for the Cadillac SRX.

- Discount Opportunities: Farmers auto insurance review provides various discounts, including a 20% multi-vehicle discount, benefiting Cadillac SRX owners.

Cons

- Mixed Customer Service Reviews: Some Cadillac SRX owners report inconsistent customer service experiences with Farmers.

- Higher Premiums for Certain Coverages: Customized plans may lead to higher premiums for specific coverage options for the Cadillac SRX.

#4 – Nationwide: Best for Customer Service

Pros

- Superior Customer Service: Nationwide is known for excellent customer service, ensuring Cadillac SRX owners receive prompt and helpful support.

- Low Monthly Rates: Nationwide offers competitive monthly rates at $112 for minimum coverage for the Cadillac SRX.

- Wide Range of Coverage Options: Nationwide auto insurance review highlighted the diverse coverage options, catering to various needs of Cadillac SRX owners.

Cons

- Premium Costs: Despite strong customer service, premium costs may be relatively higher for certain coverage levels for the Cadillac SRX.

- Discount Limitations: Some Cadillac SRX owners might find the available discounts less comprehensive compared to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policy Options: Liberty Mutual auto insurance review provides flexible policies, allowing Cadillac SRX owners to customize their coverage.

- Low Monthly Rates: Liberty Mutual offers competitive monthly rates at $120 for minimum coverage for the Cadillac SRX.

- High Multi-Vehicle Discount: With a 25% multi-vehicle discount, Liberty Mutual offers significant savings for Cadillac SRX owners.

Cons

- Customer Service Variability: Some Cadillac SRX owners report inconsistent customer service experiences with Liberty Mutual.

- Premium Costs for Full Coverage: Premiums for full coverage may be higher than some competitors for the Cadillac SRX.

#6 – Allstate: Best for Claim Satisfaction

Pros

- High Claim Satisfaction: Allstate is known for high customer satisfaction with the claims process, benefiting Cadillac SRX owners.

- Low Monthly Rates: Allstate offers competitive monthly rates at $118 for minimum coverage for the Cadillac SRX.

- Comprehensive Coverage Options: Allstate auto insurance review provides extensive coverage options to protect Cadillac SRX owners.

Cons

- Higher Premium Costs: Premium costs may be higher compared to some competitors, especially for Cadillac SRX owners seeking full coverage.

- Limited Discount Offerings: Discount opportunities may be less extensive compared to other insurers for the Cadillac SRX.

#7 – Erie: Best for Competitive Rates

Pros

- Competitive Overall Rates: Erie provides generally competitive insurance rates, making it a cost-effective option for Cadillac SRX owners.

- Low Monthly Rates: Erie offers competitive monthly rates at $108 for minimum coverage for the Cadillac SRX. Read more about their ratings in our Erie auto insurance review.

- Strong Customer Service: Erie is known for reliable customer service, supporting Cadillac SRX owners efficiently.

Cons

- Limited Availability: Erie’s services are not available in all states, potentially limiting access for some Cadillac SRX owners.

- Discount Limitations: Some Cadillac SRX owners might find the discount offerings less comprehensive compared to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Member Discounts

Pros

- Member Discounts: AAA auto insurance review provides significant member discounts, benefiting Cadillac SRX owners who are AAA members.

- Low Monthly Rates: AAA offers competitive monthly rates at $113 for minimum coverage for the Cadillac SRX.

- Roadside Assistance: AAA includes comprehensive roadside assistance, enhancing coverage for Cadillac SRX owners.

Cons

- Membership Requirement: AAA’s best rates and services require membership, adding an additional cost for Cadillac SRX owners.

- Variable Coverage Costs: Coverage costs may vary significantly based on location and membership level for the Cadillac SRX.

#9 – The Hartford: Best for Bundled Savings

Pros

- Bundled Savings: The Hartford auto insurance review provides significant savings when bundling multiple policies, benefiting Cadillac SRX owners.

- Low Monthly Rates: The Hartford offers competitive monthly rates at $116 for minimum coverage for the Cadillac SRX.

- A+ Financial Rating: With an A+ rating from A.M. Best, The Hartford offers reliable insurance for Cadillac SRX owners.

Cons

- Limited Availability: The Hartford’s services may not be available in all states, potentially limiting access for some Cadillac SRX owners.

- Higher Premiums for Specific Coverages: Premiums for certain coverage options may be higher compared to some competitors for the Cadillac SRX.

#10 – State Farm: Best for Nationwide Network

Pros

- Extensive Nationwide Network: State Farm auto insurance review has emphasize the wide network of agents and locations, providing easy access for Cadillac SRX owners.

- Low Monthly Rates: State Farm offers competitive monthly rates at $111 for minimum coverage for the Cadillac SRX.

- High Low-Mileage Discount: State Farm offers substantial discounts for low-mileage usage, benefiting Cadillac SRX owners who drive less.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm may not be as high compared to some competitors for the Cadillac SRX.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Cadillac SRX owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cadillac SRX Insurance Cost

The cost of insuring a Cadillac SRX varies significantly depending on the coverage level and the insurance provider. For minimum coverage, monthly rates range from $105 with USAA to $120 with Liberty Mutual.

Cadillac SRX Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $113 | $153 |

| Allstate | $118 | $158 |

| Erie | $108 | $148 |

| Farmers | $115 | $155 |

| Liberty Mutual | $120 | $160 |

| Nationwide | $112 | $152 |

| State Farm | $111 | $151 |

| The Hartford | $116 | $156 |

| Travelers | $110 | $150 |

| USAA | $105 | $145 |

For full coverage, the rates span from $145 with USAA to $160 with Liberty Mutual. On average, Cadillac SRX auto insurance costs $1,510 annually, equating to about $126 per month. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Cadillac SRX Auto Insurance Monthly Rates by Category

| Category | Rates |

|---|---|

| Average Rate | $126 |

| Discount Rate | $74 |

| High Deductibles | $109 |

| High Risk Driver | $268 |

| Low Deductibles | $158 |

| Teen Driver | $460 |

Additionally, rates differ based on specific categories; for example, drivers eligible for discounts can pay as low as $74 per month, while those with high deductibles pay around $109.

High-risk drivers face significantly higher premiums at $268 per month, and teen drivers encounter the highest rates, averaging $460 per month.

Cadillac SRXs Insurance Expenses

When comparing insurance expenses for the Cadillac SRX to other crossovers, its rates are moderate. The SRX’s monthly costs are $33 for comprehensive, $65 for collision, $22 for minimum coverage, and $129 for full coverage auto insurance.

Cadillac SRX Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Cadillac SRX | $33 | $65 | $22 | $129 |

| Lexus RX 450h | $33 | $60 | $35 | $142 |

| Lincoln MKC | $26 | $50 | $33 | $122 |

| MINI Clubman | $27 | $42 | $33 | $115 |

| Cadillac XT4 | $30 | $55 | $26 | $123 |

| Kia Sportage | $23 | $39 | $31 | $107 |

In contrast, the Lexus RX 450h is more expensive, especially for minimum and full coverage at $35 and $142, respectively. The Lincoln MKC is more affordable, with lower rates across most categories. The Kia Sportage offers the lowest rates overall, with $23 for comprehensive and $107 for full coverage. To find the cheapest Cadillac SRX insurance rates online, shop around, compare quotes, and explore discounts.

Factors Impacting the Cost of Cadillac SRX Insurance

Even though the average annual rate for the Cadillac SRX is $1,510, your policy can be higher or lower depending upon your profile. Those factors include your age, home address, driving history, and the model year of your Cadillac SRX. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

The age of the vehicle significantly impacts auto insurance rates for the Cadillac SRX. Newer models tend to have higher insurance premiums compared to older ones. Monthly insurance rates also decrease as the vehicle ages. For example, full coverage for a 2024 Cadillac SRX costs $126 per month, while it costs only $105 for a 2018 model.

Cadillac SRX Auto Insurance Monthly Rates by Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac SRX | $26 | $51 | $36 | $126 |

| 2023 Cadillac SRX | $24 | $49 | $37 | $124 |

| 2022 Cadillac SRX | $24 | $46 | $38 | $120 |

| 2021 Cadillac SRX | $23 | $43 | $38 | $117 |

| 2020 Cadillac SRX | $22 | $39 | $38 | $112 |

| 2019 Cadillac SRX | $20 | $36 | $38 | $107 |

| 2018 Cadillac SRX | $20 | $33 | $39 | $105 |

This trend is consistent across various coverage types, with newer models generally having higher rates for comprehensive, collision, minimum, and full coverage.

Insurance providers factor in the higher repair and replacement costs associated with newer vehicles. Additionally, advanced technology and safety features in newer models, while beneficial for drivers, can lead to more expensive claims for insurers.

Driver Age

Driver age significantly impacts Cadillac SRX auto insurance rates, with younger drivers generally paying higher premiums. This trend continues as auto insurance rates by age, with 50-year-olds paying $170 and 60-year-olds $160 per month.

Cadillac SRX Auto Insurance Monthly Rates by Age

| Age | Monthly Rates |

|---|---|

| Age: 18 | $480 |

| Age: 20 | $420 |

| Age: 30 | $200 |

| Age: 40 | $180 |

| Age: 50 | $170 |

| Age: 60 | $160 |

Notably, a 30-year-old driver pays around $66 more annually than a 40-year-old, illustrating how rates decrease as drivers gain more experience and are perceived as lower risk.

Driver Location

Cadillac SRX Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $210 |

| Columbus, OH | $190 |

| Houston, TX | $220 |

| Indianapolis, IN | $200 |

| Jacksonville, FL | $215 |

| Los Angeles, CA | $240 |

| New York, NY | $260 |

| Philadelphia, PA | $230 |

| Phoenix, AZ | $205 |

| Seattle, WA | $200 |

Conversely, cities like Columbus and Seattle have more moderate rates at $190 and $200, respectively. This variation highlights the importance of geographic factors, such as traffic density, crime rates, and local regulations, in determining auto insurance costs.

Your Driving Record

Your driving record significantly impacts the cost of Cadillac SRX auto insurance. Violations, such as accidents, DUIs, and tickets, can lead to higher premiums, especially for younger drivers. For instance, an 18-year-old with a clean record pays $480, but this increases to $600 with one accident, $720 with one DUI, and $550 with one ticket.

Cadillac SRX Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $480 | $600 | $720 | $550 |

| Age: 20 | $420 | $525 | $630 | $480 |

| Age: 30 | $200 | $250 | $300 | $230 |

| Age: 40 | $180 | $225 | $270 | $210 |

| Age: 50 | $170 | $215 | $255 | $200 |

| Age: 60 | $160 | $200 | $240 | $190 |

Drivers in their 20s face similar hikes, while older drivers see more moderate increases. For a 30-year-old, the cost goes from $200 with a clean record to $250 with one accident, $300 with one DUI, and $230 with one ticket. As drivers age, the impact of violations on insurance costs generally decreases. Read thoroughly our guide on how credit scores affect auto insurance rates.

Cadillac SRX Safety Ratings

The Cadillac SRX boasts impressive safety ratings, which significantly impact its auto insurance rates. Key ratings include “Good” for small overlap front (driver-side), moderate overlap front, side, roof strength, and head restraints and seats.

Cadillac SRX Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Acceptable |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The passenger-side small overlap front test receives an “Acceptable” rating. These strong safety ratings generally contribute to lower insurance premiums, as insurers view the vehicle as less risky to cover due to its robust safety performance in crash tests.

In addition to its commendable safety ratings, the Cadillac SRX is equipped with a comprehensive array of safety features designed to protect its occupants. These features include multiple airbags (driver, passenger, front head, rear head, and front side), 4-wheel ABS and disc brakes, electronic stability control, daytime running lights, child safety locks, and traction control.

#ESCALADEIQ and @simuliu have each had their renaissance. Now it’s time for yours. Explore the all-electric ESCALADE IQ. #BeIconic https://t.co/EhIjTiXbSX pic.twitter.com/5p1RJyVHGg

— Cadillac (@Cadillac) August 21, 2023

These safety technologies not only enhance the overall protection for passengers but also make the vehicle more attractive to insurers, often resulting in potential discounts on insurance premiums.

Cadillac SRX Crash Test Ratings

The Cadillac SRX has consistently received excellent crash test ratings, with overall ratings of 5 stars from 2020 to 2024. Each year, it earned 5 stars in frontal and side crash tests, and 4 stars in rollover tests.

Cadillac SRX Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Cadillac SRX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Cadillac SRX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Cadillac SRX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Cadillac SRX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Cadillac SRX | 5 stars | 5 stars | 5 stars | 4 stars |

These strong safety ratings suggest that the Cadillac SRX is well-engineered to protect occupants in various crash scenarios, which can contribute to lower auto insurance rates due to the reduced risk of injury and damage in accidents. Read our article to find the best accident forgiveness auto insurance companies.

Cadillac SRX Insurance Loss Probability

The lower percentage means lower Cadillac SRX auto insurance costs; higher percentages mean higher Cadillac SRX auto insurance costs. Compare the following Cadillac SRX auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury.

Cadillac SRX Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | 3% |

| Property Damage | 1% |

| Comprehensive | -16% |

| Personal Injury | -20% |

| Medical Payment | -18% |

| Bodily Injury | -9% |

Overall, the Cadillac SRX shows favorable insurance loss probabilities, particularly in comprehensive, PIP, and medical payment coverages. Check out our guide “Do you need medical payment coverage on auto insurance?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cadillac SRX Finance and Insurance Cost

If you are financing a Cadillac SRX, most lenders will require your carry higher Cadillac SRX coverage options including comprehensive coverage, so be sure to shop around and compare Cadillac SRX auto insurance quotes from the best auto insurance companies using our free tool below.

Ways to Save on Cadillac SRX Insurance

To save on Cadillac SRX auto insurance, there are several effective strategies you can employ. First, consider purchasing a roadside assistance program, which can reduce your overall insurance costs. Next, audit your driving habits, especially when you move to a new location or start a new job, as these changes can impact your rates.

Additionally, consider renting a car instead of buying a second Cadillac SRX, which can lower your insurance expenses. When comparing insurance rates and policies, ensure you compare similar coverage options to get the best deal. Finally, taking a defensive driving course or any driver’s education course can qualify you for discounts, further reducing your insurance premiums.

Top Cadillac SRX Insurance Companies

When considering auto insurance for a Cadillac SRX, it’s essential to look for companies that offer competitive rates, valuable auto insurance discounts, and recognize the vehicle’s safety features. The top insurance providers based on market share include State Farm, Geico, Progressive, Liberty Mutual, and Allstate.

Top 10 Cadillac SRX Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.3% |

| #2 | Geico | $46,106,971 | 6.6% |

| #3 | Progressive | $39,222,879 | 5.6% |

| #4 | Liberty Mutual | $35,600,051 | 5.1% |

| #5 | Allstate | $35,025,903 | 5% |

| #6 | Travelers | $28,016,966 | 4% |

| #7 | USAA | $23,483,080 | 3.3% |

| #8 | Chubb | $23,388,385 | 3.3% |

| #9 | Farmers | $20,643,559 | 2.9% |

| #10 | Nationwide | $18,442,145 | 2.6% |

These companies not only dominate the market but also provide a range of options and benefits tailored to the Cadillac SRX. State Farm leads with a 9.3% market share, followed by Geico at 6.6%, and Progressive at 5.6%. Other notable providers include Travelers, USAA, Chubb, Farmers, and Nationwide, all of which are known for their robust coverage options and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Cadillac SRX Insurance Quotes Online

You can easily start comparing quotes for Cadillac SRX auto insurance rates from some of the best auto insurance companies by using our free online tool now. This convenient tool allows you to input your vehicle and personal information to receive personalized insurance quotes from top providers like State Farm, Geico, Progressive, Liberty Mutual, and Allstate.

By comparing these quotes side-by-side, you can identify the most competitive rates and the best coverage options tailored to your needs. Additionally, the tool highlights available discounts and special offers, ensuring you get the best value for your Cadillac SRX insurance. Start now to save time and money on your auto insurance. Check out our guide “Where to Compare Auto Insurance Rates.“

Case Studies: Best Cadillac SRX Auto Insurance

Finding the best Cadillac SRX auto insurance involves comparing providers to determine which offers the most competitive rates and tailored coverage. The following case studies illustrate how different drivers benefitted from the top three providers.

- Case Study #1 – Comprehensive Coverage: John, a 35-year-old professional from New York, wanted extensive coverage for his 2016 Cadillac SRX. He chose Travelers due to their excellent comprehensive coverage. By leveraging Travelers’ policies, John was able to secure full coverage at a rate of $110/month, benefiting from their extensive network and claims satisfaction.

- Case Study #2 – Military Benefits: Sarah, a 30-year-old military officer, needed reliable insurance for her 2014 Cadillac SRX. USAA stood out for its exclusive benefits for military members. Sarah appreciated the personalized service and affordable rates, securing a premium policy for $105/month, which included several military discounts and perks.

- Case Study #3 – Customized Plans: Mike, a 40-year-old entrepreneur from California, sought a policy tailored to his unique needs for his 2015 Cadillac SRX. Farmers offered the flexibility he required with customizable plans. Mike opted for a plan that included comprehensive and collision coverage for $115/month, ensuring his vehicle was protected against a variety of risks.

These case studies demonstrate how Travelers, USAA, and Farmers each provide unique benefits tailored to different drivers’ needs, making them the best options for Cadillac SRX auto insurance (Read more: How to Compare Auto Insurance Quotes).

Travelers offers the best Cadillac SRX auto insurance with unmatched comprehensive coverage and competitive rates.Michelle Robbins Licensed Insurance Agent

By understanding these options, you can choose the provider that best suits your requirements and enjoy optimal coverage at competitive rates. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

What is the average cost of Cadillac SRX auto insurance?

The average cost of Cadillac SRX auto insurance is $126 per month.

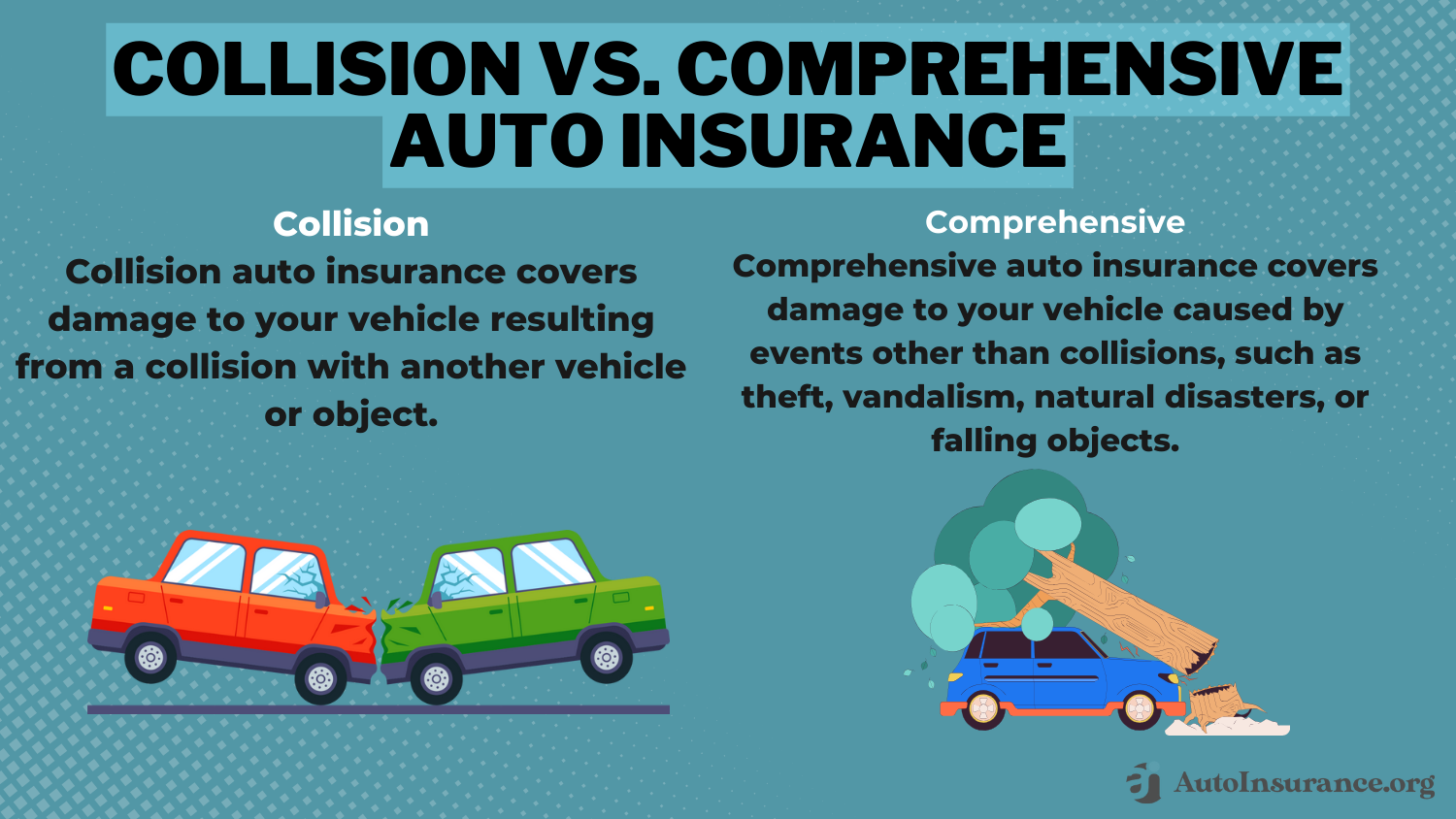

What are the average costs of comprehensive, collision, and liability coverage for Cadillac SRX insurance?

On average, comprehensive auto insurance coverage costs $368, collision coverage costs $537, and liability coverage costs $426 for Cadillac SRX insurance.

Are Cadillac SRXs expensive to insure compared to other crossovers?

The insurance rates for Cadillac SRX are comparable to other crossovers such as the Audi SQ5, Lexus RX 450h, and Lincoln MKC. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

What factors can impact the cost of Cadillac SRX insurance?

Several factors can affect the cost of Cadillac SRX insurance, including the age of the vehicle, driver’s age, driver’s location, driving record, and the safety features of the car. Check out our guide titled “Is auto insurance tax deductible?”

How does the age of the vehicle affect Cadillac SRX insurance rates?

Newer Cadillac SRX models generally have higher insurance rates compared to older models. For example, a 2016 Cadillac SRX may have higher insurance costs than a 2010 Cadillac SRX.

How does a driver’s record influence Cadillac SRX insurance costs?

A clean driving record can lead to lower insurance premiums, while a history of accidents or violations will likely increase the cost of Cadillac SRX insurance. Delve into our guide “How Auto Insurance Companies Check Driving Records.”

How does driver age impact Cadillac SRX insurance rates?

Younger drivers, such as those under 25, typically pay higher premiums for Cadillac SRX insurance, while older, more experienced drivers often benefit from lower rates.

How does the location of the driver affect Cadillac SRX insurance rates?

Drivers in urban areas with higher traffic and accident rates may pay more for Cadillac SRX insurance compared to those in rural areas with less traffic.

Are there any discounts available for Cadillac SRX insurance?

Yes, many insurance providers offer discounts for Cadillac SRX owners, such as multi-policy discounts, good driver discounts, and discounts for safety features and anti-theft devices.

What safety features of the Cadillac SRX can reduce insurance rates?

Safety features such as anti-lock brakes, airbags, electronic stability control, and advanced driver assistance systems can help lower Cadillac SRX insurance rates by reducing the risk of accidents and injuries. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.