Best Ford Mustang Mach-E Auto Insurance in 2026 (Check Out These 10 Companies)

State Farm, USAA, and Progressive are the top picks for the best Ford Mustang Mach-E auto insurance, with rates starting as low as $70 per month. State Farm leads with exceptional coverage and discounts, while USAA and Progressive also offer excellent, tailored options for the Ford Mustang Mach-E.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

Company Facts

Full Coverage for Ford Mustang Mach-E

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Mustang Mach-E

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Mustang Mach-E

A.M. Best Rating

Complaint Level

Pros & Cons

The best Ford Mustang Mach-E auto insurance providers are State Farm, USAA, and Progressive, known for their exceptional coverage and customer service.

These companies excel in offering reliable insurance tailored specifically for the unique needs of Ford Mustang Mach-E owners. See more details in our guide titled “Best Auto Insurance Companies.”

Our Top 10 Company Picks: Best Ford Mustang Mach-E Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Comprehensive Coverage State Farm

![]()

#2 10% A++ Military Savings USAA

![]()

#3 12% A+ Flexible Options Progressive

#4 15% A+ High Savings Allstate

#5 10% A Great Benefits Farmers

#6 12% A Affordable Rates Liberty Mutual

#7 10% A+ Strong Coverage Nationwide

#8 13% A++ Broad Coverage Travelers

#9 15% A Flexible Policies American Family

#10 10% A+ Excellent Service The Hartford

By selecting from these top insurers, drivers can enjoy comprehensive protection and excellent value. Mach-E owners need to consider factors like claims service, customer support, and available discounts when choosing their insurer. To compare Ford Mustang Mach-E auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- State Farm leads as the top provider of Ford Mustang Mach-E insurance

- Coverage and addresses the Mach-E’s advanced tech and safety features

- Tailored policies meet the specific needs of electric vehicle owners

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple policies, including Ford Mustang Mach-E auto insurance. Discover insights in our guide titled, State Farm auto insurance review.

- High Low-Mileage Discount: Owners of the Ford Mustang Mach-E who drive fewer miles can benefit from State Farm’s substantial low-mileage discounts.

- Wide Coverage: Tailored options for Ford Mustang Mach-E ensure comprehensive coverage for a variety of driving and vehicle protection needs.

Cons

- Limited Multi-Policy Discount: At 17%, State Farm’s multi-policy discount is lower compared to some competitors for Ford Mustang Mach-E insurance.

- Premium Costs: Despite the available discounts, premiums for the Ford Mustang Mach-E can still be relatively high at State Farm, depending on coverage level and other factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Superior A++ Rating: USAA’s A++ AM Best rating ensures top-tier financial stability for Ford Mustang Mach-E insurance. Unlock details in our guide titled, USAA auto insurance review.

- Military-Specific Discounts: USAA provides tailored discounts for military personnel, enhancing affordability for Ford Mustang Mach-E owners in the armed forces.

- Additional Vehicle Savings: Ford Mustang Mach-E owners who are veterans or active military can enjoy additional savings on their vehicle insurance through USAA.

Cons

- Eligibility Restrictions: USAA’s services, including Ford Mustang Mach-E insurance, are only available to military members and their families.

- Limited Availability: Due to its military-only focus, non-military Ford Mustang Mach-E owners cannot benefit from USAA’s insurance offerings.

#3 – Progressive: Best for Flexible Options

Pros

- Customizable Policies: Progressive offers highly customizable policy options, allowing Ford Mustang Mach-E owners to tailor their coverage as needed.

- Loyalty Rewards: Progressive rewards long-term Ford Mustang Mach-E insurance holders with progressive discounts and benefits. Delve into our evaluation of Progressive auto insurance review.

- Online Tools and Resources: Extensive online tools help Ford Mustang Mach-E owners manage their policies and claims efficiently.

Cons

- Variable Customer Service: Customer service experiences with Progressive can vary, potentially affecting Ford Mustang Mach-E owners during claims.

- Rate Fluctuations: Ford Mustang Mach-E owners might experience rate fluctuations with Progressive, depending on driving records and other personal factors.

#4 – Allstate: Best for High Savings

Pros

- Competitive Multi-Policy Discount: Allstate offers a robust 15% discount for bundling, which includes Ford Mustang Mach-E auto insurance. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Safe Driving Bonuses: Ford Mustang Mach-E owners benefit from Allstate’s safe driving bonuses, rewarding careful drivers with lower premiums.

- Innovative Tools: Allstate provides advanced tools like Drivewise to help Ford Mustang Mach-E owners track and improve driving habits, potentially lowering rates.

Cons

- Higher Base Rates: Despite the discounts, Allstate’s base rates for Ford Mustang Mach-E insurance can be higher than some competitors.

- Claims Satisfaction Variability: Some Ford Mustang Mach-E owners might find variability in satisfaction with Allstate’s claims process, depending on the region.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Benefits Specialist

Pros

- Customizable Coverage Options: Farmers offers a variety of coverage enhancements specifically beneficial for Ford Mustang Mach-E, allowing for highly personalized policies.

- Dedicated Claims Service: Farmers provides dedicated claims service that ensures Ford Mustang Mach-E owners receive efficient and effective support when needed.

- Affinity Discounts: Additional discounts are available for Ford Mustang Mach-E owners through professional and alumni associations that partner with Farmers. More information is available about this provider in our Farmers auto insurance review.

Cons

- Premium Pricing: While offering great benefits, Farmers’ premiums for Ford Mustang Mach-E insurance tend to be on the higher side compared to some other insurers.

- Limited Discount Impact: The 10% multi-policy discount may not significantly offset the higher premium costs for Ford Mustang Mach-E insurance at Farmers.

#6 – Liberty Mutual: Best for Affordable Rates

Pros

- Competitive Pricing: Liberty Mutual offers competitively priced Ford Mustang Mach-E auto insurance, making it an affordable option for many drivers.

- Accident Forgiveness: Ford Mustang Mach-E owners can benefit from Liberty Mutual’s accident forgiveness program, preventing rate increases after the first accident.

- Customization Opportunities: Extensive customization options allow Ford Mustang Mach-E owners to tailor their insurance to their specific needs. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Inconsistent Agent Experience: Experiences with individual agents can vary, which might affect the service quality for Ford Mustang Mach-E insurance holders.

- Advertisement Over Claims Focus: Some customers feel Liberty Mutual prioritizes marketing over claims service, which could affect Ford Mustang Mach-E owners during claim processing.

#7 – Nationwide: Best for Strong Coverage

Pros

- Broad Coverage Options: Nationwide offers a wide range of coverage options that cater well to the unique aspects of insuring a Ford Mustang Mach-E.

- Vanishing Deductible: Ford Mustang Mach-E owners can take advantage of Nationwide’s vanishing deductible, which reduces the deductible for each year of safe driving.

- SmartRide Discount: Nationwide’s SmartRide program offers discounts for safe driving, which is particularly beneficial for Ford Mustang Mach-E owners. Read up on the Nationwide auto insurance review for more information.

Cons

- Customer Service Variations: While generally positive, the customer service experience can vary, which might impact Ford Mustang Mach-E owners during policy management and claims.

- Rate Adjustments: Nationwide may adjust rates based on state and driving behavior, which could unpredictably affect Ford Mustang Mach-E insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Broad Coverage

Pros

- High AM Best Rating: With an A++ rating from AM Best, Travelers offers superior financial stability for Ford Mustang Mach-E insurance. See more details in our guide titled, “Travelers Auto Insurance Review.”

- IntelliDrive Program: Travelers’ IntelliDrive program monitors driving behavior, potentially reducing rates for Ford Mustang Mach-E owners who demonstrate safe driving.

- Hybrid/Electric Vehicle Discount: Ford Mustang Mach-E owners can benefit from additional discounts specifically for owning an electric vehicle.

Cons

- Complex Policy Options: Travelers offers numerous policy options and riders, which can be complex and difficult for some Ford Mustang Mach-E owners to navigate.

- Pricing Structure Complexity: The cost structure for Ford Mustang Mach-E insurance can be complicated, affecting affordability and transparency.

#9 – American Family: Best for Flexible Policies

Pros

- Flexible Policy Features: American Family offers a range of flexible policy features that suit the diverse needs of Ford Mustang Mach-E owners. See more details in our guide titled, “American Family Auto Insurance Review.”

- MyAmFam App: The MyAmFam app makes it easy for Ford Mustang Mach-E owners to manage their policies, file claims, and track claims progress on the go.

- Loyalty Discounts: Long-term customers, including Ford Mustang Mach-E owners, enjoy loyalty discounts that reward their continued patronage.

Cons

- Limited Geographic Reach: American Family is not available in all states, limiting options for some Ford Mustang Mach-E owners.

- Rate Variability: Premium rates for Ford Mustang Mach-E insurance may vary more than expected due to local regulations and driving patterns.

#10 – The Hartford: Best for Service Provider

Pros

- Tailored Services for Older Drivers: The Hartford offers services and discounts tailored to older Ford Mustang Mach-E owners, enhancing accessibility and affordability.

- High Customer Satisfaction: The Hartford is known for high customer satisfaction, particularly in handling claims from Ford Mustang Mach-E owners. Learn more in our complete The Hartford auto insurance review.

- Lifetime Car Repair Assurance: Ford Mustang Mach-E owners benefit from The Hartford’s lifetime car repair assurance when they choose a service provider from The Hartford’s approved network.

Cons

- Age-Focused Benefits: While beneficial for older drivers, younger Ford Mustang Mach-E owners might not find as many advantages or discounts.

- Higher Rates for Some: Despite excellent service, The Hartford’s rates can be higher for certain demographics of Ford Mustang Mach-E owners, not aligning with everyone’s budget needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Mustang Mach-E Insurance Rate Comparison

This section presents a detailed overview of the monthly rates for Ford Mustang Mach-E auto insurance. The table below compares the costs of minimum and full coverage across several leading insurance providers.

Ford Mustang Mach-E Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $145

American Family $76 $136

Farmers $78 $138

Liberty Mutual $82 $142

Nationwide $77 $137

Progressive $75 $135

State Farm $80 $140

The Hartford $79 $139

Travelers $80 $140

USAA $70 $130

The table outlines the monthly insurance rates for the Ford Mustang Mach-E, indicating significant differences in premiums between minimum and full coverage options. For instance, Allstate charges $85 for minimum coverage and escalates to $145 for full coverage.

In contrast, USAA offers the most affordable rates, with minimum coverage at $70 and full coverage at $130. Other providers like State Farm and Travelers offer competitive rates, both at $80 for minimum and $140 for full coverage.

This data is essential for Ford Mustang Mach-E owners seeking to balance affordability with comprehensive protection. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

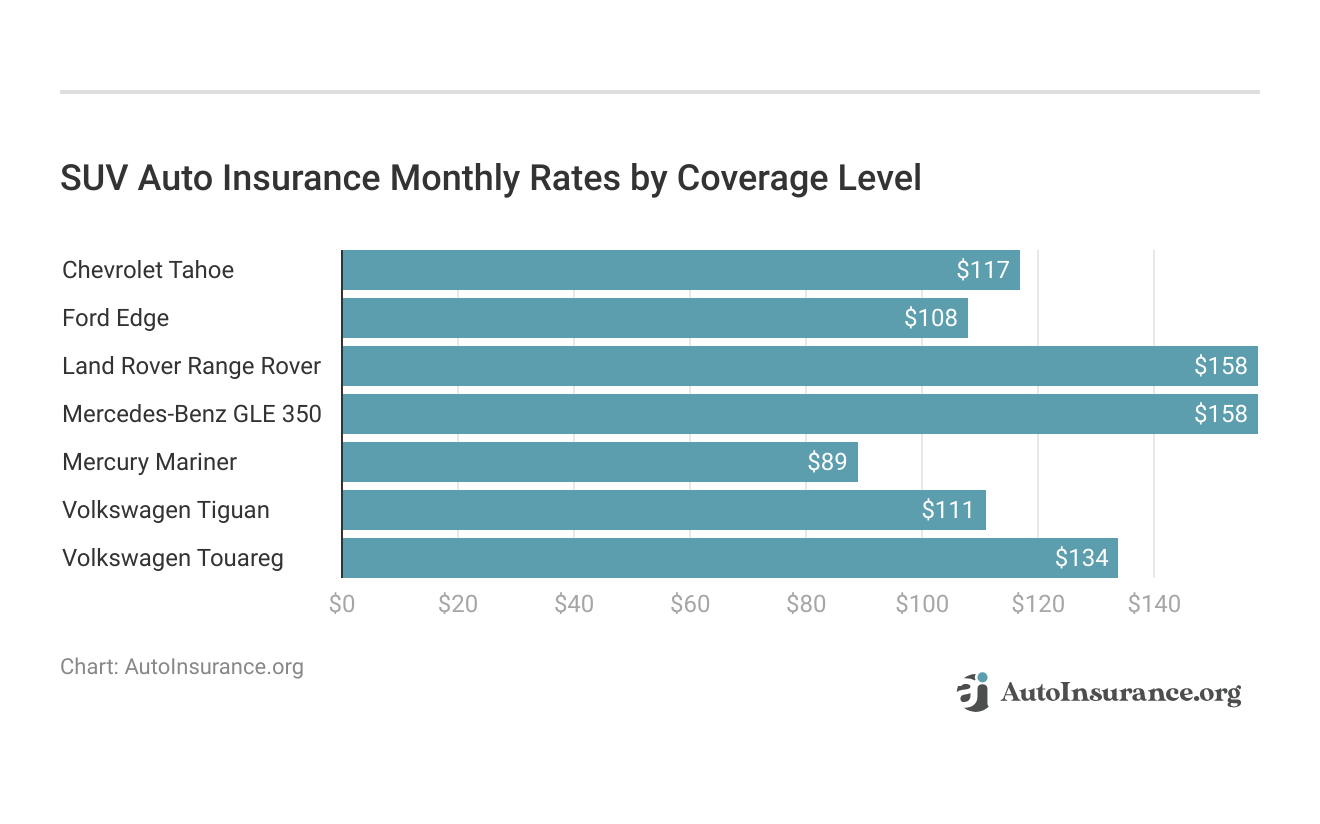

Are Vehicles Like the Ford Mustang Mach-E Expensive to Insure

When considering the insurance costs for electric SUVs like the Ford Mustang Mach-E, comparing rates with other similar models provides valuable insight. Here, we look at how the insurance expenses for vehicles such as the Audi Q8, Jeep Compass, and Jaguar E-Pace stack up.

Understanding the average insurance rates for SUVs similar to the Ford Mustang Mach-E can help potential owners anticipate the cost of comprehensive, collision, liability, and full coverage.

This comparison ensures informed decisions are made when choosing insurance for a new vehicle. For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

Analyzing these rates helps in assessing the competitive insurance landscape, enabling Ford Mustang Mach-E owners to make informed decisions when selecting the most cost-effective and suitable insurance coverage.

Insurance Rates for Vehicles Similar to the Ford Mustang Mach-E

When exploring insurance costs for electric SUVs, it’s beneficial to compare the Ford Mustang Mach-E with similar vehicles. Here’s how insurance rates stack up for various models across comprehensive, collision, and liability coverage categories.

Ford Mustang Mach-E Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Cadillac Escalade ESV | $39 | $60 | $33 | $144 |

| Mitsubishi Outlander | $27 | $47 | $26 | $111 |

| Honda Pilot | $28 | $39 | $31 | $111 |

| Jeep Patriot | $21 | $36 | $35 | $105 |

| BMW X3 | $31 | $55 | $31 | $130 |

| Volkswagen Touareg | $31 | $58 | $33 | $134 |

| Volkswagen Tiguan | $27 | $47 | $26 | $111 |

| GMC Yukon XL | $30 | $47 | $31 | $121 |

The comparison illustrates that while the Ford Mustang Mach-E might attract specific rates due to its features, similar vehicles like the Cadillac Escalade ESV and BMW X3 generally carry higher overall insurance costs. Understanding these differences can help potential buyers make informed decisions about the total cost of ownership for similar models.

What Impacts the Cost of Ford Mustang Mach-E Insurance

The Ford Mustang Mach-E trim and model you choose can impact the total price you will pay for Ford Mustang Mach-E insurance coverage.

You can also expect your Ford Mustang Mach-E rates to be affected by where you live, your driving history, and in most states your age and gender. Access comprehensive insights into our guide titled, “Factors That Affect Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Is the Ford Mustang Mach-E

The average cost to buy a new Ford Mustang Mach-E is $42,895. This cost will be affected by the trim level of your Ford Mustang Mach-E and any options you might choose to add. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Ways to Save on Ford Mustang Mach-E Insurance Cost

There are several ways you can save even more on your Ford Mach-E insurance cost. Take a look at the following five tips:

- Work with a direct insurer instead of an insurance broker for your Ford Mustang Mach-E.

- Don’t assume your Ford Mustang Mach-E is cheaper to insure than another vehicle.

- Compare apples to apples when comparing Ford Mustang Mach-E insurance quotes and policies.

- Take a defensive driving course or any driver’s education course.

- Re-check Ford Mustang Mach-E quotes every 6 months.

By employing these cost-saving measures—such as working directly with insurers, regularly comparing quotes, and enhancing your driving skills—you can ensure that your Ford Mustang Mach-E remains affordably insured. Revisiting these strategies every six months can keep your costs optimized as circumstances change. Delve into our evaluation of “How to Save on Auto Insurance With Three Vehicles.”

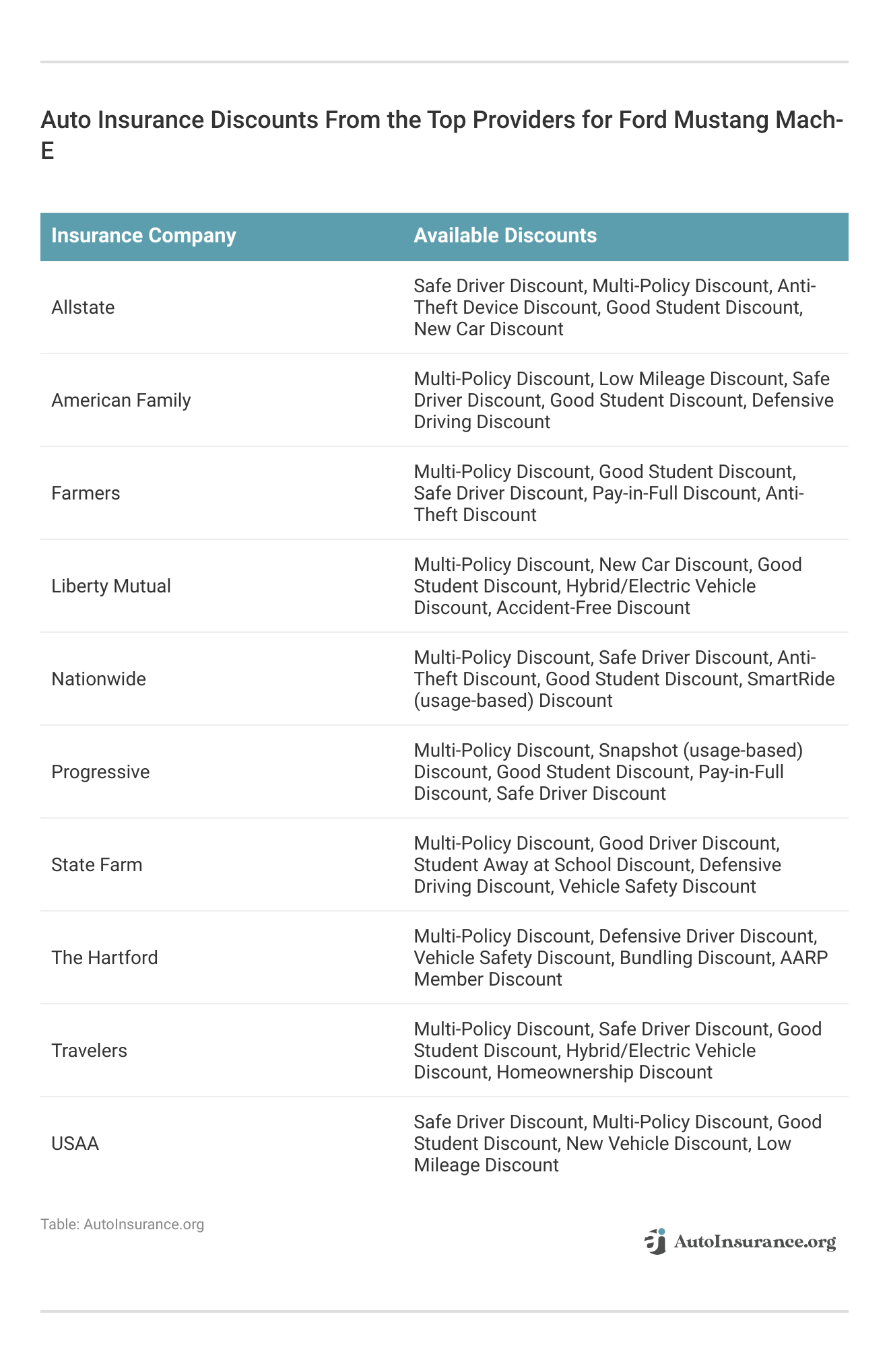

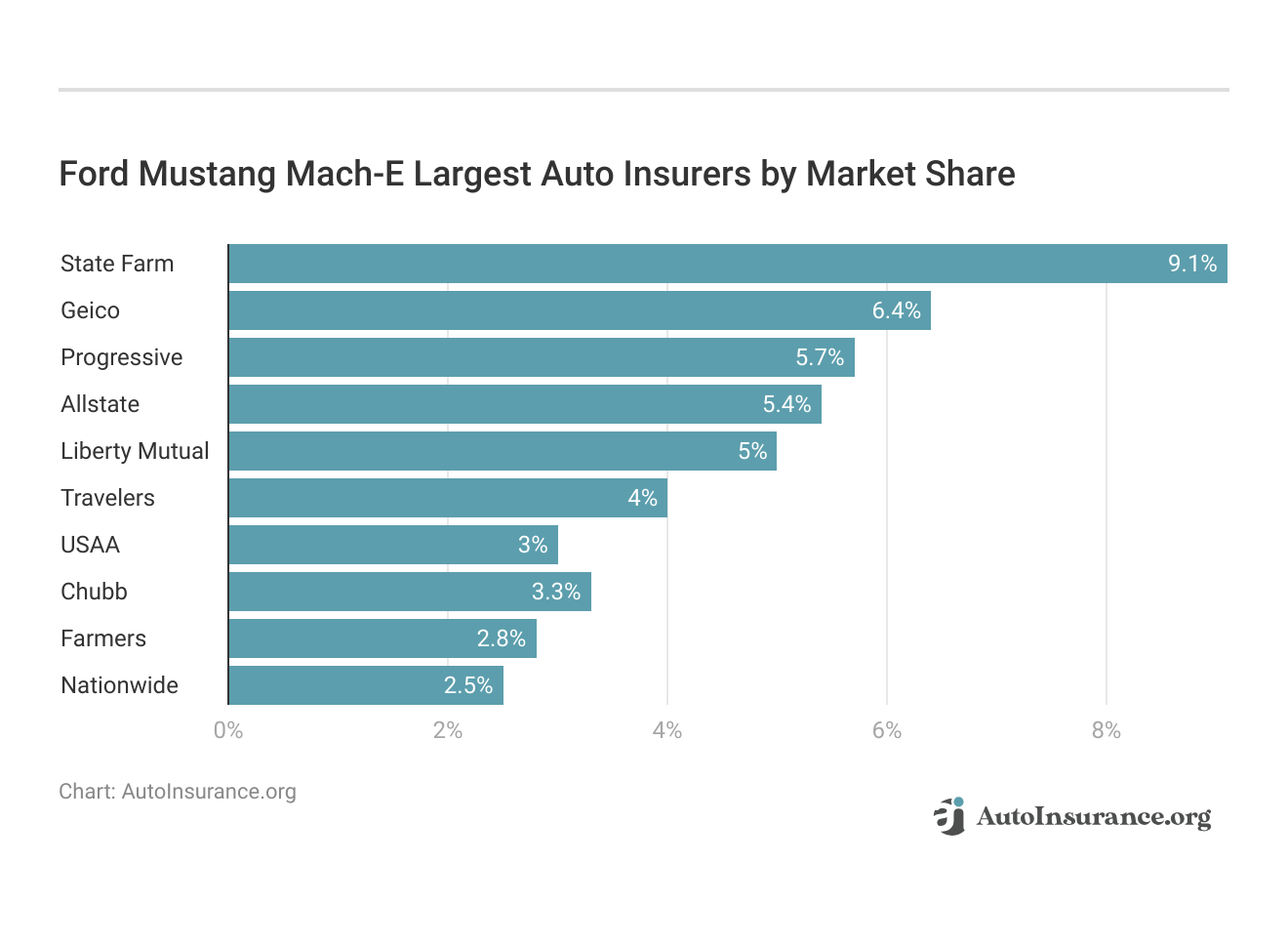

Top Ford Mustang Mach-E Insurance Companies

Selecting the right insurer for your Ford Mustang Mach-E involves understanding which companies provide the best rates and coverage options. This guide highlights the top insurers by market share, many of which offer specialized discounts for safety features inherent to the Mach-E. Learn more in our complete “Types of Auto Insurance.”

When choosing an insurance provider for the Ford Mustang Mach-E, consider companies like State Farm, Geico, and Progressive, which lead in market share and are recognized for their competitive rates and comprehensive coverage. Assessing these top insurers will help ensure that you receive the best possible insurance for your vehicle.

Largest Auto Insurers by Market Share

Market share is a critical indicator of an insurer’s influence and reach within the auto insurance industry. The following table lists the largest auto insurers by market share, highlighting their respective volumes and the percentage of the market they control.

Ford Mustang Mach-E Largest Auto Insurers by Market Share

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

This data provides a clear picture of the competitive landscape in the auto insurance sector, with companies like State Farm and Geico leading in market share.

Choosing State Farm means opting for the leader in Ford Mustang Mach-E insurance, thanks to their adaptability and customer-first approach.Chris Abrams Licensed Insurance Agent

Such information is vital for consumers and investors looking to understand which companies are the most dominant and influential in the market.

Using our free online tool today, you can start comparing quotes for Ford Mustang Mach-E insurance from some of the top car insurance companies.

Frequently Asked Questions

What type of coverage do I need for my Ford Mustang Mach-E?

The recommended coverage for your Ford Mustang Mach-E includes liability insurance, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. You may also consider additional optional coverage based on your needs.

For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

Does the color of my Ford Mustang Mach-E affect my insurance rates?

No, the color of your vehicle, including the Ford Mustang Mach-E, typically does not impact your insurance rates. Insurance companies primarily consider factors such as the make, model, trim, age, and safety features of the vehicle.

Can I get insurance coverage for modifications or aftermarket additions to my Ford Mustang Mach-E?

Yes, you can typically get coverage for modifications or aftermarket additions to your Ford Mustang Mach-E. However, it’s important to inform your insurance company about any modifications you’ve made and discuss the coverage options available for those modifications.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Can I transfer my current insurance policy to my new Ford Mustang Mach-E?

In most cases, you can transfer your current insurance policy to your new Ford Mustang Mach-E. However, it’s recommended to contact your insurance provider and inform them about the change of vehicle to ensure proper coverage.

Do I need additional insurance coverage if I use my Ford Mustang Mach-E for ridesharing or delivery services?

Yes, if you use your Ford Mustang Mach-E for ridesharing or delivery services, you will likely need additional coverage beyond personal auto insurance. Most personal policies do not cover commercial activities, so it’s important to discuss your specific situation with your insurance provider.

To find out more, explore our guide titled, “Best Rideshare Auto Insurance.”

What is the typical Mach E insurance cost?

The monthly cost for Mach E insurance varies but is generally influenced by factors like location, driving history, and chosen coverage levels.

How much does Ford Mach E insurance cost on average?

On average, Ford Mach E insurance cost can range widely based on individual driver profiles and the model specifics.

What should I expect for Mustang Mach E insurance cost?

Mustang Mach E insurance cost depends on the trim level, your driving record, and the insurance provider, but it is comparable to other vehicles in its class.

Can you provide an estimate for Ford Mustang Mach E insurance cost?

Ford Mustang Mach E insurance cost typically aligns with other high-performance electric vehicles, factoring in the car’s value and safety features.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

What are the key factors that affect Mach E insurance rates?

Mach E insurance rates are primarily affected by your driving history, the car’s safety features, and how frequently you drive.

What is the best car insurance for Mustang Mach E?

How does Ford Mustang insurance differ from other car insurance?

What does insurance cost for Mustang Mach E typically include?

What should I look for in insurance for a Ford Mustang?

What factors influence Mustang insurance rates the most?

What insurance group is the Ford Mustang Mach E in?

How much is insurance for a V6 Mustang?

What are the typical costs for insurance for Mustang Mach E?

What is the premium range for a Mach E?

What is the average Mustang insurance price?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.