Best Pay-As-You-Go Auto Insurance in Illinois (Top 9 Companies Ranked for 2026)

Allstate, Nationwide, and Progressive have the best pay-as-you-go auto insurance in Illinois. This usage-based insurance benefits infrequent drivers in Illinois seeking flexible coverage. Pay-as-you-go insurance rates start at $31/month but increase the more you drive. Allstate won't raise rates for bad driving.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best pay-as-you-go auto insurance in Illinois features top providers like Allstate, Nationwide, and Progressive.

Pay-per-mile and usage-based auto insurance help ensure that you only pay for the coverage you need, making it a smart choice for cost-conscious drivers.

Our Top 9 Company Picks: Best Pay-As-You-Go Auto Insurance in Illinois

Company Rank Usaged-Based Discounts A.M. Best Best For Jump to Pros/Cons

![]()

#1 40% A+ Infrequent Drivers Allstate

#2 40% A+ UBI Discount Nationwide

#3 30% A+ Cheap Rates Progressive

#4 30% A Customizable Policies Liberty Mutual

#5 40% A- Mobile App Metromile

#6 30% B Young Drivers State Farm

#7 30% A++ Data Concerns Travelers

#8 30% NR Roadside Assistance Root

#9 30% A Costco Members American Family

Progressive has the cheapest pay-as-you-go auto insurance rates for $39/mo, but rates go up with bad driving habits. Allstate and Nationwide will only track mileage. Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Allstate leads with rates starting at $52/month

- Pay-as-you-go auto insurance adjusts rates based on mileage and habits

- Ideal for Illinois drivers who prefer flexible, usage-based coverage

#1 – Allstate: Top Overall Pick

Pros

- Low-Mileage Discounts: Read our Allstate Milewise review, which highlights substantial savings for Illinois drivers opting for low-mileage pay-as-you-go insurance.

- Affordable Rates: Milewise focuses solely on mileage in Illinois, offering competitive pay-per-mile pay-as-you-go insurance rates.

- Flexible Coverage: Various coverage options in Illinois, including unlimited mileage or daily rates, tailored for pay-as-you-go insurance needs.

Cons

- Drains Phone Battery: Milewise pay-as-you-go insurance usage often leads to increased phone battery drain during longer drives in Illinois.

- Customer Service: Reports of inconsistent service experiences detract from Allstate’s appeal for pay-as-you-go insurance in Illinois.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best Usage-Based Discount

Pros

- Low-Mileage Savings: Read our Nationwide SmartMiles review to learn how infrequent drivers save 40% on their pay-as-you-go auto insurance in Illinois.

- Affordable Rates: SmartMiles offers competitively priced pay-as-you-go insurance in Illinois by tracking only mileage.

- Safe-Driving Bonus: Safe driving in Illinois can earn drivers an additional 10% off their pay-as-you-go auto insurance.

Cons

- Poor Customer Service: Nationwide ranks lowest for customer satisfaction among Illinois pay-as-you-go insurance providers.

- Telematics Enrollment: Mandatory telematics sign-up may be inconvenient for some seeking pay-as-you-go insurance in Illinois.

#3 – Progressive: Cheap Rates

Pros

- Telematics Savings: In line with our Progressive Snapshot review, the company offers savings through telematics for safe driving specifically for Illinois pay-as-you-go insurance.

- Competitive Rates: Safe drivers in Illinois can access cheap pay-as-you-go insurance rates starting at $39/month through Snapshot.

- Flexible Coverage: Wide range of coverage options tailored to the diverse needs of Illinois pay-as-you-go insurance customers.

Cons

- Telematics Dependency: Heavy reliance on telematics might deter some Illinois drivers from choosing Progressive for pay-as-you-go insurance.

- Service Variability: Customer service quality varies across Illinois, with some inconsistency reported in handling pay-as-you-go insurance claims and queries.

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Policies: See our Liberty Mutual RightTrack review offers extensive auto insurance customization options for pay-as-you-go customers in Illinois.

- Big Discounts: Usage-based and safe driving discounts can save Illinois drivers up to 30% on their pay-as-you-go auto insurance.

- Flexible Coverage: Extensive customization options cater specifically to Illinois drivers using pay-as-you-go insurance.

Cons

- Higher Premiums: Pay-as-you-go auto insurance rates in Illinois are notably higher, starting at $56/month.

- Poor Claims Service: Noted as the least satisfactory among Illinois companies for handling pay-as-you-go insurance claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Metromile: Best for Mobile App

Pros

- Innovative Technology: View our Metromile auto insurance review, showcasing its user-friendly Metromile’s app is praised for enhancing the pay-as-you-go auto insurance experience in Illinois.

- Beyond Telematics: Metromile’s pay-as-you-go insurance tracks comprehensive driving data, offering additional features like diagnostics and GPS tracking for drivers in Illinois.

- Cheapest Rates: Provides the lowest average rates for pay-as-you-go auto insurance in Illinois, starting at $31/month.

Cons

- Mobile Data Requirement: Heavy reliance on Metromile’s mobile app for managing pay-as-you-go insurance can increase data usage, a concern for some Illinois policyholders.

- Fewer Options: Limited discounts and fewer policy choices compared to larger pay-as-you-go auto insurance companies in Illinois.

#6 – State Farm: Best for Young Drivers

Pros

- Comprehensive Coverage: According to our State Farm Drive Safe and Save review, the company offers a range of pay-as-you-go insurance options specifically for Illinois drivers.

- Young Driver Discounts: Illinois teen drivers benefit from additional discounts for safe driving and enrolling in programs like Steer Clear, enhancing their pay-as-you-go insurance savings with State Farm.

- Extensive Network: Robust agency network provides personalized service for pay-as-you-go insurance customers across Illinois.

Cons

- Financial Downgrade: Recent downgrade by A.M. Best could affect reliability for pay-as-you-go insurance claims in Illinois.

- Telematics Enrollment: Installation and tracking requirements for obtaining discounts on pay-as-you-go insurance may not appeal to all drivers in Illinois, especially those using State Farm.

#7 – Travelers: Best for Drivers With Data Concerns

Pros

- Telematics Discounts: Follow our Travelers IntelliDrive review for significant auto insurance discounts for safe driving in Illinois through pay-as-you-go insurance.

- 90-Day Tracking: Only requires 90 days of tracking before applying annual discounts to Illinois pay-as-you-go car insurance.

- Competitive Rates: Offers affordable rates without constant monitoring, appealing for Illinois pay-as-you-go insurance at $44/month.

Cons

- Rate Increases: IntelliDrive can increase rates for bad driving in Illinois, affecting pay-as-you-go insurance costs.

- Poor Claims Service: Known for below-average auto insurance claims handling in Illinois, particularly in the context of pay-as-you-go insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Root: Best for Roadside Assistance

Pros

- Free Roadside Assistance: Each pay-as-you-go insurance policy in Illinois includes 24-hour roadside help via the Root app. Explore our Root auto insurance review to learn more.

- Safe Driver Discounts: Substantial savings for Illinois drivers who maintain good driving records under pay-as-you-go policies.

- Low Rates: Offers competitive monthly rates around $41, appealing for pay-as-you-go insurance seekers in Illinois.

Cons

- App Dependency: Extensive use of the mobile app required for managing pay-as-you-go policies may be a drawback for some in Illinois.

- Fewer Options: Limited customization for pay-as-you-go auto insurance policies available in Illinois.

#9 – American Family: Best for Costco Members

Pros

- Member Discounts: Offers special rates for Costco members on pay-as-you-go auto insurance in Illinois.

- Customizable Coverage: Delve into our American Family Insurance KnowYourDrive review to discover a range of customizable coverage options, tailored for drivers seeking pay-as-you-go insurance in Illinois.

- Affordable Rates: Competitive pricing for Illinois drivers, with low-mileage pay-as-you-go insurance rates averaging at $46/month.

Cons

- Membership Requirement: Costco membership necessary for some discounts on pay-as-you-go insurance in Illinois.

- Telematics Enrollment: Mandatory telematics installation and tracking for obtaining discounts on pay-as-you-go insurance in Illinois.

Pay-As-You-Go Auto Insurance Rates in Illinois

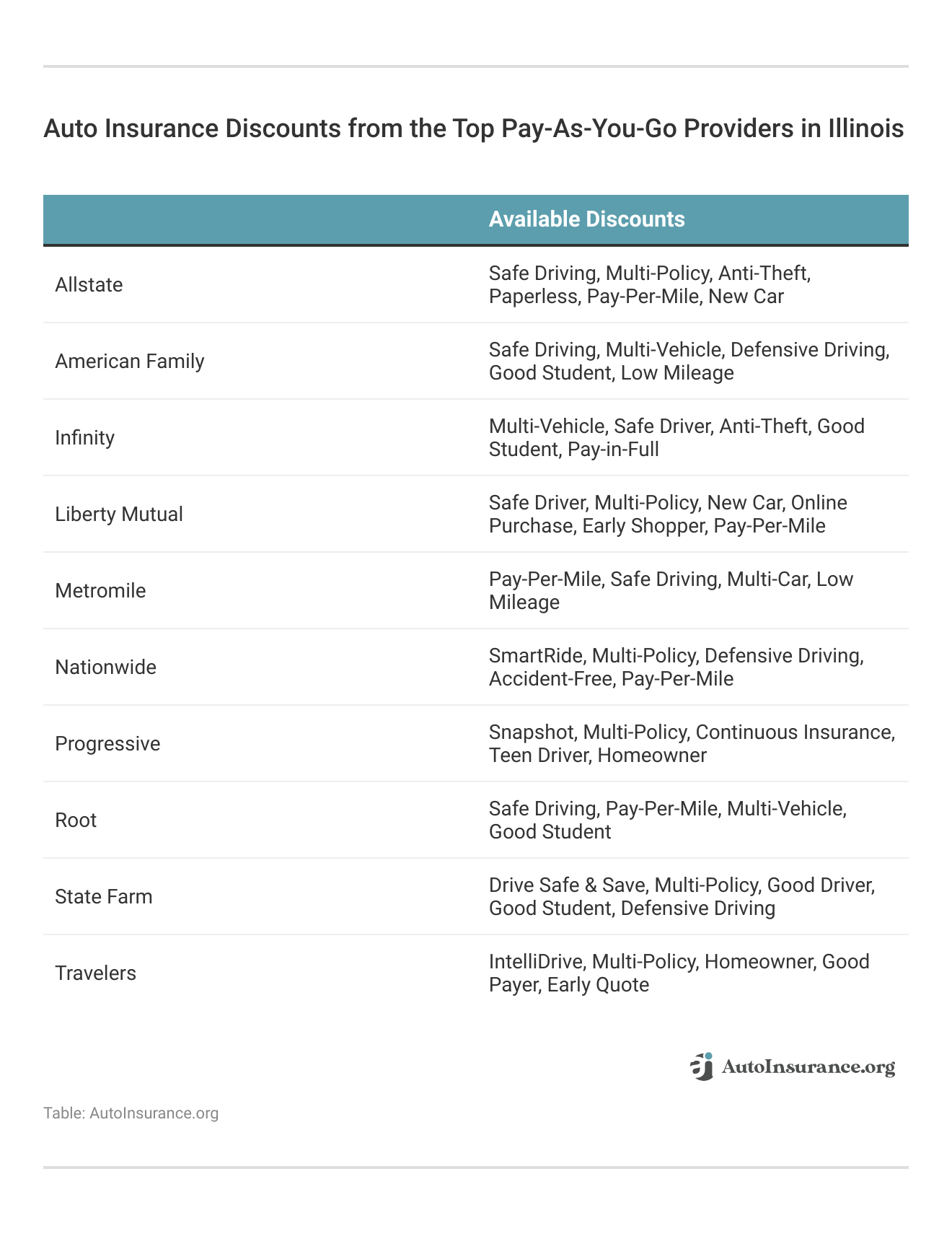

The table outlines monthly rates for Pay-As-You-Go (PAYG) auto insurance in Illinois, categorized by provider and level of coverage. The type and amount of coverage you select affect your rates, so we compare both minimum and full coverage options for the top nine companies, including Allstate, Progressive, and State Farm.

Illinois Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $52 $147

American Family $46 $144

Liberty Mutual $56 $159

Metromile $31 $118

Nationwide $48 $143

Progressive $39 $136

Root $41 $134

State Farm $37 $128

Travelers $44 $142

Rates for minimum coverage start as low as $31/month with Metromile and go up to $56 with Liberty Mutual, while monthly full coverage rates range from $118 with Metromile to $159 with Liberty Mutual.

PAYG insurance benefits low-mileage drivers with cheap auto insurance for infrequent drivers, and the telematics systems provide more detailed data on driving behavior for more accurate risk assessment and better rates on Illinois auto insurance.

Factors Influencing PAYG Auto Insurance in Illinois

When considering pay-as-you-go auto insurance in Illinois, several factors that affect auto insurance rates, like credit score, age, and gender, won’t impact your rates nearly as much as other companies.

Pay-as-you-go car insurance primarily bases its rates on how much you drive, rewarding less frequent driving with lower premiums, and uses telematics to track mileage and driving behavior.Laura Berry Former Licensed Insurance Producer

The make and model of your vehicle, your place of residence, and your driving record also impact the costs, with safer cars, rural locations, and clean driving records typically resulting in lower rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pay-As-You-Go Auto Insurance Discounts in Illinois

Many providers offer discounts for safe driving, low mileage, and policy bundling, so compare the available discounts from the best pay-as-you-go auto insurance companies in Illinois to maximize your car insurance savings.

Safe driving discounts are also common, where insurers that use telematics to monitor driving behavior such as speed, braking, and time of day, offer lower rates to those who demonstrate safe driving habits. Learn how to get a low-mileage auto insurance discount.

Not all of the Illinois auto insurance companies on our list track driving habits, so take advantage of automatic payment plans or pay your premium in full to get discounts. Many PAYG insurers also provide discounts for policy bundling, allowing you to save by combining auto insurance with other types of insurance.

To make the most of PAYG auto insurance in Illinois, implement the following smart strategies to save even more money:

- Bundle Policies: Consider bundling your PAYG auto insurance with other policies, like home or renters insurance, to take advantage of multi-policy discounts.

- Avoid Infractions: Auto insurance companies check driving records, so maintain a clean record and avoid claims to get discounts and lower PAYG rates.

- Compare Quotes: Regularly compare quotes from different providers to find the best deal on Illinois insurance.

Stay informed about new discounts or policy changes by communicating with your provider and comparing pay-as-you-go insurance quotes online.

Case Studies: Pay-As-You-Go Auto Insurance in Illinois

These case studies, based on real-world scenarios, illustrate the benefits and different coverage options from the top pay-as-you-go car insurance companies in Illinois:

- Case Study #1 – Flexible Coverage: Sarah, 30, drives infrequently and opted for Allstate Milewise. She leveraged telematics to monitor her mileage and tailored her premiums to her actual usage. Sarah also qualified for multiple discounts, including safe driving and early signing, reducing her monthly premium to $35.

- Case Study #2 – Reliable Service: Tom, 45, commutes occasionally and chose Nationwide SmartMiles to track his mileage accurately. Tom qualified for low-mileage discounts and saved money by bundling his auto insurance with home insurance, reducing his monthly premium to $40.

- Case Study #3 – Affordable Rates: Linda, 27, works from home and rarely drives. She selected Progressive Snapshot for its affordable rates. By maintaining a clean driving record, Linda lowered her premium to $32/month and received additional savings from automatic payment discounts.

Coverage offerings are diverse, allowing customers to potentially lower their Illinois car insurance rates by qualifying for multiple discounts along with pay-as-you-go savings.

Allstate leads the pack in Illinois with a stellar 95% customer satisfaction rate, making it the top choice for pay-as-you-go auto insurance.Daniel Walker Licensed Auto Insurance Agent

It’s possible to use usage-based technology to maximize savings in Illinois in many different ways, but it’s essential to compare options to find the best coverage for your needs.

Essential Guide to The Best Pay-As-You-Go Auto Insurance in Illinois

Understanding how annual mileage affects your auto insurance rates is crucial. PAYG insurance tailors premiums to actual usage, potentially saving money.

Telematics devices or apps record driving data, including mileage, speed, and driving behavior, which insurers use to calculate premiums. Several auto insurance discounts can further reduce PAYG insurance costs, such as low-mileage discounts, safe driving discounts for good driving behavior, policy bundling discounts, and incentives for maintaining a clean driving record.

The Milewise device accurately captures mileage and lets us provide you personalized driving feedback, account details, and Allstate Rewards points. The small device plugs into your car’s diagnostics port, usually located under the steering column. ^SE https://t.co/vYIVrwsUyL

— Allstate (@Allstate) December 4, 2020

Some insurers offer early signing discounts, automatic payment discounts, and full payment discounts. When selecting a PAYG insurance plan, it’s crucial to compare quotes from different providers to find the best rates and inquire about all available discounts.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the best Illinois auto insurance companies.

Frequently Asked Questions

What is the best car insurance in Illinois for pay-as-you-go auto insurance?

The best car insurance in Illinois for pay-as-you-go plans includes top providers like Allstate, Nationwide, and Progressive, known for their flexible and affordable coverage options.

What is the average cost of auto insurance in Illinois for pay-as-you-go auto insurance?

The average cost of pay-as-you-go auto insurance in Illinois typically ranges from $30 to $70 per month, depending on driving habits and mileage.

What are the cheapest full-coverage auto insurance options for pay-as-you-go auto insurance in Illinois?

The cheapest full-coverage auto insurance options for pay-as-you-go plans in Illinois are typically offered by Metromile and Progressive, but Progressive provides more comprehensive auto insurance options.

What is the minimum auto insurance in Illinois for pay-as-you-go auto insurance?

The minimum auto insurance in Illinois for pay-as-you-go policies includes liability coverage of $25,000 per person, $50,000 per accident for bodily injury, and $20,000 for property damage.

What is the best insurance company for first-time car buyers looking for pay-as-you-go auto insurance in Illinois?

The best insurance company for first-time car buyers looking for pay-as-you-go auto insurance in Illinois is Allstate, offering comprehensive coverage and multiple discounts for new drivers.

Who is the cheapest full coverage auto insurance provider for pay-as-you-go auto insurance in Illinois?

The cheap full coverage auto insurance provider for pay-as-you-go plans in Illinois is often Progressive, offering competitive rates and significant savings through telematics.

What is the lowest level of car insurance required for pay-as-you-go auto insurance in Illinois?

The lowest level of car insurance required for pay-as-you-go plans in Illinois is liability coverage, meeting the state’s minimum requirements of $25,000/$50,000/$20,000.

What are the best five car insurance companies in Illinois offering pay-as-you-go auto insurance?

The best five car insurance companies in Illinois offering pay-as-you-go plans are Allstate, Nationwide, Progressive, Liberty Mutual, and Metromile, known for their flexible and affordable options.

What insurance is required of all vehicles in Illinois under pay-as-you-go auto insurance?

All vehicles in Illinois under pay-as-you-go plans are required to have liability insurance that meets the state’s minimum auto insurance requirements of $25,000/$50,000/$20,000.

Which brand of car has the cheapest insurance with pay-as-you-go auto insurance in Illinois?

Brands like Honda, Toyota, and Subaru often have the cheapest insurance with pay-as-you-go auto insurance in Illinois due to their safety features and lower repair costs.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.